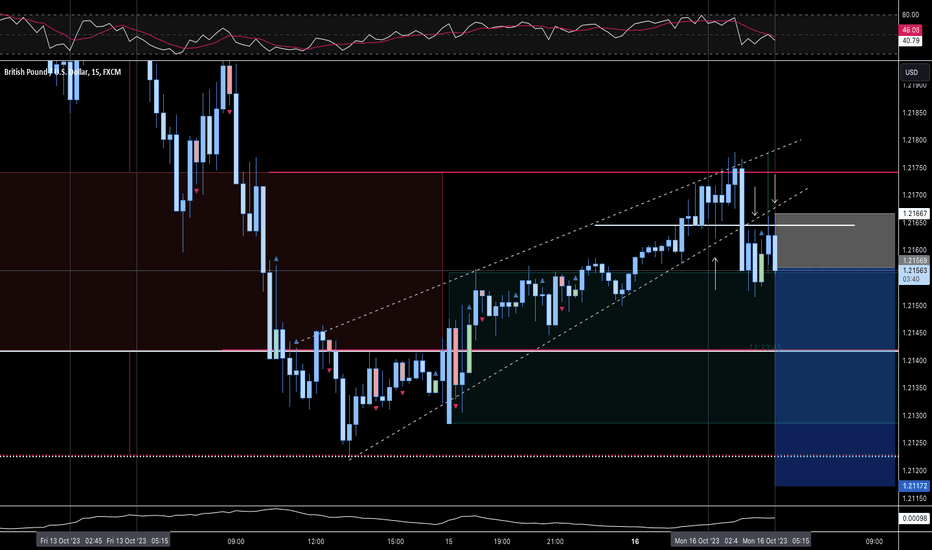

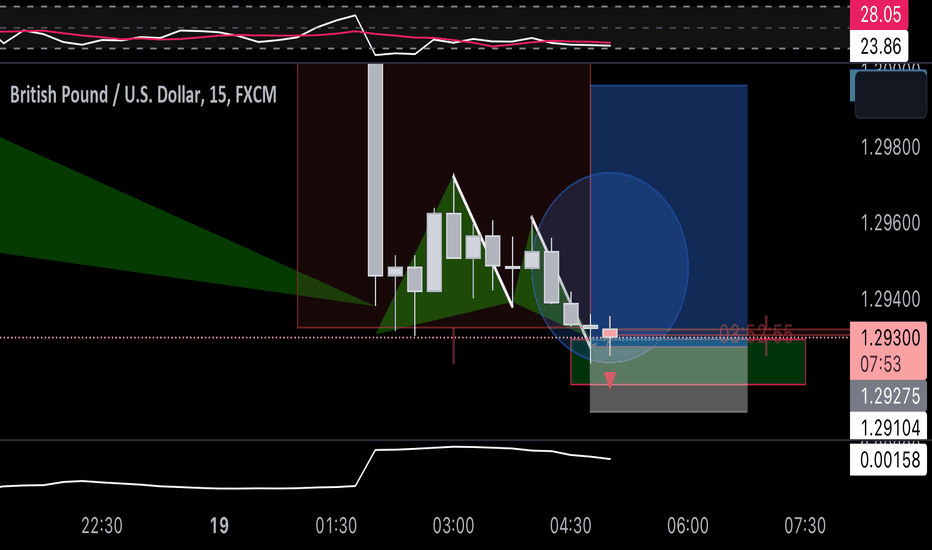

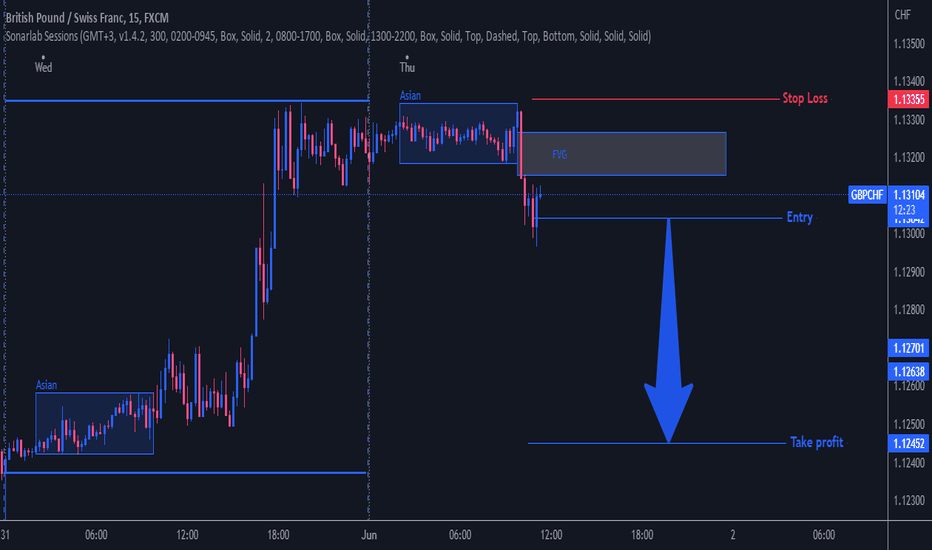

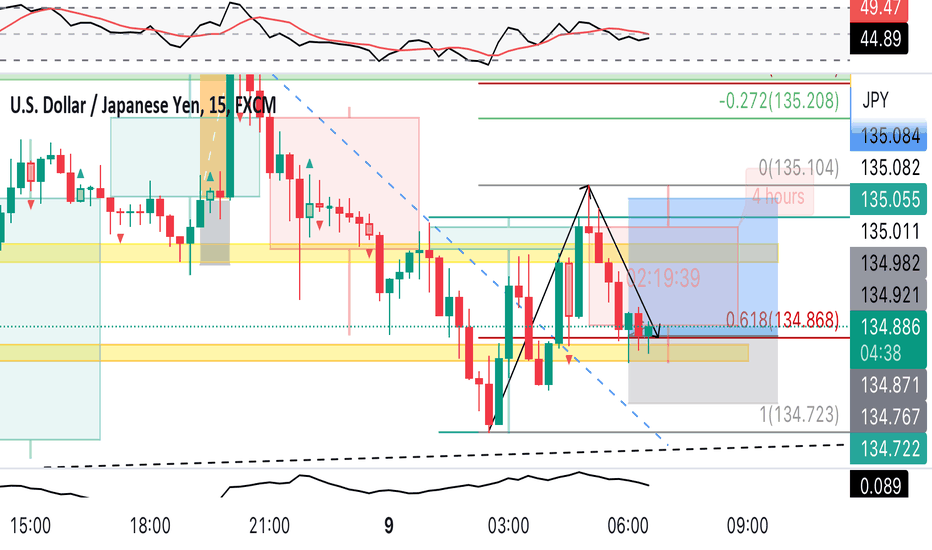

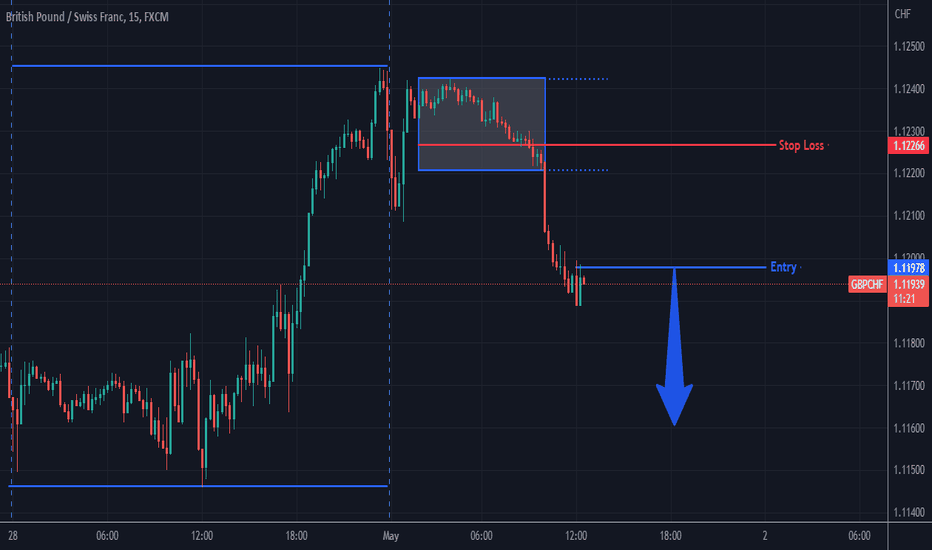

GU: “Break & Retest” Setup on “Momentum” Set Stop Entry (33/100)System has identified a “B&R” playbook setup and a potential “momentum” shift sell stop entry during the third hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 4R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using all GBP pairs. The win rate and expectancy are unknown. Please do not take these trades.

