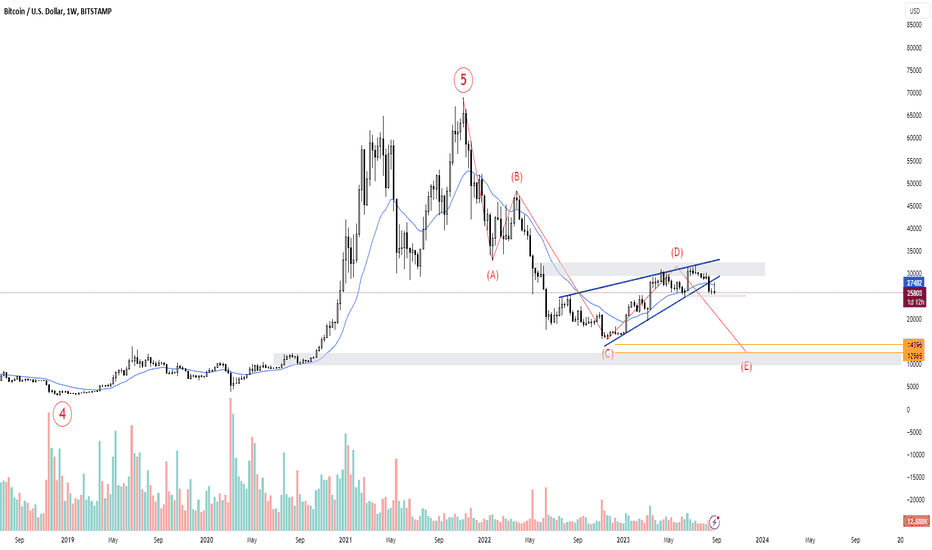

Bitcoin analysisHello friends

In the major period and in the weekly time frame, if we accept that at the price of $69,000, the 5-wave bullish Bitcoin has ended, we can imagine that we are still taking corrective steps.

Also, by hitting the supply area of 30-33 thousand dollars, we saw the breaking of the Rising Wedge pattern, which makes the above analysis more likely to be correct.

If the price level of 24800 dollars is broken, the final confirmation will be issued to continue the decline.

Based on this, my overall view on Bitcoin is bearish

Major

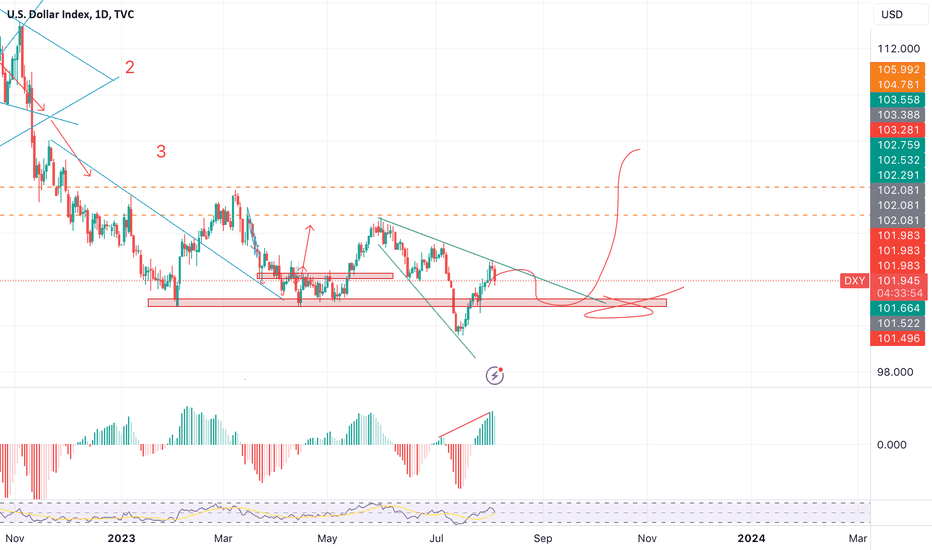

DXY - Bull or Bear?The DXY has essentially been moving sideways for half a year, it will commit to a major move soon and I think the the red support box marked by my, very well drawn, X will be it's giveaway.

What I give the higher probability of happening to is a backtest of the aforementioned box as support before a greater move up. It would also have to break out of the broadening wedge that can be seen.

Having said that there is clear bearish divergence building up and should we break below support, then confirm it as resistance, I can see a few more very bearish months that could present great opportunities for EUR, GBP and BTC.

