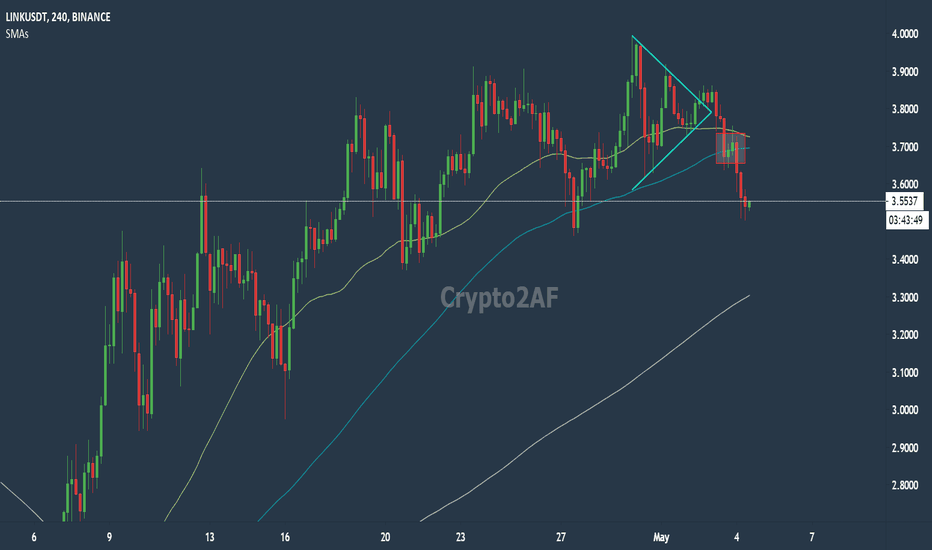

Linkusdtbinance

Link at a turning point...I want to get some feedback on a potential linkusdt trade idea.

