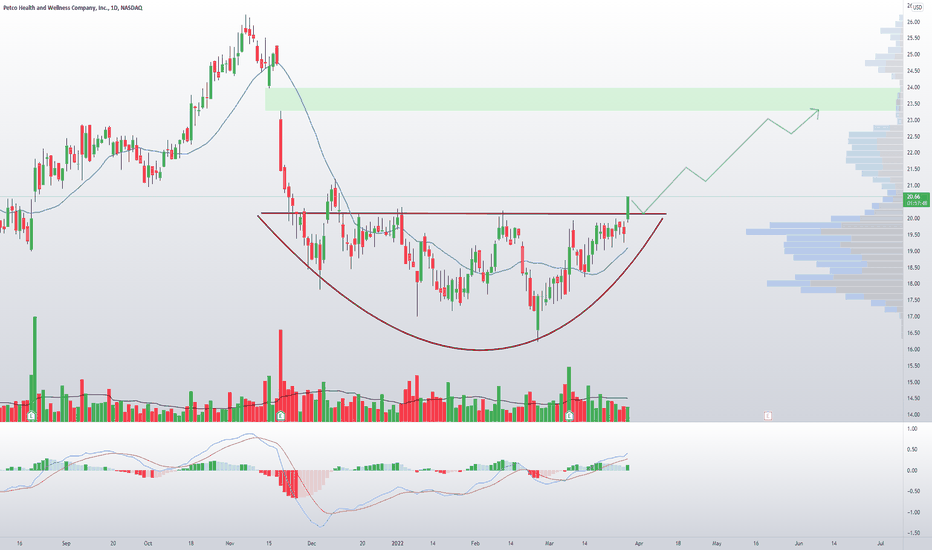

$WOOF I'm longI'm long WOOF calls . As a frenchie owner (his name is Frisco hence my trading name), I know the amount of $ people are willing to spend on their pets.

But also technically speaking, WOOF is coming out of a nice rounded bases and breaking out today. With that huge gap above needed to be filled, this looks like a good R/R long trade, aiming for $24.

Don't be surprised if there is a retest of the breakout zone, but longer term I see more upside.