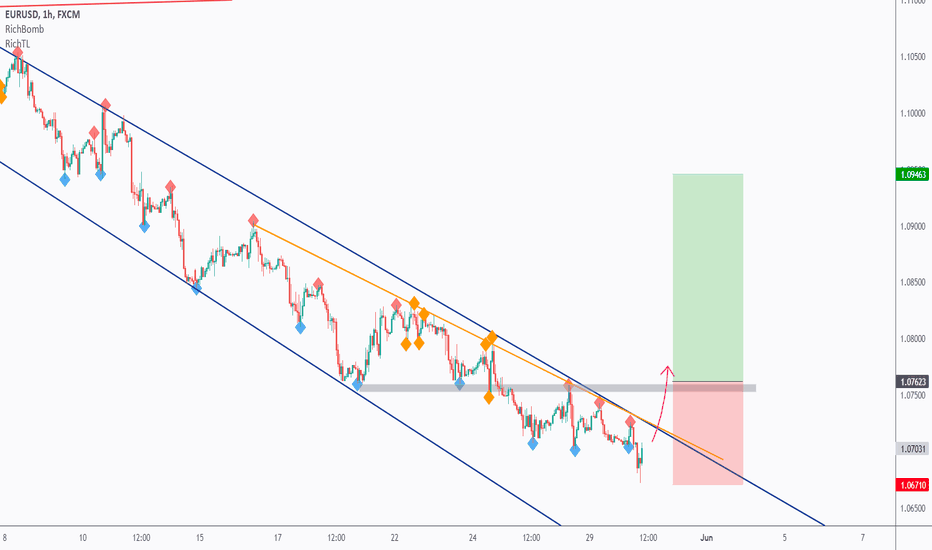

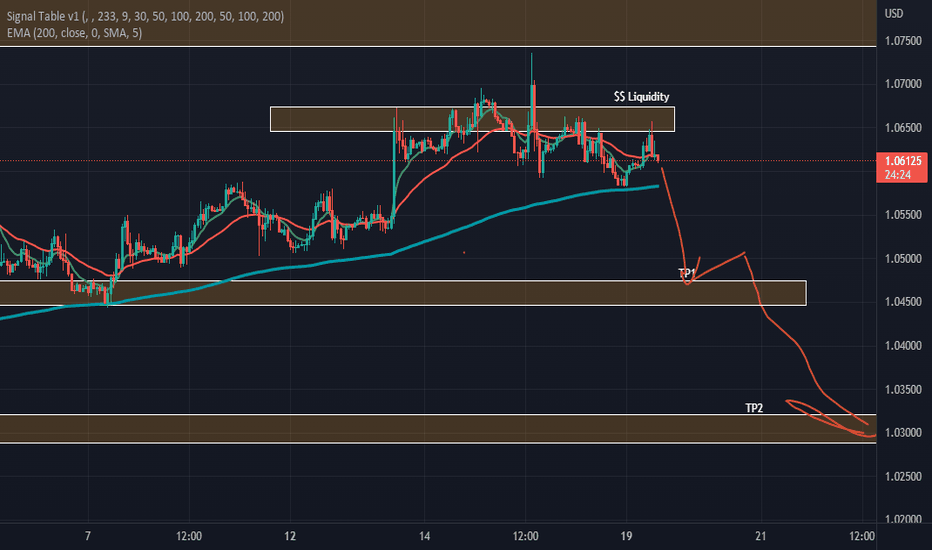

EURUSD - Video Top-Down Analysis!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Here is a detailed update top-down analysis for EURUSD.

Which scenario do you think is more likely to happen? and Why?

