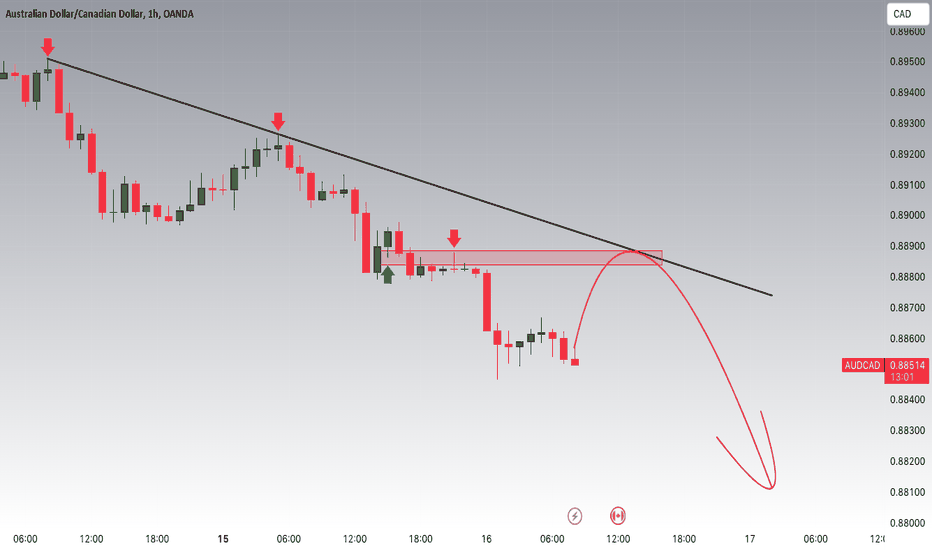

AUDCAD is under the pressure of a strong dollar Traders,

In today's trading session, our focus lies on AUDCAD, with our sights set on a potential selling opportunity around the 0.88800 zone. AUDCAD is currently entrenched in a downtrend, undergoing a correction phase as it nears the crucial support and resistance area at 0.88800.

Adding depth to our analysis, it's essential to consider the broader market dynamics, particularly the strength of the US dollar. Historically, a robust US dollar tends to exert downward pressure on indices, given their positive correlation. This relationship stems from the fact that a stronger dollar makes US exports more expensive, leading to lower corporate profits and dampened investor sentiment, thus impacting indices negatively.

Moreover, indices, being positively correlated with AUDCAD, further compound the pressure on the pair in the face of USD strength. As indices decline due to the strong dollar, AUDCAD typically follows suit, given their interconnectedness.

Therefore, with AUDCAD already in a downtrend and the US dollar exhibiting strength, the combination of these factors suggests a favorable environment for a selling opportunity in the pair around the 0.88800 zone.

Trade wisely,

Joe

J-CAD

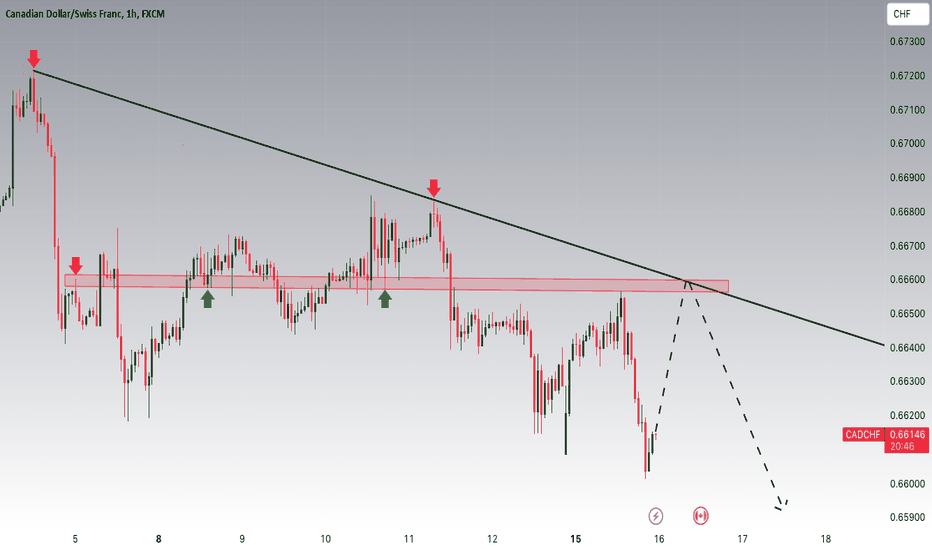

CADCHF Potential DownsidesHey Traders, in today's trading session we are monitoring CADCHF for a selling opportunity around 0.66600 zone, CADCHF is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 0.66600 support and resistance area.

