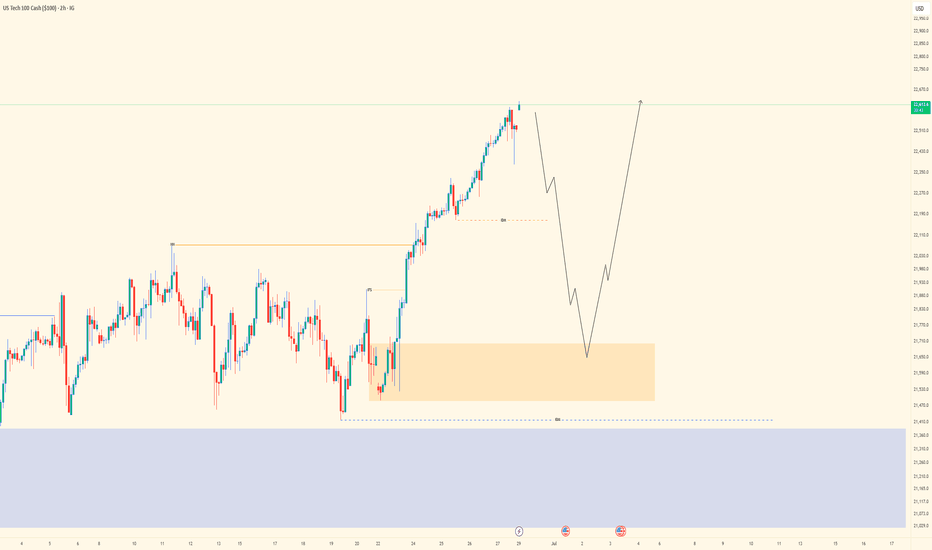

NASDAQ| - Continuation Setup Fueled by Momentum📌 Pair: NAS100 (NASDAQ)

📈 Bias: Bullish

🕰 HTF View (4H):

Strong bullish momentum unfolding with structure showing clear intent to continue higher. No major signs of reversal—smart money appears to be driving price up.

🧭 MTF View (30M → 2H clarity):

Using the 2H for cleaner narrative. Waiting for a clean sweep of sell-side liquidity (SSL) into a refined OB to continue the move. 30M showing structural alignment with the bullish bias.

🎯 Entry Criteria:

LTF CHoCH → Liquidity sweep → OB mitigation

Confirm the shift and execute on the return.

🎯 Target: Structure highs above

🧠 Mindset Note:

Momentum is your ally—but don’t let speed replace structure. Follow your confirmation sequence, stay surgical, and let price do the work.

Bless Trading!

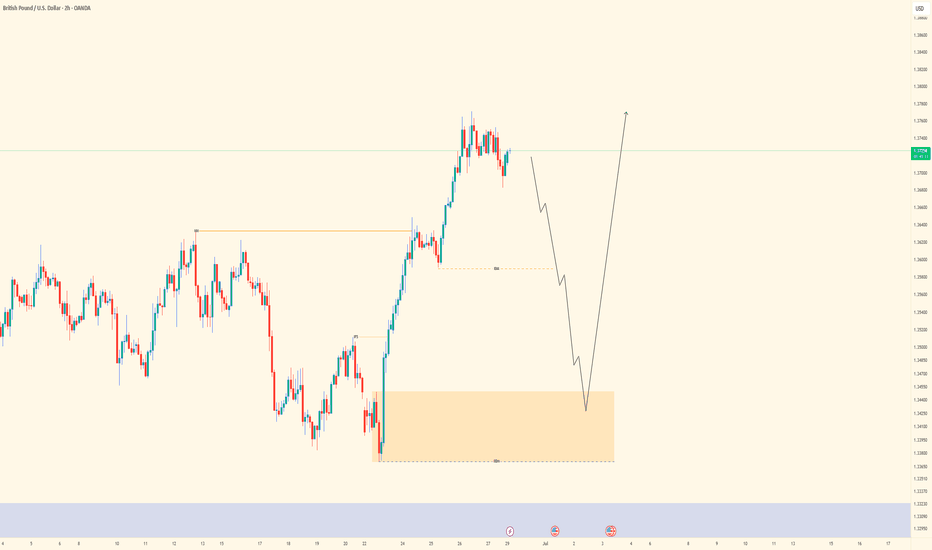

Liquidity

GBPUSD| - Riding the Bullish Wave with Precision📌 Pair: GBPUSD

📈 Bias: Bullish

🕰 HTF View (4H):

Major external structure (HH) broken to the upside — clear bullish intent from smart money. Strong momentum confirms continued interest in pushing price higher.

🧭 MTF View (30M → 2H clarity):

Refined bullish structure forming on 30M. Using the 2H to filter noise and spot deeper liquidity. Watching closely for a sell-side sweep into OB for cleaner, higher-probability LTF entries.

🎯 Entry Criteria:

CHoCH flip → Liquidity sweep → OB mitigation

Perfect sequence = greenlight for execution.

🎯 Target: Structure highs above

🧠 Mindset Note:

Sometimes the best entries come after everyone else gets taken out. Be the one who waits, confirms, then strikes with intention.

Bless Trading!

