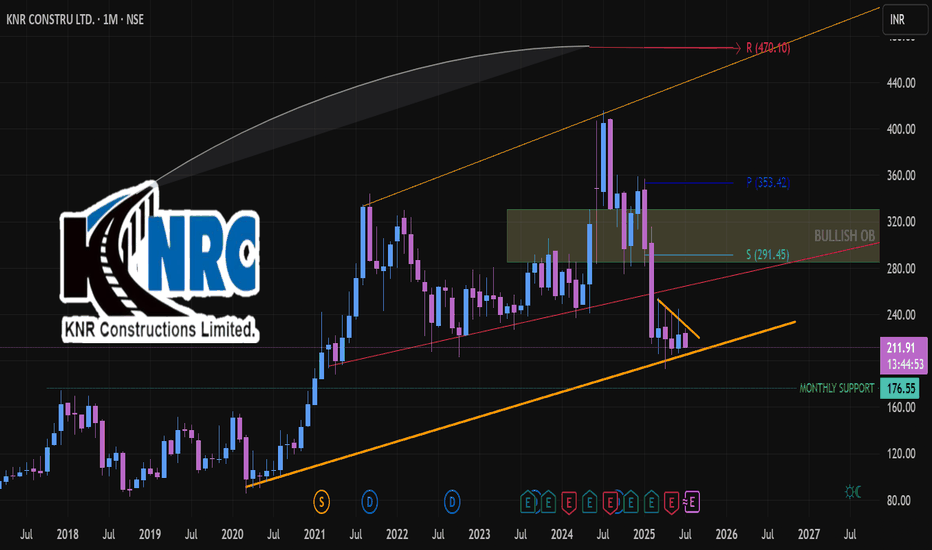

KNR Construction on the Highway to Resistance NSE:KNRCON 1M TF

🏭 INDUSTRIALS

(Infrastructure/Manufacturing – Govt Capex Tailwinds)

Hyderabad-B’luru Highway Contract-FIIs ↑2.7%

At the time of charting NRC was trading at 211

Trend 1M TF: Multi-year upward channel intact (orange lines), but price currently near the lower channel support.

Key Levels:

Immediate support: ₹176–180 (monthly support zone).

Resistance levels: ₹291–295 (Bullish Order Block + pivot S), then ₹353 (P) and upper channel resistance ₹470.

Structure: Price has been in a descending wedge (mini downtrend) within the bigger channel → typically a bullish reversal pattern.

Previous big red candles show capitulation; recent candles show reduced selling pressure → possible accumulation.

strong hands absorbing supply.

Breakout confirmation: Monthly close above ₹230–235 would validate wedge breakout and bring ₹291–353 in play.

📊 3. Fundamental Alignment (FA)

Macro context:

KRC operates in infrastructure/industrial RE/parks (if Krishnagiri/K Raheja Corp Ltd). Sector aligned with capex cycles and logistics growth in India.

Government push for Make in India, manufacturing, and warehousing supports demand.

Valuation: After a deep correction, valuations are at the lower end of historical range, making it attractive for long-term investors.

🧰 4. Strategic Outlook

►we'll follow this trade closely and within incoming week we'll up a close up view of 4h TF

Bias: Bullish reversal bias as long as ₹176 monthly support holds.

Accumulating around ₹185–211 zone.

Alternate scenario: Breakdown below ₹176 on volume → price could retest ₹150–140 support zone.

Always DYOR

See you on the other side

💡 Reflective Close

"Multi-year support zones often define💰trades for patient investors. Are you ready build positions when the market narrative is still fearful?"

Knrconstrctions

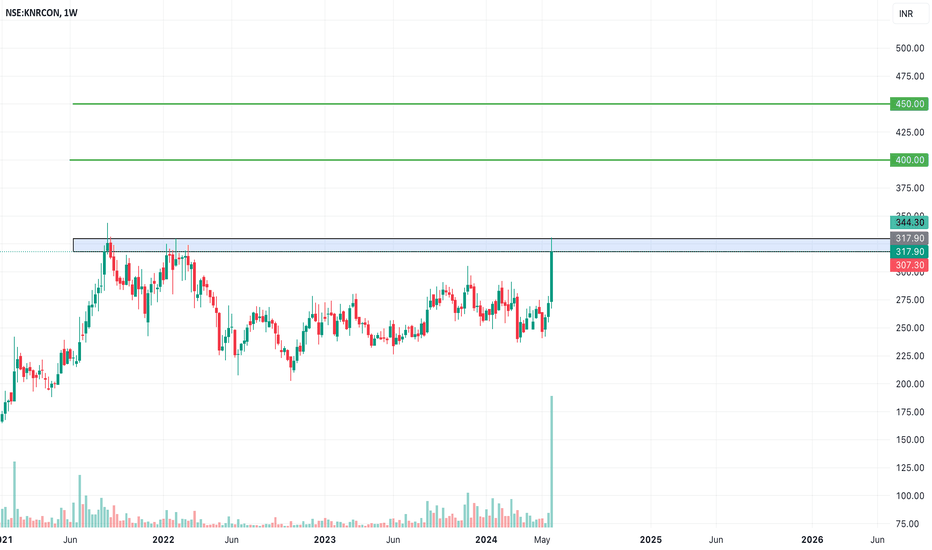

SWING IDEA - KNR CONSTRUCTIONSKNR Constructions , a leading infrastructure development company, is showing technical signals that suggest a potential swing trading opportunity.

Reasons are listed below :

325 Zone Tested Multiple Times : The 325 level has been a significant resistance zone. The price is now attempting to break through this level, indicating strong bullish momentum.

