The Death of (Terra) a StablecoinAn algorithmic stablecoin sounds complicated, but that doesn't have to be.

That's how Terra envisioned its algorithmic stablecoin and why it inevitably crashed.

Here's how stablecoin Terra & Luna work:

1. In 2018, Terra network was created with two native tokens. Let's call them Terra (UST) and Luna (LUNA), of which the reasons will become apparent later on.

2. Terra is the stablecoin of the two and Luna has a variable price. These tokens are nothing more than numbers and a protocol on the blockchain.

3. For the ecosystem to work, we need to find people who want to buy these tokens, we do marketing.

4. Luna's price can vary, and is determined by the good old concept of supply and demand. Luna's price will be right in the middle.

5. If people find Luna fantastic, the demand for Luna goes up and so the price goes up, or at least not to zero.

6. Now here come's the tricky part: the blockchain promises that people can always exchange One Terra for $1 worth of Luna.

That means if Luna is trading at $0.5 you get 2 Luna for One Terra. When Luna is trading at $4 you get 0.25 Luna for One Terra.

If Luna trades at $10 you get 0.1 Luna and so on. The price of Luna can vary, but One Terra can always be exchanged for $1 worth of Luna.

The reverse is also true and possible, people can always exchange $1 worth of Luna for One Terra.

7. Now we make an automated smart contract to make this exchange possible. Et Voila, stablecoin Terra is created.

8. Terra should always be worth $1. So terra should always trade at $1. If Terra trades above $1, arbitrage traders will buy Luna and then sell Luna for Terra for instant profit.

If Terra trades below $1, arbitrage traders will buy discounted Terra and exchange it for Luna for instant profit. Arbitrage traders will push the price of Terra back to $1 if it deviates.

9. Luna's price can fluctuate but that doesn't matter. As long as Luna is not zero, you can exchange Terra for $1 worth of Luna and Luna for around $1 of Terra.

Now we need to make sure Luna doesn't go to zero, since that would turn out very bad. So we need to give fundamental value to Luna, these are the ways to do this:

- Collect transaction fees from people who exchange Luna for Terra & Terra for Luna and distribute (a part of) these fees to Luna holders as interest.

- Create an ecosystem of smart contracts and applications on top of Luna and terra in which Luna is treated as the native currency to use this ecosystem. And ascribe a lot of value to it.

This reinforces each other pretty well.

The more fees you collect and distribute to Luna holders, the more viable your ecosystem gets. The more applications are being being built, the more Luna is being bought to interact in the ecosytem & the more fees are collected.

But besides this, there's no algorithm explicitly saying that Luna always has a particular amount of value. The algorithm just lets people exchange Terra for Luna. Luna is only valuable if people think it’s valuable and believe in the long-term value of the system that you are building.

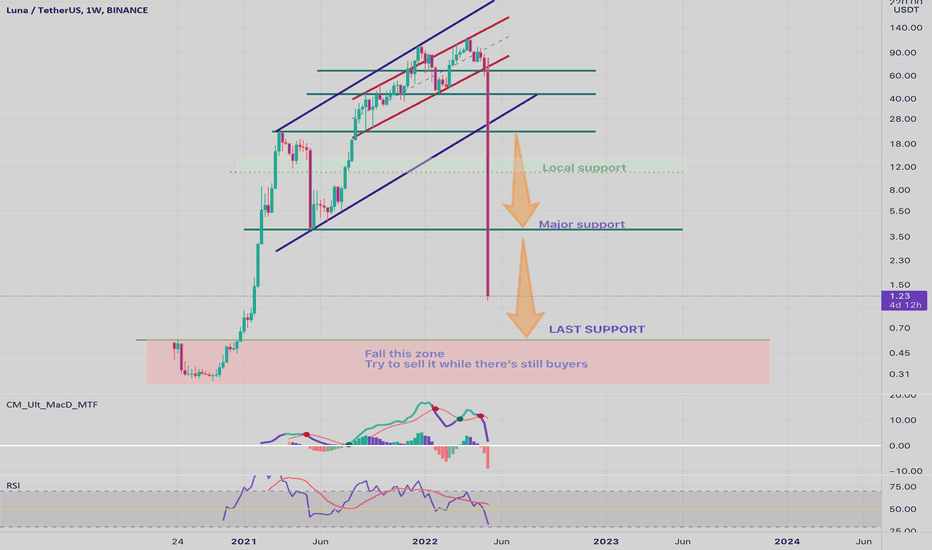

The danger arises when people suddenly turn their back on Luna and think "Wait, it's all useless and it isn't real." and all sell their Luna tokens for Terra, which should always be equivalent to $1.

If people sell their Luna, the price of Luna goes down.

If people sell their Terra, you might think "the price of Terra can't go down because of the algorithm!". So if Terra drops to $0.97, arbitrage traders would buy it and exchange it to $1 worth of Luna for instant profit.

