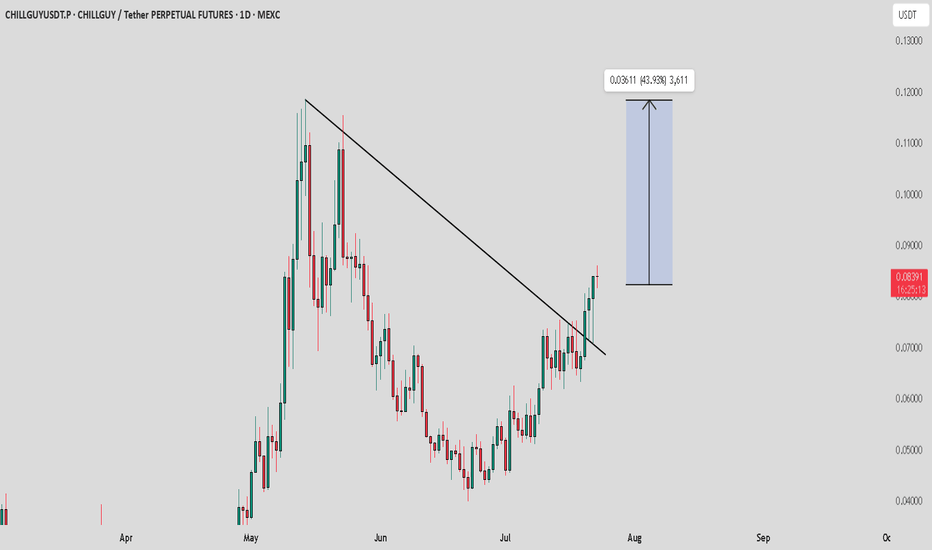

CHILLGUY / USDT : Trend shift and Retest confirmedChillGuy/USDT - Trend Shift & Retest

ChillGuy/USDT has fully shifted its trend, and after a successful retest, we expect a strong pump towards $0.10 - $0.12 soon.

Bullish Scenario:

Successful retest confirms the trend shift, leading to a potential move towards $0.10 - $0.12.

Pro Tip:

Keep a close watch for any signs of weakness or reversal before entering.

Longsetup

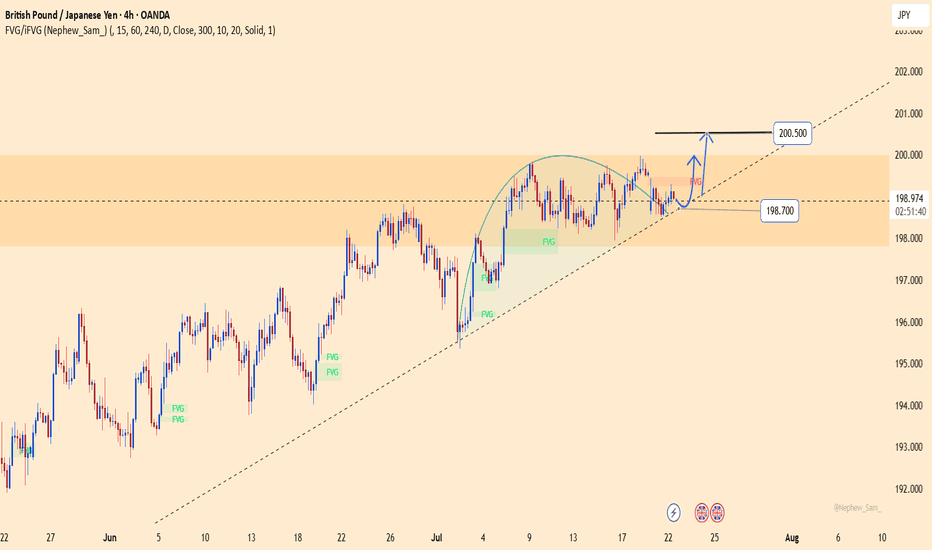

GBPJPY – breakout loading: final leap to 200.500?After days of compression, GBPJPY is flashing clear signs of an explosive breakout.

Price is holding firmly above the ascending trendline and consolidating right at the top of the FVG zone – a strong signal that buyers are preparing to punch through the 200.500 resistance in one decisive move.

Meanwhile, the JPY continues to lose ground as the BoJ shows no clear intention to hike rates, while GBP gains support on expectations that the BoE will maintain its hawkish stance longer due to persistent core inflation.

Trade setup (reference):

Buy limit: 198.900

SL: below 198.500

TP: 200.500

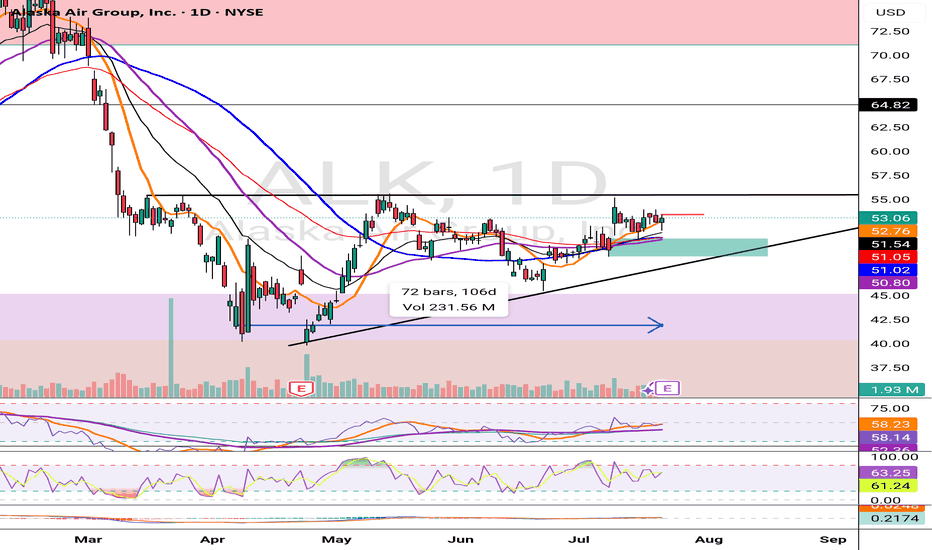

Solid setup for $DLTR in 2025 : $95-$105- NASDAQ:DLTR is a nice turn around story for 2025. It is showing great strength when the market is red.