Bullish Marubozu Candle on Weekly Timeframe : The recent formation of a bullish marubozu candle on the weekly chart indicates strong buying pressure and suggests potential for further upward movement.

50 EMA Support on Weekly Timeframe : The stock is finding support at the 50-week exponential moving average, reinforcing the overall bullish sentiment and providing a strong support level.

Breaking Out of a 3-Year Consolidation Zone : KNR Constructions is breaking out of a long consolidation phase that lasted for 3 years, signaling a potential new bullish trend.

Sudden Surge in Volumes : A noticeable increase in trading volumes confirms the strength of the price move, indicating strong investor interest and participation in the current trend.

Trading at All-Time High : The stock is trading at its all-time high, suggesting strong market confidence and potential for further gains. However, traders should watch for potential overbought conditions or profit-taking at these levels.

Target - 400 // 450

Stoploss - weekly close below 265

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

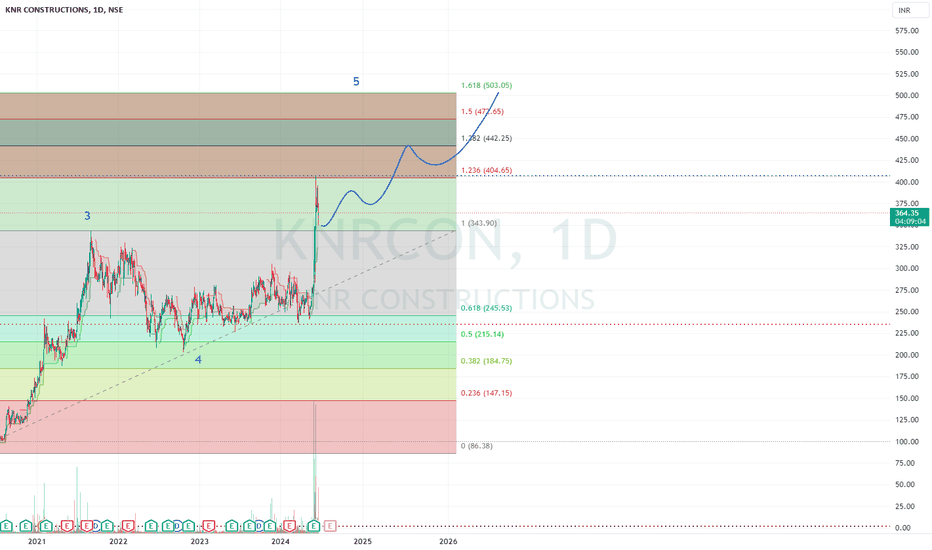

How to trade KNRCONS for 1 year timeKNR Constructions, now at 364.5 on June-20-2024 ::

Per Elliott wave, this is in Wave5,

Uptrend of wave5 confirmed at 344

There wil be 20% swing in this but ultimately will move higher

Targetsprices are --1. 404.65, 442.25, 472.65, 503

So, expected gains of 40% from present price.

Support now is till 344

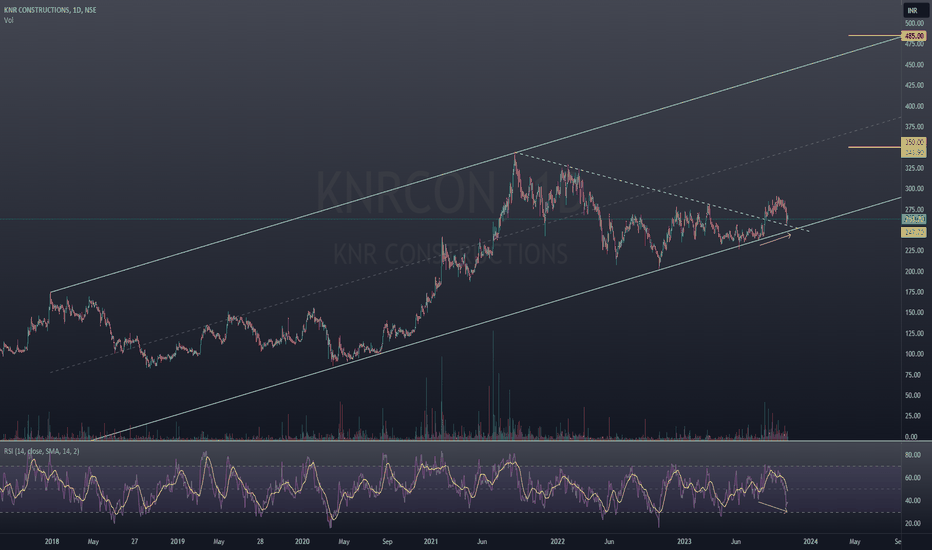

KNR Construction Ltd trend analysisAs you see the price is moving inside an ascending channel.

It broke out of trendline resistance in August and now retested for potential upside.

RSI is adding more confluence by showing strong bullish divergence.

It is currently trading at a forward PE of 14+ whereas the industry PE is around 28.

A gem amongst its peers with robust fundamentals.

Do check its fundamentals to see how steadily reserves and EPS are growing.

Good to buy at CMP with stop loss at 240 for following targets.

Short term swing target @ 350 (32.7% ROI with 3.64 R:R)

Medium term swing target @ 485 (84% ROI with 9.34 R:R)

It definitely has the potential to achieve 700+ level in long term, will update once it achieves the medium term target.

I don't think stop loss is required.

As always do your own due diligence before taking any action.

Peace!!