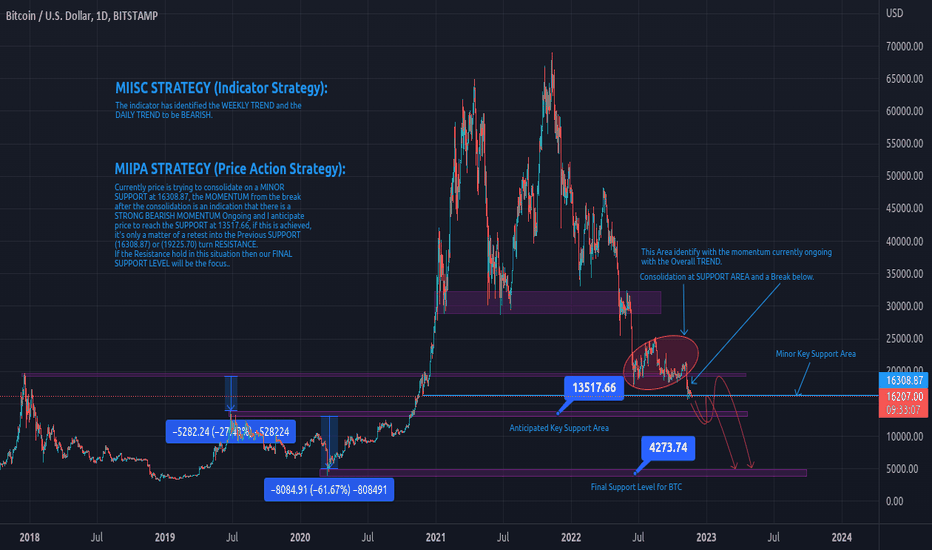

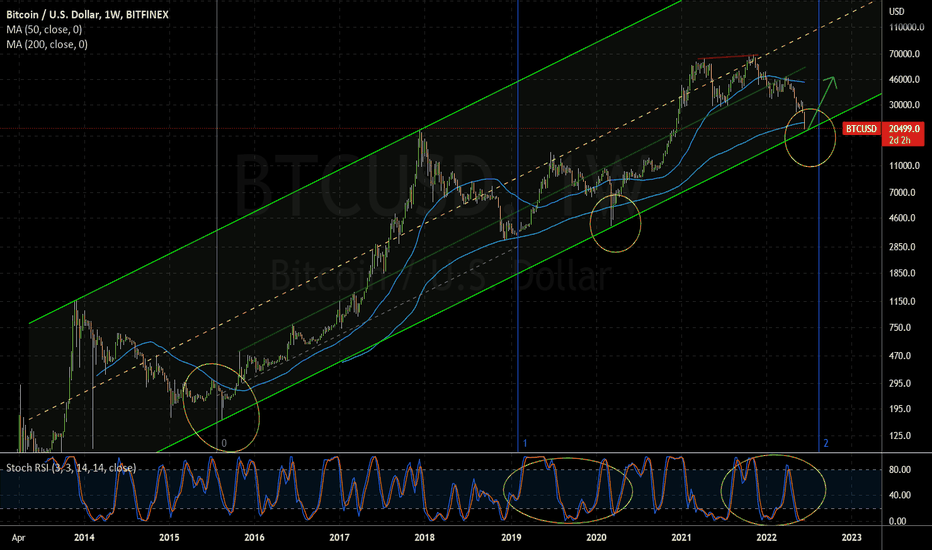

BTC Insight and what to expect in the following weeks and monthThe OVERALL TREND on WEEKLY and DAILY seems to be complimenting each other which means both time-frame agree, I shared a previous insight on BTC weekly a year ago Nov 20, 2021. Today, I am looking at what to expect and I see the correlation clearly. I might be wrong but the PRICE ACTION is obvious, carefully look at the key levels identified and see the relationship it has to what PRICE ACTION was completed on these KEY AREAS. After the CONSOLIDATION BREAK below the SUPPORT AREA at (19225.78) with a STRONG MOMENTUM, I am positive there is a potential of seeing a clear of the next "Anticipated Key Support Area" before a final Blow..