Well. The problem is that when people lose trust in the whole system, they will dump both Luna and Terra. It looks like this:

- Someone sells their Terra, and Terra drops to $.97

- An arbitrage trader buys 10 discounted Terra and exchanges it for Luna. Luna trades at $40 so the trader gets 0.25 Luna. (because exchange of Luna is at $1 par.)

- Then the arbitrage trader sells their Luna, which drops the price of Luna to $20.

- A second person sells their Terra, and Terra drops to $0.97.

- An arbitrage traders buys 10 discounted Terra and exchanges it for Luna. Luna trades at $20 and the traders gets 0.5 Luna.

- Which the arbitrage traders sells again, making the price of Luna drop even further.

- Now Luna is worth $10, so 10 Terra gets you 1 Luna, which then gets sold, so Luna goes to $5, so 10 Terra gets you 2 Luna, etc.

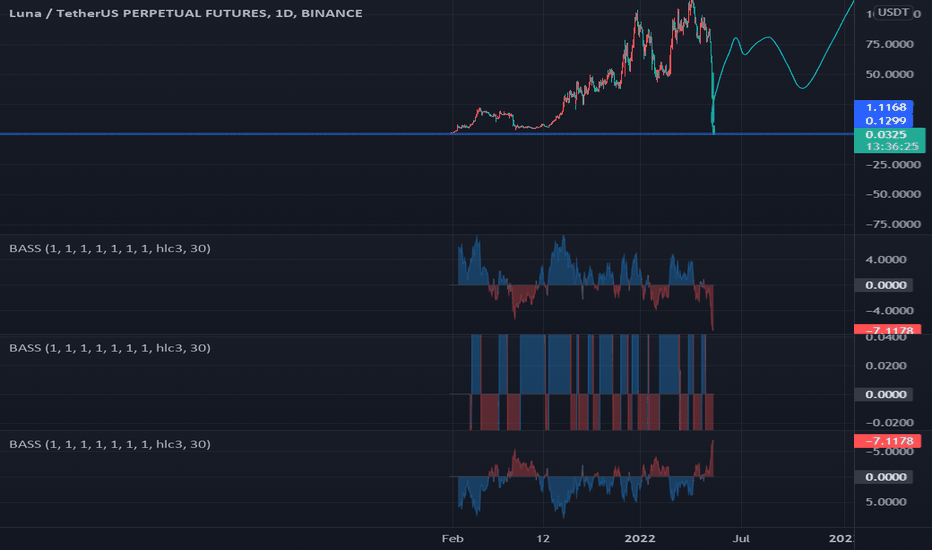

There's no stopping this process, it's a death spiral going down fast. Eventually Luna trades at $.01 and 10 Terra gives you 1000 Luna. And when you try to sell your Luna, you can't, because there are no buyers left and there are no arbitrage traders left who buy discounted Terra to exchange for Luna.

The founders are actively searching for a solution, one is looking for capital of investors and the other is to mint way more Luna, so that One Terra can reliably be exchanged for $1 worth in Luna. Even if that means bazillions of Luna.

Thanks for taking the time to read this idea. Stay safe out there. Support by following and sharing!

