Chota Packet Bada Dhamaka Supreme Power Equipment LtdTransformer Market size is valued at USD 54 billion in 2022 and is anticipated to

grow at a CAGR of 7.2% between 2023 and 2032.

o Large scale integration of renewable energy sources coupled with increasing

electrification programs primarily across the emerging economies will

accelerate the industry scenario.

o Expanding urban infrastructure to proliferate product demand for commercial &

industrial applications Power transformer market from the commercial &

industrial applications segment is expected to exhibit nearly 7% growth rate

between 2023 and 2032.

o The global power transformer market size was valued at $27.7 billion in 2019, and

is expected to reach $50.8 billion by 2027, registering a CAGR of 7.9% from 2020

to 2027.

Indian Transformer Market Size

o The India transformer market is expected to rise at a CAGR of more than

5% during the forecast period.

o The Transformer market in India can be pegged at more than INR 12,000

Crores. Power Transformers contribute 45 percent of the total market and

distribution transformers, 55 percent.

o Anticipating the huge domestic, requirement of power sector expansion

and overseas demand, the transformer industry in India has more than

doubled its manufacturing capacity over the last five years.

o Transformer manufacturing capacity in India stands at ~370 GVA with

capacity utilization rates hovering around 60- 70 percent on an average

over the last 5 years.

Power Sector

o India is the third-largest producer and consumer of electricity worldwide, with an installed power capacity of 416.59 GW as of April 30, 2023.

o India's power generation witnessed its highest growth rate in over 30 years in FY23. Power generation in India increased by 8.87% to 1,624.15 billion

kilowatt-hours (kWh) in FY23.

o According to data from the Ministry of Power, India's power consumption stood at 130.57 BU in April, 2023.

o The peak power demand in the country stood at 226.87 GW in April, 2023.

Attractive Opportunities

In Union Budget 2023-24, the government allocated US$ 885 million (Rs. 7,327

crore) for the solar power sector including grid, off-grid, and PM-KUSUM

projects. •

To meet India’s 500 GW renewable energy target and tackle the

annual issue of coal demand supply mismatch, the Ministry of Power has

identified 81 thermal units which will replace coal with renewable energy

generation by 2026.

In Budget 2023-24, Government has committed an outlay of Rs. 10 lakh crore

(US$ 120 billion) during 2023-24 towards infrastructure capital expenditure

compared to Rs. 7.5 lakh crore (US$ 90 billion) (BE) during 2022–23.

Company has reduced debt.

Company is almost debt free.

Company has delivered good profit growth of 108% CAGR over last 5 years.

Company has a good return on equity (ROE) track record: 3 Years ROE 67.2%.

Debtor days have improved from 114 to 83.3 days.

Company's working capital requirements have reduced from 87.0 days to 67.8 days

Longterminvesting

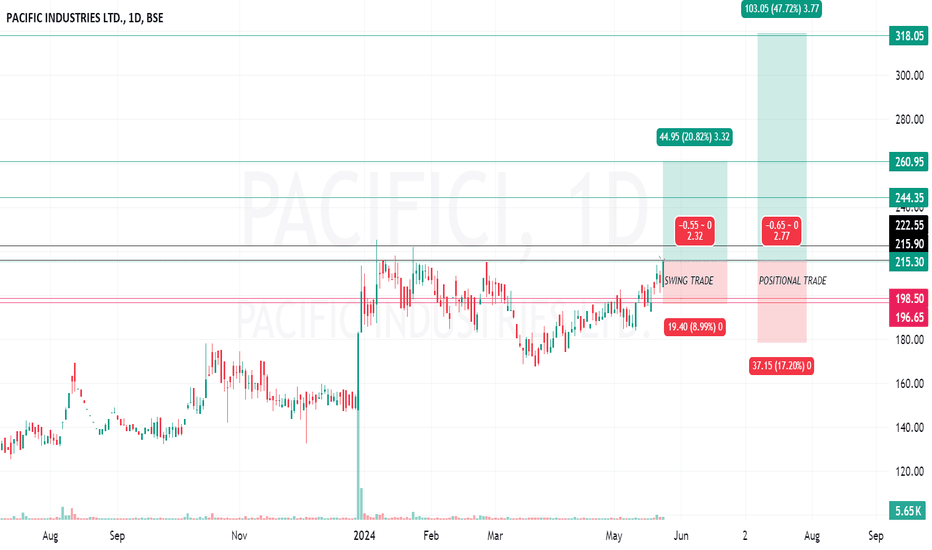

Pacific Industries Ltd Looking Good After Long CorrectionLooking Good For Long-Term Holding .

Good Fundamentals and Business Model

Stock is trading at 0.34 times its book value

CMP @ 215.30 AND BOOK VALUE @ 629

Quarterly Results Out as.....

Item YOY Mar 2024

Sales ⇡ 47% 59.6

EBIDT ⇡ 309% 5.34

Net profit ⇡ 186% 4.72

EPS ⇡ 187% ₹ 6.85

Positive factors

• Sustained Improvement in scale of operations marked by total operating income (TOI) above Rs.350 crore along with PBILDT

margin above 13% on sustained basis.

• Improvement in working capital cycle below 100 days.

Key strengths

Experienced and qualified management with strong group presence

Mr. Jagdish Prasad Agarwal, Chairman and Managing Director of PIL, has more than three decades of experience and looks after

overall affairs of the company. He is assisted by Mr. Kapil Agarwal, Executive Director, who has around 13 years of experience in

the industry. Further, the promoters are supported with the experienced second-tier management. The company belongs to

Udaipur based Geetanjali Group and group concerns include Ojaswi Marbles and Granites Private Limited, Geetanjali Marble,

Krishna Marble, Pacific Exports, Pacific Leasing and Research Limited, Yash Processors Private Limited, Pacific Iron manufacturing

Limited, Chaitanya international Mineral LLP and Geetanjali University.

As per the clarification submitted by PIL to stock exchange on February 21, 2023, Income Tax department has conducted inquiry

under section 132 and 133 of Income Tax Act, 1961 from February 16, 2023, to February 21, 2023. As conveyed by PIL’s

management to CARE Ratings, there have been no material findings from the inquiry conducted so far. As per disclosure made

to stock exchange, PIL will update stock exchange on material information of event, if any. CARE Ratings shall however continue

to monitor the developments of the case and its impact, if any on the credit profile of PIL.

Established track record of operations and diversified product portfolio

PIL was incorporated in the year 1989 and has a track record of more than three decades in the industry having established

relationship with its customers and suppliers. The company majorly exports its products to USA, Europe, Indonesia, Vietnam as

well as Middle East countries. Over the years, PIL has received various awards and certification, such as “Star Export House”

certification from the Ministry of Commerce and Industry, certificate of life member of All India Granite and Stone Association. It

also has membership of Centre for Development of Stones and Confederation of Export Unit.