Major

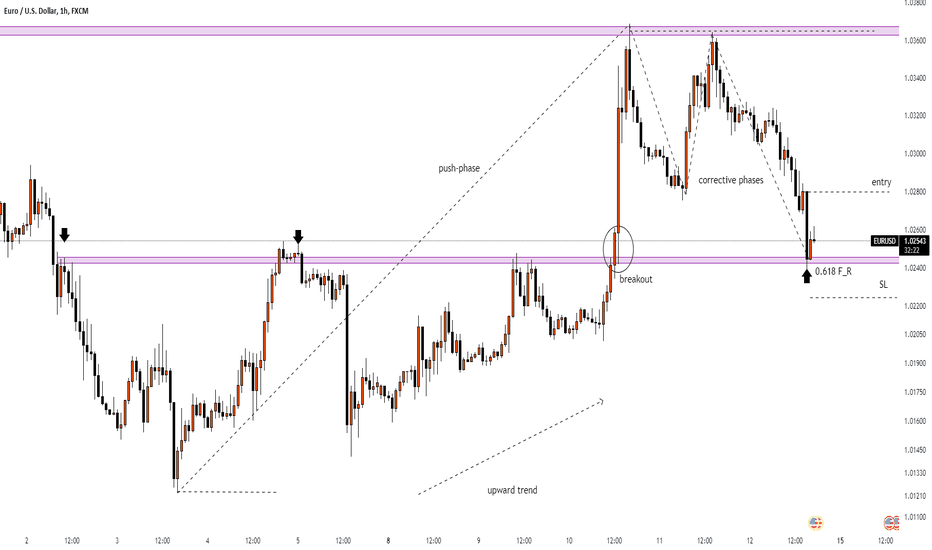

EUR/USD Weekly Forecast 14-18 November 2022 EUR/USD Weekly Forecast 14-18 November 2022

Currently the implied volatility for this asset is around 1.65%, up from 1.61% of last week.

From volatility percentile, point of view, we are currently on 35th from ATR and 38th from EVZ index.

With this volatility percentile values into account we can expected on average that the weekly candle is going to be:

1.23% for bullish

0.967% for bearish

With the current IV, we can expect with a 78.3% probability that the market is not going to close either above or below the next channel:

TOP: 1.05

BOT: 1.017

Lastly, based on previous calculations, we have:

71% to hit the previous weekly high of 1.036

28% to hit the previous weekly low of 0.99

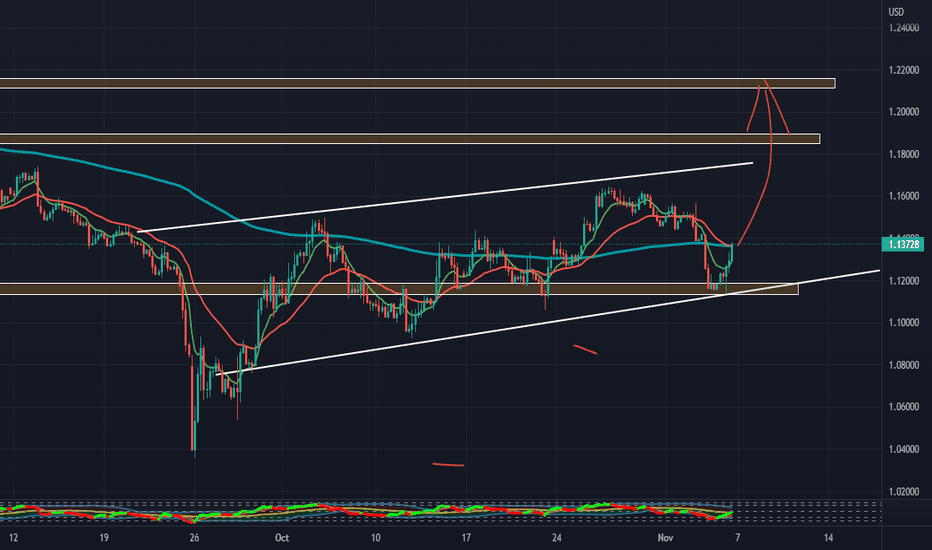

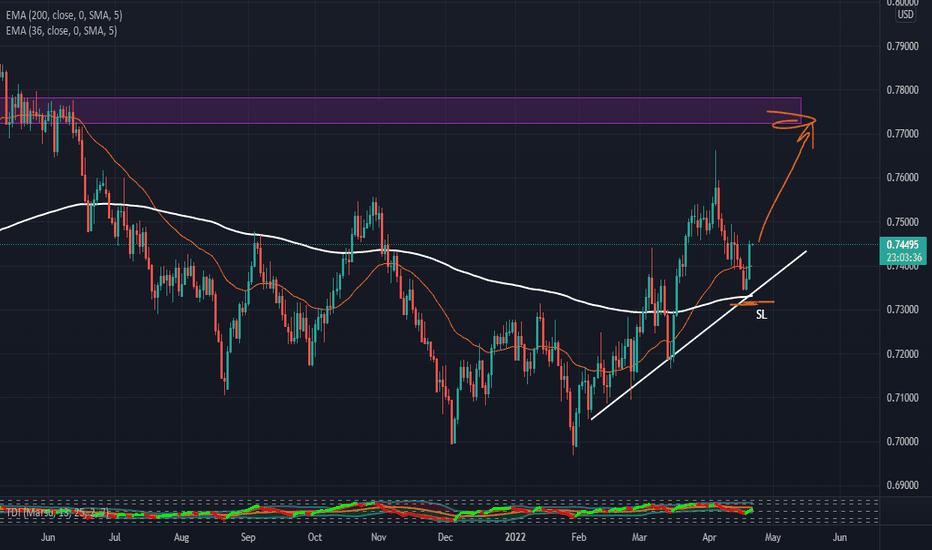

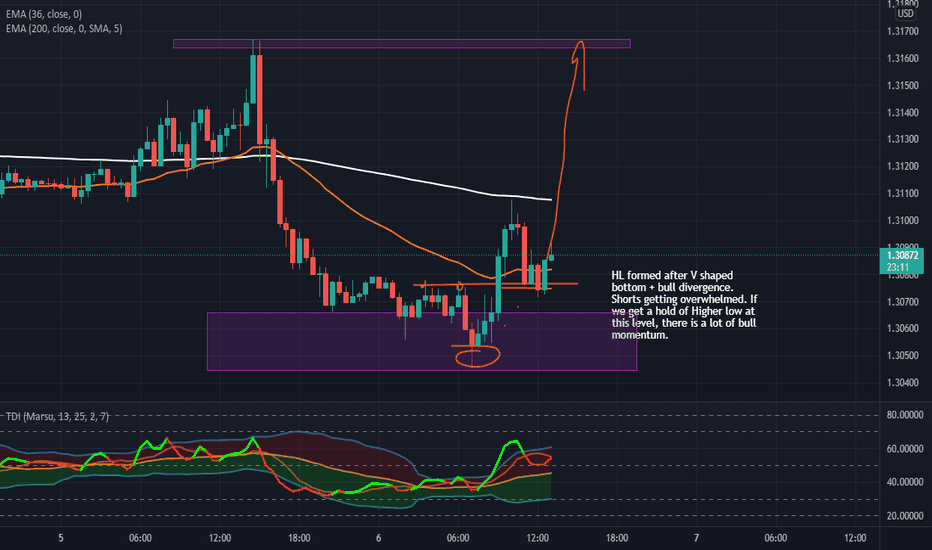

GBPUSD Longs!Gameplan is to buy GBP. Yes, we still have a major bear down trend on weeklies and daily. On daily we have been forming higher lows & higher highs, with retest of current support + a nice bullish break. What would have made this trade IDEAL would've been fully engulfing daily bull candle to offset all the bear volume. If you look at the weekly, price is overextended and in need of a retracement before another bearish move can be made.

On the daily, we have short term bullish structure forming and we have just held newly established support and made a good bullish break - very healthy bull candles coming off close to support shows plenty of momentum for GBPUSD in the week to come.

