NIO UPDATE STILL LOOKING GOOD.as noted on my last post I grab some share at 13 my first middle "golden zone" when it drop down to 10ish I loaded some more.

and if it drop down to 7 best believe I'm load even more. WHY?!?!?!?!?!?! well read below.

I still firmly believe in this company as a whole. especially when you add the pollutions problem in china, plus the ccp dump close to 1 billion dollar to back the company. a lot of time more often then not the government wouldn't want to let a company fail when they put 1 billion TAX PAYER MONEY as subsidiary. then add on populationssssss of people in china it dwarf the rest of the world. people also been thinking a lot "GREENER" not just in china but as a whole world. EV BEEN ON THE RISE by 50%more in china then the rest of the world. oh and add on the fact that people tend to support product made in their own country witch leads back to the amount of sell that would boom just in china alone due to how many peoples their is in china. they just did 50000th car not too long a go that's pretty good considering the car company is still in its infancy stages

also a side note this company also focus on tech that they make and sublease to other company so its not just a car company so don't forget that.

I can go on but I think you get the point.

the down side

sure the company balance sheet isn't as "PURRRFECT" as a lot of investors would like it to be. still its been showing a lot of growth over the pass year as a company.

just look at how long Tesla took to turn profit in the beginning Tesla was trading at 20ish for quite a few years then pop pop pop pop pop to new higher high

so what if you got in at a high price is still noting when looking at the big picture of how thing will turn out in the future.

potential. 10-100x return in 1-5 years. well worth the investment in my eyes for a growth stock. NYSE:NIO

Long-term-bullish

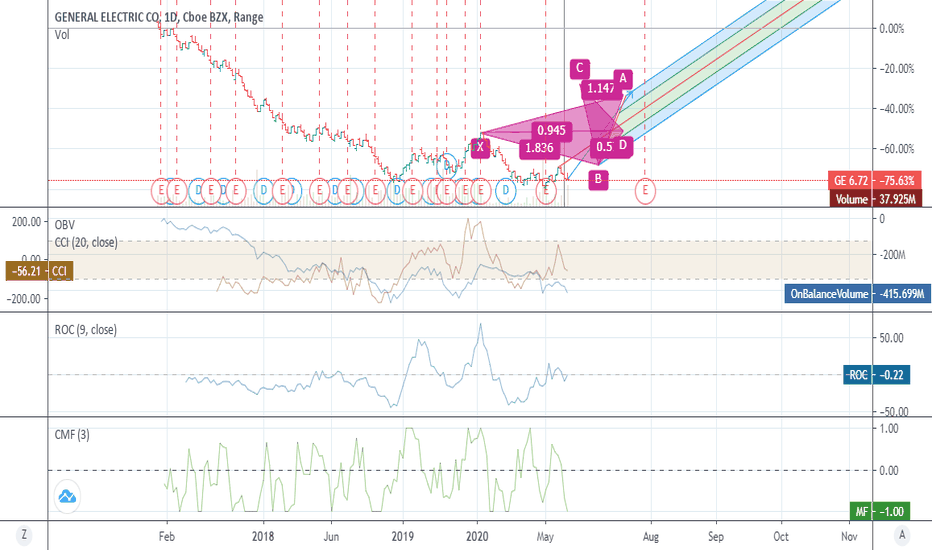

General Electric is showing improved profit performance (LONG)There is a long play to be had here I think. I feel as though General Electric's leadership has changed enough for people to start to enter the market safely for the long term. People have been selling and selling, bringing the price down and primed for a resurgence in purchasing.

You better buy it while you can and prices are this low. If you look at longer perspective volatility is down and it will switch over to the renewable space, investing in many more solar options in the upcoming future. This information has been confirmed and is now being released to the market in realtime for anyone reading.

