Jsermi

RMI Is About To Make A MoveRand Merchant Investment (RMI) Holdings is an investment holding company with a portfolio of insurance and investment products targeted at the commercial, corporate, retail and public sector. The group’s history can be traced back to 2010 with the spinning off of insurance assets from Rand Merchant Bank (RMB) Holdings, FirstRand and Remgro. RMI Holdings shares were subsequently listed separately on the Johannesburg Stock Exchange (JSE), although RMB Holdings and RMI Holdings still share the same management team.

Technicals

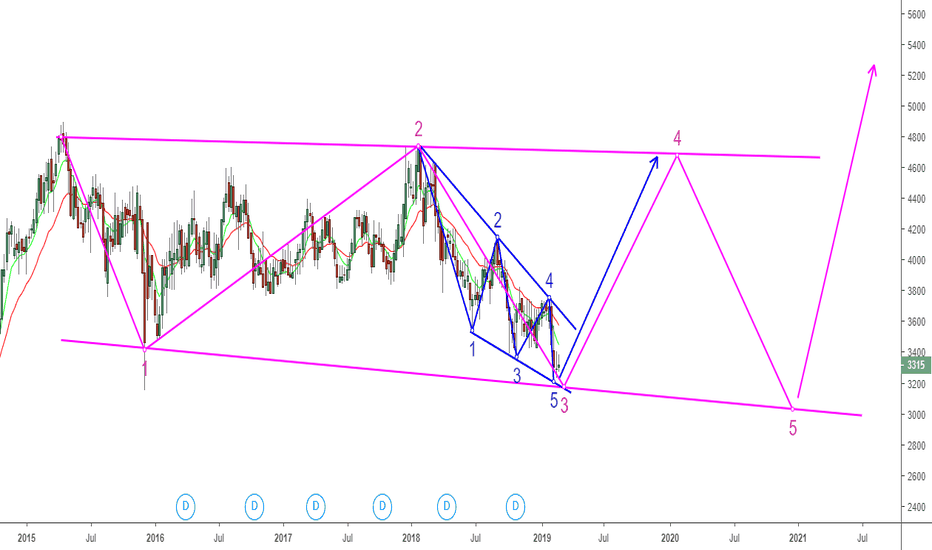

On the weekly time frame, we can see a corrective structure formation, indicated in pink. The daily time frame, indicated in blue, shows a 5 wave corrective structure which has completed. This would indicate that there should be a break to the upside soon. This break will be the start of wave 4 on the weekly structure.