LUNAUSDT

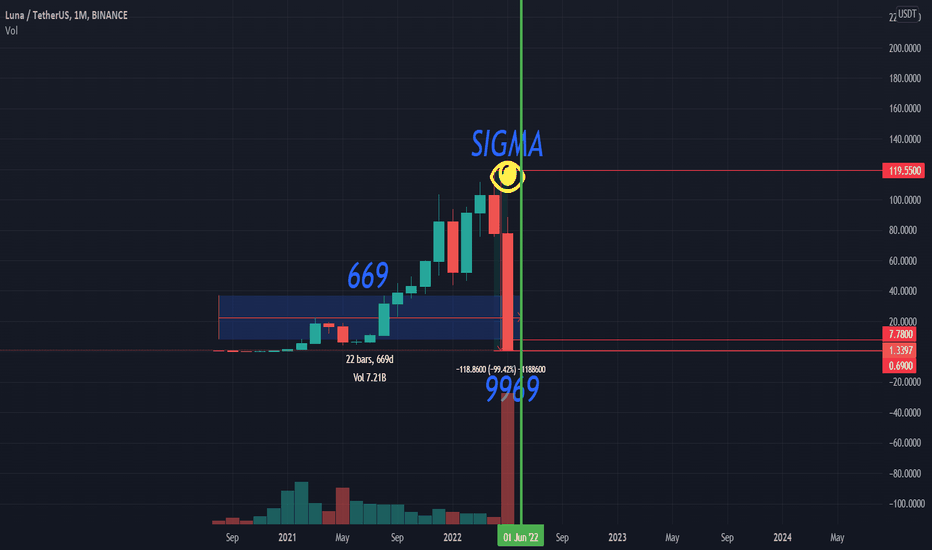

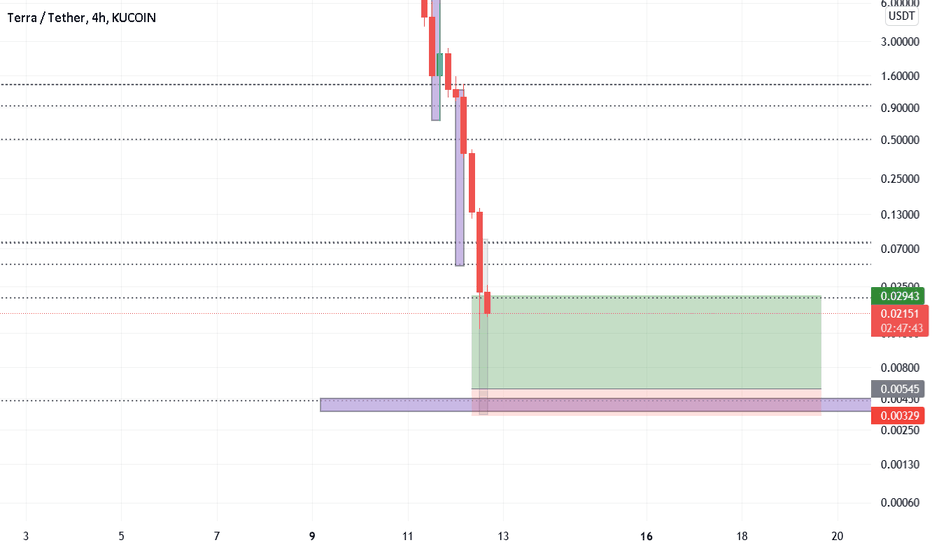

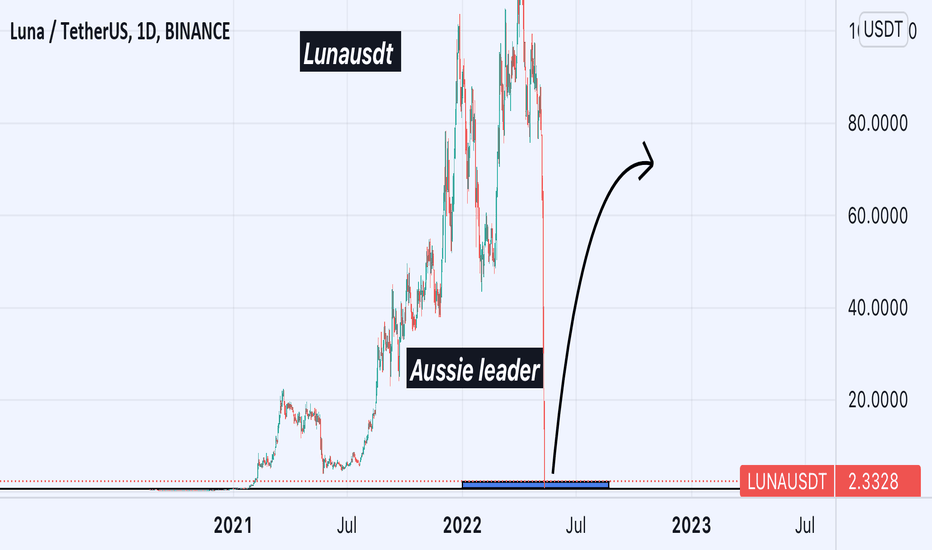

I JUST BOUGHT ALOT OF $LUNA HERE, SEE YOU NEXT YEARS ¡LUNATICS!I cannot believe what happened to TERRA, this will be EPIC.

I just put a few $$$ into $LUNA, just for fun but I am so sad for those $UST and $LUNA investors/hodlers!!

I will wait a few years and see what happen next, sad history of course.

