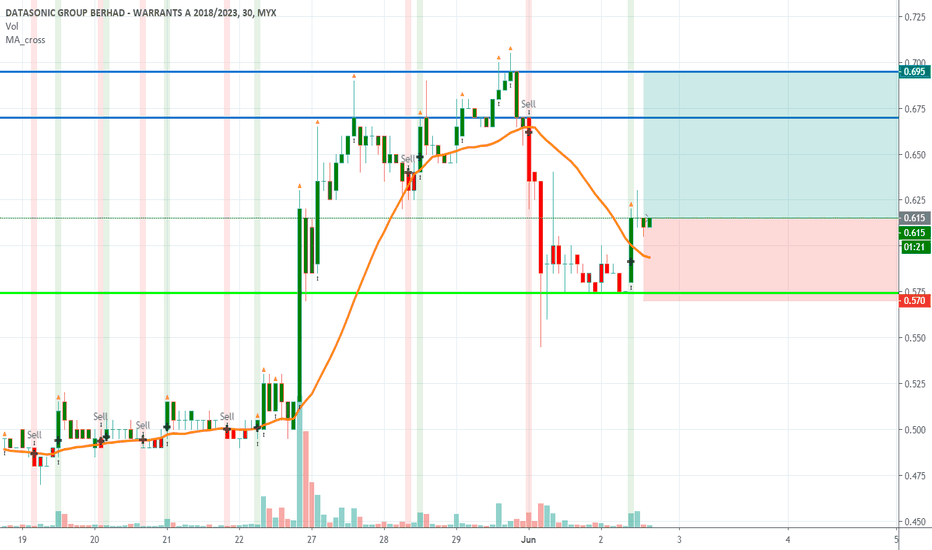

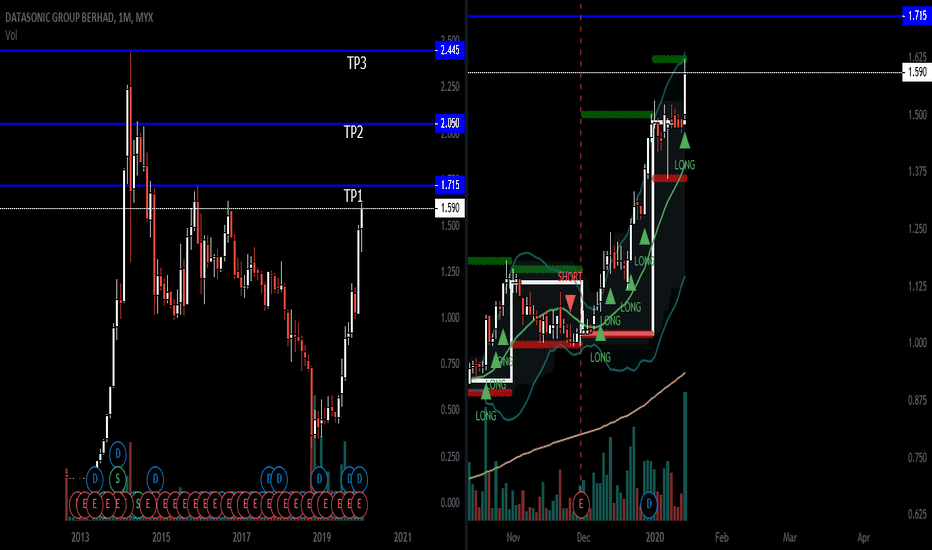

2/6/2020. Bursa Malaysia. DSONIC-WA mahu mendaki selaju sonic?Berpotensi untuk short swing dan mid swing

Dari segi TA (menggunakan indikator sendiri)

- Candle masih dalam keadaan hijau untuk daily chart

- Entry 0.610

- CL 0.570

- TP1 0.670 , TP2 0.695

- RRR = 1:1.22 , 1:1.78

(Dibawah ialah candle bagi daily chart )

(jika mahu menggunakan indikator saya, private chate saya di Trading View)

