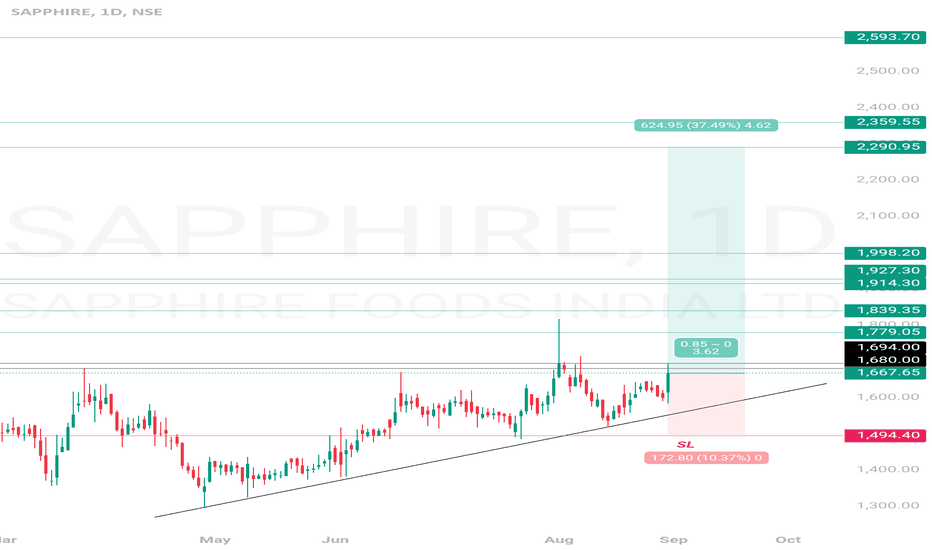

Sapphire (K.F.C & Pizza Hut) Showing Good Structural Breakout NSE:SAPPHIRE

.............................................

Company has delivered good profit growth of 26.0% CAGR over last 5 years.

.............................................

FY24 Highlights

• Sapphire has delivered the best all-round

performance in the QSR industry (all parameters considered):

Revenue scale & growth ,

Adj. EBITDA margin & growth

and New restaurant additions .

• Sapphire KFC delivered highest ever annual

restaurant EBITDA margin %: 19.7% .

• Sapphire KFC and Pizza Hut being recognized

as among the top 3 franchisees of Yum

globally on customer metrics and operating

standards.

• Sapphire Foods is ranked No.1 QSR in India

and at 95th percentile amongst QSR globally on

Dow Jones Sustainability Index (DJSI).

• We achieved our best ever employee

engagement score since inception and placed

at 88th percentile amongst all companies

surveyed worldwide by Gallup.

.............................................

Longterminvesting

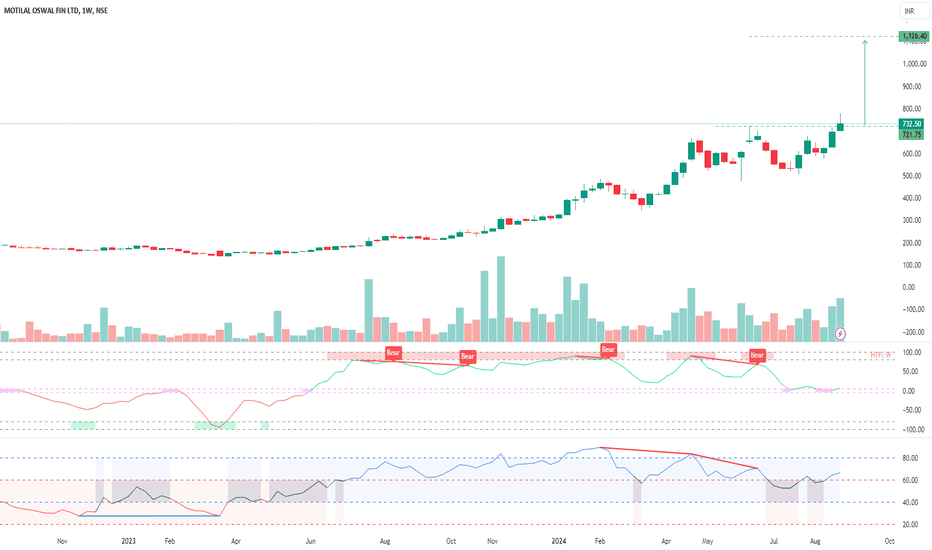

Motilal Oswal: Strong growth potential with a target of ₹1,120+Motilal Oswal Financial Services Ltd, established in 1987, is a leading financial services firm offering a broad range of services, including broking, investment banking, asset and wealth management, and housing finance. With a strong presence across 550+ cities, the company caters to over 1.6 million customers.The company's robust financial performance and growth trajectory make it a compelling investment for the long term. NSE:MOTILALOFS

I bought at ₹728 with a stop loss below ₹670, targeting a potential upside between ₹1,120 and ₹1,650+.

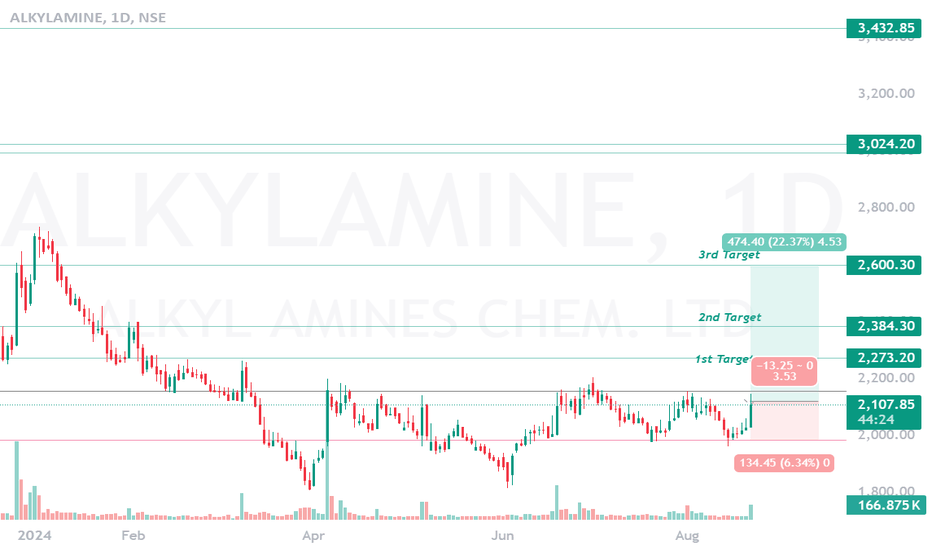

ALKYLAMINE is Reacting & Showing Change in Structure & STORYNSE:ALKYLAMINE

............................................................................................................................................................................................................................................

TURN-AROUND STORY IS IN PROGRES IN TERMS OF PRODUCTION FACILITY AND SUSTAINABLE PRODUCT WHICH WILL BE ABLE COMPETE CHINESE COMPATETORS

............................................................................................................................................................................................................................................

Company has reduced debt.

Company is almost debt free.

Company has a good return on equity (ROE) track record: 3 Years ROE 19.0%.

Company has been maintaining a healthy dividend payout of 26.5%.

............................................................................................................................................................................................................................................