Further, the company offers diversified products which includes variety of North Indian and South Indian granites in different

styles, color, size and pattern etc. Further, it has flexibility to manufacture different varieties of quartz slabs by blending resins

with quartz and other key materials to get slabs with desired colour, hardness and durability.

Location advantage with ease of availability of raw material and labour

PIL’s processing facility of granites is situated in Rajasthan and Karnataka which has the largest reserve of marbles & granites in

India with estimated reserves of 2075.64 crore cubic metres accounting of more than 91% of the total marble reserves of the

country. There are many units located in the cities of Rajasthan, Karnataka and Andhra Pradesh which are engaged in the business

of mining and processing of marbles and granites. Further, skilled labour is also easily available by virtue of it being situated in

the marble & granite belt of India.

Moderate profitability albeit moderation in scale of operations

PIL’s Total operating income (TOI) declined by 35% y-o-y to Rs. 184.11 crores as against Rs.285.40 crore in FY22. The decline

was on account of decrease in quartz sales due to levying of anti-dumping duty in July 2022 by U.S. Department of Commerce

and no sales from trading of iron ore in FY23. The anti-dumping duty was subsequently reversed in January 2023. In 9MFY24,

PIL achieved sales of Rs. 134.93 crores. PBILDT margin of PIL moderated by 322 bps to 7.55% in FY23 as against 10.46% in

FY22 on account of higher raw material cost as well as lower absorption of overhead costs. However, in 9MFY24, PBILDT margin

improved to 13.94% on the back of lower manufacturing expenses.

Comfortable capital structure albeit moderate debt coverage indicators

The capital structure of PIL improved with overall gearing of 0.43x as on FY23 end (1.25x in FY22). Improvement in overall

gearing was on account of successful completion of rights issue of Rs.47.53 crore in February 2023 which resulted in augmentation

of networth base as well as reduction in o/s debt with repayment of USL from directors/ subsidiaries and repayment of working

capital borrowings. The debt coverage indicators however continued to remain moderate in FY23 due to lower profitability with

PBILDT interest coverage of 1.72x (4.50x in FY22) and total debt/ GCA of 5.53x (6.20x in FY22)

NEXT MRF - HONEYWELL AUTO ( HONAUT ) Multiple study like flag and trend line from upper price that share price is running on 38800

CHART PATTERNS HOLD

1. Trend line on monthly

2. Multiple cup & handle

3. Ready to cross us supply zone

4 Range breakout

2 Slide flag pattern brekaout

BUY honey well auto above 39000

TRG 1 - 44000

TRG 2 - 48000

TRG 3- 52000

and above 52000 that convert in jackpot trade if that not split

TRG 64000 --- 72000 ----- 88000 if everything will be going in good that share

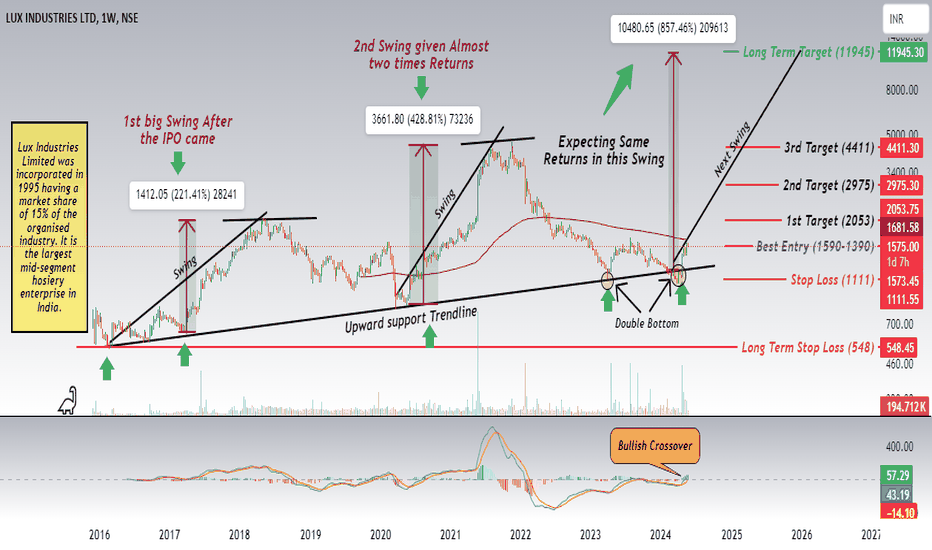

Lux Industry is getting ready for Next Big and huge huge Swing Hello Everyone, i hope you all will be doing good in your trading and your life as well, i have brought another stock which is getting ready for big move, Company name is Lux Industry. My calculation is saying it is going to give huge move in one way towards 10000+ levels in coming time, as price has formed double bottom, and if you will see stock has done sme in earlier swing, and each swing was doubled than earlier. So expecting same in next swing.

MACD is giving bullish crossover in all timeframe specially in higher timeframe.

Stock has given golden crossover in daily time frame (For those who does not know about golden crossover i will write here (whenever stock or any security trade below 200-DEMA from long time and suddenly stock gives crossover above 200-DEMA and sustains for sometimes, that is called golden crossover, usually this scenario creates bullish bias in market)).

About Company:-

Lux Industries Limited was incorporated in 1995 having a market share of 15% of the organised industry. It is the largest mid-segment hosiery enterprise in India.Company is engaged in the manufacturing and marketing of innerwear, thermals, and casuals under various brands, with ‘LUX’ being its flagship brand.

Stock P/E

47.2

Book Value

₹ 496

Dividend Yield

0.32 %

ROCE

12.7 %

ROE

9.97 %

Face Value

₹ 2.00

Industry PE

16.2

Debt

₹ 236 Cr.

EPS

₹ 35.0

Promoter holding

74.2 %

Intrinsic Value

₹ 1,262

Pledged percentage

0.00 %

EVEBITDA

27.2

Change in Prom Hold

0.00 %

Profit Var 5Yrs

12.0 %

Sales growth 5Years

17.2 %

Return over 5years

4.63 %

Debt to equity

0.16

Net profit

₹ 100 Cr.

ROE 5Yr

23.4 %

Profit growth

-44.5 %

Disclaimer:- Please always do your own analysis or consult with your financial advisor before taking any kind of trades.

Dear traders, If you like my work then do not forget to hit like and follow me, and guy's let me know what do you think about this idea in comment box, i would be love to reply all of you guy's.

Thankyou.

