Macddivergence

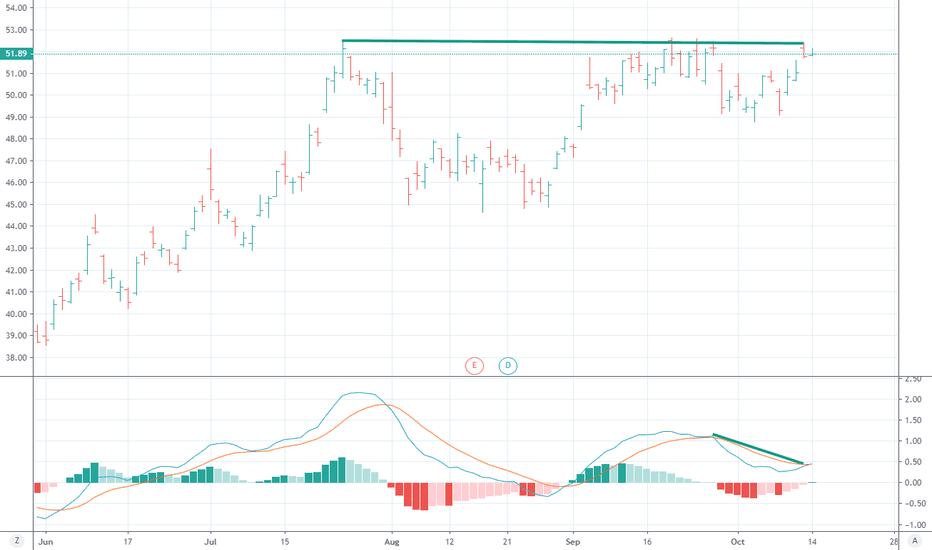

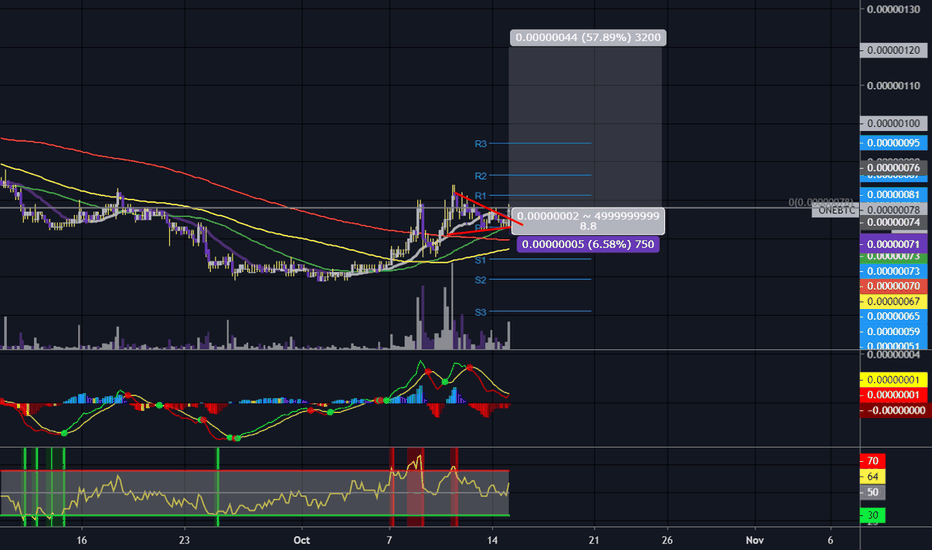

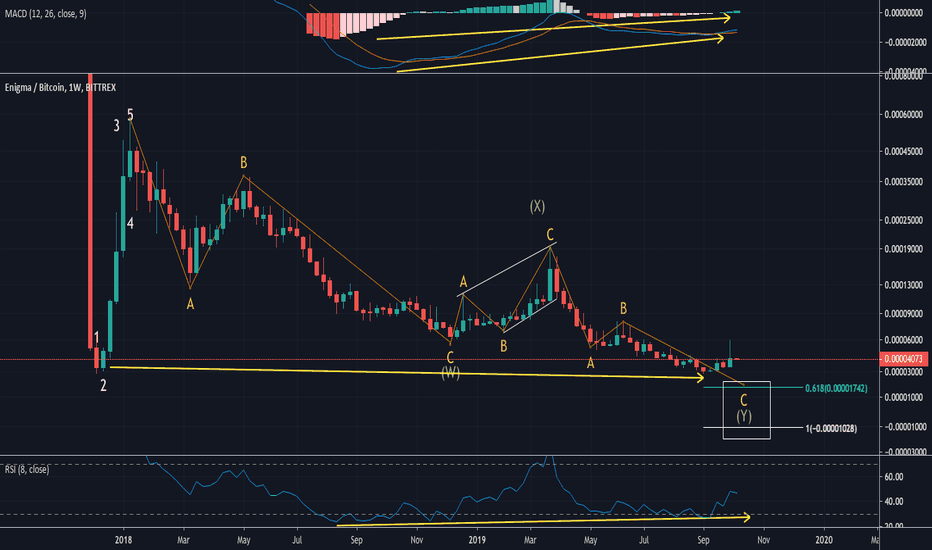

#XVG $XVG #VergeCurrency Bullish Divergences..Ready for takeoff?Coming out of the Falling Wedge we have Double Bottomed testing previous resistance as support.

MACD, RSI and Stoch Showing Bullish Divergences.

Near future incoming price at 62-78 SAT range as shown in blue box.

