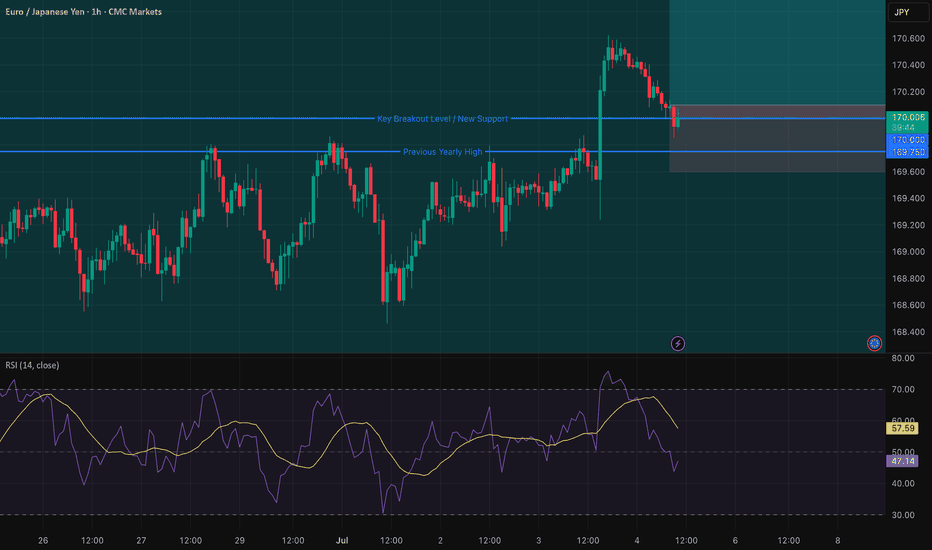

EUR/JPY: Bullish Setup on 170.00 Breakout & Dovish BoJWe've identified a compelling, high-conviction long trade setup on EUR/JPY, perfect for a limit order right now. This trade leverages a powerful combination of fundamental divergence and a confirmed technical breakout, setting the stage for quick execution and potential profit! 🎯💰

Fundamental Rationale: 🌍📊

Japanese Yen (JPY) Weakness: The JPY is under significant bearish pressure. 📉 The Bank of Japan's (BoJ) persistently dovish monetary policy, keeping interest rates at historic lows, creates a wide interest rate differential. This fuels "carry trades," where investors borrow low-yielding JPY to invest in higher-yielding currencies like the Euro, increasing JPY supply. Recent weak economic data, including a decline in Tokyo CPI, reinforces expectations that the BoJ will not hike rates in 2025. Additionally, a global "risk-on" sentiment diminishes the JPY's safe-haven appeal, leading to capital outflow and sustained Yen depreciation. 🐻📉

Euro (EUR) Stability: While the Euro isn't showing explosive bullish momentum, its relative stability provides a crucial counter-balance to the weakening Yen. 🇪🇺 The European Central Bank (ECB) is inclined to maintain its current policy, and recent Eurozone inflation data hasn't significantly altered expectations for further rate cuts in H2 2025. This steady footing, paired with the pronounced JPY weakness, creates a compelling bullish case for EUR/JPY. The Euro's role is to be a stable anchor against a fundamentally weak JPY, allowing the cross to climb. ⚖️

Technical Setup: 📊✨

Decisive Breakout Confirmed: EUR/JPY has achieved a powerful and decisive breakout above the critical psychological resistance of 170.00 and its previous yearly high of 169.75. This is a monumental technical event! Such a sustained move above key long-term barriers signals strong underlying buying pressure and confirms a "new trigger for the bulls," indicating a high probability of continued uptrend. 🚀⬆️

High-Probability Entry Strategy: Our entry strategy is designed for a quick and successful fill. Following the confirmed breakout, we anticipate a classic "breakout and retest" phenomenon, where price pulls back to retest the former resistance (now new support). By placing a limit order slightly below the current market price, at 170.10, we aim to catch this anticipated pullback, securing an optimal entry with a tighter risk profile. 🔄🎯

Clear Resistance Target: Our single Take Profit target is strategically set at 170.90, just below the next significant resistance: the 78.6% Fibonacci retracement level at 170.93. This level, derived from a previous long-term decline, represents a key area where price might encounter resistance. Targeting slightly below it increases the probability of the TP being hit before any potential reversal. 🎯✅