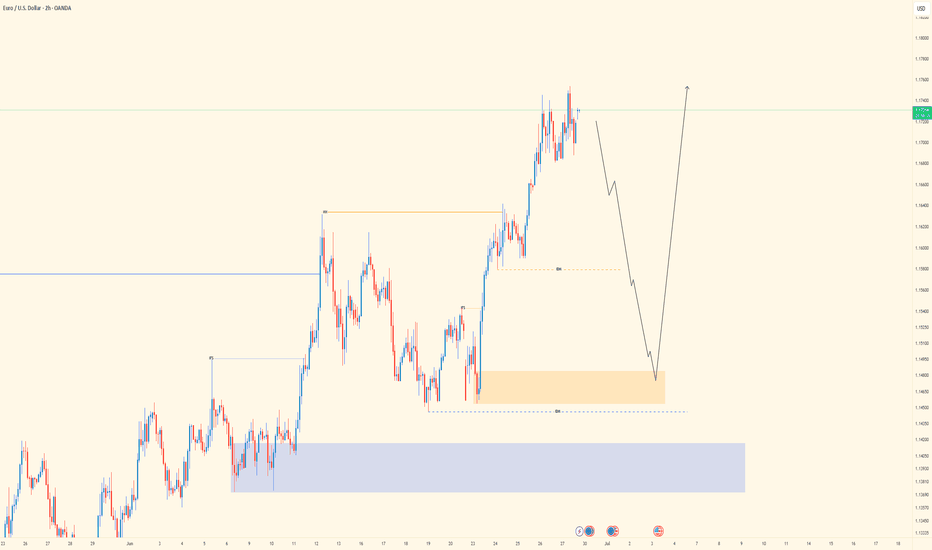

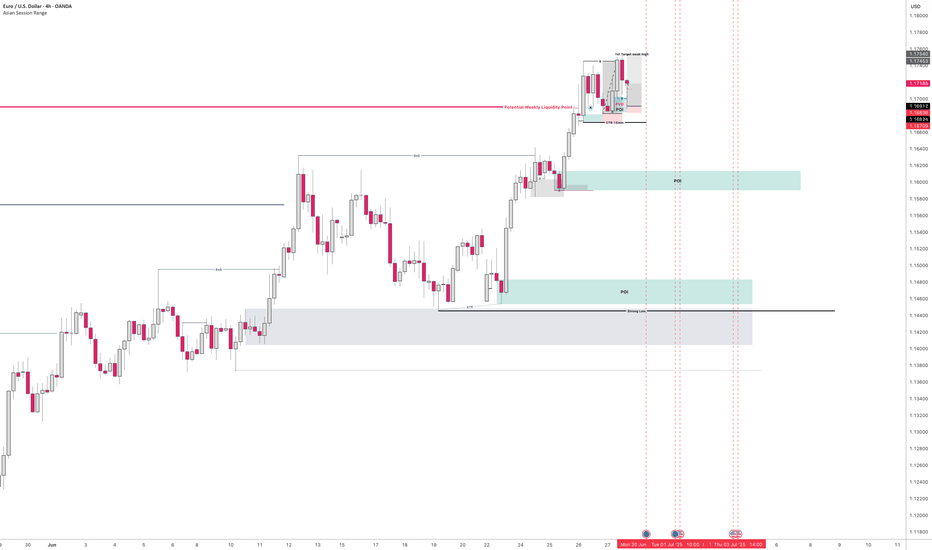

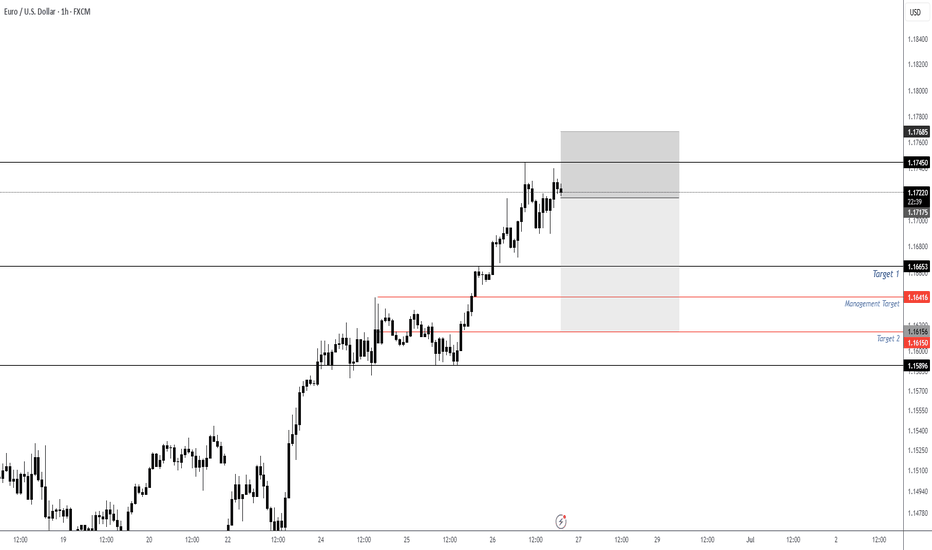

EURUSD| - Inducement Fueling Bullish Intent📌 Pair: EURUSD

📈 Bias: Bullish

🕰 HTF View (4H):

Clear bullish intent shown with a break above major external structure (higher high). Inducement remains intact—expecting that draw to price. Strong bullish momentum signals smart money positioning for more upside.

🧭 MTF Clarity (2H → 30M):

30M structure refined and leaning bullish, but using 2H for confirmation. Waiting on liquidity sweep into the OB zone for entry precision.

🎯 Entry Criteria:

LTF CHoCH → Liquidity Sweep → OB Mitigation

(Execution in that exact order for maximum confirmation)

🎯 Target: Structure highs above

🧠 Mindset Note:

Let the inducement play out—don’t rush it. This is where patience and clarity separate a sniper from a scalper. One clean entry > 10 reactive trades.

Bless Trading!

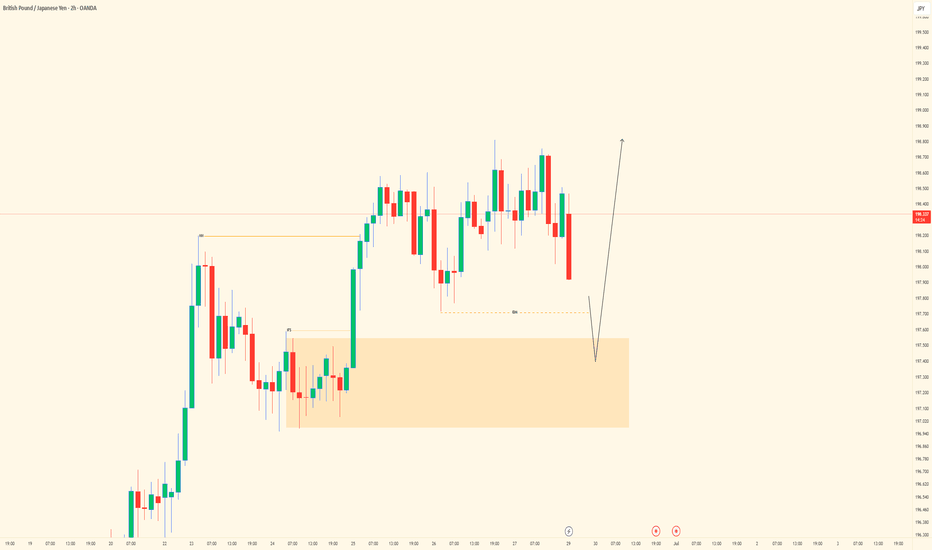

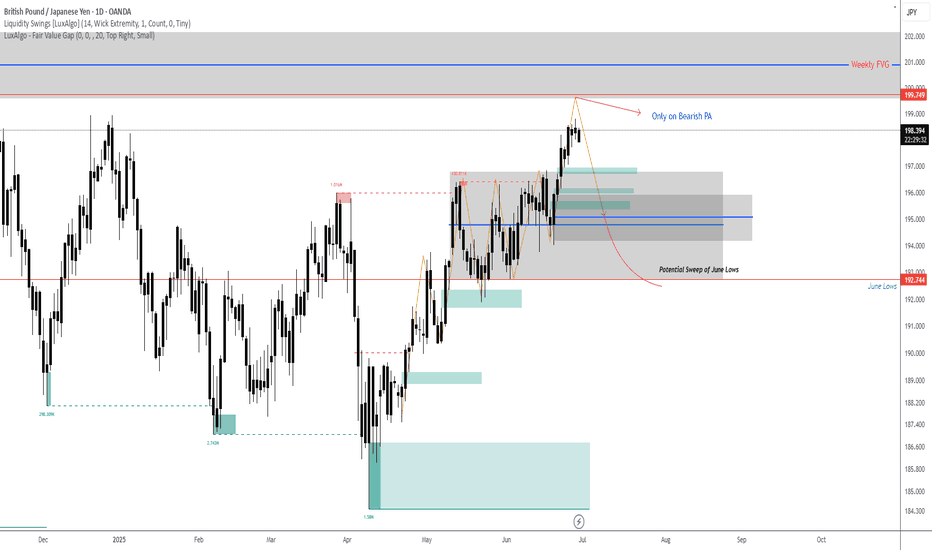

GBPJPY| - Bullish Play with Eyes on Deeper Liquidity📌 Pair: GBPJPY

📈 Bias: Bullish

🕰 HTF View (4H):

Major external structure has been broken to the upside, showing clear bullish intent. Price hasn’t aggressively swept sell-side liquidity yet, so we stay aware of the possibility—but structure favors a continuation north.