Strong financial risk profile and ample liquidity: Networth was healthy at Rs. 1263 crores as on March 31, 2024 (Rs 1165 crore as on March 31, 2023), with nil gearing as on March 31, 2024.The total outside liabilities to adjusted networth (TOL/ANW) ratio though had decreased to 0.25 time as on March 31, 2024 from 0.36 times as on March 31, 2023, and it is expected to improve over the medium term driven by steady accretion to reserves, absence of long term loans and moderate reliance on external debt for working capital and capex. Cash and cash equivalents of Rs 17 crore as on March 31, 2024, provide cushion to overall liquidity. Interest coverage ratio has improved to 60.4 times March 31, 2024. It is expected to remain healthy over the medium term.

............................................................................................................................................................................................................................................

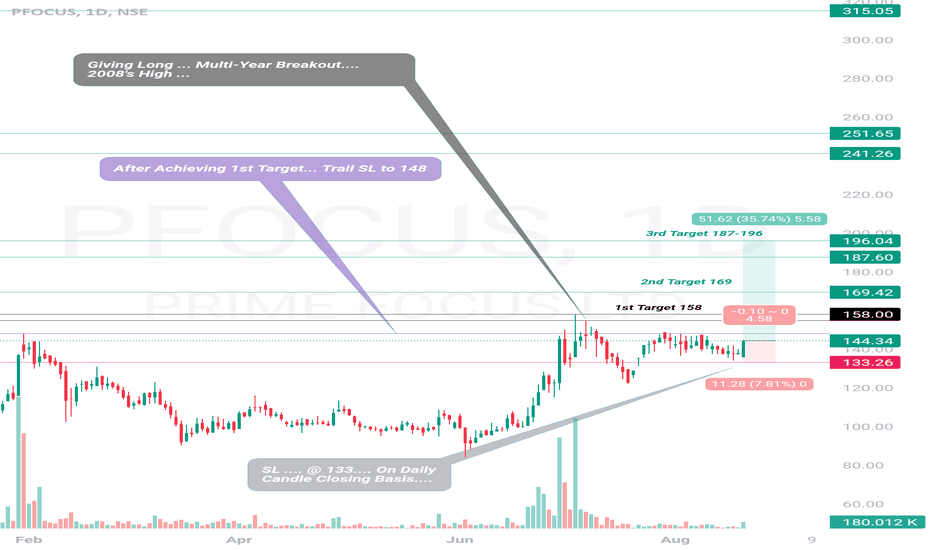

PFOCUS is Focusing on 2008's Multi-Year Long Resistance BreakoutNSE:PFOCUS

.............................................................................................................................................

.............................................................................................................................................

Over Last 4 Years ... From Year 2020 to 2024 Promoter Holdings Have Been Increased by +34.93% ......

.............................................................................................................................................

.............................................................................................................................................

Customers

PFL caters to players across the entire media industry value chain and the product life cycle of media content. Its major clients include top Hollywood and Indian studios and media companies across the globe:

Studios – Warner Bros., Disney, Netflix, etc.

Broadcast networks – Bloomberg, Disney, Star, etc.

Others – ICC, BCCI, Amazon, etc.

.............................................................................................................................................

.............................................................................................................................................

Focus

In Creative Services, it aims to expand its global footprint and diversify the business across content formats. It also expects growth in cross-selling through bundled VFX, etc.

In Tech/Tech-Enabled Services it aims to sign more strategic deals and increase revenue from existing clients by offering new modules and analytics.

Working on top Hollywood projects

One of them is

Matrix 4

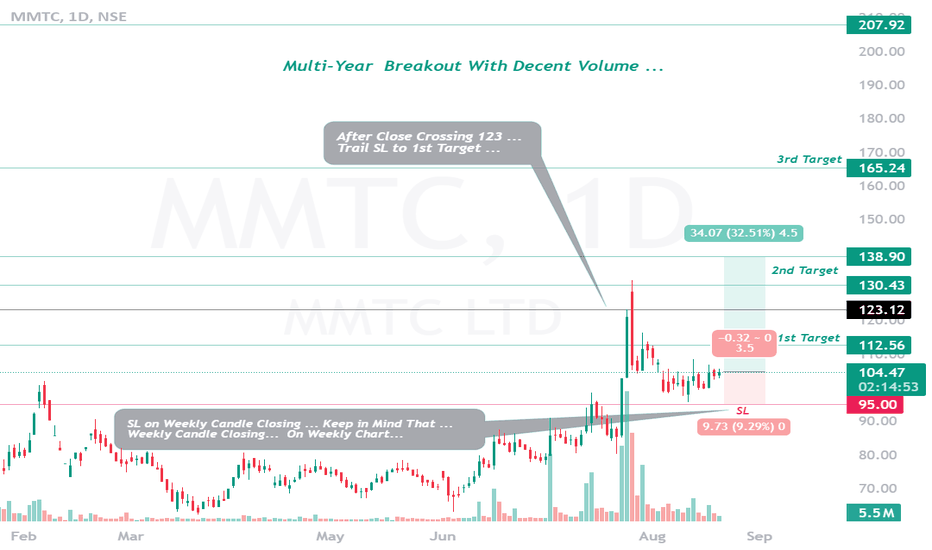

MMTC Non Profitable PSU showing MULTI-YEAR BreakoutNSE:MMTC

......................................................................................................................

......................................................................................................................

As A Research Analyst ... It is Not an Good Practice to Suggest anyone to invest in Non-Profitable and Loss Making Company....

Every Fundamental Numbers are Either Negative or Not-Satisfying .......

but if we See in Terms of Technical Analysis....

MMTC is Showing Long-Multi-Year Breakout....

so Going with Defined Risk... keeping an Decent Percentage of SL ...

......................................................................................................................

......................................................................................................................

MMTC, a public sector undertaking, was incorporated in 1963, to facilitate foreign trade in India and canalize the export and import of essential minerals and metals. It is under the administrative control of the Ministry of Commerce & Industry, and Government of India and is engaged in trading across minerals, metals, precious metals, agro products, fertilizers & chemicals and coal & hydrocarbons.

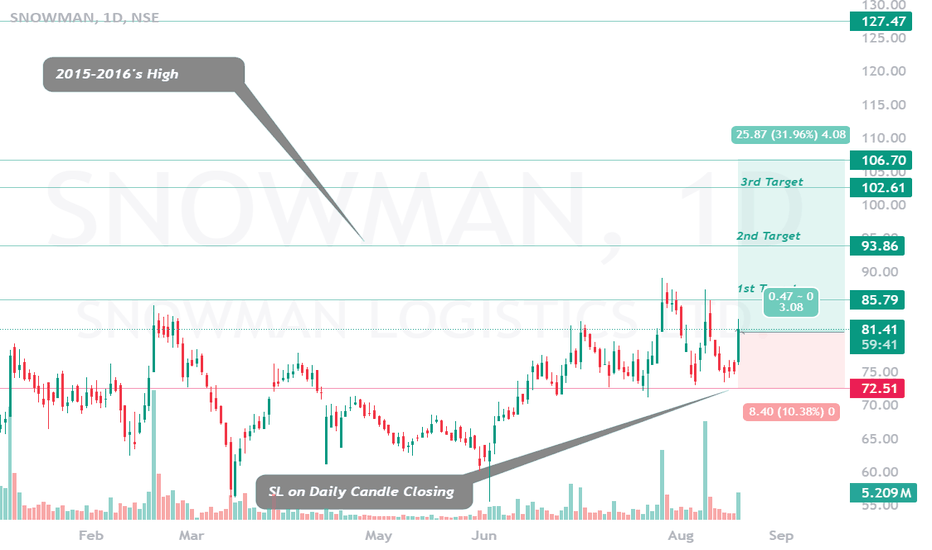

SNOWMAN Increasing Cold Temperature & New WarehousesNSE:SNOWMAN

............................................................................................................................................................................................................................................