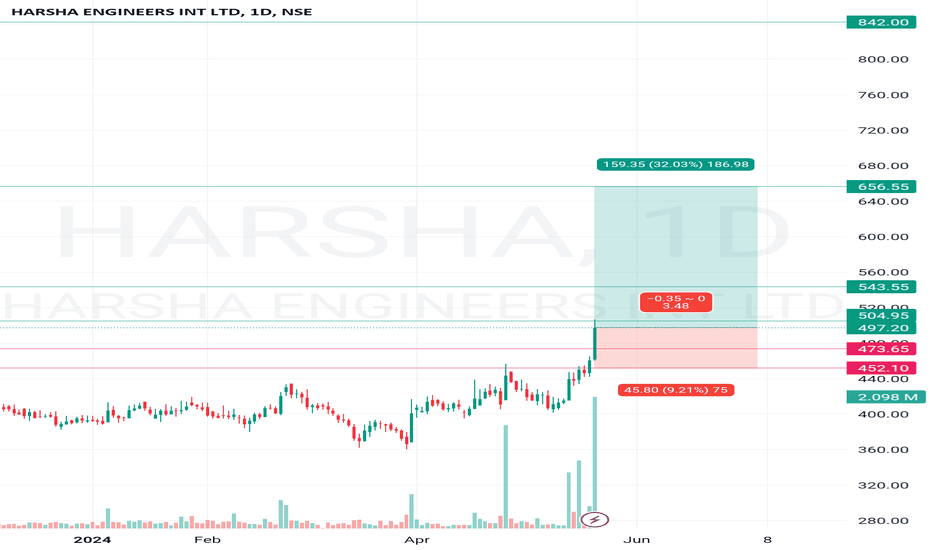

HARSHA ENGINEERS INTERNATIONAL LTDCompany is almost debt free.

Company has delivered good profit growth of 56.4% CAGR over last 5 years

The combined share of operating losses at China and Romania came down significantly because of China

reporting positive profit in Q4 FY 2024. However, Romania continued to report operating losses in Q4 FY

2024.

➢ While the demand situation in Europe both on the Wind as well as on the Industrial front remains

subdued, our strategy in Romania is to improve product mix by increasing the share of cages, which is

aimed at bringing Romania to Break-even level in FY 2025.

➢ Solar Business has reported a decent growth in top-line as well as profitability, on the back of a

favourable renewable policy regime, with our strategy continued to be on limited capital allocation in this

segment, but still allowing the same to operate in its natural tangent.

➢ The progress on our Greenfield project is satisfactory and is expected to commission in FY 2025.

On a consolidated basis Q4 FY 2024 was the strongest quarter in the current fiscal FY 2024 reflecting an allround

improvement in the top line as well as the EBITDA and PAT margins. The consolidated top line of Q4

FY 2024 has shown a growth of 17% over Q3 FY 2024 and 11% over Q4 FY 2023. The consolidated EBITDA of

Q4 FY 2024 has also grown by 23% as compared to Q3 FY 2024 and 10% as compared to Q4 FY 2023.

➢ On full year basis, while consolidated top line of FY 2023-24 reflects a marginal growth over FY 2022-23, the

EBITDA and PAT of FY 2024, though lower than FY 2023, are still reflecting a significant recovery as

compared to H1 FY 2024 and are better than our expectations.

➢ The growth in Bushing business as well as additional demand growth due to China + 1 factor was in line with

our expectations. The Progress on outsourcing projects (insourcing to outsourcing) was satisfactory, and the

growth in Japan based customers’ segment, though slightly muted, has remained positive.

➢ The expected growth in large size bearing cages segment could not be achieved due to continued global

slowdown in the Wind as well as Industrial Segment, but is expected to catch up next Fiscal.

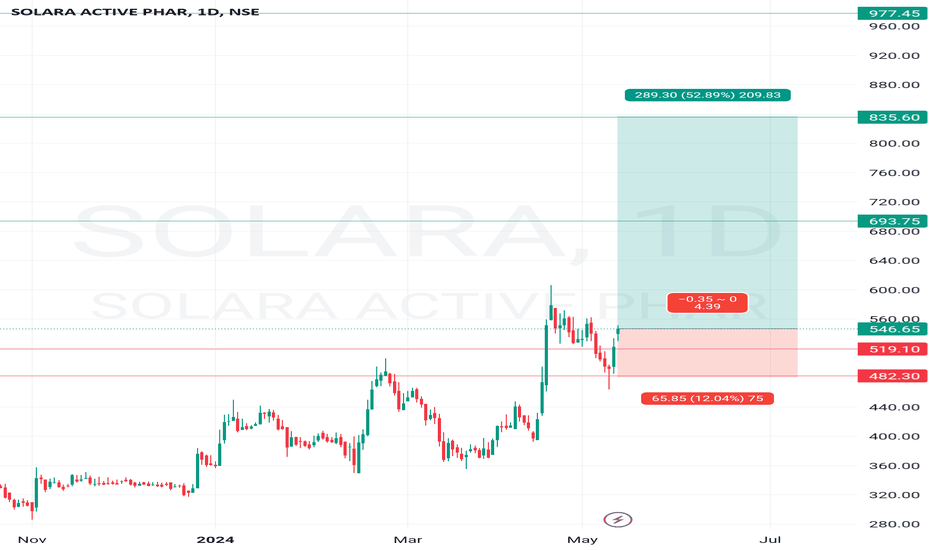

#SOLARA Looking Good for Long-Term Holding around 1 YearStrengths:

Established market position in key APIs, along with strong customer and supplier relationships: Solara has a strong portfolio of APIs in key therapeutic segments, with expertise in anthelmintic, anti-malaria, anti-infective and non-steroidal anti- inflammatory. Furthermore, it has been increasing its focus on the non-steroidal anti-inflammatory segment by adding capacity and working on other therapeutic segments. Solara has a diversified customer base, with more exposure to regulated markets. Its longstanding presence in the industry has helped Solara build healthy relationships with customers and suppliers.

Moderate financial risk profile: Solara's financial risk profile is moderate marked by comfortable capital structure, albeit constrained by expected weakening of debt protection metrics. Gearing remained healthy at less than 1 time as on March 31, 2023, while networth was robust at Rs 1083.01 crore. However, networth and gearing are expected to deteriorate to Rs 835.98 crore and 1.09 times, respectively, as on March 31, 2024 led by net loss owing to the fire incident. Debt protection metrics, likely to be negative in fiscal 2024, are expected to improve in fiscals 2025 and 2026. Improvement in financial risk profile would remain a key monitorable.

