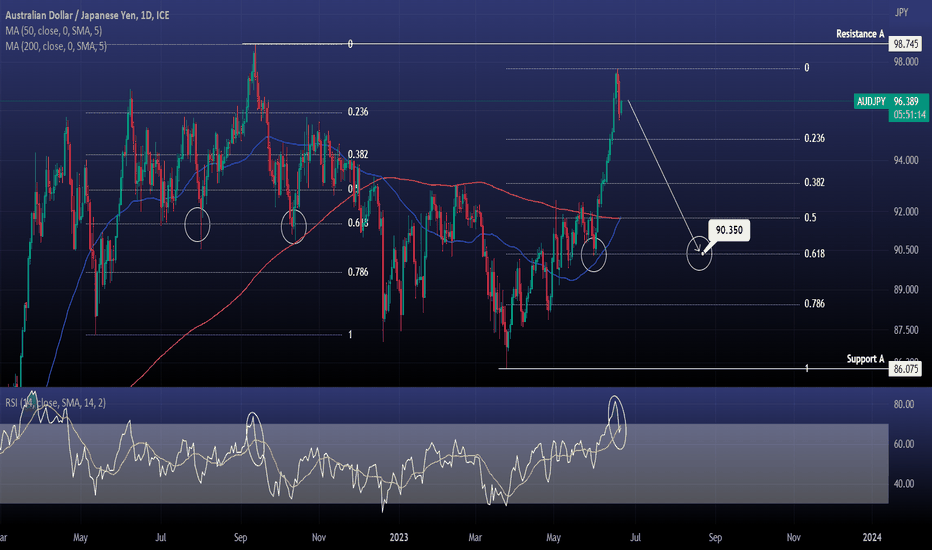

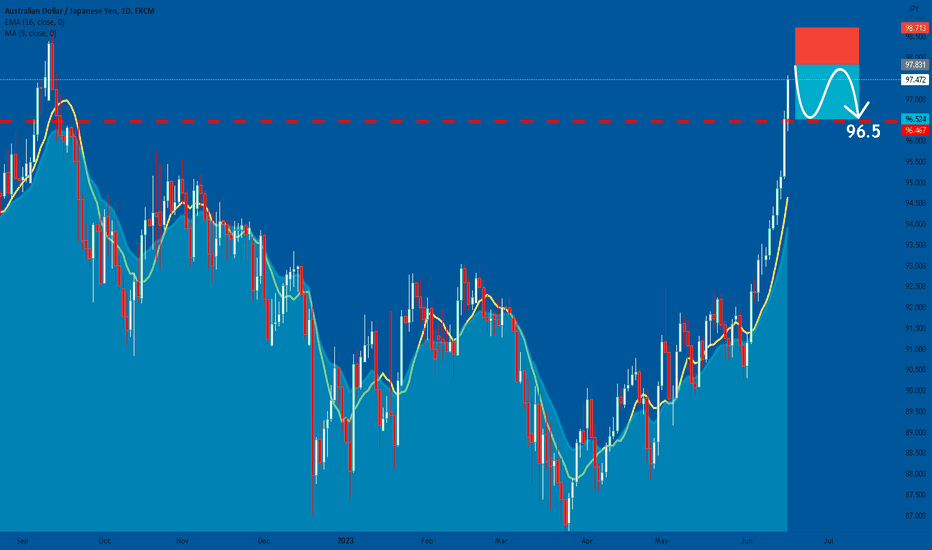

AUDJPY Excellent long term sellAUDJPY got rejected this week just before hitting Resistance A that is the High of September 13th 2022.

Any rebound is a strong sell opportunity now as even the 1day RSI crossed under the MA level after becoming the most overbought its been since March 2022.

The September 2022 peak got rejected back to its Fibonacci 0.618 level.

Sell and target the new Fibonacci 0.618 which is at 90.350.

Follow us, like the idea and leave a comment below!!

