$NOV: Lot of loss in weight loss. Is it in buy zone? Currently the weight loss drugs are having a severe loss of weightage in the corresponding indices. The poster child of weight loss and diabetes drugs XETR:NOV and NYSE:LLY are seeing some of the worst drawdown in their history. Today we look at the worst of the 2 in this space which is $NOV. Novo Nordisk had a lot of missed steps in the current year, and the stock price has lost almost 70% from its peak of 148 $ in June of 2024. It has a long and painful drawdown of almost 70% from its ATH.

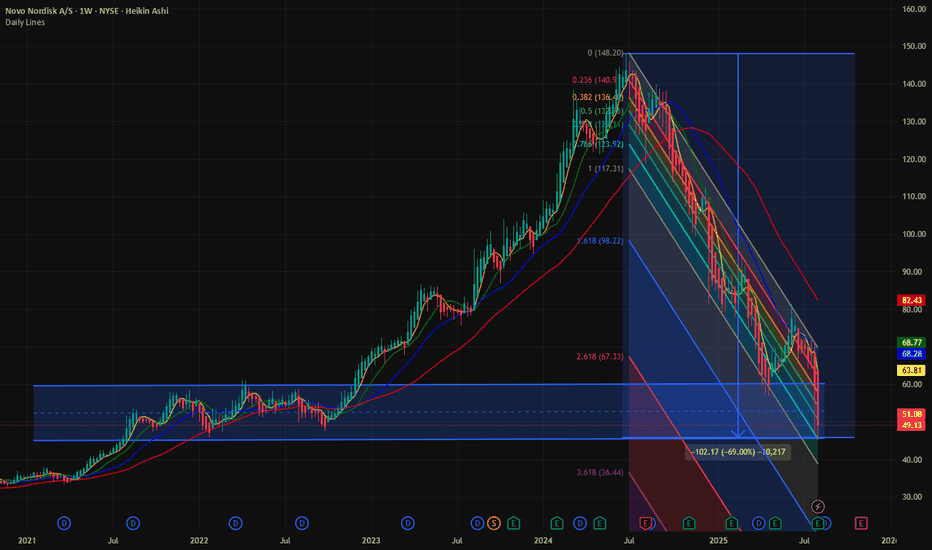

The downward sloping pattern is so prominent that it is hard to ignore the drawdown in this stock. But the question comes will there me more loss and pain this weight loss pioneer or there is a visible buy zone for this stock. I did some unorthodox chart today plotting the downward slopping Fib retracement by joining the tops of the recent lower highs and on the lower bound of the lower lows. We see the clear levels provided by the Fib levels. Currently the stock is at 0.786 level with price at 49 $. I think once the key psychological level of 50 $ is broken the stock can go below the 0.786 level and may touch the 1.0 Fib level which is @ around 40 $. And with 0.618 being the upper limit with price 52 $. This range was also in play during 2021 and 2022 when the stock did a year long consolidation before moving higher.

Verdict: XETR:NOV is within the accumulating zone with 52 $ as top and 40 $ as the bottom. 70 % drawdown from the top is a tempting discount on the price and a good entry point for long term.

Lilly

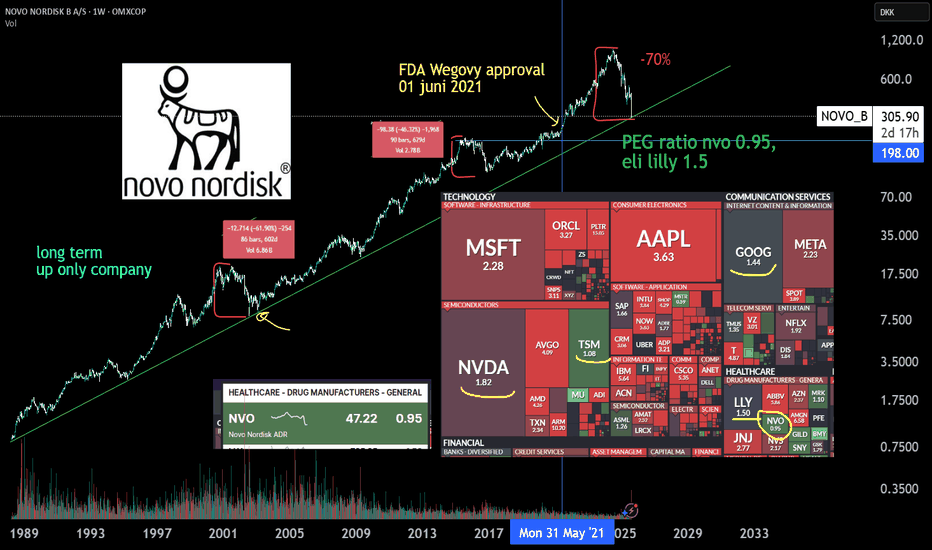

NovoNordisk, LT dirt cheap | GLP-1 a misunderstood growth marketNovo Nordisk stock has lost quite some weight since the release of Eli lilly's drug Zepbound and Mounjaro and since the rise of compounded, or generic copycat GLP-1 alternatives. The growth of the company has slown down a bit, but the overall GLP-1 market growth is still impressive and misunderstood. Both Lilly and NVO have become some of the cheapest PEG stocks in the markets and compettitors, of which most known, Hims en hers health also took a slice of growth of this market by telehealth GLP-1 descriptions.

