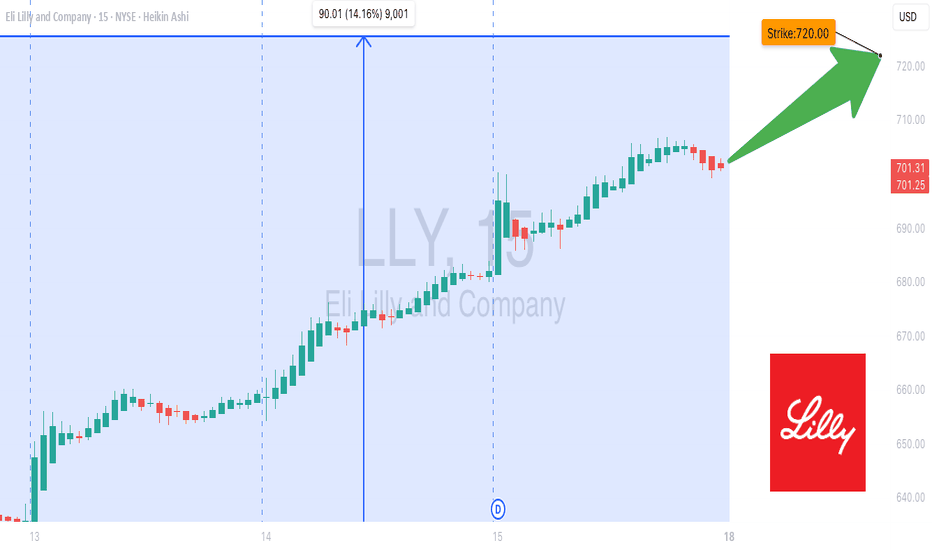

LLY $720 Call Setup: Don’t Miss Out on This Breakout Play!🚀 LLY Weekly Options Analysis (2025-08-17) 🚀

### 🔎 Comprehensive Multi-Model Insights

**Grok/xAI Report**

* 📊 RSI: Neutral (Daily & Weekly \~46)

* 📈 Flow: Call/Put = **3.87 (Bullish bias)**

* 🔊 Volume: Weak vs. previous weeks → ⚠️ no strong institutional support

* 🛑 Trade: **No entry** (weak confirmation)

**Gemini/Google Report**

* 📊 RSI: Improving but <50/55 (not yet bullish confirmation)

* 🔊 Volume: Weak

* ✅ Trade: **Moderate bullish call (\$720 strike)** | Confidence: 65%

**Claude/Anthropic Report**

* 📊 RSI: Neutral

* 📈 Flow: Call/Put = **3.87 bullish**

* 🔊 Volume: Weak patterns → cautious stance

* ✅ Trade: Moderate bullish call, but **emphasizes risks**

**Llama/Meta Report**

* 📊 RSI: Neutral/Weak

* 📈 Flow: Institutional bullish flow (3.87 ratio)

* 🔊 Volume: Non-confirmation

* ✅ Trade: Moderate bullish (aligned with Gemini/Claude)

**DeepSeek Report**

* 📊 RSI: Weak alignment despite recovery

* 🔊 Volume: Bearish divergence + resistance overhead

* 🛑 Trade: **No entry** | Confidence below threshold

---

### 📌 Agreements

✔️ All models: **Bullish call/put ratio (\~3.87)** but **weak RSI & volume**

✔️ Consensus: **Momentum is fragile**, needs stronger confirmation

### 📌 Disagreements

⚖️ Gemini/Claude/Llama → **Moderate bullish call**

⚖️ Grok/DeepSeek → **No trade (weak volume + resistance risks)**

---

## 📊 Trade Setup (Consensus-Based)

* **Direction:** CALL (Long)

* **Strike:** \$720

* **Expiry:** 2025-08-22

* **Entry Price:** \$6.50

* **Stop Loss:** \$3.25 (50% of premium)

* **Profit Target:** \$12.00 – \$13.00 (85–100% gain potential)

* **Confidence:** 65%

* **Entry Timing:** Market Open

---

### ⚠️ Key Risks

* Weak volume = 🚫 limited institutional backing

* RSI < 50 on both daily/weekly = 🚫 not yet strong bullish momentum

* Resistance @ **\$706** could cap upside

---

## 📌 Final Outlook:

**Consensus = Moderate Bullish**, but **caution advised**.

This trade favors **institutional flow > technicals**, with higher risk due to weak confirmations.