Japaneseyen

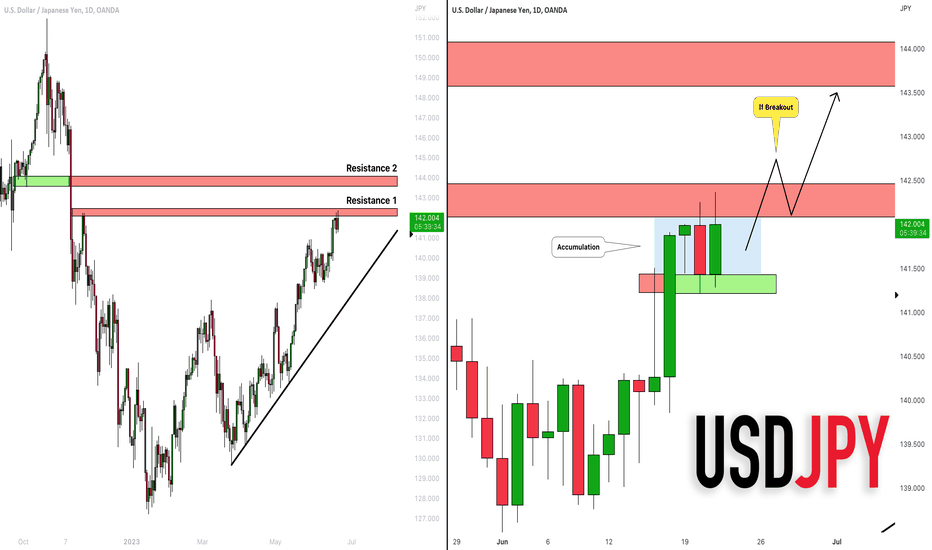

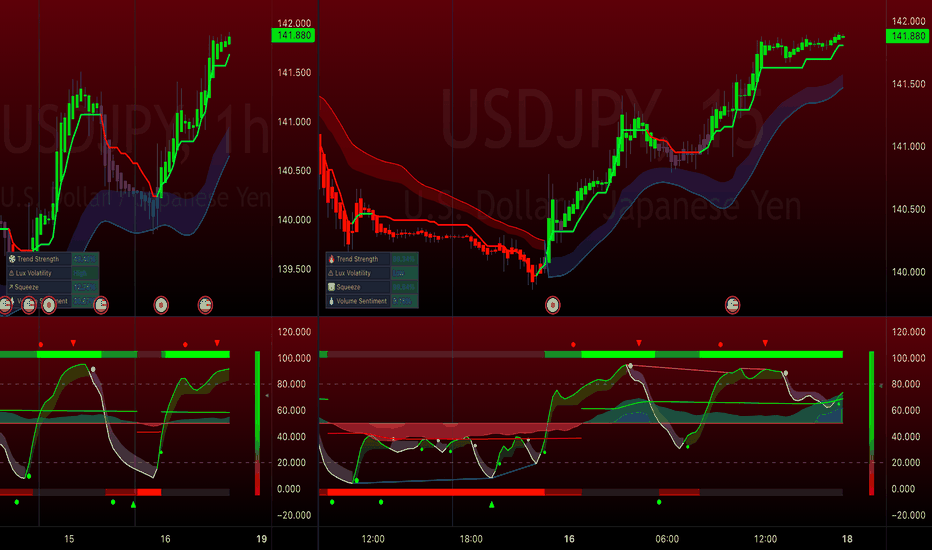

USDJPY: Bullish Accumulation & Trading Plan 🇺🇸🇯🇵

USDJPY is stuck on a key horizontal daily resistance.

The price is currently trading within a narrow range.

Because the current trend is bullish, I am looking for trend-following opportunities.

To buy with a confirmation, wait for a bullish breakout of 142.0 - 142.45 area.

Daily candle close above will confirm the violation.

A bullish continuation will be expected then at least to 143.5

Alternatively, a bearish breakout of the support of the range may trigger

a correctional movement.