Trade safe, Joe.

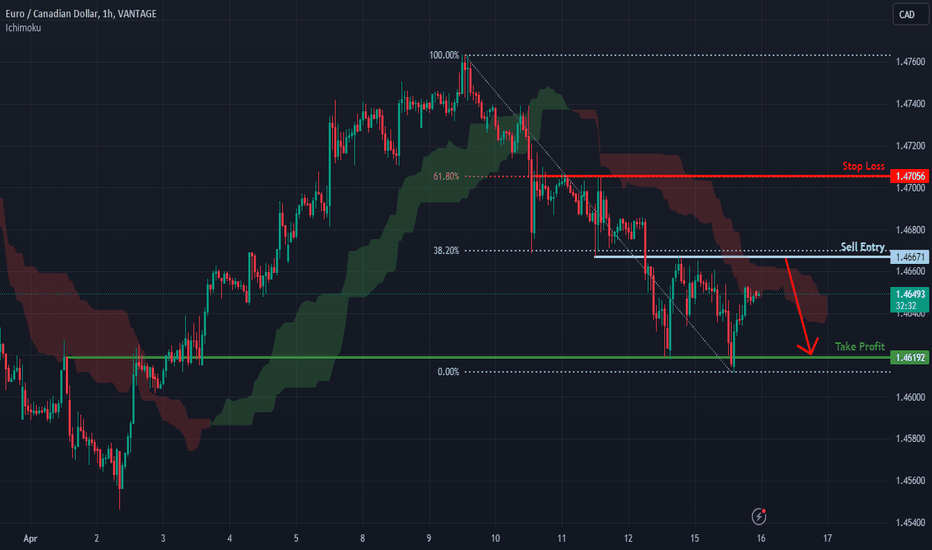

EUR/CAD has a strong bearish momentum, could it fall further?Price is rising towards the resistance level which is an overlap resistance which aligns with the 38.2% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.46671

Why we like it:

There is an overlap resistance level which aligns with the 38.2% Fibonacci retracement.

Stop loss: 1.47033

Why we like it:

There is a pullback resistance level which aligns with the 61.8% Fibonacci retracement

Take profit: 1.46192

Why we like it:

There is an overlap support level

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

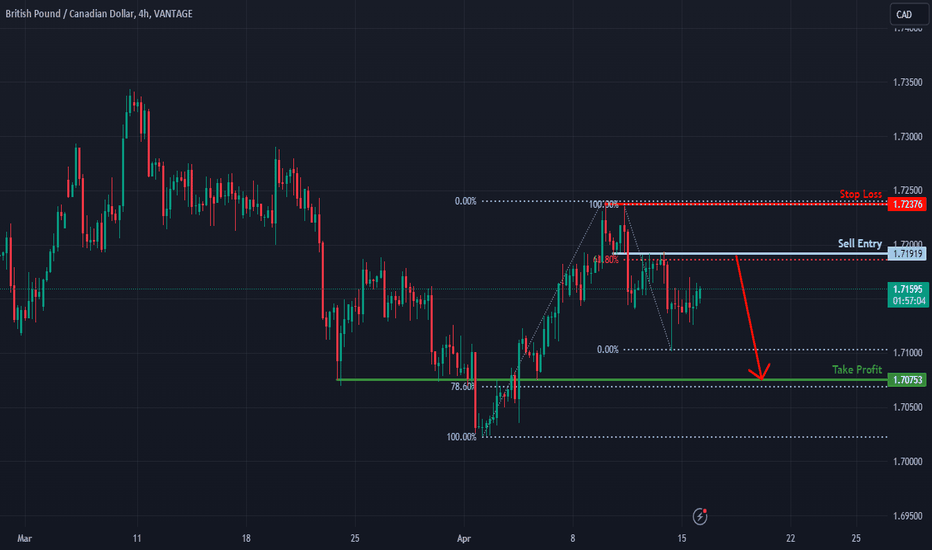

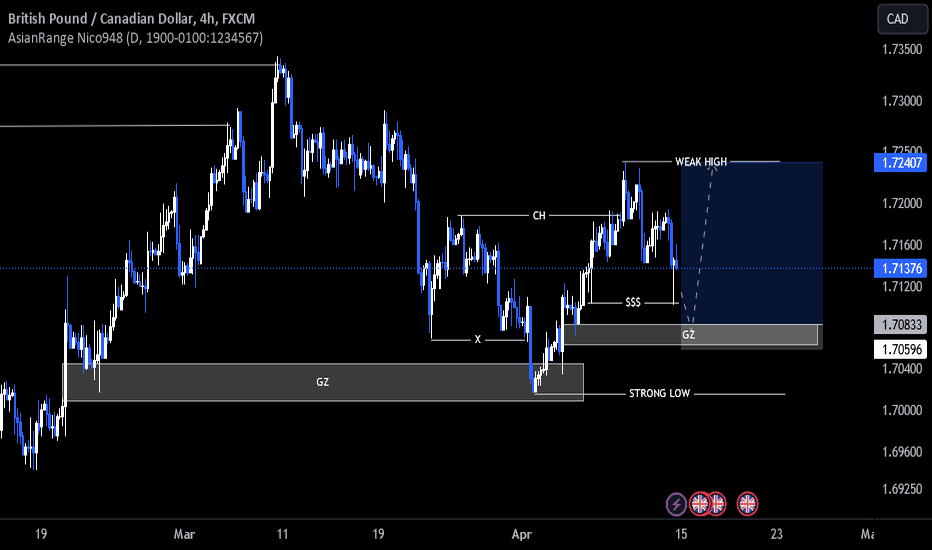

Rising towards overlap resistance, could it reverse from here?GBP/CAD is rising towards a resistance level, which is an overlapping resistance that aligns with the 61.8% Fibonacci retracement. A reversal from this level could cause the price to fall to our take profit target.

Entry: 1.71919

Why we like it:

There is an overlap resistance level which aligns with the 61.8% Fibonacci retracement.

Stop loss: 1.72375

Why we like it:

There is a pullback resistance level

Take profit: 1.70753

Why we like it:

There is an overlap support level which aligns with the 78.6% Fibonacci retracement.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

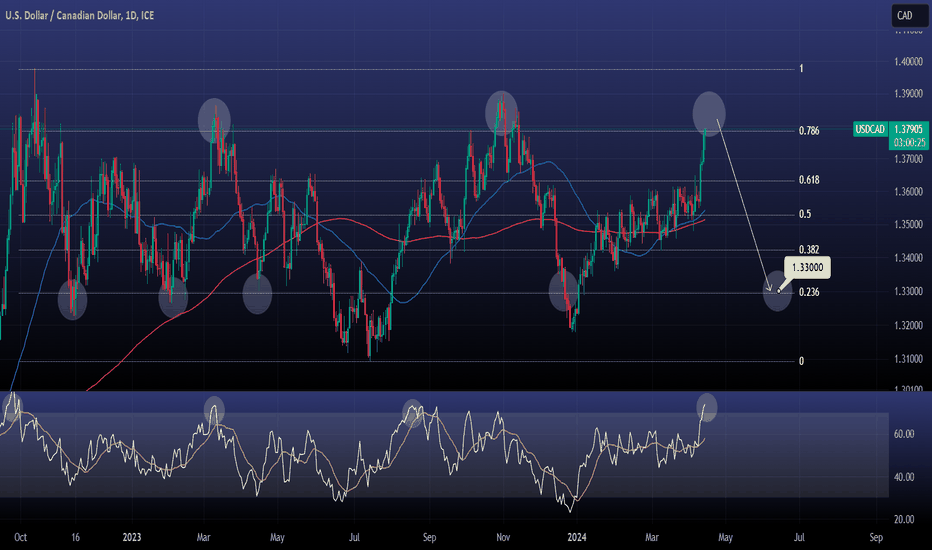

USDCAD Best sell entry in 6 months.The USDCAD pair is crossing over the 0.786 Fibonacci level of the long term range since October 2022.