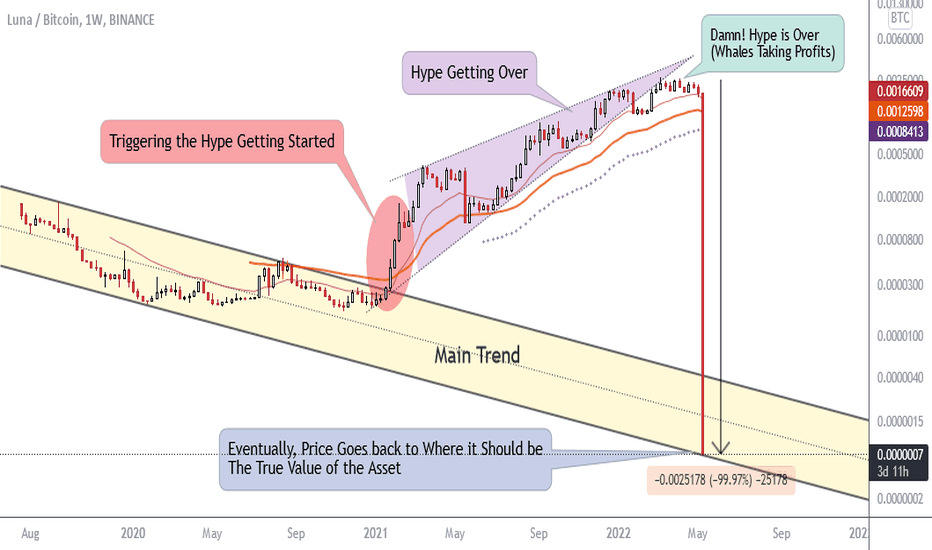

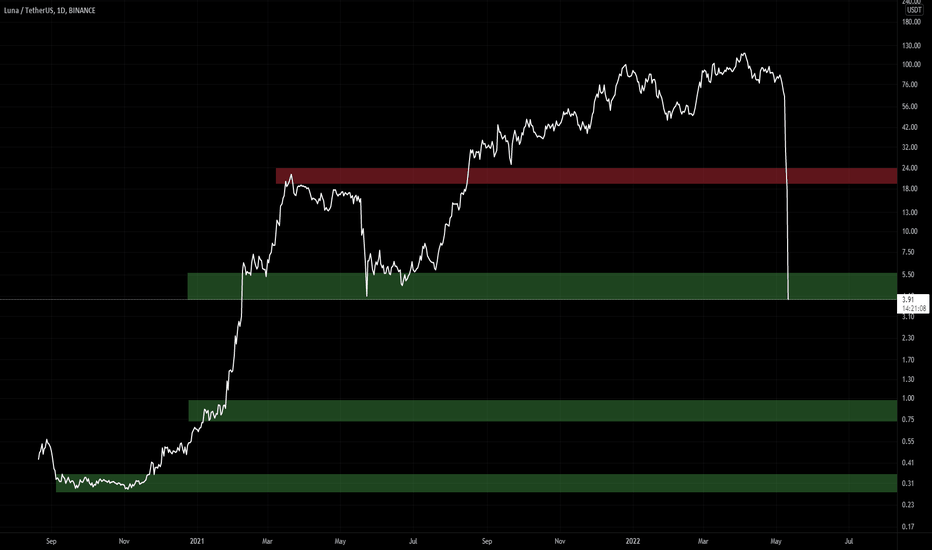

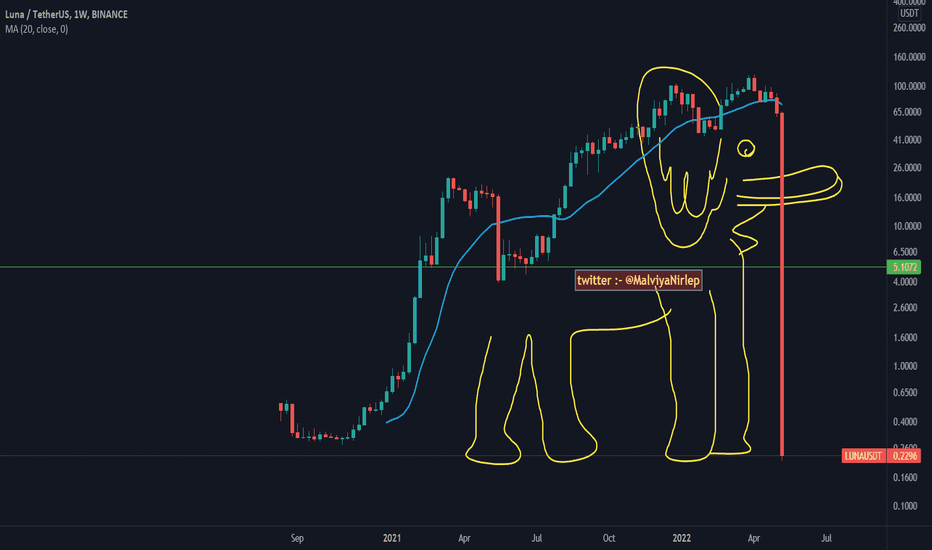

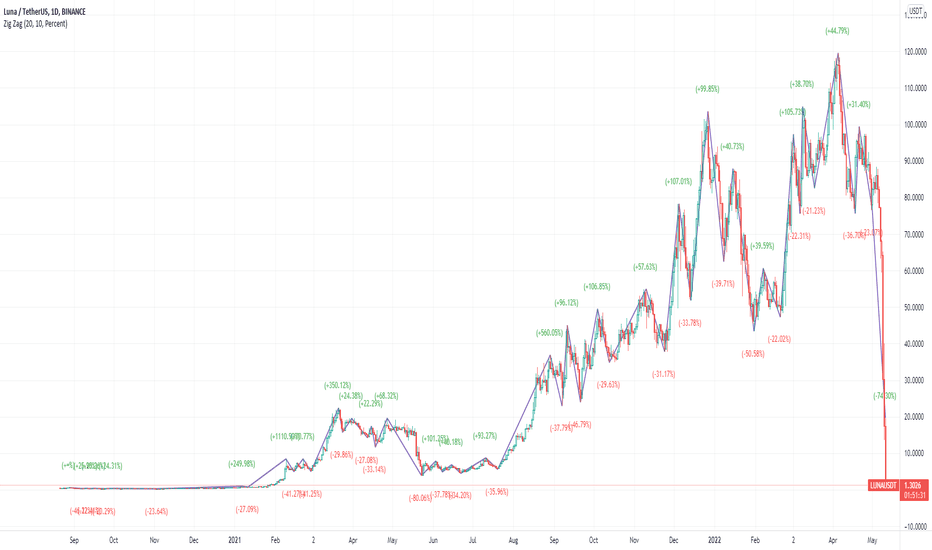

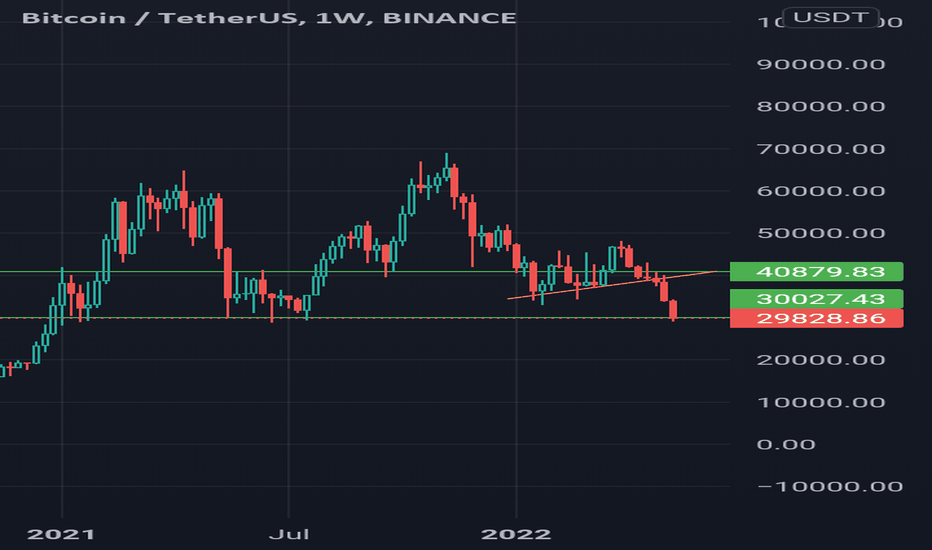

LUNA: The Story of a Hype!Maybe Luna was supposed to be here! The main channel was broken by the start