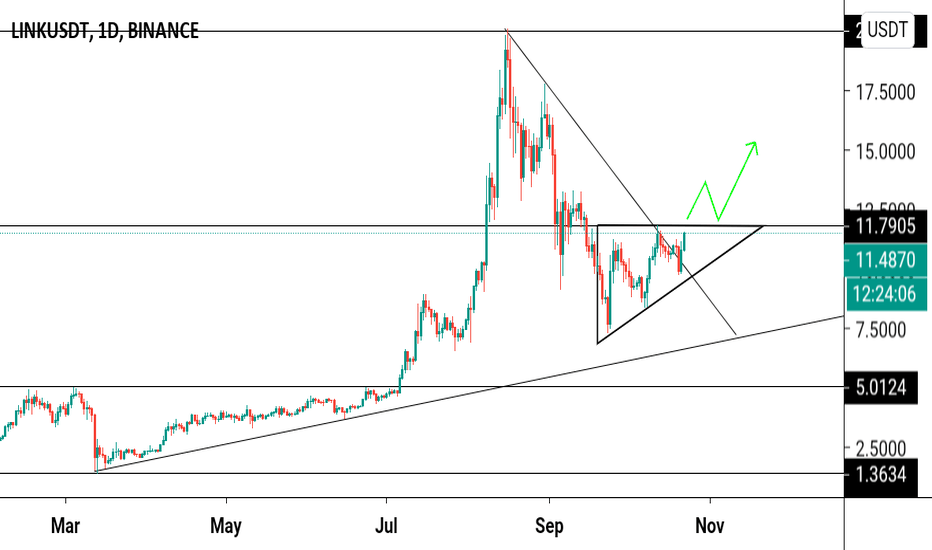

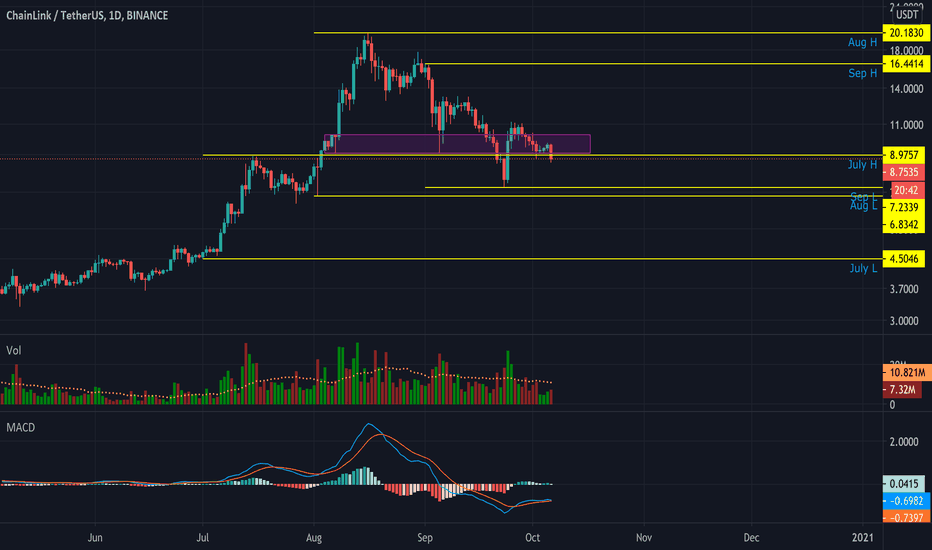

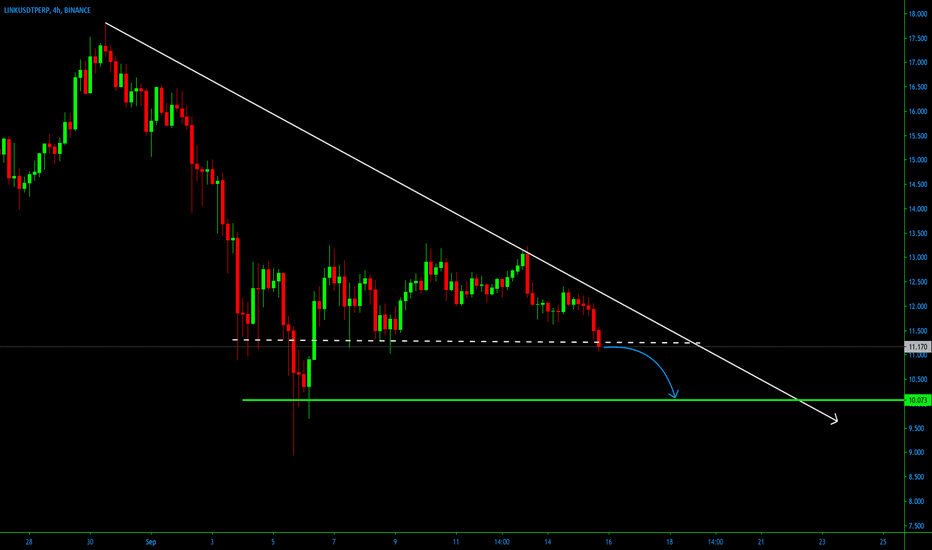

As the whole market, Link has been bleeding since the beginning of September and seen a down trend of more than 50% as of right now. It reached a low in September at around $7.20 and after saw a strong rebounded to $11 and retraced back to around $9 as of right now.

The monthly high(July) around which link is currently hovering is at $9. I have to potential scenarios I want to play.

1) If link closes below $9 on today's daily I see more potential downside for the week and will open a short position around that level. The risk to reward is good, support being lost and MACD being in the negative territory is confirming the short bias for me.

2) Closing above $9 on the daily, hovering around that level for the week and then breaking out to the upside. Bullish bias confirmation: The market has been bleeding since september and everybody has been in a light fear state all throughout the month, so a potential bounce seems reasonable at this point. On the Santiment platform the 30D MVRV ratio is showing that Link is in a potential buy territory. Lastly, $9 being a relative turning point since the last bounce to $11.

I am relatively new to trading. Started in the summer of 2019, still not profitable but doing better than before. I want to become profitable and any constructive feedback that could get me to that point is appreciated.