The last two times it did that break out, it turned into the most efficient sell opportunity. Last time to do so was on November 1st 2023.

With the 1day RSI also deep into the overbought region, we turn bearish.

Sell and target 1.3300 (0.236 Fib, it has been hit all times the pattern gave this sell signal).

Previous chart:

Follow us, like the idea and leave a comment below!!

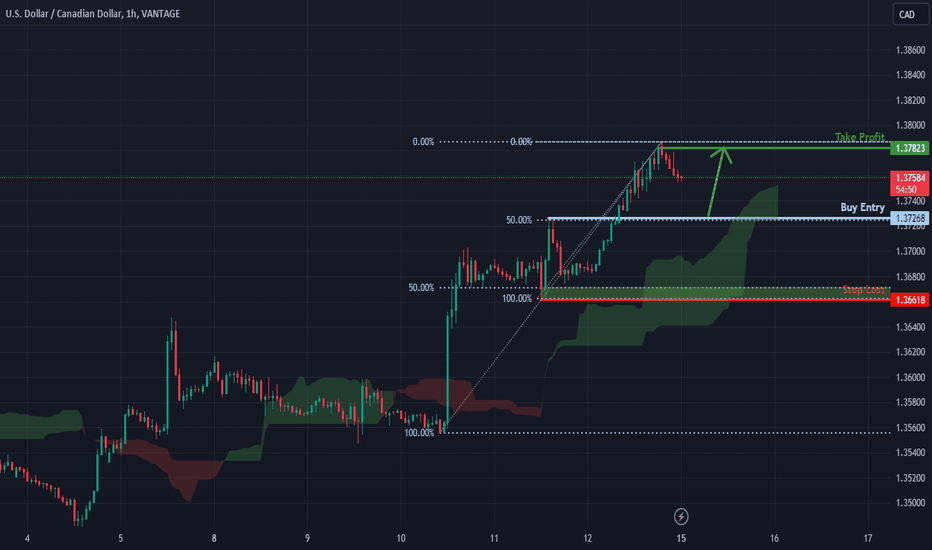

Falling towards 50% Fibo support, could it bounce from here?USD/CAD is falling towards a support level which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit

Entry: 1.37268

Why we like it:

There is a pullback support level which aligns with the 50% Fibonacci retracement

Stop loss: 1.36618

Why we like it:

There is a pullback support level which aligns with the 50% Fibonacci retracement

Take profit: 1.37823

Why we like it:

There is a pullback resistance level

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

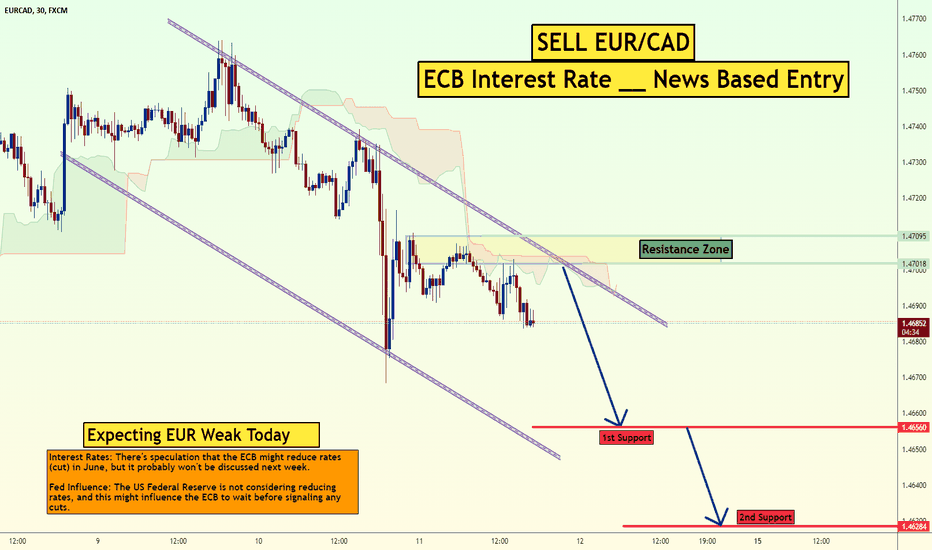

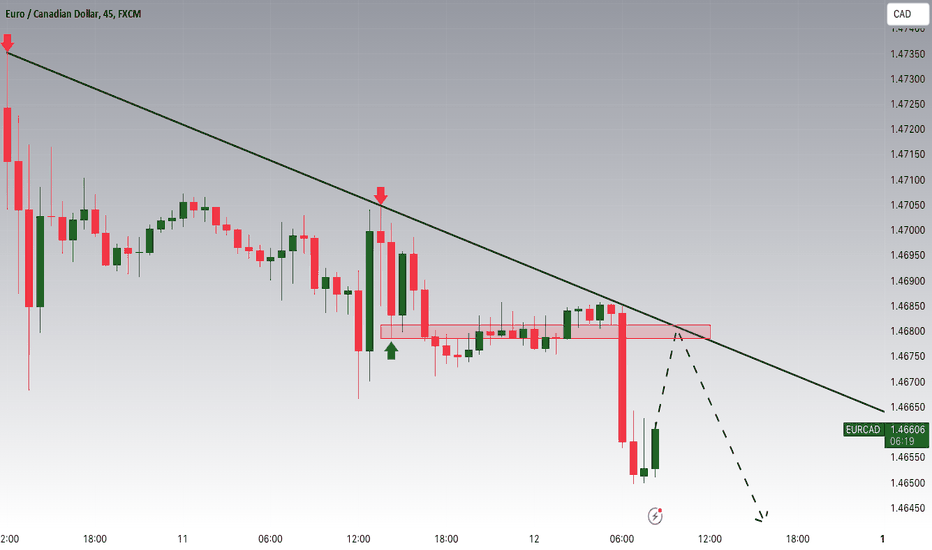

Sell EURCAD ECB Interest RateThe EUR/CAD pair on the M30 timeframe presents a potential selling opportunity due to the presence of a well-defined bearish channel pattern. This pattern suggests ongoing selling pressure and a higher likelihood of further declines in the coming minutes or hours.

Key Points:

Sell Entry: Consider entering a short position (selling) below the broken support level of the channel, ideally around 1.4700. This offers an entry point close to the perceived shift in momentum.

Target Levels: Initial bearish targets lie at the previous support levels within the channel, now acting as potential resistance zones:

1.4656: This represents the first level of support within the channel.

1.4628: This is a further extension of the downside target, based on the height of the recent price movement before the breakout.

Stop-Loss: To manage risk, place a stop-loss order above the broken support line of the channel, ideally around 1.4720. This helps limit potential losses if the price unexpectedly reverses and breaks back upwards.