Malaysiastockmarket

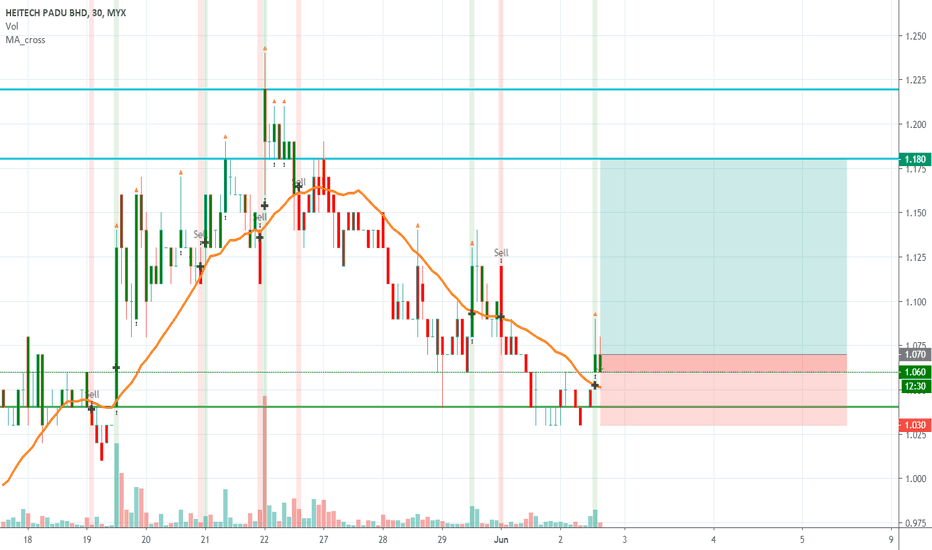

2/6/2020. Bursa Malaysia. HTPADU berpotensi untuk kenaikan paduBerpotensi untuk short swing dan mid swing

Dari segi FA

- PE > ROE

- Market volatile kerana hanya mempunyai 101.23juta jumlah share

- Sektor teknologi (Digital services)

Dari segi TA (menggunakan indikator sendiri)

- Candle masih dalam keadaan hijau untuk daily chart

- Entry 1.060

- CL 1.030

- TP1 1.18 , TP2 1.22

- RRR = 1:2.75 , 1:3.75

(Dibawah ialah candle bagi daily chart)