Weaknesses:

Exposure to risks relating to strict regulations: Most of the products manufactured by Solara face increased inspections and regulatory actions by authorities, such as the US Food and Drug Administration (US FDA). Additionally, production of a few products involves waste discharge, which needs to be treated in effluent treatment plants (ETPs). Thus, Solara needs to invest continuously to upgrade ETPs and bring efficiency in the process to reduce waste discharge.

Large working capital requirements: Working capital requirements are sizeable as reflected in significant receivables and inventory of around 142 days and 156 days, respectively, as on March 31, 2023 and is estimated to be over 120 days each for fiscal 2024. CRISIL Ratings expects working capital requirements to gradually improve over the medium term with an increase in revenue contribution from the new plant. Correction in working capital requirements that shall aid liquidity shall be a key monitorable.

Volatility in operating profitability: Operating profitability fluctuated between 23.78% and 9.3% in the last 3-5 fiscal and in the current fiscal the company is making further losses due to the fire accident. Going forward, the ability of the company to demonstrate sustained improvement in operating margins will be a key sensitivity factor.

#QTK Testing Platform Coin Set to Surge 20–30x in Bull Market!🟢QuantCheck (QTK) is a platform made for testing cryptocurrency trading strategies. It helps traders and investors improve their approaches by letting them see how their strategies would have performed in the past. Think of it like a time machine for trades. With just 120.75 million tokens available, it has the potential to grow a lot. I've been using it and find it really helpful. They recently launched their token, and I believe it could be as big as AITECH.

I've invested a good amount in it because the product works well and the tokenomics look promising.

Current Price: Approximately $0.7

Accumulation Zone: $0.70 to $0.75

Short-term Target (4 to 8 weeks): $2 to $5

Mid-term Targets (3 to 6 months): $5 to $12

Long-term Target: $20 to $30

What do you think about the future of QTK? Please share your technical and fundamental analysis insights in the comments below.

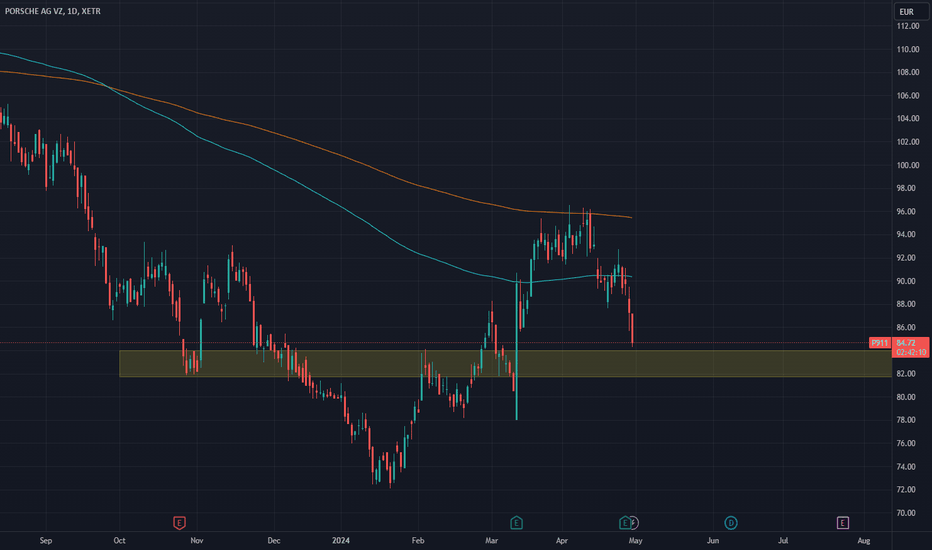

Porsche - Is worth it ? Porsche 26 of April 2024 reported its revenues and earnings. Will help us these reports consider whether XETR:P911 is worth at this price ?

Let´s have a brief look.

1. earnings positively surprised us, 3.94% exceeded its expectations. ✔️

2. revenue´s stayed behind expectations by 3.96% ❌

3. hikes dividend amount to 2.31 per share ✔️

4. launching four new models in 2024 (Macan, Panamera, Taycan, 911) ✔️

5. expects an operating return on sales of between 15 - 17%, down from 18% noticed in previous two years ❌

6. future - they focus on sustainable success of company ✔️

7. expectations to 2025 - strong recovery in China and full range of models which will kick their financials off ✔️

Revenue by countries:

- North America 29.53%

- China 23.56%

- Europe 21.66%

- Germany 12.03%

- Rest of the World 14.26%

Balanced distribution throughout the world puts this company on solid footing. China is still behind expectations due to decrease in demand and EV price war. China could be an ace up in its sleeve in the coming years.

Mixed financial reports could mislead us a bit. However Porsche still has a strong vision, sustainable business model and positive fundamental background.

Stock´s sold at 3.34 times by its book value. Obviously there´s a premium priced in we have to reckon with. Premium car segment needs premium price of stocks.

Let´s recap.

Is it worth it at this price ?

In my point of view, stock´s around the IPO price. The range between 82.5 - 84.0 seems to be very pleasant to place buy-orders. Definitely from a long-term point of view.

Consider your best price to entry and make your own call.

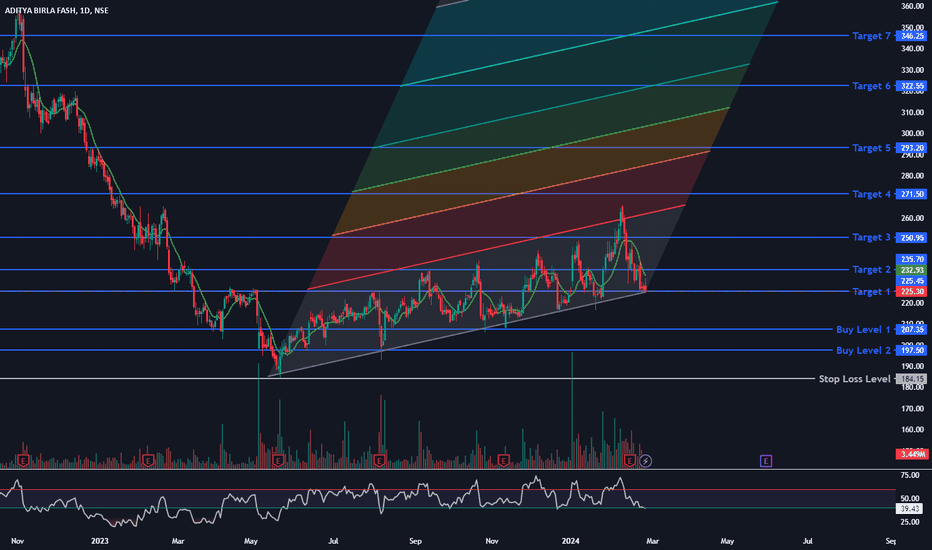

5% Trade Ideas #5PercentTrade - ABFRL#5PercentTrade #Equity #5%Profit_Trade_in_21_Days

5% Trade Ideas is a type of Equity Investment which is designed to give you 5% to 10% return in lest than 21 days via #Equity #Investment.