Thank you

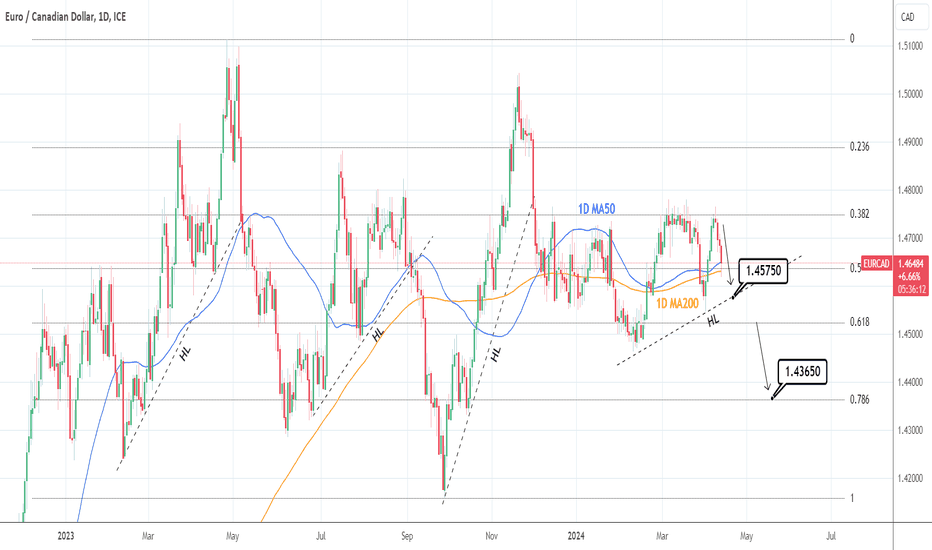

EURCAD: Quick short opportunity + bonus for long term.EURCAD marginally turned bearish on its 1D technical outlook (RSI = 44.842, MACD = 0.001, ADX = 27.243) as it hit both the 1D MA50 and 1D MA200 today. That is dead neutral on a 15 month basis as the pair has been on a wide ranged price action since the start of 2023. Currently it sits exactly at the middle of this pattern on the 0.5 Fibonacci level. This gives us the opportunity for a quick short term sell on the HL trendline (TP = 1.45750). The HL trendline has always been crossed downwards these 1.5 years so if we see a crossing under the 0.618 Fibonacci, we will sell again and target the 0.786 Fib (TP = 1.43650).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

EURCAD is approaching a significant levelHey Traders, in today's trading session we are monitoring EURCAD for a selling opportunity around 1.46800 zone, EURCAD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.46800 support and resistance area.

Trade safe, Joe.

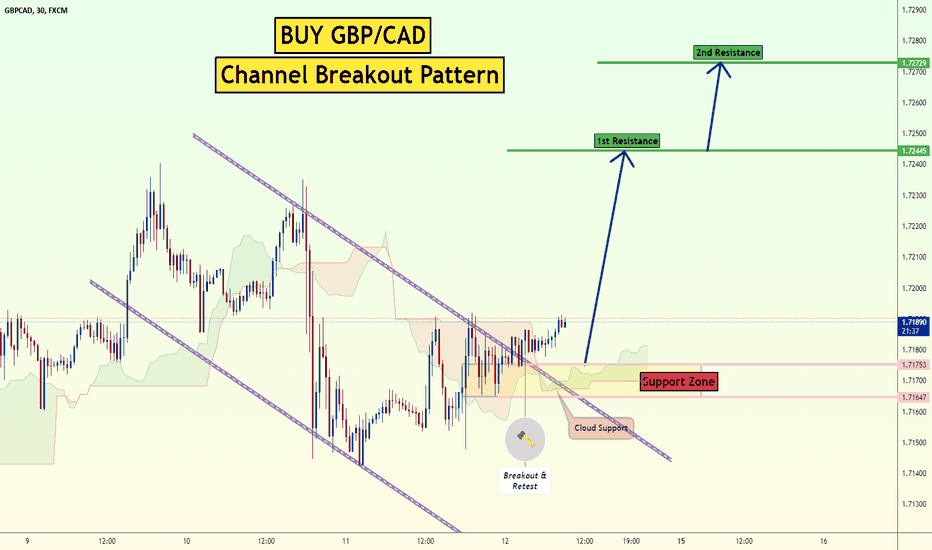

Buy GBPCAD Channel BreakoutThe GBP/CAD pair on the M30 timeframe presents a potentially interesting situation with a bullish channel breakout pattern.

Potential Long Trade :

Entry: Above the broken resistance line of the channel, ideally around 1.7175 after confirmation.

Target Levels:

1.7244: This represents the height of the channel, measured from the apex (highest point) to the base (opposite trendline), projected upwards from the breakout point.

1.7272: This is a further extension of the upside target, based on the height of the recent price movement.

Stop-Loss: Place a stop-loss order below the broken resistance line of the channel, ideally around 1.7145. This helps limit potential losses if the price fails to break out and reverses downwards.

Thank you

Could USD/CAD bounce from here?The price is falling toward a support level, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.36138

Why we like it:

There is a pullback support level

Stop loss: 1.35554

Why we like it:

There is a pullback support level

Take profit: 1.37245

Why we like it:

There is a pullback resistance level

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDCAD - Analysis using ICT ConceptsEverything was pretty much said in the video.

Basically price reached a higher timeframe Premium Array on the 3D chart, so now I have the expectation of lower prices based on the lower timeframe Premium Arrays, specifically a 2h Sibi.

Today is CPI, so anything can happen. Price can always go above and beyond what is ordinary in such events.

- R2F

Potential bearish dropEUR/CAD is currently on a resistance level which is a pullback resistance level and could reverse from this level to our take profit

Entry: 1.47378

Why we like it:

There is a pullback resistance level

Stop loss: 1.47789

Why we like it:

There is a pullback resistance level

Take profit: 1.46630

Why we like it:

There is an overlap support level which aligns with the 50% Fibonacci retracement

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.