LDO/USDT — Testing the Downtrend Line: Breakout or Rejection?Summary

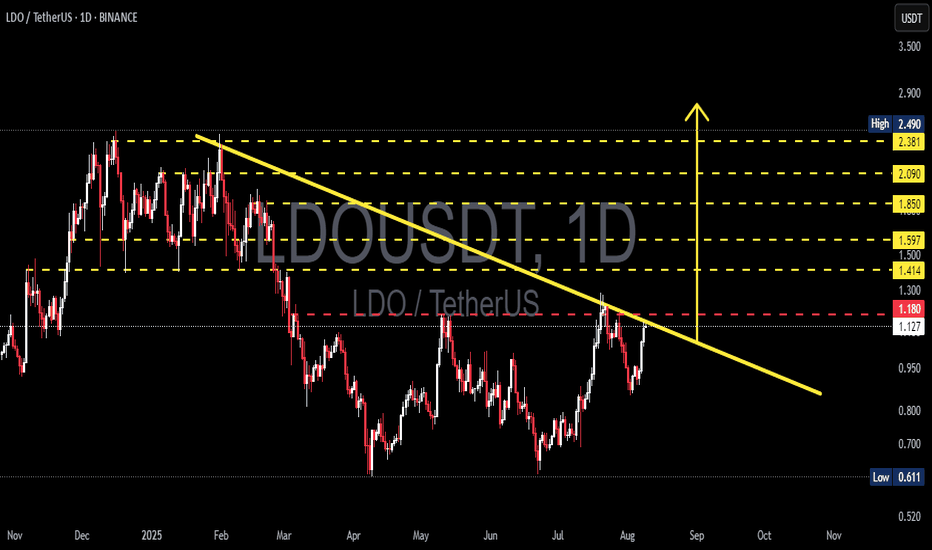

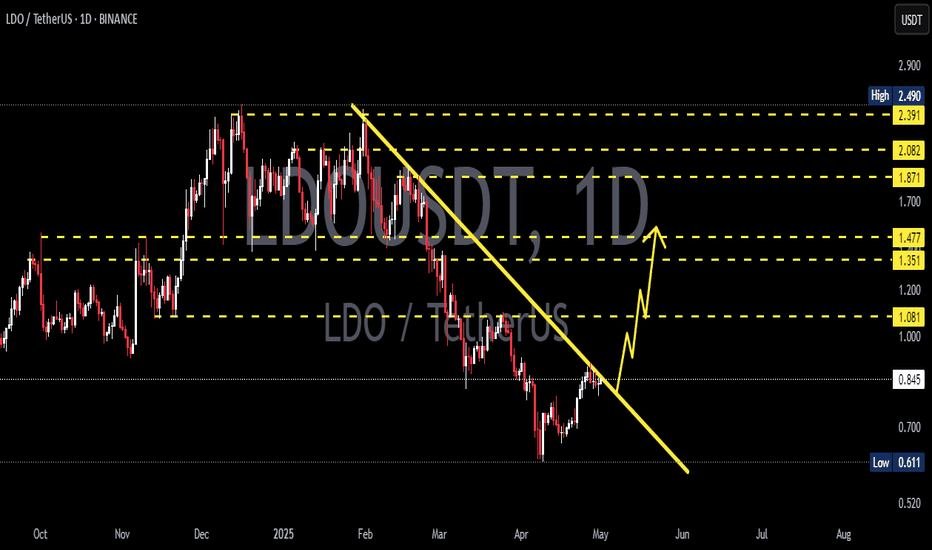

LDO price is currently testing the descending trendline (yellow) connecting this year’s major highs. This zone coincides with a key horizontal resistance around 1.18–1.30. Price action in this area will determine the next move — either a sustained breakout towards higher supply zones or a rejection leading to renewed bearish pressure.

---

Key Levels (from chart)

Immediate resistance / quick supply zone: ~1.18 (red line) — short-term key.

Descending trendline (yellow): dynamic resistance, currently intersecting near 1.18–1.30.

Staged resistance targets (yellow dashed lines): 1.414 → 1.50 → 1.597 → 1.85 → 2.09 → 2.38 → 2.49.

Main supports: 0.95–1.00 (intraday), and major swing low 0.611.

