Trading at the Market OpenTrading at the Market Open

The market open marks a critical juncture in the financial world, presenting a unique blend of opportunities and challenges for traders. This article explores the essence of trading at the open across stocks, forex, and commodities. It delves into the heightened volatility and liquidity characteristic of this period, offering insights and strategies to navigate these early market hours effectively, setting the stage for trading opportunities.

What Does the Open Mean in Stocks, Forex, and Commodities?

The open signifies the start of the trading day for various financial markets. It's a time when trading activity surges, marked by a rush of orders that have accumulated since the previous close. In stock markets, this includes shares, indices, and Exchange-Traded Funds (ETFs). The influx of orders often leads to significant price movements as the market absorbs overnight news and global economic developments.

For forex and commodity markets, the open can vary by region, reflecting their 24-hour nature. This period is crucial for setting the tone of the trading day, offering insights into sentiment and potential trends. Traders closely watch the market open to gauge the strength of these movements, which can indicate broader market trends or sector-specific shifts.

Volatility and Liquidity at Market Open

Trading at the open is often marked by enhanced volatility and liquidity. Heightened volatility is primarily due to the influx of orders accumulated overnight, reacting to various global events and news. As traders and investors assimilate this information, rapid price movements are common, especially in the first few minutes of the session. These price fluctuations can present both opportunities and risks for traders.

Increased liquidity, which refers to the ease with which assets can be bought or sold without causing significant price movements, is also a characteristic of the open. A higher number of market participants during this period may result in better order execution and tighter bid-ask spreads, particularly in highly liquid markets like forex and major stock indices.

What to Know Before the Market Opens

In terms of things to know before the stock market opens, it's essential to review the overnight and early morning news that can affect stocks. This includes company earnings reports, economic data releases, and geopolitical events. Traders also check pre-market trading activity to gauge sentiment and potential opening price movements.

For forex and commodities, understanding global events is crucial. Developments in different time zones, like policy changes by central banks or shifts in political scenarios, can significantly impact these markets. Additionally, reviewing the performance of international markets can provide insights, as they often influence the US open.

It's also vital to analyse futures markets, as they can indicate how stock indices might open. Lastly, around the forex, commodity, and stock market openings, indicators and other technical analysis tools applied to the previous day can also offer valuable context for the day ahead.

Market Open in Different Time Zones

Market open times vary globally due to different time zones, significantly impacting trading strategies. For instance, the New York Stock Exchange (NYSE) opens at 9:30 AM Eastern Time, which corresponds to different times in other parts of the world. For traders in London, this translates to an afternoon session, while for those in Asian markets like Tokyo, it's late evening.

Forex, operating 24 hours a day during weekdays, see overlapping sessions across different regions. For example, when the Asian trading session is concluding, the European session begins and later overlaps with the North American session. Such global interconnectivity ensures that forex markets are active round the clock, offering continuous trading opportunities but also requiring traders to be mindful of time zone differences and their impact on liquidity and volatility.

Strategies for Trading at Market Open

Trading at market open requires strategies that can handle rapid price movements across all markets. Here are some effective approaches:

- Pay Attention to Pre-Market Trends: This helps traders assess how a stock might behave at the market open. If a stock is fading from post-market highs, it might be wise to wait for a trend change before entering.

- Gap and Go Strategy: This involves focusing on stocks that gap up on positive news at market open, an indicator of potential further bullishness. Traders look for high relative volume in pre-market and enter trades on a break of pre-market highs. This strategy is fast-paced and requires quick decision-making.

- Opening Range Breakout (ORB): The ORB strategy uses the early trading range (high and low) to set entry points for breakout trades across all types of assets. The breakout from this range, typically the first 30 to 60 minutes of the session, often indicates the price direction for the rest of the session. Time frames like 5-minute, 15-minute, and 30-minute are commonly used for ORB.

- Gap Reversal: The gap reversal method is used when the price creates a gap, but then the range breaks in the opposite direction. If the gap is bullish and the price breaks the lower level of the opening range, it signals a gap reversal. The same concept applies to bearish gaps but in reverse.