This is not Financial Advice.

Good Luck Traders!

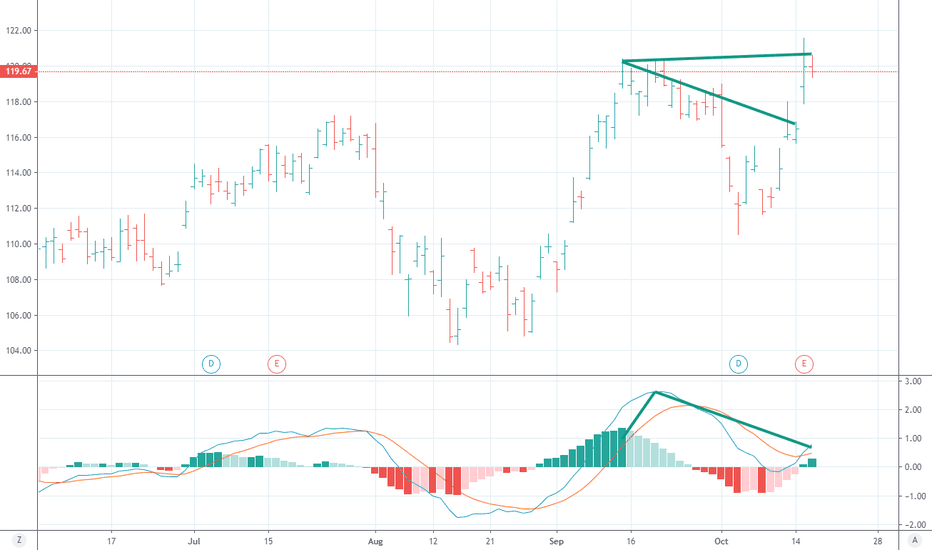

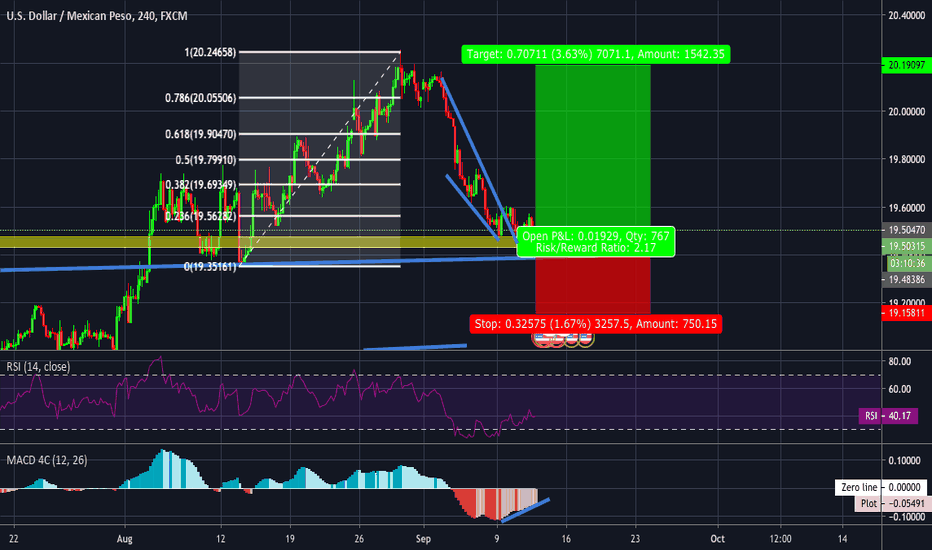

BTC/USD – Significant Rally Creates Fresh DemandAs we can see the price creates a fresh demand at the end of the past week.

This demand is also a Quasimodo level.

In addition, we can see the MACD divergence.

That cofluence of MACD divergence and fresh demand (Quasimodo) creates a great setup for buy position.