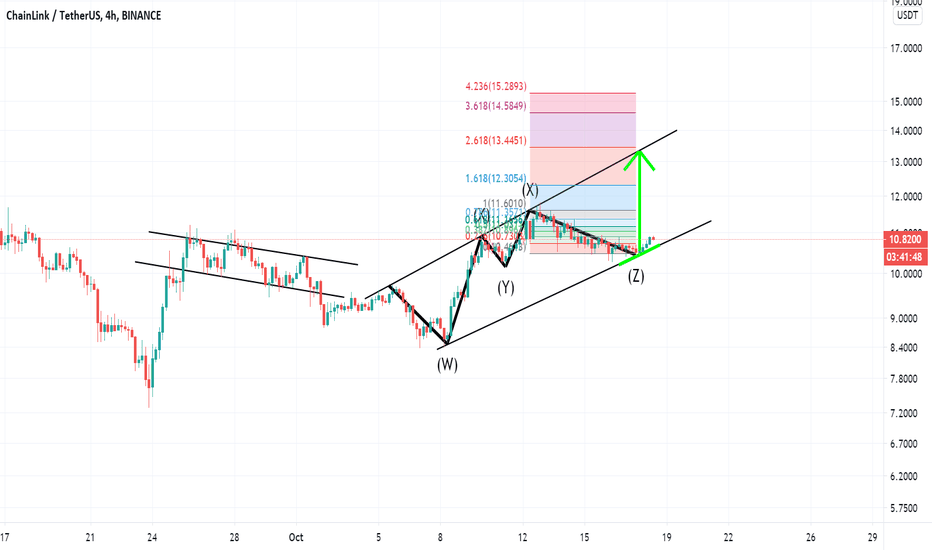

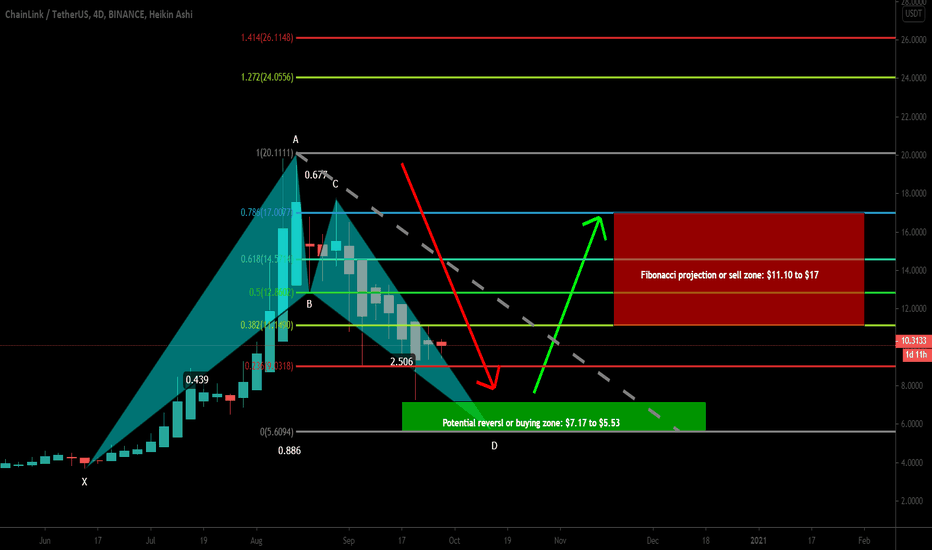

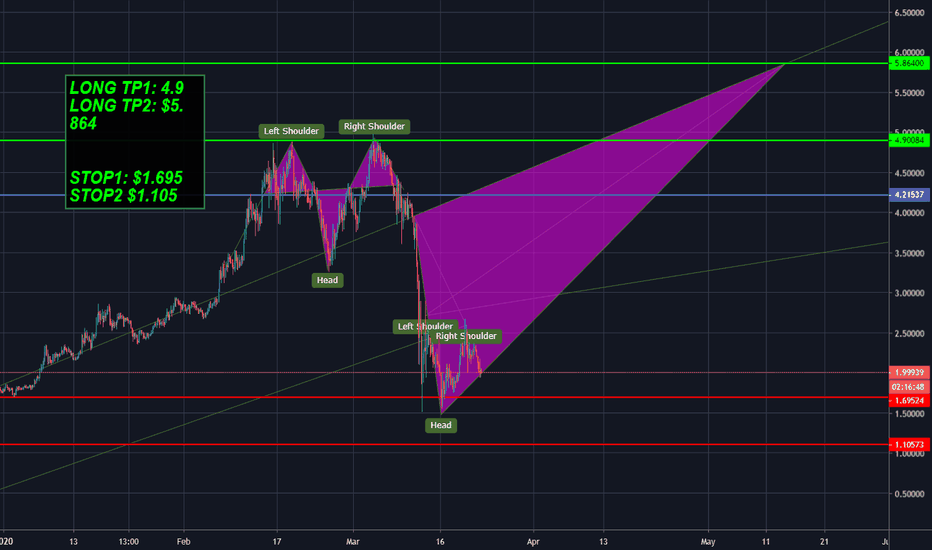

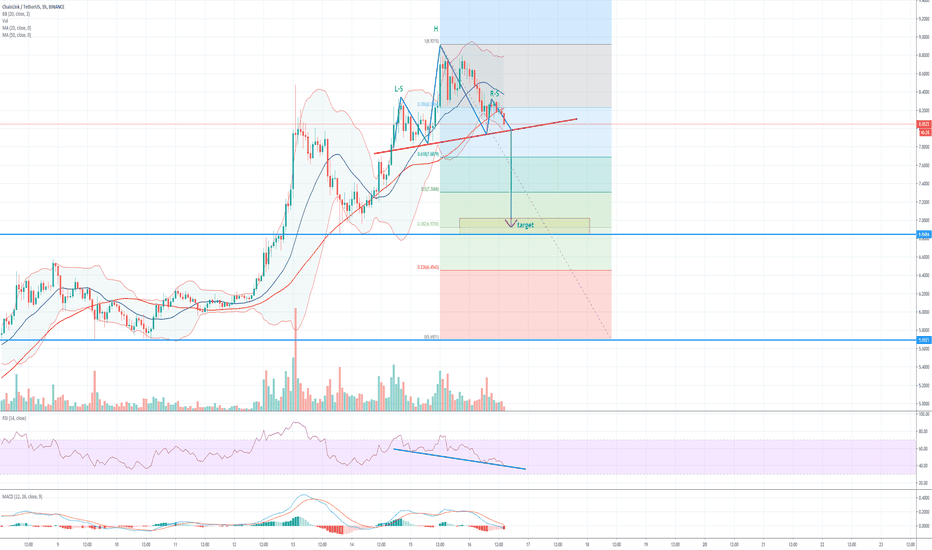

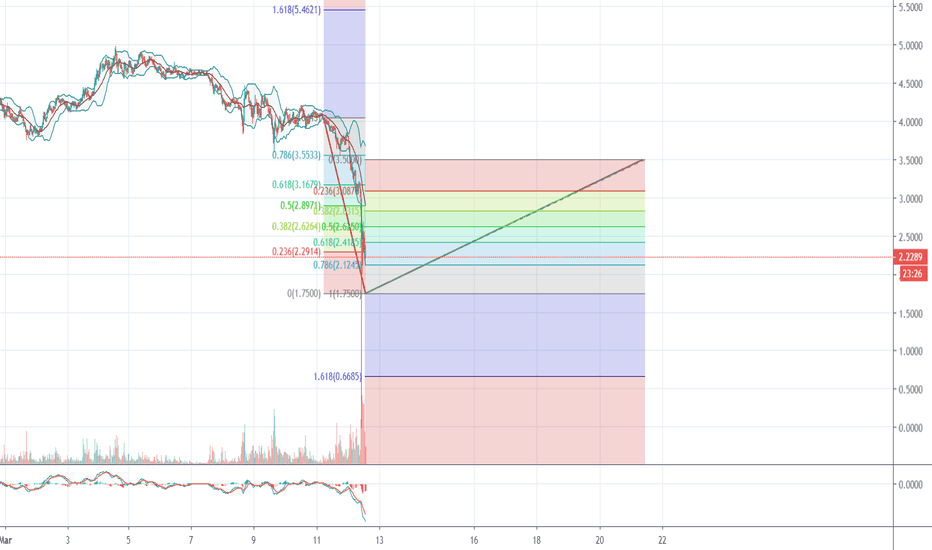

LINKUSDT completing final leg of bullish BAT | Upto 207% moveThe priceline of ChainLink is completing the final leg of bullish BAT, the targets as per the Fibonacci sequence of BAT are:

Potential reversal or buying zone: $7.17 to $5.53

Fibonacci projection or sell zone: $11.10 to $17

Regards,

Atif Akbar (moon333)