The Bottom Line

In essence, understanding unique features of market open trading is vital for those participating in stock, forex, and commodity markets. The opening moments are characterised by heightened volatility and liquidity, driven by global events and sentiment. However, savvy traders may capitalise on these early market dynamics with effective strategies.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Marketopen

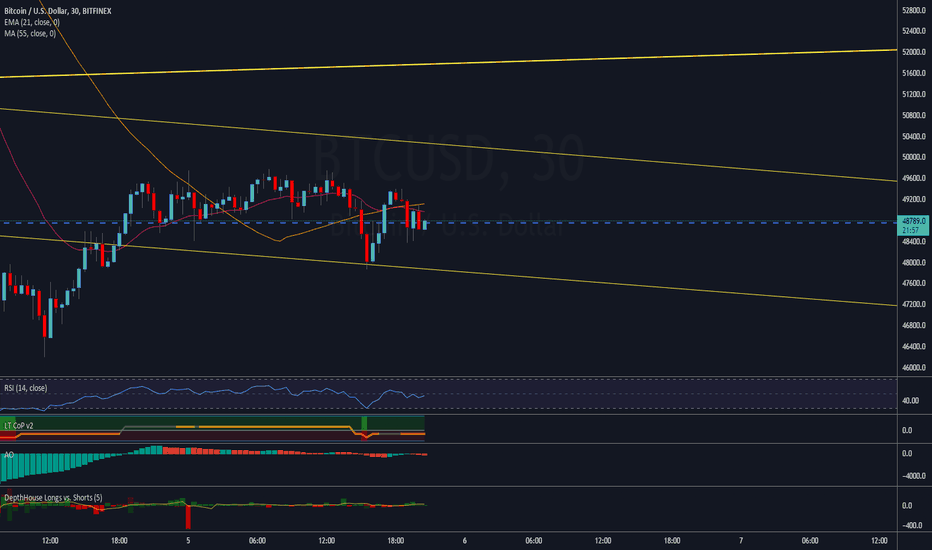

Bitcoin direction on market open at 9pm UTC? UP or DOWN?Howdy friends!

SO when market volume comes in the next hours,

will we see Bitcoin go UP???

Will we see a new monthly low or a blast up over 50k+???

Please let me know what you think below, love to hear what everyone is seeing, thinking, and feeling...

Please check out my other bitcoin and crypto charts, gimmie a follow if you like it, let me know in comments too x

have a powerful rest of 2021, buckle up!

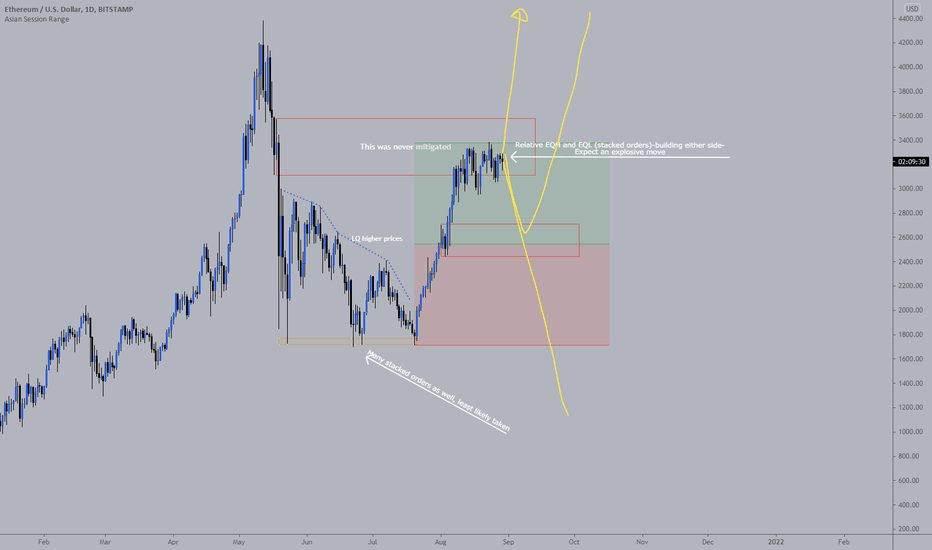

Explosive ETH move incoming?Good morning traders and welcome to a new week!

ETH continues to follow the forecasts I outlined last week. We are deep in the daily range that was never mitigated and we can see orders being stacked in both directions.

This only means 1 thing, a strong move is coming, stacked orders mean liquidity for whales to move orders, moving big orders makes big market moves.

I am still expecting a pullback in this overheated move up before the market continues higher, however with this much liquidity stacked anything is possible.