- Any fear around recession will skyrocket this stock. This is by far one of the best risk/reward setup which provide gains when the market is red or is going under correction of some sort.

- It's a better buy than its peer NYSE:DG as headwinds for NASDAQ:DLTR are temporary and can be resolved as compared to NYSE:DG which has headwinds which will take time.

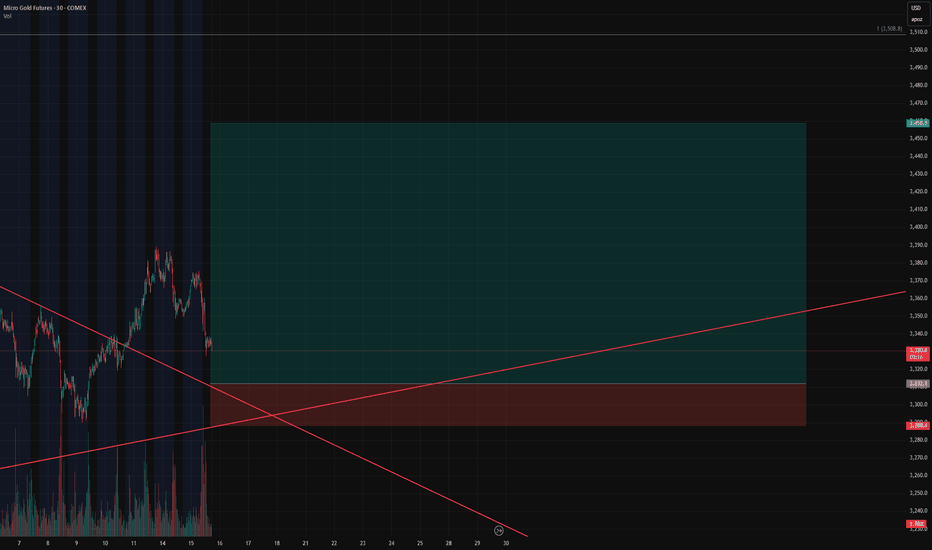

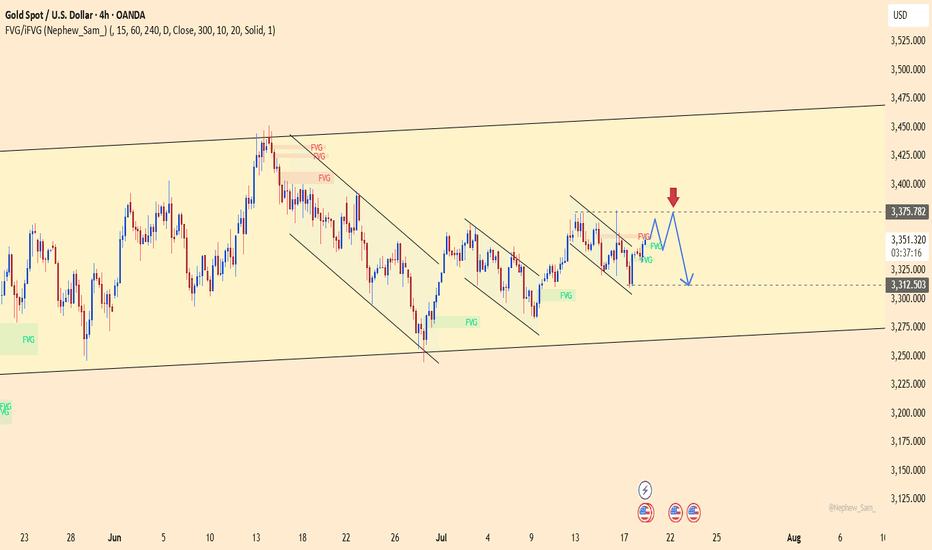

Gold Bulls Loading Up – Our Short Squeeze Trigger is Set!🚨 Gold Bulls Loading Up – Our Short Squeeze Trigger is Set!

We’re flipping the script on COMEX_MINI:MGC1! After a prolonged downtrend and textbook wedge compression, our breakout long is LIVE – but not without trapping the late shorts first.

💥 Entry: $3,312.1

🛑 Stop: $3,288.4

🎯 Target: $3,458.9

🧮 Risk/Reward: 6.19

Price just bounced at the retest of the wedge apex, and volume is confirming the move. If this holds, we’re riding momentum all the way up – and letting short pressure fuel the breakout.

📈 Trendline breached.

⏳ Time compression converging.

⚠️ If you’re still short, watch your stops!

