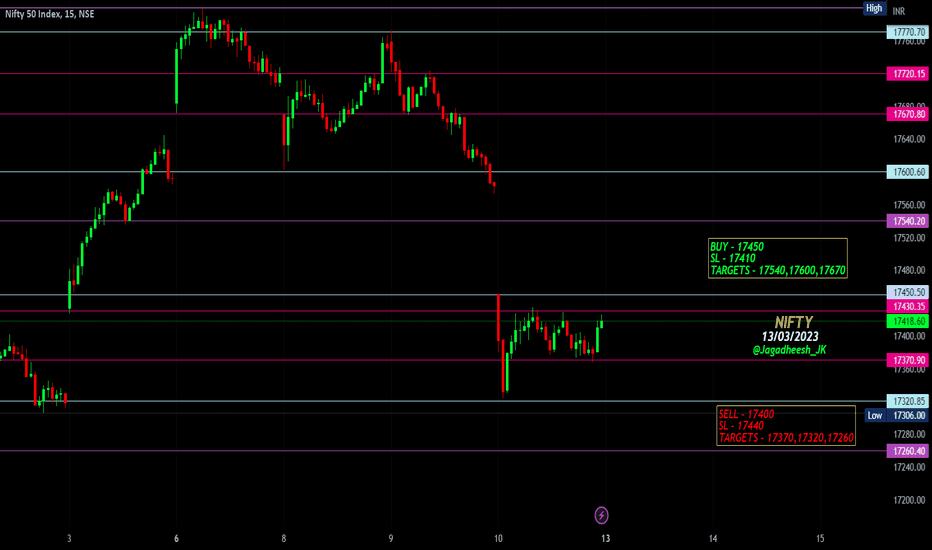

Levels

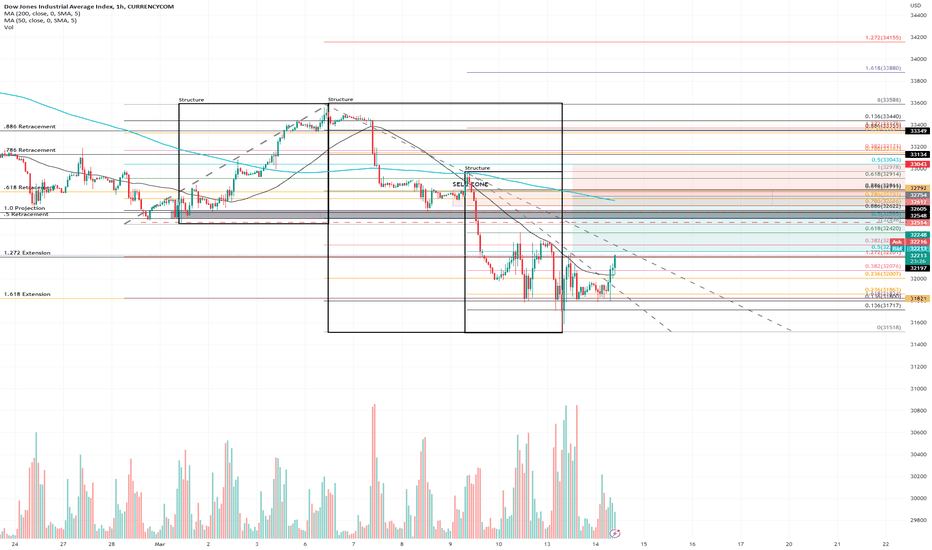

US30: Downtrend to ContinueI think the market will continue its downtrend, once price action reaches this zone. I anticipate a lot of choppiness and consolidation, so be patient with the entries and wise with the risk. If you get stopped out, again, be patient and wait for another opportunity at strong resistance.

I identified 3 different structures here and used them to plot levels on the chart.

Structure 1 (L2H) is the up structure that gave us the 1.272 & 1.618 extensions, giving us some signs that the market may be about to pull back and rally for a bit.

Structure 2 (H2L) is the larger structure that gives us three retracement levels. The .5, .618, and the .786-.886 zone. We should pay attention to these levels of interest when price arrives.

Structure 3 (H2L) is the smaller down structure that gives us a second set of levels to consider, primarily the .786 & .886 retracement. This is the structure that price is currently trading in and the one we'll use to determine how the market is trending as it approaches significant levels.