❤️Please, support this video with like and comment!❤️

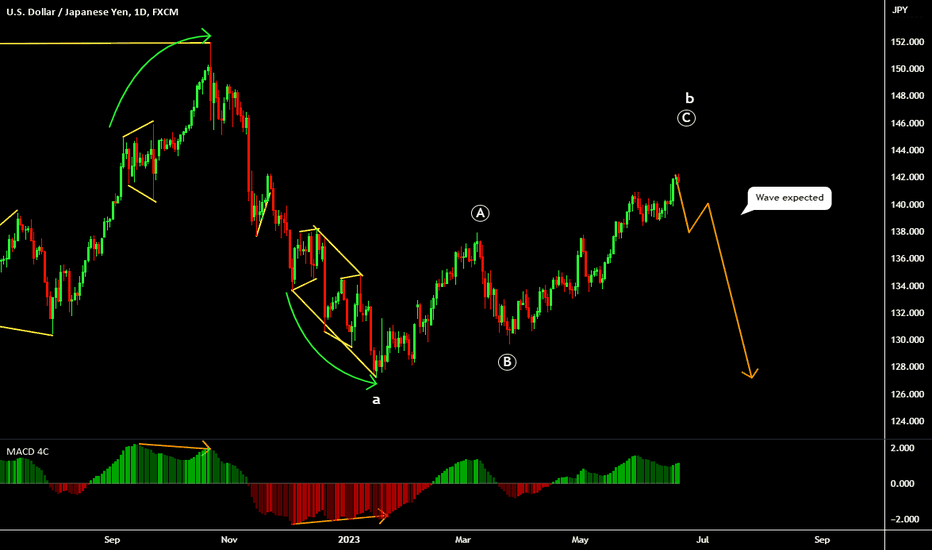

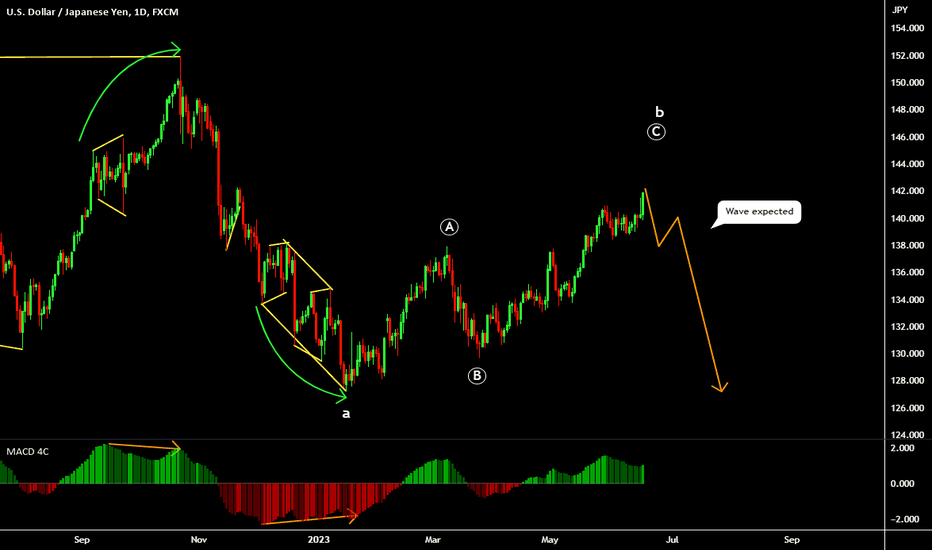

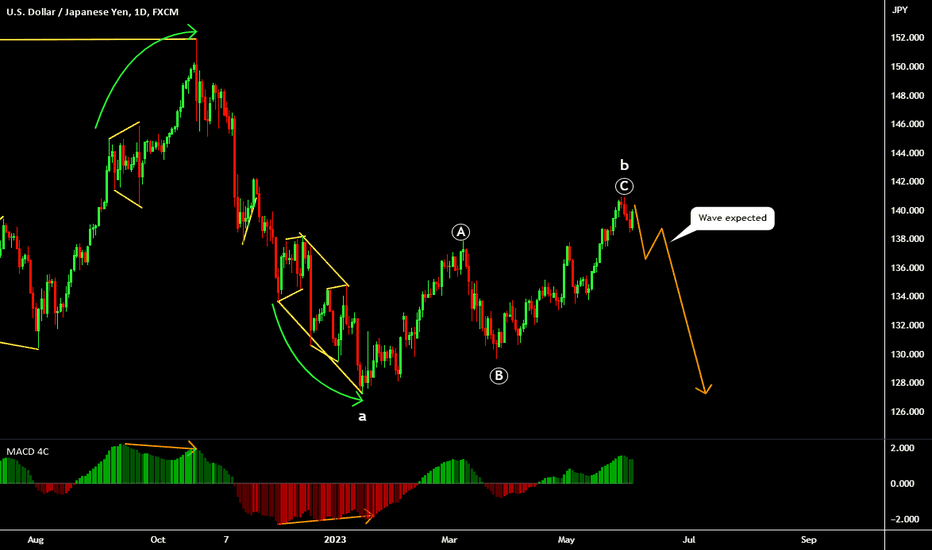

USD JPY - FUNDAMENTAL ANALYSISBNP Paribas 2023-2024 Exchange Rate Forecasts

Capital Outflows will Undermine the Dollar

A starting point for the BNP market analysis is that it considers the dollar is notably overvalued in global markets, especially against the yen.

It adds; “The USD on a G10 trade-weighted index is trading almost 2 standard deviations (about 25%) rich relative to our estimates of its long-term fair value, as captured by the BNP Paribas FEER.”

The debate surrounds whether there will be a trigger for the overvaluation to be reversed.

BNP expects a significant shift in capital flows over the next few months which will have an important impact on currency rates.

According to the bank; “The normalization of global yields should continue to encourage repatriation by Eurozone and Japanese investors, who are overweight US assets.”

BNP also considers that unease over US equity valuations will encourage a flow of funds out of the US into the rest of the world

It adds; “Coupled with FX-hedge ratios at low levels, we see space for significant USD selling.

Overall, BNP places less emphasis on Federal Reserve rate cuts in forecasting that the dollar will lose ground.

Yen Can Secure Capital Inflows

BNP continues to expect a strong recovery for the yen.

Firstly, it expects that the Bank of Japan will tighten policy in July which will tend to strengthen the currency, especially given scope for a repatriation of funds by domestic institutions.

It also expects lower US yields will support the yen while the threat of intervention will tend to curb potential selling pressure on the currency.

The dollar to yen (USD/JPY) exchange rate is not forecast to hold above the 140.00 level.

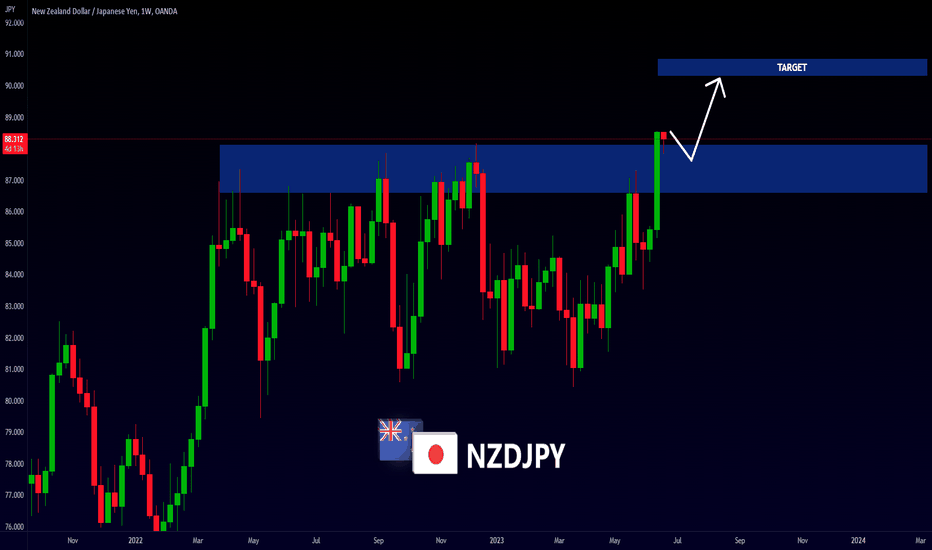

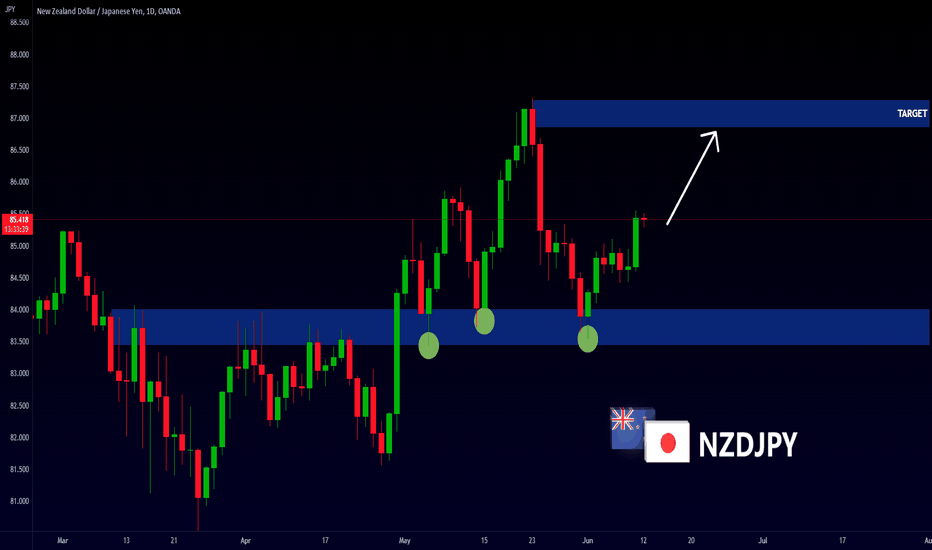

NZDJPY - NEW BREAKOUT📈Hey Traders👋🏻

On The Weekly Time Frame The NZDJPY Price Reached a Resistance Level (86.566 - 88.170)✔

Currently, This Key Level is Broken (Resistance Level Becomes new Support Level)🔥

So, I Expect a Bullish Move📈

i'm waiting for a retest...