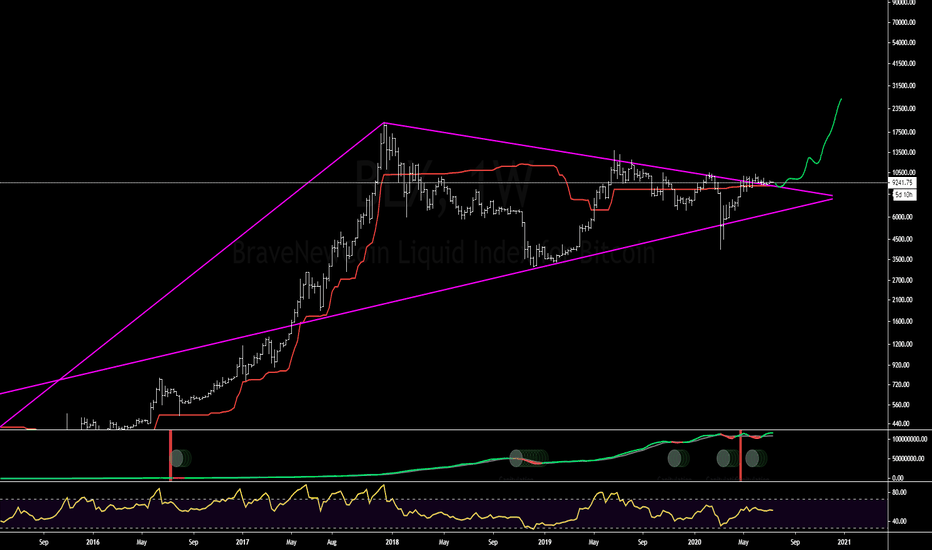

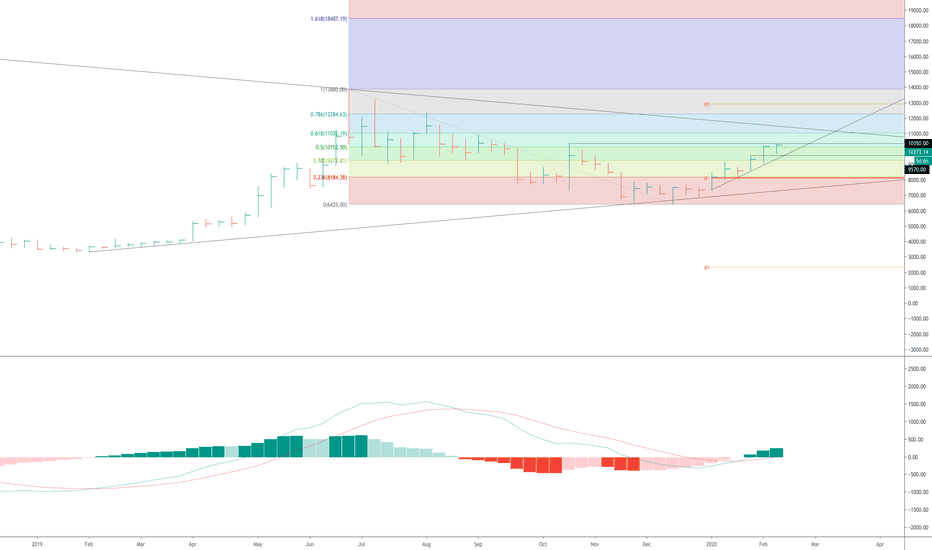

BTC Moves on This Path....?Playing around with the log chart, just trying to get some concept of where the price extremes are and where important lines (like ATH) converge. The last market cycle had bitcoin making its ATH seven weeks before the previous ATH converged with the bottom trend line. If the same thing were to happen this cycle, and the high comes in exactly on the top trend line, then we'd see a high of around $200K on the 13th of November, 2023.

That's still a ways off, but I think I can live with that kind of return in just over three years :)

BTC Pivotal pointBTC weekly chart is at a pivotal point. With heavy resistance in the 9.4k - 10.5k range it’s gonna be hard to break out for awhile. Volumes been really week, we could see a further retrace of this rally to around the 7.9k level or lower if volume continues to drop. Plenty of resistance below, I don’t see a drop below the 6.5k level. The fed has started to decrease daily bond purchases, and it has shown up in the slowed down the torrid pace of the markets. Any further decline will most likely lead to increased fed easing in the coming weeks and would reaccelerate the crypto bull market. I also believe volume to be down recently in the crypto markets due to the sudden resurgence and euphoria of the stock market in the last few months pulling traders away from crypto. But the shock to the economy we took was too great and more waves will follow soon. Housing and personal income continue to fall. With extended unemployment set to end on July 25th with no plans of an extension, be ready to take advantage of the coming crash with perhaps even greater stimulus in the near future. BTC and other crypto’s will benefit immensely from this. BTC to the moon, but be careful in the short term.

