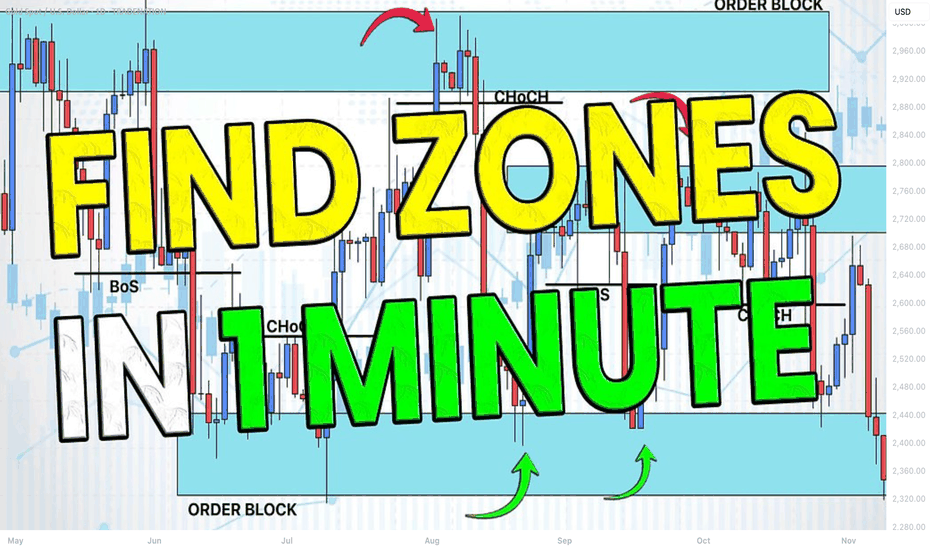

How to Find Liquidity Zones/Clusters on Any Forex Pair (GOLD)

You need just 1 minute of your time to find significant liquidity zones on any Forex pair and Gold.

In this article, I will teach you how to identify supply and demand zones easily step by step.

Liquidity Basics

By a market liquidity, I mean market orders.

The orders are not equally distributed among all the price levels.

While some will concentrate the interest of the market participants,

some levels will be low on liquidity.

Price levels and the areas that will attract and amass trading orders will be called liquidity zones.

How to Find Supply Zones

To find the strongest liquidity clusters, we will need to analyze a daily time frame.

A liquidity zone that is above current prices will be called a supply zone.

High volumes of selling orders will be distributed within.

One of the proven techniques to find such zones is to analyze a historic price action. You should identify a price level that acted as a strong resistance in the past.

4 horizontal levels that I underlined on EURGBP influenced market behavior in the recent past.

The price retraced from these levels significantly.

Why It Happened?

A down movement could occur because of an excess of selling orders and a closure of long positions by the buyers.

These factors indicate a high concentration of a liquidity around these price levels.

How to Draw Supply Zone?

One more thing to note about all these horizontal levels is that they cluster and the distance between them is relatively small .

To find a significant liquidity supply zone, I advise merging them into a single zone.

To draw that properly, its high should be based on the highest high among these levels. Its low should be based on the highest candle close level.

Following this strategy, here are 2 more significant supply zones.

We will assume that selling interest will concentrate within these areas and selling orders will be spread across its price ranges.

How to Find Demand Zones

A liquidity zone that is below current spot price levels will be called a demand zone . We will assume that buying orders will accumulate within.

To find these zones, we will analyze historically important price levels that acted as strong supports in the past.

I found 3 key support levels.

After tests of these levels, buying pressure emerged.

Why It Happened?

A bullish movement could occur because of an excess of buying orders and a closure of short positions by the sellers. Such clues strongly indicate a concentration of liquidity.

How to Draw Demand Zones?

Because these levels are close to each other, we will unify them into a one liquidity demand zone.

To draw a demand zone, I suggest that its low should be the lowest low among these key levels and its high should be the lowest candle close.

Examine 2 more liquidity zones that I found following this method.

Please, note that Demand Zone 2 is based on one single key level.

It is not mandatory for a liquidity zone to be based on multiple significant levels, it can be just one.

We will assume that buying interest will concentrate within these areas and buying orders will be allocated within the hole range.

Broken Liquidity Zones

There is one more liquidity zone that I did not underline.

That is a broken supply zone. After a breakout and a candle close above, it turned into a demand zone. For that reason, I plotted that based on the rules of supply zone drawing.

Start Market Analysis From Liquidity

Liquidity zones are one of the core elements of forex trading.

Your ability to recognize them properly is the key in predicting accurate price reversals.

Identify liquidity zones for:

spotting safe entry points,

use these zones as targets,

set your stop losses taking them into consideration.

They will help you to better understand the psychology of the market participants and their behavior.