-----------

TARGET: 90.289🎯

___________

if you agreed with this IDEA, please leave a LIKE, SUBSCRIBE or COMMENT!

USD JPY - FUNDAMENTAL ANALYSISBNP Paribas 2023-2024 Exchange Rate Forecasts

Capital Outflows will Undermine the Dollar

A starting point for the BNP market analysis is that it considers the dollar is notably overvalued in global markets, especially against the yen.

It adds; “The USD on a G10 trade-weighted index is trading almost 2 standard deviations (about 25%) rich relative to our estimates of its long-term fair value, as captured by the BNP Paribas FEER.”

The debate surrounds whether there will be a trigger for the overvaluation to be reversed.

BNP expects a significant shift in capital flows over the next few months which will have an important impact on currency rates.

According to the bank; “The normalization of global yields should continue to encourage repatriation by Eurozone and Japanese investors, who are overweight US assets.”

BNP also considers that unease over US equity valuations will encourage a flow of funds out of the US into the rest of the world

It adds; “Coupled with FX-hedge ratios at low levels, we see space for significant USD selling.

Overall, BNP places less emphasis on Federal Reserve rate cuts in forecasting that the dollar will lose ground.

Yen Can Secure Capital Inflows

BNP continues to expect a strong recovery for the yen.

Firstly, it expects that the Bank of Japan will tighten policy in July which will tend to strengthen the currency, especially given scope for a repatriation of funds by domestic institutions.

It also expects lower US yields will support the yen while the threat of intervention will tend to curb potential selling pressure on the currency.

The dollar to yen (USD/JPY) exchange rate is not forecast to hold above the 140.00 level.

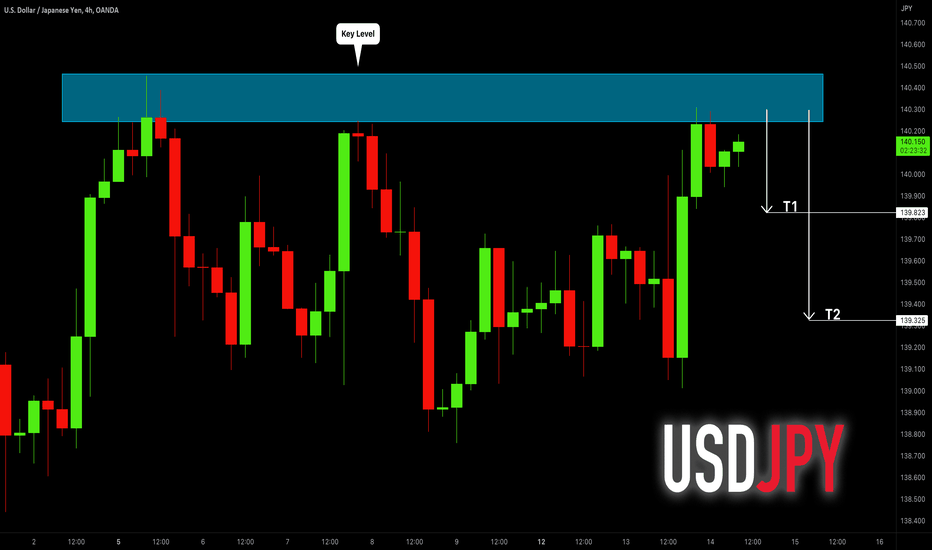

USD/JPY - Incredible Moves to close out the weekOANDA:USDJPY

Thursday we saw a nice oscillator Matrix set-up to the down side.

Then on Friday, the market makers decided to go for recent highs with 2 scalp entries.

Incredible oscillator triggers kept us on the right side of the action....

Enjoy the rest of your weekend...

AUDJPY: Swing Short From Supply Area!

Ladies and Gentelmen,

Here I present you a short

Trade from the supply level

We need to wait for the pair

To go a bit higher so this

Will be a limit order.

The details are below:

Entry Limit: 98.000

Stop Loss: 98.713

Target: 96.500

❤️Please, support our work with like & comment!❤️

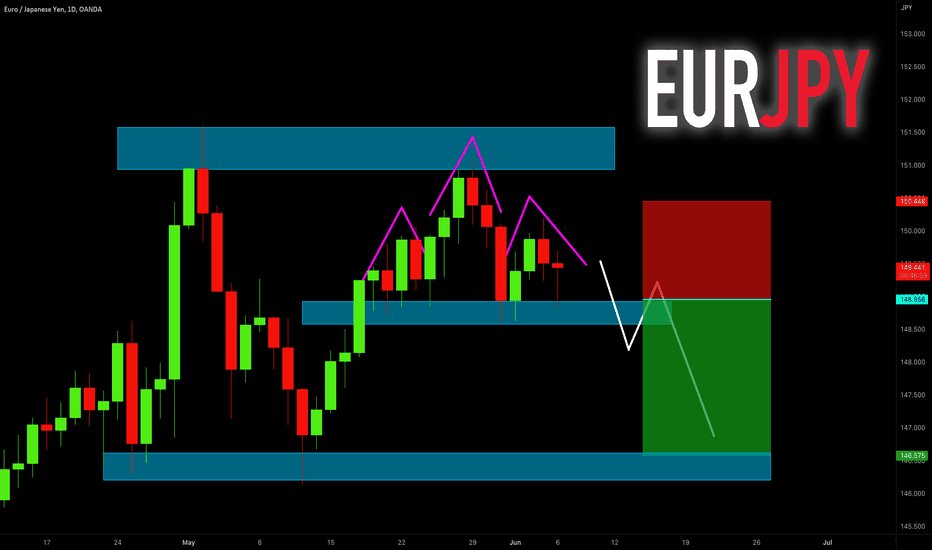

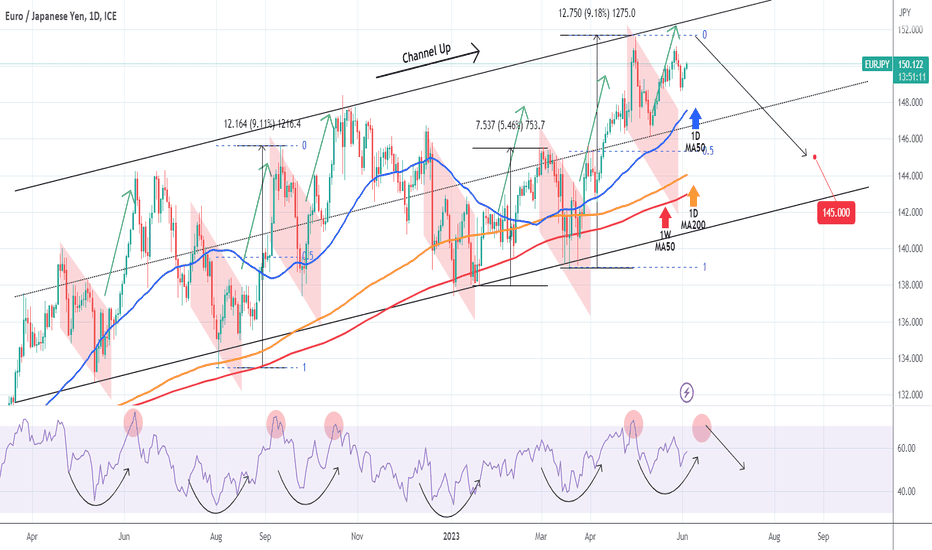

EURJPY Sell at the top of the 1 year Channel Up.EURJPY is rising aggressively since the last touch on the 1day MA50 on April 6th.

The long term pattern is a Channel Up since March 7th 2022.

The 1day RSI is extremely overbought at 77.00, the highest it has been since June 8th 2022.

Buy and target 158.000 and then sell targeting the 1day MA200 at 148.000.

Follow us, like the idea and leave a comment below!!

GBPJPY: The Historical Structures 🇬🇧🇯🇵

GBPJPY is unstoppable.

The market keeps growing like crazy.

Here are the next historical structures on focus:

Resistance 1: 180.35 - 180.75 area

Resistance 2: 186.80 - 188.80 area

Resistance 3: 194.94 - 195.83 area

I believe that the next goal for buyers is Resistance 1.

The market will most likely keep growing.

❤️Please, support my work with like, thank you!❤️

EUR-JPY Will Keep Growing! Buy!

Hello,Traders!

EUR-JPY is trading in a

Strong uptrend and the pair

Made a retest and a rebound

From the horizontal support

Of 148.00 and the pair is

Now going up so I think

That the pair will keep growing

Buy!

Like, comment and subscribe to help us grow!

Check out other forecasts below too!

NZDJPY - NEW BULLISH MOVE📈Hey Traders👋🏻

On The Daily Time Frame The NZDJPY Price Reached a Strong Support Level (84.024-83.434)✔

The Price Reject to Break This Key Level and Create a new Lower Low 📉

So, I Expect a Bullish Move📈

i'm waiting for a Retest...

-----------

TARGET: 86.848🎯

___________

if you agreed with this IDEA, please leave a LIKE, SUBSCRIBE or COMMENT!

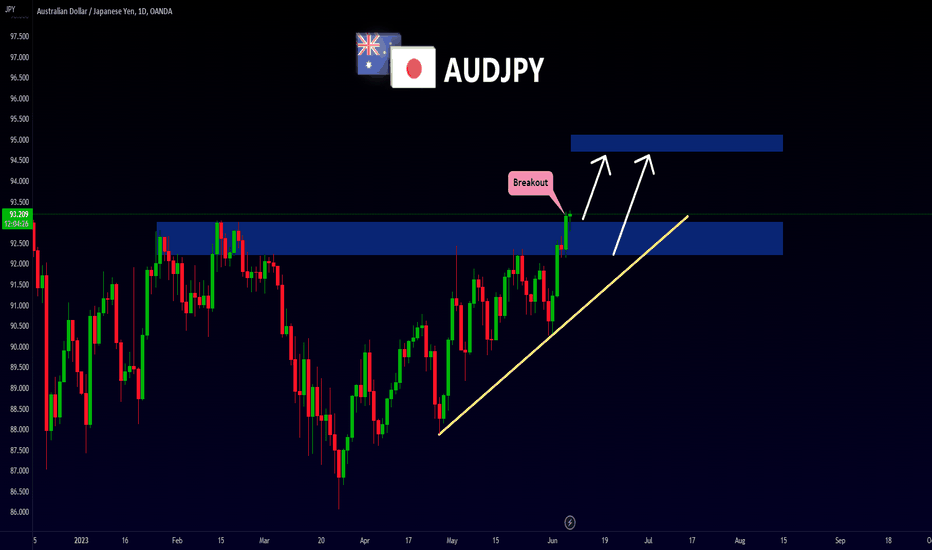

AUDJPY - RESISTANCE BECOMES SUPPORT📈Hello Traders👋🏻

On The Daily Time Frame The AUDJPY Price Broke The Resistance Level (92.189-93.048)✔

Currently, The Resistance Level Becomes New Support Level📈

So, I Expect a Bullish Move📈

i'm waiting for a retest....

-----------

TARGET: 94.700🎯

___________

if you agreed with this IDEA, please leave a LIKE, SUBSCRIBE or COMMENT!