London

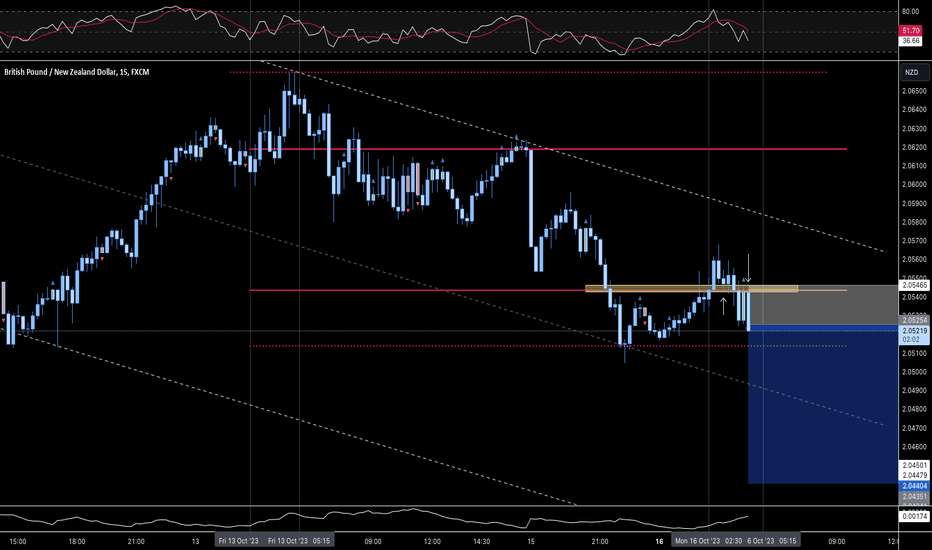

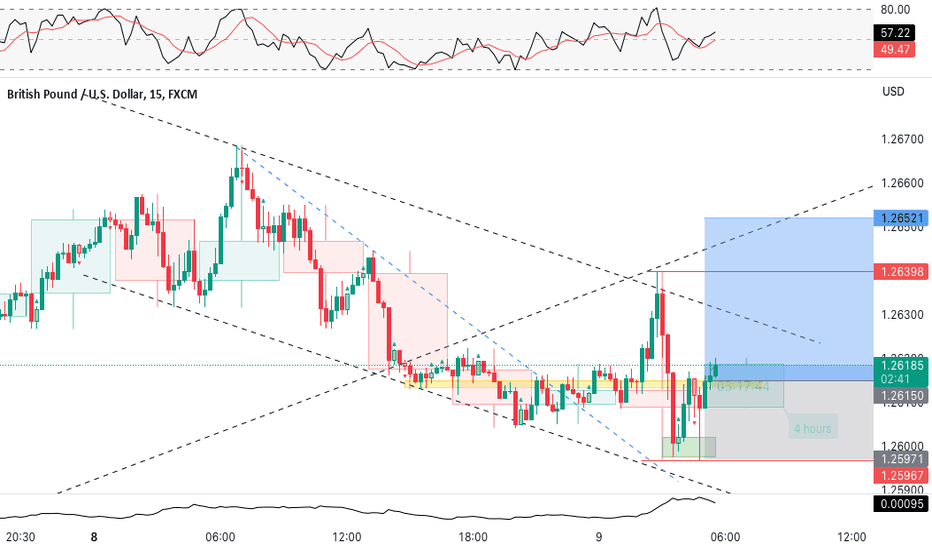

GBPNZD: “Break & Retest” Setup on “IBM” Buy Stop Entry (33/100)System has identified a “B&R” setup and a sell stop on the break of the inside bar for an entry executed during the second hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 4R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using all GBP pairs. The win rate and expectancy are unknown. Please do not take these trades.