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "LLY",

"direction": "call",

"strike": 720.00,

"expiry": "2025-08-22",

"confidence": 0.65,

"profit_target": 12.00,

"stop_loss": 3.25,

"size": 1,

"entry_price": 6.50,

"entry_timing": "open",

"signal_publish_time": "2025-08-17 08:10:17 EDT"

}

Llylong

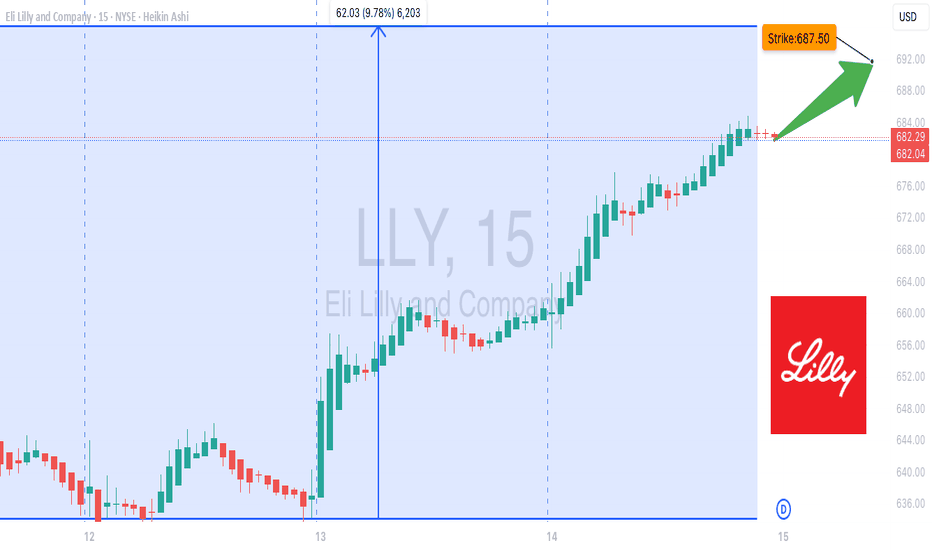

LLY \$687.50 Call – One-Day High-Momentum Play🚀 LLY \$687.50 Call – One-Day High-Momentum Play

**Sentiment:** 🟢 *Moderate Bullish*

* **Call/Put Ratio:** 3.08 → strong speculative interest

* **Daily RSI:** <45, rising 📈

* **Weekly RSI:** <50, rising 📈

* **Volume:** Weak (0.9× last week) → limited institutional support

* **VIX:** <15 → favorable for directional calls

* **Gamma Risk:** HIGH ⚡ — expiry in 1 day

---

### 📊 **Consensus Snapshot**

✅ Strong bullish options flow

⚠️ Weak volume + high gamma → cautious sizing

💡 Low volatility favors call strategy

---

### 🎯 **Trade Setup**

* **Type:** CALL (Single-leg)

* **Strike:** \$687.50

* **Expiry:** 2025-08-15

* **Entry:** \$0.79

* **Profit Target:** \$1.20 (+153%)

* **Stop Loss:** \$0.40 (–50%)

* **Confidence:** 70%

* **Entry Timing:** Market open

---

💬 *High-risk, short-term expiry play — monitor closely.*

📌 *Not financial advice. DYOR.*

---

**#LLY #OptionsTrading #CallOptions #DayTrading #StocksToWatch #GammaRisk #OptionsFlow #TradingSignals**

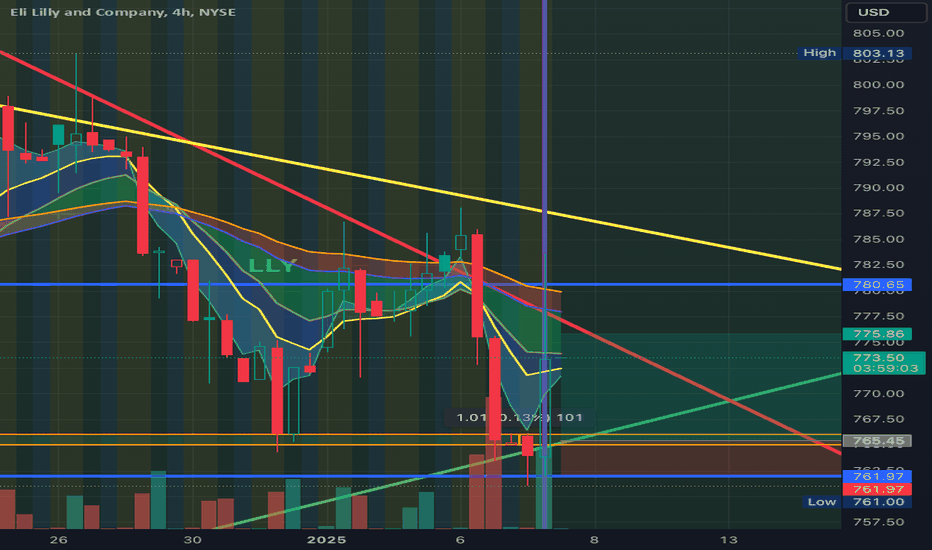

Halftime Report: LLY Up From Here? Hold for better PriceWe've been watching LLY after Open this morning allowed it to bounce up to $783.63. It has since settled on the 50% Retracement on the 5 Minute, which we were looking for it to break down back to at least the $765-$766 Price Range, looking to get in around $765.45specifically. With a Price Target $775 (Short-Term Trade Target) on the rebound and retest. We're looking at a stop around $761.97 to be safe in case it comes down hard and surpasses our entry. On a longer-time frame, we're looking for potential a $780.65 - $785 retest.