The entry-level will be the demand below and the target will be the resistance above.

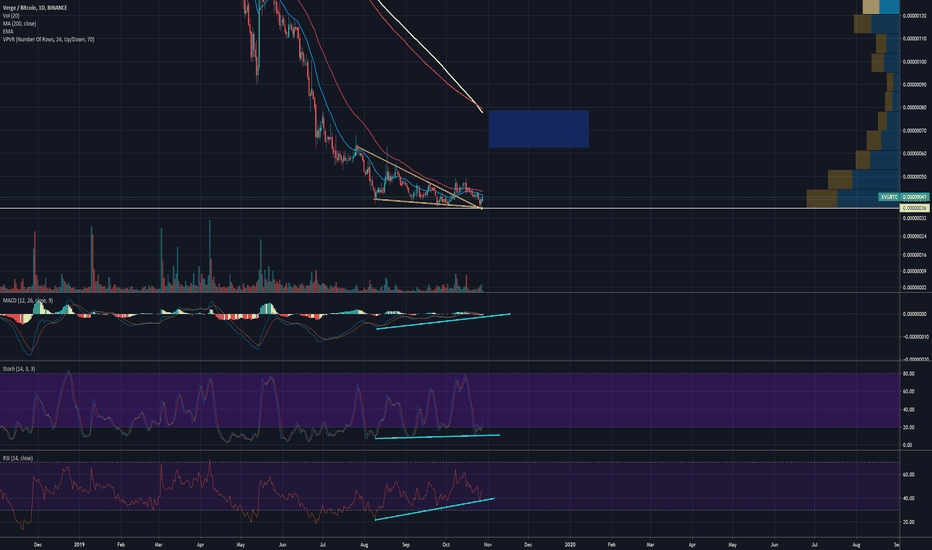

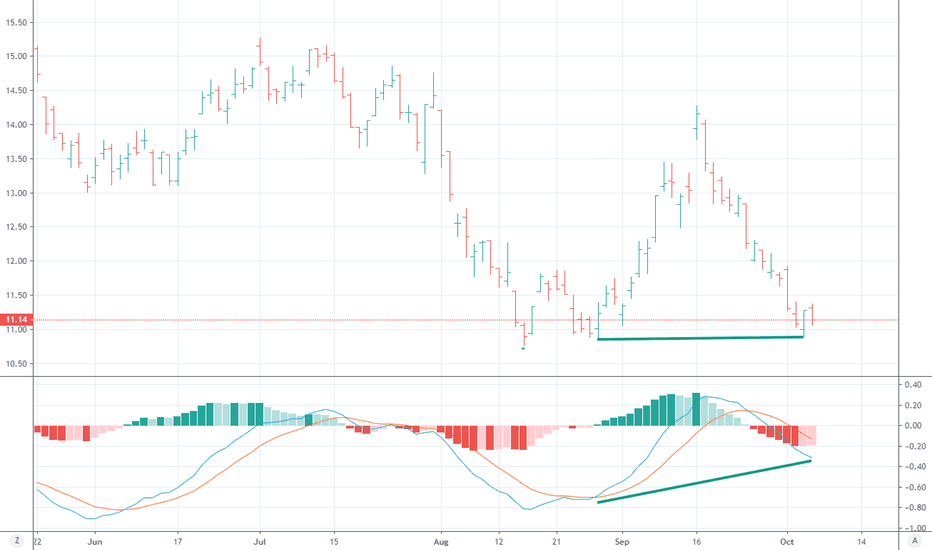

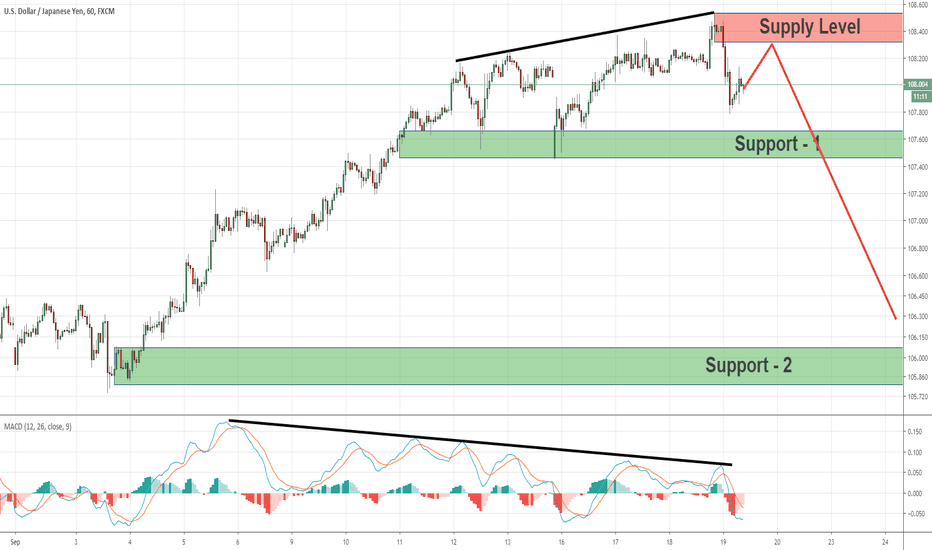

GBPJPY for sellThe price has touched the resistance zone and there is also the trendline in the same area

Also, it made a false break so we are expecting the price to head towards the support zone.

There is MACD divergence within the increasing expandable triangle.

Comment your thoughts!