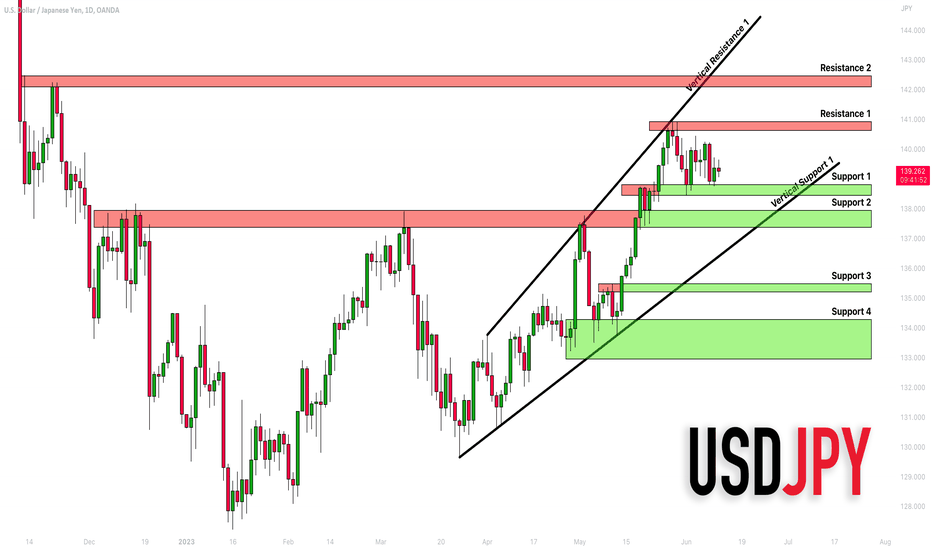

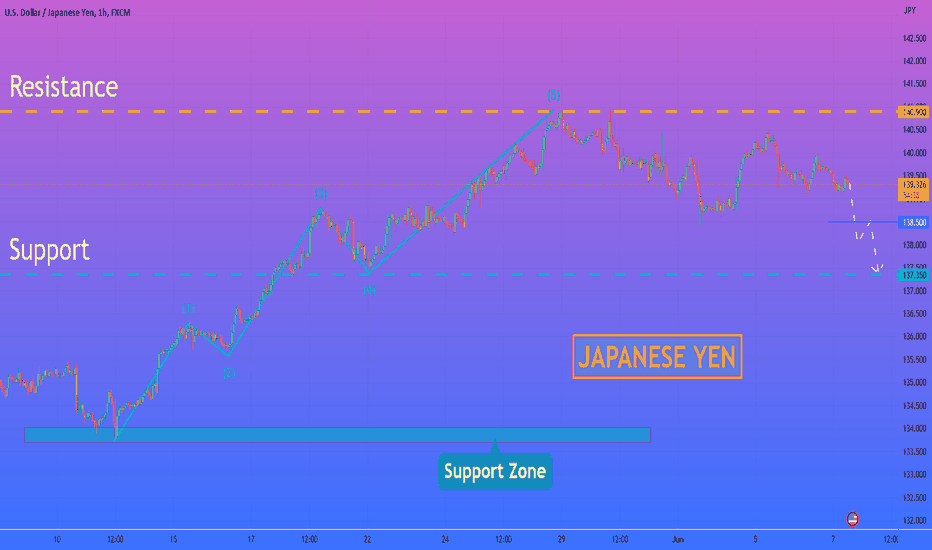

USDJPY: Key Levels to Watch This Week 🇺🇸🇯🇵

Here is my detailed structure analysis for USDJPY.

Horizontal Key Levels.

Resistance 1: 140.63 - 140.93 area

Resistance 2: 142.06 - 142.46 area

Support 1: 138.48 - 138.80 area

Support 2: 137.38 - 137.95 area

Support 3: 135.20 - 135.49 area

Support 4: 132.95 - 134.27 area

Vertical Key Levels.

Vertical Resistance 1: Rising trend line

Vertical Support 1: Rising trend line

Consider these structures for pullback/breakout trading this week.

❤️Please, support my work with like, thank you!❤️

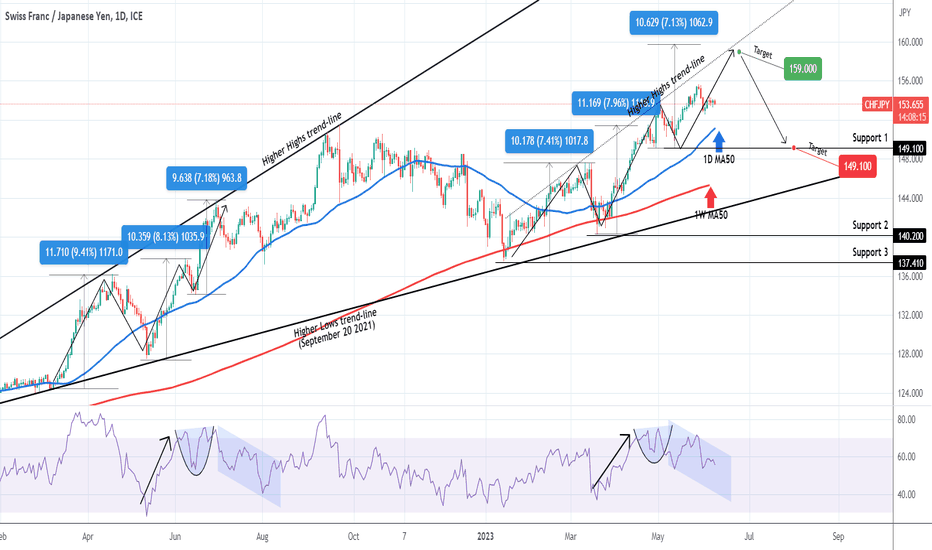

CHFJPY Last rise before a strong correction.The CHFJPY pair had a strong 5 week rally since our last buy call (see chart below) on April 28:

Our final bullish target remains 159.000, which will make a perfect contact with the Higher Highs trend-line since January. But given the fact that the 1W MA50 (red trend-line) has been tested twice this year, we expect a stronger rejection this time and decline all the way to Support 1 (149.100), where it can make contact with the 1W MA50.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