🧭 LTF View (30M):

Refined bullish structure forming. Waiting for liquidity sweep into the 30M OB for mitigation and signs of lower timeframe shift.

🎯 Entry Criteria:

After liquidity sweep → LTF CHoCH → Return into OB

Entry off optimal zone (refined precision based on PA)

🎯 Target: Near recent structure highs

🧠 Mindset Note:

Let price come to you. Don’t chase—anticipate. We’re playing the long game through structure and flow, not emotion.

Bless Trading!

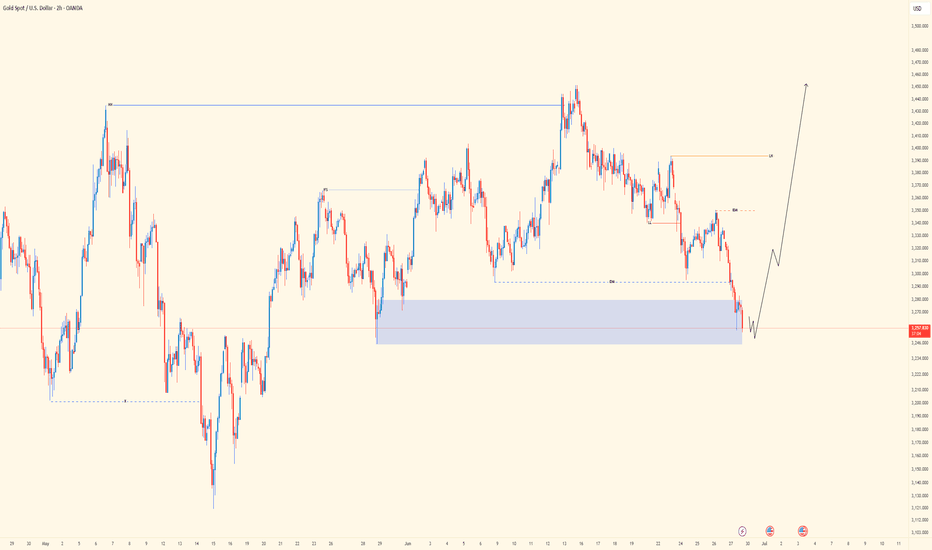

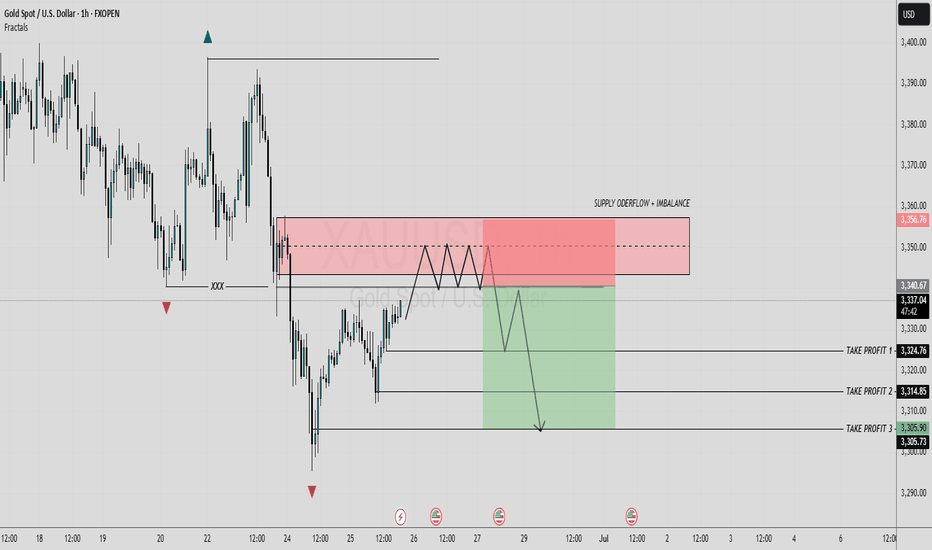

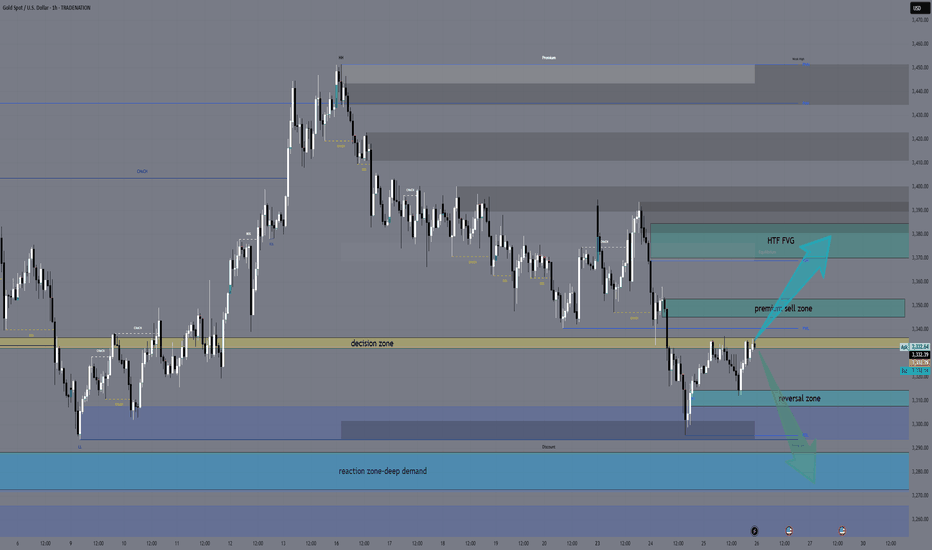

XAUUSD| - liquidity Driven Buy Setup📌 Pair: XAUUSD

📈 Bias: Bullish

🕰 HTF View (4H):

Last week’s price action formed a bullish continuation structure. Internal major high taken, sweeping liquidity—confirmation of smart money interest. Expecting continuation to upside objectives.

🧭 LTF View (30M):

Waiting for clean major LH break following the sell-side liquidity sweep. Entry zones will be refined once OB mitigation confirms buyer interest.

🎯 Entry Zone:

After SSL sweep + OB tap

🎯 Target: Recent highs and continuation beyond

🧠 Mindset Note:

Trusting the flow from higher-timeframe intention down to precision entries. Patience here pays—let the structure confirm before pressing the trigger.

Bless Trading!

