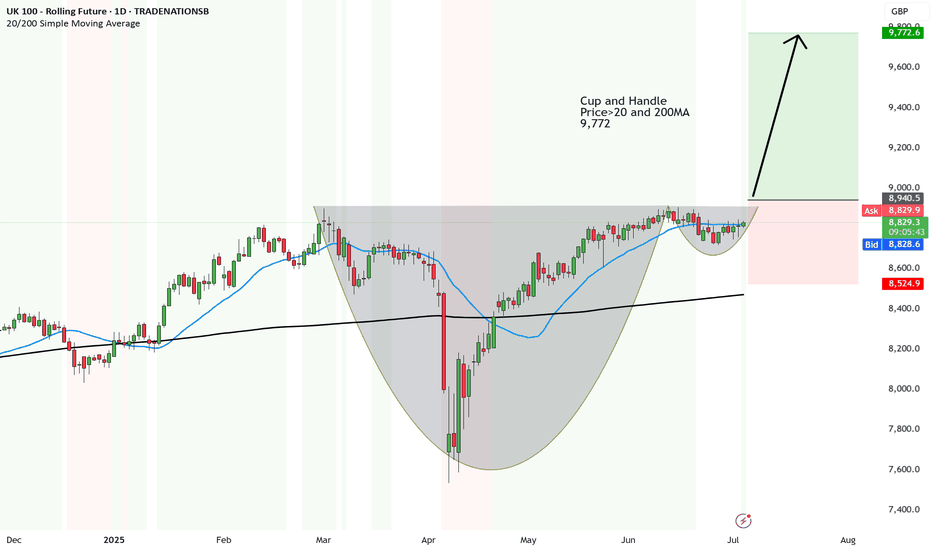

UK showing strong upside once breaks above C&H to 9,772

A very large Cup and Handle has formed on UK100.

There are many reasons for the upside to come but here are a few ones I can think of.

📉 2. Undervalued vs. Other Indices

FTSE 100 has lagged behind the US and EU — now global investors are eyeing it as a catch-up play.

💷 3. Weak Pound Helps Export Giants

A softer GBP = stronger revenue for big FTSE names like Shell, BP, Unilever, etc., which dominate global markets.

🏦 4. Rate Cut Hopes Are Back

With UK inflation cooling, the Bank of England might ease up — which is fuel for stocks, especially banks and housing.

📈 5. Rotational Flows Into Value

Traders are rotating out of overbought tech and into solid dividend/value plays — and the FTSE is packed with them.

And this is looking great for upside.

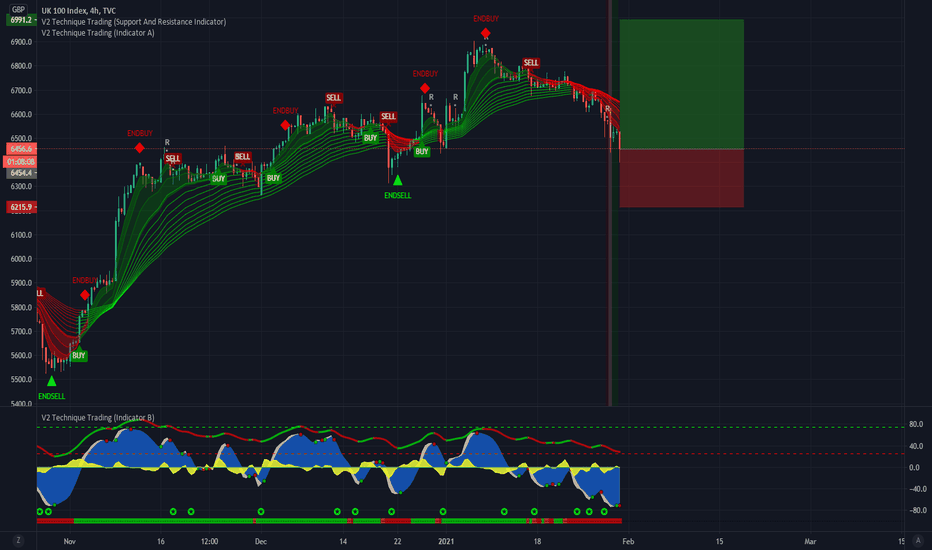

We can expect upside to come ONCE the price breaks above the brim level.