As always trade safe

EnvisionEJ

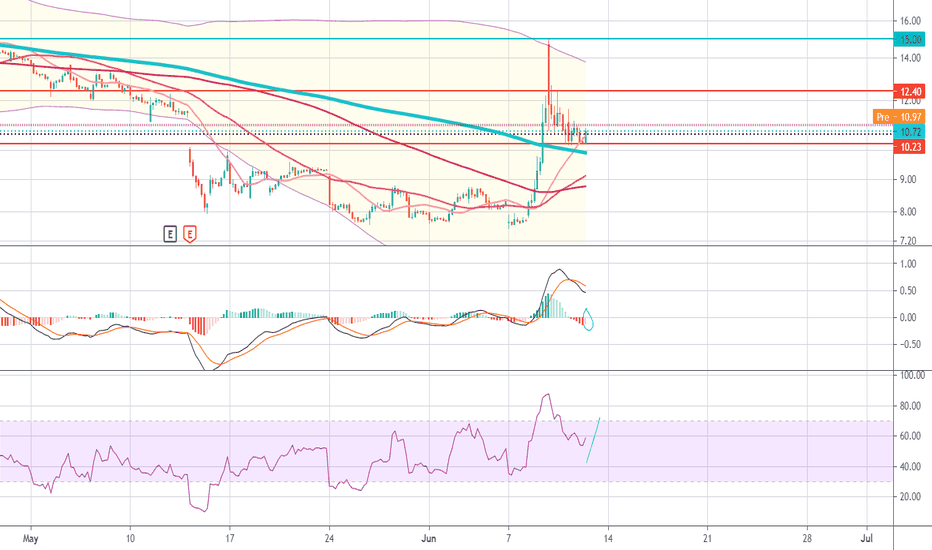

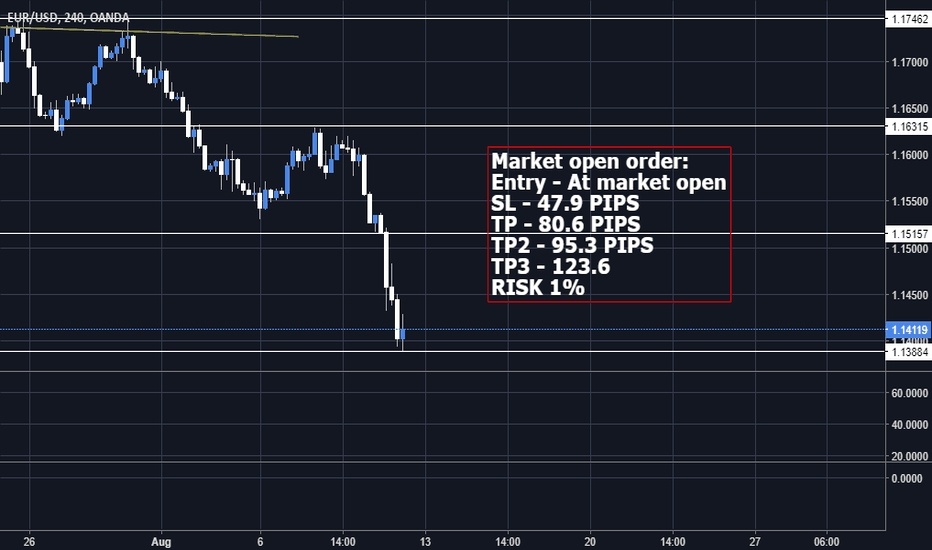

Long WISH - Target @ 15, 16.9, 20.11I have a long position on $WISH as an open market volume scalp.

The following reasons are why I am long:

High probability of retesting new high at 15

MACD (4hr tf) building up buying pressure gradually rather than abruptly (not forming triangle)

MACD (1hr tf) potential cross over upcoming in case seller volume continues to decrease

RSI remains in a buyers area

Price holding above support at 50 and 20 MA, perhaps to retest VWAP (4hr TF)

VWAP acting as support (1hr TF)

~2%+ pre-market

I have my initial target at 15, but if we push past VWAP and all indicators continue to point bullish I would aim for VWAP at 16.9, then we should push to next R at 20.11. (4hr TF)

This strategy is SHORT TERM and only during market opening volume. In case optimal volume or price is not reached during the earlier part of the market session I will close my positions.