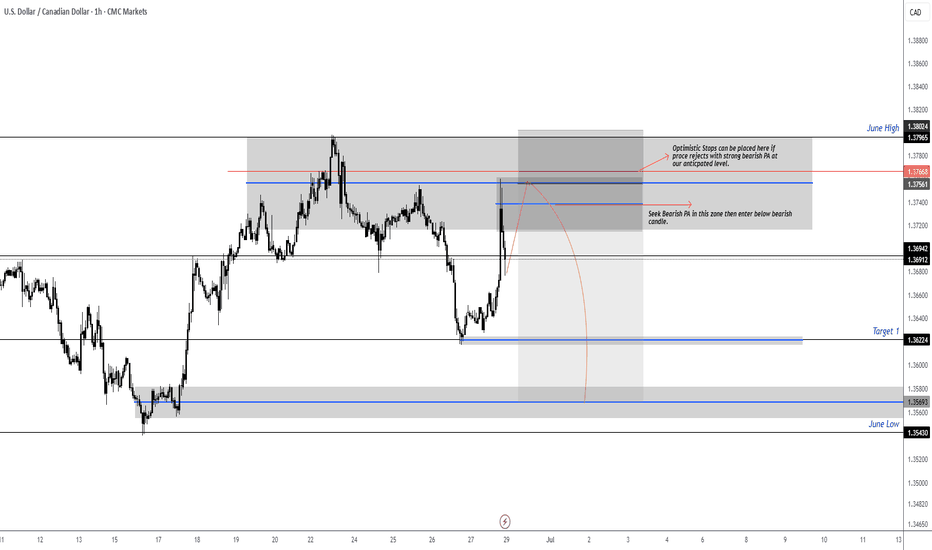

USDCAD RT of Supply Zone then ShortPrice has retraced back into a key supply zone just under the June High. We are now watching for strong bearish price action (PA) to confirm a potential short entry from this area.

Key Zone to Watch:

Supply Zone: 1.3756 – 1.3796

Optimistic stops can be placed above the zone if strong rejection occurs

Plan:

Seek bearish PA within the highlighted supply zone

Wait for confirmation via a bearish candle close

Enter below the trigger candle once setup forms

Targets:

Target 1: 1.3622

Extended Target / June Low: 1.3543

If no rejection occurs and price breaks above the zone with conviction, the setup becomes invalid and we reassess.

Execution will be reactive, not predictive — we trade confirmation, not speculation.

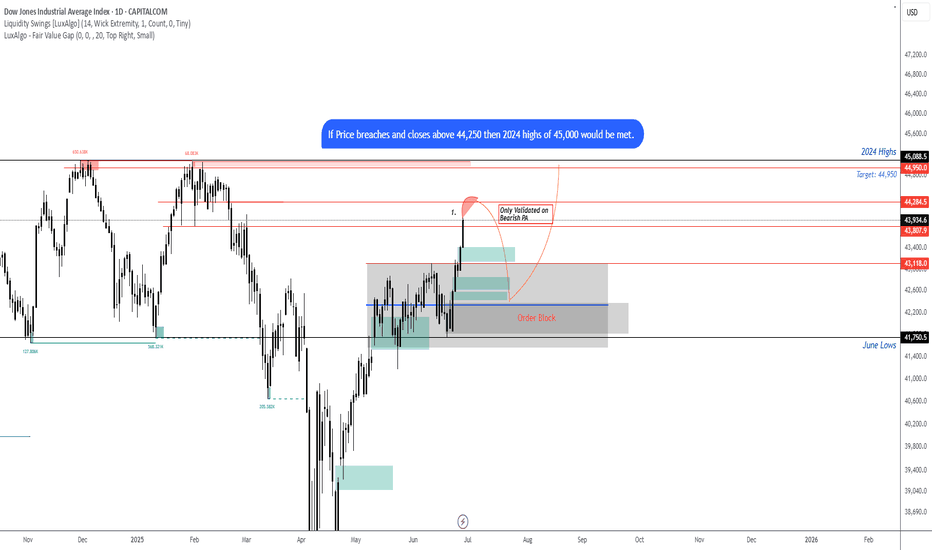

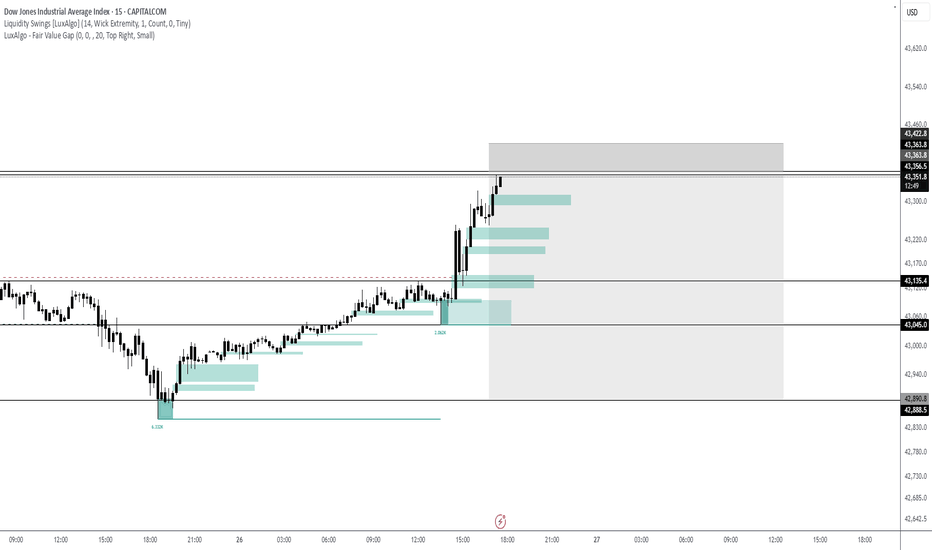

US30 looking for the short on Bearish PAI believe we can expect a pull back down to JuBias: Short-term Bearish (Contingent Setup)

Context: Price is currently trading just below a high-probability supply zone between 44,048 – 44,277. This area aligns with prior highs and liquidity, making it a prime zone to look for a short-term rejection if strong bearish price action (PA) appears on the 4H or Daily timeframes.

We are currently seeing strong bullish momentum on the Weekly, Daily, and H4 candles. Any short positions from this zone must be reactive — not anticipatory. A clear bearish signal (e.g., engulfing, structure break, supply confirmation) is required to consider entry.

Key Zone:

Seek bearish PA between 44,048 – 44,277

Contingency: If price breaks and closes above 44,250 (2024 highs), expect continuation toward 45,000

Short Targets if Rejection Occurs:

Target 1: 43,350

Target 2: 42,500

Extended Target: 41,734 (June Low)

Post-Rejection Bullish Scenario:

If we do get a rejection and targets are met, we will then look for bullish PA in the demand zones (42,500 or 41,700) to consider long setups back toward the 2024 highs and potentially beyond.

Breakout Scenario:

If price breaks and closes above the 44,277 zone early this week, we anticipate the next leg to 45,000 before any meaningful reversal.

