Royal Merchant Bank About To Break?Royal Merchant Bank (RMB) Holdings is an investment company, with its main holding being a 34% interest in FirstRand Bank Limited, one of southern Africa’s premium banking groups. The group’s history can be traced back to the consolidation of Rand Consolidated Investments and Rand Merchant Bank in South Africa in 1987, giving the group a wide interest in the financial services sector. RMB Holdings shares were listed for sale on the Johannesburg Stock Exchange (JSE) in 1992 and the group currently trades under the ticker RMH, with a market cap of R78 billion.

The group has a significant influence on FirstRand Bank (which has a market cap of R 300 billion) through non-executive representation on boards, in line with RMB’s decentralised management philosophy. FirstRand Bank currently has control of First National Bank, Wesbank, Royal Merchant Bank and Ashburton Investments.

The group recently announced that it will expand its current single investment in FirstRand through the purchase of a 25% stake in leading South African property group Atterbury.

Technicals

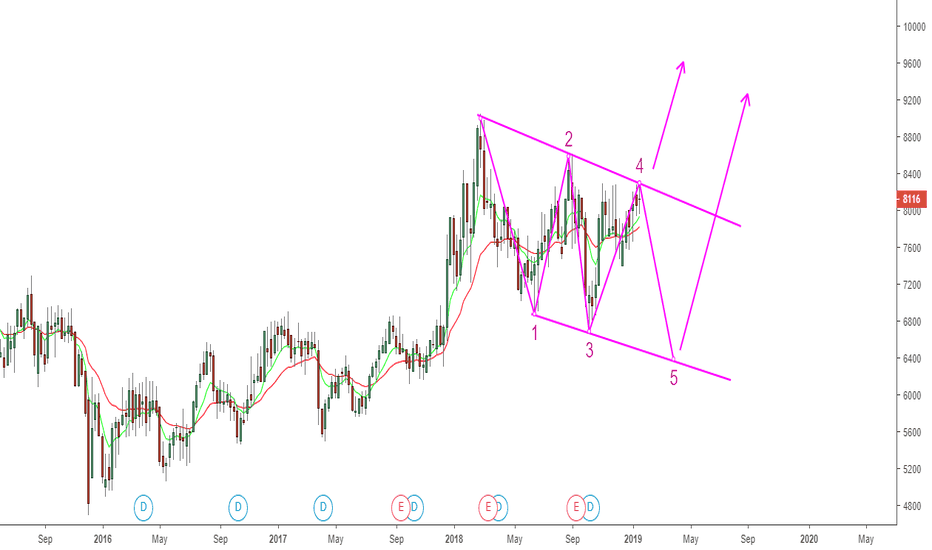

This is a bullish corrective structure and is currently trading at the top of wave 4. Should the structure break to the upside now, there are good targets but the possibility of wave 5 to the bottom of the structure does exist. I will be watching lower time frames for an entry signal.

Jsermh

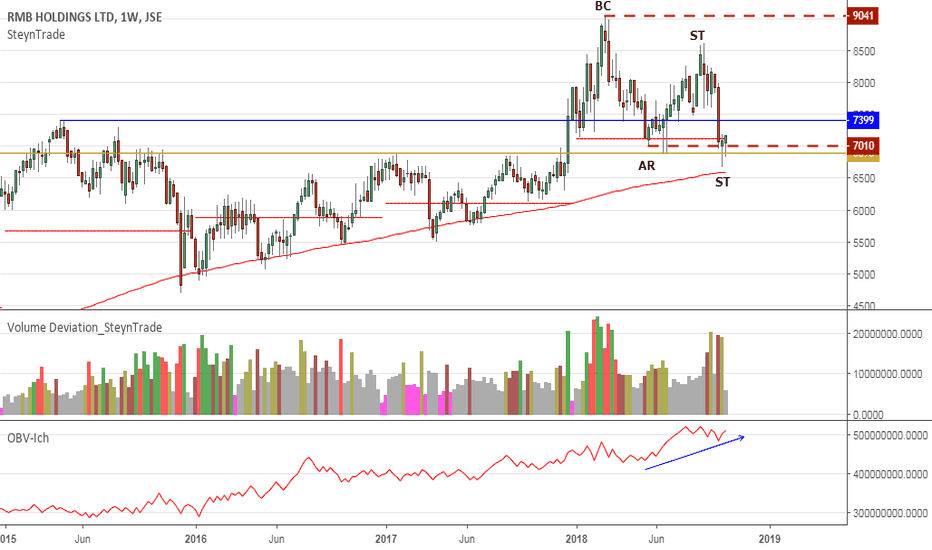

JSE:RMH RMB Holdings Re-accumulation rangeFollowing on from September's evaluation (See link below) the following. The pullback after the breakout seem to be a formation of a new trading range. Following the Wyckoff logic the breakout was on relatively high volume and the pullback to the previous trading rang a Automatic Reaction (AR). We have had another test of the bottom of the new trading range with demand again stepping in at this level. With the Rand (ZAR) strengthening this gives more confidence to this evaluation. With high volumes at the bottom of the new trading range it could be and indication that this is a re-accumulation trading range developing. For now we are looking at a test of the top of the trading range to see how it reacts.