Keurig Dr Pepper Holds Steady Ahead of Quarterly EarningsKeurig Dr Pepper (KDP) shares have shown resilience in recent weeks, climbing 5.9% over the past month while the broader S&P 500 declined by 6.9%. The beverage giant currently trades at $35.40, up $0.29 (0.83%), with 13.96 million shares traded. Analysts maintain a consensus "Hold" rating as KDP approaches its upcoming earnings announcement.

Wall Street expects the company to report earnings of $0.38 per share, unchanged from the year-ago quarter, while revenue is projected to reach $3.56 billion, representing a 2.8% year-over-year increase.

The company has seen minor positive revisions to its earnings estimates, with consensus EPS projections increasing by 0.1% over the past 30 days. This modest upward adjustment could signal improving analyst sentiment about KDP's near-term performance.

Breaking down the revenue expectations by segment, analysts forecast U.S. Refreshment Beverages will lead growth at $2.23 billion, up 6.6% year-over-year. Meanwhile, U.S. Coffee is expected to contract slightly to $884.51 million (-2.9%), and International sales may decrease to $448.32 million (-3.4%).

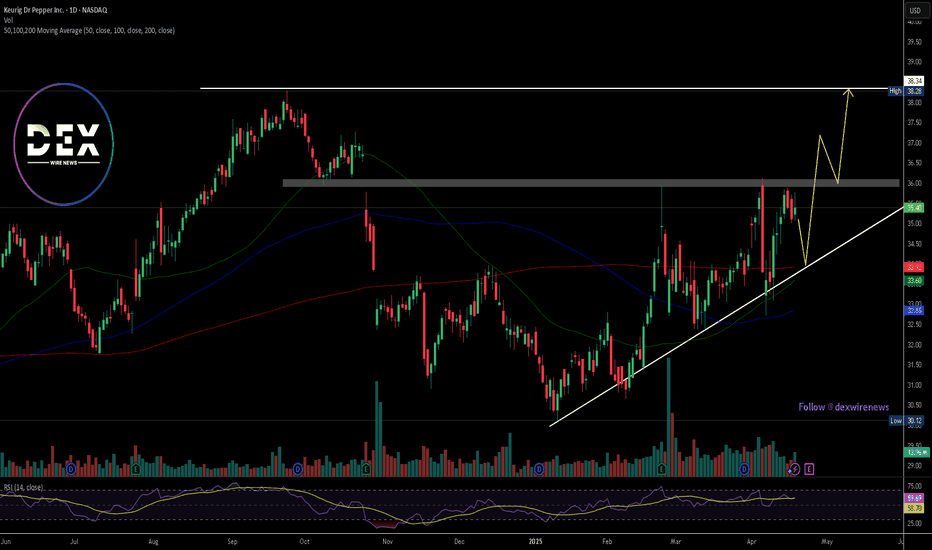

Technical Analysis

From a technical perspective, KDP has established an ascending trend line since reaching a low of $30.12. The stock currently trades above both its 50-day, 100-day and 200-day moving averages, suggesting positive momentum. The chart shows resistance around the $36 level, with support at the trend line near $33.60. Trading volume has increased during recent uptrend, potentially indicating stronger buyer conviction.