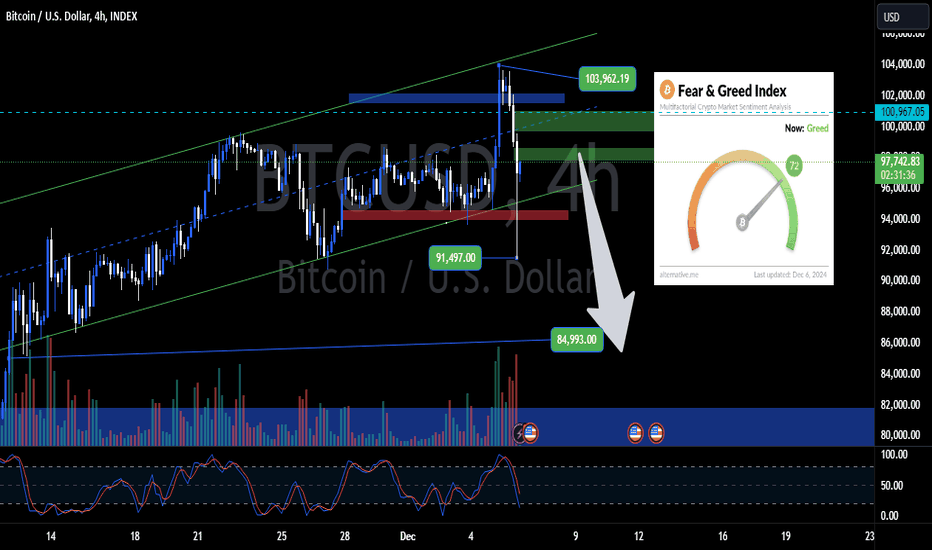

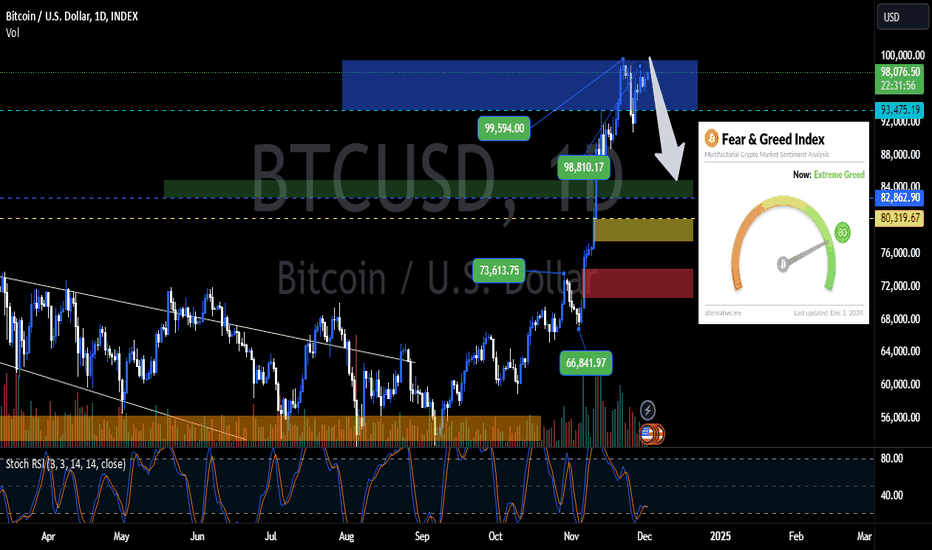

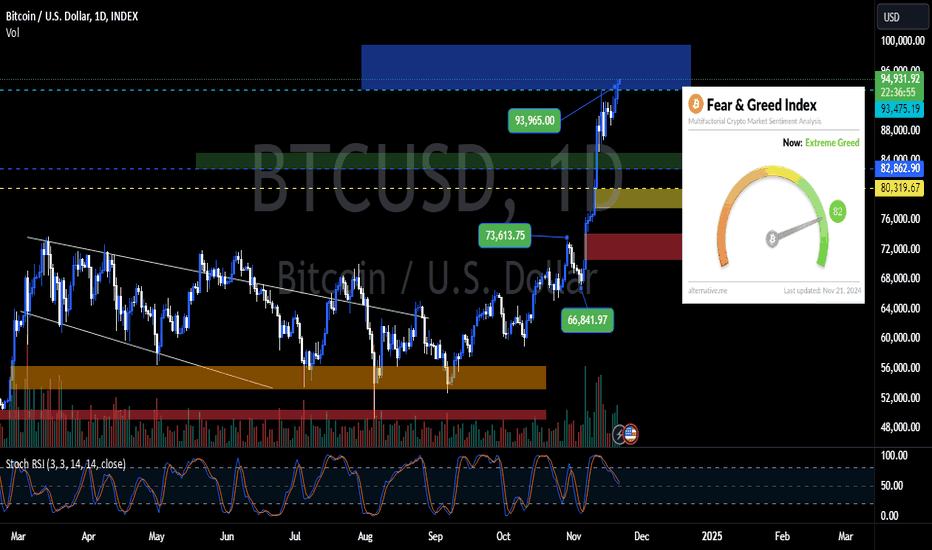

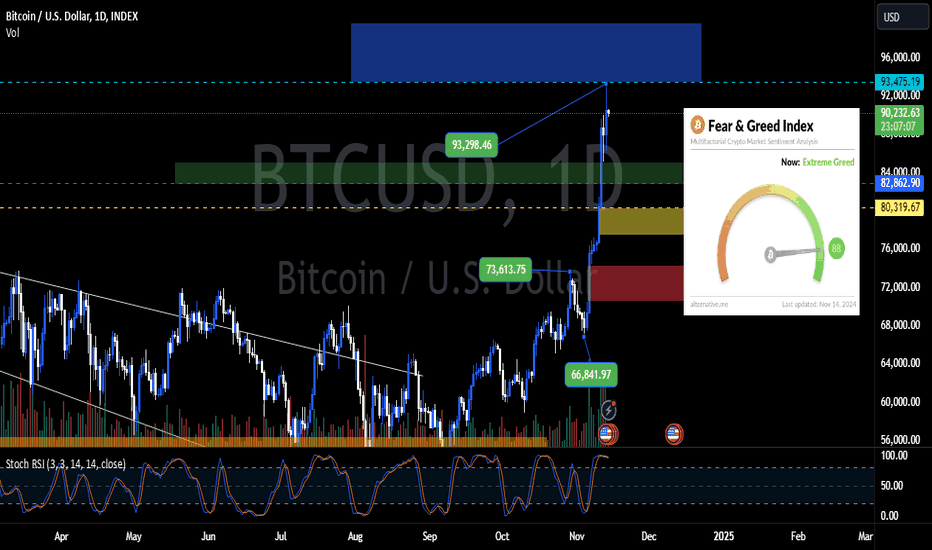

BTCUSD Hits 100K, but Is Correction Looming?Good morning, crypto enthusiasts! BTC finally hit the long-awaited 100K milestone, reaching as high as 104K on some exchanges. However, this morning saw a significant drop, breaking through our red zone at 94K-93K.

The fear and greed index has dropped to 72, now in the greed zone. On the H4 timeframe, the stochastic RSI is at 39 and heading toward the oversold area. Looking at the Daily timeframe, BTC has a big chance of continuing its correction, with potential targets in the 84K range, or pushing the fear and greed index toward the neutral zone first.

Currently, there’s no clear sign of another pump for BTC, and even if it happens, it might only retest 100K within our green zone.

Stay safe, avoid FOMO, and always manage your risk. That’s all for today’s crypto update. Akki signing off, one chart at a time. Have a nice day and stay SAFU!