Jika mahu menggunakan indikator saya, boleh private chat saya

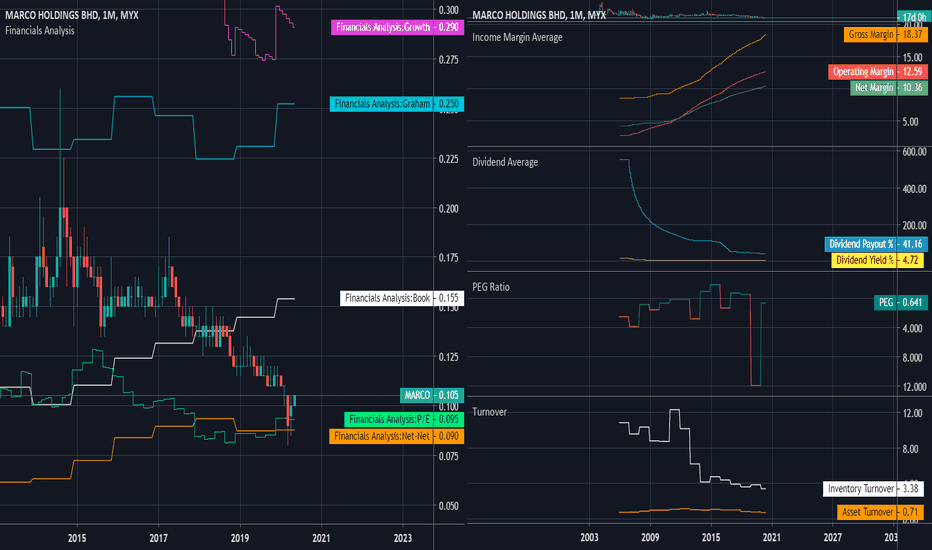

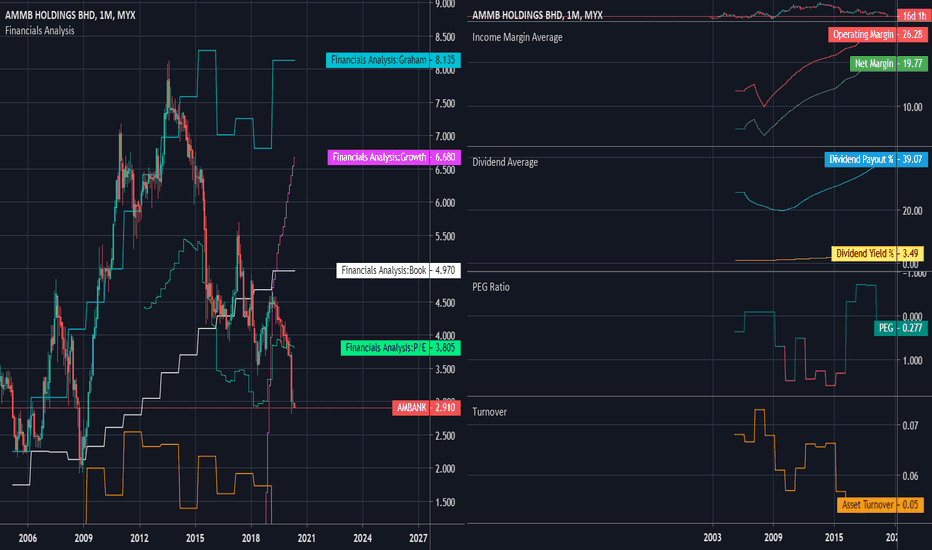

MARCO - Malaysia StockLeft-Chart - Buy below these indicator

Right chart - Analysis

Growth - Potential Growth of the stock price based on historical performance

Book - {Safety Precaution} Even if the company Bankrupt, you MAY still profit. Calculation based on all asset.

Net-net - {Safety Precaution} Even if the company Bankrupt, you have higher chance still profit. Calculation based on current asset only

P/E - Buy below this price if you want fast return on your investment.

Graham - Using Graham's number formula (Google it, I'm not sure how to explain)

Income Margin Average - Average Margin

Dividend Average - Average dividend

PEG Ratio - Indicator to show overvalued or undervalue share price. Over 1 is overvalued, under 1 is undervalued

Turnover - Measures the efficiency of a company's use of its assets in generating sales revenue or sales income to the company.

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Although left chart are not so great, but company performance doing great, the margin average are going up, consistent dividend yield and nice turnover.

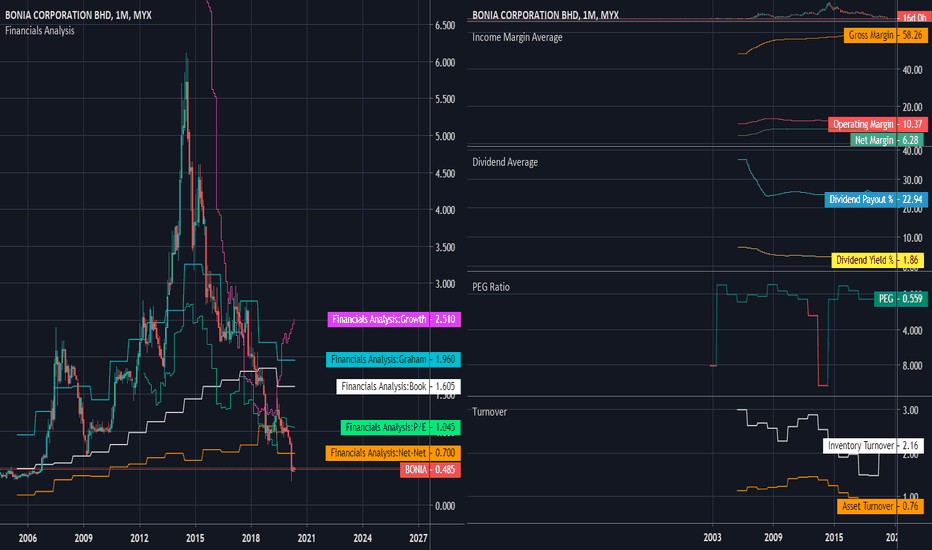

BONIA - Price just like when they go public!BONIA

BONIA - A luxury fashion company. I like their products. I'm fan of leatherwear.

As you can see their stock price have been falling since 2014, that doesn't seem very good. BUT looook to the left even more! It almost same as the price when they go public, HAHA. (poor Bonia founder keeping their shares for 17 years just to get breakeven).

