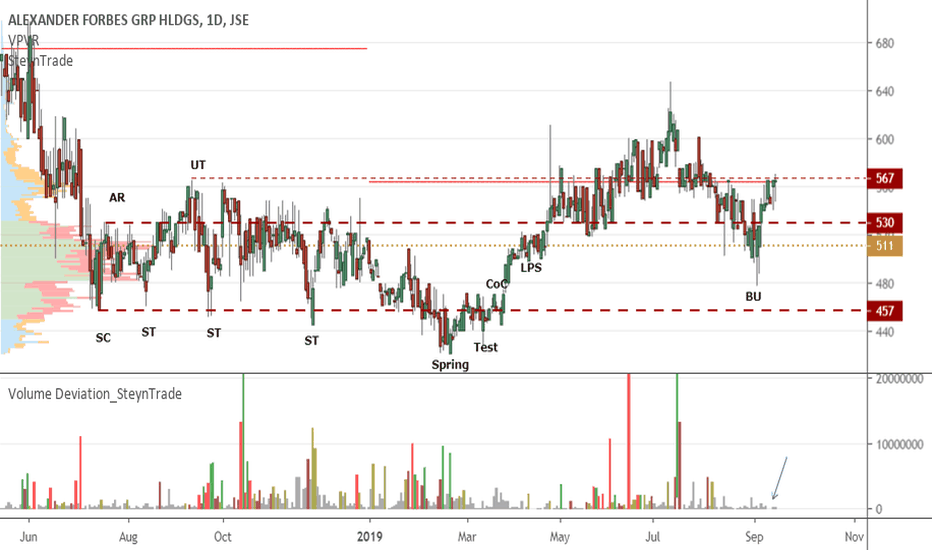

JSE:AFH Alexander Forbes Watch for the MarkupAlexander Forbes has backed up (BU) into the previous trading range (TR) but we see that volume is very low. It looks as if there is no supply left. Priced has moved back to the yearly pivot point (red line) where it previously found supply (at R2.60, see volume profile) but this time there is no supply. Watching next week if supply comes in or if we will see the markup start in phase E of the accumulation TR that started in 2018.

Jseafh

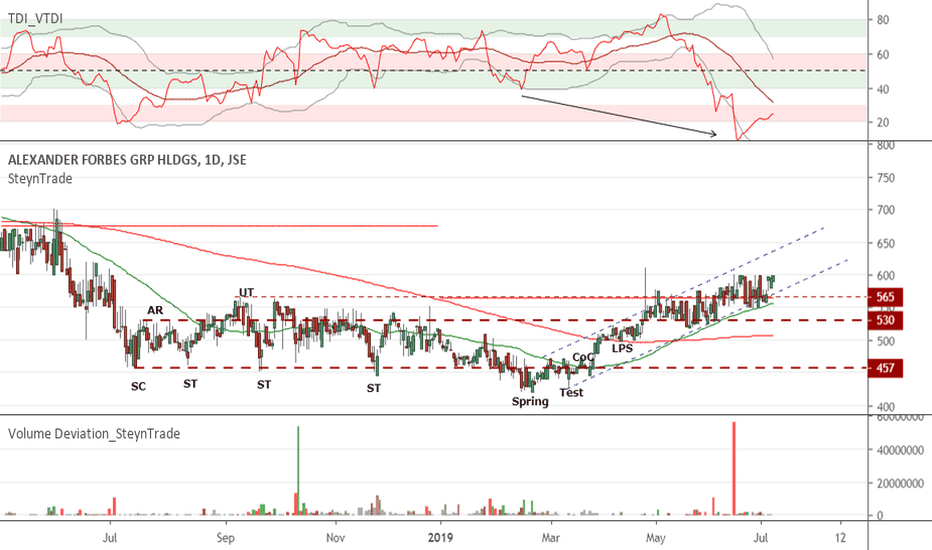

JSE:AFH Alexander Forbes Bucking the TrendI have been following the accumulation range of Alexander Forbes (See post below). Price has consolidated at the top of the TR, which is also the yearly pivot point. It has pushed above with some high volume selling pressure but remained above the TR (See the negative divergence with the volume RSI and volume spike). In spite of the week market conditions it still looks as if this is about to start the markup and is being defined by the 50 day MA and clear upward stride.

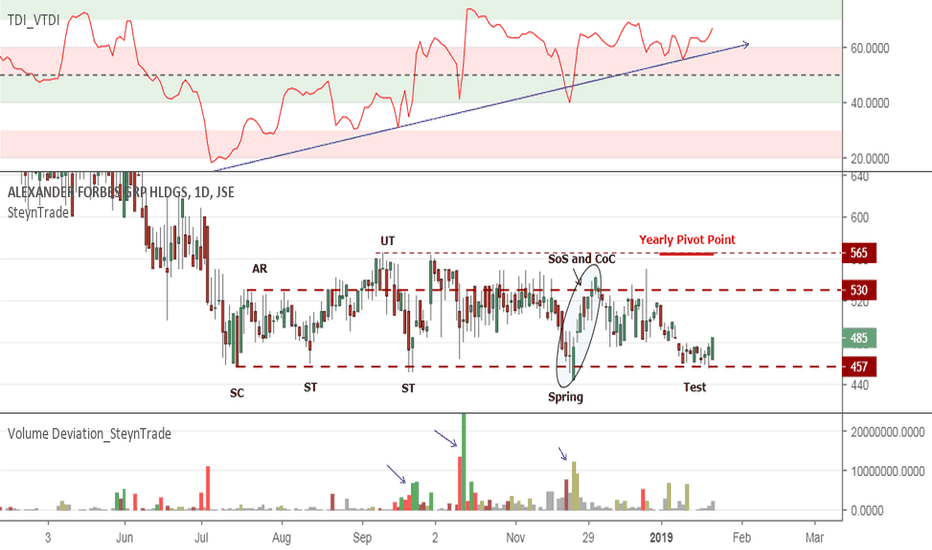

JSE:AFH Alexander Forbes AccumulationAlexander Forbes has been in a trading range which seems to be accumulation. Volume increases at the bottom of the range and divergence of the volume RSI show upward pressure (Effort without response). We have seen a Sign of Strength (SoS) and Change of Character (CoC) after a spring and currently a low volume test has occurred.