Marketoutlook

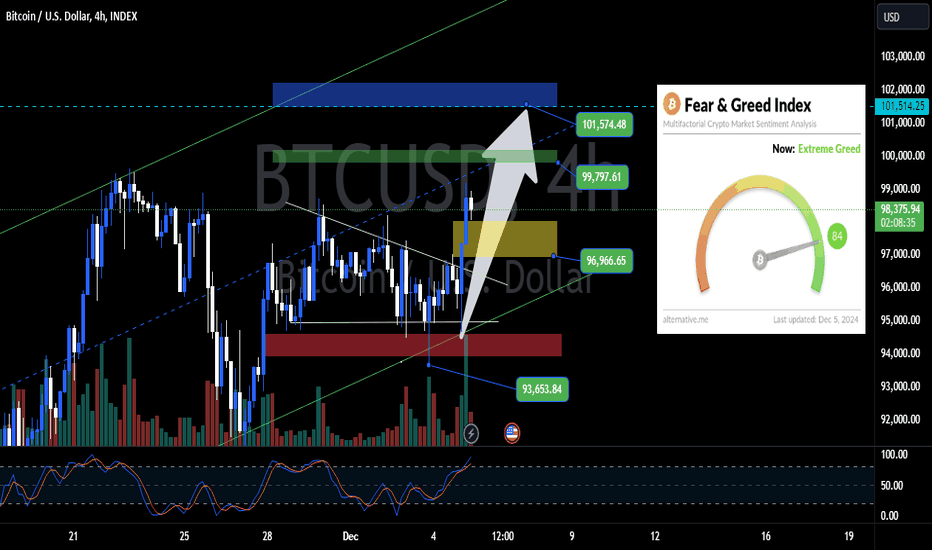

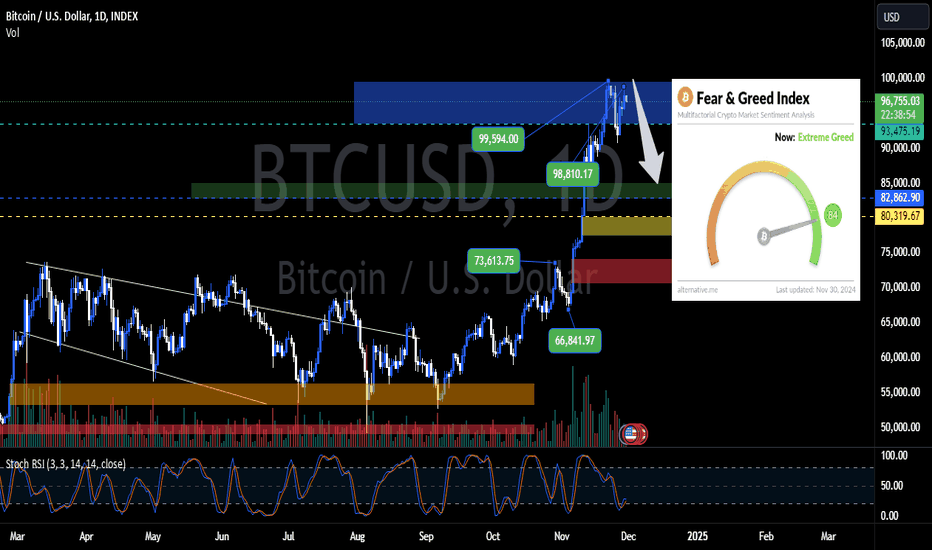

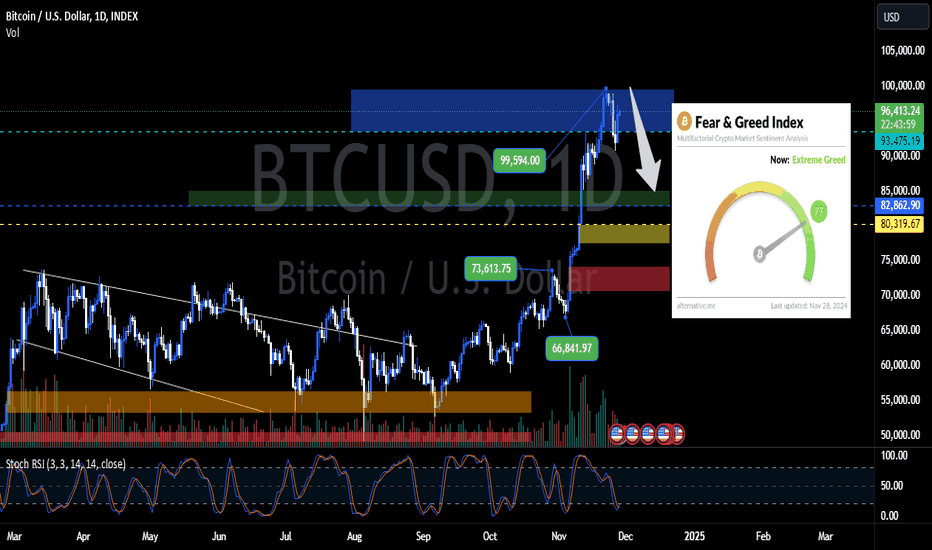

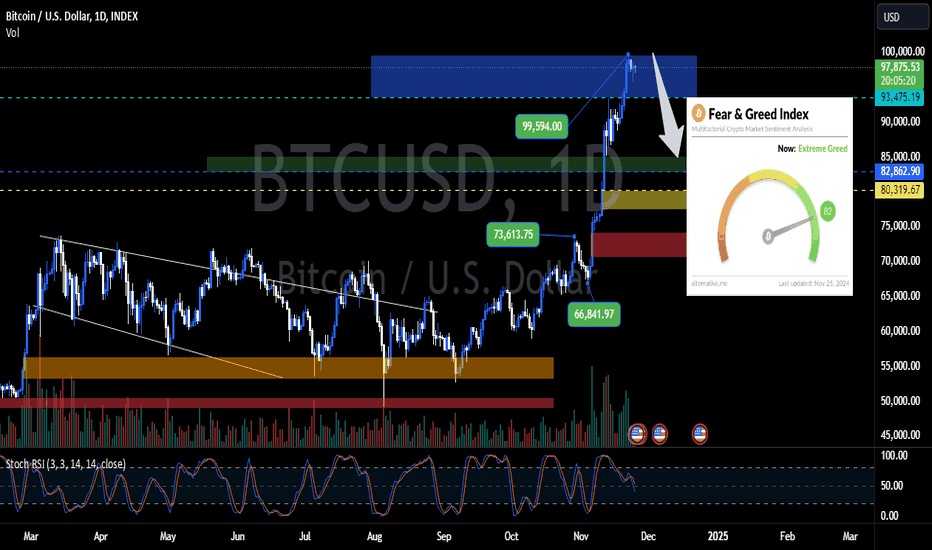

BTCUSD Approaching Key Resistance: Will 99K Hold?Good morning, crypto enthusiasts! Today’s fear and greed index stands at 84, maintaining extreme greed status. Meanwhile, the stochastic RSI has entered the oversold area, sitting at 88.

From a price action perspective, the range of 96,900 - 97,500 has been successfully broken. The next target is 99K. However, caution is advised as there’s a potential correction range between 98,061 - 96,911.

Stay safe, avoid FOMO, and always manage your risk. That’s all for today’s crypto update. Akki signing off, one chart at a time. Have a nice day and stay SAFU!