Up trend after offering $EVFMwe should see $8 before september , hopefully they will do good job after offering

WTC/BTC 550% Incoming? LONG, Bullish, Alt-Season? Break of long downward trendline, MACD RSI divergence on the daily & 3D. Have we found the floor? Is Alt-Season finally here? Will WTC do a 5X soon?

If you're enjoying these posts:

Like & Sub to keep the free content coming!

Comment; What do you think? Do you agree?

Never Trust. Verify.

DYOR. Not Financial Advice Just an Observation.

Always remember: technical analysis is not about being right, it's about increasing your odds.

Be prepared to be wrong. Risk management is key. Capital preservation above all else.

Finally free?

MACD and RSI Divergence on the daily:

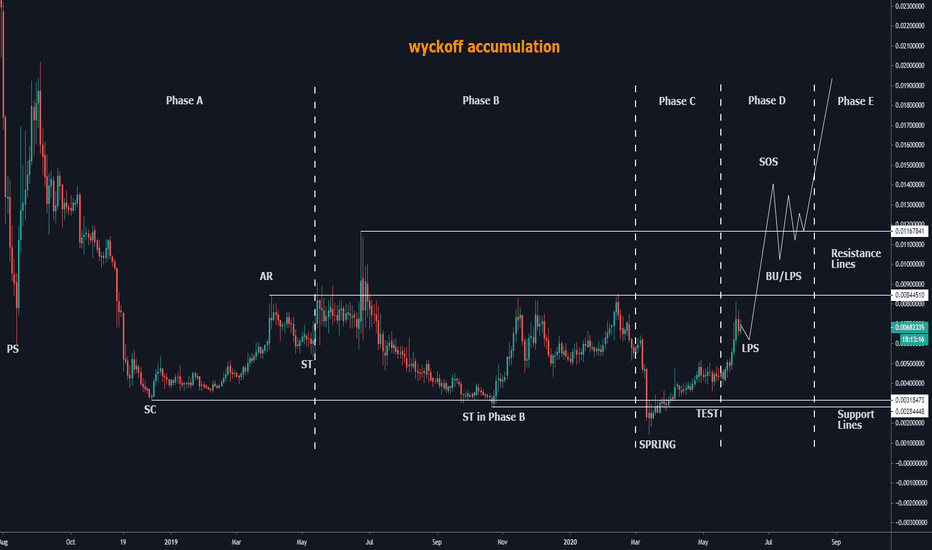

VECHAIN/USDT Wyckoff Accumulation LONG Sometimes you need to zoom out, get out of the noise and look at the bigger picture. It appears Crypto may have put in a hard low and we are well into the accumulation phase. Exhibit A; This looks like a Wyckoff Accumulation pattern for VET.

In my opinion , it's no longer time to trade in and out of these high potential projects, instead it's time for accumulation. The charts sometimes give us clues as to what the larger players are planning, and know this; they are rarely wrong. It is their job to take as many of your hard earned $ats as possible. So when you get an opportunity, and you manage to catch a glimpse of what they are doing, grab it with both hands. And RIDE the whales tale. I believe it is time to Pack your bags & #HODL

Never Trust. Verify.

DYOR. Not Financial Advice Just an Observation.

Always remember: technical analysis is not about being right, it's about increasing your odds.

Be prepared to be wrong. Risk management is key. Capital preservation above all else.