Stay tuned by connecting at the website in our signature! We deliver this and more financial tools to make life that much easier on You!

- @MyMIWallet #MyMIWallet

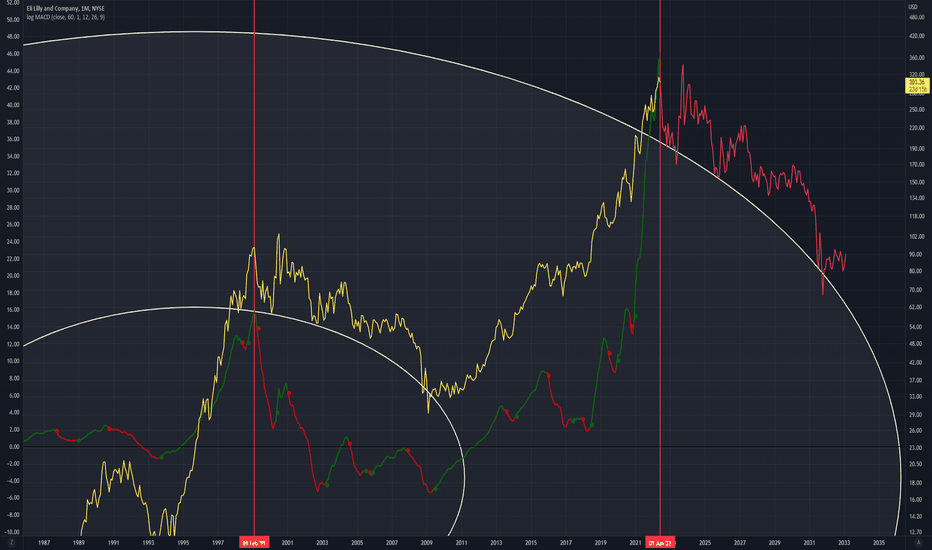

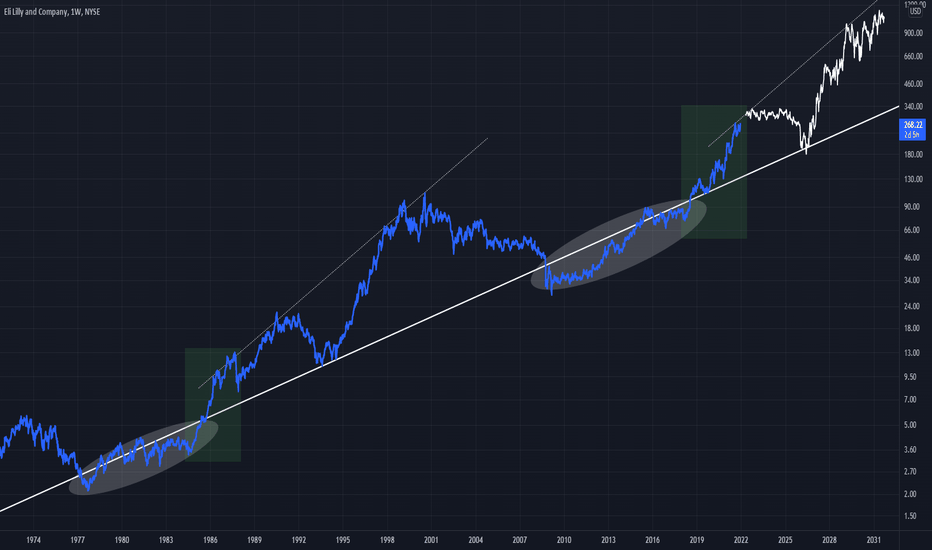

LLY Long Opportunity LLY has provided a nice long opportunity with the recent break above the major trendline

This breakout is comparable to a previous point, which led to a large megaphone price structure

Price will likely stay above the trendline and climb within the megaphone (attempted to roughly sketch what it would look like)

LLY - STOCKS - 21. OCT. 2021Welcome to our Weekly V2-Trade Setup ( LLY ) !

-

4 HOUR

Small pullback towards previous sr level.

DAILY

Expecting more bullish pa!

WEEKLY

Overall great market structure.

-

STOCK SETUP

BUY LLY

ENTRY LEVEL @ 241.21

SL @ 231.90

TP @ Open

Max Risk: 0.5% - 1%!

(Remember to add a few pips to all levels - different Brokers!)

Leave us a comment or like to keep our content for free and alive.

Have a great week everyone!

ALAN