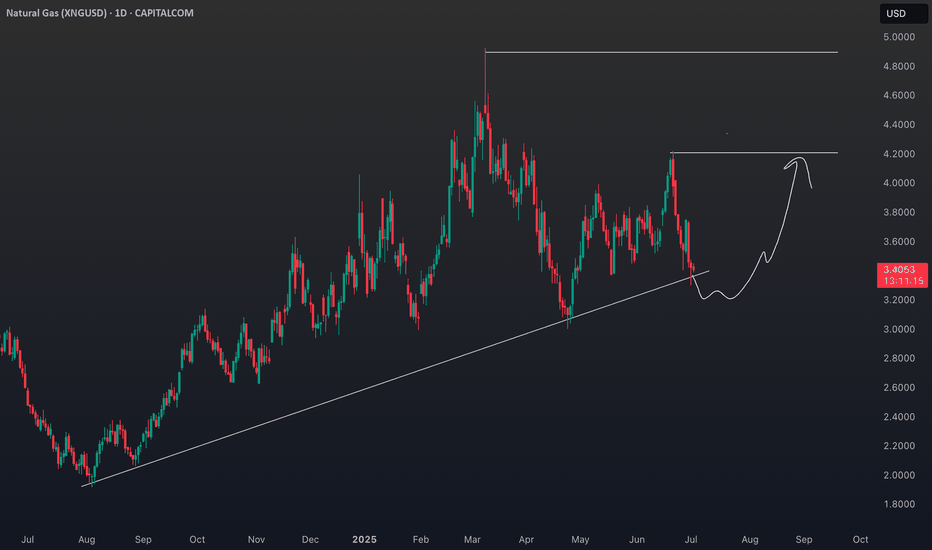

LNG Bull Market: How Geopolitics and Demand Are Fueling XNG🔥 The Natural Gas market presents a compelling risk/reward opportunity with strong fundamental support from ⚖️ supply/demand imbalances and 🌍 geopolitical factors. The technical chart shows a healthy 📊 consolidation after the explosive 🚀 February–March rally, with the potential for another leg higher.

📌 Key Investment Thesis:

• 📈 Structural bull market driven by demand growth outpacing supply

• 🌐 Geopolitical premium supporting price floor

• 🌦️ Weather-driven volatility creating trading opportunities

• 🛳️ LNG export growth providing long-term demand foundation

🧭 Recommended Approach:

• 💰 Accumulate positions on weakness near $3.00–$3.40 levels

• 🎯 Target initial resistance at $4.00, with extended targets at $5.00+

• ⚠️ Maintain disciplined risk management with stops below $2.60

• 👀 Monitor weather patterns and geopolitical developments closely

📊 Risk Rating: MODERATE TO HIGH (due to volatility)

💵 Return Potential: HIGH (⏫ 50–100% upside potential over 12–18 months)

❗ This analysis is for informational purposes only and should not be considered as financial advice.

⚠️ Natural gas trading involves significant risk and volatility.

📚 Always consult with a qualified financial advisor and conduct your own research before making investment decisions.

Lngforecast

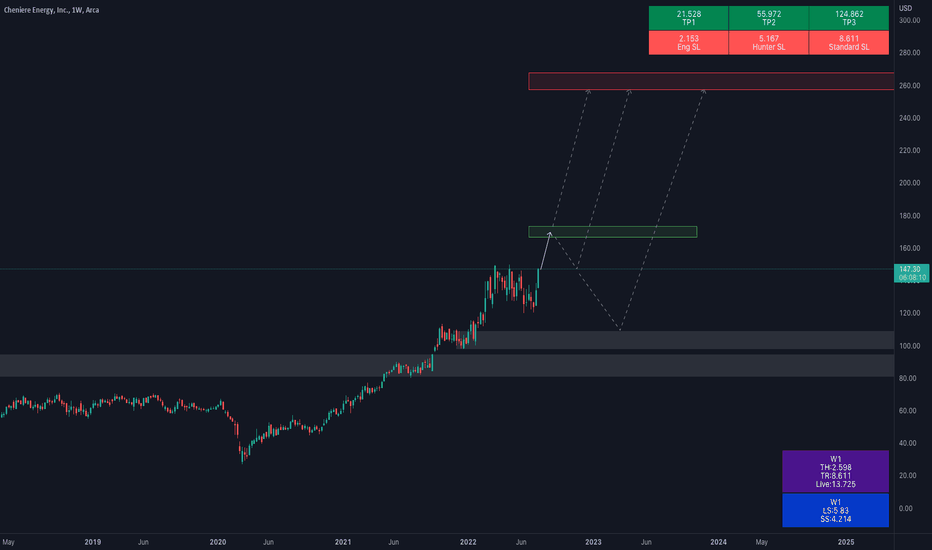

$166 is the new ATH!in weekly time frame, green box $166~$173 is the first target.

after that i think price need retracement.

the current upward movement structure and how meet the green box and the lng market at that moment, show us the $147 support zone or $110 support zone will lead the price up to the red box.