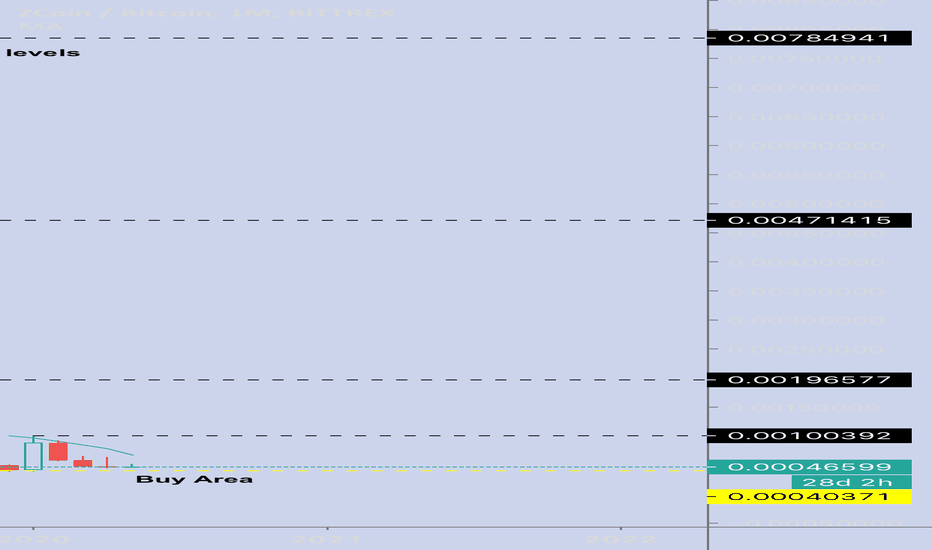

Zcoin Next Bull movesThis is an analysis based on S/D as well as S/R

Zcoin is around a monthly pivot and could jump to the next target. However, the 14 MA breakout is required for safe trading. If you wish to take this trade, it is your responsibility to do more research on the matter.

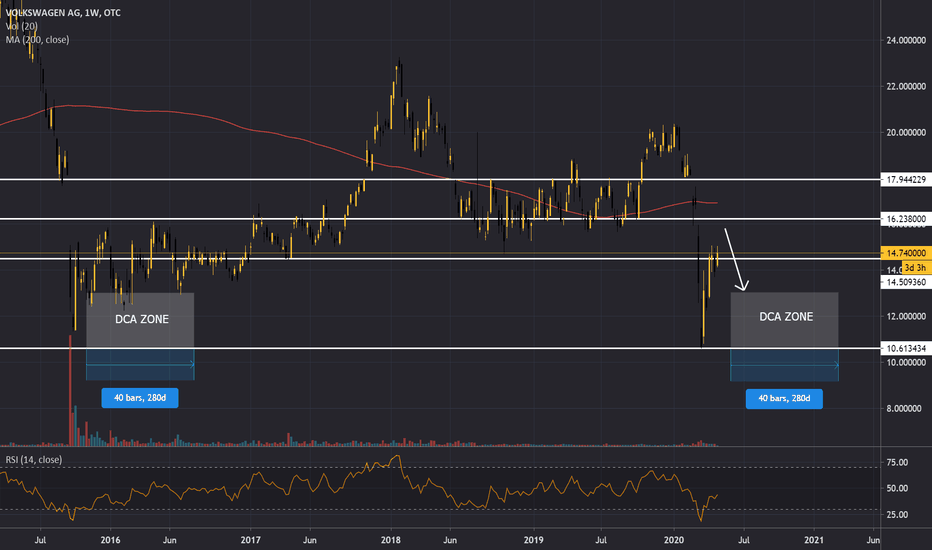

VWAGY (Volkswagen) - WeeklyShort term forecast for long term positioning

Looking for a reversal within the coming month & eventual downwards trend towards the DCA zone

Recent news: Volkswagen recently restarted operations amid concerns of actual demand within the global market.

FA: From 2018 to 2019, Volkswagen saw a 20+% increase in yearly net operating earnings generating up to just over $16.9 billion.

As a major player, the company is well positioned to adapt to future automotive trends, given they continue to embrace smart

car innovations. Due to the current global environment and reasonably forecasting decreasing demand for vehicles for at least

the short term, it wouldn't be a surprise to see price action return to the range between 10.65 - 14.51, this area may serve is a

good opportunity for securing some longer term positions via DCA.

Always DYOR & keep risk managed :)

*Disclaimer: The above analysis is an expressed opinion only and should not

be confused as professional financial, investment, trading or legal advice.