of 2021 which I think was a hype and in other words, a bubble created in not only this coin but in a bunch of crypto assets. Now, these bubbles are bursting, that simple.

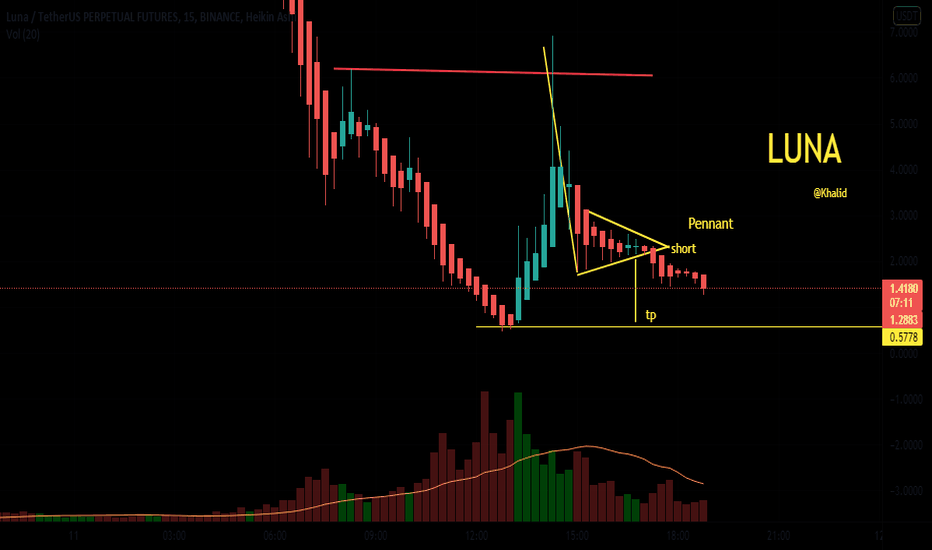

LunausdtJust my guess. Not a financial advice for sure. Let me know about your ideas in the comments