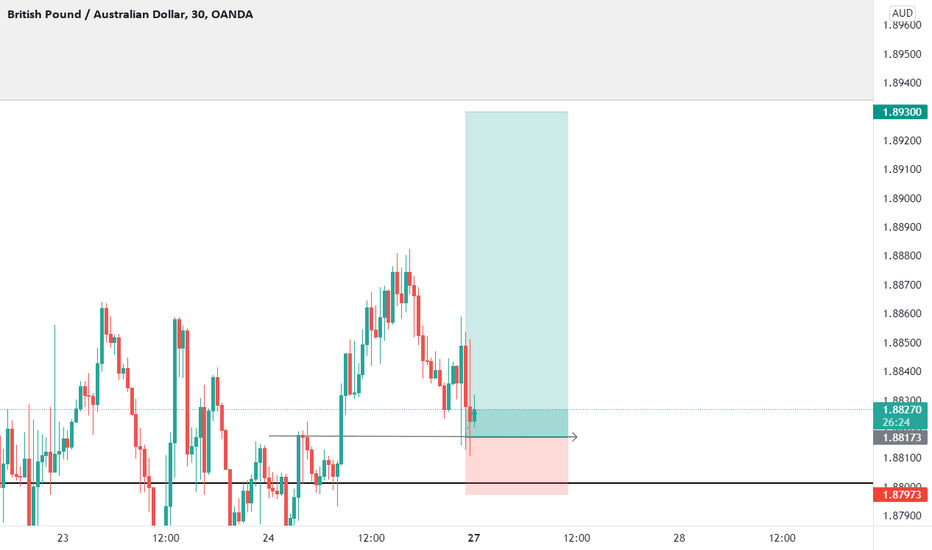

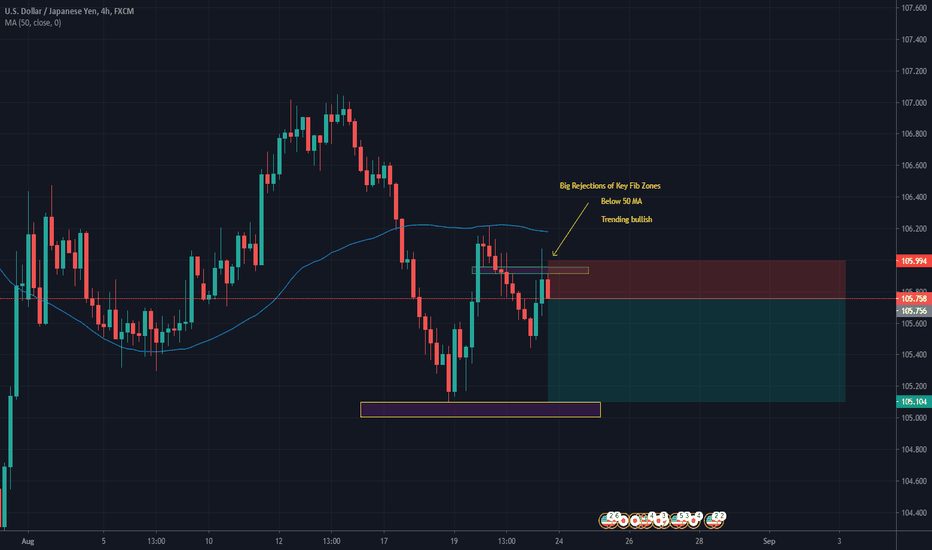

***USDJPY*** Bears are starting the weekI believe that USD/JPY will continue bearish at market open. Monday morning market open is always risky but I believe my analysis holds a strong case for it to remain bearish. Firstly on the 5 minute chart, we see a engulfing bearish candle with the overall session pushing to the downside. We are also trending below the 50 MA which to me indicates a continuation of the downtrend. This small pullback has also held up nicely on the FIB as we see strong rejections of the 0.78 and 0.5 zone.

On market open i will wait to see if we see a small retest of the zone and then look at entering for a short, targeting the recent lows. If I am sure the lows will be hit I will trail and stop my way to the bottom of the trend.

Remember this is just my opinion, take it with a grain of salt and use proper risk management.

Please comment, like and follow so I can continue to provide helpful content.