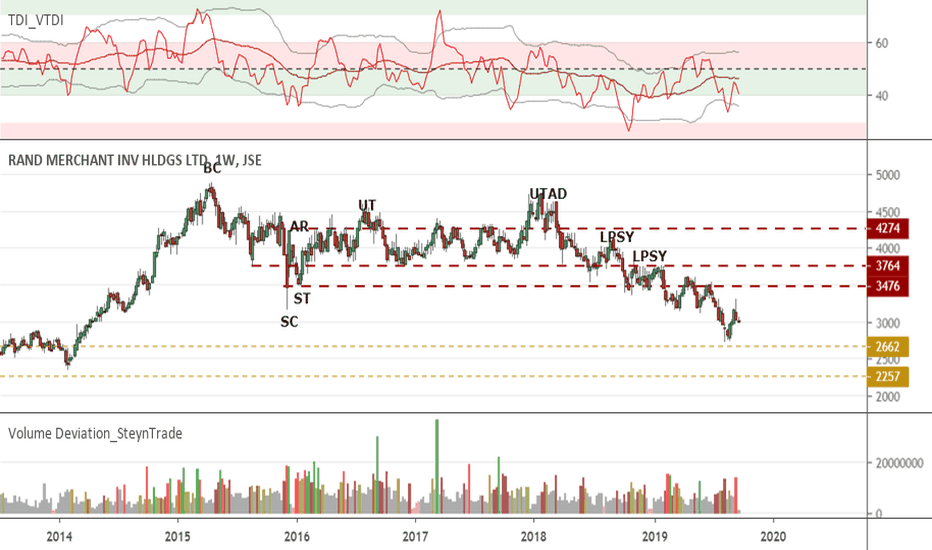

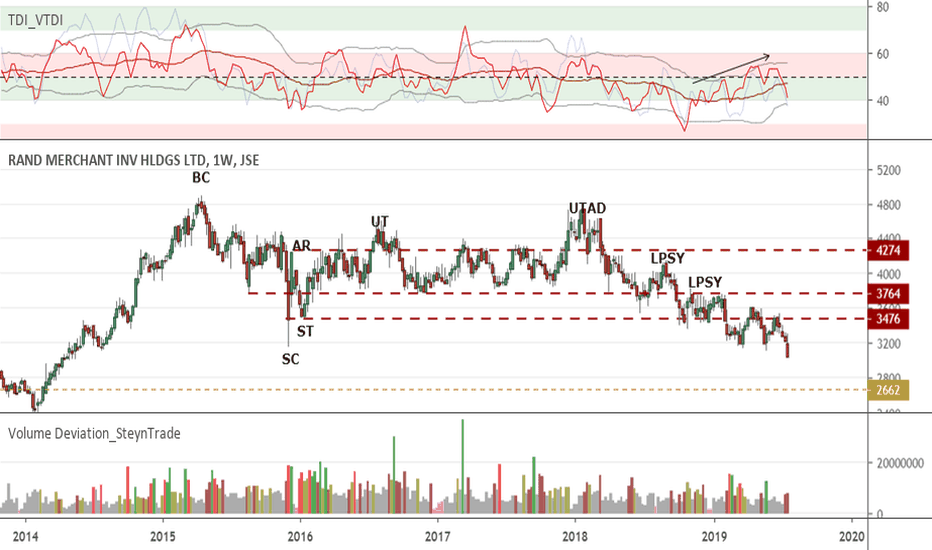

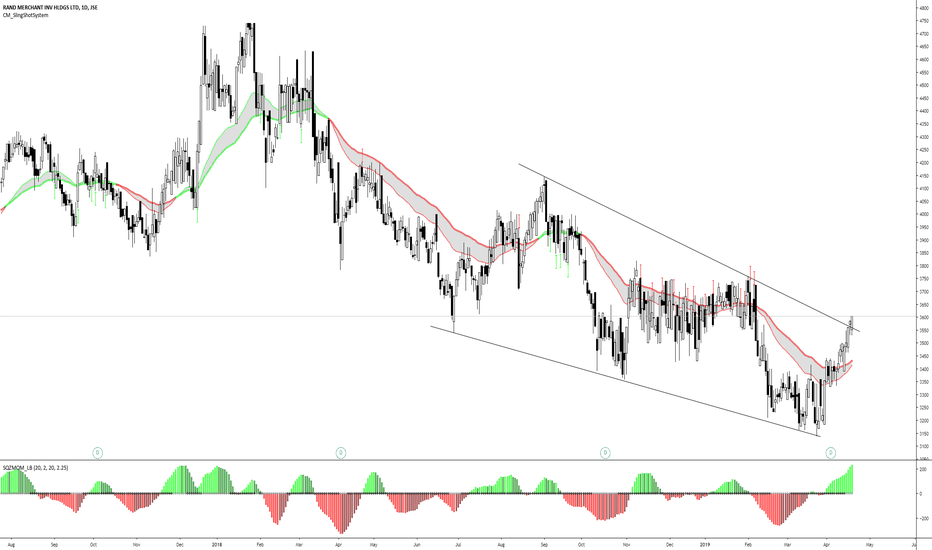

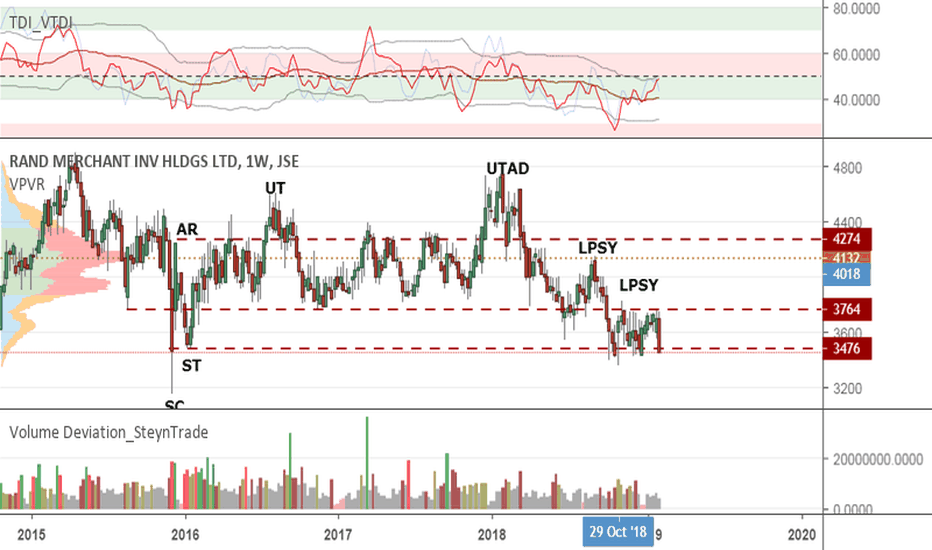

JSE:RMI Rand Merchant Investments Markdown to start?Last year I followed the distribution pattern on RMI (See post below) which now seems to be completing. Price had found support at the at the bottom of the Trading Range (TR) but was unable to rally back the top of the TR. After some consolidation, we see a change of character bar (Significant reversal bar). RMI could now be ready to break out and start the markdown.

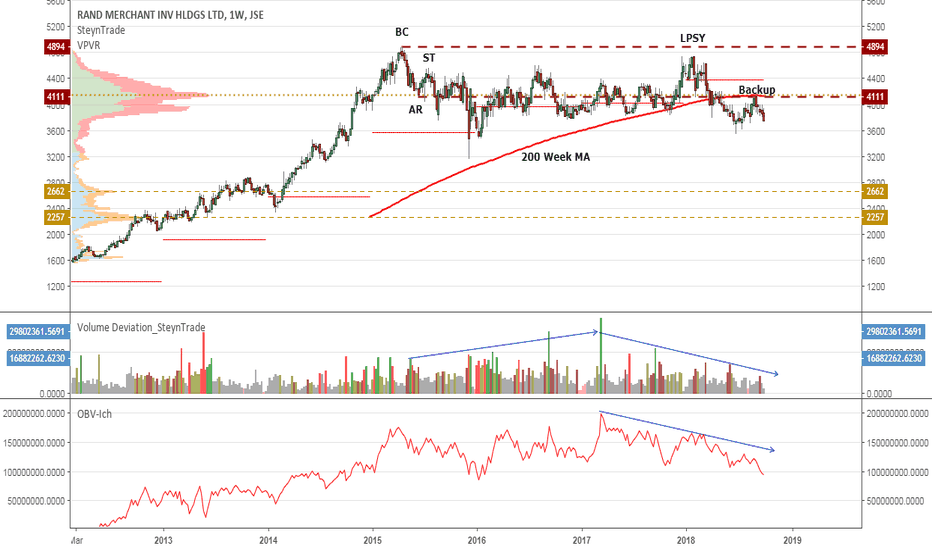

JSE:RMI Rand Merchant Investments DistributionRMI has been looking week since April 2015. After the Buying Climax (BC) and Automatic Rally (AR) was formed the stock has been week and kept moving below the trading range. After some last effort to move to the top of the trading range we see volume drying up indicating that the large players have completed the distribution after the initial increase in volume. The OBV has shown divergence with the price. After breaking the 200 Week MA was broken and retested it looks like the stock is ready to be marked down. The next significant points of interest could be as low as 2662 or even 2257 which is about a 30% decrease in price.