Longidea

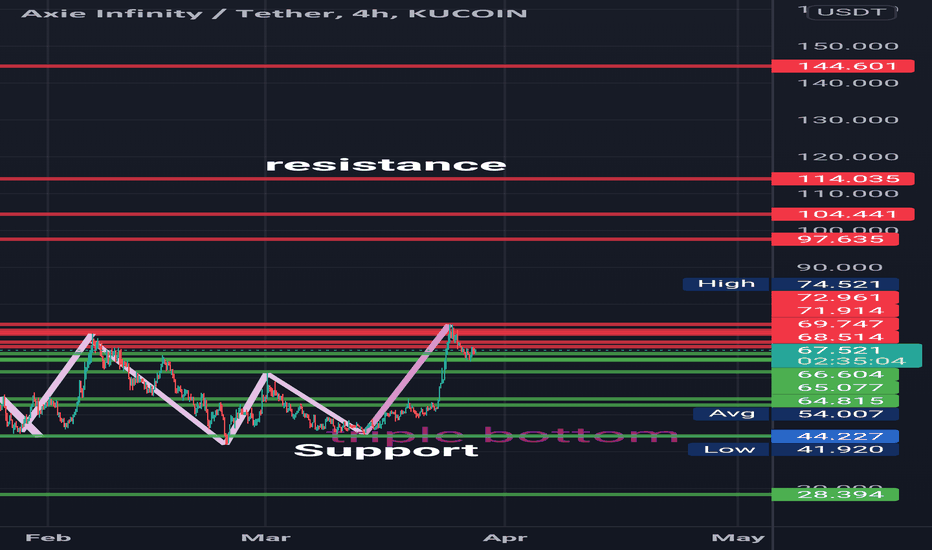

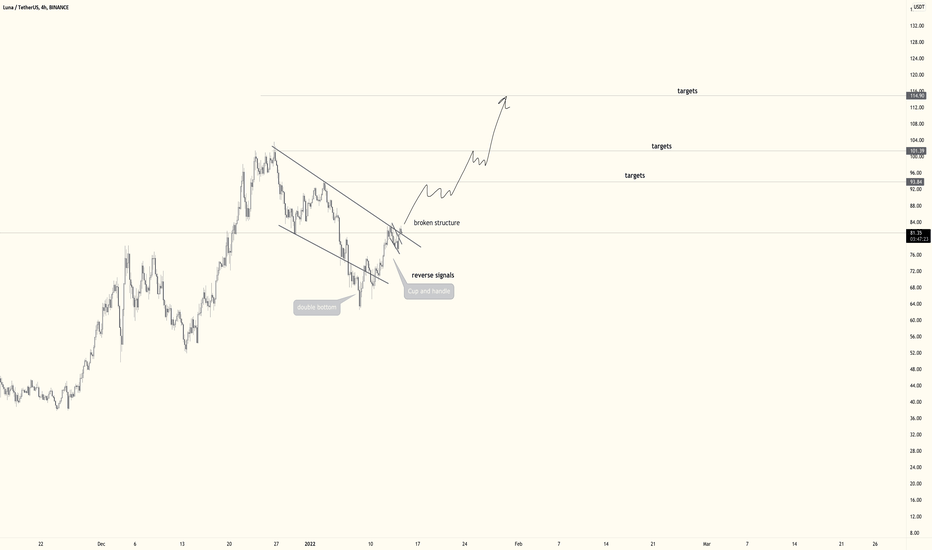

Axie created a triple bottomaxie triple bottom let's goooo. resistance and support marked on chart. will we make a run to ath? let's hope btc stays bullish. not a financial advisor do your own research. the king paves the way. always use low leverage. always use stop loss and have an exit strategy. good luck and like/follow if you liked my chart.

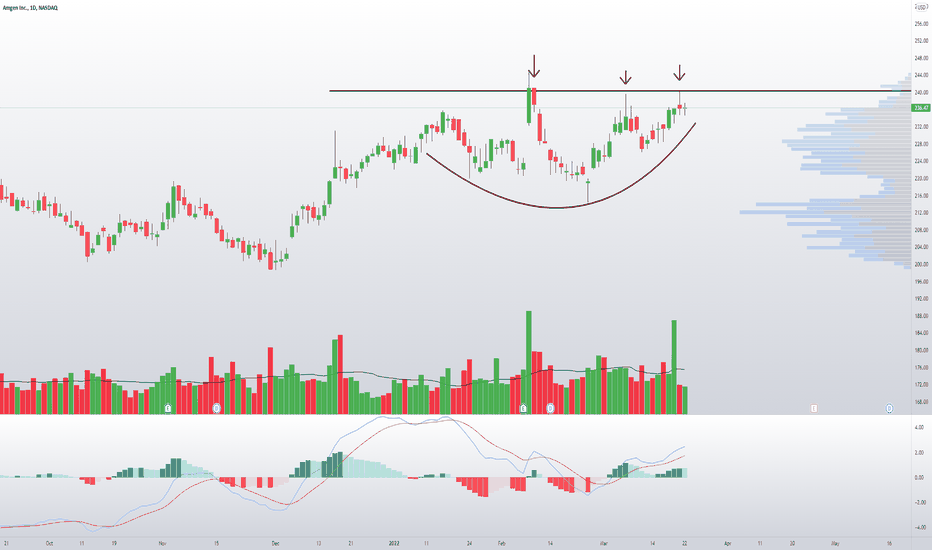

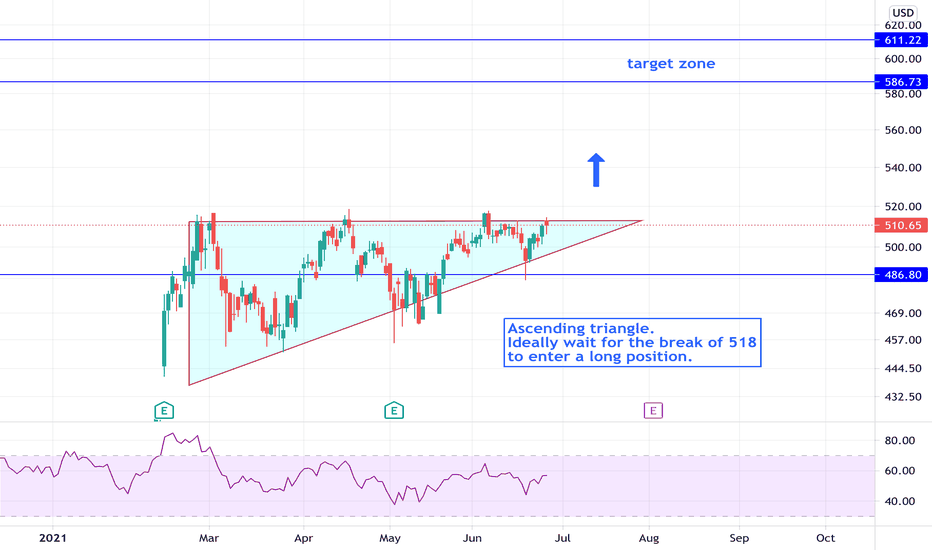

$AMGN watch for break of the 240 zoneSellers have been present in Amgen , keeping this stock under the 240 zone since FEB's pop.