HAPPY TRADING

-MATT

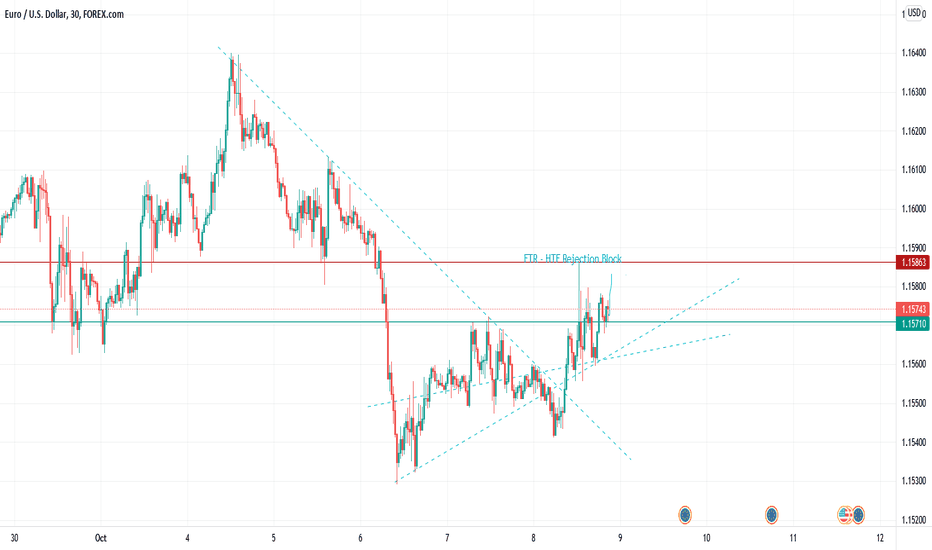

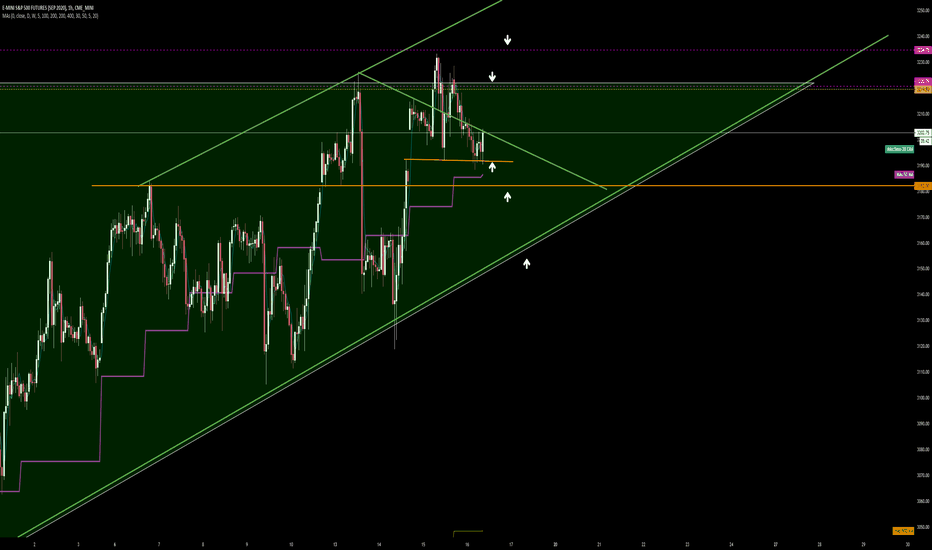

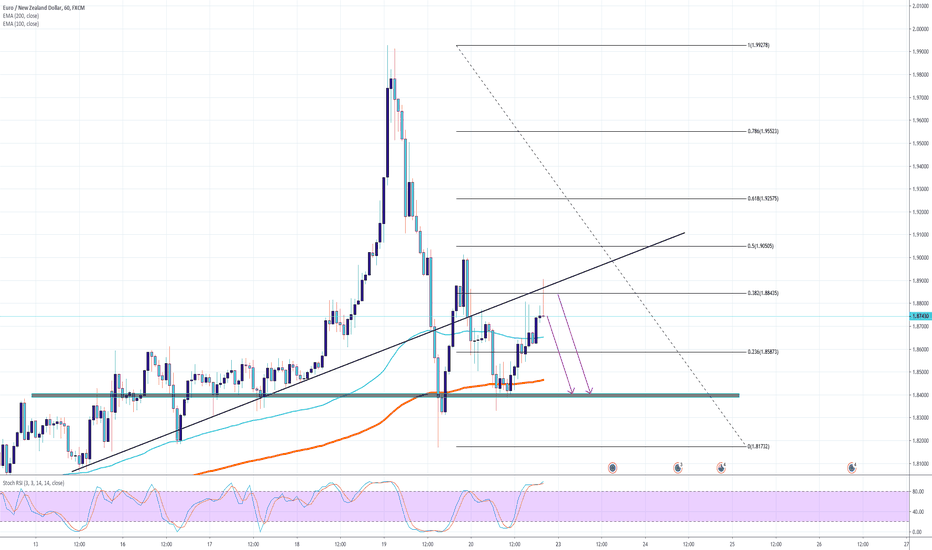

Plan Your Trades BEFORE Market OpenBefore the trading day starts its imperative to have a plan. This will keep you from making decisions on-the-spot which are usually emotionally driven. We all suffer from our emotions affecting our trading, so we need to do everything we can to limit these affects.

Make sure you are taking into account support and resistance on the monthly, weekly, daily, and 4 hour chart. You can drill down further to using 1 hour and 5 minute, or even a 1 minute or 30 second chart, but first you must have the other time frames charted out.

Make sure you only draw support and resistance lines that will trade on. Anything else is just noise and a distraction. Many new traders draw trend lines and support lines everywhere they see them, which will later overwhelm the trader and make it impossible to trade.

When you draw a trend line or support/resistance line, Tradingview gives you the option to select which time frames they appear on. So if you don't want your 5 minute trend lines appearing on your monthly chart, I suggest creating a template called "5 Minute" for trend lines and unchecking the higher time frames. This will give you a much cleaner chart.