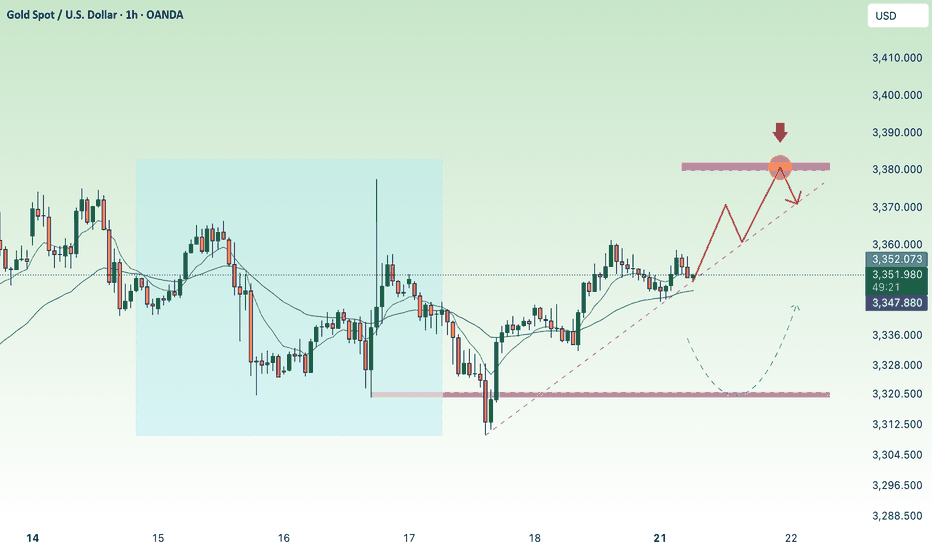

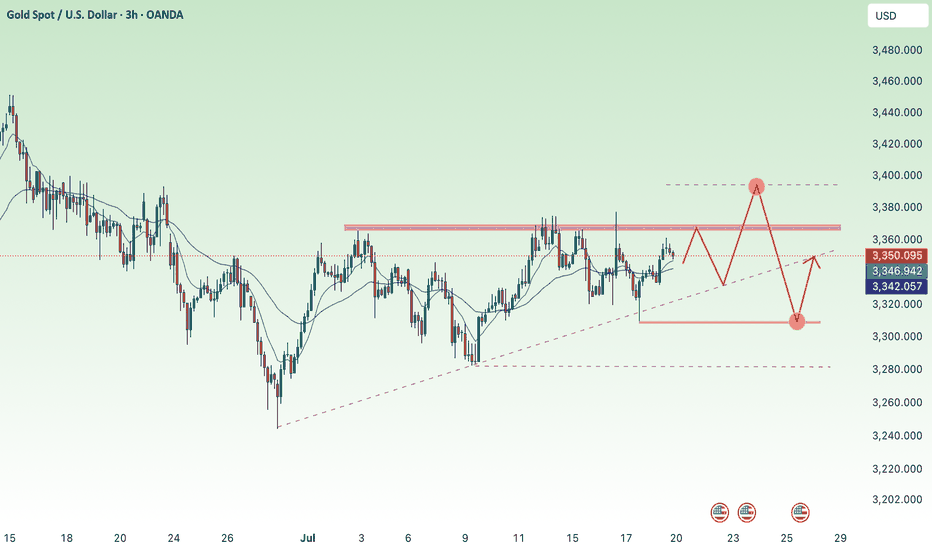

Gold price maintained above 3400⭐️GOLDEN INFORMATION:

Gold prices surged over 1% on Monday as both the US Dollar and Treasury yields declined sharply, driven by ongoing uncertainty surrounding trade negotiations, despite a generally positive risk tone in broader markets. At the time of writing, XAU/USD trades at $3,397, having rebounded from daily lows of $3,338.

While risk sentiment has improved ahead of upcoming US corporate earnings releases, anxiety lingers as the August 1 tariff deadline set by the White House approaches. Investors remain cautious about potential trade disruptions between the US and its key partners—the European Union (EU), Canada, and Mexico.

Meanwhile, reports from Bloomberg indicate that EU officials are preparing to convene this week to finalize a retaliation strategy, should trade talks with President Trump collapse. This backdrop of trade tension continues to support gold’s safe-haven appeal.

⭐️Personal comments NOVA:

Gold price continues to increase before FED's statement, market's expectation of early interest rate cut, setting new ATH in Q4/2025

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3450- 3452 SL 3457

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3332-$3330 SL $3325

TP1: $3345

TP2: $3358

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

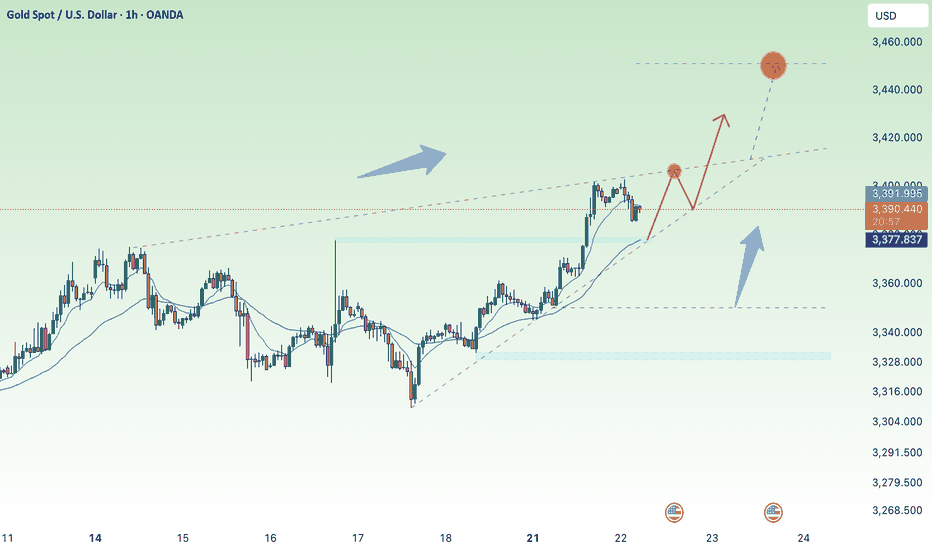

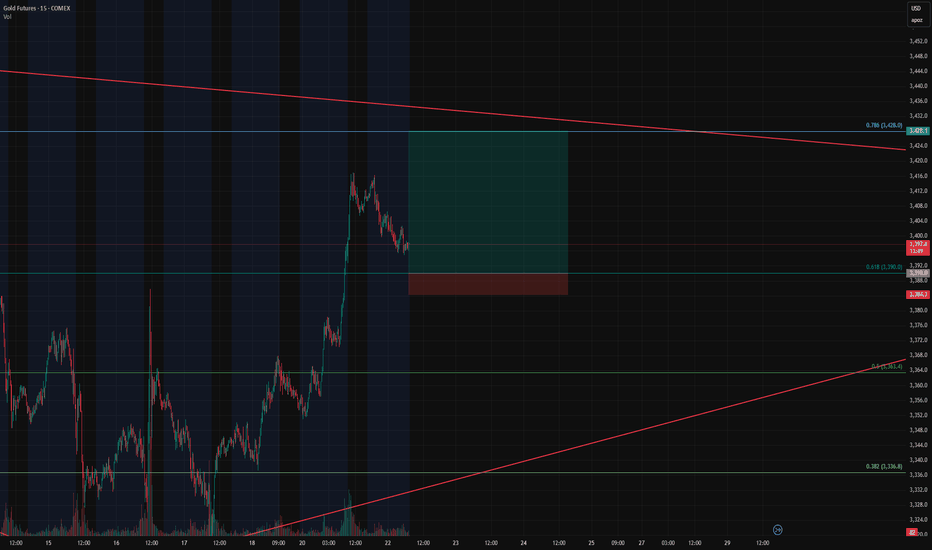

Gold Futures Long Setup – Breakout Continuation off the 0.618 FiGold Futures Long Setup – Breakout Continuation off the 0.618 Fib