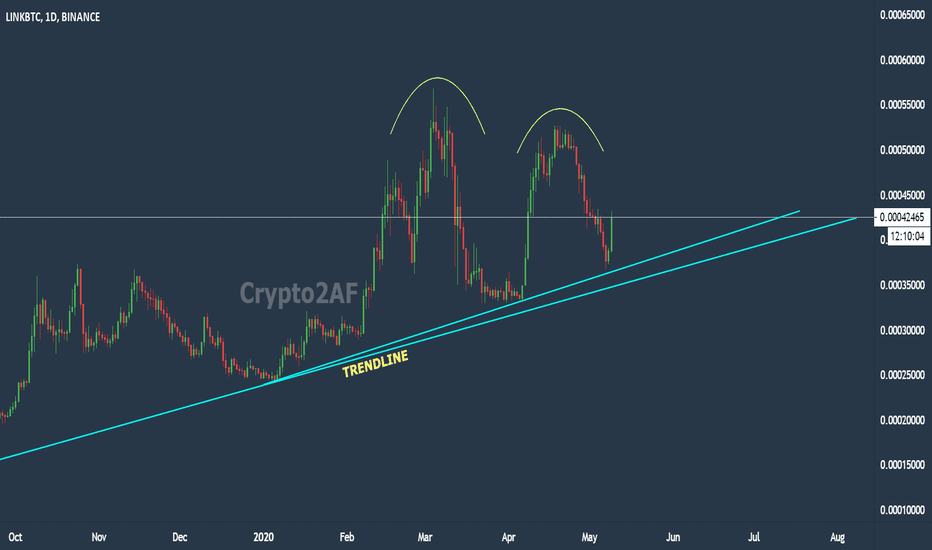

link is going to die ?!

🌴FREE COIN ANALYSIS🌴

💎Poor $LINK going to see more blood soon. 4H closed below the swing low. Aligns with the idea of more altcoin blood to come.

💎 BTC dominance seeing a rise over the last 48h ( weekly open ) as Bitcoin seemingly outperforms the market (but does not look good as well no more). Immediately this can be interpreted as bearish for altcoins, especially if we start to see a run-up towards resistance at 64%. Presently, we don't recommend buying new alts as they are likely to keep dropping against bitcoin.

💎Stay safe✅😎

Have you given up hope? LONG LINKUSDPlaced two stop losses (S1 being for day-swing traders) & then the main one being S2 -- for the superlong HODLER) who has been in this far too long to quit.

I learned to program python 3.6, cobolt 6, java, API & cloud computation + data compression through kubernetes/docker... I've invested too much time into this career, what am I supposed to do?

I learned to be a financier (from trendline breakouts) to fundamentals/market data, conducting TA & more...as I've said -- TOO MUCH OF MY LIFE/TIME INVESTED/WASTED, WHAT AM I GONNA DO?!

Just QUIT?! & "LearntoCode?"

I can't...this is ALL i know how to do...

Anyway I'm balls deep in and when I see a superlong like this (est. timeframe >30 days min-- though if I had to GUESS a ballpark on these figures I'd say 2-3 months. So by start of Q3, that's a complete pulled out my ass figure so don't take that as bond.

When I see patterns emerge like this from a fundamentals perspective I cannot help but get excited for the future, despite the fact that i've cried myself to sleep last night and every night since last Monday.

Disclaimer

Note: This is strictly conjecture based on my own technical analysis and not any information based on any sources from the GOP Or federal government/treasury dept / ay institution of any form this example is for educational purposes only and should not be relied upon for any other use. Please invest responsibly and make all decisions based on your head; not your gut. Any projections or figures provided in this analysis are Forward-looking statements And have no basis Other than my own opinion and not information related to the GOP, SEC or wall sf in general. Just the wiz doing what he always did best — Disclaimer must be extended and extensive So forgive me as I need to truly emphasize None of the information obtained in conducting this analysis was provided by insider trading in anyway shape or form.

Certain information set forth in this presentation contains “forward-looking information”, including “future oriented financial information” and “financial outlook”, under applicable securities laws (collectively referred to herein as forward-looking statements). Except for statements of historical fact, information contained herein constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) completion of, and the use of proceeds from, the sale of the shares being offered hereunder; ( iii ) the expected development of the Company’s business, projects and joint ventures; (iv) execution of the Company’s vision and growth strategy, including with respect to future M&A activity and global growth; (v) sources and availability of third-party financing for the Company’s projects; ( vi ) completion of the Company’s projects that are currently underway, in development or otherwise under consideration; ( vi ) renewal of the Company’s current customer, supplier and other material agreements; and ( vii ) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.

These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

Peace & Love

Twitter / LInkdeln / Steemit / TradingView / StockTwits / IG

-@a1mtarabichi

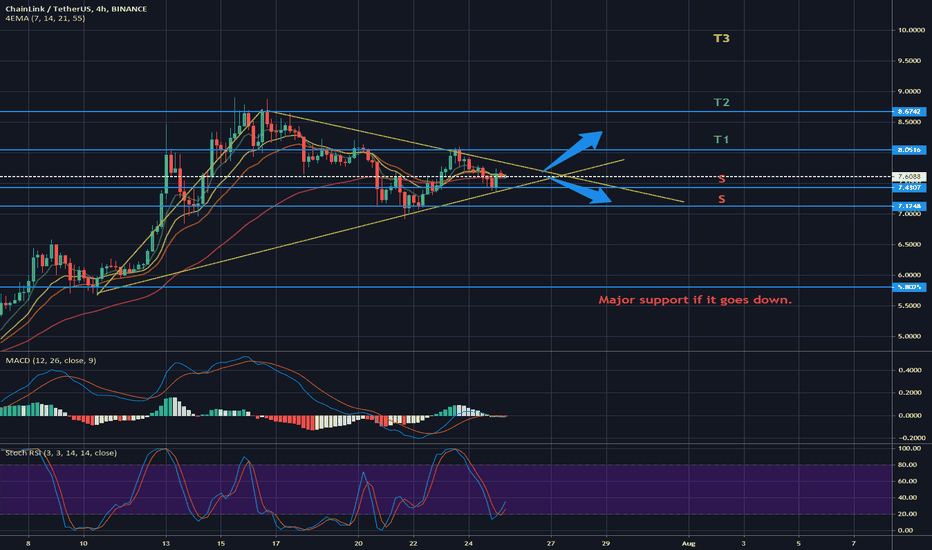

LINKUSDT - Triangle pattern, what will happen ?Greeting,

we are now watching LINK USDT on 4h chart. It looks like a bullish triangle pattern, but needs to wait for confirmation.