Lot of dark pool and call option flow showing bullish signs as the stock continues consolidating and eating away supply.

I think the bulls win here, alarm it for $240 as a good long idea.

I'm in a starter JAN 275c looking to add more positions upon breakout

Conversely , if bulls fail to capitalize downside target would be 220 zone.

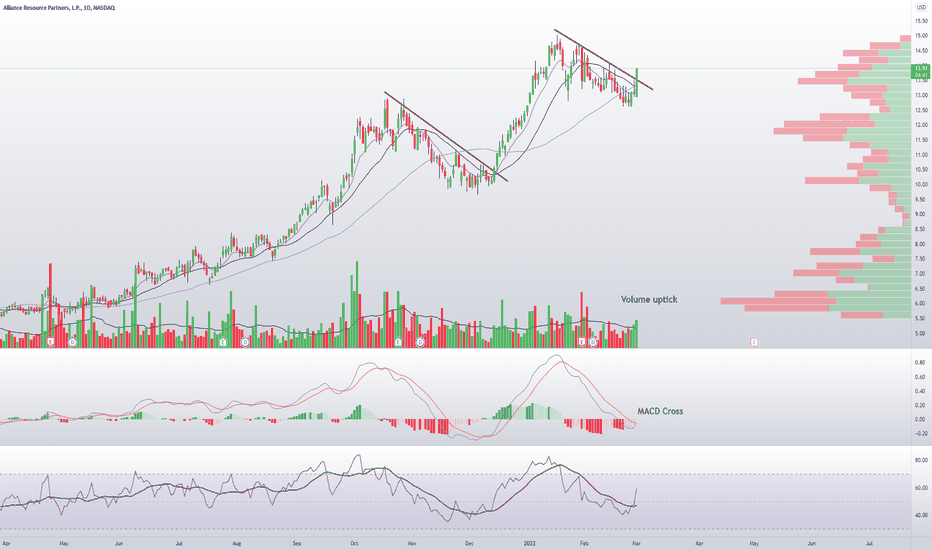

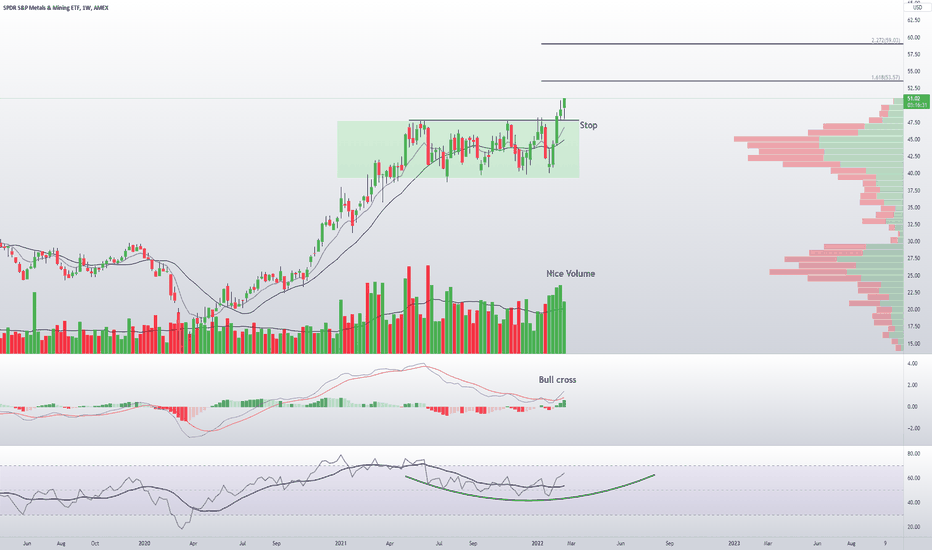

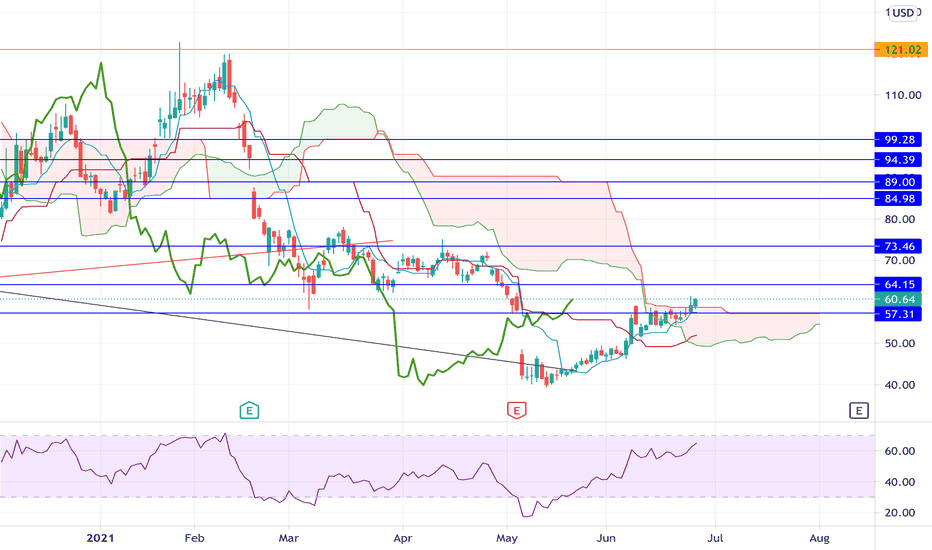

XME Metals and Mining Weekly Long IdeaWeekly chart on XME looks bullish IMO.

I went long commons with price targets above 53.5 and 59 , stop around 48.