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

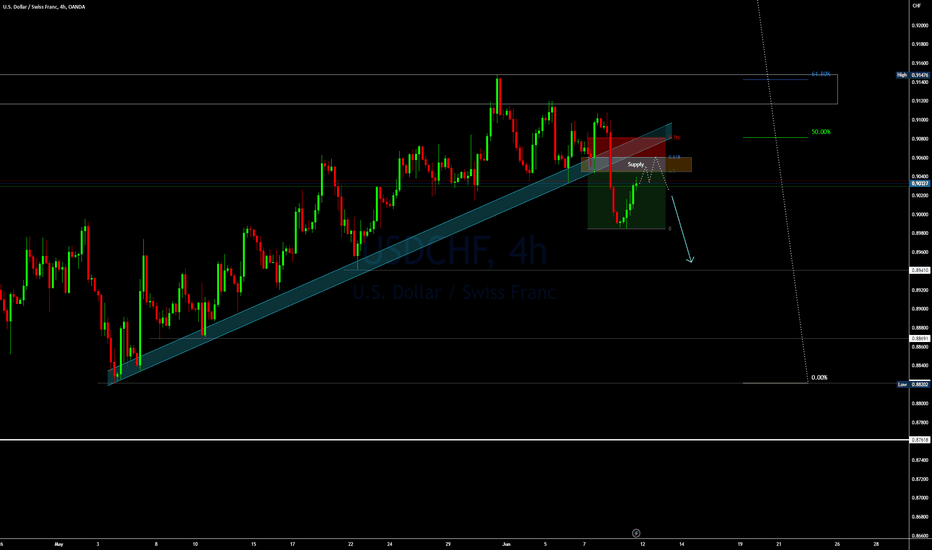

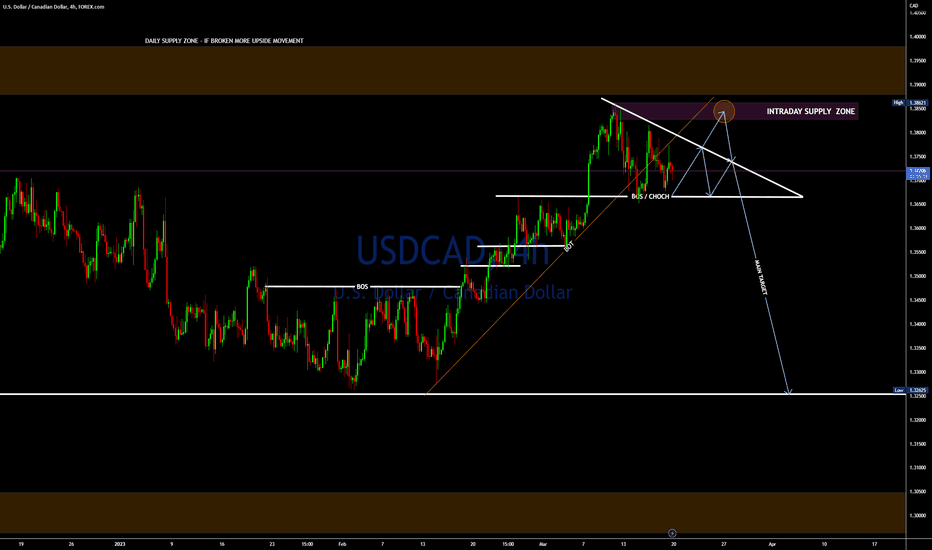

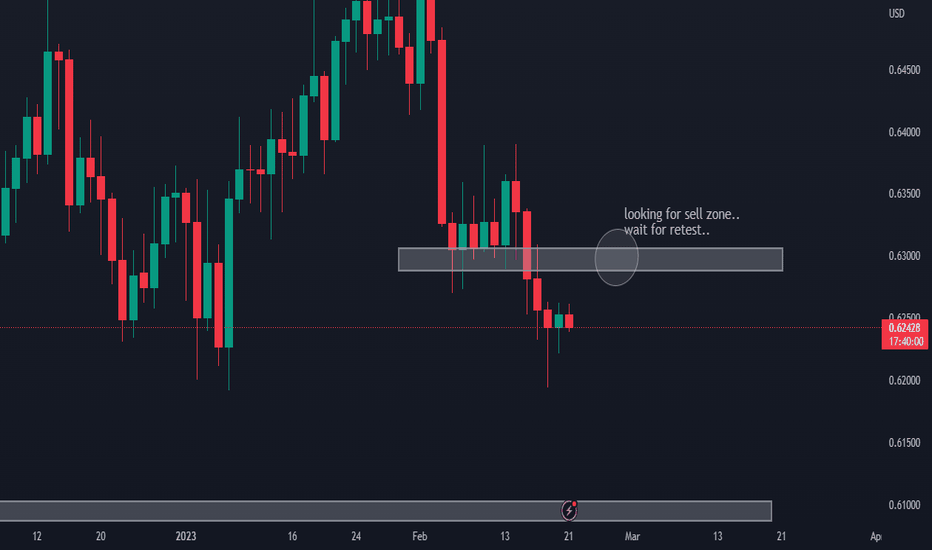

Bearish setup on USDCADHi Traders,

Check this out - USDCAD could start a fresh bearish momentum, after breaking of the bullish trend.