It can move in any direction.

T1 - is obvious if it goes up.

T2 - wait for confirmation (bullish candle) after T1

T3 - some higher goals we can only guess

T1 goal = stop below 7.4

T2 goal = stop below 7.00 - which is the main support for the current price range (7.0-8.8)

Under 7.00 we are going deep down to 5.8-5.7

Just my opinion.

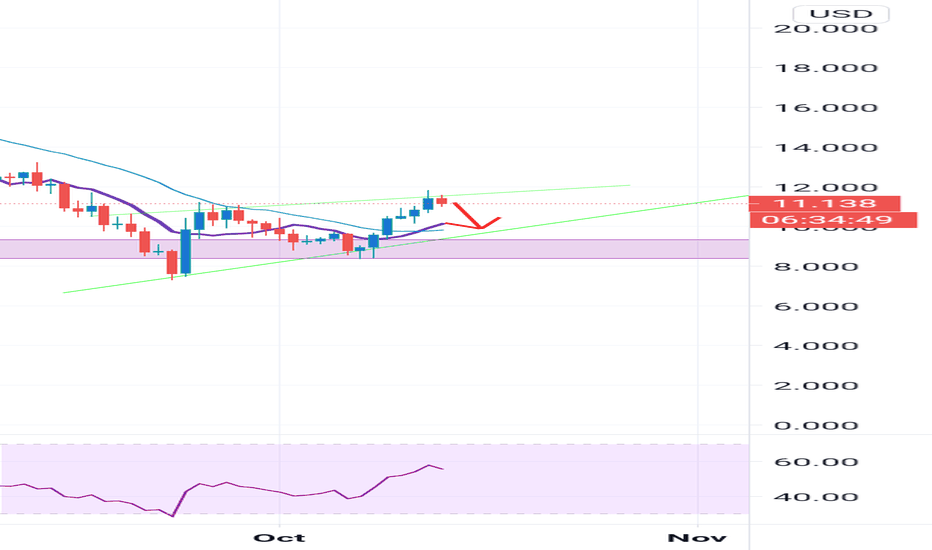

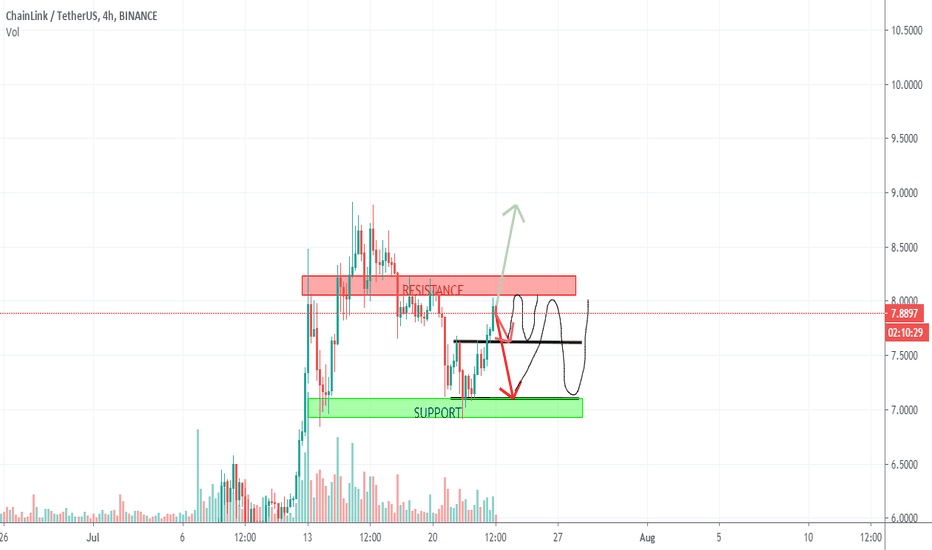

LINK/USD, FOMO is Still in the AirMy Last Analysis on LINK/USD, has reenacted somewhat similar, and I pulled out at 7,1ish.

Overall I don't think greed for LINK/USD is not over yet and FOMO is in the air.

I advise we all just stay calm and be rational, LINK just reached its all-time high, it doesn't sound logical that it will go any higher in upcoming weeks. I would say a ranging market to appear would be more logical if LINK able to maintain its value than going on a higher price.

For those that wish to trade in the current situation, you are welcome to use this as your references:

From here we could identify 3 key levels for LINK; 8,1ish, 7,6ish, and 7,1ish.