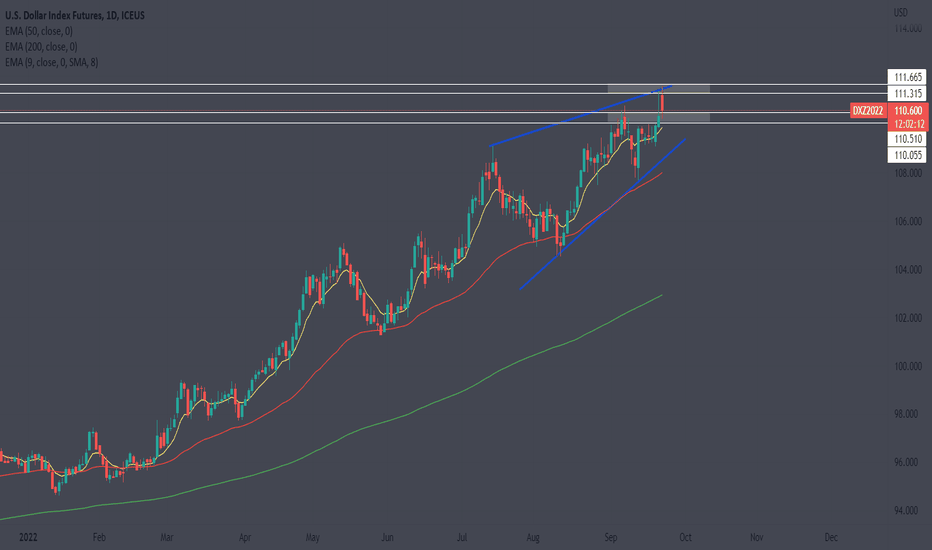

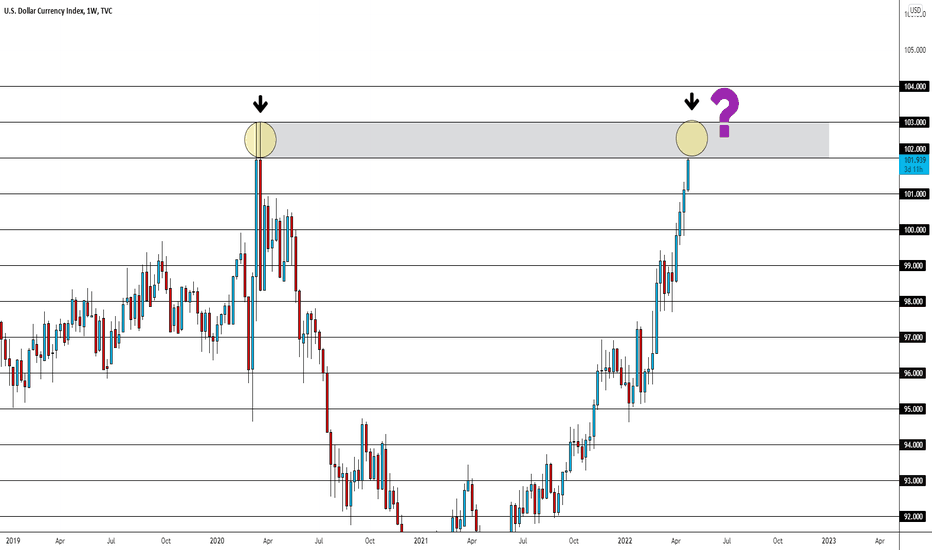

$DXY - It has been my best friend for while...$DXY - It has been my best friend for while...

We have a saying in trading: The trend is your friend until it breaks!

We reaching key areas, my longer term target if we break above 110 areas next 120 IF we get there. I do really like to keep an open mind to either direction. However, we had a large pull back this morning which makes sense to have. Keep an eye on the key areas we at break above or below shorter term and longer term the big question is - Is this a pattern brewing of a rising wedge to have a pull back medium term?

Things to keep in mind are the key fundamental data we had FOMC yesterday dovish and 75 hike it was expected the slimmer chance weeks went by of 100 and that did sound like a joke imo. However, we pulling back FX Majors check HT as it really key and we entering near end of month as well.

Remember: Follow your own trade plan, it will make you very successful.

TJ

Here We GoHi everyone,

In my last post, I was explaining how we might still be bearish and how we might make a pullback to the upside for BTCUSDT.

Looking at the price, we just broke above the trendline shown above which represents the resistance for the area of consolidation. In other words, we are looking at a breakout.

Since we are retesting the higher time frame (H4) previous highs, I am really interested in the 21100 level, where we might see some consolidation. The main reason I think this would be an important level is that it is in confluence with previous H4 lows above the price we are at right now, as well as the 0.382 Fib level considering the last upward move and the 0.5 Fib level considering the last downward move.

The direction of the trend will be determined by the breakout from the next consolidation level.