The copycat descriptions could be dangerous due to unvalidated low quality GLP-1 or agonist GLP-1 substances. Therefore a lot of law suits have been initiated by NVO.

Where Oral Wegovy still has to be FDA approved withinin ~4, 7 months in USA, the company also has new medication approvals awaiting in the pipeline, medications like Cagrisema. (Phase 3 clinical trials, approval in late 2025 or early 2026)

Amycretin - a unimolecular long-acting GLP-1 and amylin receptor agonist.

Where investors have already praised Lilly for the better drug, GLP-1 demand is surging harder than production for both companies.

Where Wegovy and Ozempic are approved by The FDA to sell, many costs for the patients themselfs aren't covered by the health insurance yet. Wegovy or Zepbound isn't covered for mainstream when prescribed by your physician yet. it's only covered for severe obisty for example. Therefore penetration rates of the drug aren't very high yet and will get higher where it will be coverd for more people. Also due to the high cost many copycat GLP-1 agonist market have arisen.

There is some improvement in cost coverage for these types of medicine Which will boost the revenue due to prescribtion sales.

Next these facts, there are still new markets for GLP-1 to be approved like in india and Japan where worldwide demand is much greather than production capacity. Both Lilly and NVO are expanding fast. Many new production volume is created and Needed!, NVO is expanding production sites in brazil and china.

I'm exited for the earnings today. NVO has had many dumps before but has proven to be a up only company. The profits of the company have doubled from $7B to >$14B since Wegovy FDA approval. from the top shares have dumped 70% where there is still >10% growth. Since the FDA approval (june 2021), other markets excluded the share is just +40% up. The stock is much cheaper now with double the profits and revenue, and still >10% growth.

Let's see what happens with earnings. Good luck.

LLY, LILLY IS THIS STOCK PRICE SILLY?I hope you appreciated my rhyme.

So what to say about this.

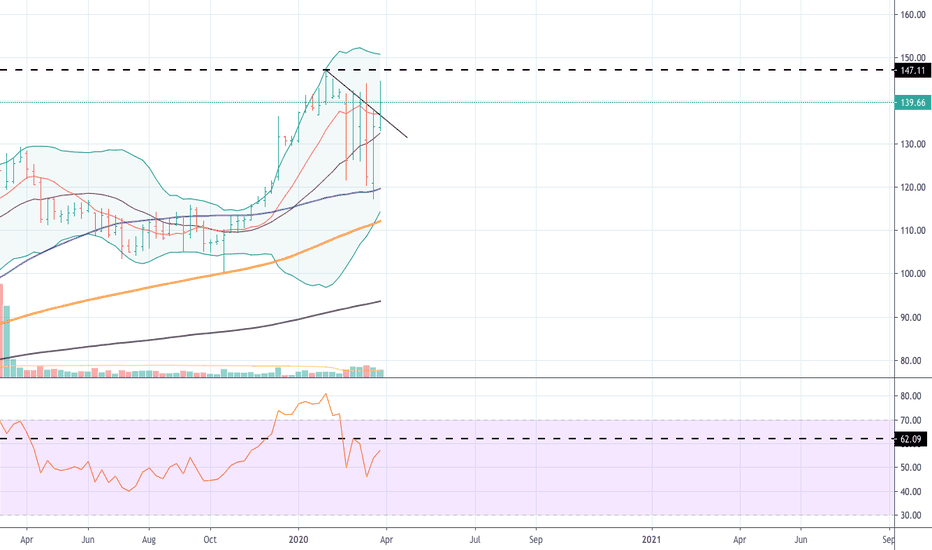

One main trend line at the moment.

Big support incoming at 580 to 560 range.

Really big support at 108.

The lines in the middle (light green and red) are fairly weak and more likely short term targets.

I assume the long term targets will line up well with the gaps which are marked in orange.

Orange also on RSI, which is saying be careful.

Short term can take it up to 980 or so but I think the lower targets are more likely and we'll see the higher targets after trend breaks and before it starts to really drop.

However, there are a lot of possibilities that can occur.

The main possibility looks to be a chance of a move to 980, but more likely won't get there and might stick around 780.

I really have a hard time saying what this will do and when it will top out, I could tell you more if I watched this daily, but I don't.

This chart is long term price targets for the downside and the upside.

Given the single trend, you'll need a new chart as more develop, feel free to message if I haven't updated after some time.