I use arrows to dictate where I will long and short. I move them later into the day if they happen to get in the way.

If this helped you in any way, please leave a like and follow!

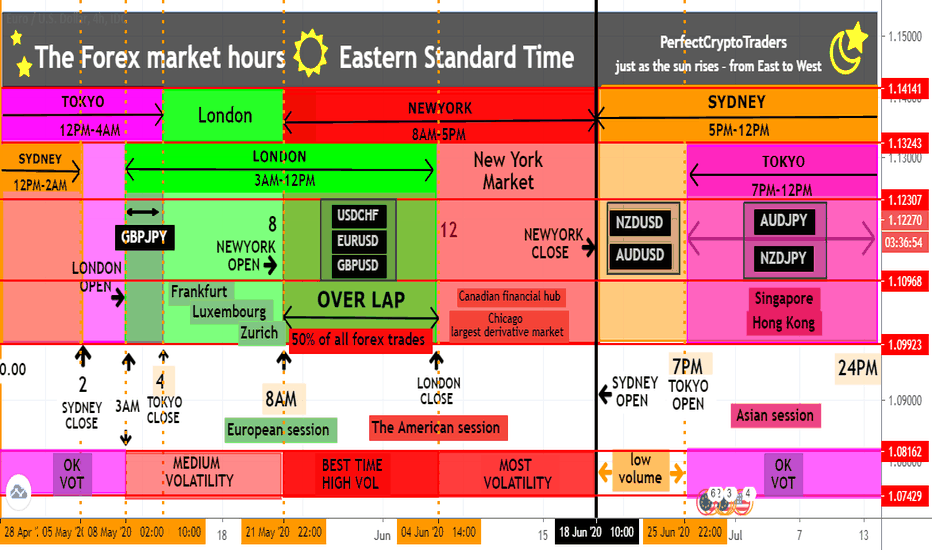

Forex Market Hours and Sessions (everything you need to know)As Forex traders, it is very important to know when the Forex market opens and closes what is the availability of the market . Moreover, it is important to understand how do the different trading hours or sessions impact your trading strategy.

The Forex market opens and closes as well as the four global sessions.

Fx market is open 24-hours a day for retail trade* every Sunday at 5 pm EST . It then closes each Friday at 5 pm EST.

Please note that market liquidity is very low at the start of the trading week. Therefore, many traders consider the market to be open only for the 5 weekdays.

At this point you may be asking, if Forex is indeed a 24 hour market, why can I only trade Monday through Friday?

*************************************************

What is a retail trader, you ask? Put simply, a retail trader is someone who buys or sells for their personal account, and not for another company or organization. So unless you are an institutional trader, you are a retail trader.

*************************************************

This brings me to a very common misconception in the Forex world – the idea that the market closes on weekends. In truth, the Forex market never closes. The only thing that closes is the ability for retail traders to participate.

This is what creates so called “gaps” when the market opens at the beginning of the week. It’s simply the result of your broker updating their charts from last week’s price action to the current price action at the start of the trading week.

For now, just know that the market never closes due to the needs of international trade, as well as the needs of central banks and global industries to conduct business.

So although the ability for retail traders to participate is halted over the weekends, the Forex market as a currency exchange is alive and well.

There are various sessions that occur around the world which make up the Forex hours each day.

Let’s take a look at those market sessions

Because this is a 24 hour market, there is always at least one active trading session. There are even times when these sessions overlap.

The easiest way to visualize how these Forex market sessions operate is to imagine the earth relative to the sun. Wherever the sun is shining, the Forex market is open. This is of course a simplified way of thinking about it, but it does help to visualize the Forex hours in this way.

A trading week consists of the following major sessions:

-- - - Session - - - - - - - - - Duration (GMT/ET)

Sydney (Australian) - - - - - GMT: from 10:00 PM GMT to 7:00 AM GMT

- - - - - - - - - - - - - - - - - - ET: from 5:00 PM ET to 2:00 AM ET

Tokyo (Asian) - - - - - -- - - GMT: from 12:00 AM GMT to 9:00 AM GMT

- - - - - - - - - - - - - - - - - - ET: from 8:00 PM ET to 4:00 AM ET

London (European) - - - - - - - - - GMT: from 8:00 AM GMT to 5:00 PM GMT

- - - - - - - - - - - - - - - - - - ET: from 3:00 AM ET to 12:00 PM ET

NewYork (American) - - - - - - - - --GMT: from 1:00 PM GMT to 10:00 PM GMT

- - - - - - - - - - - - - - - - - - ET: from 8:00 AM ET to 17:00 PM ET

Greenwich Mean Time (GMT).