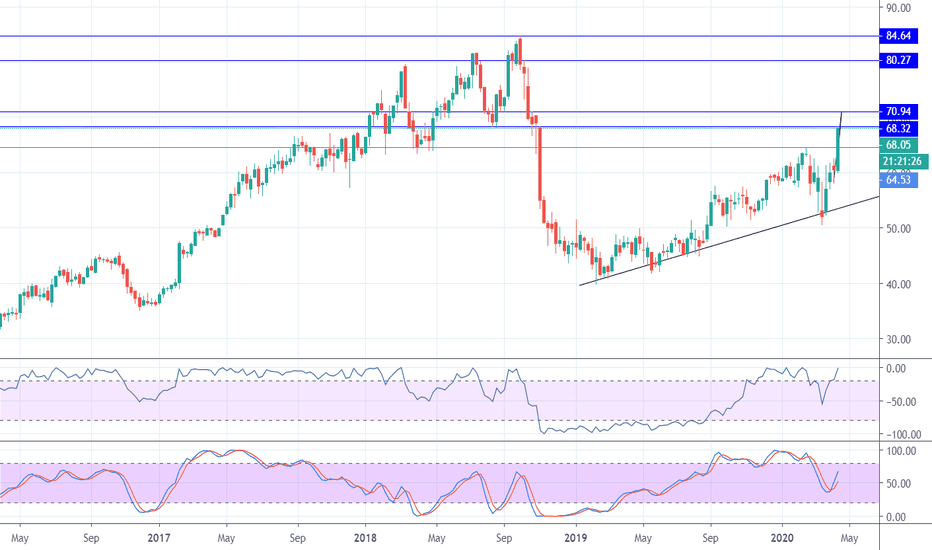

ATVI longACTIVISION is a video game software company with a promising future due to its Call of Duty franchise and games alike. ATVI may be a fruitful investment for the long term with the prices already surpassing highs prior to the start of the COVID-19 Bear market, its one of the first companies to have fully recovered all of its losses from 2/20/20 to 3/20/20 (COVID-19 Low). As of 4/16/20, ATVI has broken the high of $64.44 (2/20) trading above $69 in after-hours. From its low of $52.05 on 3/20/20 to now it has recovered 100% of its losses with a beautiful pivot and is now up 30.64% in a month. Not to mention the release of newer game consoles such as the long anticipated PS5 from Sony (SNE), and Xbox Series X by Microsoft (MSFT), it is easy to see that ATVI will be a greatly benefited stock given these circumstances and will certainly test the $80+ highs recorded in the Fall season of 2019. If you're looking for virus proof stocks to add to your portfolio, Activision (ATVI) is high on the list.

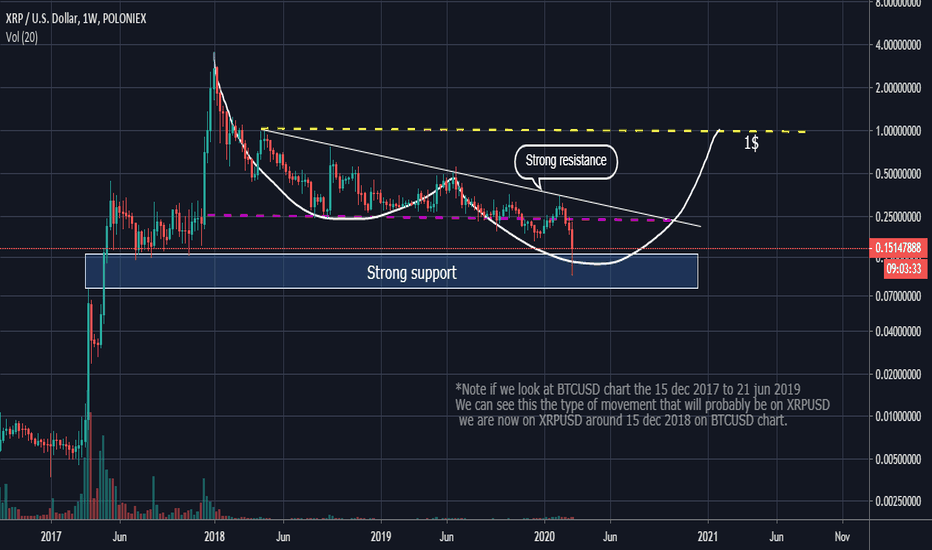

XRP forming a large Double bottom Target 1$ We can see this that from 13 aug 2018 to 13 aug 2019 the 0.28-0.3 cents area was acting like support (like on BTCUSD chart (12 nov 2017 to 12 nov 2018) the same period what a coincidence) then a false breakout on BTCUSD then another rally to 14k $.Now we see the false breakout on XRPUSD and i expect a move like BTCUSD did.

