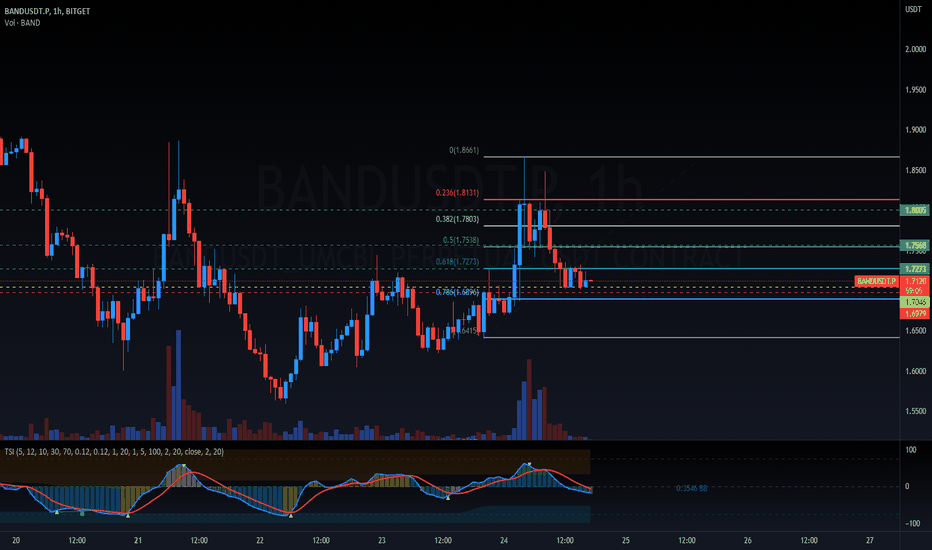

BAND Bullish consolidation Hi Tradingview,

BINANCE:BANDUSDT

BAND has double bottomed at 1.7046. We are expecting bullish movement to the 1.72 fibonacci line then continueing to 1.75+

We can also see TSI is curing towards a bullish takeover on the 1 hour timeframe.