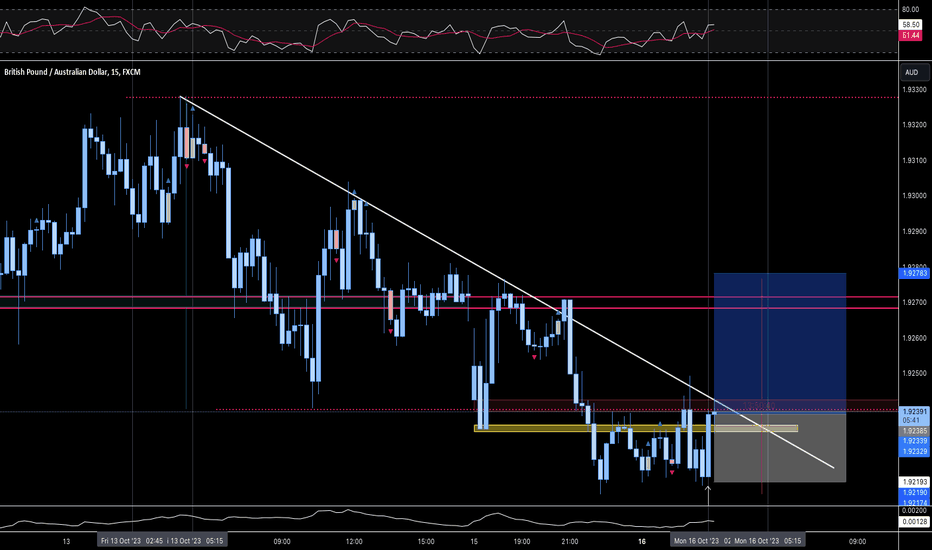

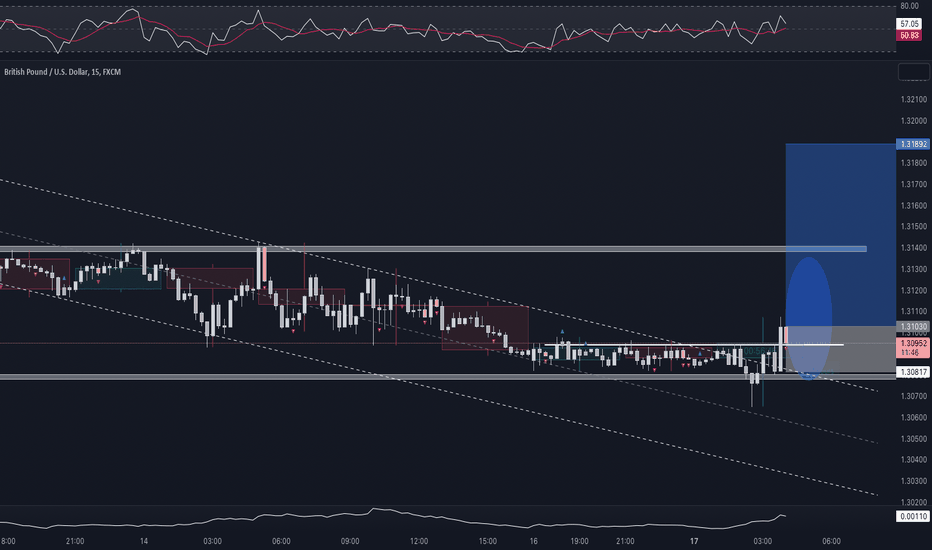

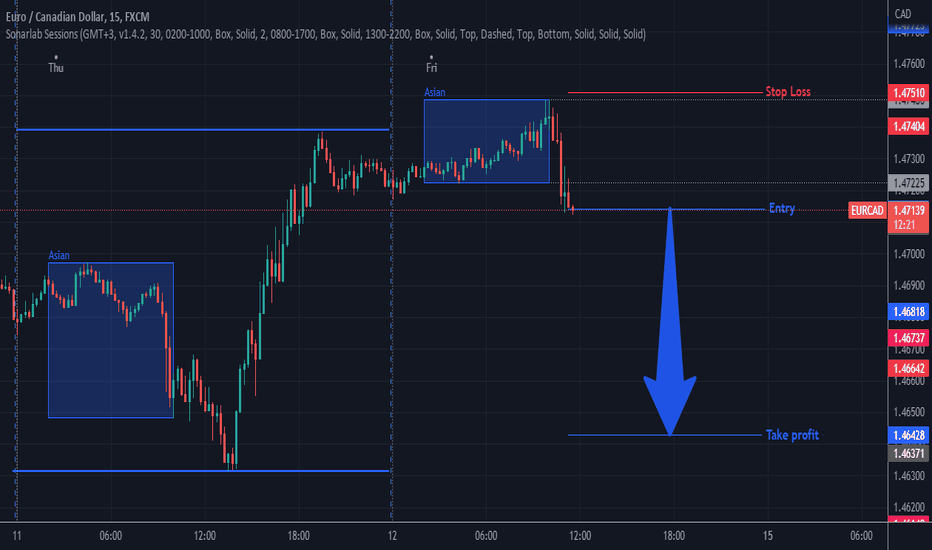

GA: “Break & Retest” Setup on “Momentum” Buy Stop Entry (32/100)System has identified a “B&R” playbook setup and a potential “momentum” shift buy stop entry during the first hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 2R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using GBP pairs. The win rate and expectancy are unknown. Please do not take these trades.