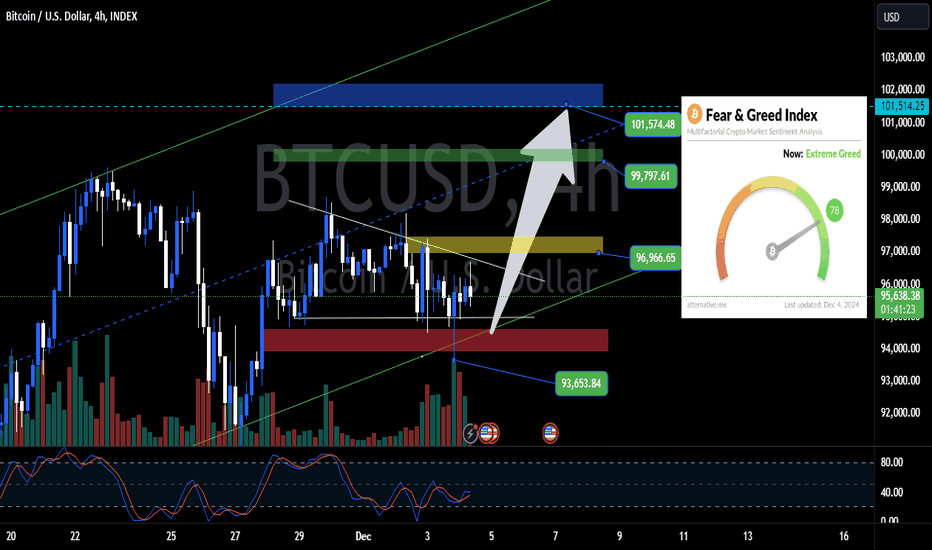

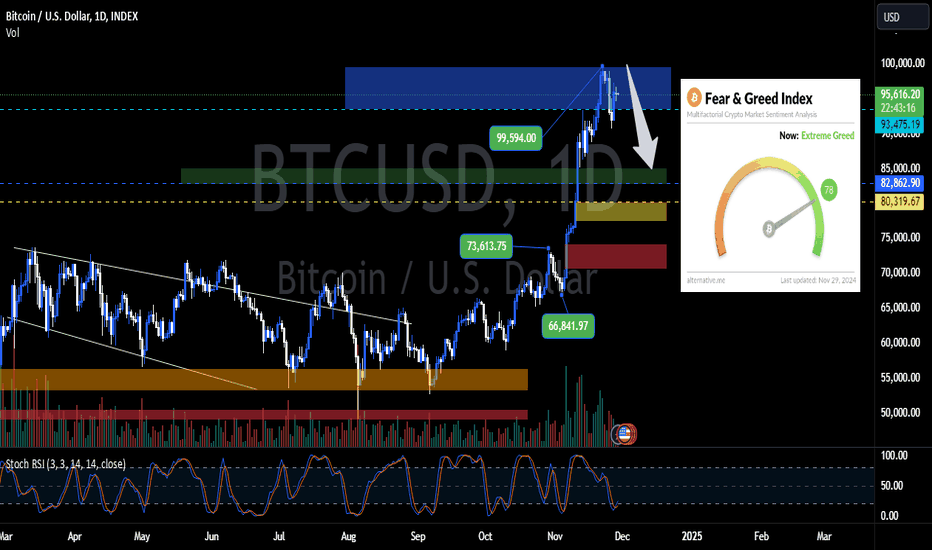

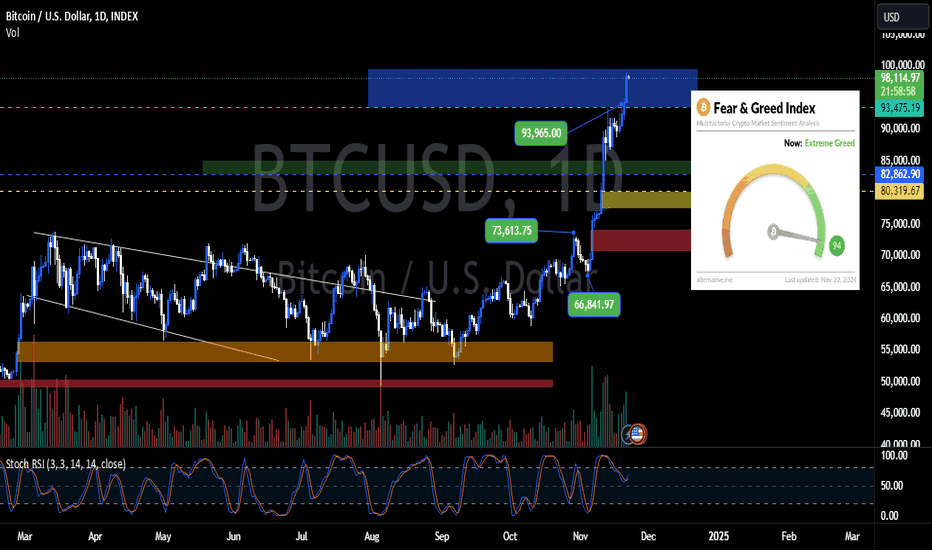

Bitcoin Reclaims $96K – Is $100K Within Reach This Month?Good morning, crypto bro's! Starting from today's market update, I will likely focus more on the H4 timeframe rather than D1. Larger timeframes will only be reviewed every 3 to 7 days, while daily updates will now rely on the H4 timeframe.

This morning, the Fear and Greed Index remains in the Extreme Greed zone, currently at 78, while the Stochastic RSI is in the middle range, around 40.

As I mentioned in yesterday's market update, Bitcoin had the potential to revisit the $93K range, and it finally did. Now, it has climbed back to $96K.

The $96,900 - $97,500 range and the $99,700 - $100,200 range remain challenging areas to break. Challenging doesn’t mean impossible—based on current price action, there is a high probability for Bitcoin to hit $100K within this month.