✅ Stock Name - NSE:ABFRL (Aditya Birla Fashion Retail Limited)

Trade Process :-

✅ - Buy only at Buy Level as recommended in the chart. Use GTT feature available with all online brokers

✅ - On successful purchase, immediately create a SL GTT (Stop Loss level asper chart).

✅ - Once Stock Price is at Target 1 level, move your SL to Cost Price or 3% down from Target 1.

✅ - Keep Trailing the SL as Stock Price moves to next Targets.

If you like this idea, Do give us boost and follow us for more ideas to invest NSE:ABFRL

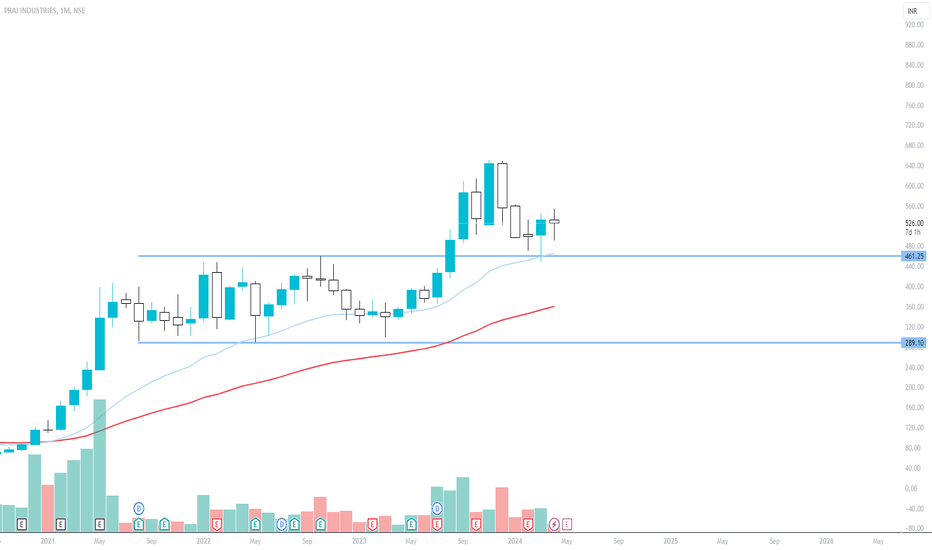

20% Upside Potential idea 🔥 - SAREGAMA🔥 20% Upside Potential idea - NSE:SAREGAMA

This Trade Ideas is a type of Equity Investment which is designed to give you 10% to 20% return in short-term via #Equity #Investment.

✅ Stock Name - NSE:SAREGAMA

Trade Process :-

✅ - Buy only at Buy Level as recommended in the chart. Use GTT feature available with all online brokers

✅ - On successful purchase, immediately create a SL GTT (Stop Loss level asper chart).

✅ - Once Stock Price is at Target 1 level, move your SL to Cost Price or 3% down from Target 1.

✅ - Keep Trailing the SL as Stock Price moves to next Targets.

Thanks

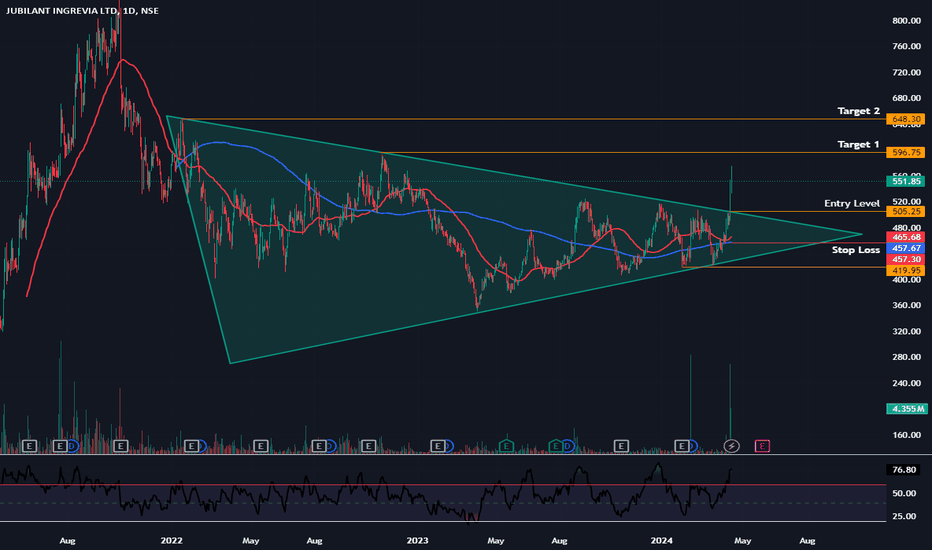

5% Trade Ideas #5PercentTrade -JUBLINGREA #5PercentTrade #Equity

5% Trade Ideas is a type of Equity Investment which is designed to give you 5% to 10% return in lest than 21 days via #Equity #Investment.

✅ Stock Name - NSE:JUBLINGREA

Trade Process :-

✅ - Buy only at Buy Level as recommended in the chart. Use GTT feature available with all online brokers

✅ - On successful purchase, immediately create a SL GTT (Stop Loss level asper chart).

✅ - Once Stock Price is at Target 1 level, move your SL to Cost Price or 3% down from Target 1.

✅ - Keep Trailing the SL as Stock Price moves to next Targets.