Sorry for last week's absence

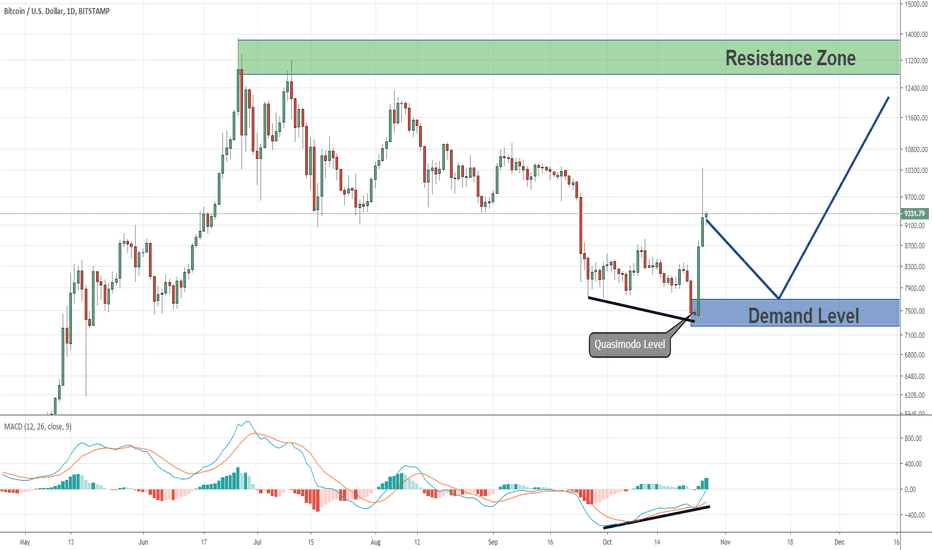

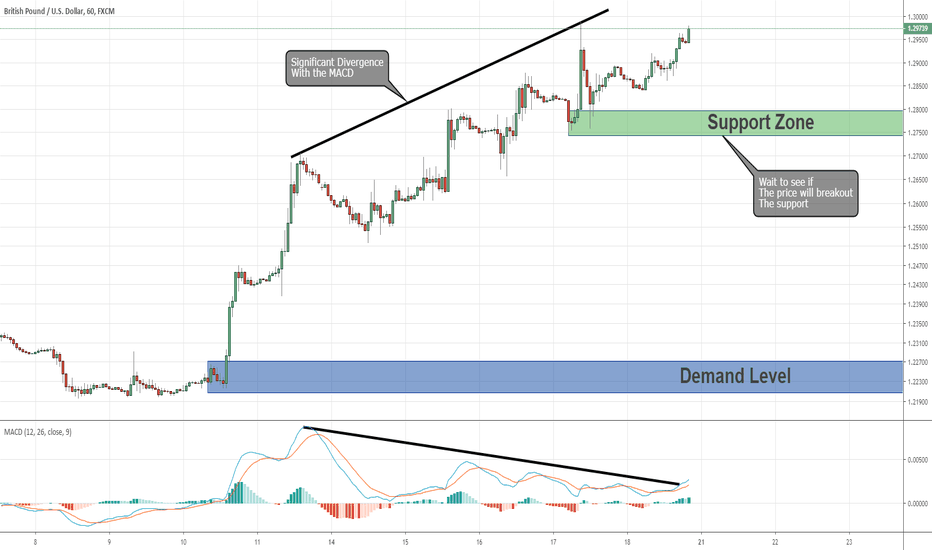

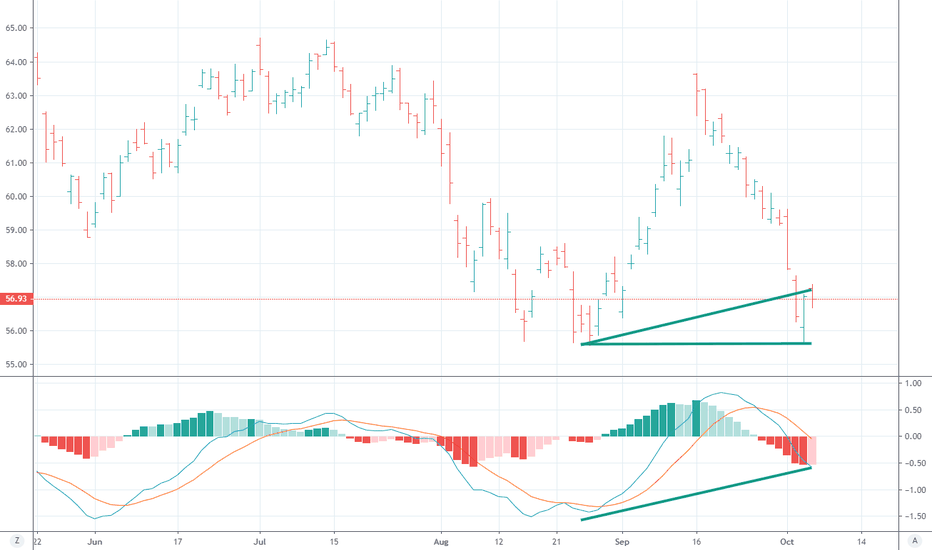

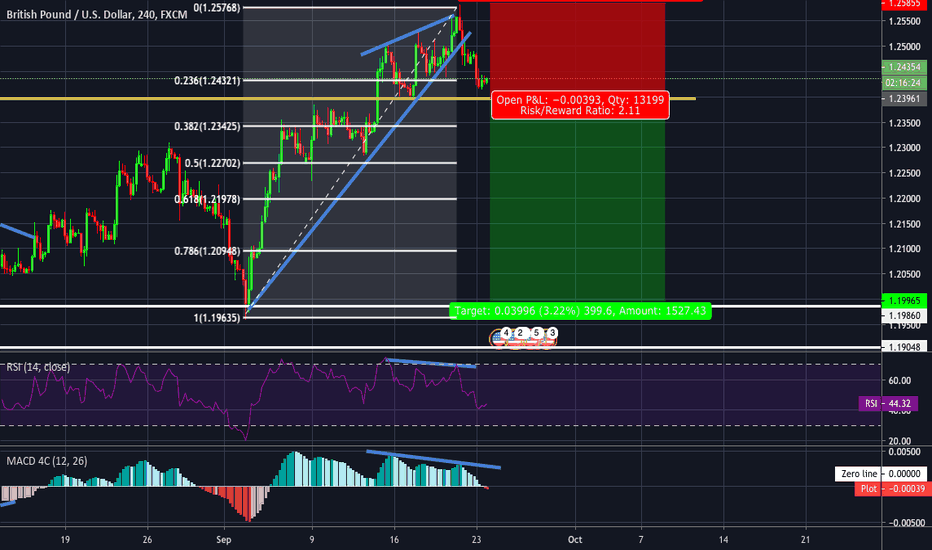

GBP/USD - What Will be The Signal For Reversal Opportunity.GBP/USD is in amazing rally for the last 10 days,

For now, I prefer to look for a reversal signal.

If the price will breakout the support below it will be the signal for changing momentum to bearish,

In that case, I'll look for a price action setup to sell GBP/USD.

In addition, there is a significant MACD divergence which indicates the buyers running out of power.

The target for the sell position will be the demand at the bottom.

One and DoneI opened a position here on ONE. I like the potential macd bull cross, with upticking histogram, bull break of the pennant and declining dominance. I'm in!

#ONE/BTC

Exchanges: Binance

Signal Type: Regular (Long)