Trade Parameters: 📋✨

Currency Pair: EUR/JPY 💶🇯🇵

Direction: Long (Buy) ⬆️

Entry (Limit Order): 170.10

Take Profit (TP): 170.90

Stop Loss (SL): 169.60

Risk-Reward Ratio: 1.6:1 (A favorable ratio for a high-probability setup!) ✅

Jpyweakness

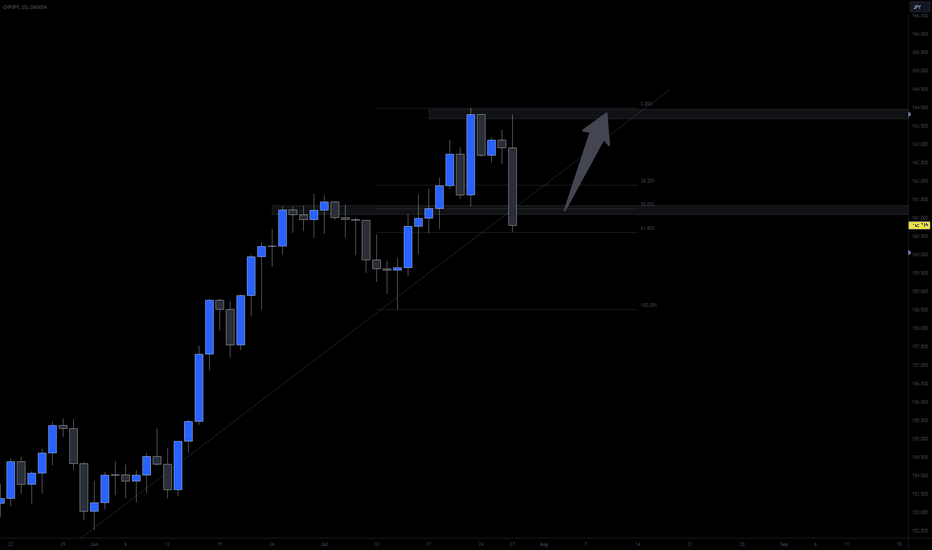

CHFJPY - Continuation Higher?Analysis:

Strong upwards trend (bullish confluence factor)

Break and retest of previous area of resistance for support (bullish confluence factor)

50% fib retracement touch (bullish confluence factor)

Upwards trendline touch (bullish confluence factor)

CHF is the 7th strongest major currency whereas the JPY is the 8th strongest major currency (bullish confluence factor)

2K short position increase for the CHF (bearish confluence factor)

27K short position decrease for the JPY (bearish confluence factor)

Comments:

Whilst some of the fundamentals go against our bullish thesis, we still have the technicals and some fundamentals pointing to bullishness on this pair. With the majority of the confluences we pay attention to pointing to bullishness and with the setup we see, we have enough confidence to have a bullish outlook on this pair. Only time will tell if we're correct but from what we can see currently, we see price continuing this bullish rally that it's in and heading higher.

Stay Safe - The JPI Team

Please feel free to leave any comments you have and like this idea if you agree with us. Any feedback or comments will be read and responded to. We any comments at all so thank you!

Disclaimer:

This does not constitute as financial advise. We are not responsible for any monetary loss that you endure. Trading is hard to be profitable with and we take losses just like everyone else does too. Our ideas won't always be correct which is why we urge you to always do your own analysis first before entering into the market but please feel free to use our analysis to assist you with yours.

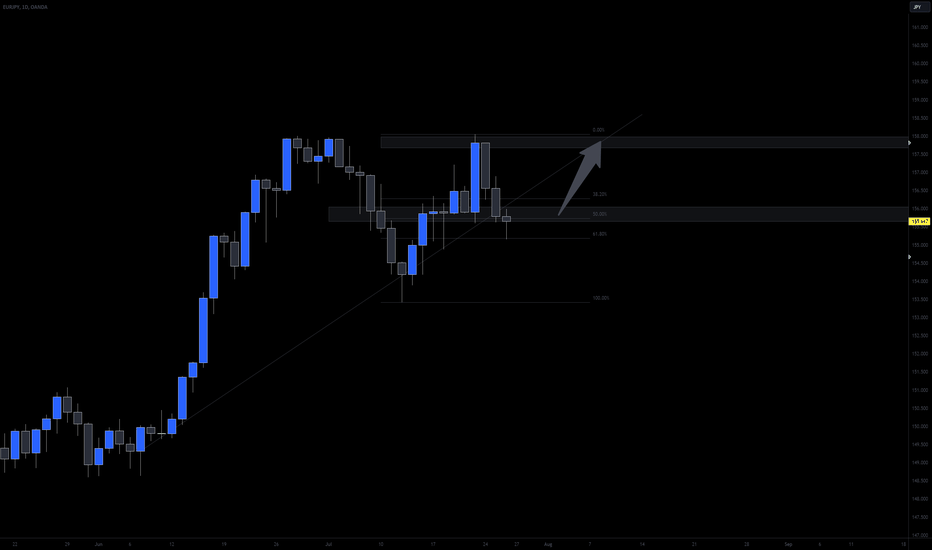

EURJPY - Will The Bullish Rally Hold?Analysis:

Strong upwards trend (bullish confluence factor)

50% fib retracement touch (bullish confluence factor)

Upwards trendline touch (bullish confluence factor)

EUR strongest major currency (bullish confluence factor)

JPY weakest major currency (bullish confluence factor)

40K long position increase for the EUR (bullish confluence factor)

27K short position decrease for the JPY (bearish confluence factor)

Comment:

Price has been heading higher and higher for ages and now we finally have a chance to enter. Lets see if this bullish rally will continue.