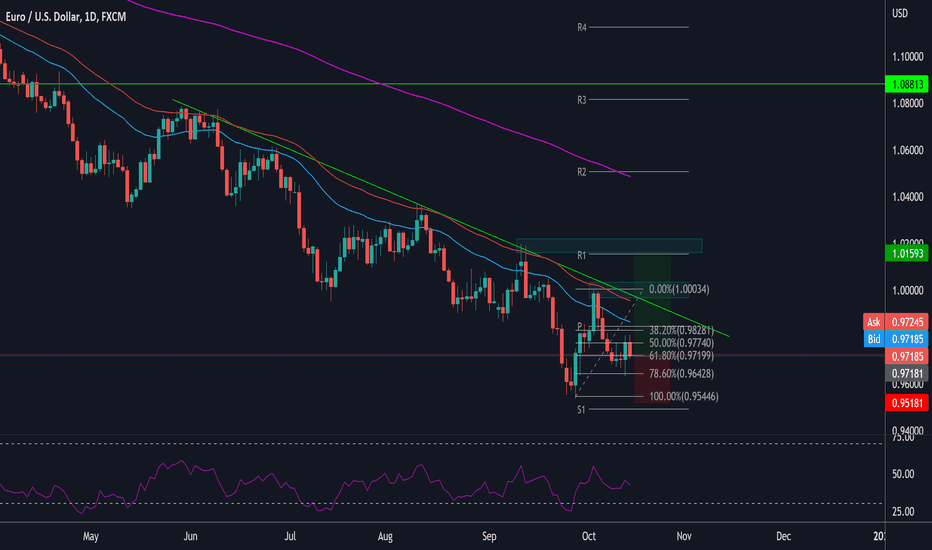

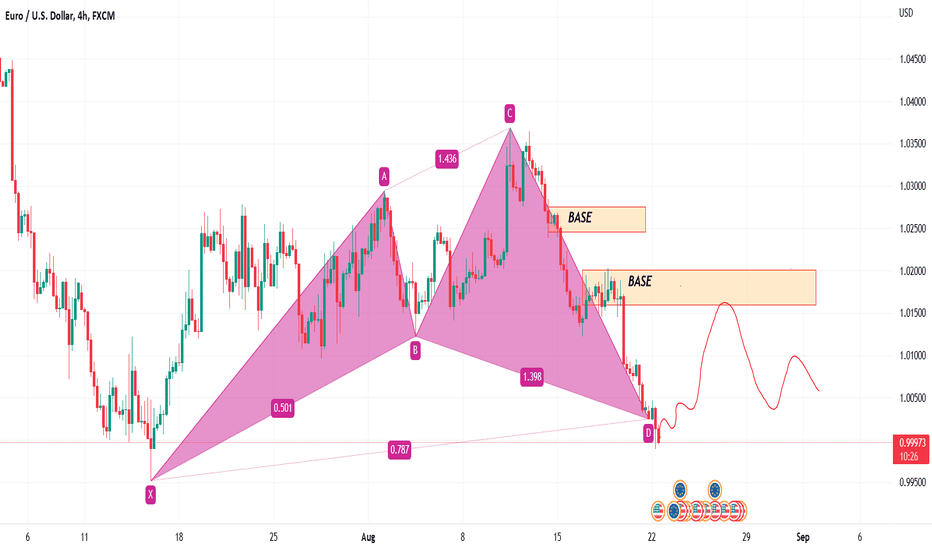

Bullish cypher + order block EURUSD created a bullish cypher pattern and is now trading below parity level.

We can notice a clear drop-base-drop structure.

Now I expect the price to retrace until the base (institutional zone).

We might consider to open then a short trade at the base if price reacts well at that level or for more aggressive trader we might now open a buy with the base as target.

The second opportunity is riskier because we would trade against the major and minor trend.