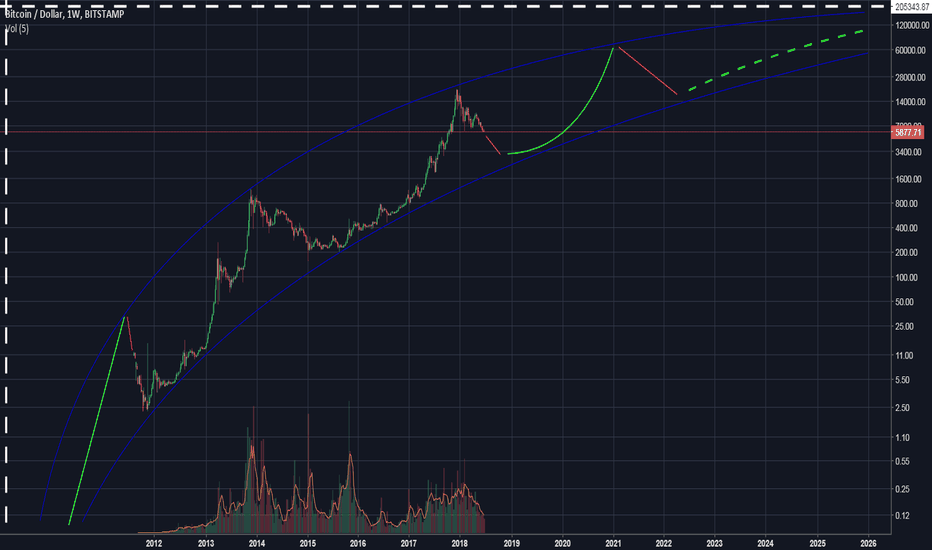

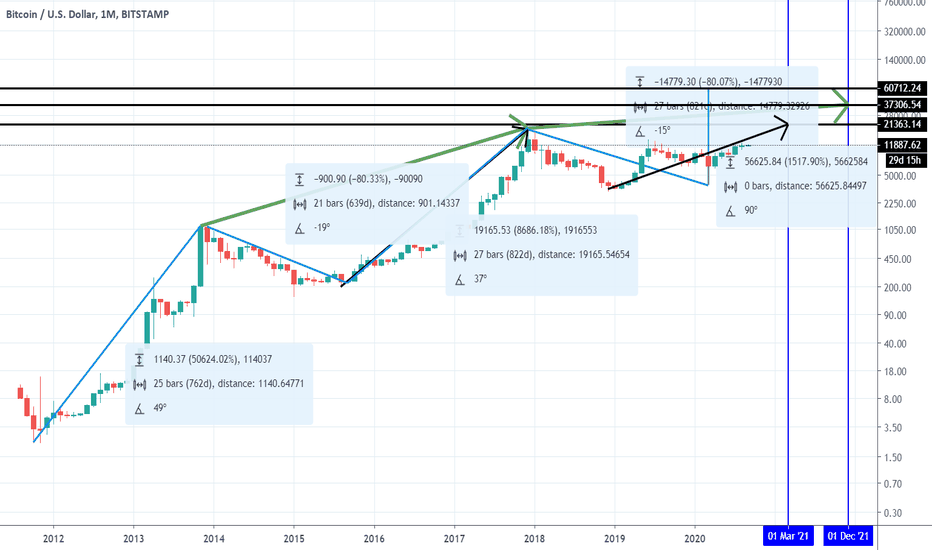

Bitcoin 8 year forecastThe white vertical line is Jan 09.

The white horizontal line is my personal estimation for a ceiling in price and adoption.

The blue lines are my personal extrapolation of the range using historical peaks and dips.

A stabilization between 100 000 and 200 000 $ would put Bitcoin between 2 - 4 trillion $ market cap.

This would be relatively small compared to global money supply but still a wonderful achievement.

... and a nice ride :----))

I expect the 2018 bubble to overshoot down to 2 500 $ around falls 2018.

An important aspect of this scenario is a significant decrease in volatility, making then Bitcoin a reasonable option for storage of value.

With all sorts of arguments, some people predict up to a million $ / Bitcoin, while some others predict it to eventually be worthless.

Things often turn out to be a compromise, which is the principle of a "market", and this scenario is my personal vision of this compromise.

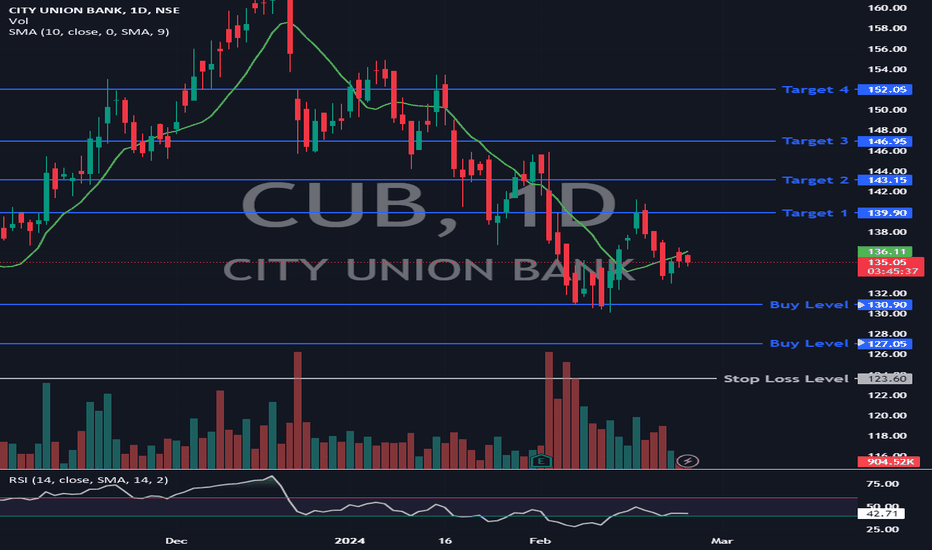

5% Trade Ideas #5PercentTrade - CUB#5PercentTrade #Equity #5%Profit_Trade_in_21_Days

5% Trade Ideas is a type of Equity Investment which is designed to give you 5% to 10% return in lest than 21 days via #Equity #Investment.

✅ Stock Name - #CUB (City Union Bank)

Trade Process :-

✅ - Buy only at Buy Level as recommended in the chart. Use GTT feature available with all online brokers

✅ - On successful purchase, immediately create a SL GTT (Stop Loss level asper chart).

✅ - Once Stock Price is at Target 1 level, move your SL to Cost Price or 3% down from Target 1.

✅ - Keep Trailing the SL as Stock Price moves to next Targets.