However, with the uncertainty on how heavy FED could bump dollar this is better wait on for a break below the Triangle pattern before looking for a better short trade entry.

That is what i will do, provided that we get a solid breakdown and retest of the "Pennant like descending Triangle".

Watchout

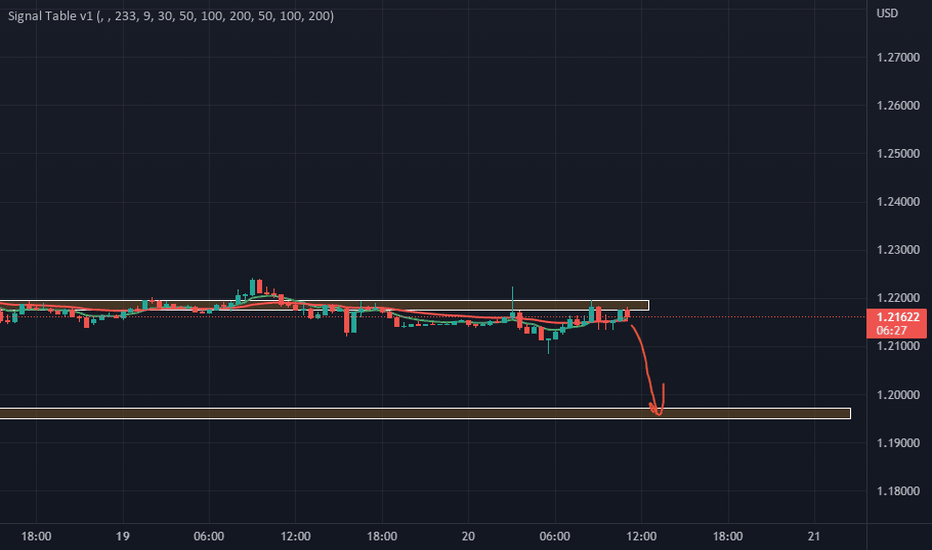

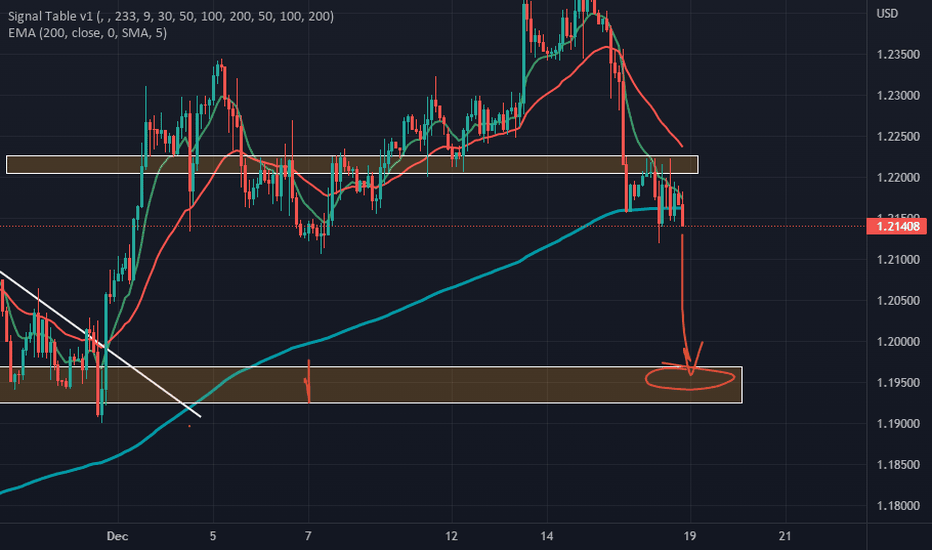

Retest to the supply zonePrice tested the supply zone and dropped, now we notice a beautiful complete retest. The retest is followed by a huge bearish candlestick that indicates a strong rejection. Expecting a massive drop to the breaker block as highlighted. However, we should be wary of the 1.21385 for a partial setback nor rejection…

