BULLS GET PAID & BEARS GET PTSD (welcome to 2020 bull market) Good evening -Yurlo 👍

(Please like/comment if you like the visuals & perspective I've shared with you today on (btsusd) $BITCOIN.

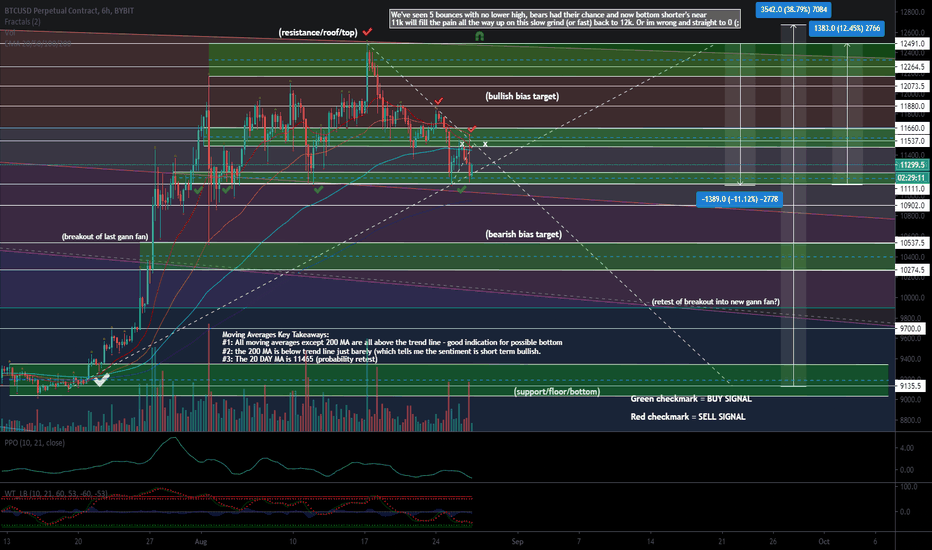

Market psychology plays a huge roll in the markets and what the next move will be, and most people don't think about this which could be playing a role in why they aren't a profitable trader yet.

Most people are forgetting we haven't even had a PROPER retest of the prior historical resistance that has been flipped into support. (any bounce from 9595 - 10550 would be VERY bullish in my opinion)

Do we need to retest these levels? Probably not considering all bears are targeting this price and targeting a price below a 2 year downtrend that got flipped into support would be silly.

Bears have had their chance to create a lower low but failed, now horny bulls run this shit back to 12k.

Screenshots to confirm all targets will be posted, along with updates and visuals as price action comes along.

Klp

SHORT TERM BOTTOM MAY BE IN (11675 target #1) BULL DIVERGENCEGood afternoon -Yurlo

(I hope you're all having a great day, please hit that like button if you appreciate the visuals I've provided for you today)

Trend-line takeaways:

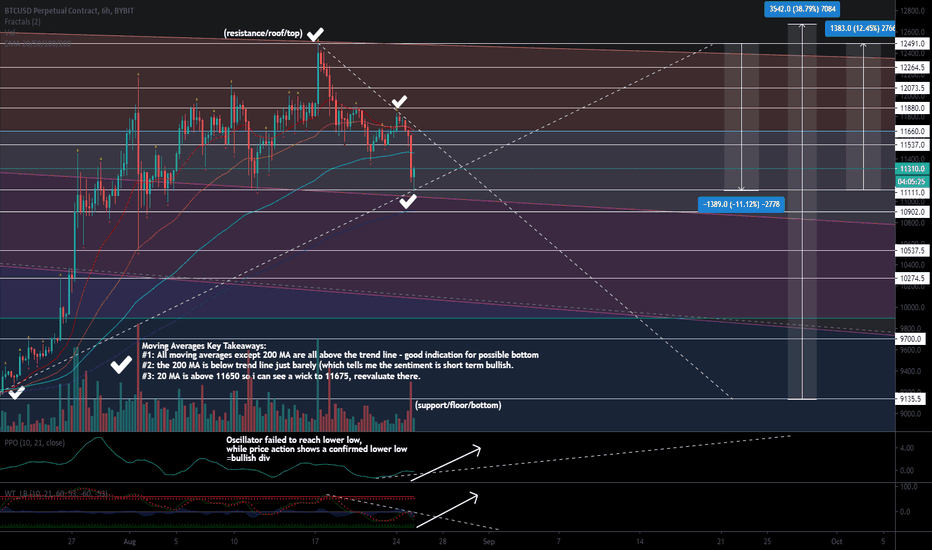

#1: Uptrend - 2 validation points - since the 9250 break to trigger the prior rally, we haven't even tested any area of interest (key support levels that liquidity pools would be in) - we've broken the 10500 resistance (historical bear trend resistance) - (over 2 years) - We've been over this support level for 30 days roughly.

#2: Downtrend 2 validation points - 12495 is the current top - we hit the 0.618 fib level 12500 (ZONE), and now we're currently ranging between 0.5 and 0.618.

I think it's likely we see 9600 - 10250, but I feel we'll possibly bounce from here considering the lower lows but failing to reach a lower low on oscillator (bull div),

thus why short term target 11675 - followed by reevaluation and watching levels closely at that range. I'll be looking for exhaustion from bulls (toppy) or momentum from bulls (possibly break the 12.1k & 12.4k top.

Moving Averages Key Takeaways:

#1: All moving averages except 200 MA are all above the trend line - good indication for possible bottom

#2: the 200 MA is below trend line just barely (which tells me the sentiment is short term bullish.

#3: 20 MA is above 11650 so i can see a wick to 11675, reevaluate there.

Low leverage, low risk, sticking to your plan & TA, consistency, discipline, focus,and balls to the floor with learning is what it takes to make it in this space.

Don't chase the market, let the market come to you.

FOMO is psychologically designed to make you feel as if you're missing you on a once in life time opportunities. (this is false) - the market does things PURPOSELY to trap you into thinking theres no way it turns around and goes the other way (they hold) then get rekkt.

"The market is a tool to take the money from the impatient to the patient pockets"

Stay safe.