At this stage, it’s a waiting game — let price action lead. We don’t predict, we react.ne lows before an

Market Re-Cap and Outlook for NEXT WEEKHere I am giving you a little insight as to what trades I am currently in, taken & looking to take for the week just gone and the week coming.

1 Winning trade on EU

1 Current open position on EU

EURGPB - Breakdown

AUDUSD - Breakdown

NZDUSD - Breakdown

Gold - Breakdown

If there are any pairs you would like me to share my feedback on give me a message and I will be happy to try and do so.

Thanks

Happy Hunting

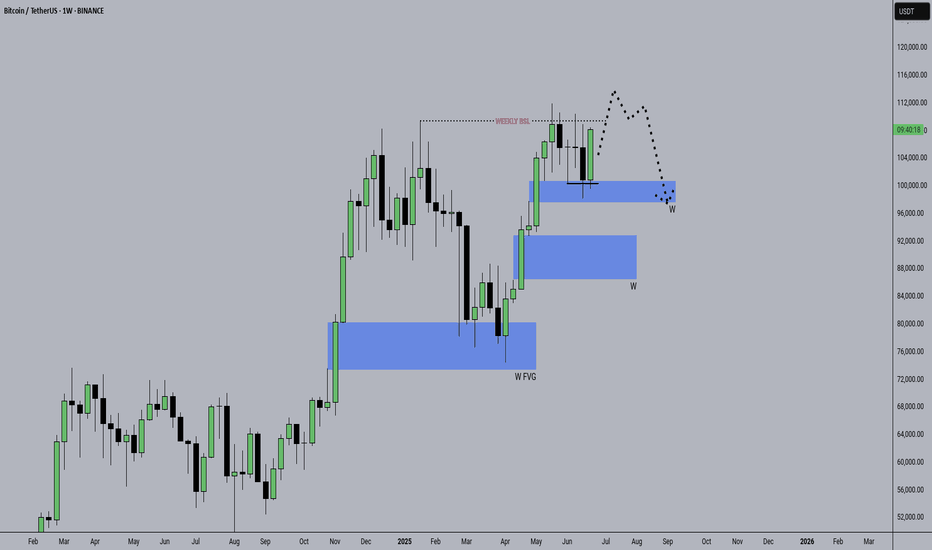

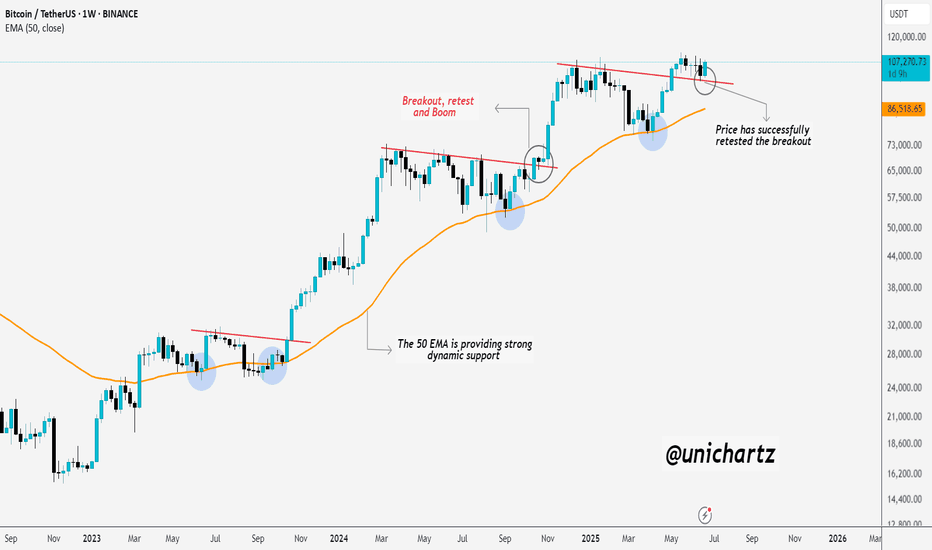

Bitcoin Bounced Right Where It ShouldBitcoin continues to respect the script — breakout, clean retest, and now holding strong.

The 50 EMA has been a reliable dynamic support throughout the entire uptrend, and once again, it helped catch the recent dip. Price has now successfully retested the breakout zone and is starting to bounce.

Structure looks healthy, momentum is building, and unless the support fails, the next leg up could be just around the corner.

Simple setups. No noise. Just trend.

DYOR, NFA

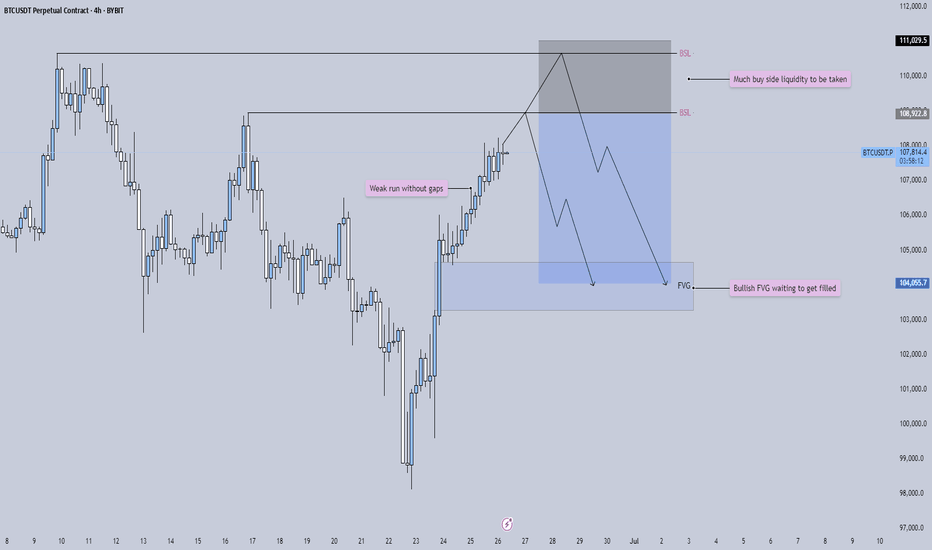

BTC - Will the Bears finally get their chance?Buy Side Liquidity Sweep in Progress

Price is currently climbing toward a region densely packed with resting buy side liquidity, marked by multiple previous highs. The area around 108,900 to 111,000 is especially significant, with two clear liquidity pools stacked above recent swing highs. These levels are likely to attract price as market participants seek to trigger stop orders and induce fresh buying interest—setting the stage for a potential reversal.

Weakness in the Current Impulse

The recent rally has advanced with minimal retracement and virtually no visible Gaps. This lack of corrective structure often indicates imbalance and suggests the move is overextended. When price moves upward too cleanly, it tends to leave behind thin liquidity zones, making the entire leg vulnerable to a sharper correction once exhaustion sets in.

Fair Value Gap as a Draw Below

Below current price lies a prominent bullish Fair Value Gap around 104,000. This inefficiency was left unfilled during the last leg up and may now serve as a magnet for price. These types of Gaps are often revisited by the market in an effort to rebalance supply and demand, especially after aggressive moves that break structure to the upside.