Eastern Standard Time(ET).

As you can see from the chart above, there are several market sessions which overlap. The most obvious, and the most heavily traded, is the London / New York overlap. This is when liquidity is at its highest as many Forex market participants prefer trading during this time.

But like most things, it’s all relative to your trading style as well as your lifestyle. Obviously if you’re located in a part of the world where the London / New York session overlap occurs at 3 AM, this may not be the most advantageous for your lifestyle.

The great thing about trading price action on the higher time frames is that Forex hours and market sessions don’t particularly matter. For example, if you spot a bullish pin bar on the daily time frame, you would simply set your pending order and let the market decide what becomes of it. It doesn’t particularly matter which session triggers the order.

But in the lower time frames

Learning the details of each session is key to identify market liquidity levels and spot the optimal times to place an order. That’s why in this article we will review the Forex market hours and the best times to trade.

Let’s begin!

The four global sessions

Sydney Session

Tokyo Session

London Session

New York Session

Let’s look at the sessions one-by-one and see what exactly happens over a 24-hour period on the Forex Market.

SYDNEY SESSION

If we go from right to left (just as the sun rises – from East to West), then you will notice that the first major session to open is the Sydney Forex Market session. This session is open from 10:00 PM GMT to 7:00 AM GMT or from 5:00 PM ET to 2:00 AM ET.

Despite the low market volume versus other major sessions, when Sydney opens is when the Australian Dollar and New Zealand Dollar , in pairing with the US Dollar, get to the trading action.

TOKYO SESSION

The Tokyo session follows shortly after. This session is also called the Asian session , because right after Tokyo large economic hubs like Singapore and Hong Kong start waking up. The Asian session starts around 12:00 AM GMT, when most of Europe is in a deep sleep. This is why you often hear European traders talking about waking up at 3 AM to trade the Asian session before going back to bed.

Also, you may have already noticed that some Forex sessions overlap quite significantly. For example, the Australian session and Asian session. You can use this to your advantage knowing that pairs like AUDJPY and NZDJPY will have the highest volatility during the Forex Market Hours of these two sessions.

LONDON SESSION

Undoubtedly, London is the Economic Centre of Europe, and it’s just natural that the European session is also called the London session . Moreover, by the time the Brits wake up, other major economic hubs like Frankfurt, Luxembourg and Zurich have already started into their Forex Market Hours for the day.

An interesting observation is that the Forex Market Hours of the Tokyo and London sessions overlap for approximately 1 hour (varies for other European countries). You can (and probably should) use this fact to your advantage. This means that all the crosses of European currencies and the JPY will have the highest volatility at the start of the European session.

So if you are trading the GBPJPY you can simply carry out a few powerful trades between 8:00 and 9:00 AM GMT, and then you are free for the day.

NEW YORK SESSION

Forex market hours of the US start with New York. This is because New York is one of the biggest financial centers in the world as well as being the East-most major city in America. The American session includes other major economic hubs such as Chicago (World’s largest derivative market), Toronto (Canadian financial hub) , and others.

Market volume increases significantly as New York and London sessions, the two World’s biggest finance centers, overlap. The American session starts when Europe is only half-way through. Also, please note that you are going to get an extremely fast-paced and volatile market.

Volume traded during the New York and London sessions represents 50% of all forex trades in a day.

A lot of the major pairs like EURUSD, GBPUSD and USDCHF experience massive movements and specific patterns during this time.

Finally, you can see that although the New York and Australian sessions don’t overlap, they follow each other back-to-back, with a break during weekends.

As you could see from the information above, there are three main overlaps when you can see higher market activity, representing the best times for Forex traders:

The New York and London Overlap: from 1:00 PM to 5:00 PM GMT

The Tokyo and London Overlap: from 8:00 AM to 9:00 AM GMT

The Tokyo and Sydney Overlap: from 12:00 AM to 7:00 AM GMT

Advantages of a 24-Hour Market:

It offers the ability to trade at any time of the day regardless of where you live

There are very few gaps from day to day, unlike the stock market

More liquidity even during slower sessions

Disadvantages of a 24-Hour Market:

The 24 hour nature of the Forex market can lead to traders over-thinking their positions

The Forex market requires more self-discipline to take breaks away from trading due to the market never closing

The fact that the Forex market never sleeps means it’s easy to overtrade.

Instead of trading for a few hours each day, you may find yourself waking up early or staying up late just to place trades.

That’s a bad idea!

Furthermore, many new traders find it hard to take breaks from the market.

They feel the need to monitor their positions 24-hours a day.

This is one of the more destructive habits of new traders and is enabled by the fact that the Forex market never closes.