I think that covers most everything.

Summary.

I think this stock is overvalued big time, but still has potential to keep seeing more upside in the short and mid term.

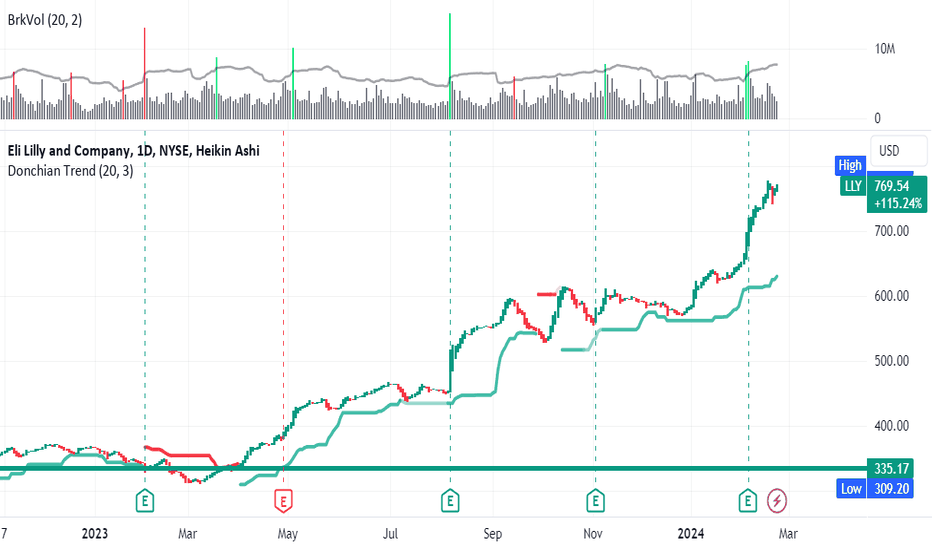

LLY rides its success against obesity and diabetes LONGLLY shown on a daily chart has doubled in the past year with the introduction of new FDA

approved drugs into the market. It has but out a series of favorable earnings reports with

optimistic realistic guidance and glowing analysts' forecasts. It has done so without any volume

pumps and just keeps grinding higher. This is because it is in the shadows of big technology

stocks. Revenues consistently beat analysts' forecasts quarter after quarter.

Institutions add small lots trying to preserve the price for future buys without any

run-ups. I have done the same thing and I will continue to do so. While day trading

biotechnology penny stocks, LLY along with UNH, PFE, and AZN is where the profits are

parked for growth and compounding.

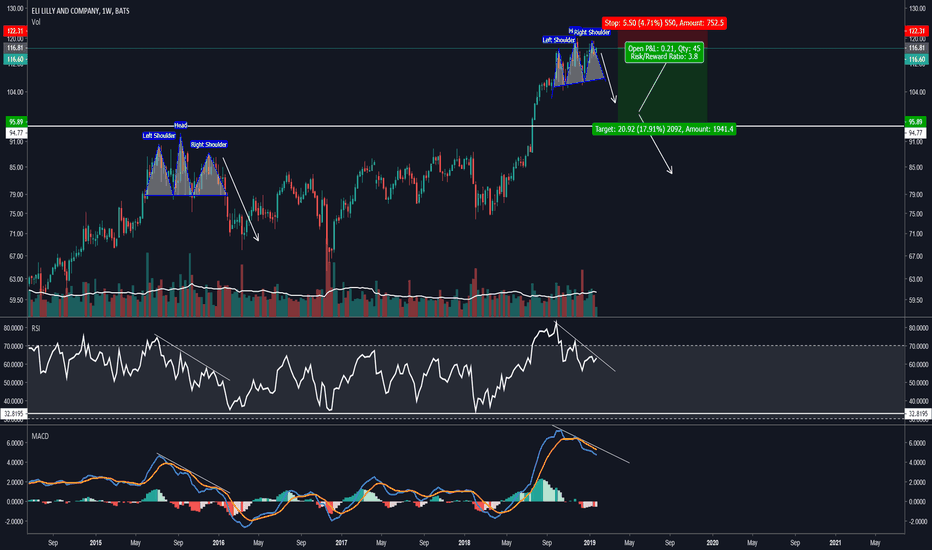

Eli Lilly, Bear Divergence and a Repeat Head & Shoulders PatternEli Lilly Oversold on the Monthly RSI.

RSI and MacD are both indicating bearish divergence.

Repeat on Head & Shoulders Pattern

Stock trading at 50x of earnings (forward P/E is 20), PEG ratio of 3.50! Price is 9x book value.

High Risk to Reward Ratio

3.8 to 1 with a large stop of $5.50

6:1 or better with a stop above the swing high

Target 1: $96

Target 2: $90

You could open a short now with a 5.5% stop loss, or you could wait for the H&S to complete itself.