Nice breakout retest bounce and the volume leads me to be bias to more upside.

Swinging this with shares, but the April 54C also looks active with 3K OI

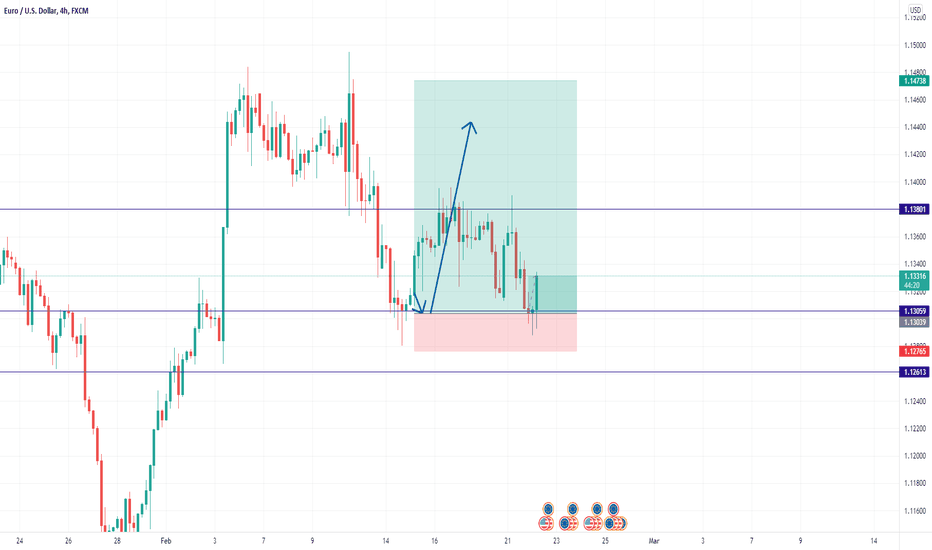

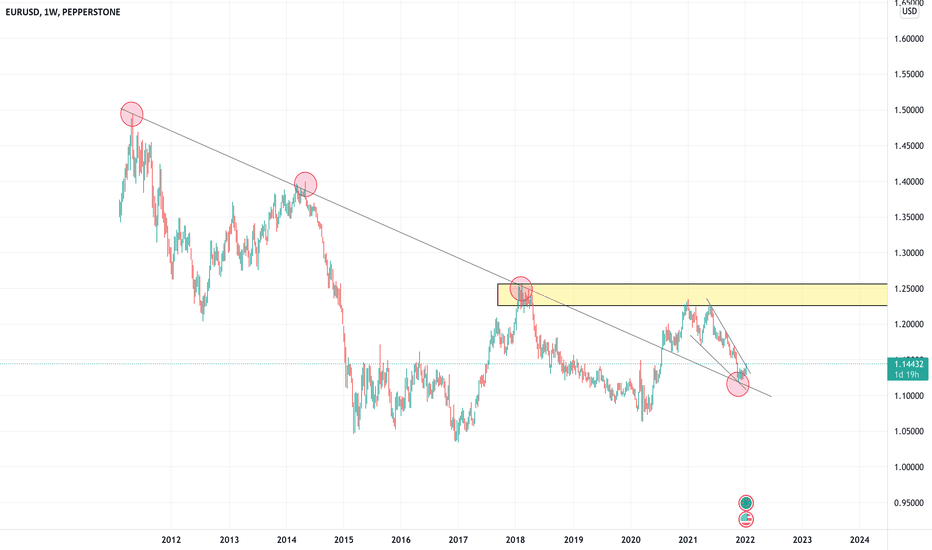

EURUSD short term BUY trades once againPrice has been respecting that support of 1.13000 very nicely so I've taken another long from there, I'm holding my trade a risk free at the moment as price on the higher time frame does look very weak, so this upside move we are seeing now may just be the retracement before then going lower.