If you like this idea, Do give us boost and follow us for more ideas to invest

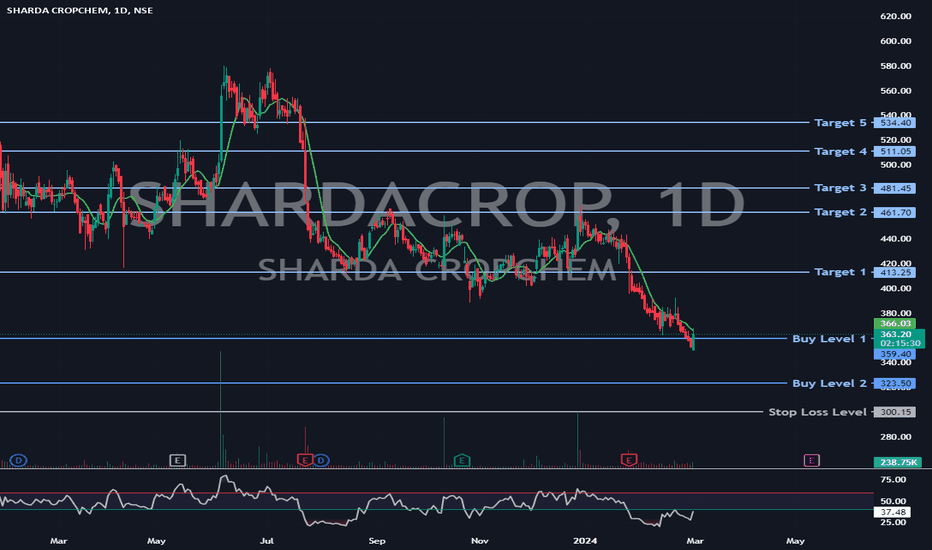

5PercentTrade Trade Ideas - SHARDA CROP#5PercentTrade #Equity #5%Profit_Trade_in_21_Days

Stock Name - NSE:SHARDACROP

Launching our next service of Equity Investment which is designed to give you 5% to 10% return in lest than 21 days via #Equity #Investment.

Trade Process :-

✅ - Buy only at Buy Level as recommended in the chart. Use GTT feature available with all online brokers.

✅ - On successful purchase, immediately create a SL GTT (Stop Loss level asper chart).

✅ - Once Stock Price is at Target 1 level, move your SL to Cost Price or 3% down from Target 1.

✅ - Keep Trailing the SL as Stock Price moves to next Targets.

Share this message to your friends and ask them to join

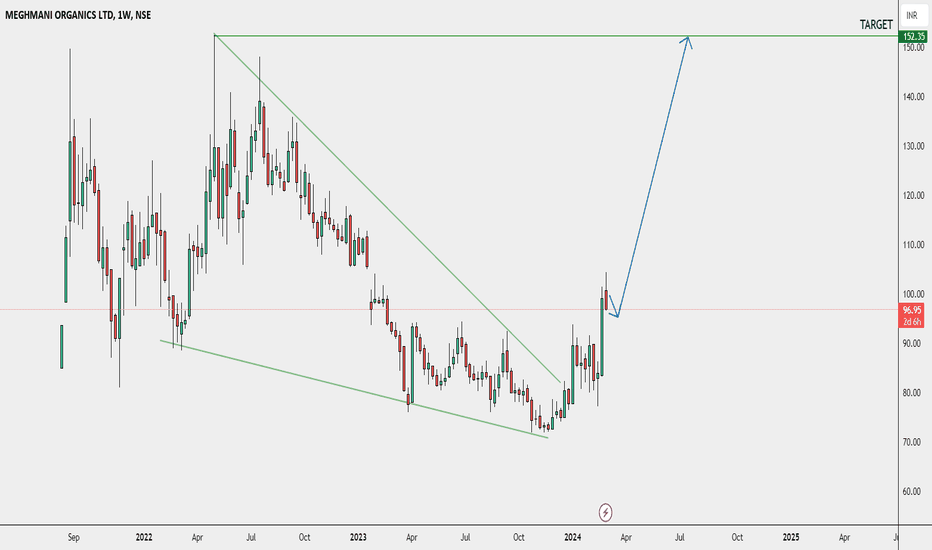

MEGHMANI ORGANICS LTD - LONG TERM STOCK - MY VIEW ✅✅✅The Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Keep it simple, keep it Unique.

please keep your comments useful & respectful.

Thanks for your support....

Tradelikemee Academy

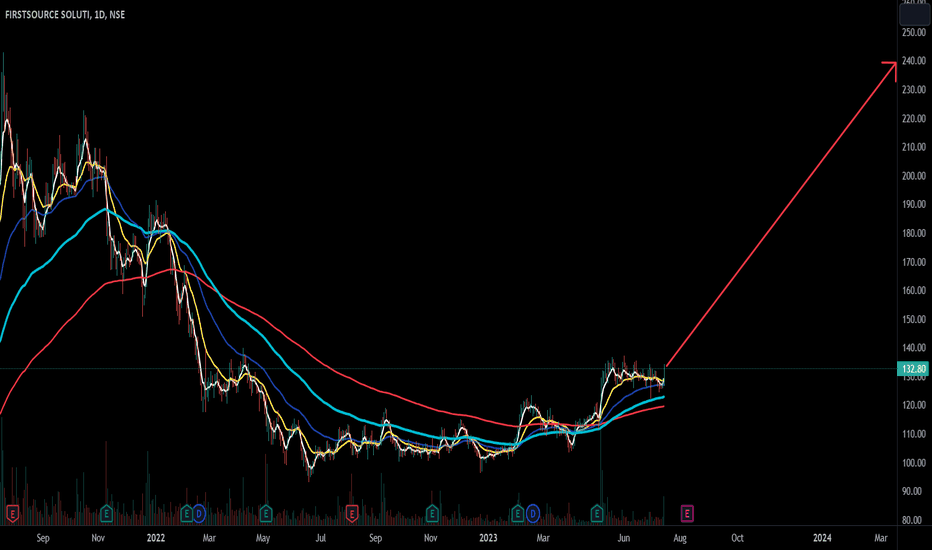

Med/Long term BUY - FSL heading for ATH after Volume breakout?Many technical parameters have indicated that Firstsource Solutions Ltd (FSL) could double from current levels of around 120-130 to at least 240 within 1 year. Multiple TA indicators have aligned together, including volume increase between 9May23 to 14Jul23.

It is a medium to long term buying opportunity for upto 100% gains with a Stop Loss (SL) of 112 (15% risk).

Also, FSL is a fundamentally sound company, with current Market Cap of ₹ 9,325 Cr. and:

- Dividend payout of 47.5 % (yield of 2.64 %)

- P/E 18.3

- Stock Face value - ₹ 10

Marico might mend the trend..Marico Ltd. Is manufactures and markets products under the brands such as Parachute, Parachute Advansed, Nihar, Nihar Naturals, Saffola, Hair & Care, Revive, Mediker, Livon, Set-wet, etc. Marico’s products reach its consumers through retail outlets serviced by Marico’s distribution network comprising regional offices, carrying & forwarding agents, redistribution centers & distributors spread all over India. Marico Ltd CMP is 536.20.

The Negative aspects of the company are High Valuation (P.E. = 47.4), FIIs are decreasing stake, Promoter Holding decreasing. The company's Positive aspects MFs are increasing stake, improving annual net profit, Improving cash from operations annual.