Here another bonus

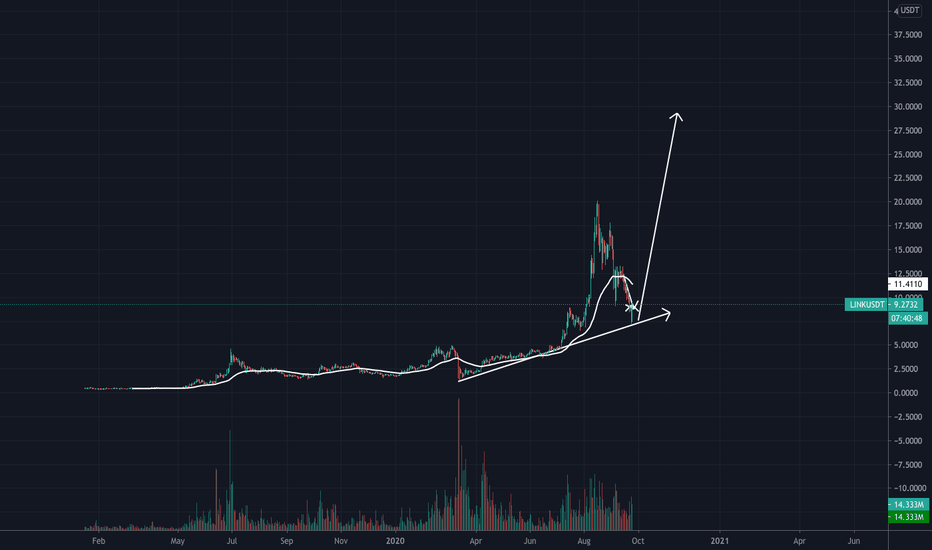

Will LINK be the alt that'll link us to the moon? LINKUSDT

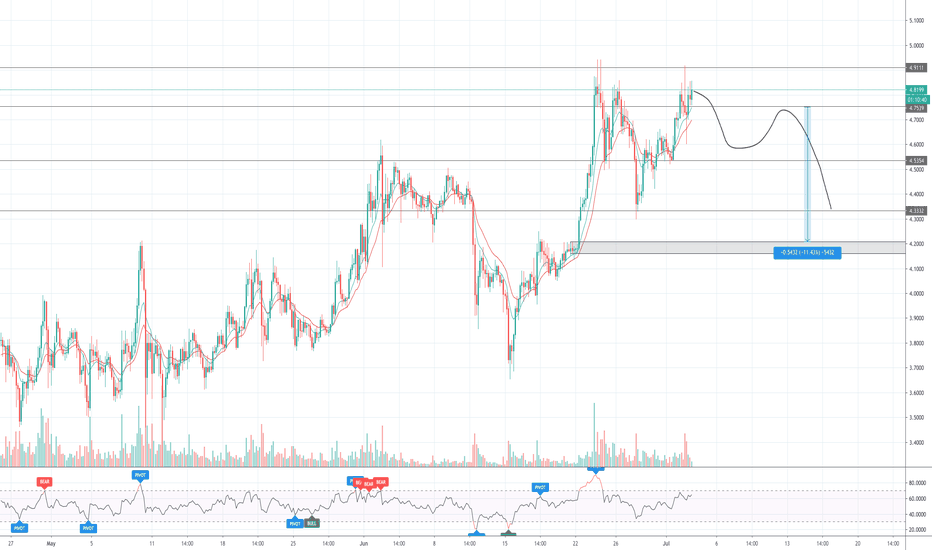

Loving what I’m seeing on LINK atm. There could potentially be a huge reversal coming after such a long bullish run.

We have hit a level of major resistance at LINKs ATH resulting in a double top. I can still see bullish momentum so I don’t feel the bulls are tired just yet, some large bodied green candles show me they’re still around and still fighting. I want to see them starting to get exhausted with smaller candles and a bearish engulfing.

The long wicks on some of the red candles at this area show me there is a fight going on to bring the price down but in this momentum, who will win is still undecided.

I’m not sure I would long if we were to break above residence as I wouldn’t have previous structure to guide me however, if we were to break support and retest, creating and LH followed by a LL, then I would definitely be opening up shorts to ride this baby down!

Take profit areas would be at previous structure around 4.5354, 4.332 and final at supply around 4.2. This would be a multiple take profit trade for me.

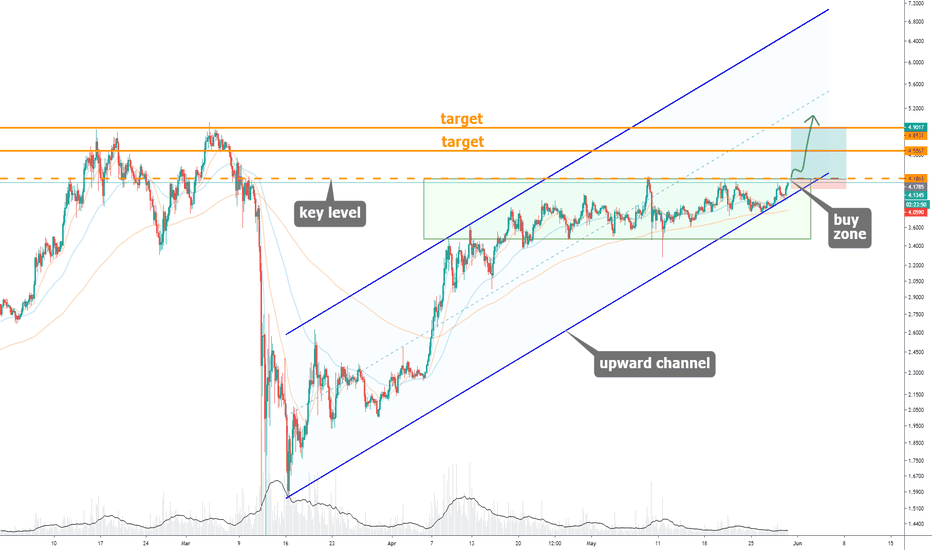

LINK/USD - upward channel

☝️ Price consolidation in green rectangle. The exit from which can give an impulse at least in the yellow taggants. The longer and wider the accumulation goes, the stronger the impulse will be.

👉 Movement in upward channel.

☝️ Cancel Long Scenario: The price drops down from the upward channel.

Push ❤️ if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Thanks for your support!