Please feel free to leave any comments you have and like this idea if you agree with us. Any feedback or comments will be read and responded to. We any comments at all so thank you!

Stay Safe - The JPI Team

Disclaimer:

This does not constitute as financial advise. We are not responsible for any monetary loss that you endure. Trading is hard to be profitable with and we take losses just like everyone else does too. Our ideas won't always be correct which is why we urge you to always do your own analysis first before entering into the market but please feel free to use our analysis to assist you with yours.

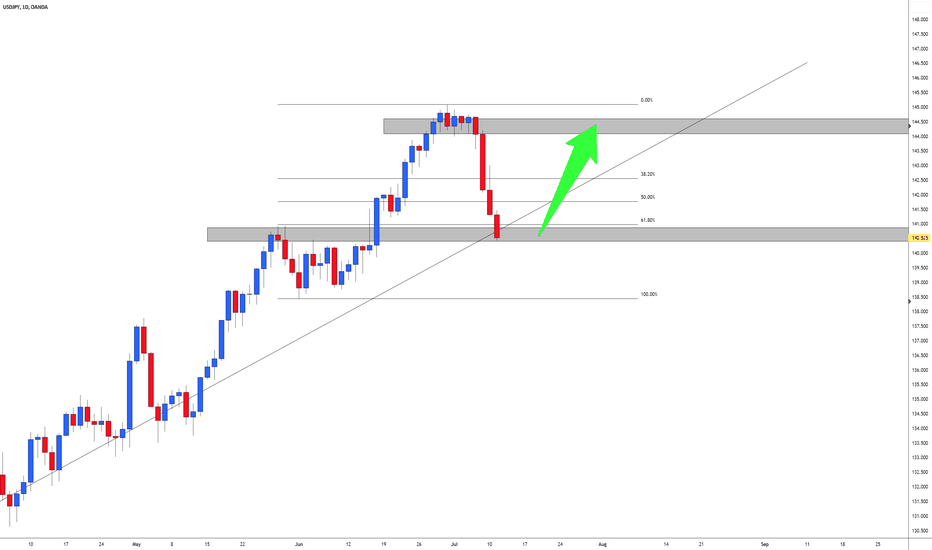

USDJPY - Is This Just A Healthy Pullback?Analysis:

Recently price has just been heading higher and higher on this pair, and we've been looking to catch this move for a while now but we needed to stay patient and wait for a pullback and that's exactly what we might have now. Price has pulled back to a key level of prior resistance and as we know, resistance often becomes support, so this is starting to look like a potential place to enter long. We're also still in an upwards trend as the most recent higher low hasn't been broken so this move to the downside is just a healthy pullback rather then a break of structure. At our area of previous resistance now turned support we also have the 61.8% fib retracement level which is often classed as the strongest fib retracement level so we'd expect that buyers would be sat at this area wanting to hold price and push it higher. On top of that we also have an upwards trendline touch, which acts as dynamic support, so we'd expect buyers to also be sat at this area wanting to hold price and push it higher. All of these technical confluences line up together and signal that this area could hold and provide bullish momentum so we like the look of this. We don't just have the technicals on our side but we also have the fundamentals too. Fundamentally the USD is the strongest major currency compared to the JPY which is the weakest major currency, so this massively goes in our favour. As of the most recent report for institutional positioning we saw the USD stay pretty bullish whereas for the JPY we saw an increase in long positions but we also saw an almost 2.5 times bigger increase in short positions compared to long positions opened. This signals that there is still more possible bearishness to come for the JPY, making it favourable to short rather then going long. With all of the technicals and fundamentals lined up together we have a very strong bias to the long side of USDJPY.

Please feel free to leave any comments you have and like this idea if you agree with us. Any feedback or comments will be read and responded to. We any comments at all so thank you!

Stay Safe - The JPI Team

Disclaimer:

This does not constitute as financial advise. We are not responsible for any monetary loss that you endure. Trading is hard to be profitable with and we take losses just like everyone else does too. Our ideas won't always be correct which is why we urge you to always do your own analysis first before entering into the market but please feel free to use our analysis to assist you with yours.