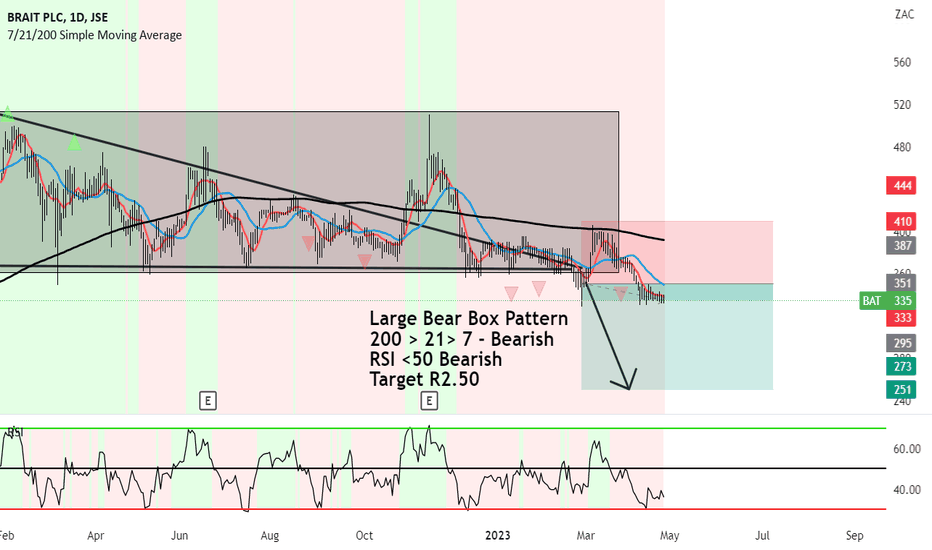

TRADE UPDATE: BRAIT Plc great company but still coming downLarge Bear Box Pattern formed and the price broke below.

The signs were showing downside to come.

But it's been a slow trade.

200 > 21> 7 - Bearish

RSI <50 Bearish

Target remains at R2.50

ABOUT THE COMPANY

Brait SE was founded in 1991 and is headquartered in Johannesburg, South Africa.

The company has a diversified portfolio of investments in various sectors, including healthcare, food, retail, and financial services.

The company has investments in several well-known brands, including Premier Foods, Virgin Active, and New Look.

The company has a market capitalization of approximately R4.4 billion as of April 2023.

Brait's largest shareholder is Christo Wiese, a South African billionaire businessman.

Brait's current CEO is John Gnodde, who has been with the company since 2014.

In 2015, Brait acquired a 90% stake in Virgin Active, one of the largest health and fitness club operators in the world.

Jsebat

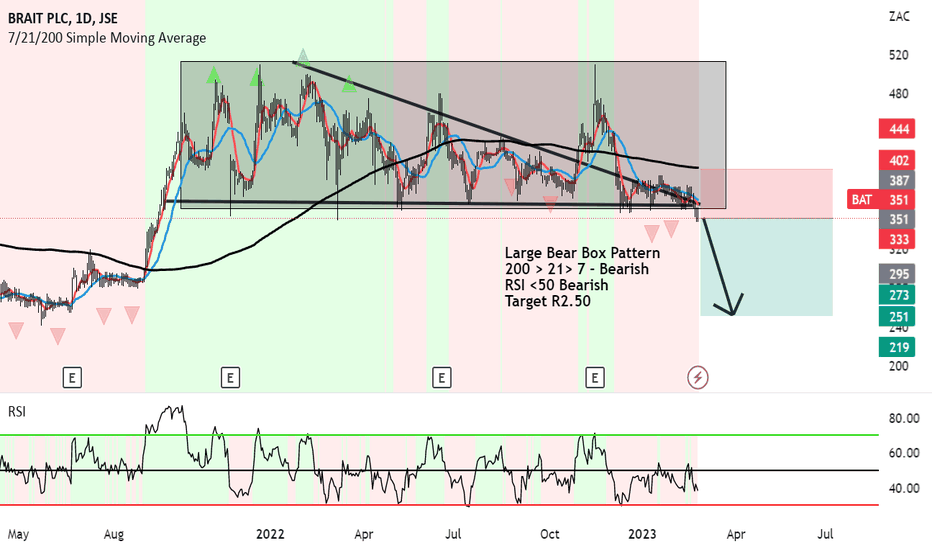

BRAIT showing strong downside to come to R2.50Large Bear Box Pattern formed over the last year with Brait.

And unfortunately it gets worse.

The Highs have become lower and lower accompanied by bearish indicators.