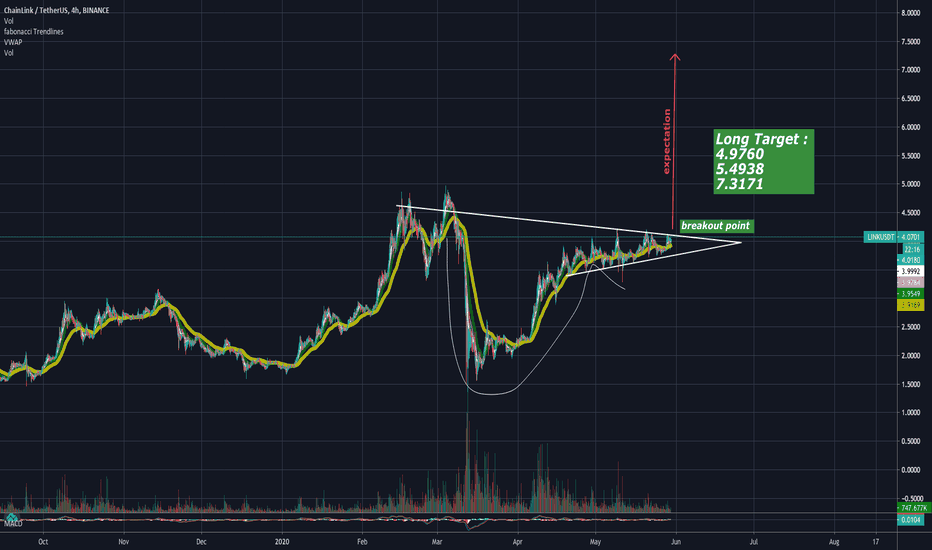

Chainlink is about to UNLOCK ( Huge Crypto in PLAY 7.0 Coming?)Hi friends, The printer is about to start printing on Chainlink as a Crypto in play.

I want to say thank you to all those who have been liking my ideas, I really appreciate the love so far, I have come with another good crypto in play but in return I will ask for your likes to keep growing my ministry.

without much stories, here is the pattern discovered and my trade set up.

PATTERNS DISCOVERED

1, Bullish pennant

Pennants are good continuation pattern, the patterns are characterized by a clear direction of price trend, followed by a consolidation or sideways movement or rangebound movement, which is then followed by a resumption of the trend.

2, Cup and Handle

Cup and handle is also a good continuation pattern, that usually forms in bullish markets.

Here is my trade setup

Enter: a "long" trade above the top of the cup level at 4.200

Stop loss : place a "stop" order below the handle at 3.7343

Targets: target 62% to 100% of the cup depth 7.3

Take profit points:

4.9760

5.4938

7.3171.

Thank you for liking this post idea and for following my work.

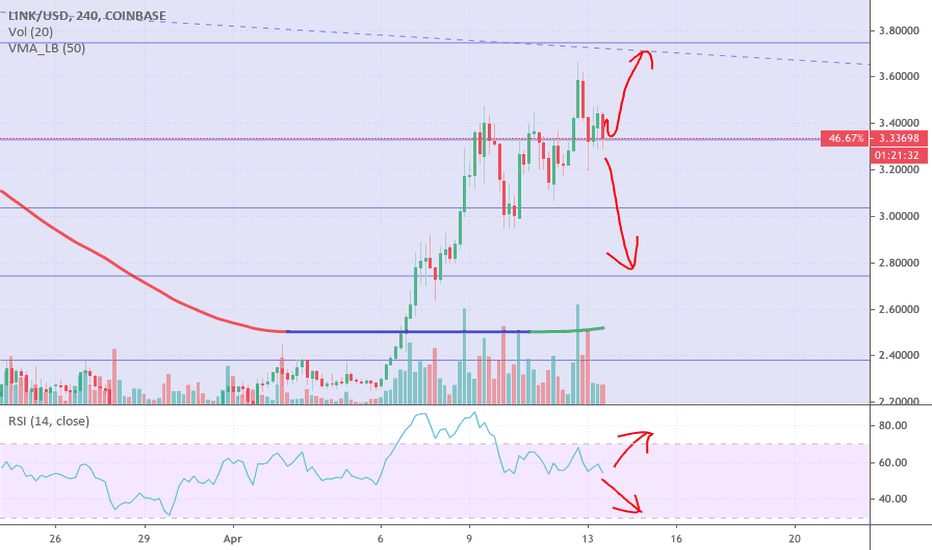

LINKUSD - Won't resist this time...But I'm not sure at all after drawing fibo lines. To a continuation it needs a pump and hold that level around $3.75, if bears succeded and RSI goes lower we can expect to retest $3.00 or even ¢2.75 close to the VMA and wait for more action to come.

This time I'd be in the bear side due the latest "mainstream" good news you can find about LINKUSD recent run. Personally, and as a good contrarian, I think they are showing the opposite to get more people somehow involved in the crypto market and in a professional way get that value from all these weak hands ignoring how it is, and how it's going to be a new concept of market and/or value.

It's "The greatest transfer of value in history"! Now.

What do you think? Will it take us long to adopt this new form of P2P value exchange? Will it succed with all this never-ending money printing machine mode ON?

Thanks!