• Network Advantage - Ability to offer customers the largest Pan-India cold chain networkfor storage and distribution

• Expansion Plans – Planned expansion basis our customers’ requirements to reach new markets & to address the demand of the organised sector• Technology Driven - Snowman has developed customised software & apps for increasing efficiency of operations

• 25+ Years of Experience - Snowman has innovated best practices and is a knowledge leader in the industry

• Customer Trust & Satisfaction - Full visibility & transparency provided to customer using in-house tech platforms & many uninterrupted years of satisfactory customer service

............................................................................................................................................................................................................................................

Leading integrated temperature-controlled logistics

• Snowman Logistics Ltd was incorporated in 1993 and Gateway Distriparks acquired a majority stake in 2006• Pan India network of 45 warehouses across 20 cities

• Integrated service offering of warehousing services, transportation, and distribution bundled with value added services• Modern facilities with high quality infrastructure across the country

• Expansion plans to increase warehousing presence for catering to the fast-growing demand of the organised sector• Snowman is first Indian cold chain company to introduce 5PL services, which offer innovative and integrated solutions

............................................................................................................................................................................................................................................

Strengths:

Established market position in the temperature-controlled logistics industry: Snowman is the largest provider in the highly fragmented temperature-controlled warehousing, transportation and logistics industry in India. The company provides quality service and end-to-end solutions to customers in the temperature-controlled industry, thereby resulting in repeat orders and long-term contracts providing around 80% revenue visibility. As on March 31, 2023, the company had warehousing capacity of 1,35,552 pallets across 44 warehouses in 18 cities. It also had 239 refeer vehicles (refrigerated trucks) providing last-mile, inter-city distribution services through a consignment agency model. It caters to marquee customers in diversified end-user industries, such as seafood, pharmaceuticals, dairy, e-commerce and quick service restaurants (QSR). Under the dedicated warehouse segment, the company has opened 4 warehouses for e-commerce and pharmaceutical clients including Amazon, Fraazo, Impelpro, among others.

Adequate financial risk profile: Gearing was 0.25 times as on March 31, 2023, and is expected to remain low in the medium term. Debt protection metrics are adequate with interest coverage and net cash accrual to total debt ratios are ~4.3 times and 0.63 times, respectively, in fiscal 2023. Any higher-than-expected debt for funding capex could adversely impact the capital structure and debt protection metrics and will remain a key rating sensitivity factor.

Continued parentage of GDL: Post settlement of agreement between Snowman and Adani Logistics Ltd (ALL) in July 2020, GDL is the single largest owner with 40.25% stake in the company and substantial control on the board. The rating continues to benefit from moderate operational and strategic linkages with GDL, as both the companies offer complementary services in the logistics industry, thereby providing cross-selling opportunities to customers. GDL is one of the largest private players in the container freight station, railways and inland container depot businesses in India. Furthermore, Snowman is well established amongst the leading organised players, providing temperature-controlled services in India

RUPA indicating is No More an Ordinary Underwear BrandNSE:RUPA

Commenting on the financial performance Mr. Vikash Agarwal - Whole Time Director, said,

“We are pleased to report a stable performance in Q1 FY25, though the industry continues to witness resistance to any price increase. We

demonstrated steady improvements across key financial metrics. This quarter, we witnessed 8% rise in revenue, primarily driven by strong sales in our

core product line. Our volume growth for the quarter reached 9%, supported by strong sales in the economy and athleisure segments.

Our EBITDA saw a year-on-year increase of 59%, totaling Rs. 18.0 crores for the quarter, showcasing our commitment to cost management and

operational efficiency. Operating margins also improved by 280 basis points compared to the same period last year. Furthermore, our net profit

experienced substantial growth of 149%, reaching Rs. 10.5 crores for the quarter. This underscores the effectiveness of our financial strategies and the

resilience of our business model. Net profit margins improved by 280 basis points during the quarter.

Notably, our exports have shown progress, with a healthy 32% year-on-year growth, reaching Rs. 8 crores. This reflects our steady penetration into

international markets. Revenue contribution from Modern Trade remains robust at 8% in Q1 FY25.

The pilot project “Pragati’, which was launched last quarter, has received encouraging feedback from our distributors. We expect healthy expansion of

the project going forward.

Our cash flow from operations remains strong, generating Rs. 44 crores in Q1 FY25. We have made significant progress in reducing our debt, achieving

a net debt-free status as at end of Q1 FY25. Our branding and advertising strategies accounted for 9% of revenues in Q1 FY25.

Looking ahead, we are confident in achieving new business milestones and delivering innovative products to our diverse customer segments. Our

customer-first approach will help us strengthen our position as an industry leader and contribute to our sustainable business model

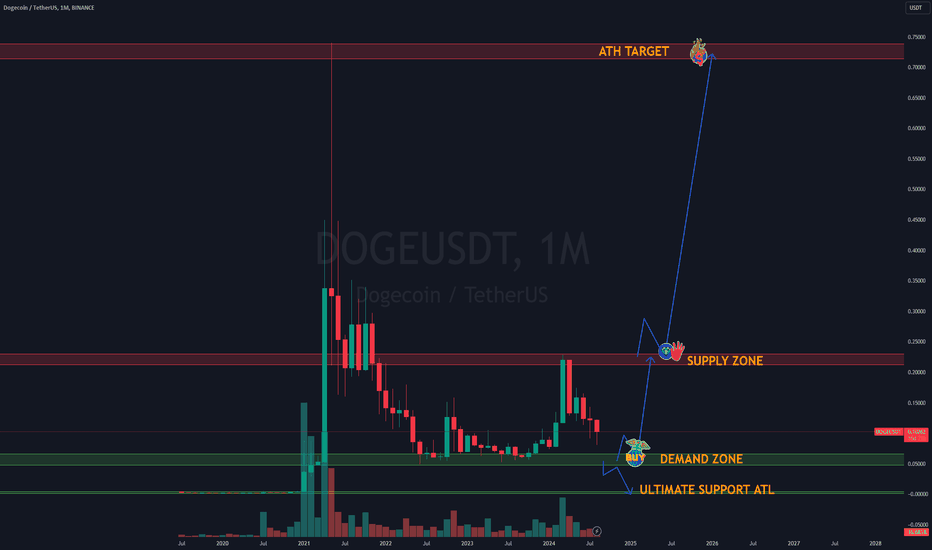

DOGE | Long Term Profits PlanHello traders!

At this very moment, there's a lot of uncertainty, and we can't know for sure what's going to happen exactly, so having a plan of action is the best idea. Plan ahead so you know what to expect and are ready to act on it when the moment arrives.

So here's my plan:

1) DOGE is stuck in a box; clearly, we can pinpoint support and resistance on the monthly timeframe. This indicates the asset is actually in balanced mode, so usually no action should be taken. However, I've marked certain demand zones to buy, and if, for whatever reason, it gets pierced through, you'll also know where the price is most likely to land next.