Price>20 and 200MA.

9,772

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

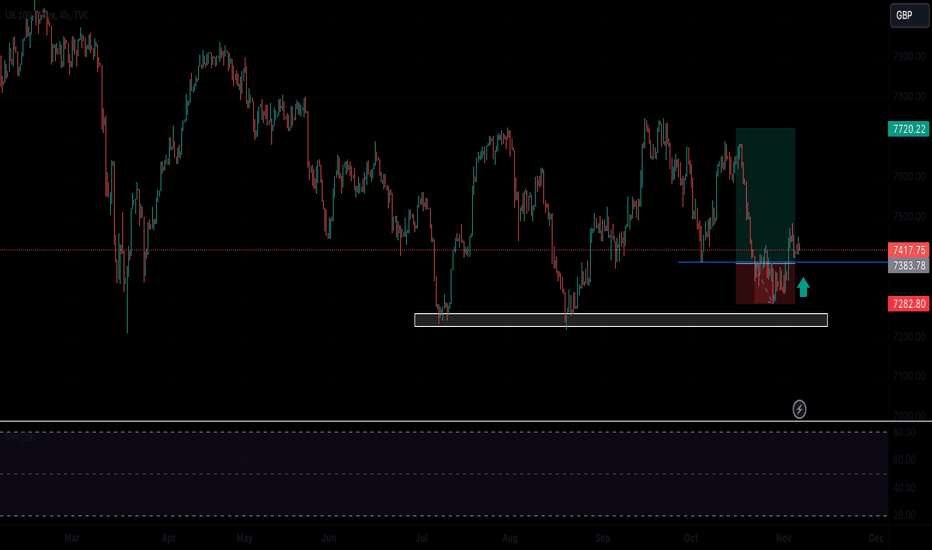

Longuk100

Long UK 100 Index I'm waiting for pice to retest back into the 7385 level, once there I would begin to add on long positions. We've had a nice rally from the 7286 level, which created a new short term high and for me indicating a market shift. I would look for price to reach towards the highs of 7708 since taking out the lows below the 7300 level. Good luck traders, let me know your thoughts in the comments.

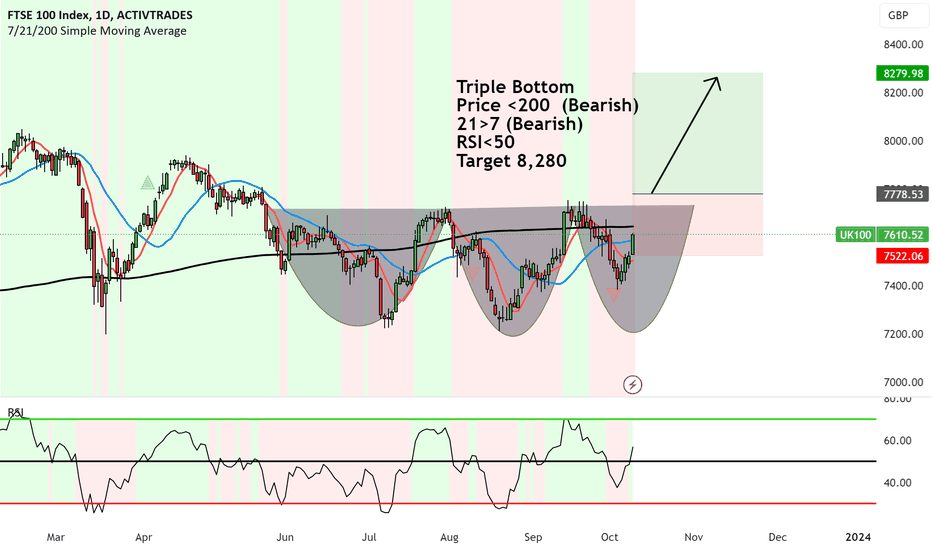

Is the FTSE100 setting itself for a rally?Triple Bottom seems to be forming on FTSE100...

Could it be showing signs that it wants to rally for the rest of the year?

If so, we need to wait for the price to close above the neckline before acting.

Other indicaators also show it's too early, but things can change. So we'll keep our eyes peeled.

Price <200 (Bearish)

21>7 (Bearish)

RSI<50

Target 8,280