Trade Parameters

Entry 1.70 - 1.72

Stop loss: Below 1.69

TP1: 1.72

TP2: 1.75

TP3: 1.8

Longidea

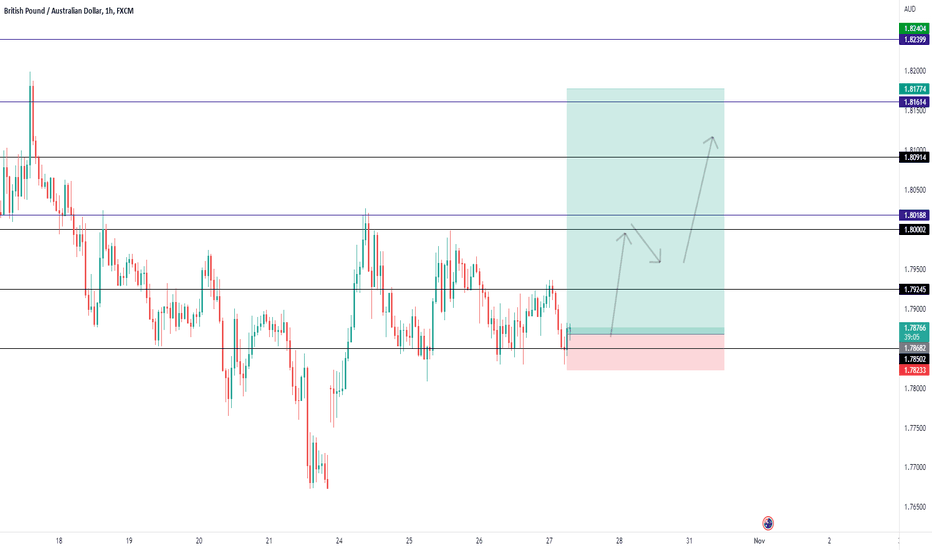

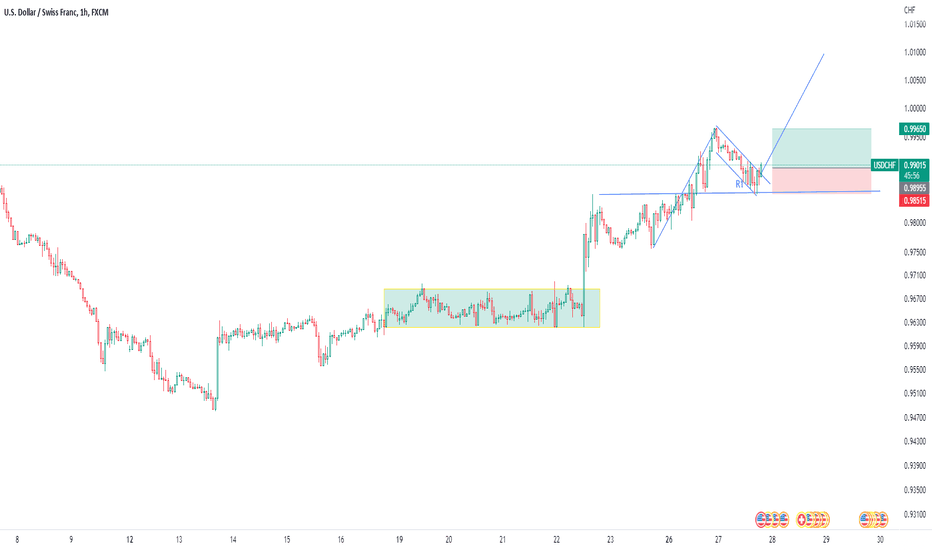

USDCAD - RISK COMES FIRST! UPDATEAs always make sure stops are at break even if you took buy trades, price is in an area of 2 key levels as highlighted and can do anything from here... (create a right shoulder for a short) or ( continue long term continuation to the upside). I believe price will be slow and will be waiting for a reaction to the fundamentals before giving a clear direction!

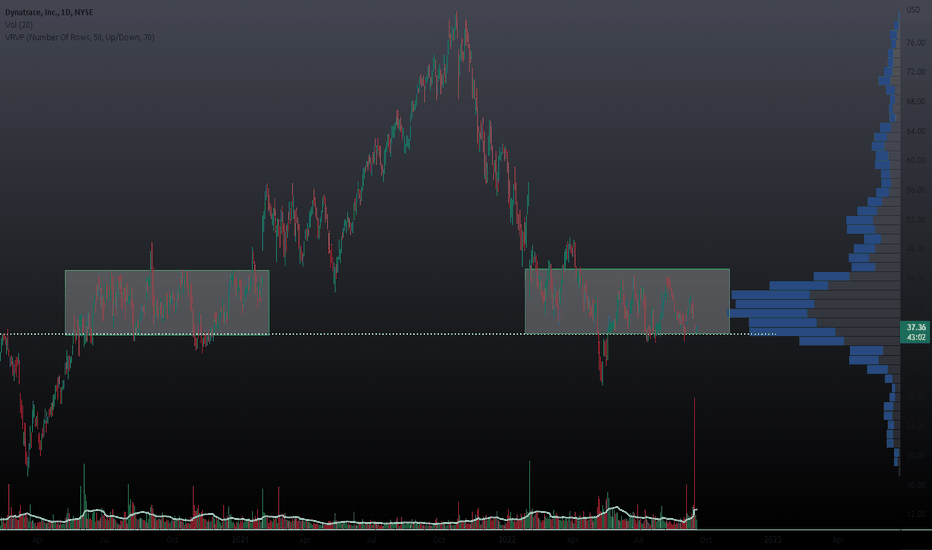

$DT Long IdeaDynatrace is back in it's consolidating phase similar to 2020 after the May shake out.

An idea is to go long with a break below support / the box a stop with first target the upside 44 zone.

More upside implied with a Darvas box breakout .

DEC bull risk reversals bullish option positioning bolsters the idea of upside in the coming months.

Interesting volume spike as well, definitely a name to keep on watch IMO.