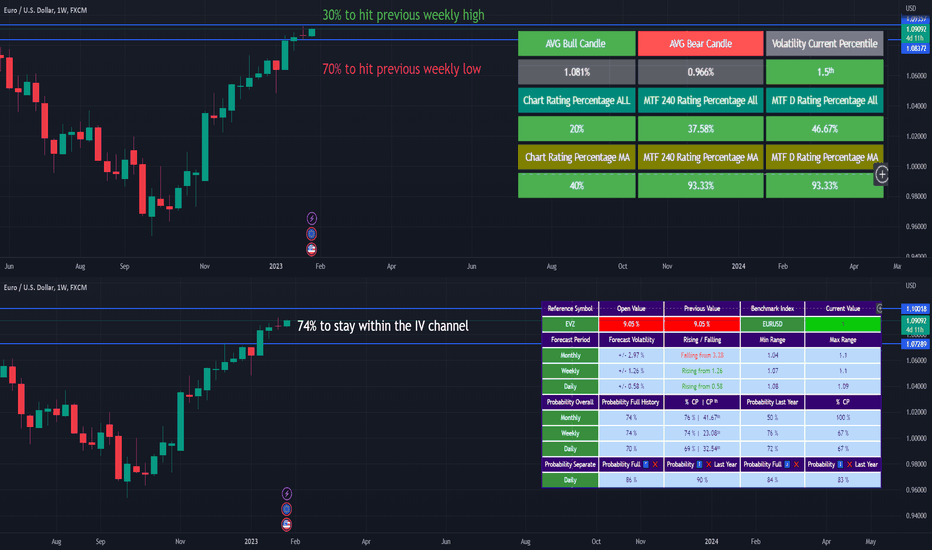

EUR/USD Weekly Forecast 30 Jan - 3 Feb 2023 hEUR/USD Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from EVZ we can see that currently the IV for this week is at 9.05%, equal to last week.

This can be translated in +/- 1.26% weekly movement from the open of the candle, which makes the next top/bot channel

TOP: 1.10

BOT: 1.073

If we were to make a more accurate statement, based on the current percentile of the EVZ( from 0 to 25) , we can apply a condition in the filter

to look for scenarios when the volatility were lower than 50 percentile( bottom half). If we were to take this data we can see, that our numbers would be:

74% according to the last 20 years of data

67% according to the data since 2022

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

30% to touch the previous weekly high

70% to touch the previous weekly low

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: +93% Bullish Trend

D Timeframe: +93% Bullish Trend

W Timeframe: +40% Bullish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

1.081% from the open to the close candle for the bullish scenario

0.966% from the open to the close candle for the bearish scenario

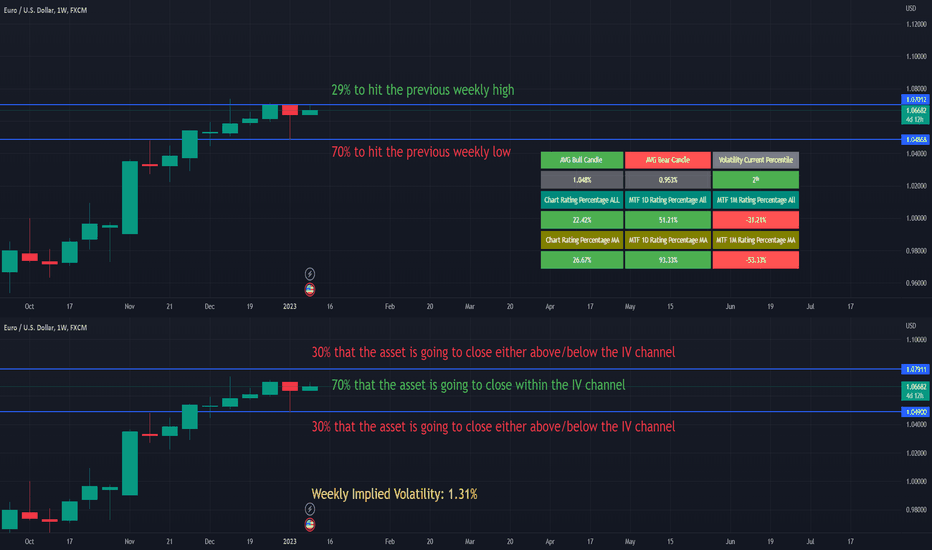

EUR/USD Weekly Volatility Analysis 9-13 Jan 2023 EUR/USD Weekly Volatility Analysis 9-13 Jan 2023

We can see that currently the implied volatility for this week is 1.31%

With this in mind, currently from ATR point of view we are located in the 2th percentile.