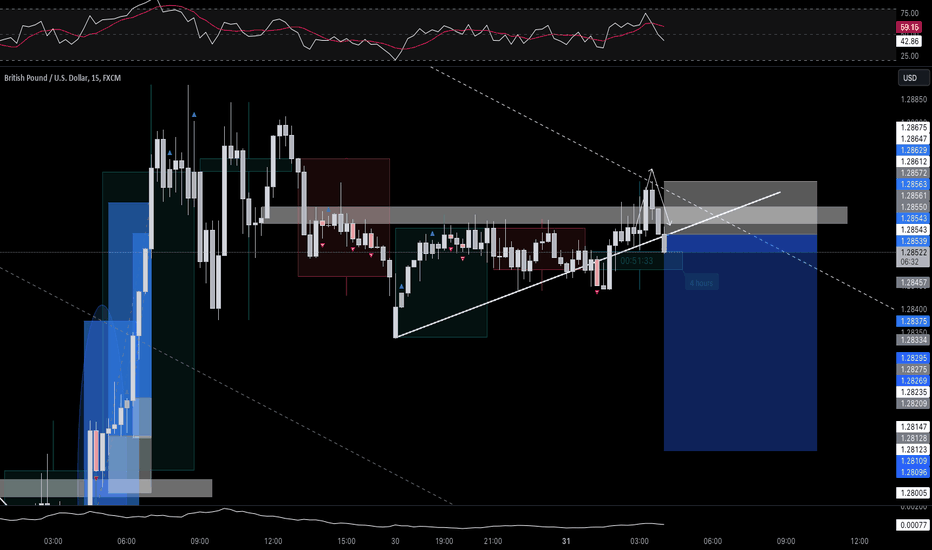

GA: “Break Out” Setup on “Momentum” Entry (31/100)System has identified a “BO” playbook setup and a potential “momentum” shift market entry during the first hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 2R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using all GBP pairs. The win rate and expectancy are unknown. Please do not take these trades.