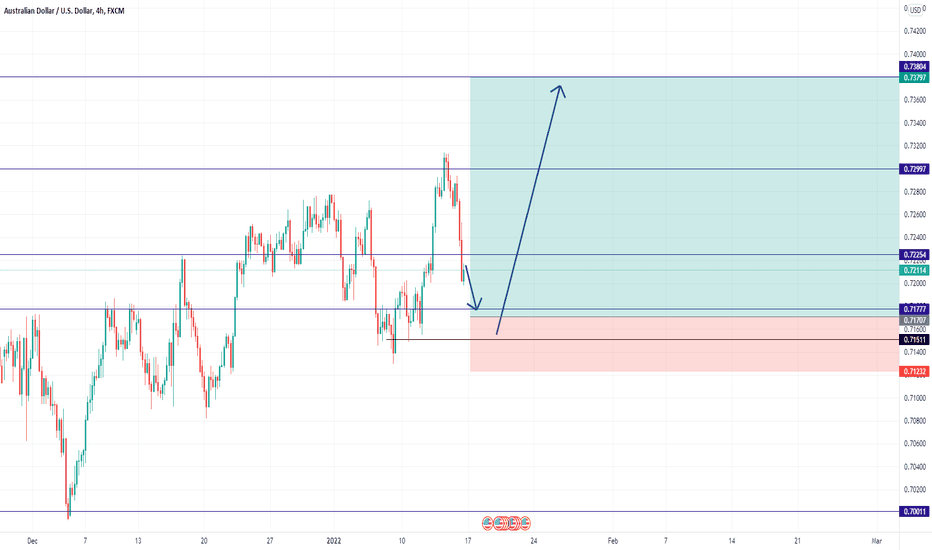

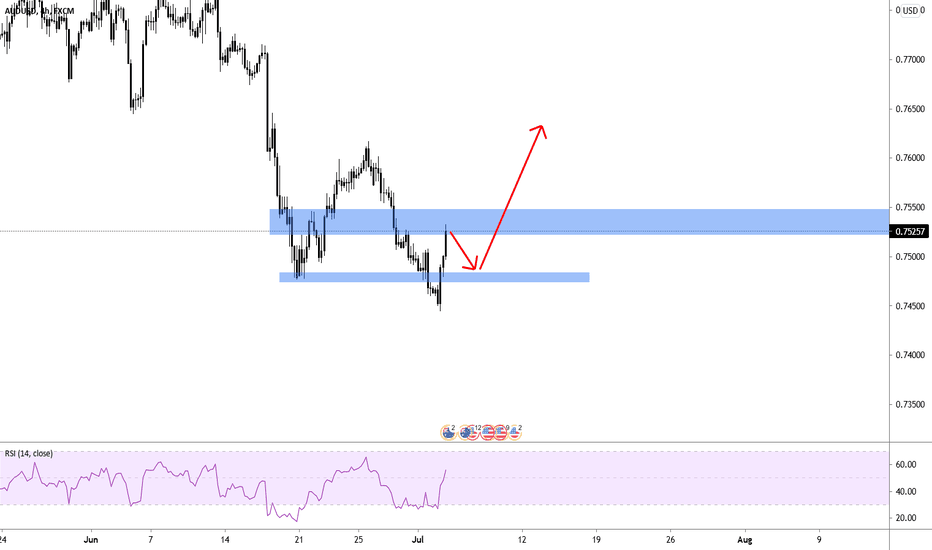

AUDUSD buy trade ideaLooking for AUDUSD to make similar moves as EURUSD as we can hopefully get more weakness for the USD. So when price reaches the area of 0.71700 I will be looking for rejection and a push back up, if price breaks below the last higher low of 0.71500 this idea is invalid. Ill try update, and another reminder to always risk manage make sure you have a plan and stick to it!! good luck everyone