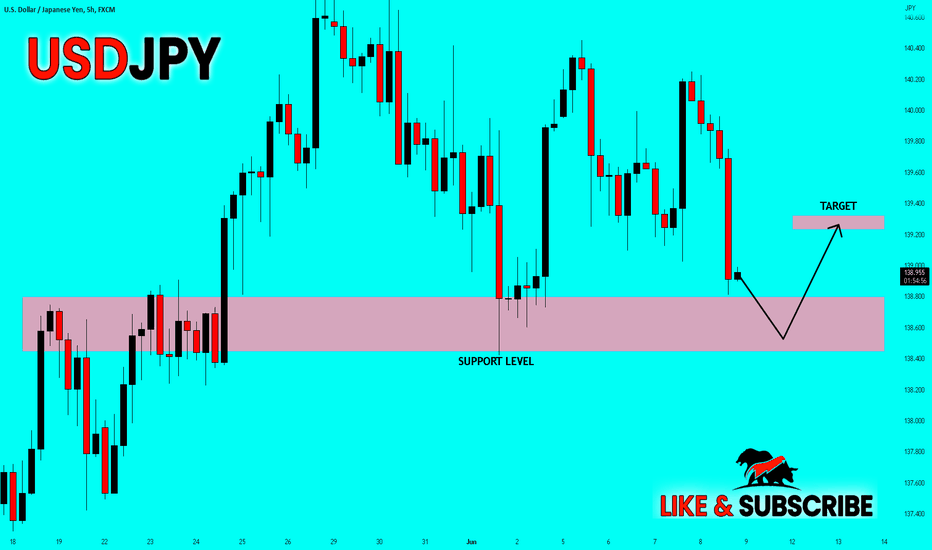

HelenP. I Japanese Yen may continue to fall and achieve supportHi folks today I'm prepared for you JAPANESE YEN analytics. The Japanese Yen created a support zone of 134.05-133.70, from which started to grow the and form Elliott Waves. The price rose to mark 136.30 (1 wave) and after a downward correction, rose (2 wave) broke through the level of 137.35 and continued the local uptrend (3 wave). The Japanese Yen declined (wave 4), retested current support, and continued to rise. The price rose to the level of 140.90, where the 5th wave was completed, and after a re-test resistance, it started to decline. After a slight upward correction, the Japanese Yen continued to move down. Now the uptrend may be completed, and the price may continue to decline. I hope that the Japanese Yen may start a local downtrend, or may make a deep downward correction to support at level 137.35. Therefore, goals will be set at levels 138.50 and 137.35. If you like my analytics you may support me with your like/comment ❤️

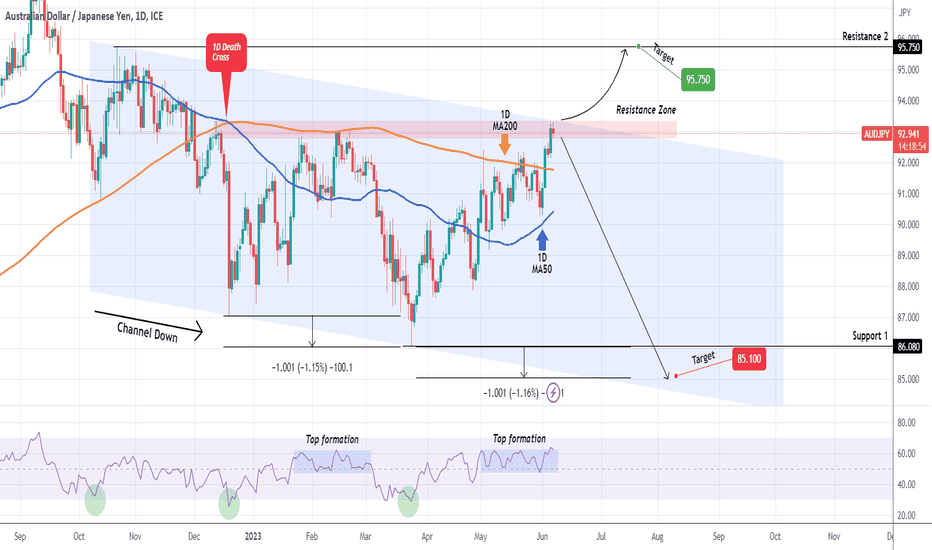

AUDJPY Double Sell SignalThe AUDJPY pair has been trading within a Channel Down pattern since the October 21 2022 High. Supported by the 1D MA50 (blue trend-line), it not only entered yesterday the Resistance Zone of December 13, but also reached the top (Lower Highs trend-line) of the Channel Down.

This is a Double Sell signal and as long as candles close below it, we will be selling towards Support 1 and the bottom (Lower Lows trend-line) of the Channel Down at 85.100. If a 1D candle closes above the Resistance Zone, we will continue buying for a short-while and target Resistance 2 (95.750).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDJPY: starting the final sell wave of the Head and Shoulders.NZDJPY is on neutral 1D technicals (RSI = 50.536, MACD = 0.110, ADX = 26.358) as the price is consolidating after a rebound on the 1D MA50. The rejection on the R1 Zone, is technically the Head of the Head and Shoulders pattern, a bearish formation seen on market peaks. This rebound is forming the Right Shoulder.

With the 1D RSI on Higher Lows for the whole year, we can't ignore the possibility of a fake Head and Shoulders formation, so the level which invalidates this is the LS overhead Resistance at 85.940. Under this, we will target the 0.236 Fibonacci level (TP = 81.550), which is a standard target for the price after rejections on the R1 Zone since April 2022.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

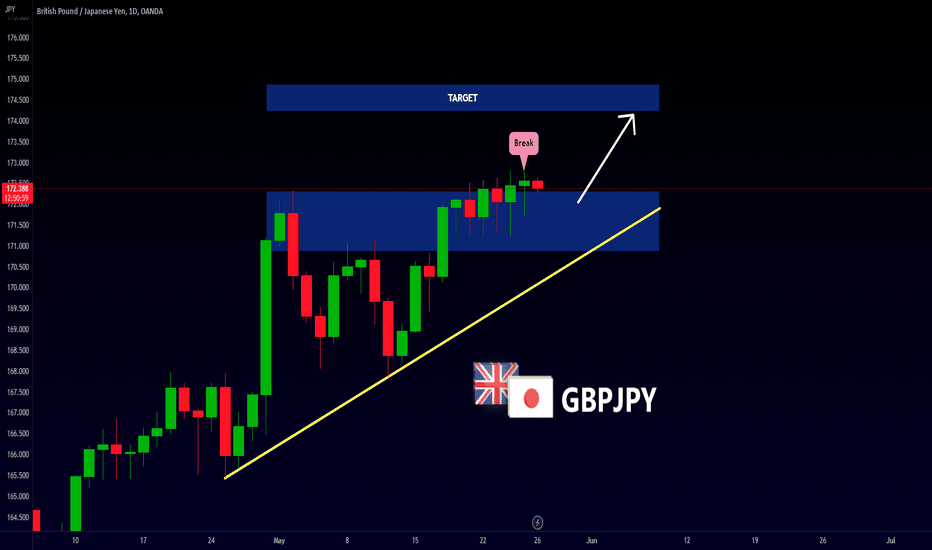

GBPJPY - NEW BREAKOUT📈Hey Traders👋🏻

On The Daily Time Frame The GBPJPY Price Broke The Resistance Level (170.853-172.334)✔