The good news is that these disadvantages are easily cured by a well-structured Forex trading course, discipline and no small amount of practice.

WHAT ABOUT WEEKENDS?

The weekend is the best time for planning. No open markets, no news, no economic events to disturb you. Ideally, it would be best if you don’t leave short term open positions over the weekend, while the Forex market doesn’t move over the weekend, there might be expectations on economic events that influence prices.

Elections, referendums, or similar events may cause market gaps, which can delay the trigger of StopLoss orders. In other words, the broker will close the trade when there’s a market, at the first available price, not at the one specified initially.

Scalpers, swing traders, and investors have a different time horizon . For this reason, they may have different expectations regarding the duration of a trade. Scalpers will strive for precision and accuracy. However, swing traders will strive to get the right market direction. Finally, investors will choose the time, rather than price, for positioning.

You should assess the risk to take the following week. This will depend on your trading strategy and profile.

CONSIDERING MAJOR ECONOMIC EVENTS

One of the main reasons why the Forex market moves come from economic data or news. Fortunately, these events are scheduled in the economic calendar . Then, traders know in advance that markets get volatile during specific hours of a day.

The impact of an economic event like the Non-farm payroll (NFP) in the US can alter the market’s usual behavior during the week.

So it is always handy to keep an economic calendar while planning your trading week.

Final Words

I hope this lesson has shed some light on the subject of Forex market hours as well as the various market sessions that make up a 24 hour period.

Here are a few key points to keep in mind:

Support me by pressing like button .

The Forex market is a 24 hour market that technically never closes

Retail traders are those who trade for their personal account

Retail trading hours in the Forex market are between 5pm EST on Sunday until 5pm EST Friday

There are 4 market sessions that make up the Forex market hours – London, New York, Sydney and Tokyo

Whatever your trading strategy, it is always beneficial to keep in mind the Forex Market Hours of the Four Forex sessions. Different sessions are dominated by different types of traders, banks, governments and, as we saw, – currency pairs. Taking this into account will certainly give you a competitive advantage.

Thanks for Support likes and follow

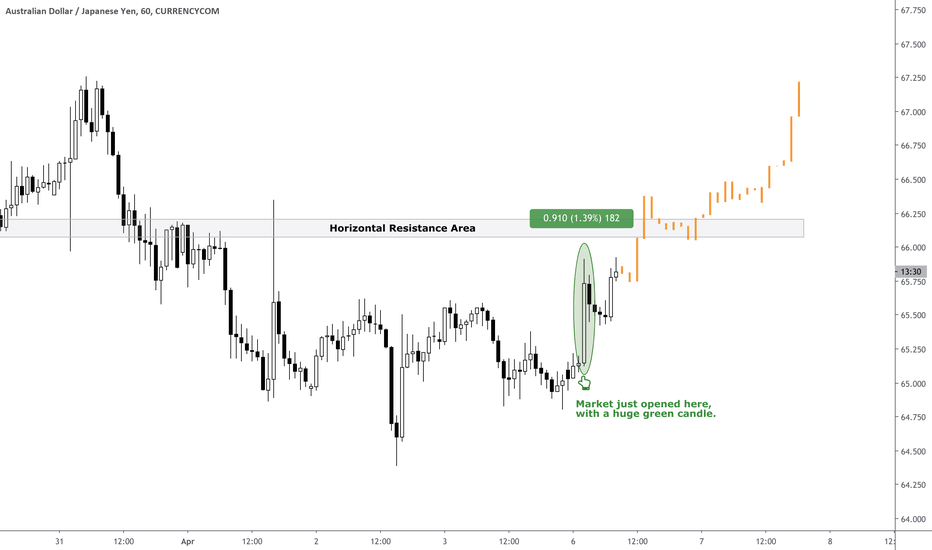

AUD/JPY Incredibly Bullish Directly after Market OpenWhat an amazing candle here directly after the open of the market. I got alerted through an Abnormal Volatility Alert of 100eyes and for both AUDJPY and NZDJP and just opened the chart. What a rare sight, not to see an open gap, but to have the market open normally at first, and then take off almost immediately thereafter.

I am really bullish on AUD/JPY and in forex trading the trend can be really powerful. AUD/JPY Definitely just started a strong uptrend.

The main thing to look at now is this horizontal resistance. Will the bulls be strong enough to push it all the way through the resistance? Or will this be the place that the bears finally wake up and start their trading week as well?

Follow me for consistent high quality updates, with clear explanations and charts.

Please like this post to support me.

- Trading Guru

--------------------------------------------------------------

Disclaimer!

This post does not provide financial advice. It is for educational purposes only!