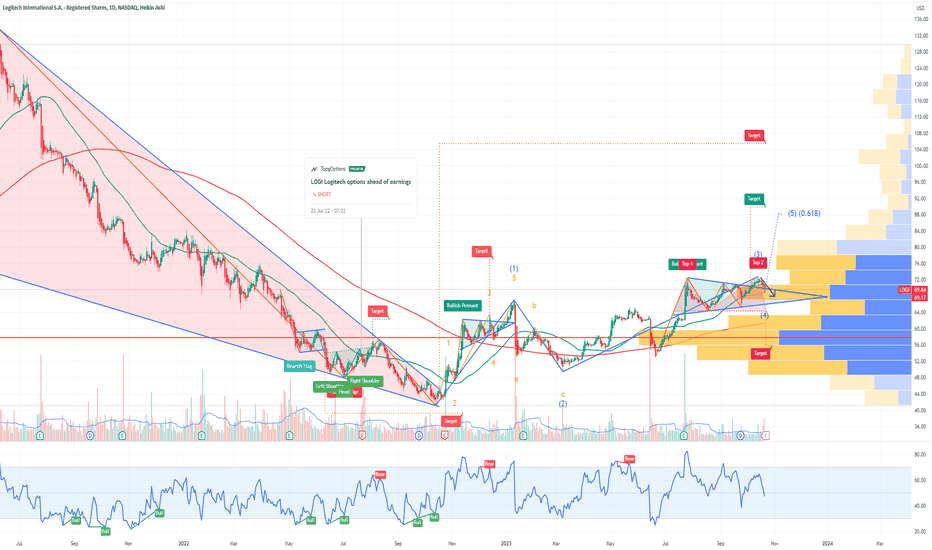

LOGI Logitech International Options Ahead of EarningsIf you haven`t sold LOGI here:

Then analyzing the options chain and the chart patterns of LOGI Logitech International prior to the earnings report this week,

I would consider purchasing the 80usd strike price in the money Puts with

an expiration date of 2024-1-19,

for a premium of approximately $11.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Logitechinternational

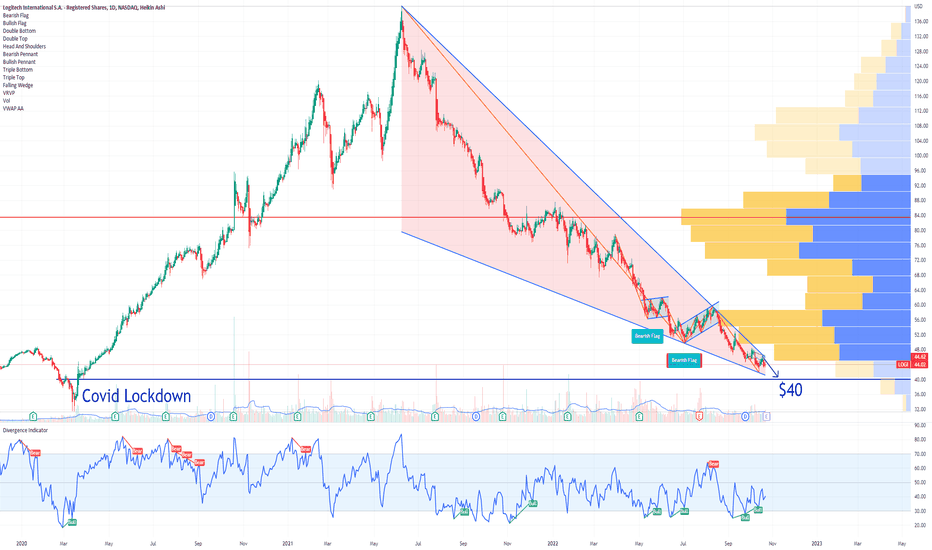

LOGI Logitech International Options Ahead of EarningsIf you haven`t bought puts or shorted the stock here:

then you should know that looking at the LOGI Logitech International options chain, i would buy the $40 strike price Puts with

2022-11-18 expiration date for about

$1.18 premium.

Looking forward to read your opinion about it.

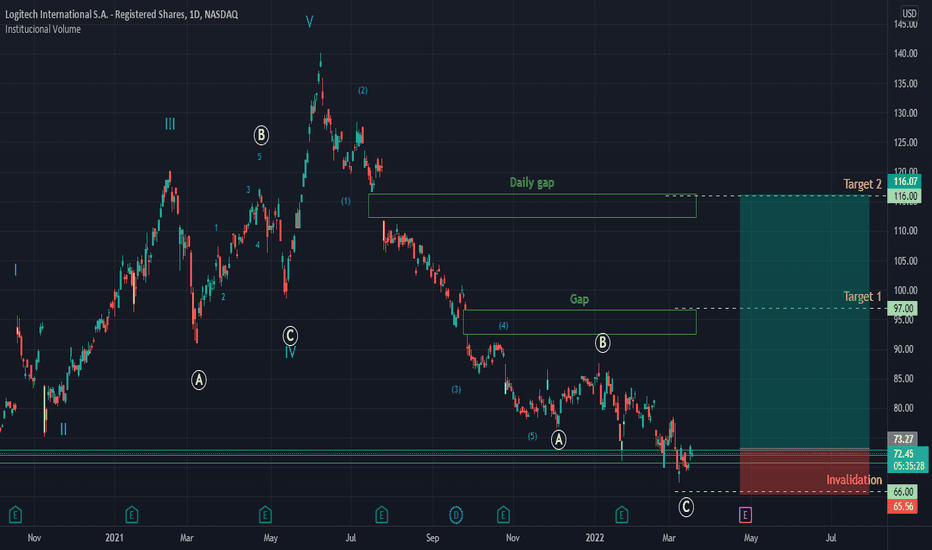

LOGITECH LONG POSITIONMarket finished full Elliot wave 1-5 and ABC correction, market has to fill the gaps it made going down so that is where are targets are.

Entry: 74 (Now because we just bounced off of an demand zone and 50% fib zone)

Target 1: 97 (First gap zone)

Target 2: 116 (Second gap zone)

Invalidation: 66 (Just below demand zone)