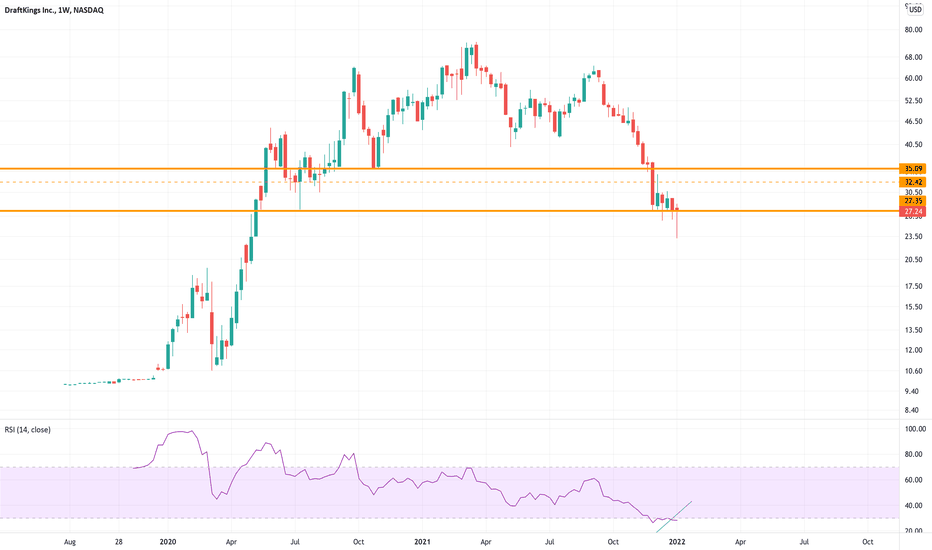

DKNG: another bounce candidate?DKNG :

Some pros and cons to play a potential bounce.

--Big Wyckoff distribution on weekly and daily.

++ Hammer candlestick on weekly (indicating bullish reversal if next candle confirms it, i.e.we get follow through)

++ Bullish RSI divergence on daily (that you can't see on my weekly chart)

Since I like the set up I will look for an entry today, but only for a swing trade (maybe 1 or 2 weeks max ). My target is around 33-35 .

Be careful below 27.

Trade safe!

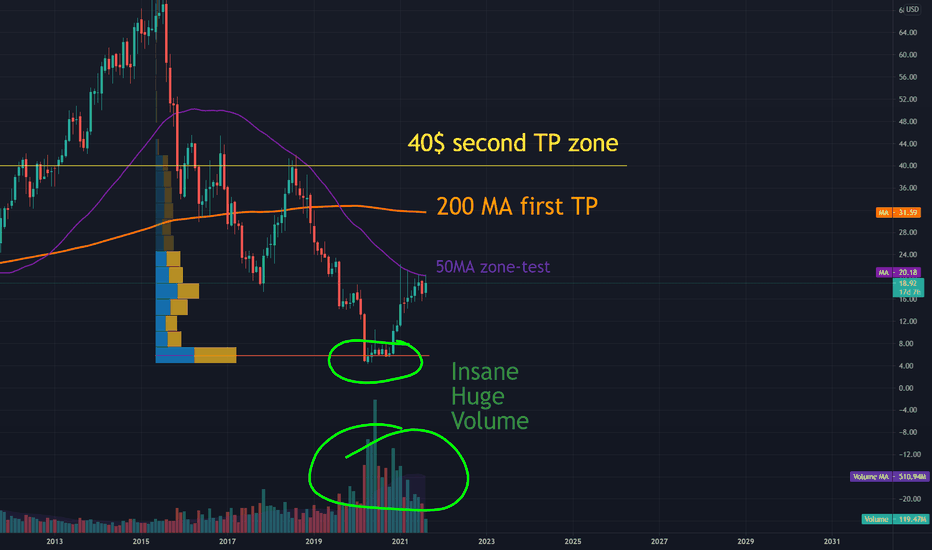

Macy's rocket ready for launch! LongHey Guys!

I see a good Long potential for M .

We are testing 50MA price zone on M-chart and looks like we are ready for break-out and push the price to 200MA on the Month chart.

Price stays very close to the 50MA for more than 5 months. - good sign for long. Also, we see a huge volume on the "bottom".

SL ~ 15-16$

TP1 200 MA on moth chart

TP2 40% zone.