Entry Zone: 74-76

Take-Profit Targets: 80-90-100-110-120

Stop Targets: 71

Risk: 6.58%

Rate: 75

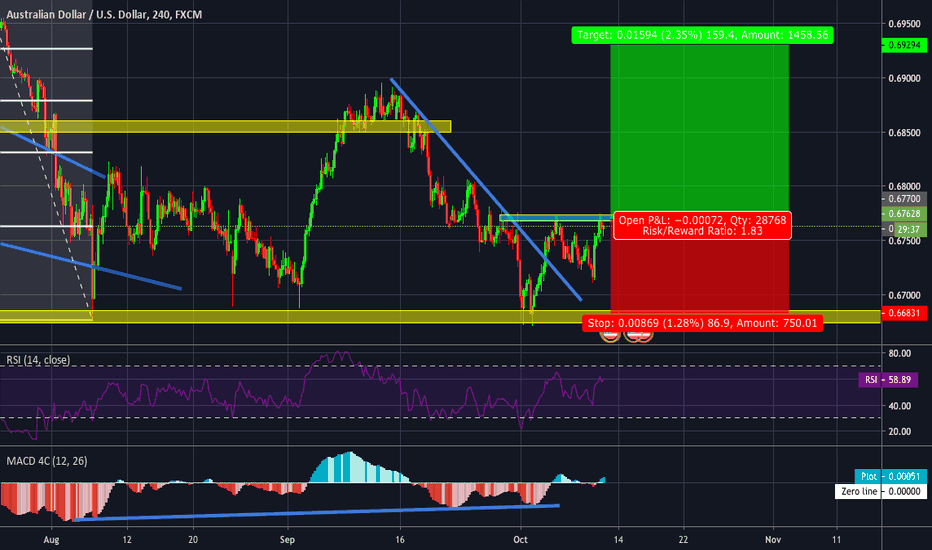

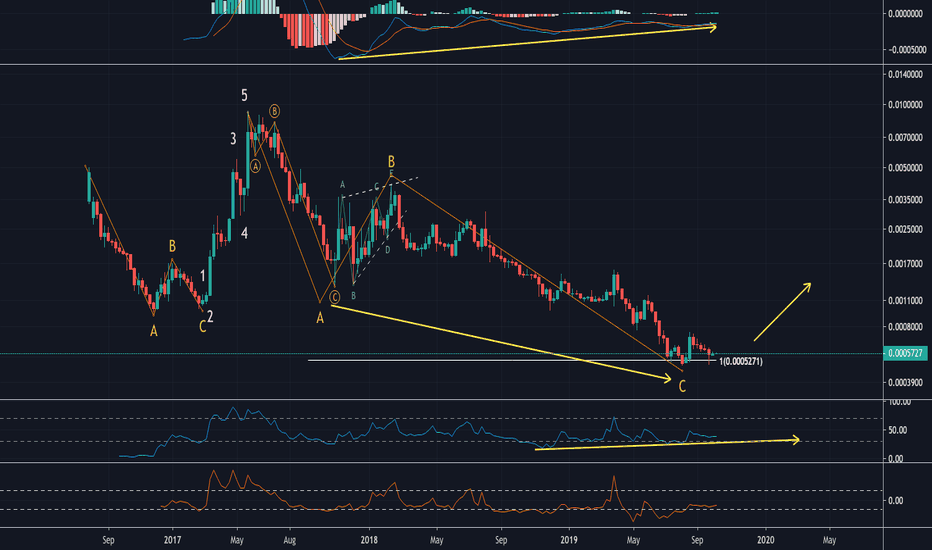

ENGBTC Bear scenarioConsidering the daily time frame showing possible bullish divergence.

If we're following Elliott wave theory it seems a long WXY correction is not yet over. As it must respect Fibonacci ratios which are most the golden ratio of 61.8.

The bull scenario here if it will break out from the trend line resistance. It's still possible since bullish divergence is already present.