Well well, it's an opportunity for people like us that born late to the game to get this kind of price. The company have good performance, stable profit, efficient in managing their goods and assets, having lower debt ratio (debt<asset/current/equity), a stable like dividend, and the most important thing the price is very cheap!

p.s. it also very safe even if they go bankrupt, look at the Net-Net indicator and Book indicator, it means even if they go gg, we may still profit or at least get our investment back. (Not guaranteed, don't blame me if something goes wrong)

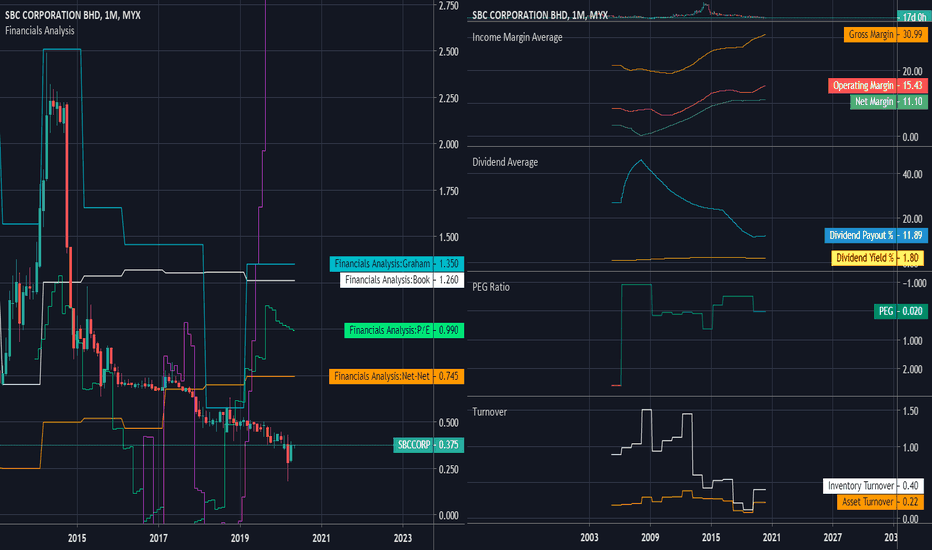

SBCCORP - MALAYSIA STOCKLeft-Chart - Buy below these indicator

Right chart - Analysis

Growth - Potential Growth of the stock price based on historical performance

Book - {Safety Precaution} Even if the company Bankrupt, you MAY still profit. Calculation based on all asset.

Net-net - {Safety Precaution} Even if the company Bankrupt, you have higher chance still profit. Calculation based on current asset only

P/E - Buy below this price if you want fast return on your investment.

Graham - Using Graham's number formula (Google it, I'm not sure how to explain)

Income Margin Average - Average Margin

Dividend Average - Average dividend

PEG Ratio - Indicator to show overvalued or undervalue share price. Over 1 is overvalued, under 1 is undervalued

Turnover - Measures the efficiency of a company's use of its assets in generating sales revenue or sales income to the company.