I hope that the today's tutorial demonstrated you that it is very easy to find them.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Liquiditysmc

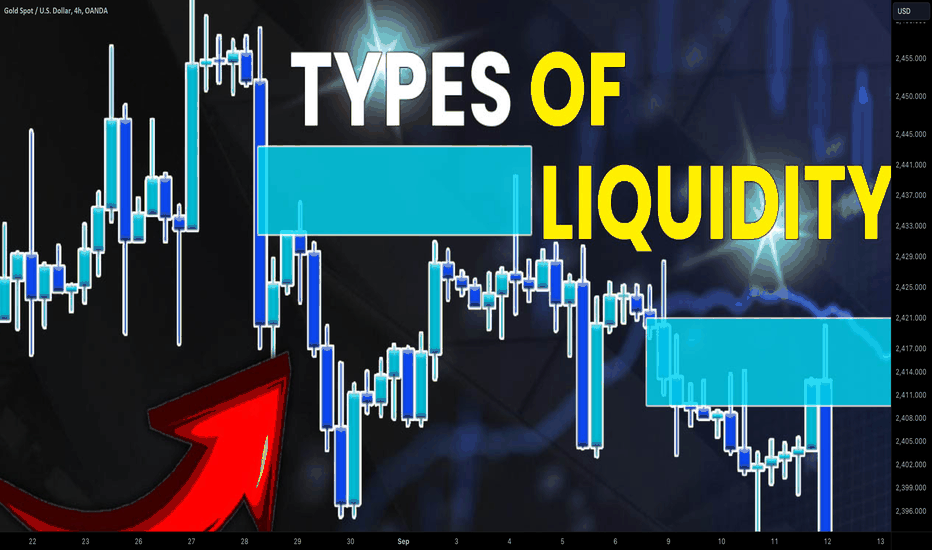

Learn 7 Types of Liquidity Zones in Trading

In the today's article, we will discuss 7 main types of liquidity zones every trader must know.

Just a quick reminder that a liquidity zone is a specific area on a price chart where a huge amount of trading orders concentrate.

Read carefully, because your ability to recognize and distinguish them is essential for profitable trading.

1. Fibonacci Zones

The zones based on Fibonacci levels can concentrate the market liquidity.

Classic Fibonacci retracement levels: 0,382; 0,5; 0,618; 0.786

and Fibonacci Extension levels: 1,272; 1,414; 1,618 attract market participants and the liquidity.

Above, you can see an example of a liquidity zone based on 0,618 retracement level.

The reaction of the price to that Fib.level clearly indicate the concentration of liquidity around that.

Also, there are specific areas on a price chart where Fibonacci levels of different impulse legs will match.

Such zones will be called Fibonacci confluence zones.

Fibonacci confluence zones will be more significant Fibonacci based liquidity zones.

Above, is the example of a confluence zone that is based on 0,618 and 0,5 retracement levels of 2 impulses.

The underlined area is a perfect example of a significant liquidity zone that serves as the magnet for the price.

2. Psychological Zones

Psychological zones, based on psychological price levels and round numbers , quite often concentrate the market liquidity.

Look at a psychological level on WTI Crude Oil. 80.0 level composes a significant liquidity zones that proved its significance by multiple tests and strong bullish and bearish reactions to that.

3. Volume Based Zones

The analysis of market volumes with different technical indicators can show the liquidity zones where high trading volumes concentrate.

One of such indicators is Volume Profile.

On the right side, Volume Profile indicate the concentration of trading volumes on different price levels.

Volume spikes will show us the liquidity zones.

4. Historic Zones

Historic liquidity zones will be the areas on a price chart based on historically significant price levels.

Market participants pay close attention to the price levels that were respected by the market in the past. For that reason, such levels attract the market liquidity.

Above, you can see a historically significant price level on Silver.

It will compose an important liquidity zone.

5. Trend Lined Based Zones

Quite often, historically significant falling or rising trend lines can compose the liquidity zones.

Above is the example of an important rising trend line on GBPJPY pair.

Because of its historical significance, it will attract the market liquidity.

Trend lined based liquidity zone will be also called a floating liquidity area because it moves with time.

6. Technical Indicators Based Zones

Popular technical indicators may attract the market liquidity.

For example, universally applied Moving Average can concentrate huge trading volumes.

In the example above, a floating area around a commonly applied Simple Moving Average with 50 length, acts as a significant liquidity zone on EURJPY.

7. Confluence Zones

Confluence zones are the liquidity zones based on a confluence of liquidity zones of different types.

For example, a match between historic zones, Fibonacci zones and volume based zones.

Such liquidity zones are considered to be the most significant.

Look at the underlined liquidity zone on US100 index.

It is based on a historical price action, psychological level 17000, significant volume concentration indicated by volume indicator and 618 Fibonacci retracement.

Always remember a simple rule: the more different liquidity zone types match within a single area, the more significant is the confluence zone.

Your ability to recognize the significant liquidity zones is essential for predicting the market movements and recognition of important reversal areas.

Liquidity zones are the integral element of various trading strategies. Its identification and recognition is a core stone of technical analysis.

Study that with care and learn by heart all the liquidity types that we discussed today.

❤️Please, support my work with like, thank you!❤️