As always, stay safe, don’t FOMO, always manage your risks, and that’s all for today’s update. This is Akki, signing off with one chart. Have a great day and stay SAFU!

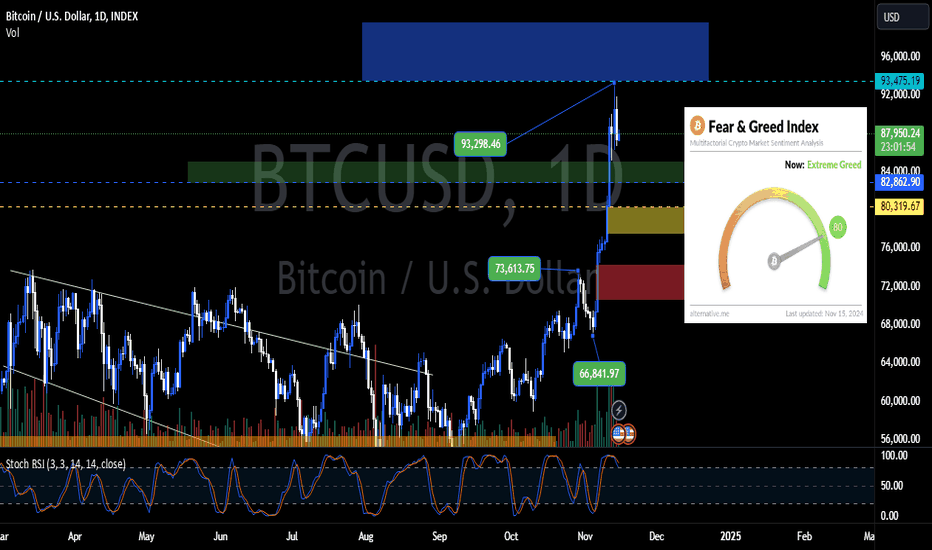

$BTC Correction to $93K? Or Pump to $101K?Good morning, crypto bro's! 🌅

📊 Fear & Greed Index: 76 (Extreme Greed).

📈 Stoch RSI: Still oversold (19).

💡 Analysis:

Current Action: Bitcoin is currently dropping and has reached the $94K range.

Next Move:

High probability to visit $93K.

Small chance for an instant pump to $101K.

📌 Stay vigilant, avoid FOMO, and always manage your risks.

I'm Akki, one chart at a time. Have a great day and stay SAFU!

