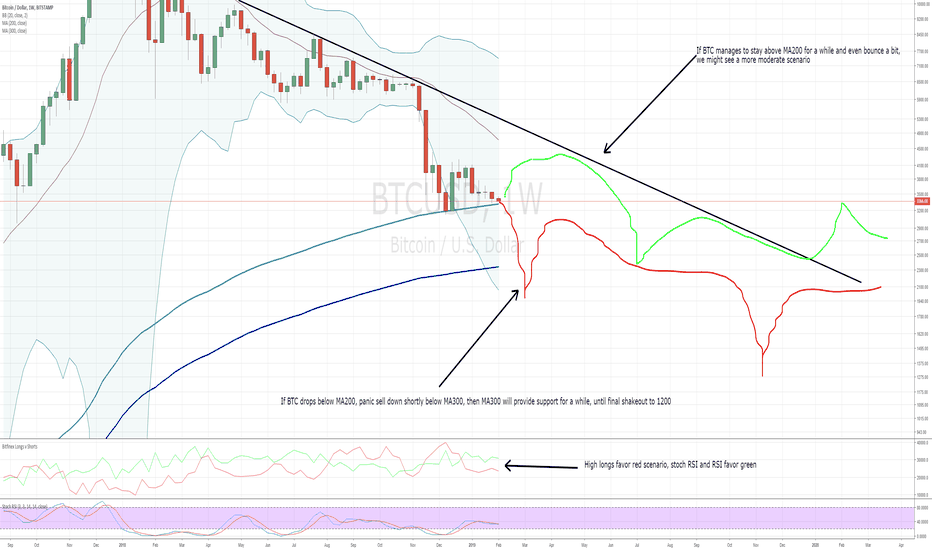

Possible paths for BTC depening if MA200 support holdsSo, we have been floating around the weekly MA200 for a while now. BTC seems to want to drag out the decision as long as possible.

I expected a rally towards 5000, but because the longs are too high, this rally is almost impossible now. It would have done a rally, if shorts remained higher than longs, which wasn't the case unfortunately.

This means that at best, we now could get a slow creeping upwards towards 4500ish, and then the final low at around 2000, represented by the green line.

The red line, represents what will probably happen if BTC breaks MA200 support. A quick panic sell to 2000ish plusminus, then recovery, but then the final low a few months later to 1200.

THe MA300 will provide some solid support in both cases, it will be hard to penetrate it down for a long time. I think the accumulation phase will form either way at around the MA300 support.

The flashcrash to 1200 would be fast, and bounce back up to MA300 support.

In both cases, due to the increasing network activity (www.blockchain.com), and thus increasing Network price, plus also the halving come nearer and nearer, in both cases I think that from 2020 onwards, we'll see the new bullmarket.

An excellent opportunity to buy below 3000, either way. Good luck catching the knife to all :)