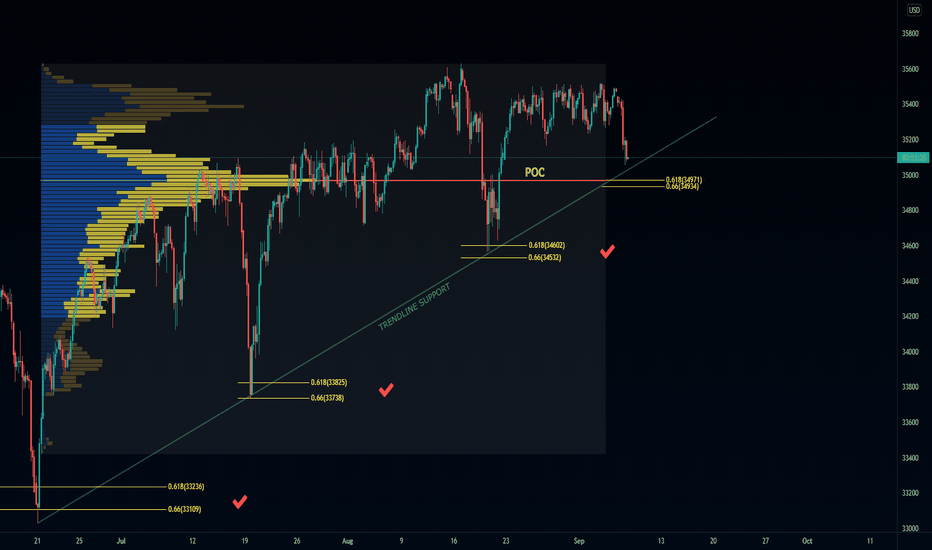

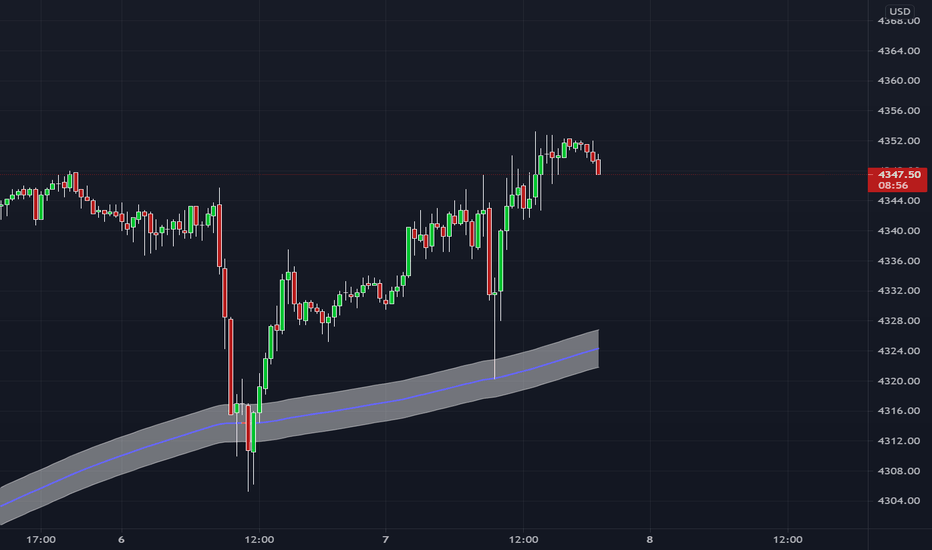

DOW JONES - Bounce off the Trendline support, POC and .618 NextStraightforward analysis on the US30 using fib pull , fixed range to demonstrate how respected this PA is to these levels pulled .

Market structure still in tact and expecting PA to either tap the POC and marked level and continue the trend .

Like and Follow for regular analysis

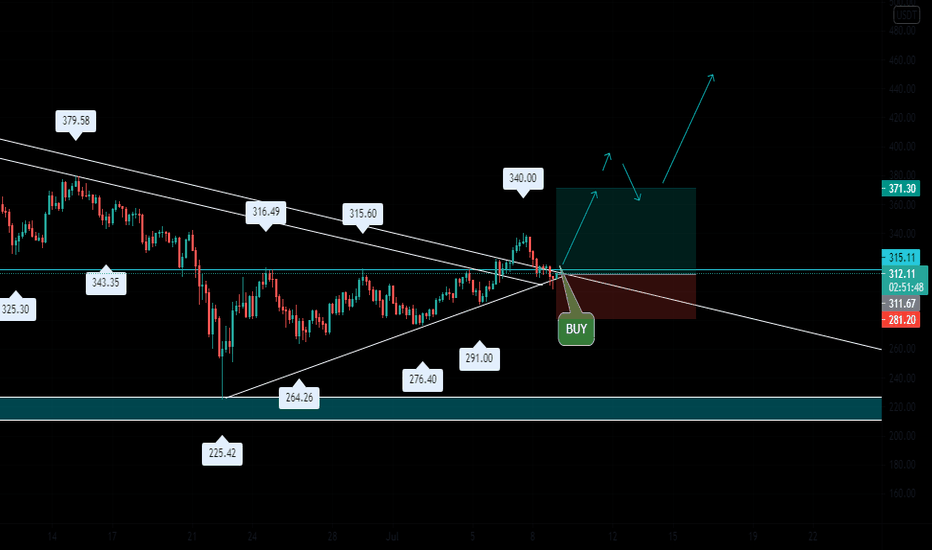

Tutorial | How To Create An Order Panel Trading TemplateThe TradingView Order Panel doesn't currently have a template setting to save the order parameters. Here's a work around thanks to a comment from @thatjeph Appreciate it!

Instructions:

1) Using the Long/Short Drawing Function and drop it on a chart.