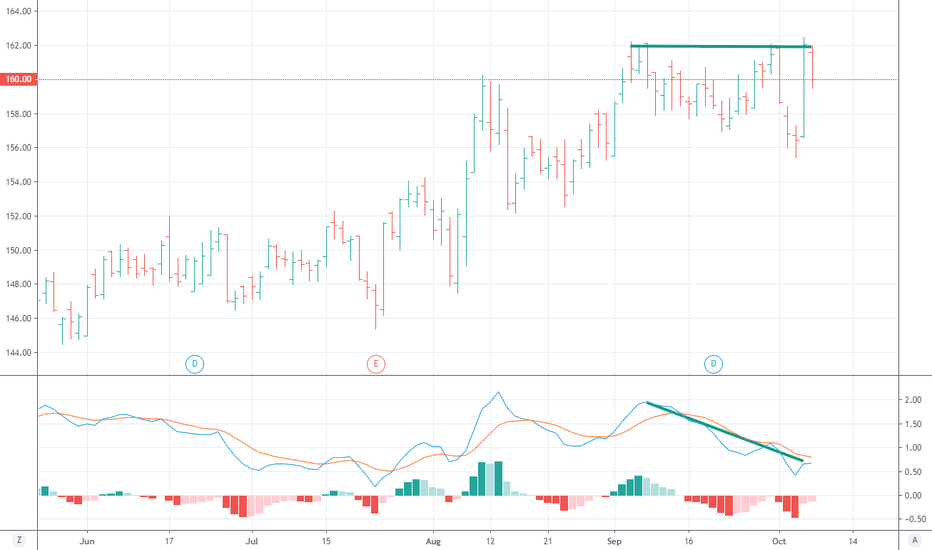

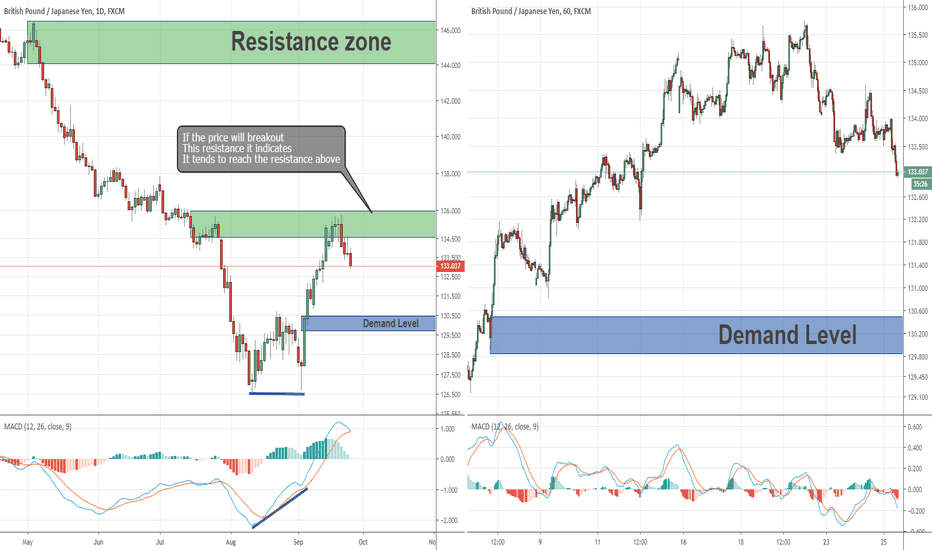

GBP/JPY Performed a Double Bottom After MACD Divergence.The price has performed a double bottom pattern on the D1 chart,

Also, while the price created the double bottom the MACD created a higher low, which's called MACD divergence.

The combination of double bottom and MACD divergence creates a great setup for buy position.

If the price will break the resistance above I'll look for a buy signal,

If the price will move down toward the demand below I'll buy at the demand,

For both options, the target will be the resistance at the top

GBPUSD sell set upThe price has broken the trendline and we are waiting for it to close below the first fibo level of .236. Once it closes it is a good opportunity to sell but to have another confirmation of the bearish trend you could wait to close below the support zone.

There is MACD divergence with RSI divergence as well.

Comment your opinions!

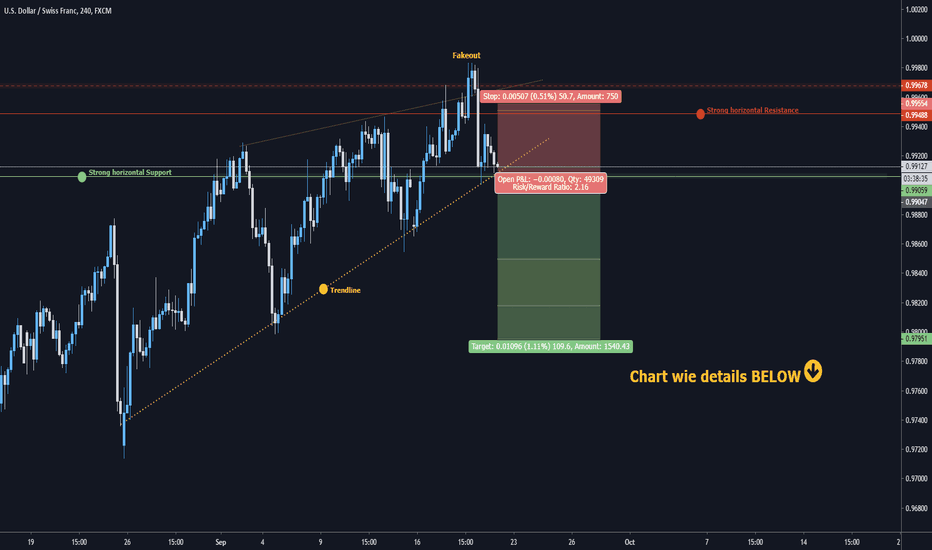

USD/CHF: Day-Swingtrade-OPPORTUNITYHey tradomaniacs,

welcome to another free signal of WEEK 38 NR. 13

How to trade: Wait for the breakout of the rising Wedge and the horizontal Support-Line!

We want to see an S&R-Flip before we sell!