#Chainlink | Update LINK made a good rally in the previous month 135%

And we had expected this rise before it happened. You can see the idea below

The price has entered a correction period for about two weeks, and we expect this correction to end with the weekly candle closing and then continue rising

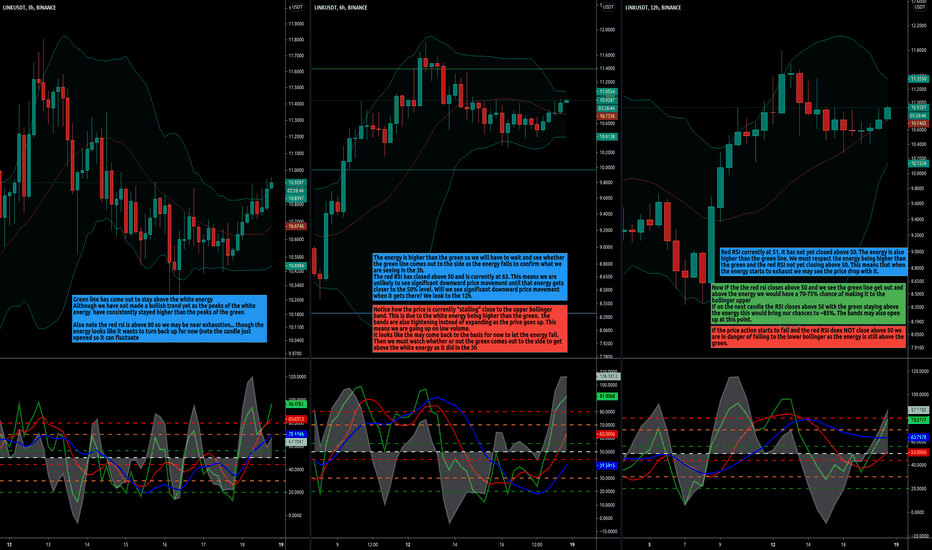

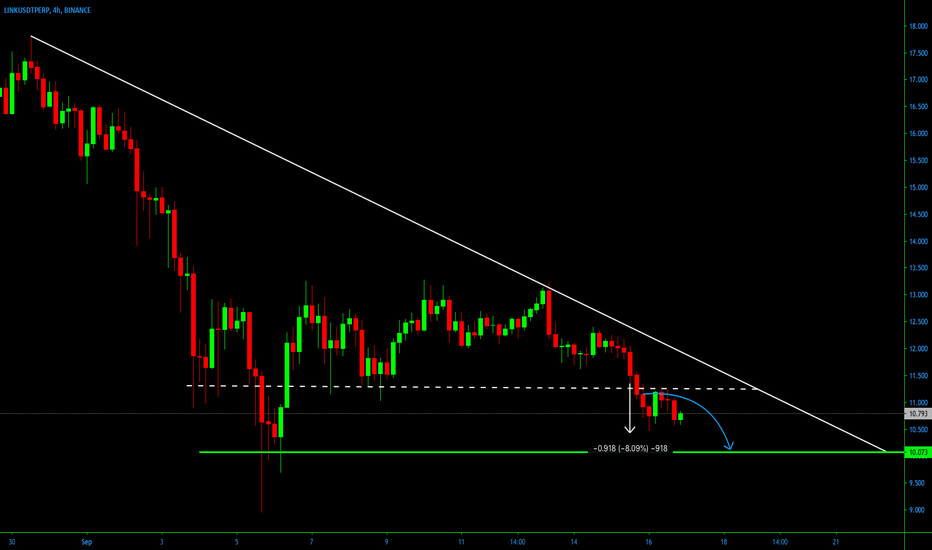

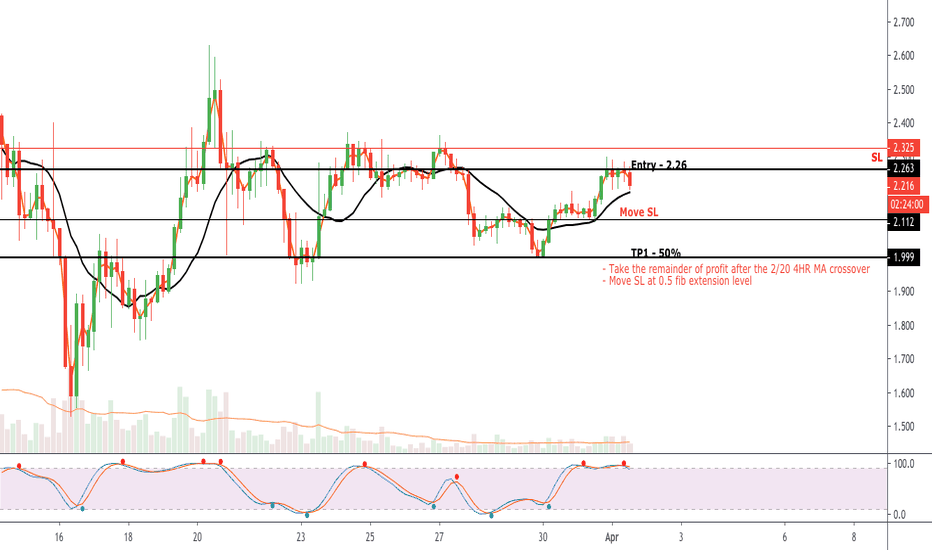

LINKUSDT SHORTLooking to go short here. I'm not as confident as I previously was because it looks like we may be hitting some support. However, IMO the charts look bearish for the following reasons:

1. 4hr 0.6 fibonacci retracement

2. 4 HR stoch oversold

3. Price sitting under 200MA and failing to make a higher high

4. Coronavirus appears to be picking up speed in the US

If this trade goes my way I'll be looking to TP at the levels indicated. However - if we don't get a 4HR 2/20 moving average crossover shortly then i may pull this trade. I'll update later today if i haven't been stopped out before.

**TRADING STRATEGY RULES**

1. Only trade with the trend - establish HHs and LLs or another easier system is: when the price is under 200MA look for short opportunities, when above look for long opportunities

2. Wait for a 4HR 0.5/0.6 fibonacci retracement

3. 4 hr stochastic must be overbought/sold (90+ or 10-)