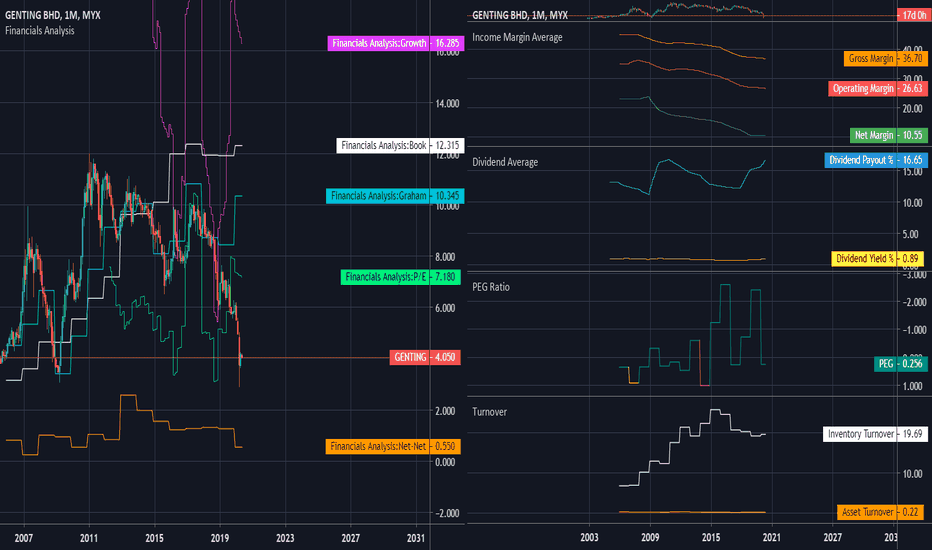

GENTING - MALAYSIA STOCKLeft-Chart - Buy below these indicator

Right chart - Analysis

Growth - Potential Growth of the stock price based on historical performance

Book - {Safety Precaution} Even if the company Bankrupt, you MAY still profit. Calculation based on all asset.

Net-net - {Safety Precaution} Even if the company Bankrupt, you have higher chance still profit. Calculation based on current asset only

P/E - Buy below this price if you want fast return on your investment.

Graham - Using Graham's number formula (Google it, I'm not sure how to explain)

Income Margin Average - Average Margin

Dividend Average - Average dividend

PEG Ratio - Indicator to show overvalued or undervalue share price. Over 1 is overvalued, under 1 is undervalued

Turnover - Measures the efficiency of a company's use of its assets in generating sales revenue or sales income to the company.