-----------------------------

Type: Day-Swingtrade

Sell here: 0,99050

Stop-Loss: 0,99555

Target 1: 0,98500

Target 2: 0,98180

Target 3: 0,97950

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

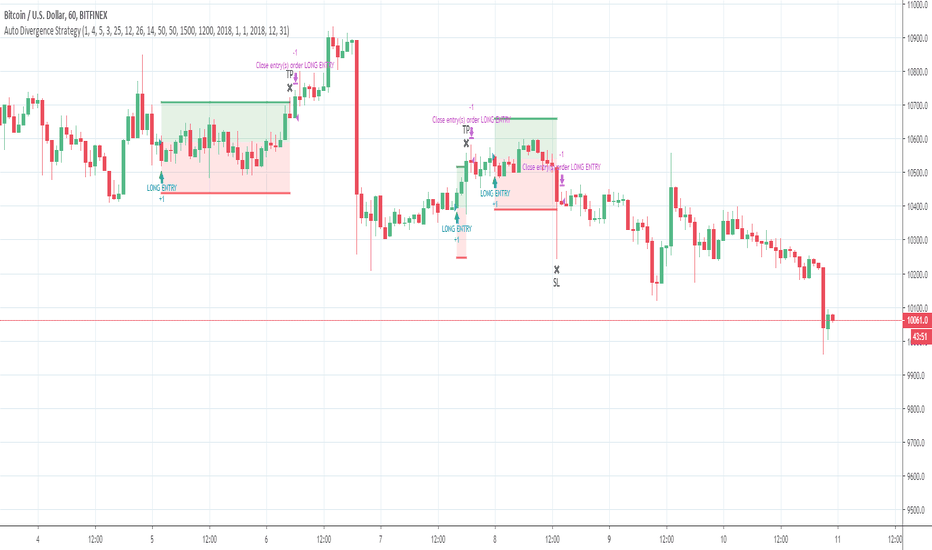

Huge BTCUSD gains by trading MACD DivergencesI've been playing around with the AutoDivergence Strategy on the 1H BTCUSD chart (Bitfinex) and tried some "unconventional" settings

As with a lot of other Crypto-Pairs, trading only longs seems to perform much better than going long AND short.

I configured AutoDivergence to use the MACD-histogram as an oscillator to find Divergences. I started to increase the oscillator length and the results kept getting better - "25" seems to be a perfect length.

By reducing the number of candles that need to diverge to 4, I got more signals while still maintaining a high profitability.

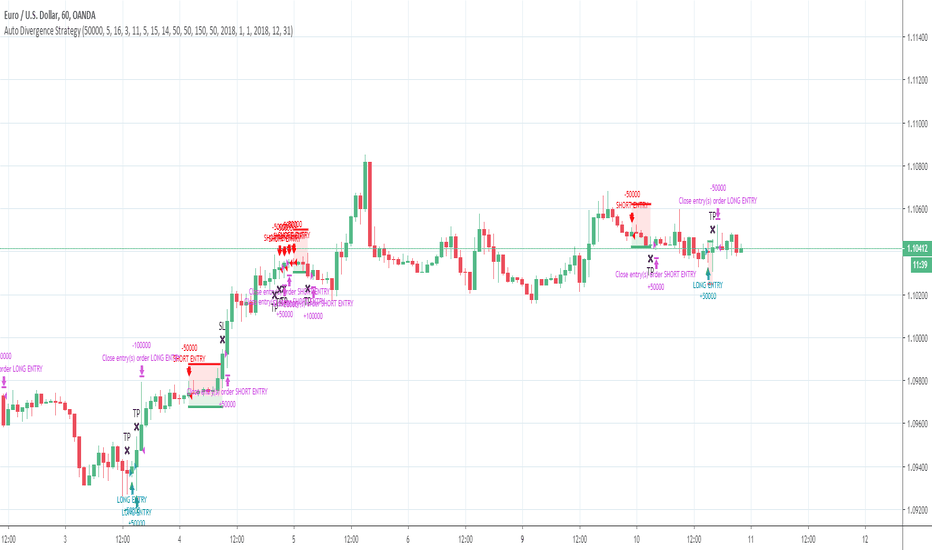

Find MACD Divergences on the EURUSD 1H ChartHere are the settings that can be used to find divergences of MACD vs. Price on the 1H EURUSD chart:

AutoDivergence Settings

To automate this strategy you would need to apply the AutoDivergence Study to the chart - check that the properties are set to the same values as for the strategy.

Luckily OANDA is supported by autoview, so you can automate the strategy. Or if you prefer a more manual approach - just use the Email-Alerts to get notified if you need to enter or exit a trade.