Once the higher liquidity levels are swept, watch for a clear reaction—either a strong rejection or lower timeframe structure shift—which could signal that the top is in. If that shift materializes, price may begin a downward leg targeting the unfilled Gap below. The magnitude of the move, combined with the lack of structure on the way up, leaves plenty of room for corrective action.

For those looking to engage, waiting for confirmation on a lower timeframe—such as a break of short-term bullish structure or the formation of a bearish Gap—can help time entries more precisely. In setups like these, patience is key: let the Sweep play out, observe how price reacts, and only then consider stepping in.

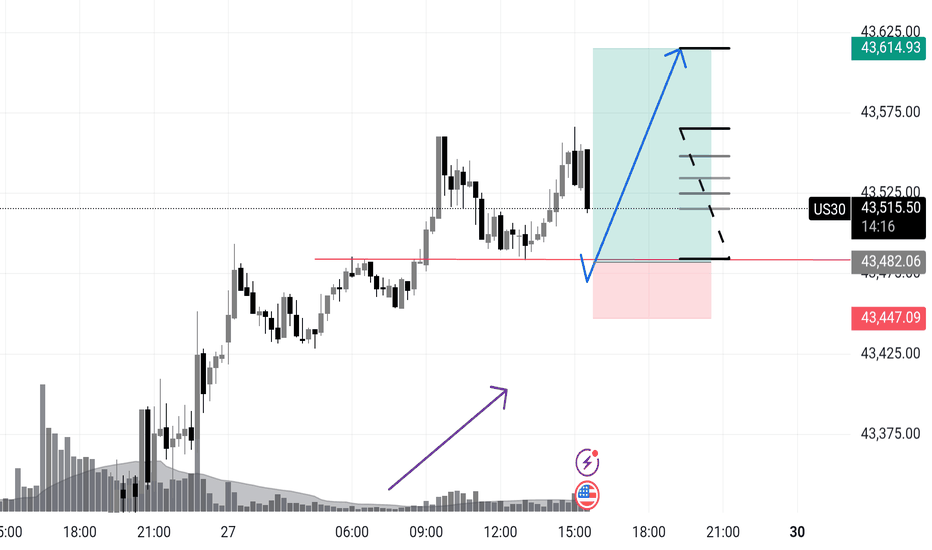

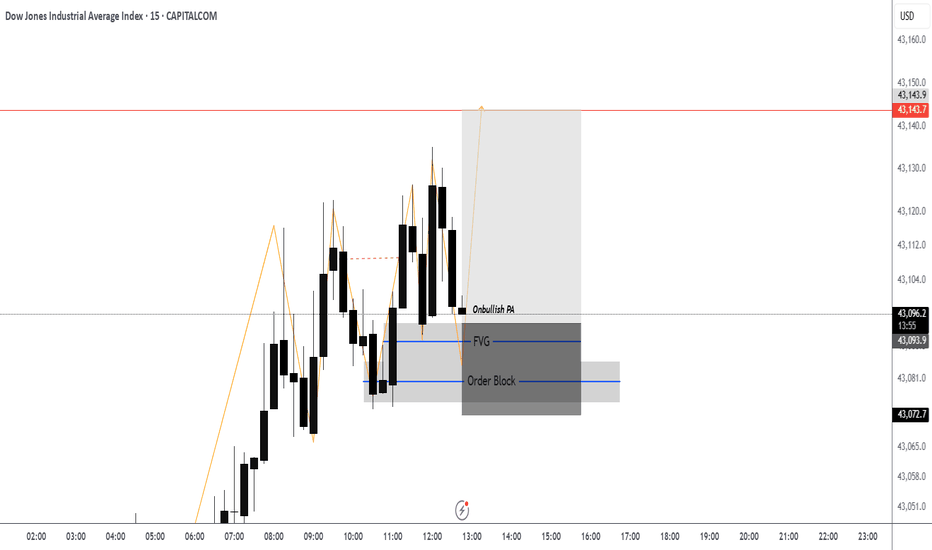

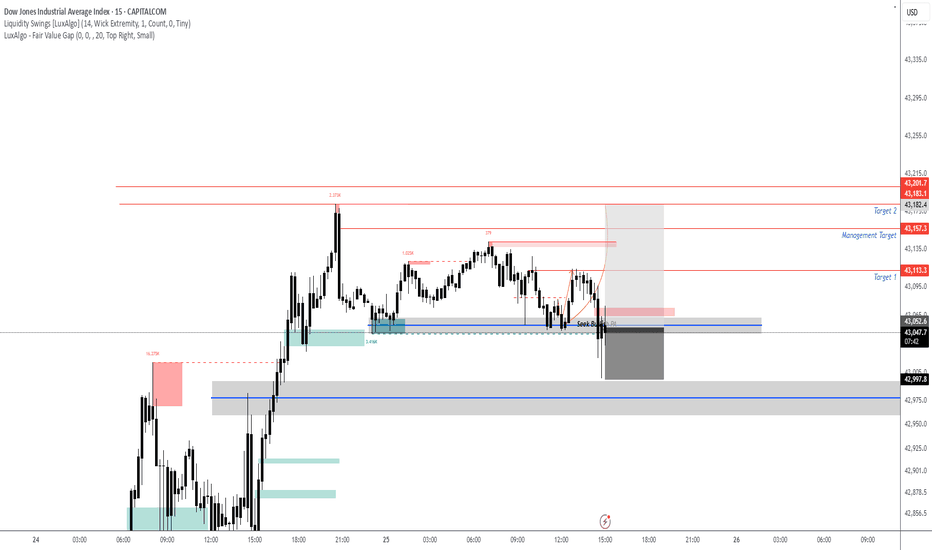

US 30 Potential longUS30 – Wyckoff Spring Setup for NY Session | Intraday Execution Play

Price rallied in the London session with rising volume and structure breaks —

Now we’re anticipating a classic Wyckoff spring scenario just ahead of NY open.

📍 Key Expectations:

Sweep of intraday support around 43,482

Strong buyer reaction (spring confirmation)

Expansion into the 43,600+ zone — possible 1.5R+ continuation

⚠️ Volume buildup + stop placement below prior structure make this zone ripe for a fakeout → reversal.

I’m watching for a quick flush below the line → wick rejection → engulfing confirmation to trigger longs.

This is a trap trade — smart money baits shorts, I’m betting they get squeezed.

🔫 Entry: On confirmation after spring

📉 Invalidation: Below the spring low

🎯 Target: 43,610 zone and trailing after break of 43,570

Let them walk into the trap. Then pull the trigger.