---

Pattern / Structure Analysis

Mid-term trend — bearish: a clear series of lower highs since the start of the year, marked by a descending supply line.

Current condition — accumulation pressure: after months of sideways consolidation, price is rallying into trendline resistance — often a decisive point leading to either breakout or rejection.

No clear classic reversal pattern (e.g., full inverse head & shoulders) — more of a trendline test after consolidation.

Volume and daily close confirmation are critical to avoid false breakouts.

---

Bullish Scenario (requirements for a valid bullish setup)

Bullish trigger (confirmation):

1. Daily close above trendline + above ~1.30 (body close, not just wick).

2. Rising volume during breakout, showing strong buying participation.

3. A successful retest of the trendline as support after breakout for safer entry.

Step targets after confirmation:

Target 1: 1.414 — partial profit zone.

Target 2: 1.50 – 1.597 — mid-term resistance.

Target 3: 1.85 – 2.09 — major supply zone; if momentum remains, extend to 2.38 – 2.49.

Risk management:

Initial stop-loss below retest area or under 0.95 (adjust to position size).

Consider trailing stops for strong momentum moves.

---

Bearish Scenario (rejection / continuation)

Bearish trigger (confirmation):

1. Rejection at trendline: long upper wick + daily close back under 1.18 without volume confirmation on buying.

2. Increasing sell volume during rejection and follow-through.

Downside targets:

Target 1: 0.95–1.00 (intraday support).

Target 2: 0.80 (mid-level support).

Target 3: if breakdown continues, retest major low at 0.611.

Short strategy on confirmation:

Enter after rejection candle with volume confirmation; stop-loss above wick high / slightly above trendline.

---

Key Signals to Watch Before Entry

1. Daily close — avoid acting solely on intraday wicks.

2. Volume — breakouts without strong volume are prone to failure.

3. Retest confirmation — ideal for safer entries after breakout.

4. Broader market context — BTC/DeFi sentiment can accelerate or reverse moves.

5. Orderflow / on-chain / Lido news — large unlocks or updates may trigger volatility.

---

Trading Plan Highlights

Position sizing: risk only 1–2% of capital per trade.

Measured stop-loss: under breakout retest or under 0.95 for longs; above rejection wick for shorts.

Take profits in stages at resistance zones; avoid aiming for one all-or-nothing target.

Prepare a contingency plan for false breakouts.

---

Final Note

LDO is at a decision point — whether to break the yellow trendline or get rejected will set the mid-term direction. Wait for confirmation (daily close + volume + retest) before committing capital, and maintain strict risk control.

---

Hashtags (for TradingView):

#LDOUSDT #LDO #Lido #Crypto #TechnicalAnalysis #Breakout #SwingTrade #RiskManagement

Ldousdtsignal

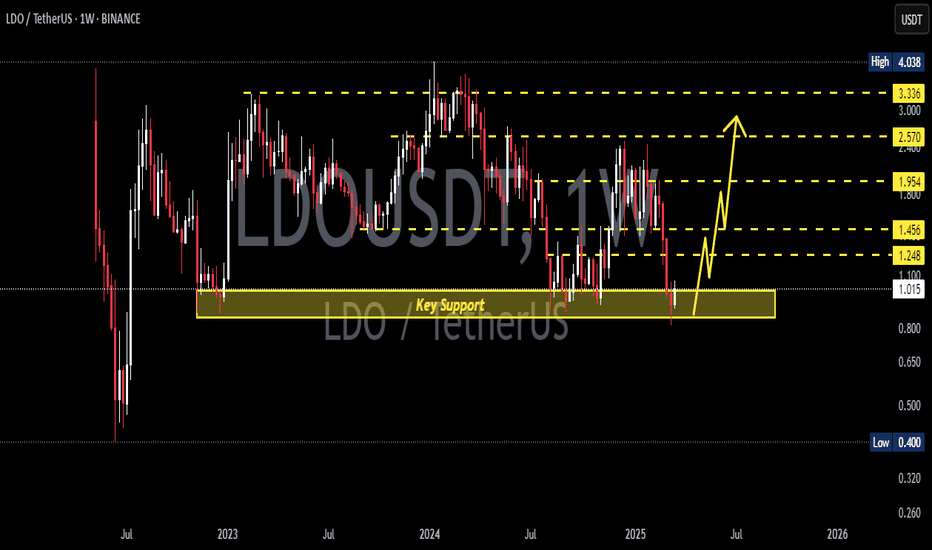

LDO/USDT Breakout Watch Ready to Fly After a Strategic Breakout?🔍 Full Technical Analysis