Confirmations: Wait for the price to hit the areas marked; be patient, and you'll get rewarded accordingly. Once price hits the zones, wait for a candlestick and a reversal pattern on the lower timeframes to time your entry smoothly.

2) TARGETS: Whichever demand zone price hits, make sure your target is the closest supply zone. Don't expect the price to hit the moon just because. That's just not going to happen, and on the contrary, there are massive amounts of sell trade limit orders sitting on those supply zones, so be smarter and take profit before the sell-off gets activated.

This idea is to spot for the long term. This asset is still in balanced mode; there hasn't been a breakout of the range yet. However, it's worth noting that as of now, price might just come down into a very important demand zone, giving an extremely great opportunity to enter and hold for the bullrun next year.

I hope you find it useful and are able to take advantage of this idea.

Kina Tip of the Day: Take profits partially even when they don't seem much because, in the long run, they will grow in a balanced way with the rest of the portfolio.

Keep it shiny ⭐

Kina, The Girly Trader

SHK is Spreading its Fragrances on ChartNSE:SHK

.....................................................................................................

.....................................................................................................

Q1 FY25 performance overview compared with Q1 FY24.

Revenue from operations at Rs. 470.3 crore as against Rs. 422.6 crore, up by 11.3%.

EBITDA** at Rs. 83.3 crore as against Rs. 70.6 crore, higher by 18%.

EBITDA** margin at 17.7% as against 16.7%, expanding by 100 bps.

Adjusted PBT stood at Rs. 46.5 crore as against Rs. 37.8 crore, up 23.1%.

Cash profit at Rs. 55.8 crore as against Rs. 47.7 crore, growing by 17.0% .

.....................................................................................................

.....................................................................................................

Key Developments.

Incorporation of step-down subsidiary – Keva Germany GmbH.

Incorporated Keva Germany GmbH to serve as a Creative Development Centre (CDC)

for European operations, while also providing support to customers in Dubai and

Middle East.

.....................................................................................................

.....................................................................................................

Update on Debt Position:

The Company’s net debt increased to ~Rs. 542 crore as on 30th June 2024 as

compared to Rs. 504 crore as on 31st March 2024.

The debt increase was due to the need to replenish inventory following the fire incident

at its Vashivali facility in April 2024 .

.....................................................................................................

.....................................................................................................

Update on the Fire Incident at the Company’s Fragrance facility located at Vashivali.

A fire incident occurred at the Company’s Vashivali facility in April 2024.

There was no loss of human life, and the safety of all personnel was ensured.

The Company has comprehensive insurance coverage including cover for loss

of profit.

The Company operates five manufacturing locations in India and, in response to the

incident, swiftly implemented a Business Continuity Plan (BCP) by shifting production

to alternate sites.

The new facility is projected to be re-established within 9 to 12 months.

All facilities are now operating in double/triple shifts, ensuring adequate capacity to

meet current and future customer requirements.

Recently commissioned Indonesia facility is ramping up production to cater to both

local and export orders, ensuring continuity and fulfilling commitments to overseas

customers.

An exceptional loss of ₹120 crore (net of tax) was recorded during the quarter due to

the fire, covering plant and machinery, building, and inventory. This loss is expected

to be fully offset by insurance reimbursement in FY2025.

The Company has filed a request for interim payment of Rs. 50 crore with the Insurance

Company. The Insurance company is carrying out the necessary procedure to process

the claim .

LONG TERM WEALTH IDEA - IMAGICAA WORLD ENT LTDLONG TERM WEALTH IDEA - IMAGICAA WORLD ENT LTD

Company has some issues, still I believe it's could be a turnaround story.

This is not a recommendation, just for educational purpose. DO NOT COPY this trade. Consult your financial advisor before investing!

BAJAJ HIND SUGAR good Long 10% ROIBajaj Hind Sugar is ready to move out of 1 month old consolidation zone.

One may consider to enter at 25 and exit at 28.30 for a quick swing.

The stock is also ready to move out of 37 zone, supply zone sooner or later, if 37 zone is taken off in monthly, one can look for a good long term target of 100.

The 37 rs zone is a strong 12 year old consolidation supply zone, the RSI also indicates a strong up swing.

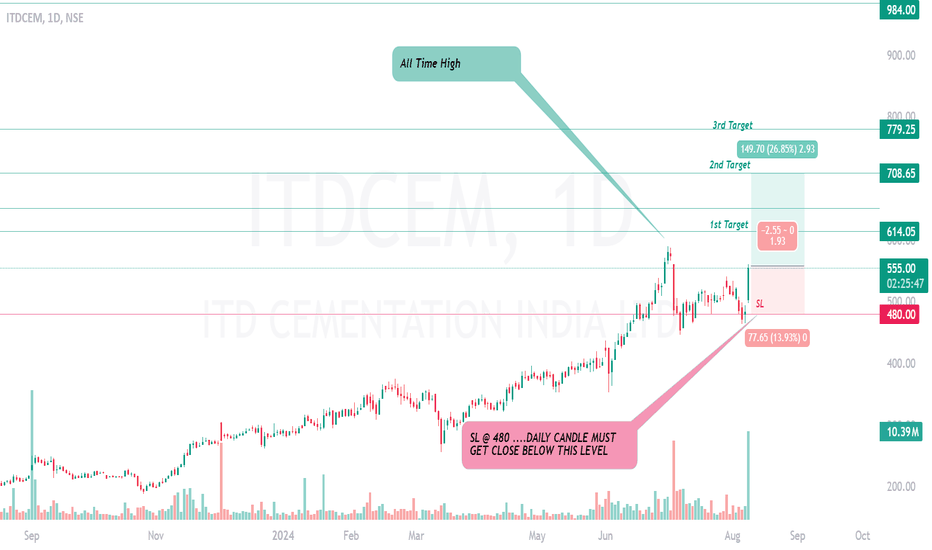

ITDCEM Going 2 Break All Time High With Huge Positive NumbersNSE:ITDCEM

Over 90 years of rich industry experience

......................................................................................

......................................................................................

Company is expected to give good quarter,

Company has delivered good profit growth of 26.4% CAGR over last 5 years

......................................................................................

......................................................................................

Amongst the leading infrastructure & construction company in Thailand

for over 60 years.

......................................................................................

......................................................................................

Received ‘The Royal Seal of Garuda’ in 1985 - Highest and most

honorable achievement for civilian companies in Thailand

Global presence in India, Bangladesh, Lao PDR, the Philippines,

Vietnam, Africa etc.

Access to the latest technology and know-how, international design and

engineering as well as skilled personnel to augment our local strength.

......................................................................................

......................................................................................

MULTI YEAR REVENUE VISIBILITY ORDERBOOK OF RS 18,536 CRORE.

• Secured orders worth over Rs 1,053 crore in Q1 FY25.

• Clientele comprises of Government (48%), PSU (17%) and Private Sector (35%).

• Established presence in India with 13 states / 1 union territory and is currently executing project in Sri Lanka and Bangladesh

......................................................................................

......................................................................................

Major Projects under execution worth of Rs 6,401 crore.

Marine project in Bangladesh.

West Container Terminal in the Port of Colombo, Sri Lanka.

Balance Outer Harbour Works in Andhra Pradesh.

Piers, Landside Tunnels & Building in Karwar, Karnataka.