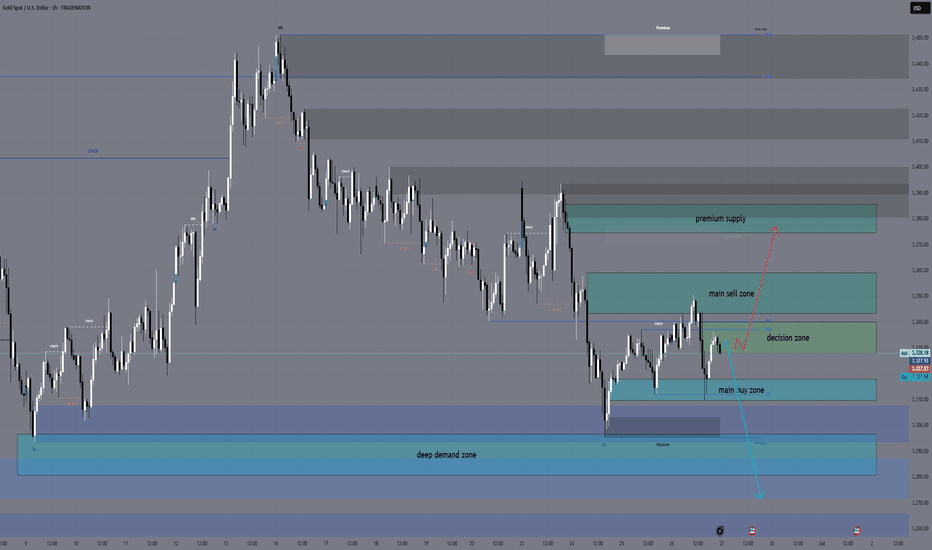

XAUUSD Daily Sniper Plan – June 27, 2025Hey traders! Today’s a trader’s dream: high-impact US news, gold trapped in a tight coil between supply and demand, and price flirting with the decision zone. The first breakout will be explosive — but only one side survives the trap. Let’s lock in the real structure, real bias, and sniper-level execution.

🔸 HTF Bias Breakdown

Daily Bias: Neutral → Price trapped between major supply (3359) and HTF demand (3282). Expect breakout after news.

H4 Bias: Bearish → Lower highs holding below 3359, structure weak below 3340.

H1 Bias: Mixed → Bullish momentum building off 3310–3282, but compression under EMAs warns of a fake rally.

🔹 Key Levels Above Price

3385 – Final top-side liquidity zone (last week’s spike high)

3359–3344 – HTF supply & OB (main short zone)

3340–3330 – The pivot zone (battle for control)

🔸 Key Levels Below Price

3317–3310 – Primary demand zone (where buyers stepped in yesterday)

3297–3282 – Deep liquidity pocket & HTF OB (last chance for bulls)

3260 – Breakdown zone if everything fails below

🔥 Sniper Zones & Execution Logic

🔴 3385–3375 – Extreme Supply

Only trade this zone if NY news launches price up and rejection is instant. Needs M5/M15 bearish reversal (engulfing, CHoCH, FVG fill). No news spike = no trade.

🔴 3359–3344 – Main Supply Zone

This is your first real short setup. Sweep into this area + rejection = clean short trigger. Confluence: HTF OB, FVG, EMA 100 rejection, bearish CHoCH.

⚔️ 3340–3330 – Pivot Decision Zone

This is where direction flips.

Break and hold above 3340 = bullish → targets 3359 / 3375

Rejection under 3330 = bearish → back toward 3310 or 3282

Plan: Use for break/retest entries only with M5/M15 confirmation. No blind trades.

🟢 3317–3310 – Primary Demand Zone

Watch for news-induced sweep, then M15 bullish PA (CHoCH, engulfing, RSI bounce). First safe buy zone if structure holds.

🟢 3297–3282 – Deep Demand Zone

Only used if NY session nukes the market. Enter only on textbook SMC/ICT reversal + RSI sub-30. This is the last stand for bulls.

🧠 Execution Strategy

Wait for NY news and first liquidity sweep. Don’t guess.

Sell 3359–3344 or 3375+ only on strong rejection

Buy 3310 or 3282 only on bullish reversal confirmation

Pivot 3340–3330 is the heart of today — use for break/retest or trap reversal

If you love clear logic, tap like, follow, and share your bias in the comments! 🚀👇

Disclosure: I am part of TradeNation's Influencer program and I'm using their TradingView charts in my analyses and educational articles.

GoldFxMinds

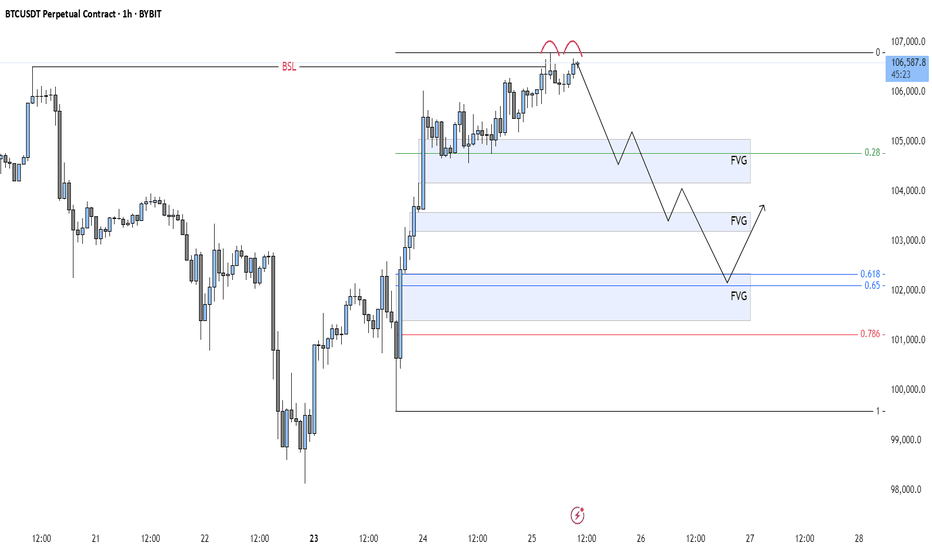

BTC - Double Top after Liquidity Sweep?Price has recently executed a Buy Side Liquidity Sweep just above the previous high. This type of move often signals a potential shift in market direction, especially when followed by signs of exhaustion or failure to push higher. In this case, price has formed a double top near the 106,600 level, a classic sign of weakening bullish momentum and hesitation at a key resistance area.

Following the Sweep, the projection suggests a possible rejection from this region, leading to a corrective move to rebalance the inefficiencies left behind by the sharp upward impulse. These inefficiencies are marked as Fair Value Gaps —areas where price moved too quickly, leaving imbalanced zones between buyers and sellers. The market tends to return to these areas over time as it seeks equilibrium.

The first Gap lies just below the 0.28 Fibonacci retracement and may serve as an initial area for a reaction. If price slices through this level without meaningful support, attention shifts to the second Gap, which aligns closely with the 0.50 to 0.618 retracement zone. This region is historically significant for pullbacks and could offer a temporary pause or bounce.

Should the move extend further, the third and deepest Gap, located between the 0.618 and 0.65 levels , becomes a key area of interest. It marks a critical rebalancing zone that could attract stronger buying interest. If this area fails to hold, the 0.786 retracement level sits just below and may act as a final point for support before any broader directional change.

For refined entries, traders can watch lower timeframes like the 5-minute chart. Look for signs of weakness, such as an inverted Gap or a lower-timeframe break in structure, to time positions with tighter risk. This allows participation in the broader move while maintaining tactical precision.