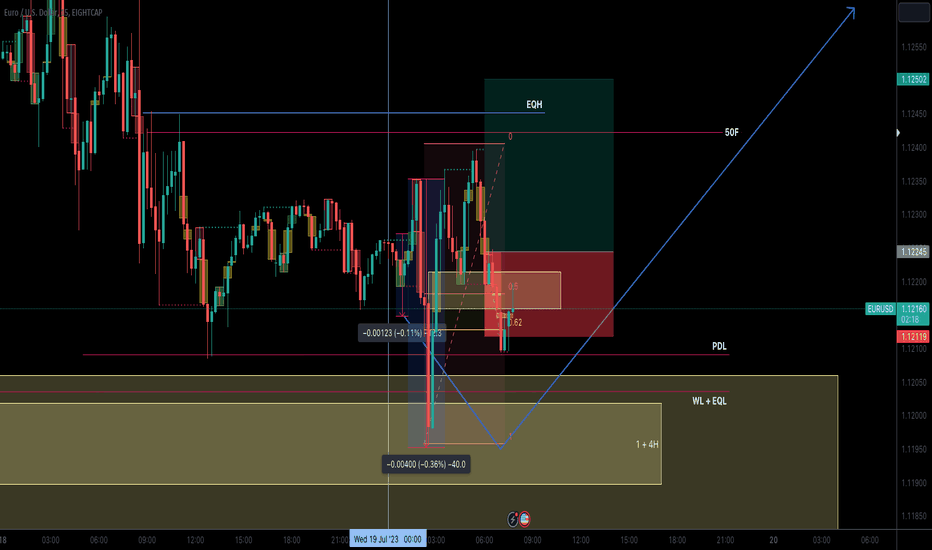

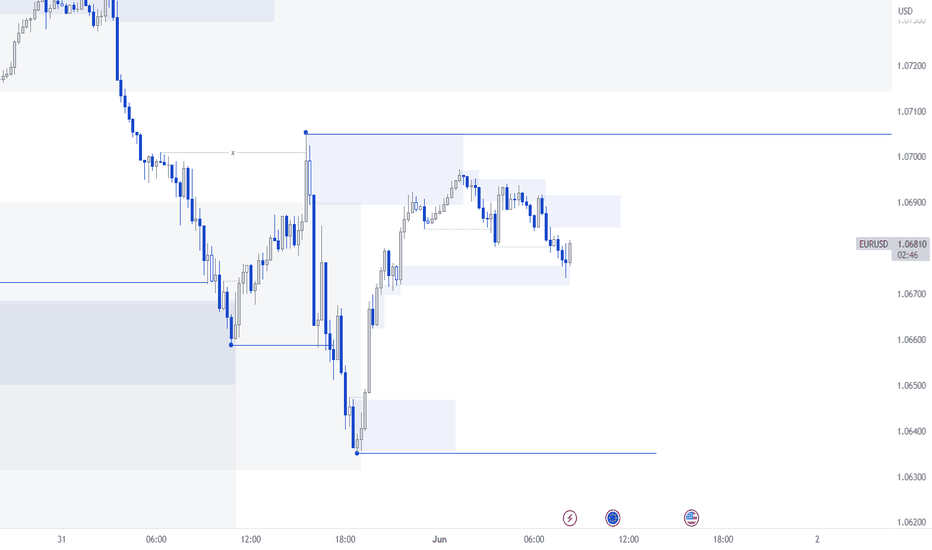

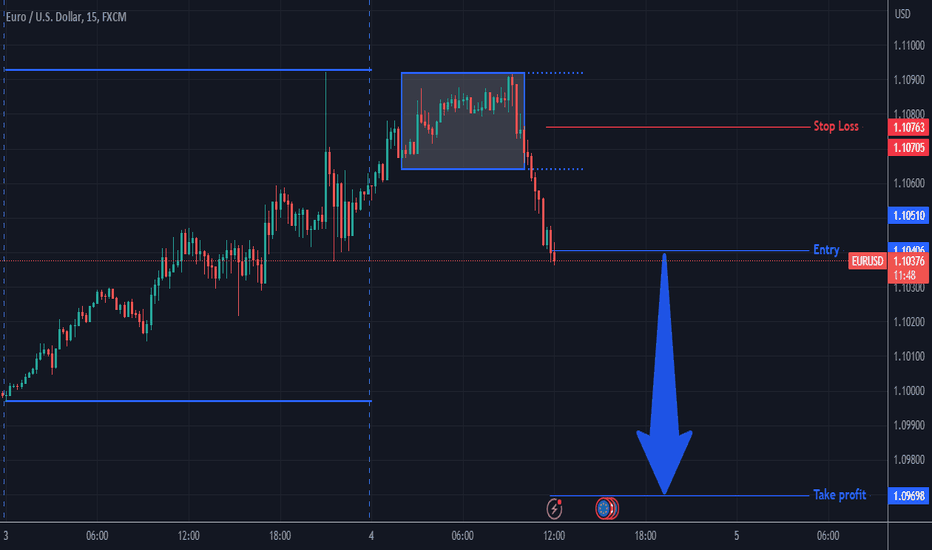

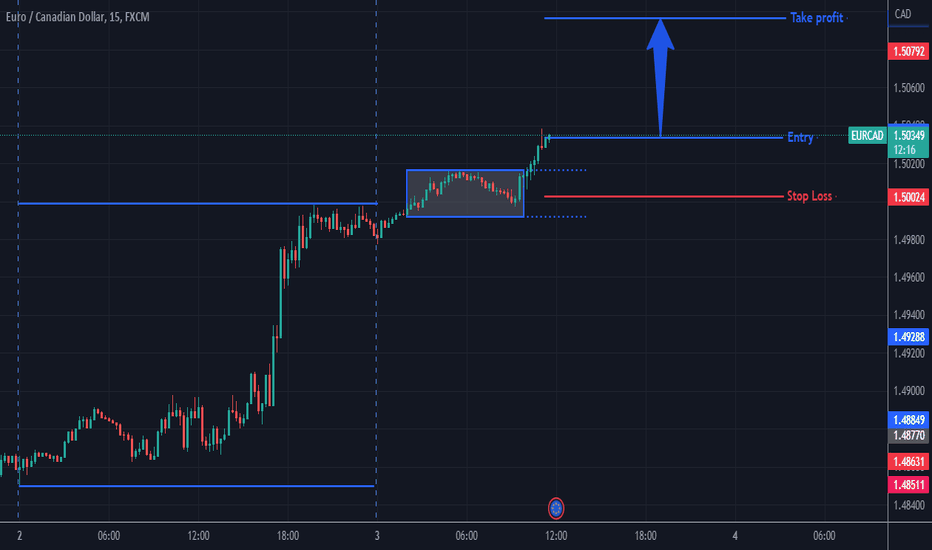

EU Long - LDN - Breakeven- PA was rangey during Asia

---- PO3 Accumulation

---- 12 pips

- PA swept WL, EQL and PDL @ 2:40

---- PO3 Manipulation

---- Price dropped into 4H FVG

---- Liq Raid to kick off move

---- 40 pips

- Reversal @ 2:45am

---- 1 X FVG on 5m

---- 40 pips jump and BOS

Entry

---- entered on FVG

Result: Breakeven

---- Price eventually went to 1RR but had no "energy" to go further.

---- Also, DXY showed that it was going bullish.

---- On the DXY 1H, we had a Bu OB, with long wick rejections.

Psychology

---- Bit nervous because the BOS was not there.