Currently, The Resistance Level Becomes New Support Level📈

The Price Formed an Ascending Triangle

So, I Expect a Bullish Move📈

i'm waiting for a retest....

-----------

TARGET: 174.220🎯

___________

if you agreed with this IDEA, please leave a LIKE, SUBSCRIBE or COMMENT!

EURJPY Final pump before a long-term sell.The EURJPY pair is about to complete the long-term bullish leg it started within the Channel Up and has already hit the bullish target we set (see chart below) on February 16:

The price is now about to complete the final bullish leg to re-hit the top of the Channel Up and price the new Higher High before it gets rejected and start the new long-term bearish leg towards the bottom for the new Higher Low. It needs a 1D RSI Double Top at 70.00 to do that and in those terms it looks very similar to the August 02 - October 21 sequence.

The 1D MA50 (blue trend-line) has been supporting since March 29. When broken, it will be a (rather late) signal to sell. Our long-term target is the 1W MA50 (red trend-line) and we project contact to be made a 145.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD JPY - FUNDAMENTAL ANALYSISThe Bank of Japan's (BoJ) monetary stance remained unchanged as they didn't convene, keeping the key policy rate at -0.10% and the 10-year yield at around zero percent due to Yield Curve Control.

Several factors contributed to the Yen's weakening, including reassessments of the Federal Reserve's monetary tightening outlook, which generally boosted the dollar.

The 10-year breakeven rose significantly, hinting at rising inflation expectations in Japan. With inflation hitting new highs and property values also increasing, real yields in Japan are falling.

Despite rising inflation, the BoJ's apparent lack of urgency to change its current monetary stance has also influenced the Yen's movement.

However, there are suggestions that the BoJ might change its Yield Curve Control without much warning.

With possible political factors also in play, the overall view, according to analysts at MUFG, is of limited scope for further rise in the USD/JPY exchange rate, given the Fed's projected pause in June.

Japanese Yen Performance in May

The Yen's performance against other major currencies in May has been mixed, the Japanese currency saw a depreciation against the US dollar but a strengthening against the Euro.

"In May the yen weakened further versus the US dollar in terms of London closing rates from 136.09 to 139.68" says Derek Halpenny, Head of Research, Global Markets EMEA and International Securities at MUFG.

Bank of Japan's Monetary Stance

Despite the fluctuations, there hasn't been a change in the monetary policy of the Bank of Japan (BoJ). The central bank's current stance remained steady with a key policy rate of -0.10% and the ten-year yield managed within a +/- 50bps range due to Yield Curve Control (YCC).

"The BoJ did not meet in May and hence its current monetary stance was unchanged with the key policy rate at -0.10% and YCC restraining the 10-year yield within a range of +/-50bps around zero percent," says Halpenny.

Factors Influencing the JPY's Exchange Rate Performance

Several macroeconomic dynamics influenced the Yen's performance in May. A crucial contributor to these dynamics was a reappraisal of the Federal Reserve's perspective on monetary policy tightening in the US, which resulted in a strengthening of the US dollar.

"Firstly, the reassessment of the outlook for monetary tightening by the Fed helped lift the dollar in general in May and that helped propel USD/JPY higher," Halpenny states. He adds, "From close to a zero probability, OIS pricing now indicates around a 50% probability of another rate hike by the Fed."

Furthermore, the Yen's value was impacted by domestic economic indicators. There's been a significant increase in real yields (the returns on investments that have been adjusted for the effects of inflation) in Japan, accompanied by a surge in inflation expectations.

"Real yields have been falling sharply in Japan with inflation expectations jumping. The 10yr breakeven jumped 20bps in May and reached close to 1.00%, the highest since June 2022," Halpenny notes.

Impact of Asset Price Inflation

The rising inflation in Japan wasn't just limited to goods and services, but also included a surge in asset prices. A broad spectrum of assets, including the Topix Index, property prices, and land prices, experienced significant gains.

The TOPIX, or Tokyo Stock Price Index, is a broad stock market index that tracks all domestic companies listed on the First Section of the Tokyo Stock Exchange (TSE), the largest stock market in Japan. It includes a wide range of company sizes and sectors, making it a comprehensive barometer of the overall Japanese equity market.

"The Topix Index surged 3.6% in May in contrast to a 0.2% gain in the S&P 500. Property prices and land prices are also moving higher in Japan," says Halpenny.

Despite the rising inflation and falling real yields, the BoJ appears untroubled about the situation and is in no hurry to change its monetary policy.

"Adding to yen selling is the clear sense of a lack of urgency from Governor Ueda to change the current monetary stance," says Halpenny.

However, there are signs that the BoJ might spring a surprise and make quick alterations to its YCC policy. "We suspect the BoJ could pivot quickly and alter YCC without much warning," Halpenny states.

In the backdrop of all these factors, the outlook for the Yen seems nuanced. The combination of increasing inflation, changing monetary policy stances, and political factors all paint a picture of restrained potential for further appreciation of the Yen against the US Dollar, especially with a projected pause in the Federal Reserve's policy actions in June.

"With the Fed set to pause in June, we see limited scope for USD/JPY to move higher from here," Halpenny concludes.