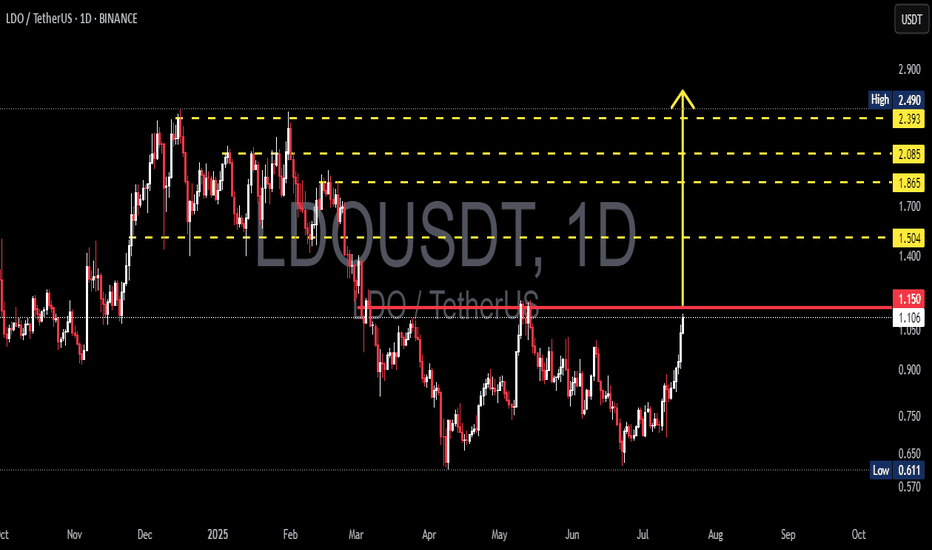

After months of downtrend and tight consolidation, LDO/USDT is showing clear signs of a bullish resurgence. The breakout above the key psychological resistance at $1.15 opens up a wide path toward higher resistance zones, potentially marking the beginning of a strong upward trend.

📐 Key Pattern Formed:

✅ Double Bottom Pattern

> Clearly visible from May to July 2025, with a neckline at $1.15. This is a classic bullish reversal pattern. The breakout above the neckline confirms the setup, projecting a significant upward move based on the measured height of the pattern.

✅ Horizontal Resistance Breakout

> The $1.15 level acted as a major resistance since April 2025. A clean breakout above it suggests that bulls are regaining control of the market momentum.

✅ Bullish Scenario (Primary Bias)

If the price successfully holds above the $1.15 zone and confirms it as support (successful retest), we may witness a bullish rally targeting the following levels:

🎯 Target 1: $1.504

— A minor resistance and previous consolidation area.

🎯 Target 2: $1.865

— A strong resistance level from earlier distribution zones.

🎯 Target 3: $2.085

— A technically significant level and key reaction point from past price action.

🎯 Target 4: $2.393 – $2.490

— A major supply zone and swing high from early 2025. This serves as the potential final target of the current bullish leg.

🟢 Volume increased during the breakout — a strong confirmation signal that this move is genuine, not a fakeout.

🟢 RSI likely gaining strength — though not shown on this chart, momentum indicators are likely supporting the move with a breakout from neutral levels.

❌ Bearish Scenario (If Breakout Fails)

If the price fails to hold above $1.15 and drops back below $1.05:

🔻 Potential Fakeout Risk

— A correction could send LDO back to:

Minor support at $0.90

Base support at $0.75

Major support at $0.611 (2025’s low)

📉 A breakdown below $0.611 would invalidate the bullish structure entirely, putting LDO back into a strong downtrend.

📊 Final Thoughts:

> LDO/USDT is at a critical decision point. A clean breakout from a strong medium-term structure opens the door for a significant bullish continuation. With pattern confirmation and strong volume support, this setup could mark the beginning of a mid-term uptrend.