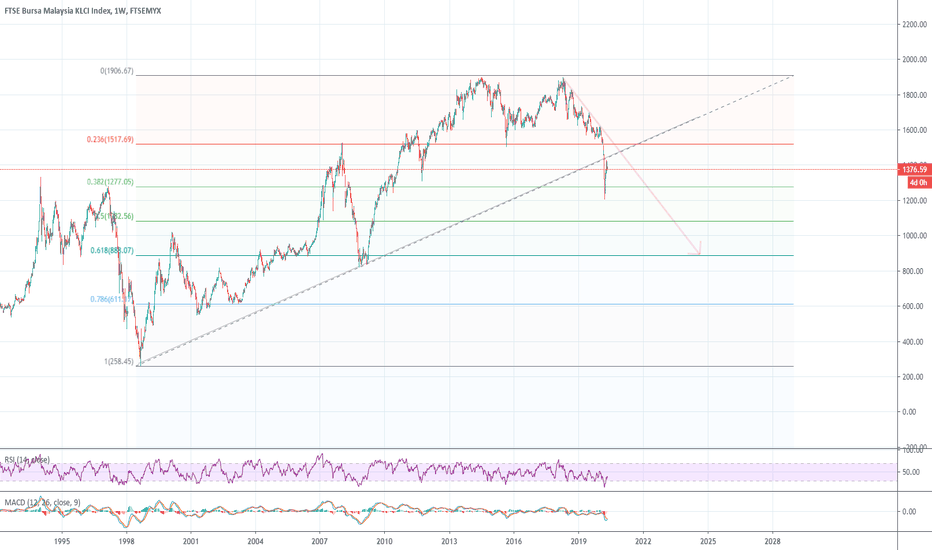

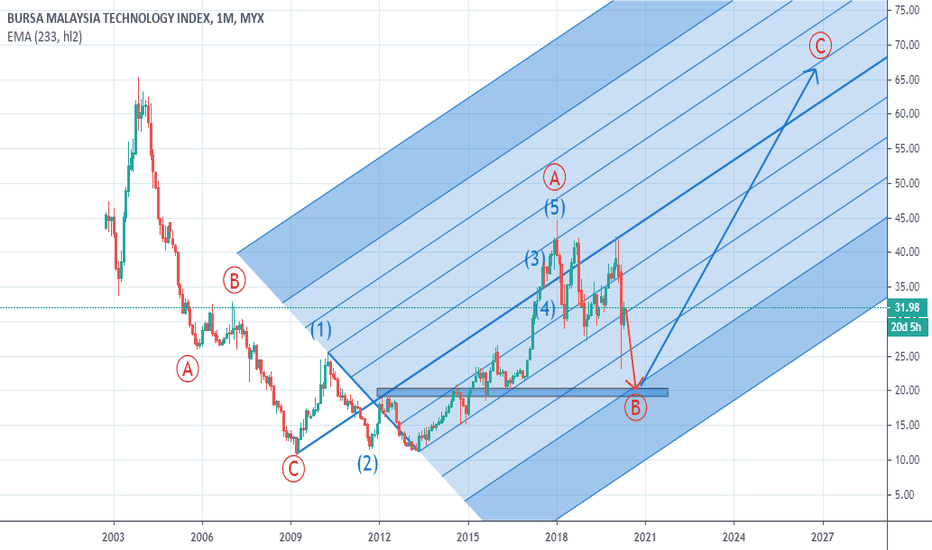

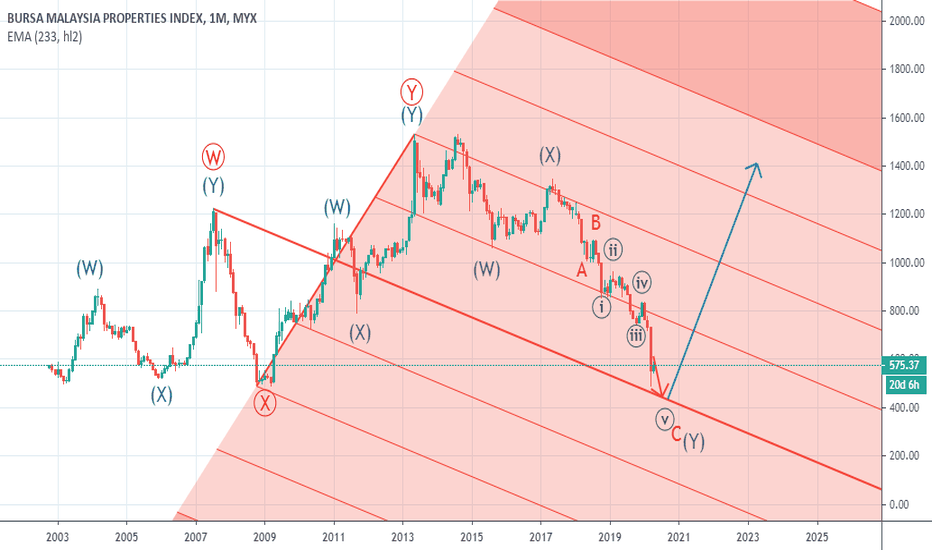

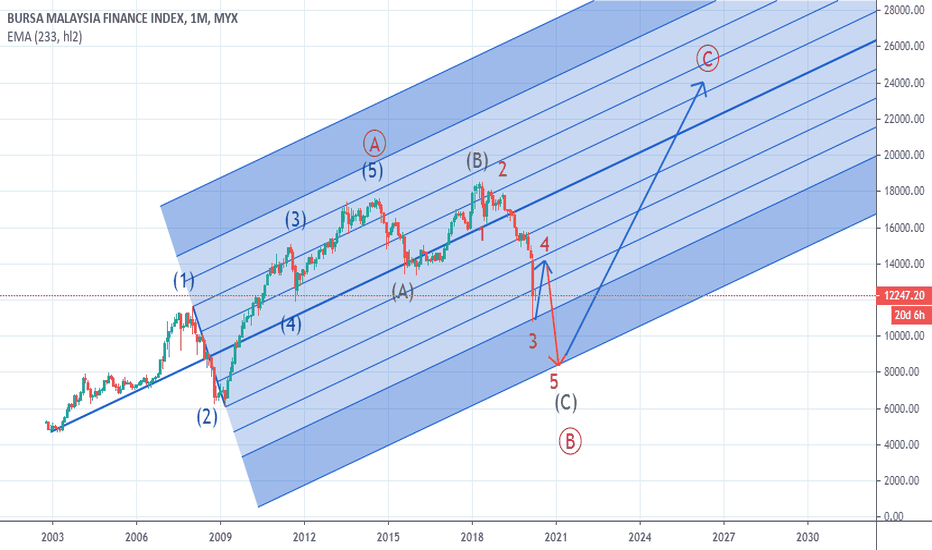

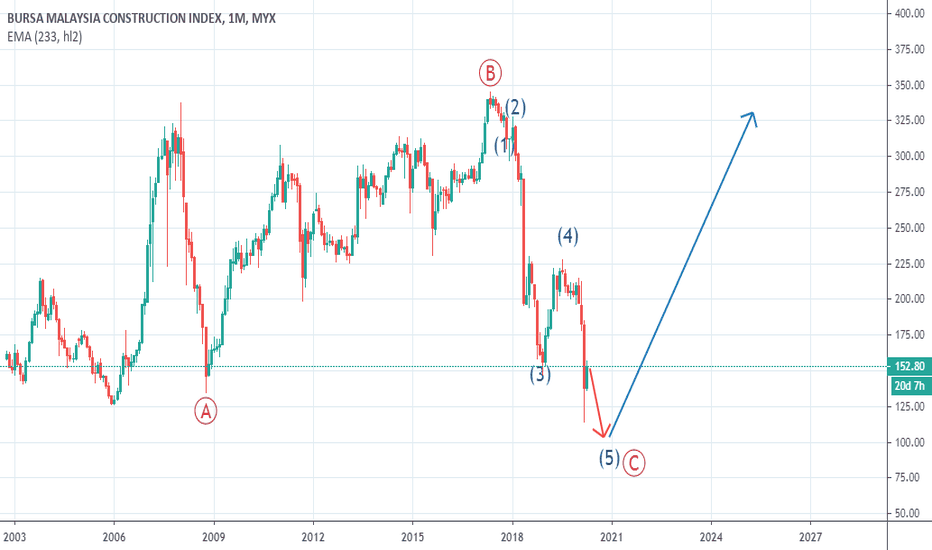

Longest Bear market in history for FBMKLCI is about to be made.Bearish market until 2024?

the trader is having no trouble making money in the bearish market but an investor who aims for long term investment is having trouble with this.