The confluence of a Buy Side Liquidity Sweep, a double top , and multiple Gaps below provides a clear framework for a potential downside play. As always, let the price action lead.

Patience, confirmation, and context are key to executing with confidence.

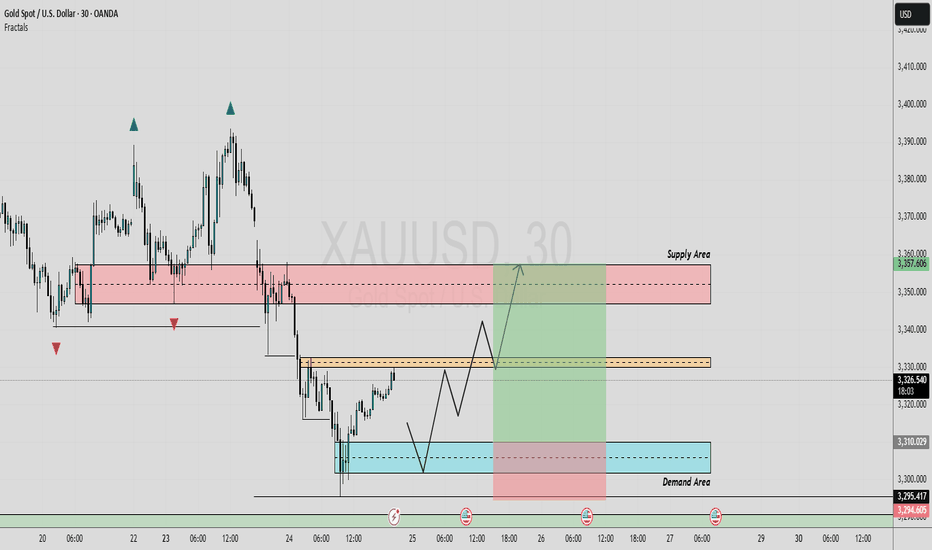

GOLD REVERSAL POINT [Bearish Bias]According to this analysis, today I'm expecting a sell opportunity. So here we're analyze 1H time frame, Price is currently moving near a strong order flow area, and has also SIBI is pending. If price faces clear rejection from this key levels, So there is a high probability that the market may decline from this level. Wait with patient and maintain discipline, confirmation is key.

Now let's see how our sell zone plays out.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

#GOLD 1H Technical Analysis Expected Move.

GOLD 30M ANALYSIS (LONG)In this analysis we're focusing on 30Min time frame. If we look in this 30Min chart, we have supply area and demand area. And we have also a minor resistance level. Now what I'm looking for that price move impulsively upside after sweeping all SSL. I'm expecting that price will come back and retest (3310 - 3305) area at least. So keep an eye on these level, confirmation is key.

Second Condition:

If price break above 3332 and close above 3332 with strong momentum than we will plan a buy trade on retracement.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

#XAUUSD 30M Technical Analysis Expected Move.

XAUUSD – Sniper Entry Plan June 26, 2025👋 Hello traders,

Gold is currently consolidating after recent downside liquidity sweeps, and Thursday brings high-impact USD catalysts. Let’s break it down and build a precise plan for sniper entries around these volatile zones. We’re trading structure, not noise — eyes on the prize. 🎯

🔸 HTF Outlook (D1 → H4 → H1)

🌐 Macro & Geopolitical Context

Markets are bracing for:

USD Unemployment Claims (Forecast: 244K, previous: 245K)

Final GDP q/q and Durable Goods Orders

Fed speakers (Barkin, Barr, Harker)

Stronger-than-expected data could reinforce USD bullish sentiment, sending gold down. Weaker reports + dovish Fed = bullish pressure on gold.

🗺️ Daily Bias: Neutral to Bullish

Price is ranging above a key CHoCH low + Daily OB (3272–3288)

Strong bullish continuation only confirmed with a break above 3370–3384

FIBO: 50% retracement of the last swing is near 3310, giving structure to Buy Zone 1

Bias: Bullish as long as 3272 holds — PA supports HL structure above imbalance

🕓 H4 Bias: Bearish Pullback

CHoCH at 3384 → clean Lower High + price failed to close above premium FVG

Pullback testing EMA 50/100 + FVG at 3345

FIBO extension zone at 161.8% aligns near 3288 = reactive downside target

Bias: Reactive bearish under 3352. If 3370 breaks cleanly → short invalid.

🕐 H1 Bias: Bullish Short-Term

CHoCH → HL printed at 3310 → higher lows forming toward supply

EMA 21/50 crossed to the upside, RSI mid-range (50–60)

PA structure showing ascending triangle under resistance

Bias: Bullish continuation valid toward 3352–3370, unless breakdown under 3308

🔸 LTF Precision (M30 → M15)

🔹 Sell Zone 1 – 3352–3345

H1 OB + M15 FVG + upper range sweep

RSI expected to peak near 70 → potential divergence

FIBO: 78.6% retracement of previous bearish leg

PA: Watch for M15 liquidity sweep + bearish engulfing

🔸 Entry: Wait for break/retest → confirmation on M5–M15 BOS

🔹 Sell Zone 2 – 3370–3384

HTF premium imbalance zone + weak high above

RSI likely in exhaustion zone

FIBO extension 1.272–1.618 completes inside this supply

PA: Only enter after stop hunt wick + clear CHoCH (M5)

🔸 Entry: Reactive fade after liquidity trap

🔸 Buy Zone 1 – 3308–3313

H1 CHoCH + OB + EQ zone

RSI bounce zone (30–40)

FIBO 50–61.8% retracement of bullish swing

PA: Watch for M15 bullish engulfing or double bottom formation

🔸 Entry: Only on structure break + retest confirmation

🔸 Buy Zone 2 – 3288–3272

Daily OB + HTF FVG + massive imbalance

RSI expected to overshoot under 30

FIBO: 1.618 extension from previous M15 bullish leg

PA: High-RR reversal zone if flushed by NY open

🔸 Entry: Enter only after M5 CHoCH or strong engulfing near the OB

⚖️ Decision Zone – 3333–3336

Previous supply turned EQ zone

PA shows indecision — do not enter here

Useful for monitoring if price holds support or rejects

🔸 Trade Scenarios

🟢 Bullish Scenario

If USD data is weak:

Flush to 3308 or 3288

Confirm HL formation → sniper buy from OB → aim 3345+, possibly 3370 sweep

🔴 Bearish Scenario

If USD prints strong:

Price spikes into 3352 or 3370 zones → rejection + BOS

Sniper short entry → targets 3310 → 3288

🔸 Final Plan & Action Points

✅ Patience is key during news. Let structure confirm.

✅ Track price behavior near 14:30 CEST, avoid instant spikes.

✅ Best sniper RR zones:

🔹 Sell from 3352 or 3370

🔸 Buy from 3308 or 3288

📊 Precision matters. Structure wins.

👍 Like this if it helped you map the move, and 🔔 follow for tomorrow’s sniper entry.

— GoldFxMinds

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.