2) Adjust the levels to reflect the trade entry, take profit, and stop level. (Note: The default quantity is a bit weird)

3) Save the object as a Template named to reflect the settings.

4) Right click on the trade object and Select > Create Limit Order.

5) Boom - you Order Panel is opened with the trade setting from the order object.

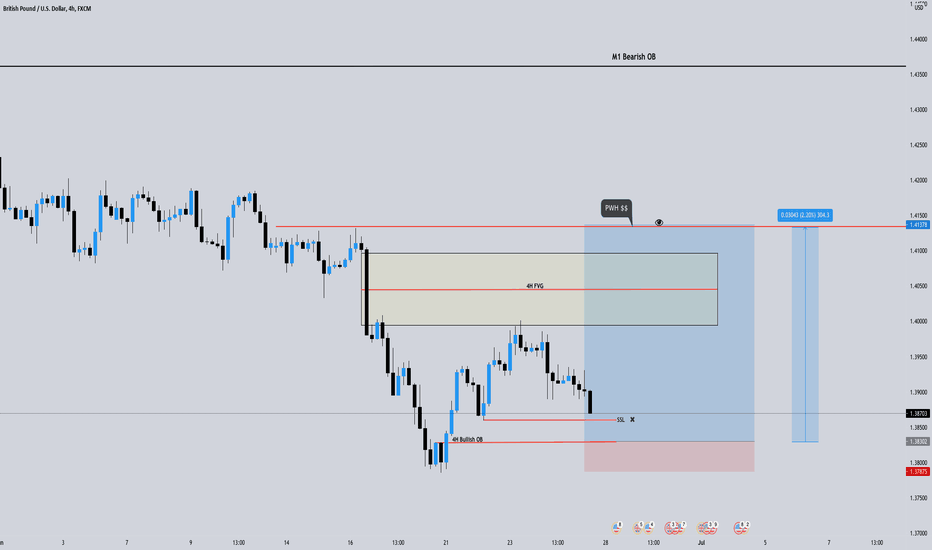

FSLY: Ichimoku bullish set up with all levelsFSLY Ichimoku analysis and all supports and resistance

Ichimoku : Price above the cloud, lagging span broke kinjun and tenkan = bullish on daily, long trend.

Mind the 1st resistance and enter accordingly.

All levels are on the chart (support and resistances).

I'm long. Swing trade with option expiring in January 2022.

Trade safe.

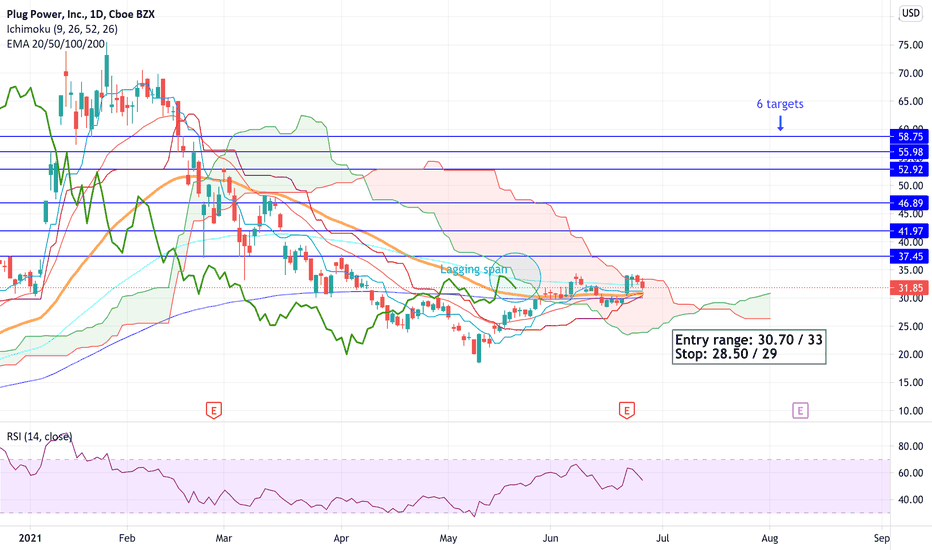

PLUG: WATCH FOR BREAK OUT OF THE ICHIMOKU CLOUDPLUG ICHIMOKU ANALYSIS :

The price is currently supported by Kijun, Tenkan and 20 and 50 EMAs, with Kinjun and Tenkan about to cross over. The price action is building pressure for a move above the 2 following resistances:

1. the current candle is just at the top of the cloud, looking for a break out.

2. The lagging span is stuck below the 100 EMA and the cloud. Watch for a retest and a potential break.

I'm entering a long trade on Plug .

Good risk vs reward trade as a stop can be placed just below the 50 EMA. Success will also depend of the overall market next week.

All targets on the chart .

Trade safe.