EPF, Tabung Haji and ASB earning will be lower each year in this coming few years.

I wish I could be wrong about this as our Rakyat will suffer more than ever but they don't know why.

Everyday is a struggle.

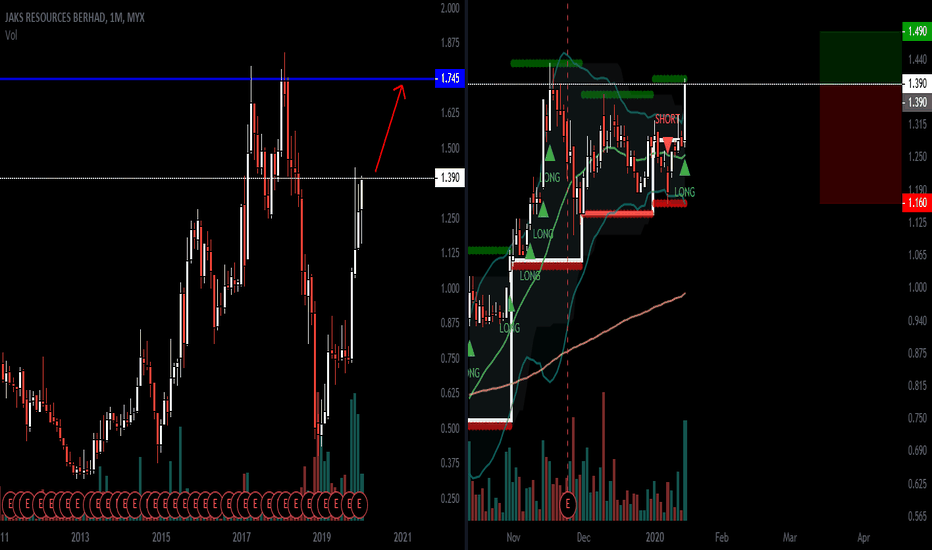

Let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied.

I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

Buy at your own risk.