---- I also entered early

---- So used small risk

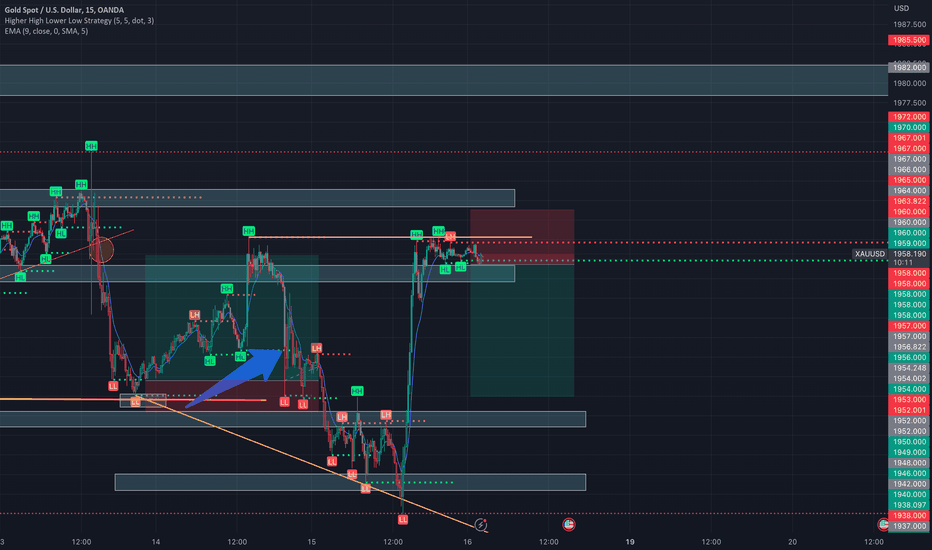

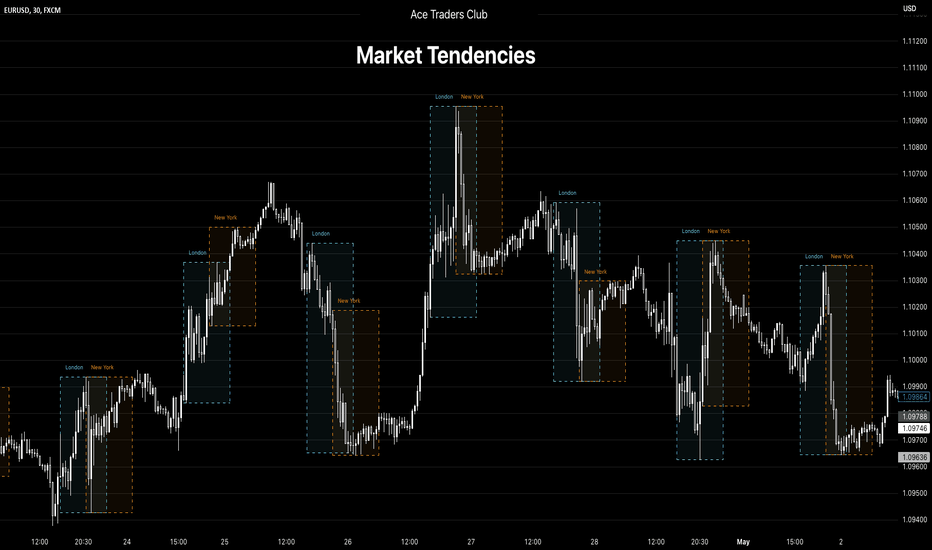

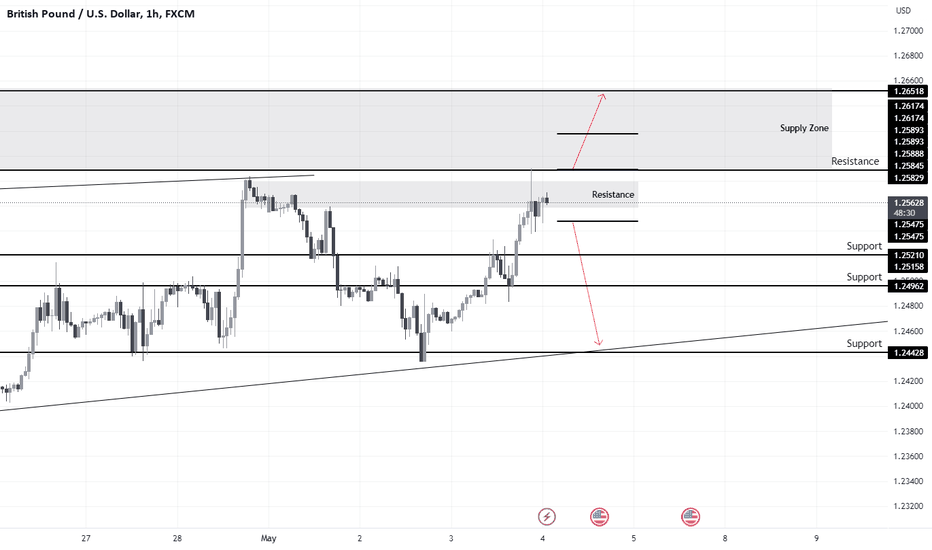

EURUSD Market Tendencies👋 Hey traders! For Day 10 of our 100-day challenge, we'll talk about the market tendencies of EURUSD in London and NY session.

I scrolled back a bit to a random range and we can see certain market tendencies present here.

1. London offers the biggest trading range vs NY and Asia

2. NY offers second biggest trading range

3. Overlap of London and NY is usually a reversal/pullback

4. Seldom is the overlap a continuation

You can use these tendencies to your advantage to:

- Increase your directional accuracy

- Decrease floating profit drawdown

- Secure maximized profit within the day

There are many other ways to capitalize off this market tendency. Hope this gives you a different perspective on EURUSD.

Enjoy your Sunday and we will be back posting trade ideas tomorrow! See you then 🥂