Instrument: Gold Futures – COMEX ( COMEX:GC1! )

Timeframe: 15-Minute

Trade Type: Long – Breakout Continuation

Entry Zone: 3390 (0.618 Fibonacci retracement)

Take Profit: 3428 (0.786 Fib)

Stop Loss: 3384

Risk/Reward Ratio: 6.68

Setup: Bullish Flag on Retest

🔍 Trade Thesis

This trade is part of an ongoing breakout continuation strategy we've been trading, and now we're eyeing a pullback entry as price returns to a key retracement level.

Price nearly exploded through the 0.618 Fibonacci level (3390) during the prior breakout.

Now it's pulling back in a textbook bullish flag formation, suggesting healthy consolidation before the next leg.

The 0.618 retracement is aligning with previous intraday structure and trendline support — making this an ideal level to scale in.

This is a high R:R continuation play, with targets set at the 0.786 Fib level (3428) — right before macro resistance kicks in.

🎯 Entry & Exit Strategy

Entry: As price touches 3390 or forms bullish confirmation at the level.

Stop Loss: 3384 – tight and below key fib/flag structure.

Target: 3428 – based on 0.786 Fib extension and breakout continuation projection.

📊 Why This Works

Breakout behavior: Price respected the breakout impulse and retraced cleanly into a bull flag.

Fib confluence: 0.618 pullbacks are a classic entry in trending markets.

R/R of 6.68: Excellent reward profile vs. limited risk.

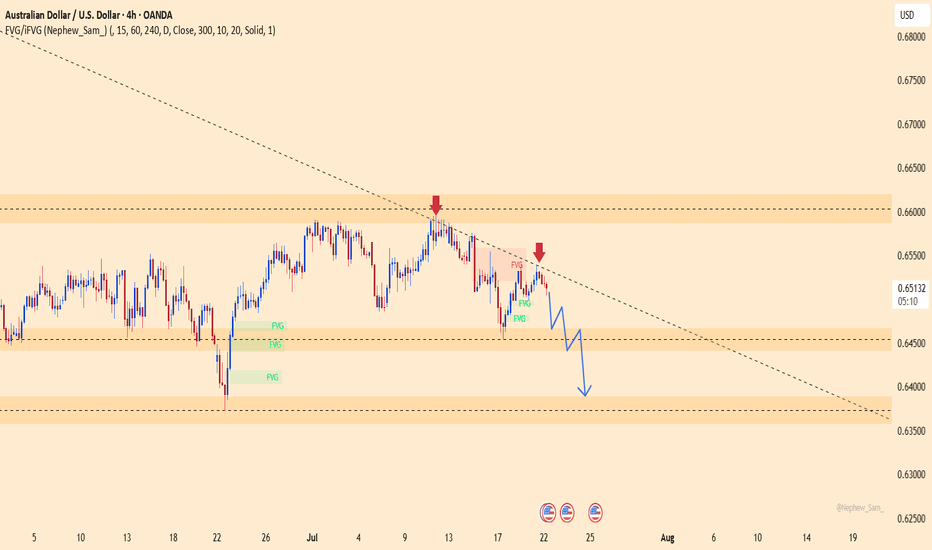

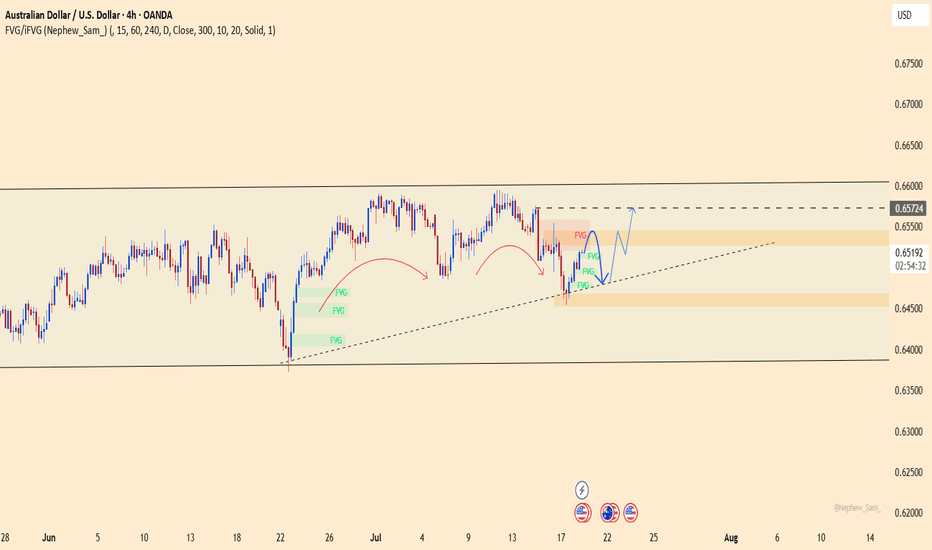

AUDUSD – Sellers taking over, the drop is on!This pair just got slapped hard at the descending trendline, right as it hit a familiar resistance zone. No more doubts – buyers are losing steam, and sellers are waiting to strike.

Market sentiment from Down Under is shaking, with weak economic signals piling up. Meanwhile, the mighty U.S. dollar is reclaiming the spotlight after gold’s flashy surge. The tide has turned!

Unless a miracle shows up, AUDUSD is set to dive deeper – and this is the perfect stage for traders who thrive on strong downtrends.

Sellers are in position – are you ready to join the ride?