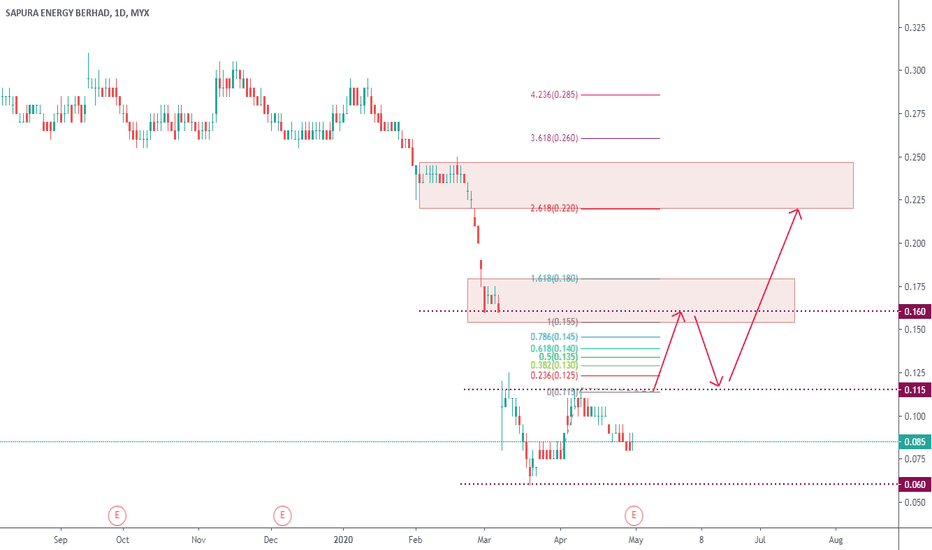

POTENTIAL LONG FOR OIL COUNTER (MYX:SAPRNG)Potential double bottom and might be close the gap if break resistance level MYR 0.115. We can chip in long or wait until the price break the resistance and make pullback to the breakout pattern.

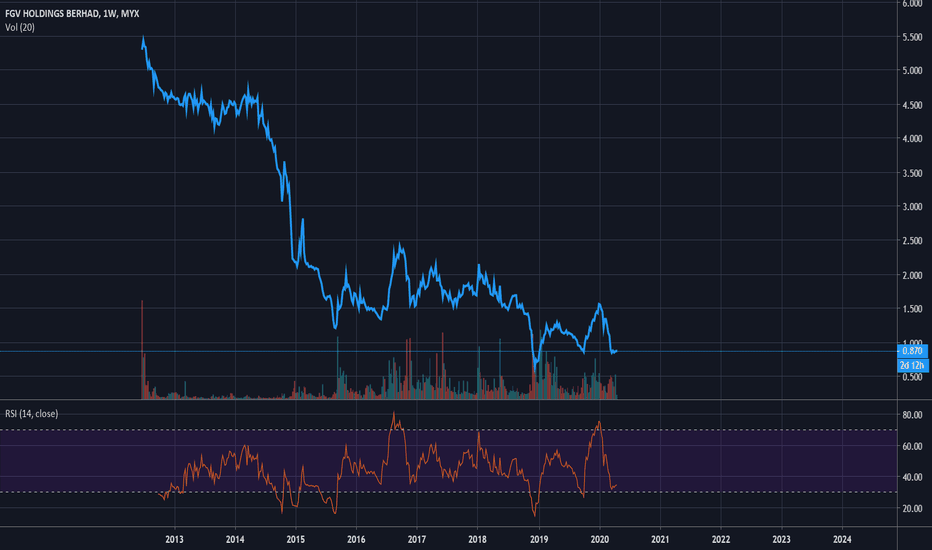

FGV FELDA Strong Buy To RM1.025 and RM1.333| 15th Apr 20The most controversy stock in Malaysia which is Malaysian-based global agricultural and agri-commodities company. With operations worldwide, FGV produces oil palm and rubber plantation products, soybean and canola products, oleochemicals and sugar products.

Trending the price at RM0.87 as this article published. As I made an analysis, I believe the price can go up above RM1.025 as the chart tells us on the weekly started to give a very very good signal and we stumbled upon it at the right time. The grape has ripe.

With their new CEO of Haris Fadzilah bin Hassan, I believe the stock can make a comeback by this year 2020. I heard some say that India will not buy our palm oil and they will buy from Indonesia. Whether it is true or not, let it be. We can sell our palm oil to other side of market despite India is the biggest buyer palm oil at Malaysia. The demand for FGV stock has now being in the good potential result after several years the stock has been compromised within the Malaysian political economy. The demand of the palm oil now is being in the topic and people around the world will looking towards our the best quality product of palm oil.

Regards,

Zezu Zaza

2048

DSONICBreakout from consolidation, stop loss below the swing fractal low. May result in big trend but may take profit in tp1 tp2 or tp3 if the swing still intact. TAYOR.