200 > 21> 7 - Bearish

RSI <50 Bearish

Target R2.50

WARNING:

The breakout was definitely not a strong one. So, if there are strong prospects and investors want to protect the company, it could very well be a fakeout. Until then it's bearish until the trend turns.

ABOUT BRAIT

BRAIT SE (Est. 1995 in Stellenbosch, South Africa) is an investment holding company listed on the Johannesburg Stock Exchange (JSE) and the Euro MTF market of the Luxembourg Stock Exchange.

BRAIT invests in a diversified range of businesses, including consumer goods, health and wellness, and technology, media, and telecommunications (TMT) sectors.

BRAIT has a global presence, with investments in South Africa, Europe, and the United States.

Here are some companies BRAIT has major investments in

Premier Foods - a leading food manufacturer in South Africa, producing a range of products under popular brands such as Blue Ribbon, Snowflake, and Manhattan.

Virgin Active - a global health and fitness club chain, with over 200 locations in the UK, South Africa, Italy, Spain, Portugal, and Australia.

Iceland Foods - a UK-based frozen food retailer, known for its value and convenience, with over 950 stores across the UK.

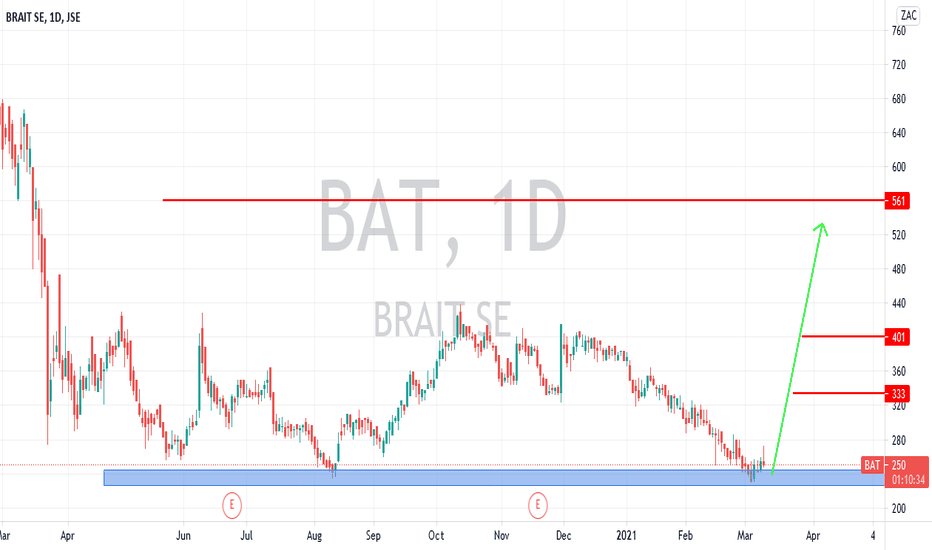

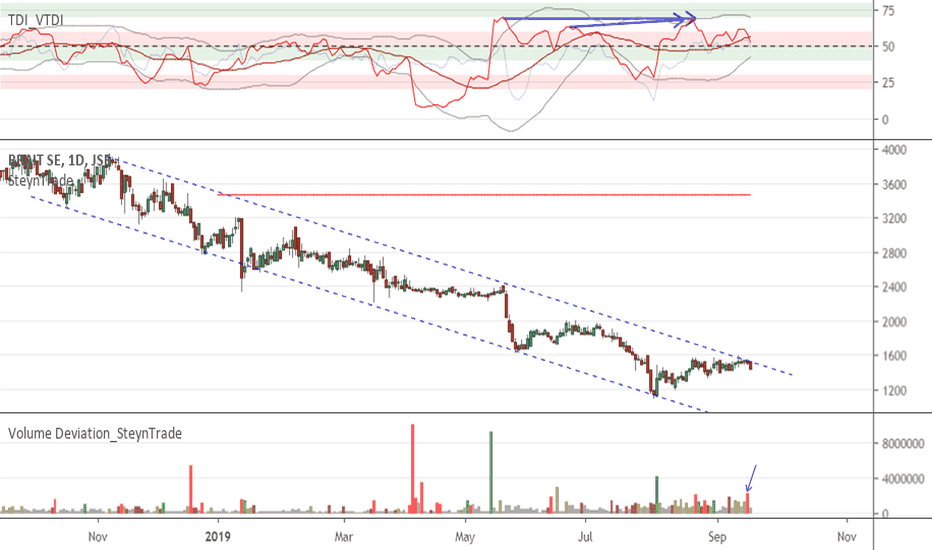

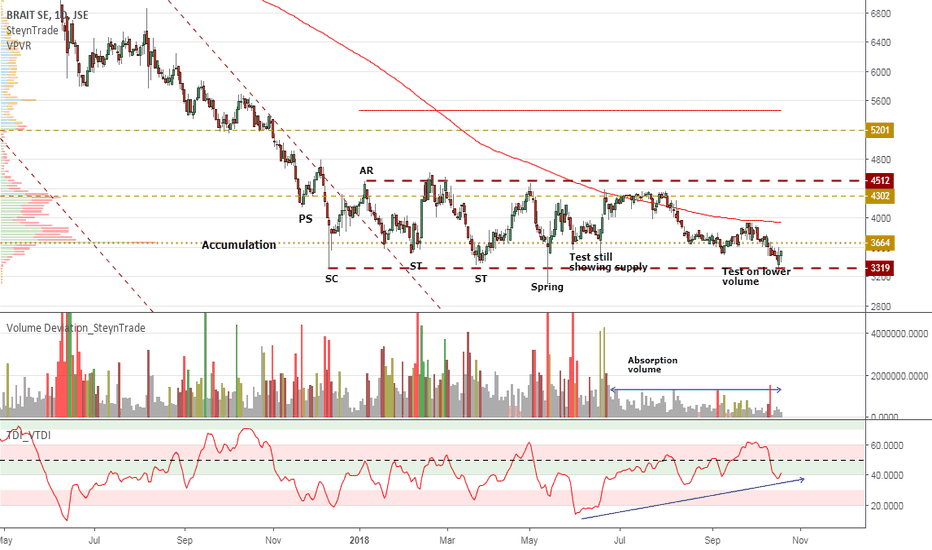