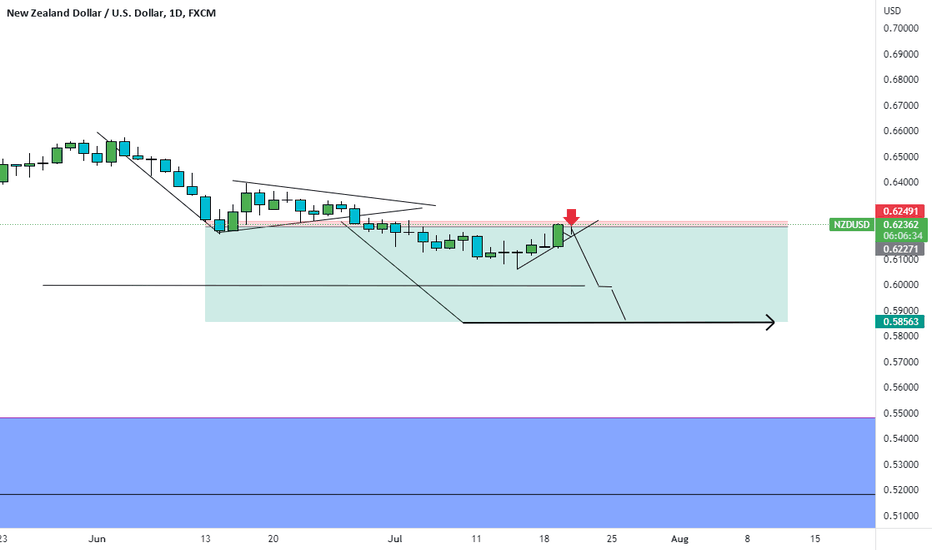

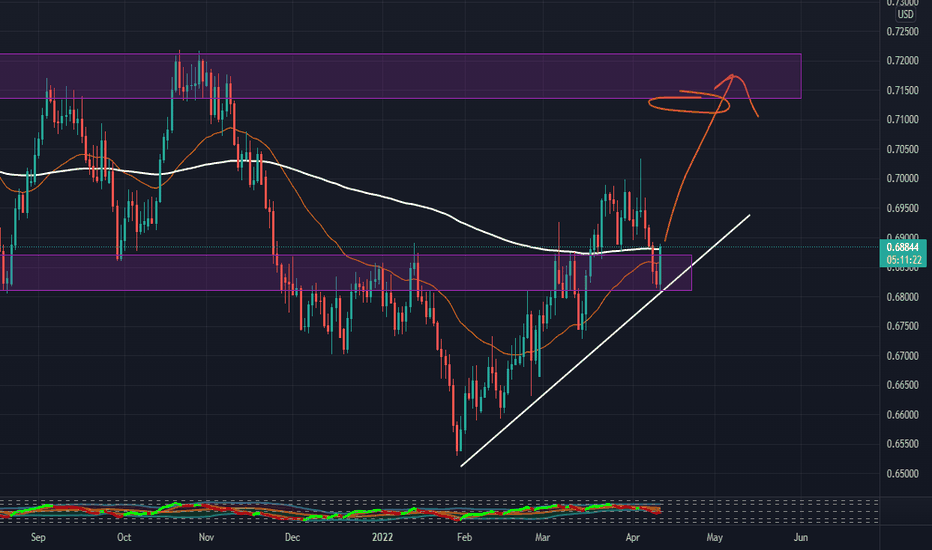

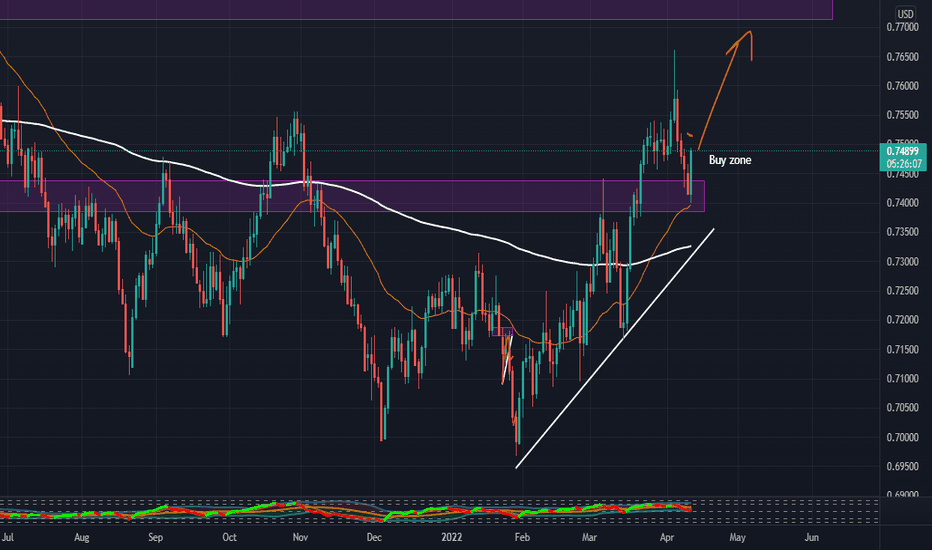

NZDUSD Best Setup Time to divorce GOLD 1 Structure 1/2 : bullish to sideways down

2 imbalances :target marked

3 Current Move 3: impulse

4 Entry TF : D1

4.1 ETF Structure: Bearish

4.2 move : Correction CIP

5 CIP

6 FIB: strong rejection at 50 almost done

7 candle Pattern: Up Momentum but not able to break resistance

8 Chart Pattern: Falling wedge REsistence

9 Volume : Very high on reversal

10 Momentum: Bearish to side ways

11 Volatility : Somewhere bullish

12 strength: curve bearish in bearish

13 Sentiment : weakest in commodities driven

14 Final conclusion: for refine your entry you also need to switch your tf in d1 to h4

15 Buy /Sell/Wait : Sell

16 Entry: 0.6225

17 Sl: 0.6255

18 Tp: 0.5856

19 Risk to reward Ratio: 1:17

Excepted Duration : 15days