Based on this, we can expect that the current weekly candles ( from open to close ) are going to between:

*For calculations, I am using the data since 2022*

Bullish: 1.05% movement

Bearish: 0.95% movement

At the same time, with this data, we can make a top/bot channel which is going to contain inside the movement of this asset,

meaning that there is a 30% that our close of the weekly candle of this asset is going to be either above/below the next channel:

TOP: 1.079

BOT: 1.049

Taking into consideration the previous weekly high/low, currently for this candle there is :

29% probability we are going to touch previous weekly high

70% probability we are going to touch previous weekly low

Lastly, from the technical analysis point of view, currently from

Daily timeframe indicates 93.33% BULLISH trend from the moving averages index

Weekly timeframe indicates 26.67 BULLISH trend from the moving averages index

Monthly timeframe indicates -53.33% BEARISH trend from the moving averages index

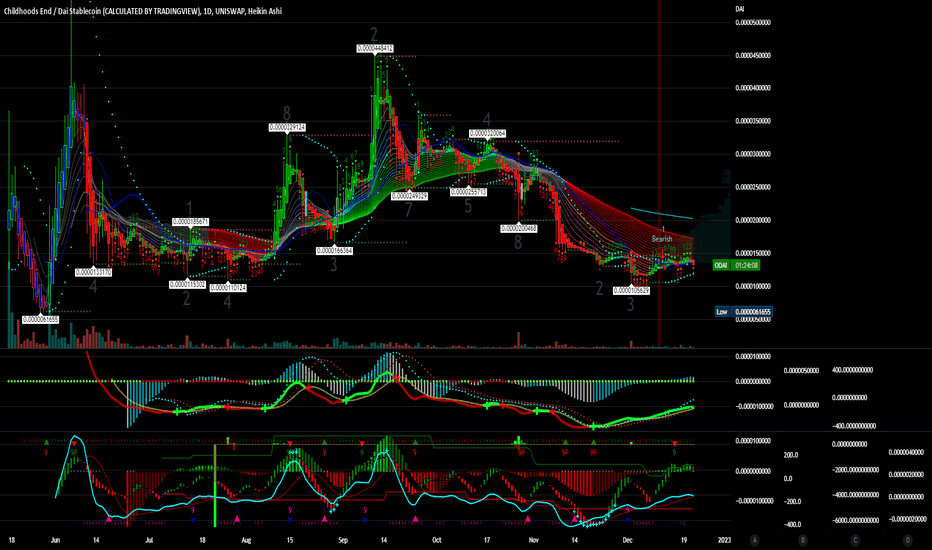

$O Childhoods End ✨ The live Childhoods End price today is $0.000013 USD with a 24-hour trading volume of $5,703.27 USD. We update our O to USD price in real-time. Childhoods End is up 0.61% in the last 24 hours. The current CoinMarketCap ranking is #4958, with a live market cap of not available. The circulating supply is not available and the max. supply is not available.

GBPUSD Short PotentialHuge R to be gained potentially. We are in the middle of a bearish retracement on daily, with bearish price structure printed on intraday timeframes. Bouncing off from supply zone, and should hopefully break out of this range. I think this could be the time.