The key lies in holding above $1.15 and watching for a healthy retest. This is a premium setup for swing traders and trend followers looking for early entries before a possible major move.

🧠 Trading Tips:

✅ Ideal Entry: On successful retest around $1.15 – $1.10

❌ Stop Loss: Below $1.00

📈 Targets: $1.50, $1.85, $2.08, and $2.49 (scaling out recommended)

#LDO #LDOUSDT #CryptoBreakout #AltcoinRally #TechnicalAnalysis #DoubleBottom #CryptoSignals #TradingViewIdeas #SwingTradeSetup #BullishPattern

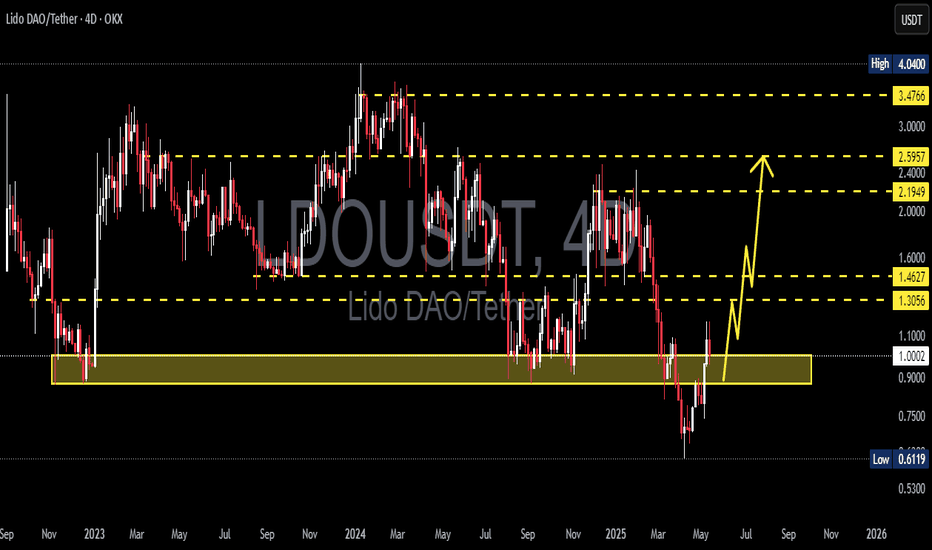

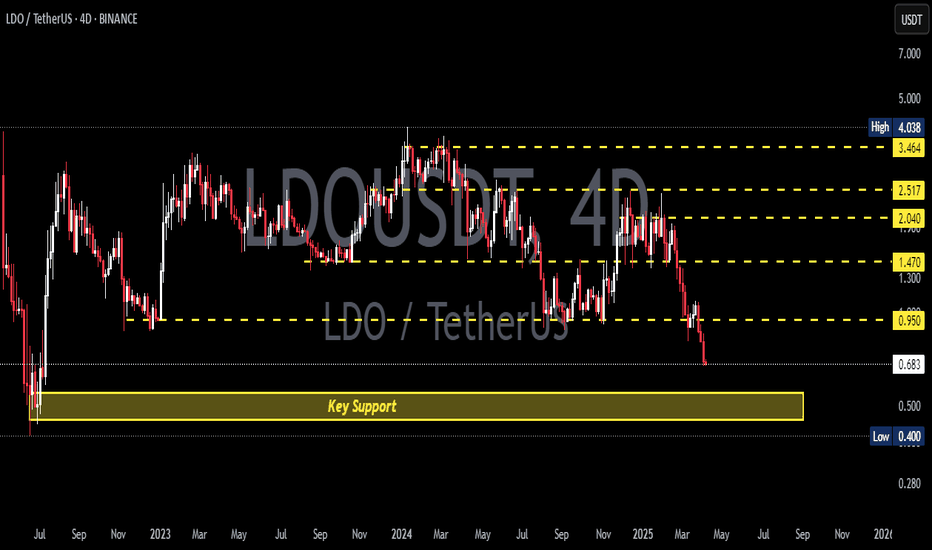

LDO - big lie - Many influencers have been touting this coin.

- the coin is found in the side

- the exit was down and I expect the downtrend to continue

if you like the idea, please "Like" it. This is the best "Thanks!" for the author 😊 P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your friends.