Udangudi project in Tamil Nadu.

Wharf and Approach trestle works at JNPT in Maharashtra.

Captive Oil Jetty at Kamarajar Port in Tamil Nadu.

Third Berth (Jetty) at Dahej LNG Terminal in Gujarat

......................................................................................

......................................................................................

Major Projects under execution worth of Rs 3,936 crore.

Underground tunneling and stations for metros in Chennai, Bengaluru, Mumbai and Kolkata.

Elevated metro stations and buildings in Kolkata

Depot metro building in Surat

Modification & Refurbishment of terminal buildings in Ahmedabad airport

......................................................................................

......................................................................................

Major Projects under execution worth of Rs 2,717 crore

Six laning road project in Uttar Pradesh

......................................................................................

......................................................................................

Major Projects under execution worth of Rs 2,341 crore

Redevelopment of Residential colony at

Kasturba Nagar in New Delhi.

Circuit bench of Calcutta High Court at Jalpaiguri in West

Bengal.

Thal Sena Bhawan in Delhi.

Aerospace museum at AF station in Palam, Delhi.

Piling and Civil work for Coke Oven Project at

Hazira plant in Gujarat.

Construction of buildings for Sikkim University

......................................................................................

......................................................................................

Major Projects under execution worth of Rs 2,120 crore

Railway tunnels in West Bengal and Sikkim.

Civil & Hydro-Mechanical Works of 500 MW Hydel Power, Pumped Storage Project in Andhra Pradesh.

Water conveyor system of lined gravity canal/tunnels in Telangana

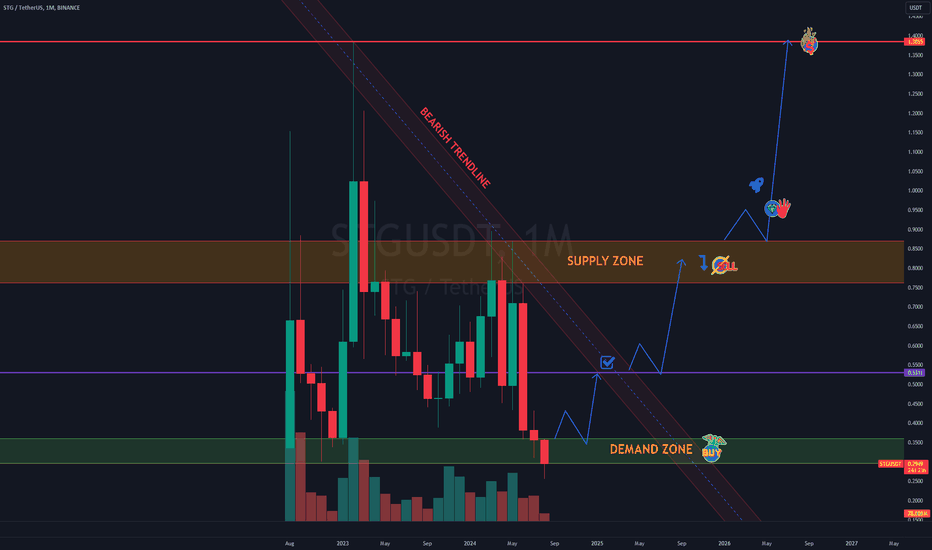

STG Long Term Profits PlanHello traders!

Currently, we are experiencing a big drop in Crypto but other markets have also been dropping hard. So, now instead of going all panic mode let's switch gears and plan ahead to take advantage of the buying opportunities. So, here's my plan in the long term for StarGate.

1) Right now, we can see price hit the Demand Zone which is the zone marked in green. It got pierced though recently after a real long time. However, it's turning into a hammer candle and reversing altogether which means strong buying pressure stepping and it could totally be a fakeout, so we should stay alert to see how it plays out.

Possible confirmations for the demand zone to be safe are: Wait for the price breakout and take a position when it re-test the zone back again.

In the future if the bearish trendline gets broken, we can expect an important rise on the price. We still have to deal with a strong supply zone which is marked in red. If price manages to pierce through the supply then we fly to the moon ♥ meanwhile, I'll be monitoring weekly and informing STG movements over time.

2) TARGETS: The nearest one would be 0.53, which would act as a mean reversion zone. After that, we can expect ranging, and we'll have to wait for signs and clues to find out what could possibly happen next. Targets long term: the supply zone and the ATH +

This idea is to spot for the long term. This asset is still in ranging mode; there hasn't been a breakout of the range yet. However, it's worth noting that there's a triangle pattern playing out in the monthly timeframe, right now.

I hope you find it useful and are able to take advantage of this idea.

Kina Tip of the Day: Take profits partially even when they don't seem much because, in the long run, they will grow in a balanced way with the rest of the portfolio.

Keep it shiny ⭐

Kina, The Girly Trader

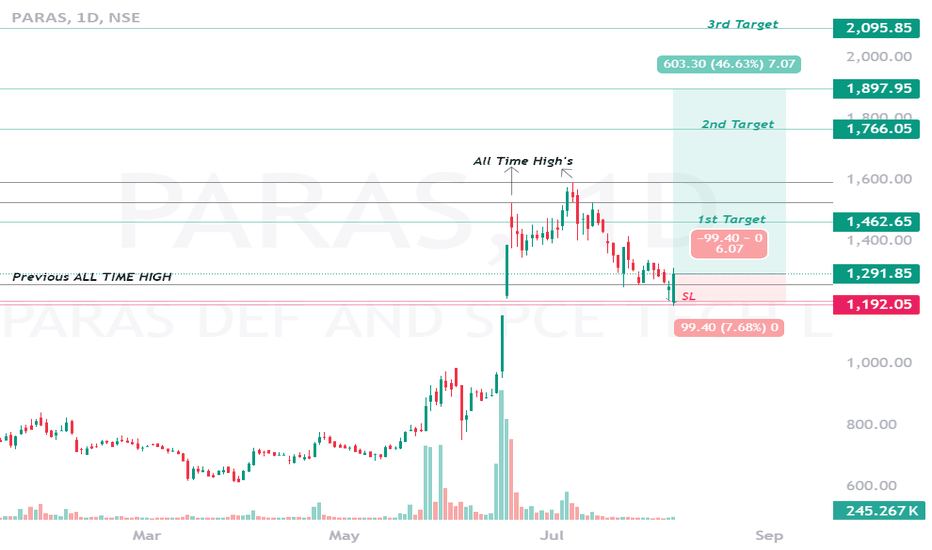

PARAS DEFENCE Getting Support @ Previous ALL Time HighNSE:PARAS

Positive factors – The outlook will be revised to Stable if the company demonstrates a material improvement in its working

capital cycle and liquidity position, along with improvement in earnings and scale of operations.

Healthy order book provides medium-term revenue visibility – The company’s fresh order inflows over the past four fiscals

remained adequate, with orders worth ~Rs. 621 crore added in the last 21 months ending December 31, 2023.

The pending order book of Rs. 526.3 crore as on December 31, 2023 (OB/OI ratio of 2.4 times of the OI in FY2023) provides medium-term

revenue visibility.

Comfortable capital structure and healthy coverage indicators – The company’s capital structure remains comfortable with

TOL/TNW of 0.3 times as on September 30, 2023, supported by equity infusion of Rs. 162.3 crore during FY2021-FY2022 and

low debt levels.