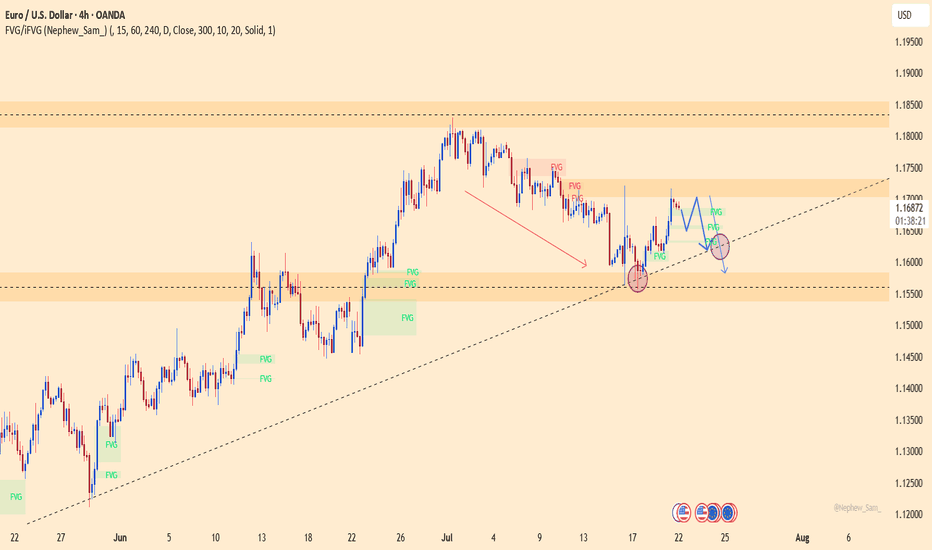

EURUSD – Is the rally over? Time for a collapse?The technical picture reveals that EURUSD is losing momentum after a brief rebound. The 1.1700 level stands as a key resistance – if bulls fail to break it, the bears will take the wheel! A clear scenario is forming: lower highs, FVGs filled, and a potential drop toward the 1.1580 support zone this week.

The bad news for the euro isn’t over: yesterday’s Eurozone PMI data disappointed heavily, signaling stagnating growth. Meanwhile, the USD is gaining traction from strong labor data and hawkish Fed remarks, putting EURUSD under double pressure.

If the ascending trendline breaks, EURUSD could plunge even further – get ready for a potential breakdown!

Suggested strategy: Prioritize SELL below 1.1700, with a short-term target at 1.1580.

Stop-loss: Above 1.1720 – a breakout here would invalidate the bearish setup.

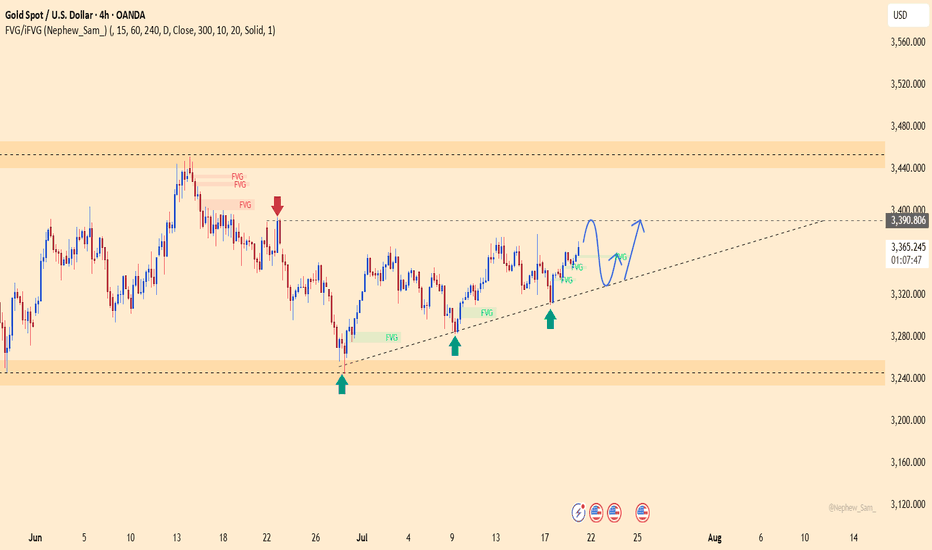

XAUUSD – Strong bullish structure, buyers in control!Gold is trading within a well-defined ascending channel, with each higher low being consistently respected – indicating strong buying pressure. The recent move broke through a fair value gap (FVG) and is approaching short-term resistance. High-probability scenario: a pullback toward the rising trendline, followed by a strong rebound aiming for the previous highs.

RSI remains in a positive zone, supporting the bullish bias. If the trendline support holds, the next target is the upper resistance area.

Supporting news: The US dollar has stalled after a sharp rally, while persistent inflation concerns and renewed hopes for a mild Fed rate cut are boosting gold’s appeal.

3380 gold price recovered at the beginning of the week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade with modest gains around $3,350 in early Asian hours on Monday, supported by persistent uncertainty surrounding global trade negotiations as the US tariff deadline approaches. Lingering concerns over fresh levies are likely to sustain demand for the safe-haven metal. Investors now look ahead to comments from Federal Reserve (Fed) Chair Jerome Powell, scheduled for Tuesday, for clearer policy direction.

On Sunday, US Commerce Secretary Howard Lutnick confirmed that August 1 remains the firm deadline for countries to comply with Washington’s tariff demands. While President Trump’s earlier announcements saw shifting deadlines, the White House now insists this date is final. This cloud of uncertainty continues to bolster gold’s appeal as a hedge in volatile markets.