The Sell Zone I have marked is the confluence between the .618 of S2, and the .786-.886 of S3. This area also coincides with a potential testing of the 200MA, Several resistance zones that the market may retest, a 1.0 price projection, and the .5 retracement of S2. This is a large area to consider, so as always, be responsible with your risk. If the market doesn't reach our levels and sells off quickly then no worries, there will be other trades. No FOMO!

---

Levels of Development LLC is providing this material for this site and any other related sources (including newsletters, blog posts, videos, social media, and other communications) for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options, or other financial instrument transactions are for illustrative purposes only and may not represent specific trades or transactions that we have conducted. We may use examples that are different or the opposite of transactions we have conducted or positions we hold.

All investing and trading in the securities market involve risk. Any decision to place trades in the financial markets, including trading in stock or options or other financial instruments, is a personal decision that should only be made after thorough research, including a personal risk and financial assessment, and the engagement of professional assistance to the extent you believe necessary.

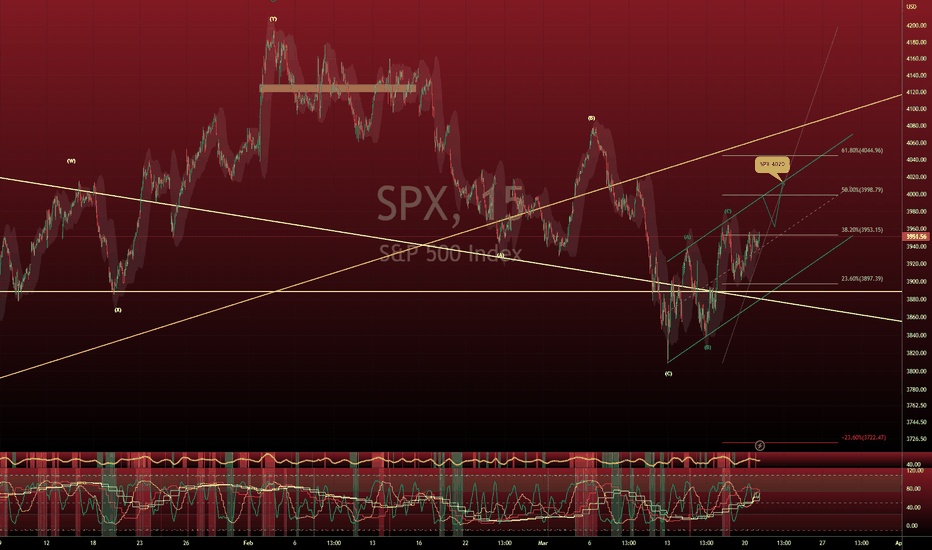

Key Levels and Stocks to Watch Leading Up to FOMC MeetingAs the market anticipates the upcoming Federal Open Market Committee (FOMC) meeting, investors are keeping a close eye on key levels and stocks that may experience significant movements. In this article, we will discuss the potential scenarios for the S&P 500 Index (SPX), Nasdaq 100 (QQQ), and several prominent stocks, as well as the importance of the FOMC meeting in shaping market momentum.

SPX and QQQ: Key Levels to Watch

SPX appears to be setting up for a test of the 4000 level, with the potential to run up to 4020 if it can break through the resistance. The FOMC meeting will play a crucial role in determining market direction, so investors should monitor developments closely.

Similarly, QQQ is approaching the 309 level, currently up almost 2 points in premarket trading. A break above 309 could lead to a test of the 315 level. As with the SPX, the FOMC meeting will be a key factor in shaping the QQQ's performance.

Stocks to Monitor: TSLA, AAPL, NVDA, AMD, META, and MSFT

Tesla (TSLA) is poised for a potential move towards 190, with 196 as the next target level.

Apple (AAPL) is best positioned if it can maintain support at 157.

NVIDIA (NVDA) is setting up for a move towards 269, with premarket trading showing an increase of almost 4 points.

Advanced Micro Devices (AMD) still has the potential to reach the 100 level.

Meta Platforms (META) may experience a 5-point gap up if it can break above 205, with the potential to run up to 213.

Microsoft (MSFT) appears somewhat weak at present, with a stronger outlook if it can move through the 276 level.

