Lululemon

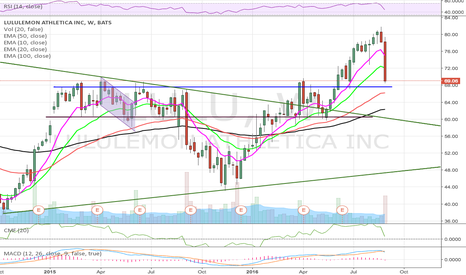

LULU Bullish Flag formation near completion.LULULEMON is currently in the controlled profit taking stage of the flag for the current bull flag formation. The previous advance since an earnings surprise is used as the length of the flagpole and also the measuring objective of the next advance. If we see some significant volume on the breakout then we could be set up for some nice quick profit. If volume diverges from an increase or does not increase at all this is Bearish and therefore no entry should be taken. Could see some more controlled profit taking before an advance, watch for volume.

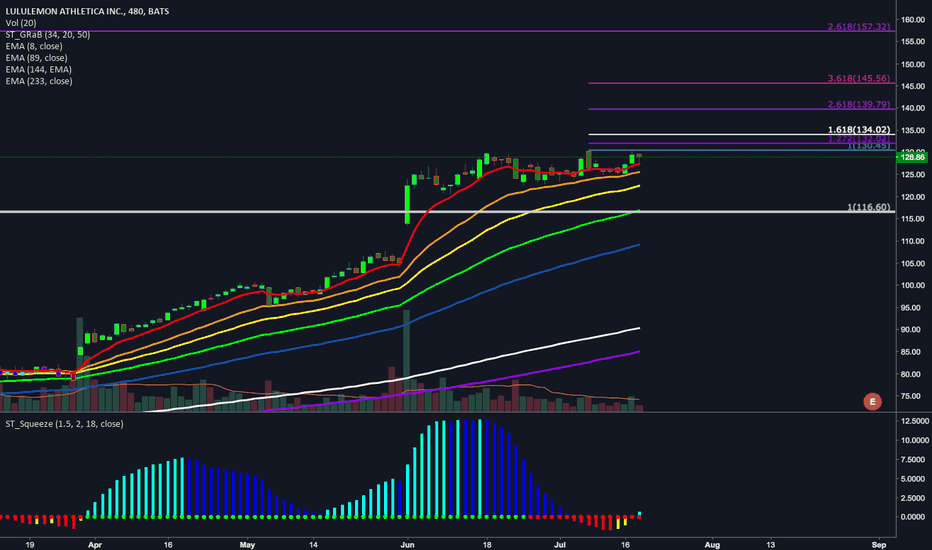

Looking Long For LULULULU has been a MONSTER this year! With Squeezes setting up on both a daily and four-hour chart makes me think it will be headed higher towards earnings which looks to be at the end of August. Depending on how it opens tomorrow (looking for a pullback) will ultimately decide how I play it. I'd like to sell an at the money put credit spread, but with the way it's been moving, I'm also looking at the ITM August Call options.

With one of their biggest competitors (Alo Yoga) being under intense scrutiny all year, it appears they have been the benefactor from their misfortune. That aside, the chart looks very bullish and I'll be looking to play it long with options.

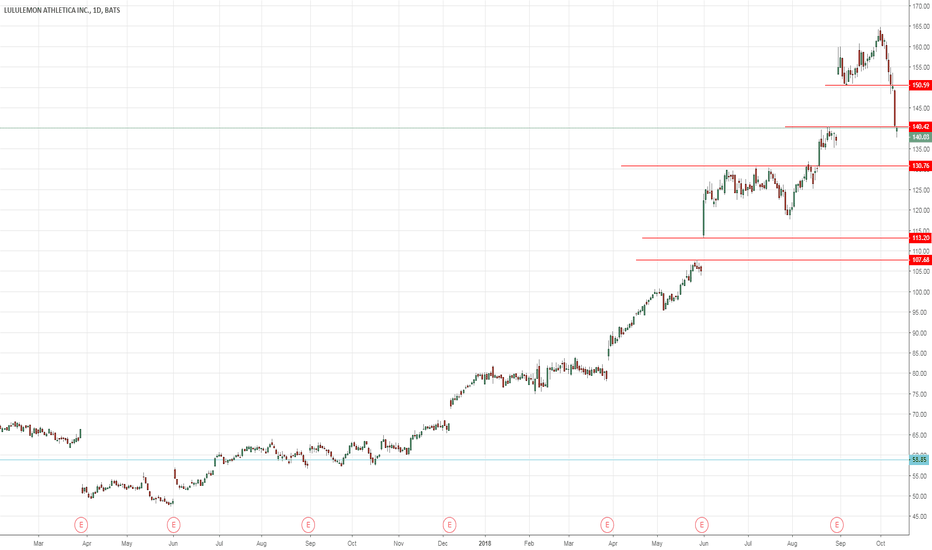

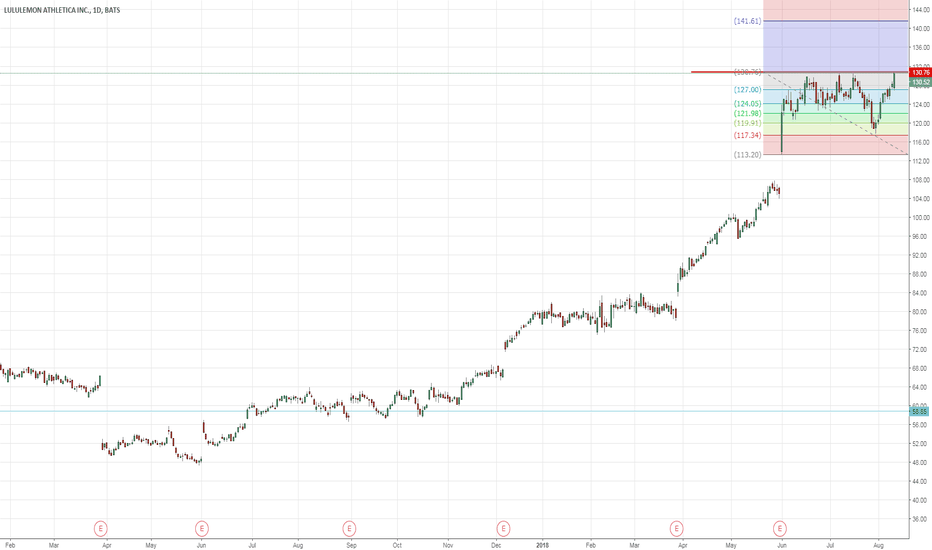

Lululemon Athletica (LULU). Another chance to gain big.This is an update of my old chart published more than a year ago (see related idea)

That call paid well and here is another chance to gain big.

It looks like sideways correction is coming to an end and another big drop is on the cards.

The wave C (blue) is already larger than wave A within a small wxy (white).

MACD shows Bearish Divergence.

Target is at the previous major low at the 36.26 mark.

Athletic apparel makers are under pressure though.

$LULU Falling$LULU has been one of the hottest stocks this year....until today. Their mixed guidance for next year is nothing to worry about. If you don't live in a cave you know every girl either wants or wears lulu. I know there are cheaper options, but lets be honest...they are a status symbol. As long as the stock holds $67, i think you pick some up.

www.trendyprofits.com