⭐️Personal comments NOVA:

Gold prices continued to recover last weekend, mainly still accumulating above 3300.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3380- 3382 SL 3387

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3322-$3320 SL $3315

TP1: $3333

TP2: $3345

TP3: $3356

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

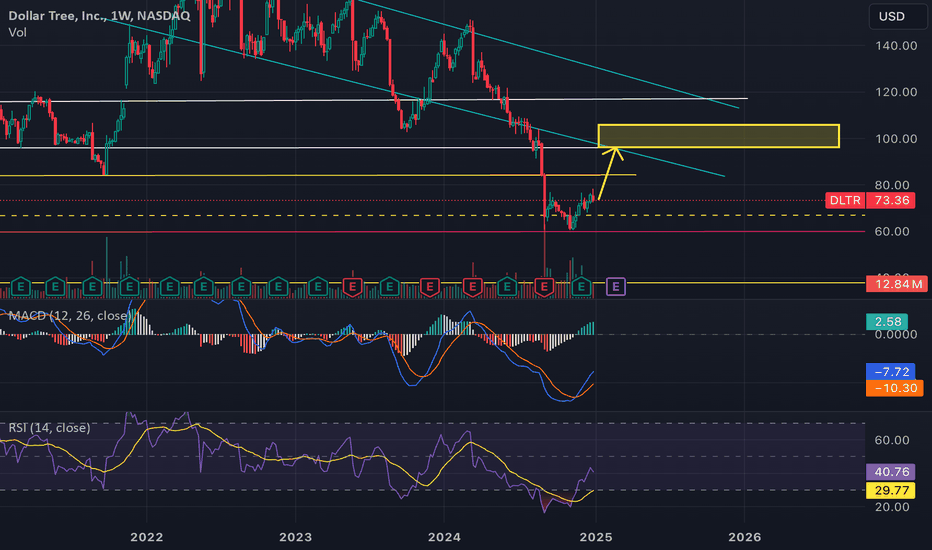

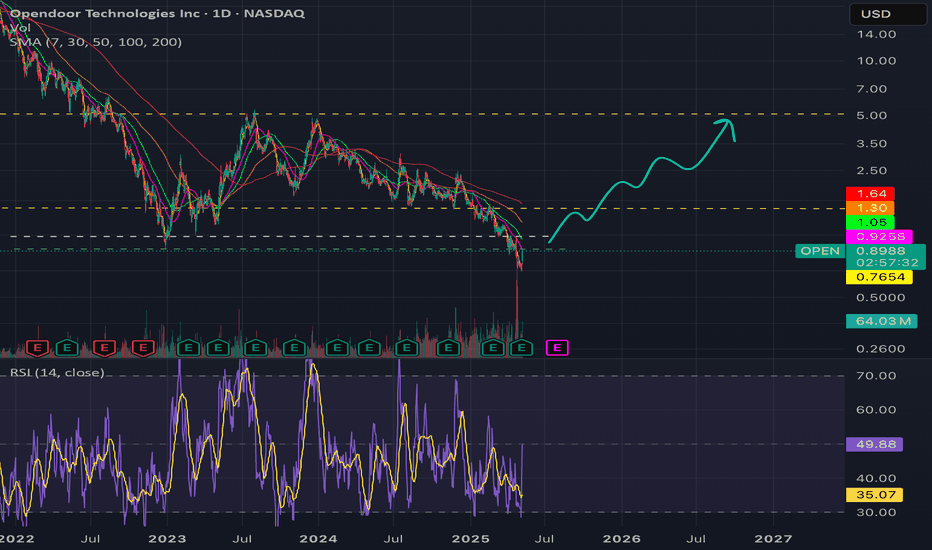

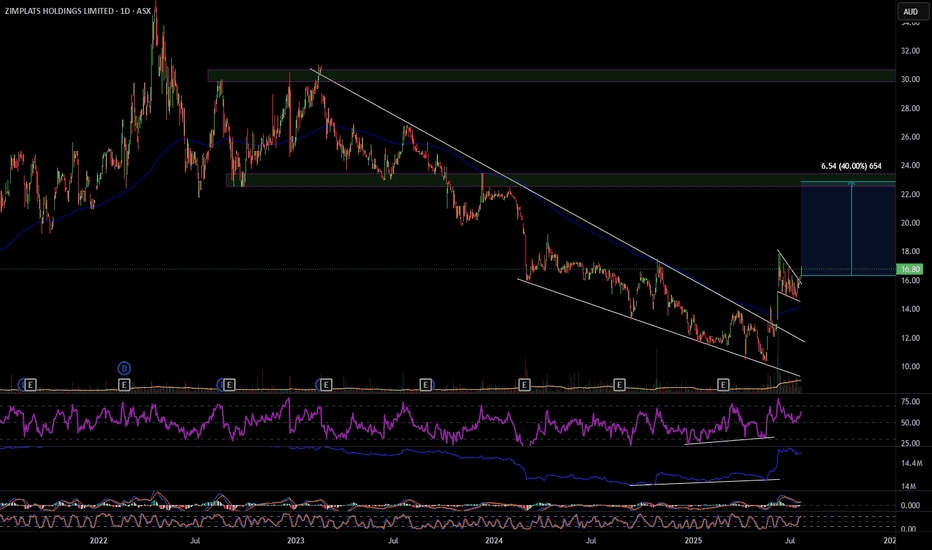

ZIM 40% move up

ZIM has broken out of a descending wedge with bullish RSI and OBV divergence, also multiple divergences on smaller time frames. On the hourly it's had a pull back and formed a bull flag that it has also broken out of. ZIM looks to have formed a change of structure forming higher highs and higher lows, my first target will be $22.90 a move of 40%. Definitely one to consider. Good luck and happy trading 🍀