Market Momentum and FOMC Meeting

As the market begins to gain momentum on the upside, it is essential for investors to monitor the FOMC meeting's outcome. Ideally, a strong close near the 4000 level for the SPX and 309 for the QQQ would indicate a bullish market environment leading into the FOMC meeting.

In anticipation of the FOMC meeting, you should remain vigilant and monitor key levels for the SPX, QQQ, and select individual stocks. The market's momentum leading into the meeting will play a significant role in shaping future trends, so staying informed on the latest developments is critical for successful investment strategies.

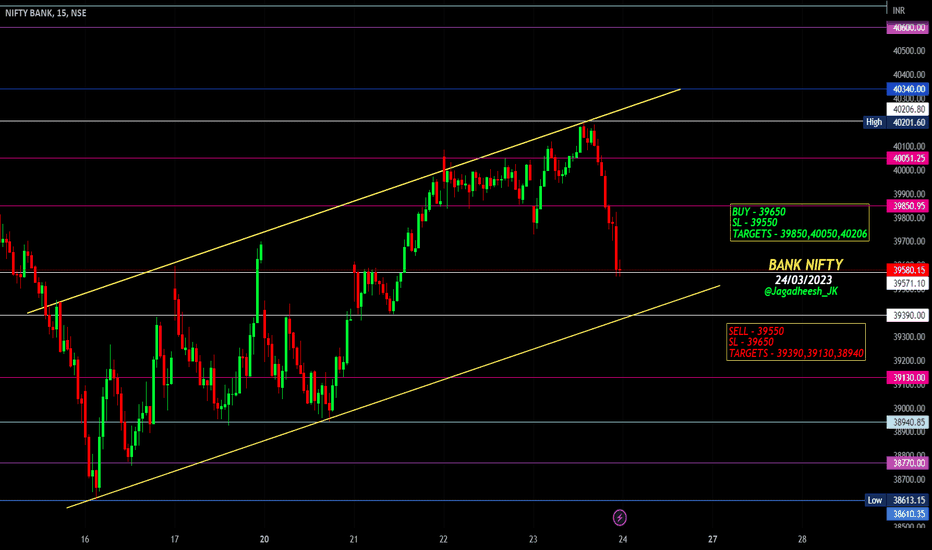

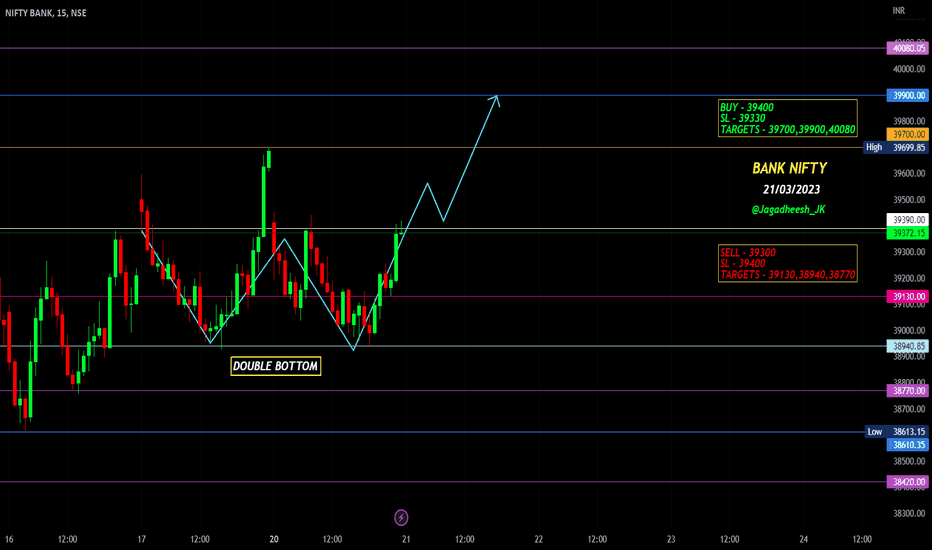

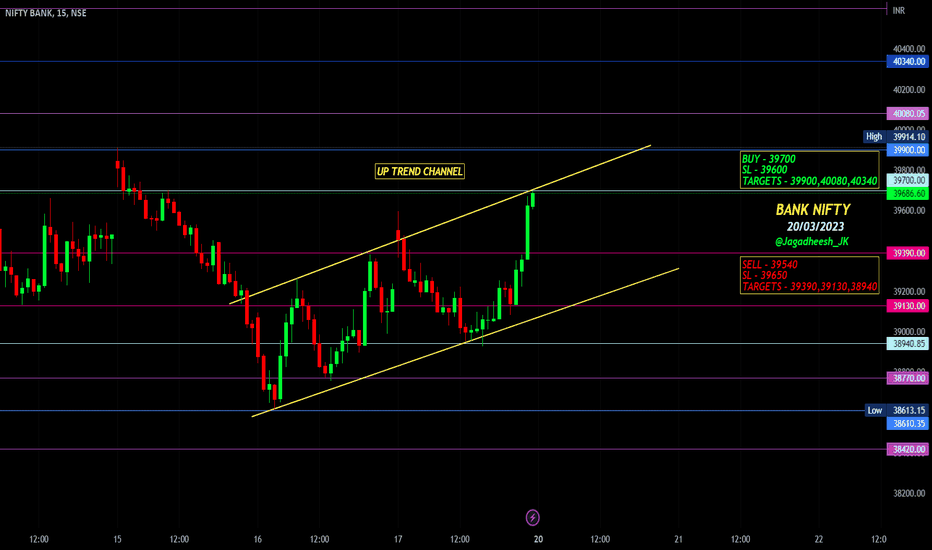

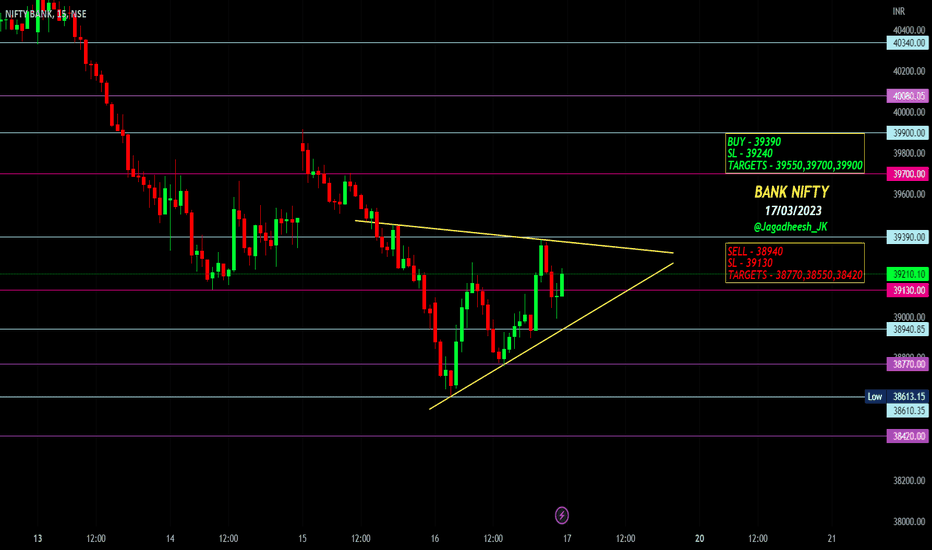

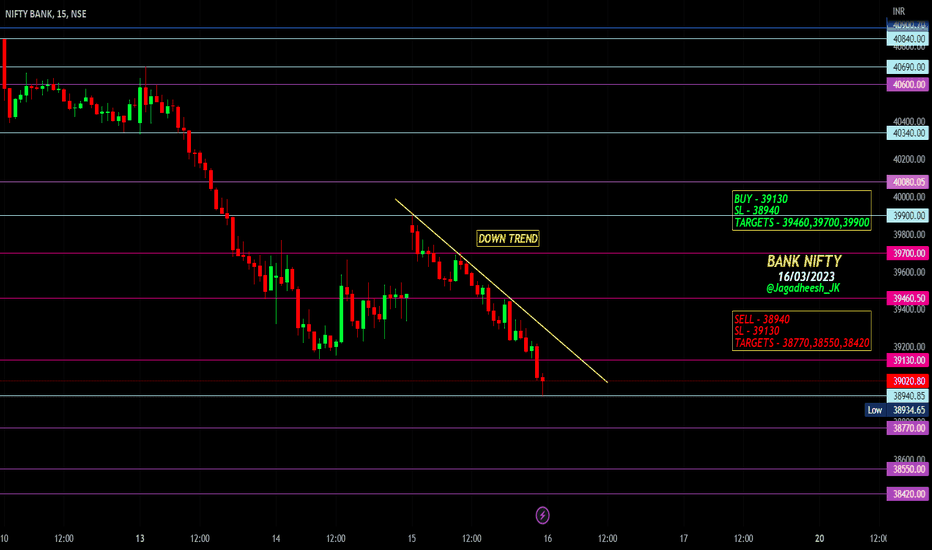

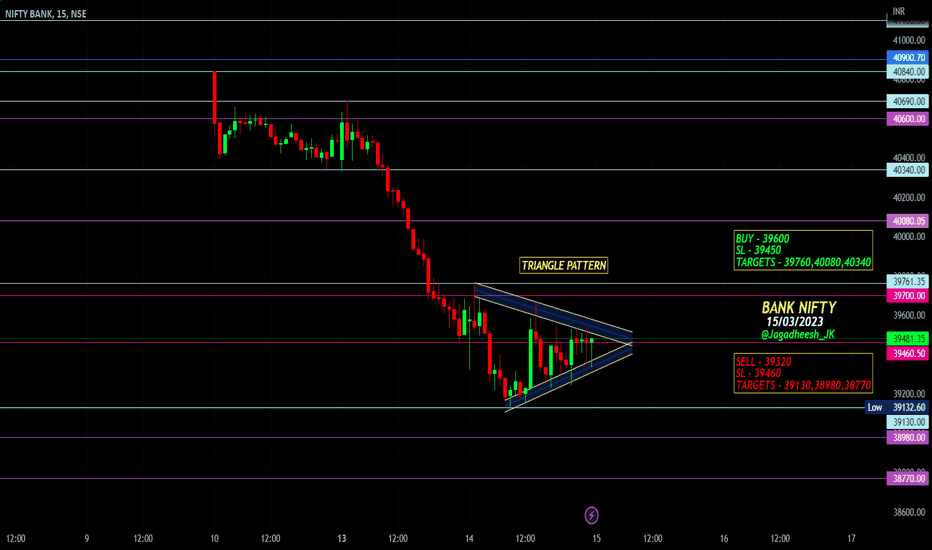

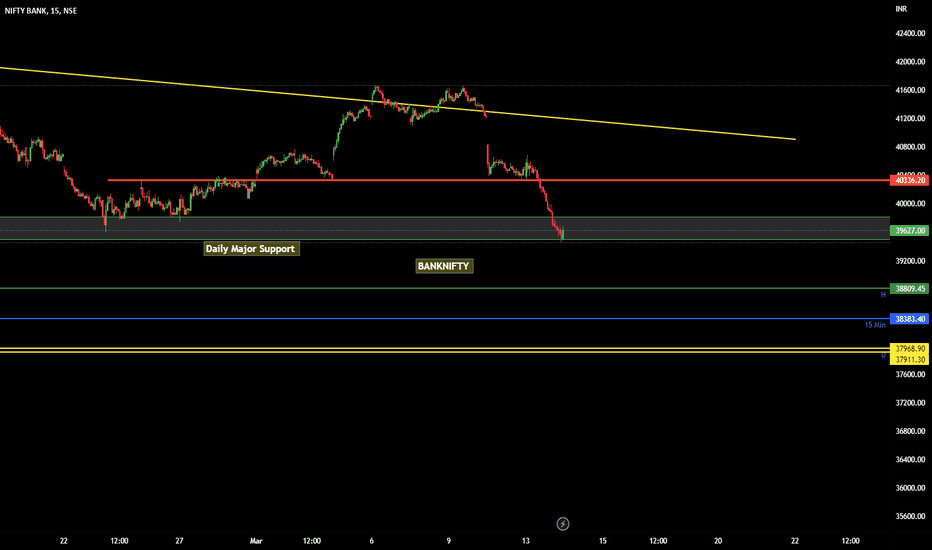

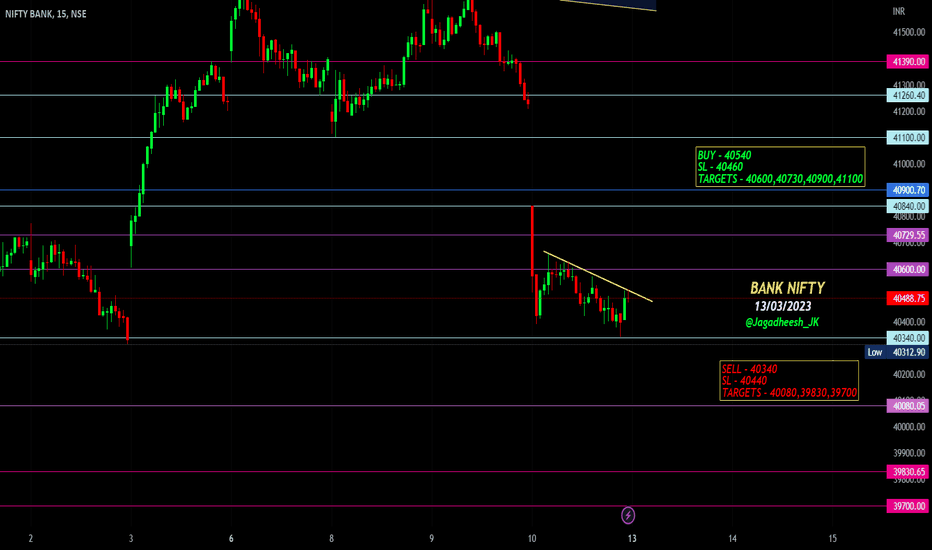

BANKNIFTY : on daily supportBANKNIFTY closed is near major daily support level. Once it break we may see next daily support in coming days.

Levels of daily, hourly & 15min timeframe marked on chart for today. Follow Price action & trend

Like, Share, Comment for regular updates.

Disclaimer

I am not sebi registered analyst

My studies are Educational purpose only

Please consult with your Financial advisor before trading or investing

I may be 100% wrong as its my personal trade.

First Learn and then remove "L"

