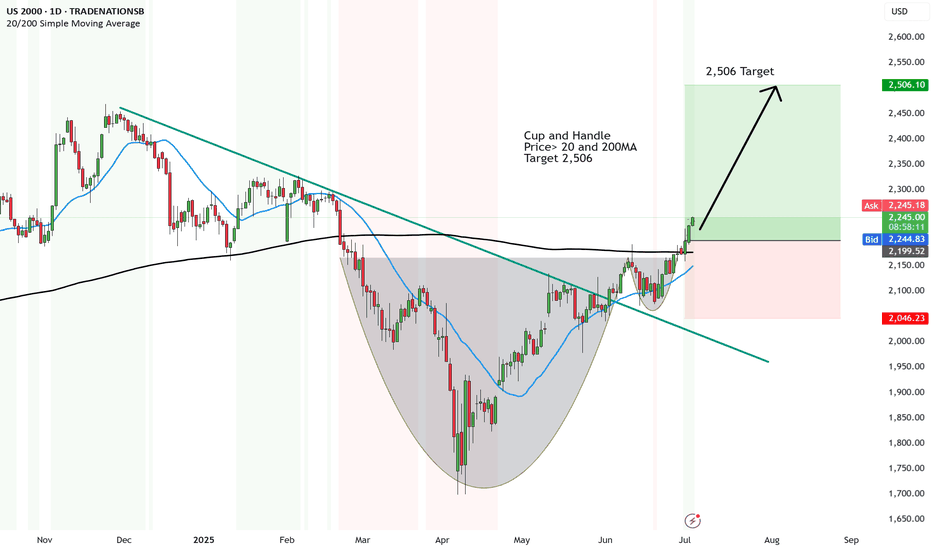

Go Russel - Strong upside for the small fry to 2,506First analysis ever done on the Russell 2000.

And the reason is because there is MAJOR upside to come for the first time in a LONG time.

So why now?

🧨 1. Rate Cuts = Small-Cap Lifeline

Small-cap stocks love lower interest rates — and the Fed's softening tone is a green light for upside.

💥 2. Breakout Setup After Long Chop

The US2000 has been stuck in a sideways range — now it's building energy for a potential breakout.

🏦 3. Regional Banks Bouncing

Regional financials (big weight in US2000) are showing signs of life — that’s a major boost to the index.

🧠 4. Under the Radar = Big Move Potential

While everyone’s chasing Nasdaq and S&P, smart money is quietly positioning in small caps before the crowd catches on.

📊 5. Economic Resilience Helps the Little Guys

US economy staying stronger than expected = tailwind for smaller domestic-focused businesses in the Russell 2000.

Cup and Handle

Price> 20 and 200MA

Target 2,506

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.