Also we a forming a potential very big double bottom since 2017.

My first target is 1$ per XRP.

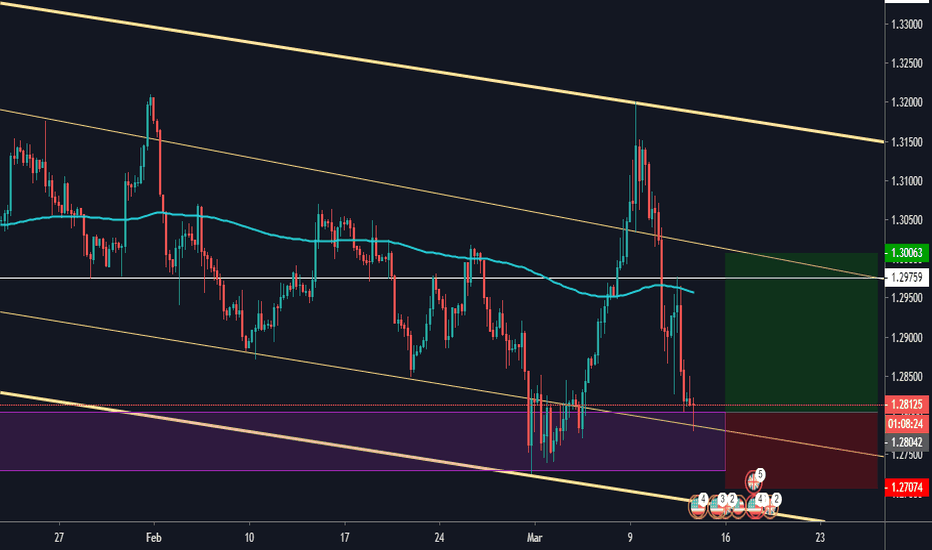

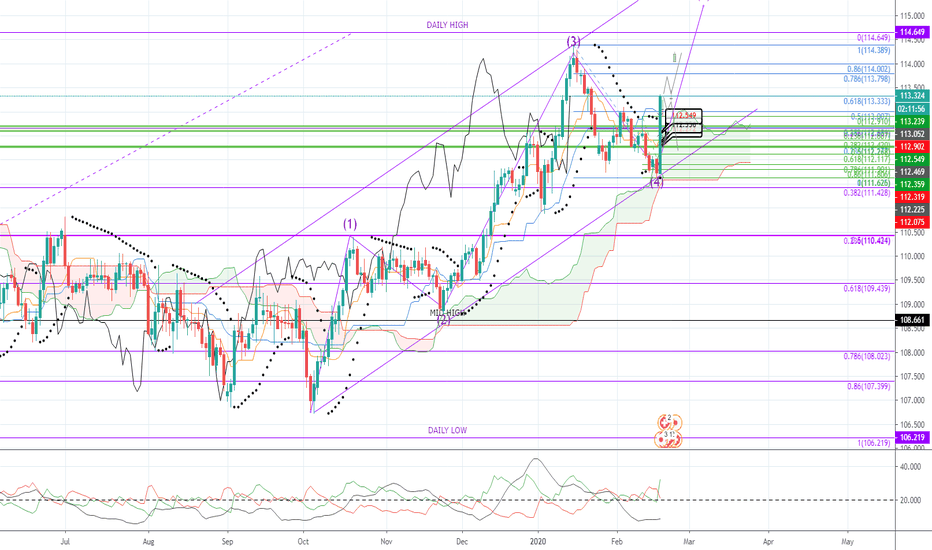

CHFJPY impulse I have to look at the lower timeframes again, but it looks like longer term, we'll be seeing that 5th impulse in the move.

BUT from what I've been seeing today, it's been pretty bullish. I don't know how long this bullish move on the 1H will last before it turns bearish, but I'm sure it will. Definitely will have to watch for it though