The interest coverage stood at 12.2 times in 9M FY2024 due to the limited dependence on external borrowings

to fund its working capital. Going forward, ICRA expects the coverage indicators to remain comfortable, benefitting from the

scale-up in operations, given the strong order pipeline.

Extensive experience of management team – PDSTL’s promoters have more than three decades of experience in designing,

developing and manufacturing a wide range of engineering products and solutions for the defense and space sector in the

domain of optics, heavy engineering and electronics. Its long presence in the defence and space sector has helped to establish

strong relationships with its customers as well as suppliers. It has developed a strong management and execution team

comprising several ex-employees of BEL and DRDO, among others.

High working capital intensity due to elongated receivables cycle – The business is working capital intensive with NWC/OI of

88.3% and 114.8% in FY2023 and H1 FY2024, respectively, owing to the high inventory holding period and long receivables

cycle.

The inventory levels are high because of additional stocking of critical raw materials to avoid any disruption in the

delivery schedules and high work-in-progress due to elongated manufacturing cycle.

PDSTL has been partly managing its

working capital cycle by stretching its trade payables by more than three months as it has a longstanding relationship with

most of its suppliers and availing mobilisation advance for part orders. Going forward, the company’s ability to alleviate its

working capital intensity while scaling up its revenues and improving its operating margins will be the key rating monitorable.

Moderate scale of operations – Though the company reported a robust YoY revenue growth of 21% and 10% in FY2023 and

9M FY2024, respectively, supported by healthy order book and the timely execution of orders, the scale of operations still

remains moderate. Given the Government’s thrust on ‘Make in India’ in the defence sector, PDSTL has been mainly catering

to domestic demand (~84% of OI contributed by domestic orders in FY2023). Driven by the healthy order book status, ICRA

expects the company to sustain its revenue growth in FY2024 and FY2025.

High customer concentration risk, though largely mitigated by reputed customer base and repeat orders – The company

faces client concentration risk with top three clients contributing 46% to the total order book as on December 31, 2023 and

top five clients accounting for 51% of the revenue in FY2023. The client profile mostly comprises government organisations

with repeat orders received over the years, largely mitigating the counterparty credit risk. A major part of PDSTL’s clientele

included reputed government organisations, namely Laboratory for Electro-Optics Systems (a unit of ISRO), BEL, Instruments

Research and Development Establishment (a unit of DRDO) and private companies like RRP S4E Innovation Private Limited and

Unifab Engineering Project Private Limited. The company has long standing relationships with most of its clientele. PDSTL also

exports to companies based in Israel, Singapore and USA.

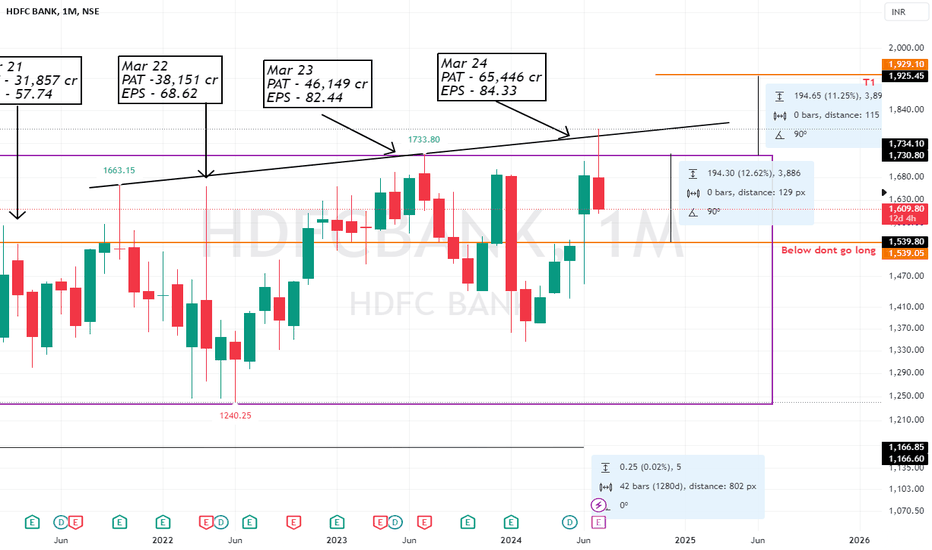

HDFC Long ScenarioI believe HDFC will move past Rs.2000/-

Despite Posting good results HDFCs price is trading in btw 12% Zone (1540-ATH) Since March 2021

My Thoughts:

HDFC was trading at High valuations due to its leadership in sector before 2020. Now HDFC leadership is gone, just like Asian paints superiority .So, Valuations are adjusting and price not moving with good results.

With Reduction of PB Value to 3.

Best Entry Zone is 1520-1540.

TGTs are 1920,2000,2100

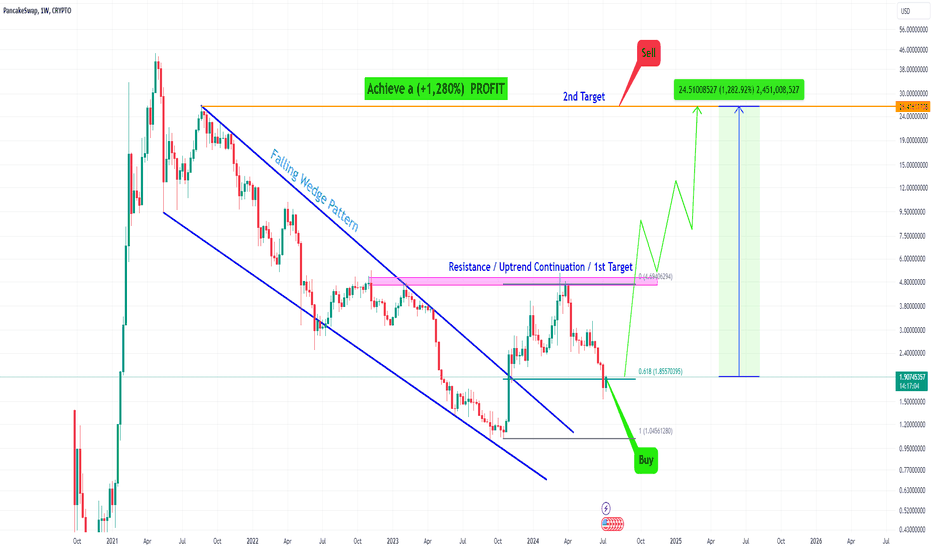

PancakeSwap _ Wedge Pattern Breakout _ Biggest Profit (+1,282%)Falling Wedge Pattern formed and Breakout and also reached 0.6 Fibonacci Retracement level. Now going to Uptrend and Resistance level is the 1st Target. Offering a chance to Achieve Biggest Profit of (+ 1,282%) Percentage. This is Long-Term Analysis, must follow the Trend Continuation Technique. Guess the 3rd Target ?????

Follow & Support me; I want to Help People Make PROFIT all over the "World".