TRADING IDEA --- NOT AN INVESTMENT OPPORTUNITY

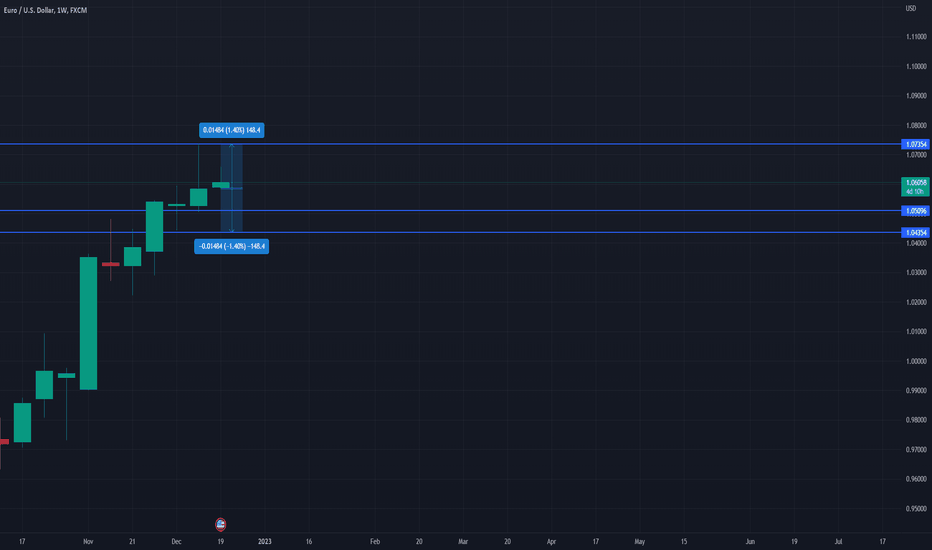

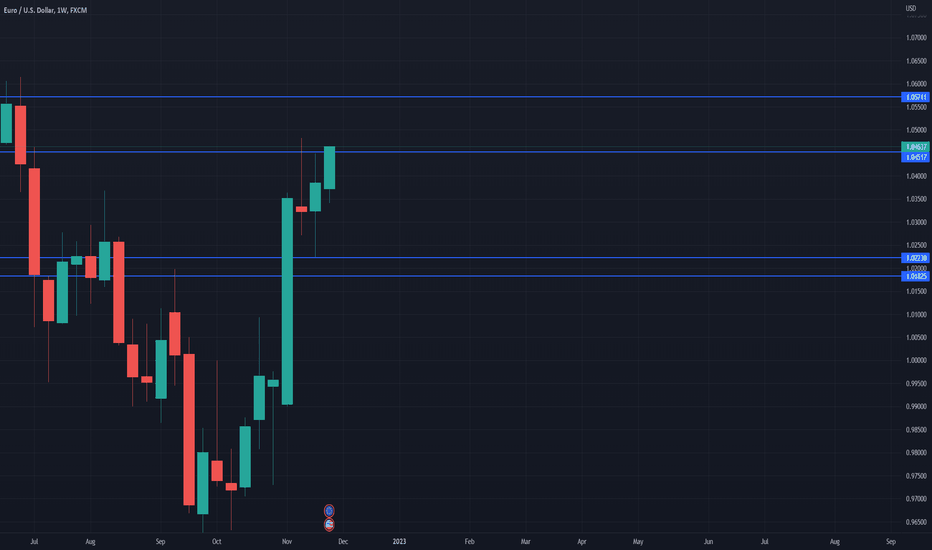

EURUSD Weekly Volatility Analysis 19-23 Dec 2022 EURUSD Weekly Volatility Analysis 19-23 Dec 2022

We can see that currently the implied volatility for this week is around 1.4%, DOWN from 1.53% from last week

With this in mind, currently from ATR point of view we are located in the 1st percentile.

Based on this, we can expect that the current weekly candles ( from open to close ) are going to between:

Bullish: 1.089% movement

Bearish: 0.966% movement

At the same time, with this data, we can make a top/bot channel which is going to contain inside the movement of this asset,

meaning that there is a 30% that our close of the weekly candle of this asset is going to be either above/below the next channel:

TOP: 1.075

BOT: 1.043

Taking into consideration the previous weekly high/low, currently for this candle there is :