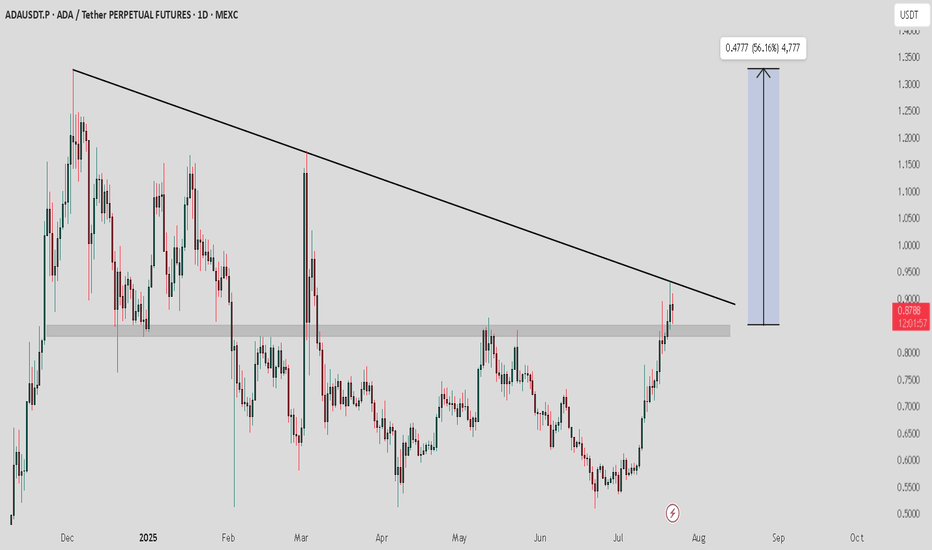

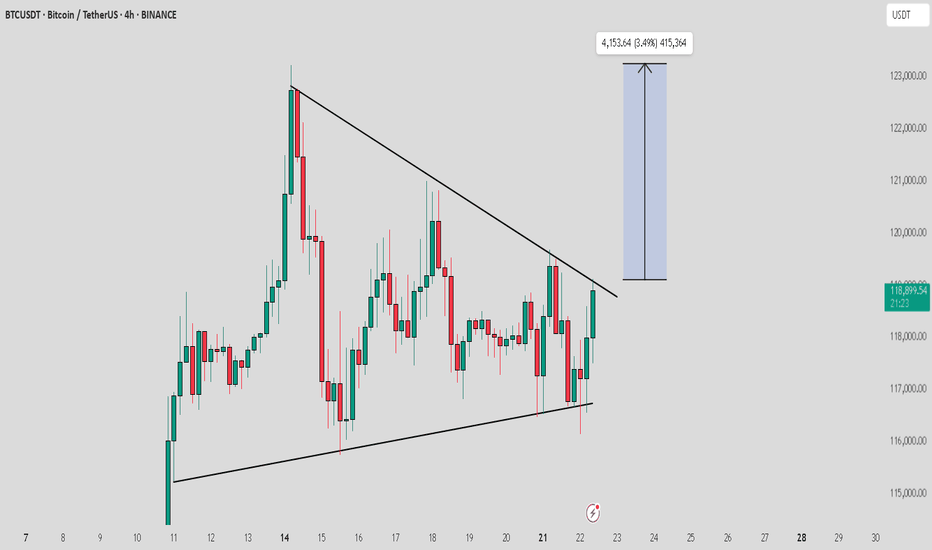

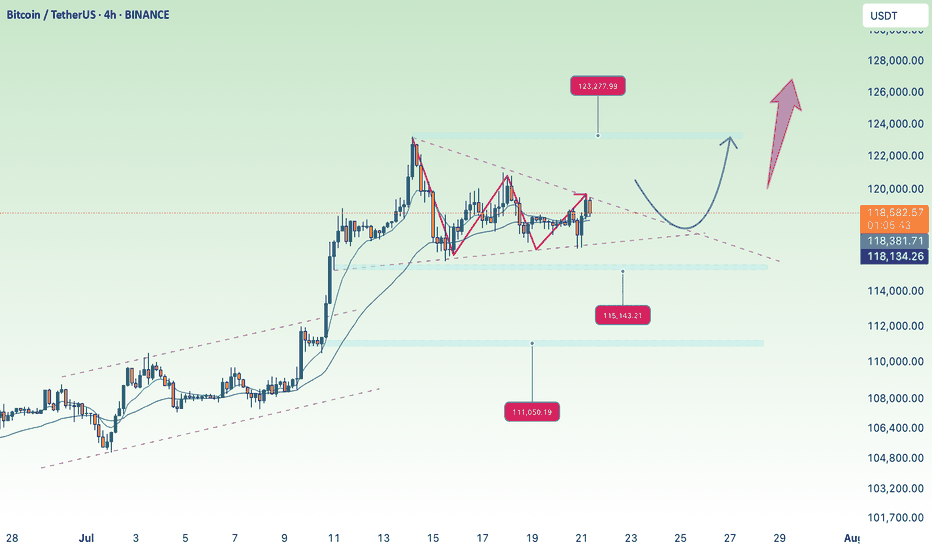

accumulate, continue to aim for new ATH💎 Update Plan BTC (July 21)

Notable news about BTC

CEO of Charles Schwab, Rick Wurster, said the company plans to deploy Bitcoin and Ethereum transactions for customers.

This company aims to compete with Coinbase, where customers buy BTC.

This development takes place after the progress of cryptocurrencies when President Donald Trump signs the Genius bill into law.

In an interview on Friday, the CEO of Charles Schwab, Rick Wurster, said the company plans to launch Bitcoin (BTC) and Ethereum (ETH) to compete with Coinbase cryptocurrencies. The move took place after President Donald Trump signed the Genius bill, officially confirming the first cryptocurrency law in the United States.

Technical analysis angle

🟠 Main trend:

BTC is sideway accumulated in the amplitude of 117,000 - 122,000 after a sharp increase.

The chart shows the descending triangular model - a potential sign for Breakout.

🔍 important areas:

Resist:

122,000 - 122,700: Strong resistance area, fibonacci mold 1.0.

130,600 - 131,100: The expected area if Breakout is successful (Fibonacci extension 1.618).

Support:

116,000: Support close, coincide with EMA 200.

111,100: The support area is stronger if the current support breaks.

✅ Scenario 1 - Rise:

If the price turns from supporting 116k → Test the resistance area of 122k.

If the 122K break is definitive, the next goal is 130k - 131k.

❌ Scenario 2 - Discount:

If the 116k area is lost, the possibility of falling will fall more deeply at 111k.

This is also the strong EMA area Fibo 0.382 of the previous wave.