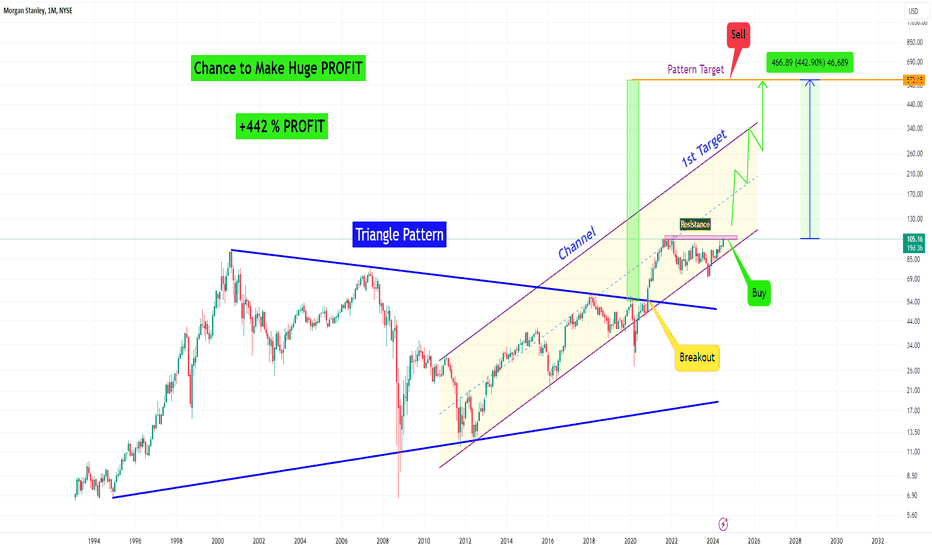

Morgan Stanley _ Chance to Make HUGE PROFIT + 442%.Morgan Stanley Trading within the Rising Channel Pattern and has Breakout the Triangle Pattern. If Breakout above the Resistance level, market significant Bullish Trend then the 1st Target is the Channel Top price around USD 350 or more, depending on the time. And 2nd Target is the Triangle Pattern Target price at USD 572. Offering a Chance to Achieve +442 % of HUGE PROFIT. This is Long-Term Analysis, must follow the Trend Continuation Technique.

Support me; I want to Help People Make PROFIT all over the "World".

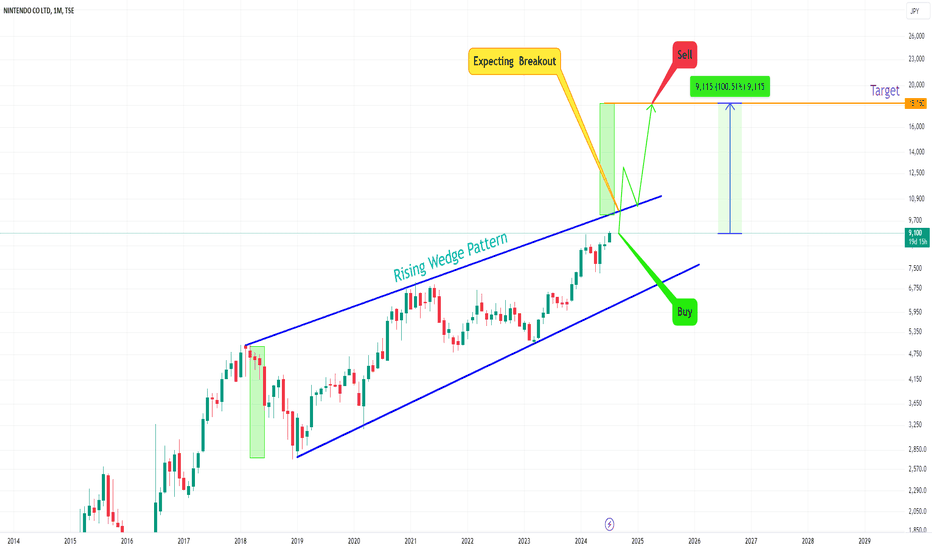

NINTENDO _ Rising Wedge Patter Target _ Achieve +100% PROFITRising Wedge Pattern forming and Expecting a Breakout. If Breakout above the Rising Wedge Pattern, market approaching the Pattern Target at price JPY 18,160. Offering the potential to Achieve a 100% PROFIT. This is Long-Term Analysis, must follow the Trend Continuation Technique.

Support me; I want to Help People Make PROFIT all over the "World".

Retracement ahead...trade cautiouslyWe predicted this V-shaped stock market recovery one month ago in one of our videos. Happy that it has overcome the fall of election results day.

But a retracement is due now, hence trade cautiously.

A perfect time to invest for long-term investors in fundamentally strong and sector-specific leagues

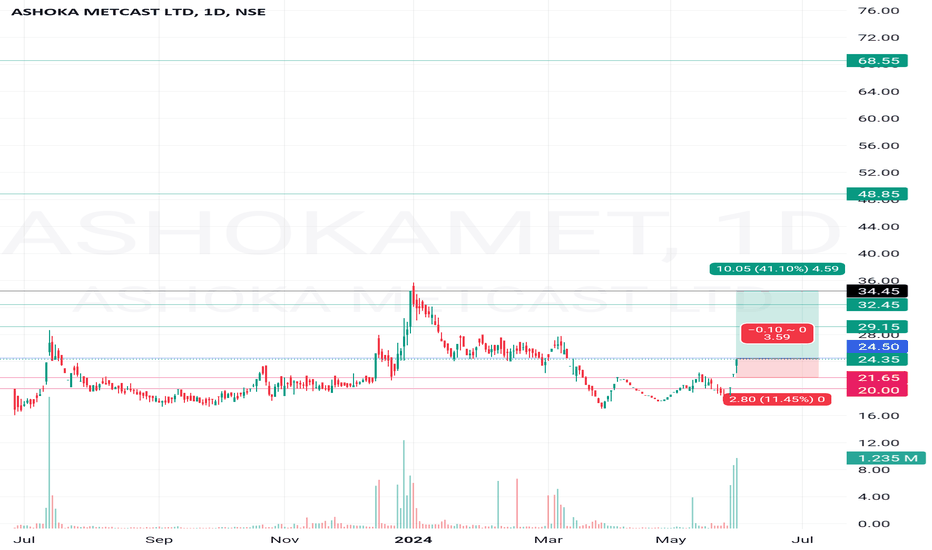

ASHOKA METCAST LTD Chota Packet Bada DhamakaStock is trading at 0.58 times its book value

Promoter Holding Increased 9.66 % over Last 6 Years

From Year 2020 to 2024 Company Have Gradually Purchased their Fixed Assets of 20.57 CR .

in Year March 2018 Company Reported Total Annual Sales of 19.17 CR

Now in Year March 2024 Company Reported Annual Sales of 66.25 CR

Net Cash Flow Is Healthy

Cash Convertion Cycle and Working Capital Days have Also Decreased

Reserves and Equity Capital showing Increasing Strength

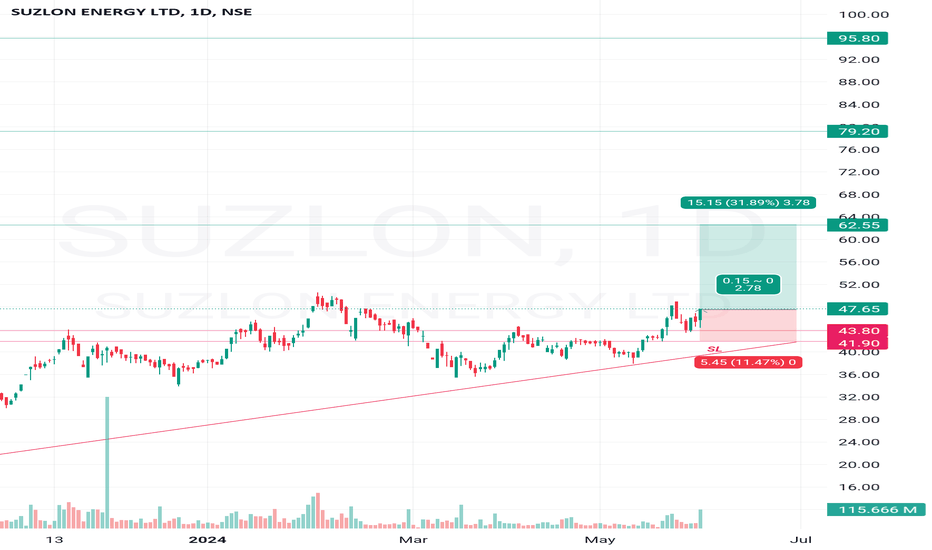

SUZLON Entering 14 Years High ZoneCompany has reduced debt.