Entry can be taken after closing above 537. Targets in the stock will be 554 and 563. The long-term target in the stock will be 575 and 592. Stop loss in the stock should be maintained at Closing below 508.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

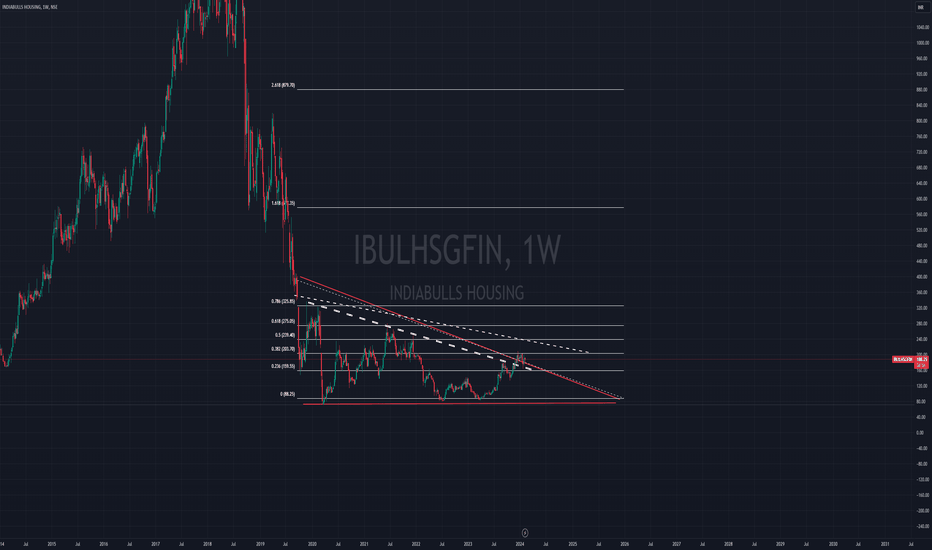

IBULHSGFIN is ready for BULL RUN IBULHSGFIN is bad in fundamental but ready for reversal

1- Rounding bottom reversal

2- trend line breakout

3- fab. .5 point will came

4- triangle also seen in this chart

buy above 188

TRG 1st - 240

2nd -280

3rd- 340

SL 152

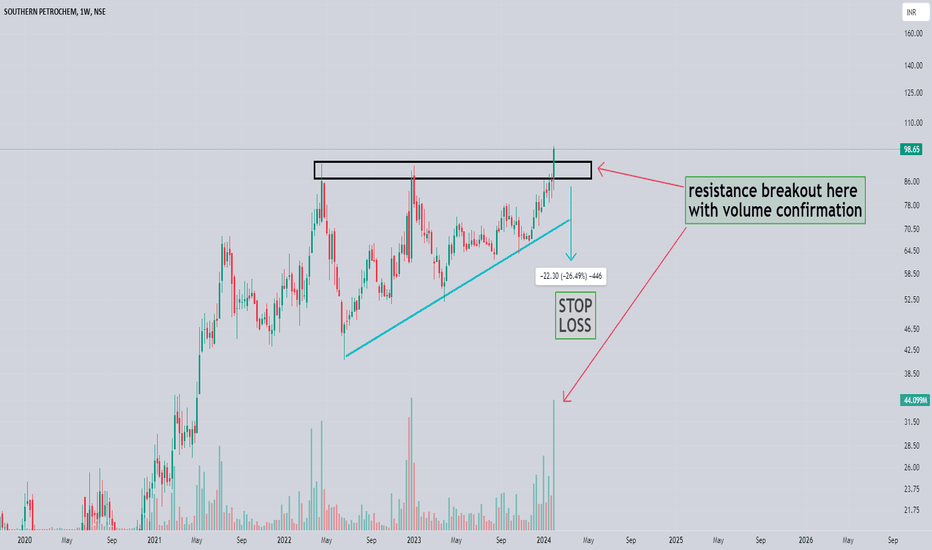

FOR LONG TERM SPIC LTD (Southern Petrochemicals Industries Corporation Ltd)

LOOKING GOOD FOR INVESTMENT PROSPECTIVE

BUYING RANGE- CMP

VIEW ONLY EDUCATIONAL PROSPECTIVE

FUNDAMENTALY COMPANY IS GOOD

ABOUT

Southern Petrochemicals Industries Corporation Ltd is engaged in manufacturing and selling Urea and Nitrogenous chemical fertilizer

Product Portfolio

The product offerings of the Co. include Primary nutrients, Secondary Nutrients, Water Soluble Fertilisers, Organic Fertilisers, Non-edible deoiled Cake Fertilisers, Bio Pesticides among other agricultural products.

Disclaimer:

I am not a SEBI Registered Analyst.

Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any

decision or trade.

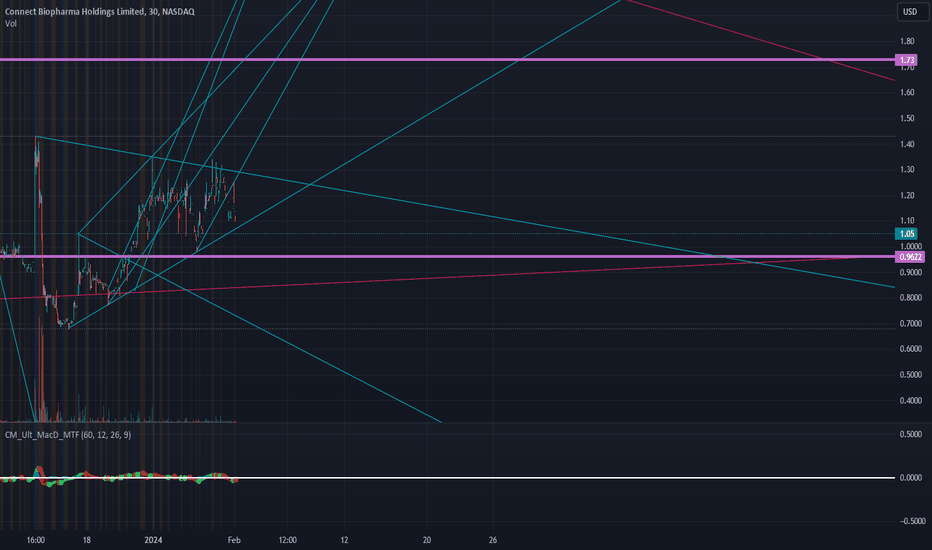

CNTB to Climb to $2Looking at the micro data, we have an uptrend where we're following along the rising bottom.

Looking a bit further out, we can see we're in a bullish wedge.

General trends say that this will come up, and the company will have only good news about their trials progressing which will drive the price higher.

Very near to $2 by the end of February, and we could very well see $4 by the end of Summer.

NASDAQ:CNTB