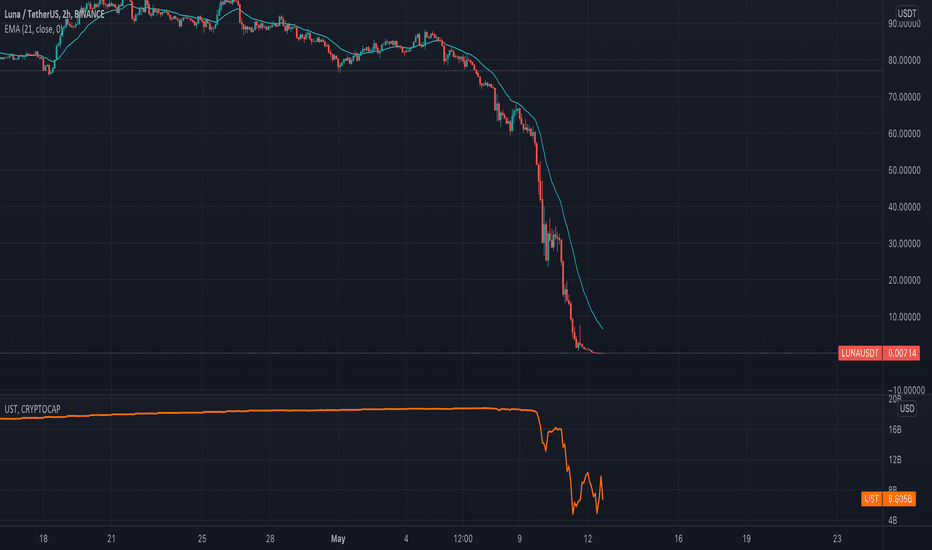

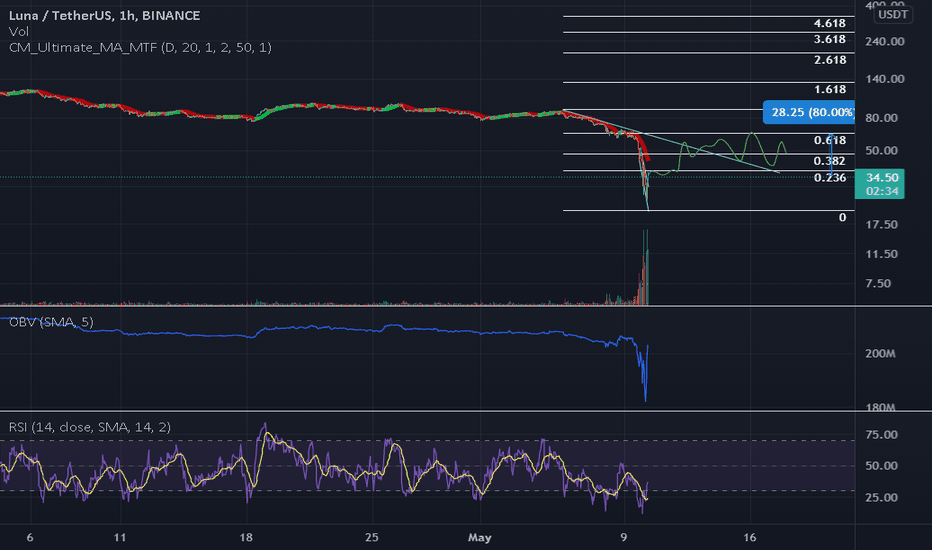

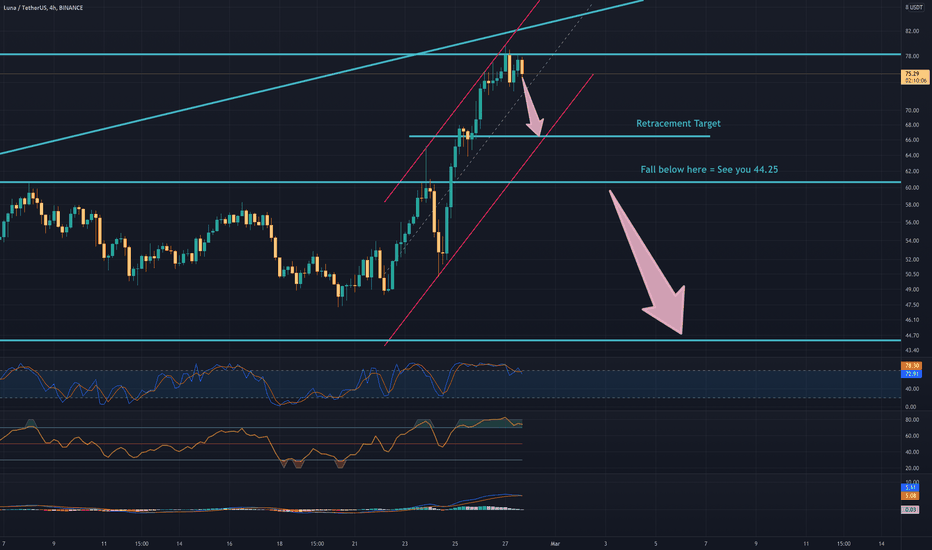

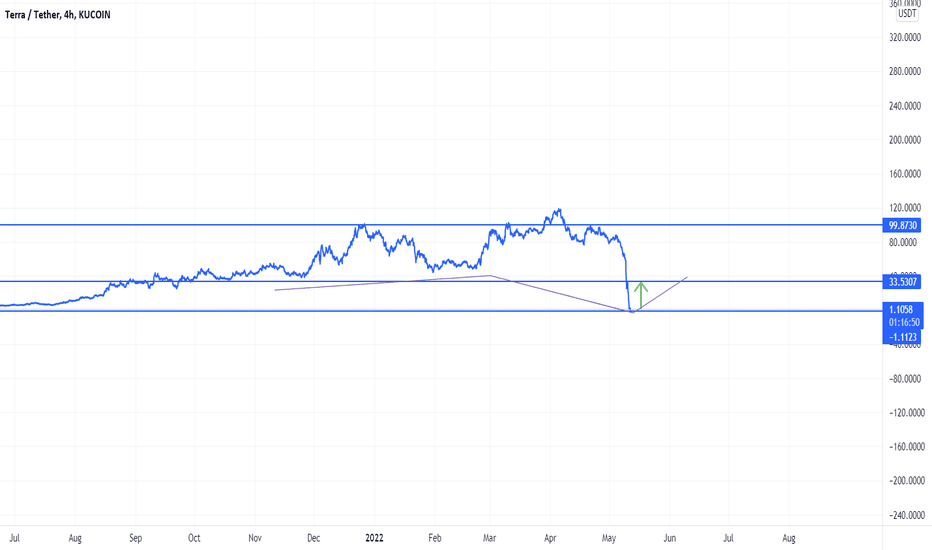

LUNAUSDTustdepegged today and luna tumbled hard

i bought a tiny posi around here just thinking we might retest the .618 or .382 here