Please follow the channel to receive the latest and continuous updates on XauUSD, currency and BTC

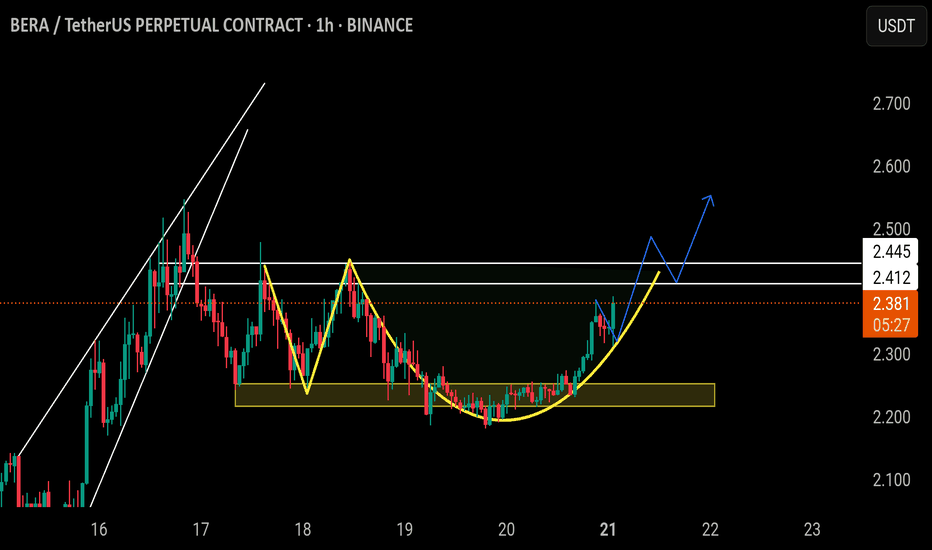

$BERA/USDT | READY TO FLY (ADAM AMD EVE PATTERN)BINANCE:BERAUSDT.P

$Bera/Usdt

The price is forming Adam and even pattern, if the price able the break above the white lines resistance, following a successful retest, the price will go higher and higher.

Aggressive entry at Current market price.

Safe entry after the breakout of white lines resistance following a successful retest of the white lines.

NFA DYOR

Gold price maintains accumulation below 3400✍️ NOVA hello everyone, Let's comment on gold price next week from 07/21/2025 - 07/25/2025

⭐️GOLDEN INFORMATION:

Gold prices edge higher in Friday’s North American session as a softer US Dollar and pre-weekend profit-taking lend support. Dovish remarks from a Federal Reserve (Fed) Governor, hinting at a possible rate cut as early as July, further bolster the yellow metal. At the time of writing, XAU/USD is trading around $3,353, gaining 0.43%.

Improved market sentiment also underpins bullion, following the University of Michigan’s report showing that US consumers are growing more optimistic about the economy, with inflation expectations easing. Meanwhile, Fed Governor Christopher Waller’s call for rate cuts weighed on US Treasury yields, adding positive momentum to gold.

The US Dollar Index (DXY) weakens to 98.48, down 0.13%, making USD-priced gold more attractive to foreign buyers and helping sustain the current uptrend.

⭐️Personal comments NOVA:

Gold price remains in the accumulation range of 3300 - 3400, the market awaits information on upcoming interest rate policy

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3367, $3392

Support: $3305, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

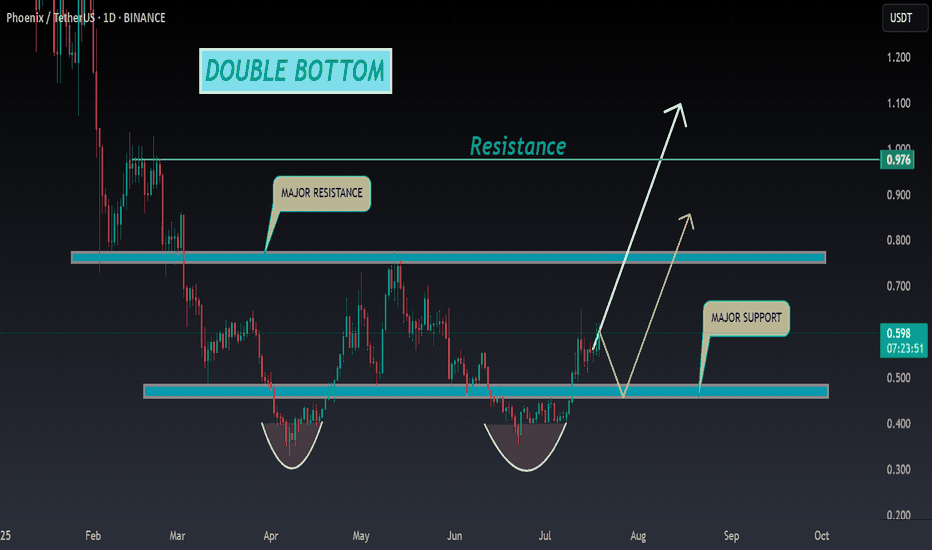

PHB ANALYSIS🔮#PHB Analysis :

📈📈 #PHB is making perfect Double Bottom Pattern. We can see a good pump if #PHB breakout the major resistance zone with good volume and sustains the higher price after breakout 🚀🚀

📊 Current Price: $0.595

⏳ Target Price: $0.780

⁉️ What to do?

- We can trade according to the chart and make some profits in #PHB. Keep your eyes on the chart, observe trading volume and stay accustom to market moves.💲💲

#PHB #Cryptocurrency #Pump #DYOR #Breakout

AUDUSD – bullish momentum returns, ready for a breakout?AUDUSD is showing clear strength after rebounding from a key support zone. The bullish structure remains intact with a series of higher lows, and the ascending trendline continues to hold. The recent pullback appears to be a healthy retracement before the market gathers momentum for the next leg up.

On the news front, the pair is supported by strong Australian employment data and expectations that the Federal Reserve will keep interest rates steady. This has slightly weakened the US dollar, giving AUD room to recover.

If buying pressure holds, AUDUSD could break through the overhead resistance and enter a new bullish phase. Now is the time for traders to watch price action closely and wait for a clear confirmation signal!

GOLD hits resistance – usd strikes back!XAUUSD is charging into the "danger zone" around 3,375 – a level where bulls have fallen before.

But this time, gold faces a heavyweight opponent:

– The US economy is revving up like a race car: consumer demand is surging, jobless claims are dropping.

– The Fed holds its hawkish stance like a loaded weapon: high interest rates aren’t going away.

– The US dollar is back in full force, and bond yields are shooting sky-high.

While gold buyers try to climb higher, pressure from the “USD fortress” is building fast.

Every uptick in XAUUSD now… might just be a setup before the fall.

If selling pressure returns near the previous highs, another sharp drop in gold could be just around the corner.