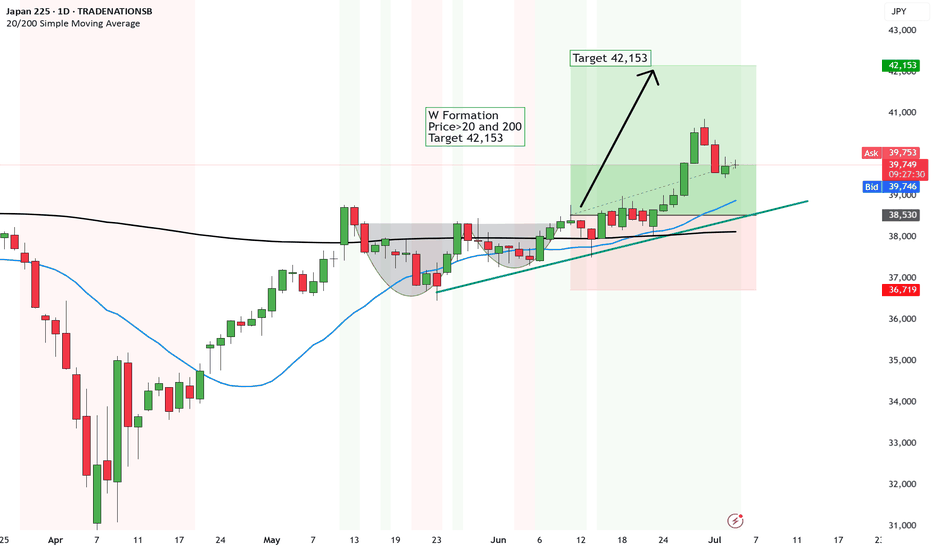

UPDATE Japan cruising to 42,153 thanks to the Tech War btw E & WIf you read my previous post about China you'll note, there are MAJOR developments in the East compared to the west.

It's always been a battle between the two. But this time it's based on research, developments and upgrades.

Loving the war on technology, because it is helping us normal folk with living quaility.l

Anyway, fundamentally Japan continues to expand.

🗳️ Political Stability = Market Confidence

Japan’s government is stable, and investors love certainty — it sets the tone for bullish momentum.

📉 Weak Yen = Export Party

A weaker yen boosts Japanese exports like cars and tech — big names like Toyota and Sony are crushing it.

💹 BOJ Staying Chill

The Bank of Japan isn’t rushing to hike rates — that’s fuel for equities and easy money flow.

📊 Value + Tech Combo

Japan’s got solid value plays AND hot AI growth stories — a killer combo right now.

🌍 Foreign Funds Are Piling In

Global investors are rotating into Japan — and that buying pressure alone can keep pushing prices higher.

And technically it's the same as last time, hence it's an update.

The price broke above the pattern and is slowing moving up a consistent uptrend to 42,153.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Longjapan225

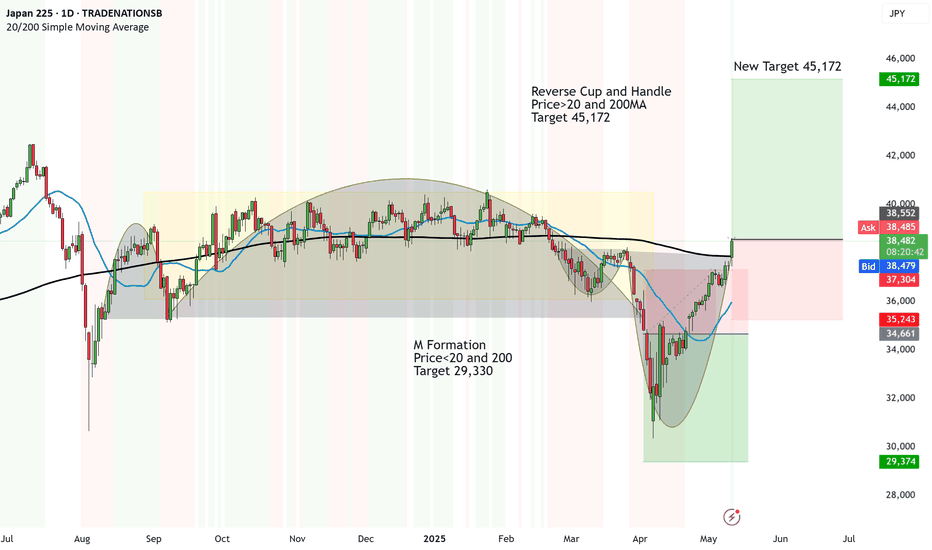

UPDATE - Japan Index is now set for upside to 45,172The last analysis, was working like a charm until Trump had to pause the tariffs, and go back on everything he said bit by bit.

So, the analysis has now turned from bearish to bullish - and as traders we adjust our sails accordingly.

There are a few other reasons for the rally to come.

📈 Positive U.S.-China Trade Developments Boost Market Confidence

Recent progress in U.S.-China trade talks has alleviated investor concerns, leading to a 0.4% rise in the Nikkei 225, reflecting renewed optimism in the Japanese stock market.

💰 Significant Foreign Investment Inflows Strengthen the Market

In April 2025, foreign investors injected 3.68 trillion yen into Japanese equities, marking the largest monthly inflow in two years, driven by confidence in Japan's corporate reforms and stable economic outlook.

Reuters

📊 Analysts Forecast Record Highs by End of 2025

A Reuters poll predicts the Nikkei 225 will reach an all-time high of 42,500 by the end of 2025, driven by attractive valuations, corporate reforms, and supportive monetary policies.

So this goes in line with this technical analysis - even though they are completely independent analysis.

Reverse Cup and Handle

Price>20 and 200MA

Target 45,172

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.