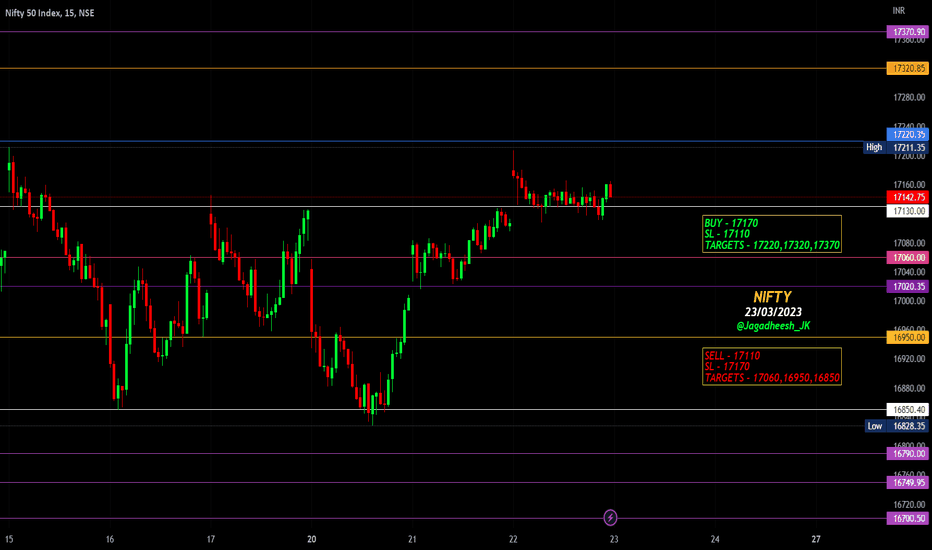

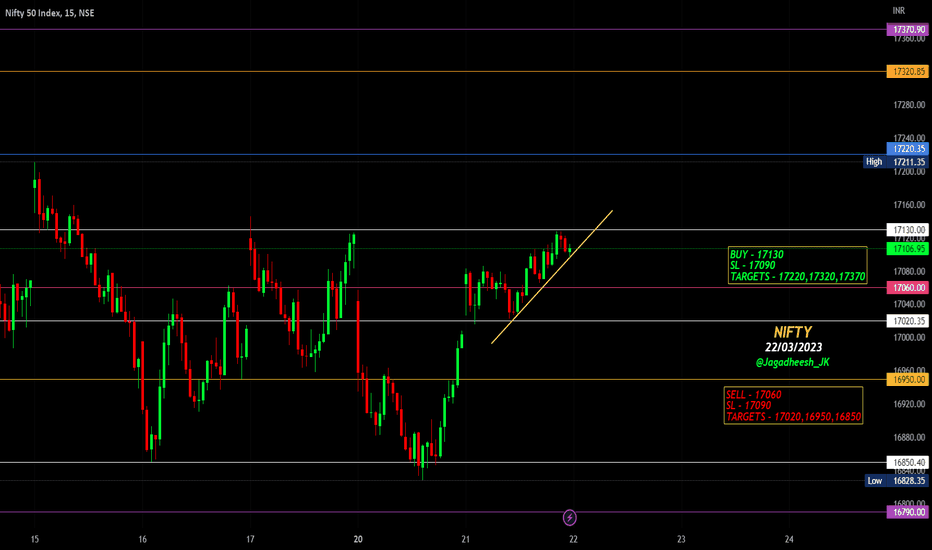

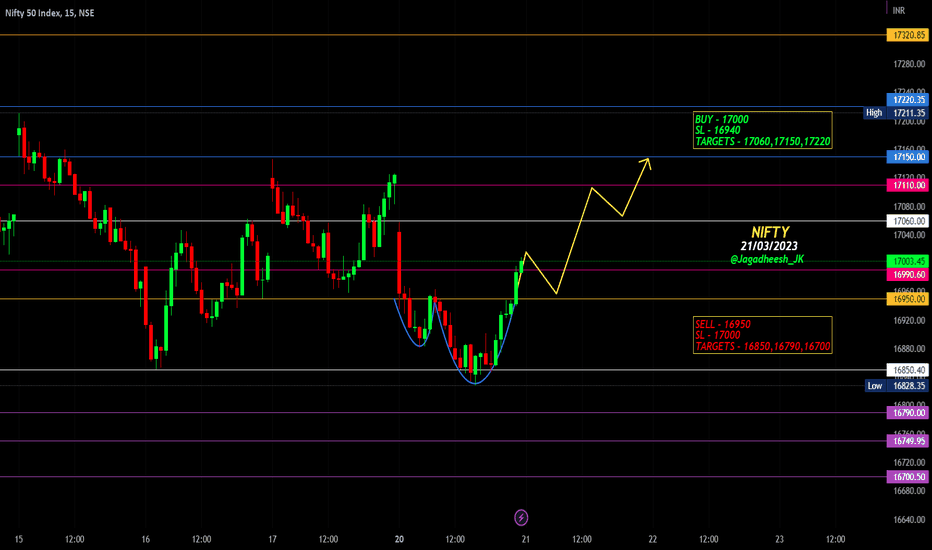

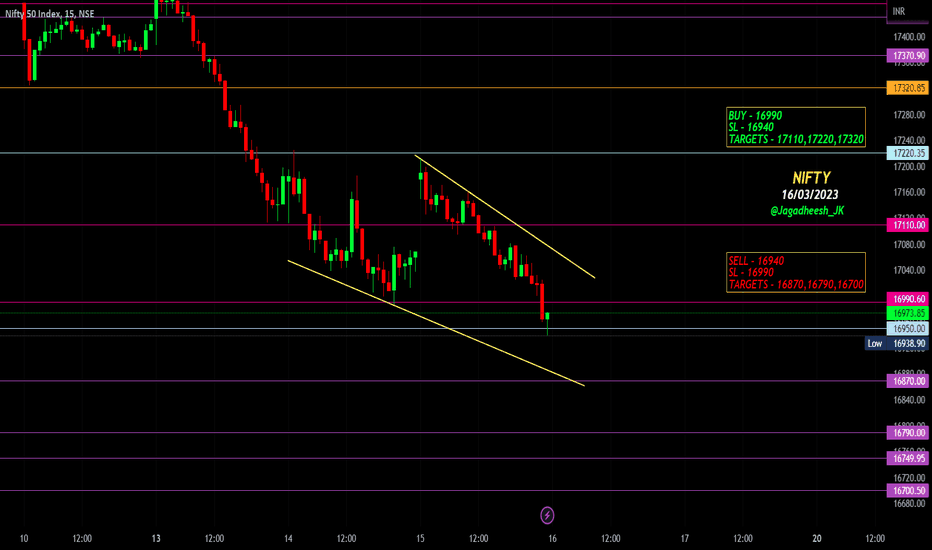