I'm long via bull risk reversal and short puts

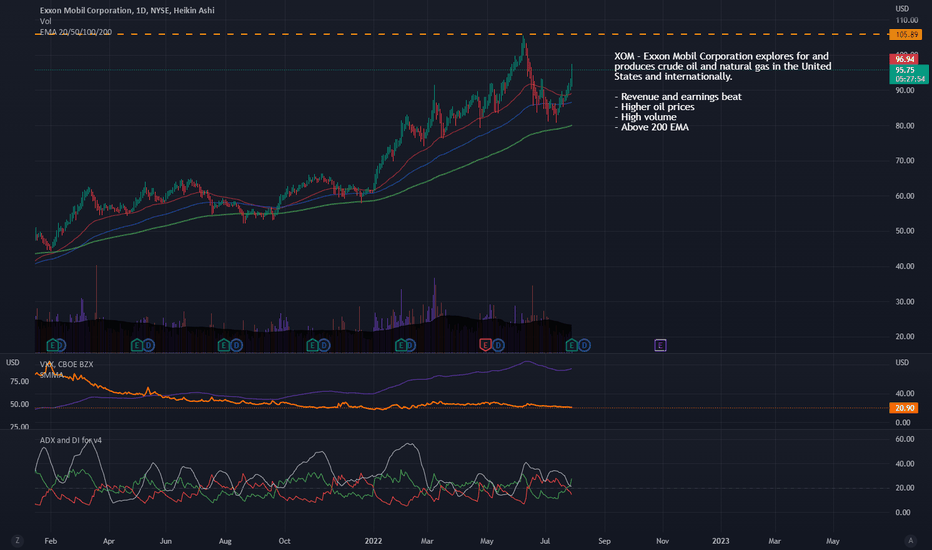

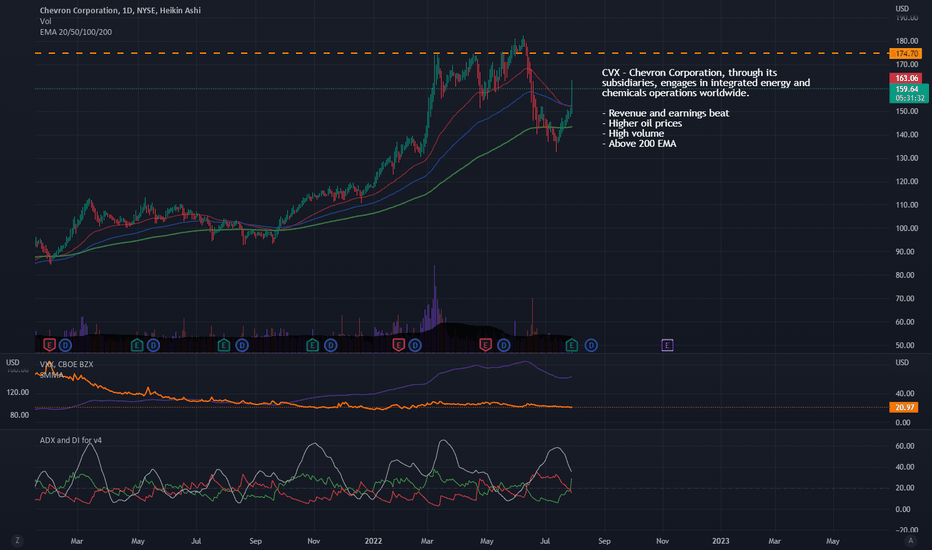

OXY - Occidental Petroleum long setupOccidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, Africa, and Latin America.

- BERKSHIRE HATHAWAY (Warren Buffet) is acquiring shares

- Expected earnings and revenue beat

- High oil prices

- High volume

- Above 200 EMA

DORM long ideaDorman Products - DORM

Consumer Cyclical

Auto Parts

USA

Dorman Products, Inc. supplies replacement parts and fasteners for passenger cars, light trucks, and medium- and heavy-duty trucks in the automotive aftermarket industry worldwide.

- High volume in stock

- Crossed 200 EMA

- Next earnings date - 25 Jul 2022

GOEV longCanoo

Consumer Cyclical

Auto Manufacturers

USA

Canoo is a mobility technology company, designs, engineers, develops, and manufactures electric vehicles for commercial and consumer markets in the United States.

- High volume in stock

- Crossed 100 and closing in on 200 EMA

- Next earnings date - 15 Aug 2022

$PFE Call Sweeps and ER next week hmmmPfizer has ER next week and 5/20 calls sweeping today

Technically it looks like we can get a run up to ER , as PFE is at trendline support and possible "fill out" of the triangle pattern

Any run up will capture some gains, will trim position and leave a few runners for ER.

Sweeps were 55.5 and 57 strike which are pretty far out the money, worth noting. Could just be a traders Lotto on $37K of premium (must be nice haha)

Cheers

$ASIX long ideaASIX with a close above the resistance line at $50.5 zone and support at 30day MA , leads me to believe we turn higher after cooling off from the 33-57 leg

Oscillators are turning with good volume and relative strength in a weaker tape market.

In the resin / fertilizer basic materials space, LWLG another name also with a bullish chart IMO.

Keeping this one tight, two closes below the 30 day MA and I'll close my JUN 60 calls, already up 35% and I think there's more room to the upside / good RR on this trade idea IMO.

Cheers