Company is almost debt free.

Company has delivered good profit growth of 19.7% CAGR over last 5 years

Strengths:

Stable cash flow from the O&M services business to support overall debt servicing: The Group has ~14.5 GW of installed fleet under O&M business as on Dec 31, 2023. While the fleet under O&M reduces with decommissioning of WTGs, post completion of the design life, new wind turbine generators delivered and commissioned get added to the fleet every fiscal. Revenue from O&M services has been steady as this is contractual activity over a fixed timeframe and at contracted price. Also, escalation in revenue is inbuilt into the contracts, ensuring stability of operating margin over a period. The Group has demonstrated stability in revenue and profitability of O&M services business even in stressed times in the past. Stable cash flow with EBIDTA above Rs 700 crore per fiscal from the O&M services business is expected going forward.

Leading market position in the wind turbine segment and a healthy order book: The Group has a successful track record of project execution with technical expertise, evident from the healthy market share of 30-35% in the WTG business in India over the past many years and also in cumulative installed capacity. The company’s healthy market position should help to obtain orders in the long run. SEL’s order book stood at ~3.16 GW (as on 31st Jan 24), to be executed till fiscal 2026. The company has been able to overcome the dependence on customer-backed financing to execute orders which had constrained growth in the last fiscal.

Improved financial risk profile: The term debt stood at Rs. 1,773 crores as on March 31, 2023, on the back of scheduled repayments of term loan and additional reduction of ~Rs 900 crores from rights issue in October 2022. Furthermore, the company’s networth turned positive as on March 31, 2023 on the back of refinancing (gain on derecognition of OCDs & CCPS) and rights issue of Rs 1,200 crores in fiscal 2023.

On August 14, 2023, the company approved the allotment of equity shares to Qualified Institution buyers aggregating to ~Rs. 2,000 crores. The company subsequently utilized the required amount to repay its entire debt at SEL, significantly improving the financial risk profile of the company. Further, SEL does not have material debt funded capex plans over medium term.

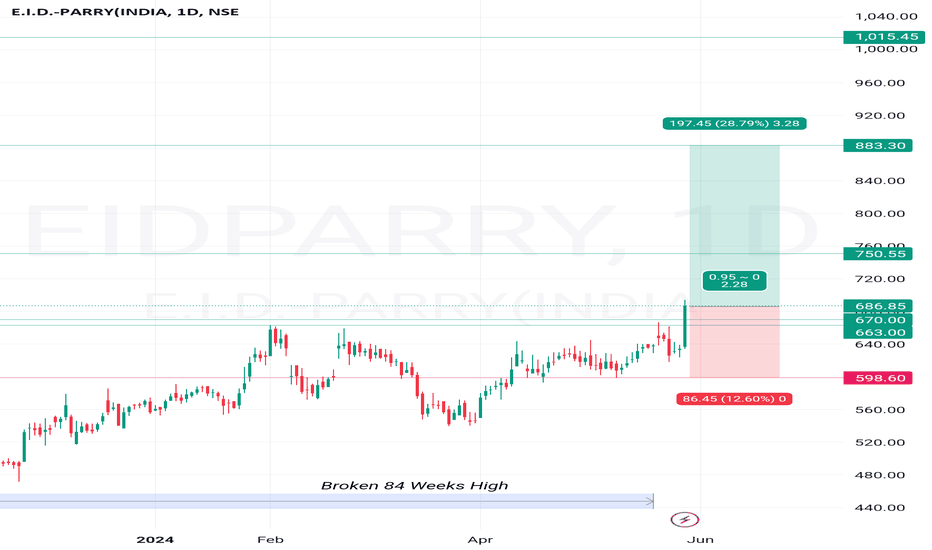

EID PARRY INDIA Freshly Broken 83 Weeks HighCompany has delivered good profit growth of 41.5% CAGR over last 5 years

Company has been maintaining a healthy dividend payout of 19.7%

Expected diversion for Ethanol in SY 2023-24 is ~ 20LMT of Sugar

(against 38LMT diverted in SY 2022-23). Overall blending is 12%

as of March’24.

E20 petrol is available at 12,000 fuel retail outlets and the

government targets a pan-India rollout by 2025.

Syrup/B Hy diversion to Ethanol restricted from 7

th Dec 2023 and

subsequently on 15th Dec 2023, allowed 17 LMT of Sugar

diversion (as B Hy) across the country. Additional 10LMT has

been allowed in April’24 for supply in Q3 of FY’25.

Maximize and grow the Refined / Pharma Sugar

Business

• Health and wellness segment has been identified

to focus on specialty sweetener business

• Focusing on Brown sugar and Jaggery as

alternate sweetener

• To become a sweetening solutions provider for

B2B Customers

1. Packaged staples has a large Total Addressable Market

(TAM) of ~ INR 9 L Cr

• Highly unorganised with only a few pan-India

players

2. Overall branded penetration is less than 20%.

• Significant growth expected with consumers

preferences shifting towards branded products

• Coincides with India’s overall growth and expansion

of the consumption class

3. Parry’s brand presence and the strong foundation laid

through the sweeteners to be leveraged

• To further build on the capability to ‘brand the

unbranded’

4. Aspiration to capture >10% of the kitchen shelf in every

household in South India

The Company made a pioneering leap towards community water

resource management projects through its flagship Project NANNEER

• Under the first phase, seven lakes and ponds in Oonaiyur area

(Pudukkottai and Sivagangai district in TN) were desilted across 250

acres (depth of 1-3 meter)

• Under the second phase, twelve lakes and ponds (in the Cuddalore,

Tiruppur, Villupuram and Erode districts in TN) were desilted across

127

• The excess desilted soil was utilized to create islands in each of the

water bodies. Close to 1100 Million Liters were conserved in Phase 1

and 2.

• Currently third phase being planned in TN, KN and AP.

• The Company aims to achieve Ten Billion liters of water holding

capacity through Project NANNEER by the end of 2026.

Increase in Cash Fixed Cost in FY’24 majorly due to:

• Manpower capability building for project expansion and new business

• CPG infrastructure building

• Special repairs undertaken in major plants

Lower cane volume by 1.7 LMT over last year further contributed to the

increase in CFC/MT

Increase in cane cost, drop in recovery & yield due to climatic

conditions, restriction in sugar diversion for ethanol has led to drop in

EBITDA.

The benefits on expansion of distillery capacities are expected to flow

in FY’25