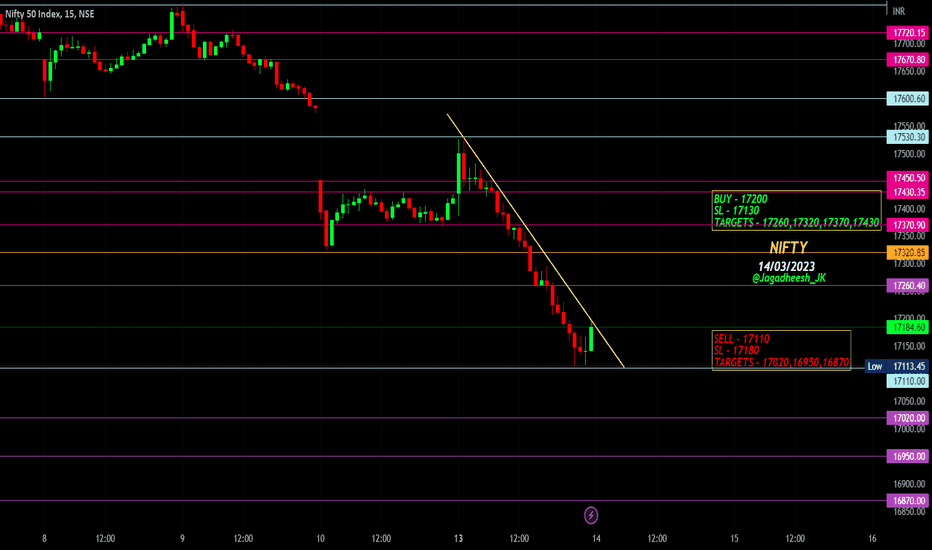

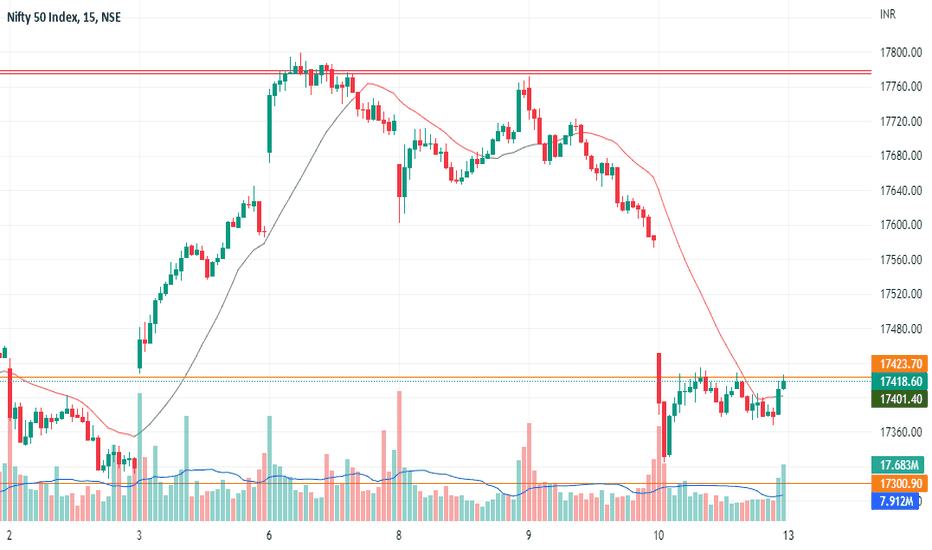

NIFTY at ??????After gap down on friday sharp selling coming on next week.

last month support on 17250 - 17300 level it will brake.

market will break 17000 in this month that will take new level on chart.

some high weightage stock are week on chart.

data is negative.

sharp selling is upcoming in short.