65% probability we are going to touch previous high 1.0735

35% probability we are going to touch previous low 1.0435

Lastly, from the technical analysis point of view, currently from

Weekly timeframe indicates 26% BULLISH trend from the moving averages index

Daily timeframe indicates 80% BULLISH trend from the moving averages index

4H timeframe indicates -13% BEARISH trend from the moving averages index

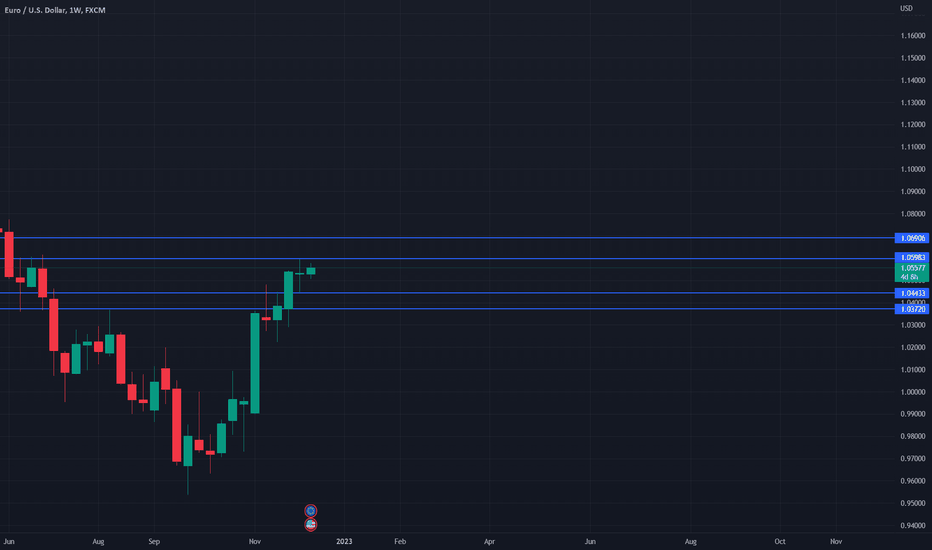

EURUSD Weekly Volatility Analysis 12-16 Dec 2022 EURUSD Weekly Volatility Analysis 12-16 Dec 2022

We can see that currently the implied volatility for this week is around 1.48%, DOWN from 1.53% from last week

according to EVZ data

With this in mind, currently from ATR point of view we are located in the 1ST percentile,

while according to EVZ, we are on 1th percentile.

Based on this, we can expect that the current weekly candles ( from open to close ) are going to between:

Bullish: 1.121% movement

Bearish: 0.966% movement

At the same time, with this data, we can make a top/bot channel which is going to contain inside the movement of this asset,

meaning that there is a 30% that our close of the weekly candle of this asset is going to be either above/below the next channel:

TOP: 1.069

BOT: 1.037

Taking into consideration the previous weekly high/low, currently for this candle there is :

71% probability we are going to touch previous high 1.059

30% probability we are going to touch previous low 1.044

Lastly, from the technical analysis point of view, currently from

Weekly timeframe indicates 26% BULLISH trend from the moving averages index

Daily timeframe indicates 93% BULLISH trend from the moving averages index

4H timeframe indicates 80% BULLISH trend from the moving averages index

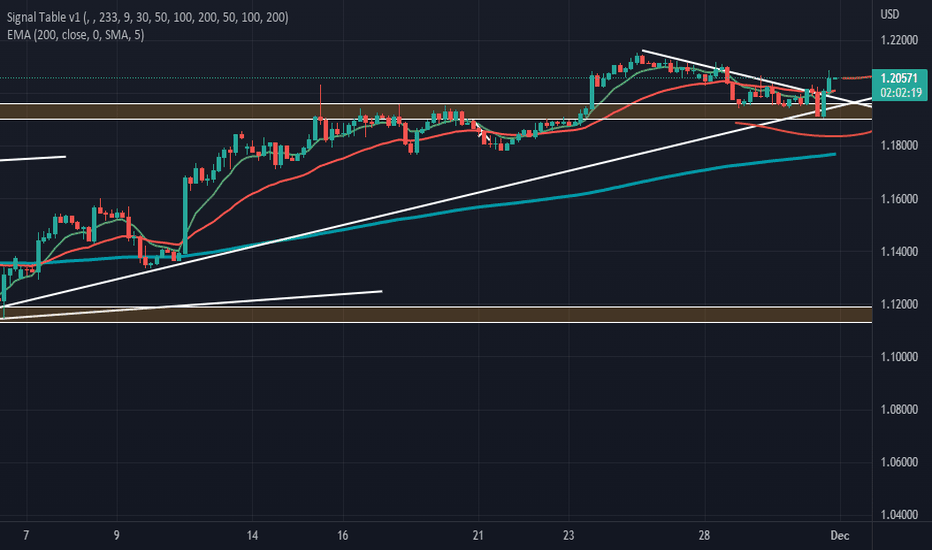

EURUSD Weekly Forecast Analysis 28 Nov-2 Dec 2022 EURUSD Weekly Forecast Analysis 28 Nov-2 Dec 2022

We can see that this week, the current implied volatility is around 1.65% , down from 1.86% of last week.

According to ATR calculations, we are currently on the 13th percentile, while with EVZ we are on 1th percentile.

Based on this data, we can expect on average, the movement from open to close of the weekly candle to be :

In case of bullish - 1.185%

In case of bearish - 0.966%

With the current IV calculation, we have currently 30% that the close of the weekly candle is going to finish either above

or below the next channel:

TOP: 1.057

BOT: 1.018

At the same time, taking into consideration the high/low touch calculation from the previous values, we can expect for this week:

30% chance that we are going to touch the previous low of the weekly candle of 1.022

70% chance that we are going to touch the previous high of the weekly candle of 1.045( already hit)

Lastly from a technical analysis point of view, currently 4% of the moving averages rating, are insinuating we are in a BULLISH trend.