ust appears to be trying to repeg, went from 60c to 90c last few hours

i doubt luna runs aths anytime soon but still

if you wanted a better entry here it is

stay safe out there

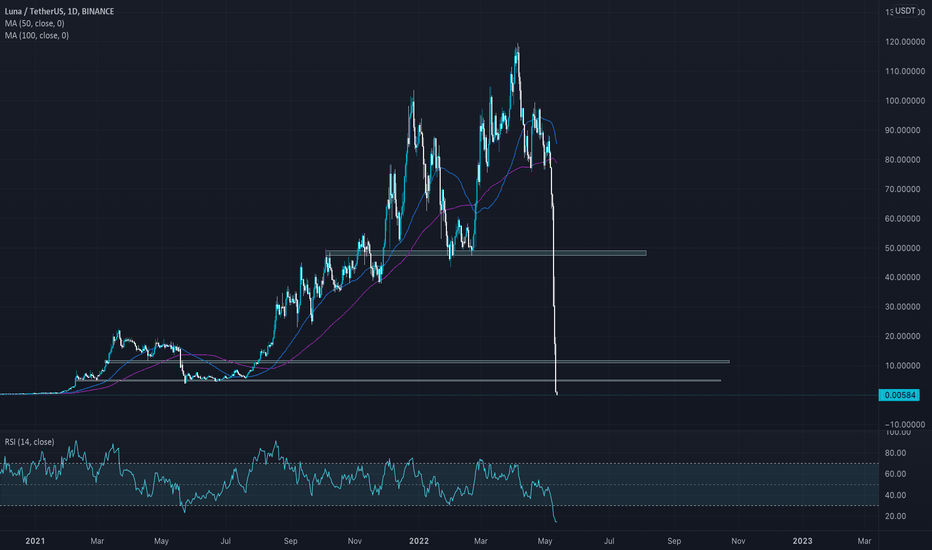

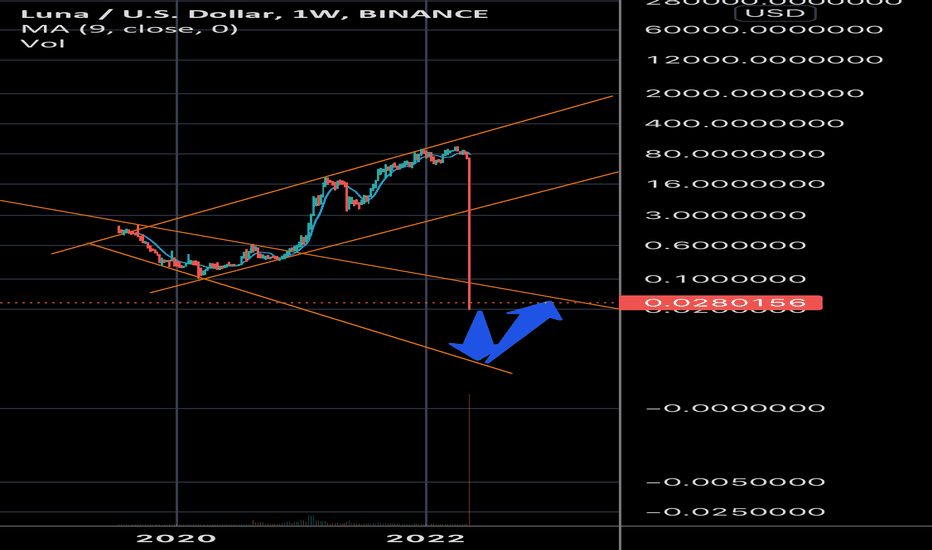

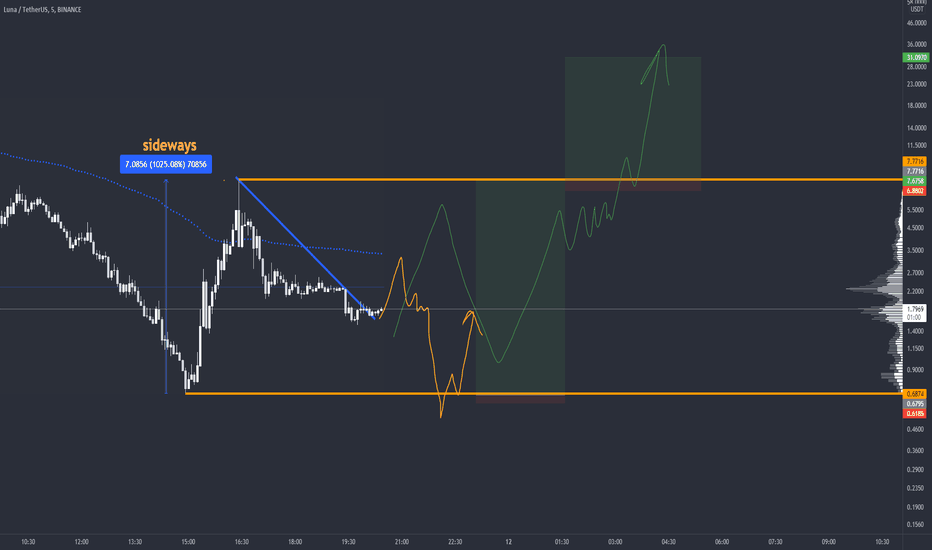

Long luna Black swan event this is rare price action pattern I've seen since I started trading. This is not a financial advice

LUNA : Will stop falling when ..... There's no buyers left in the market

or... Buyers are more powerful than sellers.....

. Cheer up to Do Kwon and the believers

.

Now I'm comparing this TOP 10 good fundamental,

token that mechanism burn and UST adoption...

to the MEME coins...

. wondering if it could get back to 4$ again ever ? ...

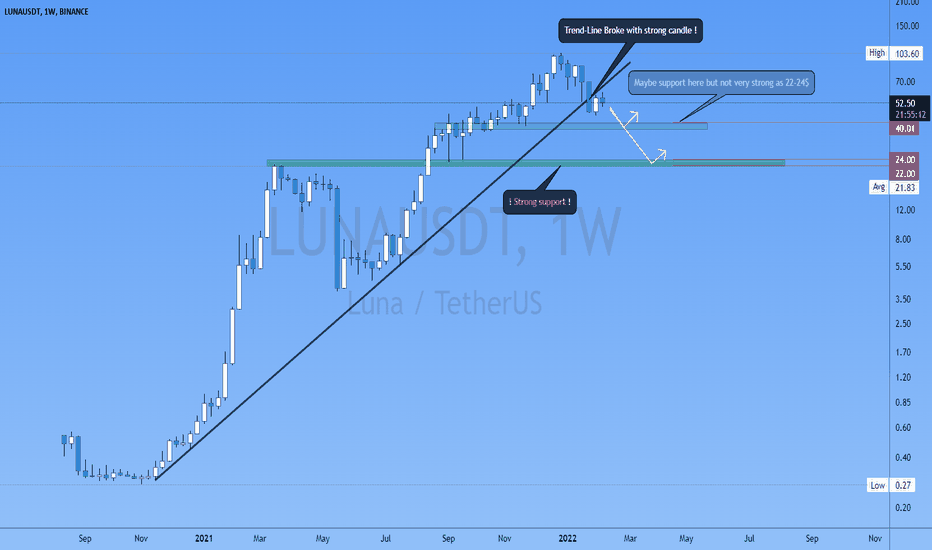

LUNA - The trend of nowWe have seen Luna's last hours, and this was a history breakdown - the question is will luna recover back?

Most importantly this coin should not come to a casino coin - trade only with a plan, and at this moment this coin is in a risk zone - on this reason always manage your risk.

There are no guarantees in markets.

If this company makes a good re-start, we could go back in the long term to 30 USD, but at this moment there is nothing confirmed, and trade safe.

We know the example of an oil that was going below 0 and did recovery, but this is crypto, and time will show where it can go.

is there life after #codeblueWe are innately optimistic people, we fail to question assets exhibiting meteoric rises because we expect values to increase over time…yet we are aghast at downward spirals. Take for instance the “stablecoin” Terra / LUNA / UST – translated to LAND MOON and US Treasury? A strange name for an Asian crypto company that has nothing to do with Spanish words or US Treasury…

lunausdt - UST more quickly.Yellen Cites UST Breakdown While Calling for Stablecoin Rules

Treasury Secretary Janet Yellen said the de-pegging of TerraUSD shows the urgency to have a regulatory framework on stablecoins, which aim to minimize the volatile price swings seen in most cryptocurrencies.

“A stablecoin known as TerraUSD experienced a run and had declined in value,” Yellen said during testimony before the Senate Banking, Housing and Urban Affairs Committee on Tuesday. “I think that simply illustrates that this is a rapidly growing product and that there are risks to financial stability and we need a framework that’s appropriate.”