USDJPY Analysis for November 6, 2024: Slight Bullish Bias DrivenUSDJPY Analysis for November 6, 2024: Slight Bullish Bias Driven by Key Market Fundamentals

As of November 6, 2024, USDJPY appears to have a slightly bullish bias, influenced by various fundamental factors and recent shifts in market conditions. Traders and investors are paying close attention to developments affecting both the US dollar (USD) and the Japanese yen (JPY) as economic data and policy expectations guide market sentiment. Here’s a look at the key drivers contributing to USDJPY’s bullish outlook today.

Key Drivers Supporting a Bullish Bias for USDJPY

1. Federal Reserve’s Hawkish Stance

The Federal Reserve has maintained a hawkish stance, signaling a commitment to keeping interest rates elevated for an extended period. This approach supports the USD as higher yields attract investors, driving demand and potentially leading to further gains in USDJPY. If the Fed continues to prioritize inflation control, this could provide a steady tailwind for the dollar against the yen.

2. Divergent Monetary Policies Between the US and Japan

While the Fed remains hawkish, the Bank of Japan (BoJ) is expected to maintain its ultra-loose monetary policy. The BoJ has shown little intention of changing its low-interest-rate environment, making JPY less attractive in comparison to USD. This divergence in monetary policy provides a bullish edge for USDJPY as the yield differential widens.

3. Strong US Economic Data

Recent economic data from the US, including robust GDP growth and stable employment figures, further supports USD strength. These indicators suggest a resilient economy, giving the Federal Reserve more flexibility to maintain or even raise rates. Consequently, the USD is positioned favorably against the yen in the near term.

4. Risk Appetite Supporting USD over JPY

Although JPY traditionally benefits as a safe-haven currency during periods of market uncertainty, today’s risk sentiment leans toward moderate optimism. As risk appetite grows, traders are more likely to favor the USD over JPY, adding another layer of support to the USDJPY’s bullish momentum.

Technical Indicators Highlight Potential Upside

From a technical perspective, USDJPY is trading above its key support level at 150.00, a sign of bullish resilience. If USDJPY can break above the 150.80 resistance, it may pave the way for further gains toward the 151.50 mark.

Conclusion

In summary, today’s analysis indicates a slightly bullish bias for USDJPY, driven by the Fed’s hawkish stance, divergent monetary policies, positive US economic data, and favorable risk sentiment. Traders should watch for potential resistance levels that could influence USDJPY’s momentum in the short term.

Tags:

#USDJPYanalysis

#Japaneseyenforecast

#Forexmarkettrends

#USdollaroutlook

#FederalReservepolicyimpact

#USDJPYNovember62024

#Interestratedivergence

#Forexbullishtrends

#Riskappetitecurrencytrading

Japaneseyenforecast

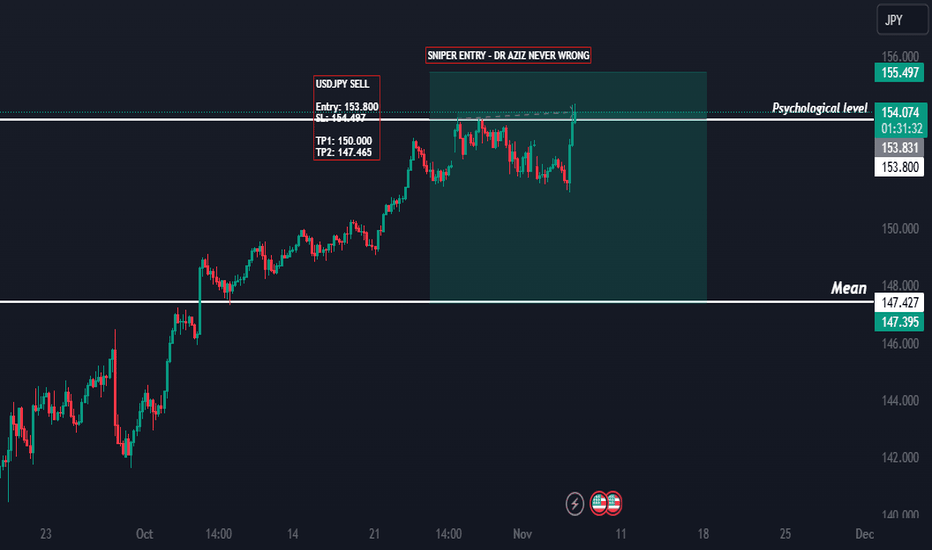

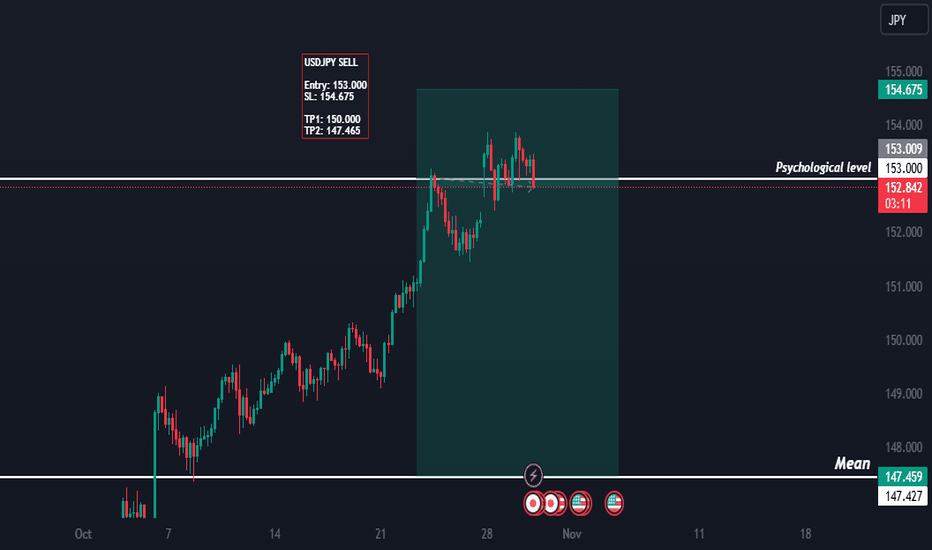

USDJPY Analysis: Potential Bearish Bias for October 30, 2024Find out what’s driving a potential bearish trend for USDJPY today. Explore the latest analysis of USDJPY with insights on central bank policies, risk sentiment, and technical trends that could impact this popular currency pair.

---

Introduction

Today, October 30, 2024, USDJPY may lean slightly bearish as a confluence of economic and fundamental factors unfolds in favor of the Japanese yen (JPY) over the U.S. dollar (USD). This article analyzes the forces potentially influencing a decline in USDJPY, including central bank actions, the latest market sentiment, and key technical indicators. This analysis is essential for traders seeking insights into the short-term trajectory of USDJPY.

Current Market Sentiment and Risk Aversion

USDJPY typically reflects shifts in global risk sentiment, with the Japanese yen often viewed as a safe-haven currency. Recent signs of global economic caution have led to a “risk-off” sentiment, benefiting the JPY as investors look to reduce exposure to riskier assets. Additionally, concerns over U.S. economic stability have cast a shadow over the dollar, potentially encouraging a mild bearish tilt in USDJPY.

Key Drivers Influencing USDJPY

1. Bank of Japan’s Policy and Yield Curve Control

The Bank of Japan (BoJ) has remained consistent with its ultra-loose monetary policy, particularly its yield curve control (YCC) measures. However, with recent statements indicating potential tweaks to long-term interest rates, there is speculation that the BoJ may be open to slight policy adjustments to control inflation. A BoJ with even minor adjustments on the table could create downward pressure on USDJPY as expectations build for a stronger yen.

2. U.S. Federal Reserve’s Monetary Policy Outlook

The U.S. Federal Reserve’s approach remains a major influence on USDJPY. As markets anticipate that the Fed might pause or slow down its rate hike trajectory due to signs of slowing growth, this uncertainty around rate increases could dampen USD demand, thereby adding to USDJPY’s potential bearish bias. Any U.S. economic data releases today, such as inflation or consumer confidence indicators, could further impact USDJPY if they reflect economic cooling.

3. Risk Aversion and Safe-Haven Flows

Growing risk aversion in the global markets favors the Japanese yen, as it traditionally acts as a safe-haven currency during uncertain times. With geopolitical tensions and financial market uncertainty persisting, demand for the yen could increase, putting downward pressure on USDJPY. Investors often turn to the yen in times of volatility, and today’s market conditions support that trend.

4. Economic Data from Japan and U.S.

Economic data out of Japan has shown moderate improvement, suggesting the potential for a slightly stronger yen. Japan’s latest industrial output and consumer spending figures indicate resilience, adding support to the yen. Conversely, any soft U.S. economic data today could reduce USD appeal, enhancing a bearish bias for USDJPY.

Technical Overview

On the technical side, USDJPY is trading near key resistance levels, and a downward break could signal further declines. With momentum indicators such as the RSI showing overbought conditions, traders might see bearish opportunities if USDJPY breaks below the 20-day moving average. A drop below key support levels could further confirm a short-term bearish outlook for the pair.

Conclusion

The USDJPY outlook for today points to a slight bearish bias, fueled by risk aversion, potential policy tweaks from the BoJ, and moderate U.S. dollar weakness in the face of Fed uncertainty. While there are several factors at play, traders should monitor any significant data releases that could shift sentiment and impact the USDJPY trend.

This analysis is essential for traders focused on USDJPY’s short-term fluctuations amid shifting economic indicators and market sentiment.

---

SEO Keywords:

USDJPY analysis,

USDJPY today,

Japanese yen forecast,

USDJPY bearish bias,

Bank of Japan policy,

Federal Reserve outlook,

USDJPY risk sentiment,

forex trading USDJPY,

USDJPY technical analysis,

USDJPY trend.