JSE:BAT Brait Short Term AccumulationBrait has been in a long-term downtrend. After a substantial redistribution in 2018, the markdown continued in 2019 with a smaller redistribution also forming. Now we have seen another range forming that has broken the downward stride of the recent markdown. Some volume on the rallies and a spring-like action has made me biased that this is a small accumulation range. This backup in the longer-term downtrend could take us back to the previous smaller redistribution range and possibly the larger redistribution range and yearly pivot point. Divergence on the volume RSI also points to a short-term rally.

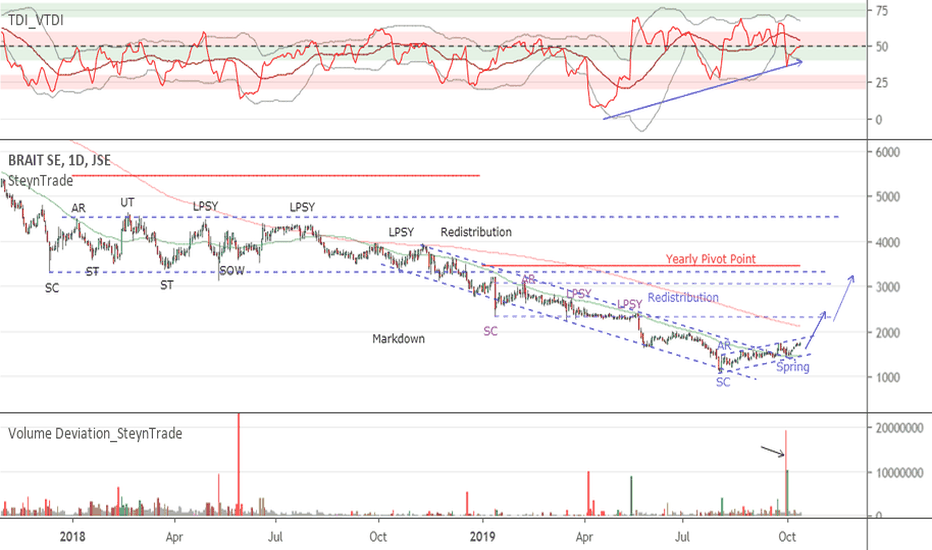

JSE:BAT Brait still waiting to see the change of characterSince last months Wyckoff evaluation of the trading range (see link below) we are still waiting to see a change of character signalling that the creek will be jumped. Price has tested the bottom of the trading range on low volume indicating that supply has dried up. Volume has been low since the previous high volume test of the bottom of the trading range. Divergence with the Volume RSI indicates the upward pressure in the stock. It now looks that the stock could be ready to be marked up with in the trading range to test and potentially break the top of the trading range.