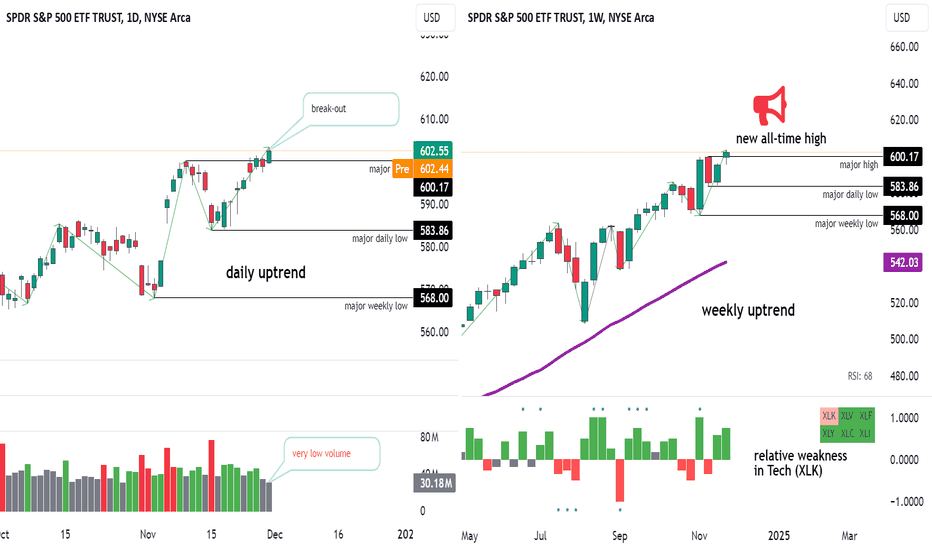

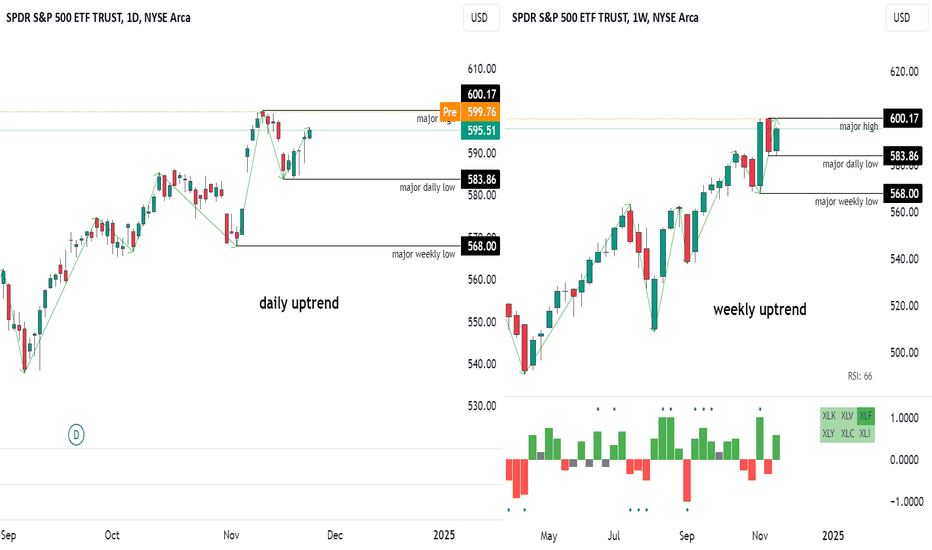

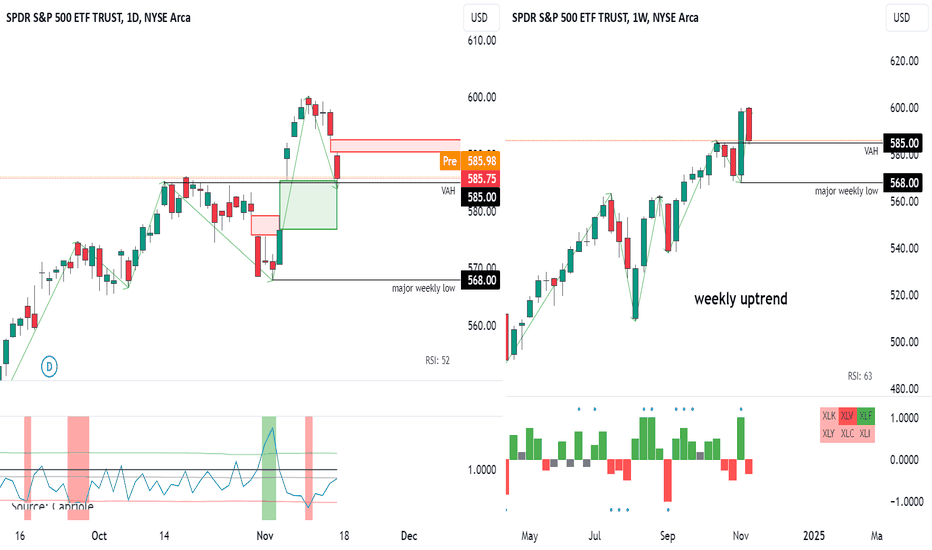

S&P: Weekly Recap and OutlookLast week, the market opened with a gap up that was quickly filled, after which price hovered near the previous all-time high. Bolstered by new economic data, which delivered no negative surprises, bulls pushed the price out of the trading range, establishing a new all-time high.

While this is undoubtedly a positive development that reinforces the bullish thesis, a few warning signs warrant closer attention:

1. Low Breakout Volume: The breakout occurred on significantly low volume. While volume is less critical in indices and ETFs compared to individual stocks, observing below-average volume during such an important event raises concerns about the breakout’s sustainability.

2. Relative Weakness in the Tech Sector (XLK): This deviation signals hesitancy among growth investors, which could potentially ripple through to other market participants.

Additionally, concerns highlighted in my previous review remain unresolved and continue to be relevant.

At this stage, there is no concrete evidence of a sentiment shift or technical signals pointing to a broad trend reversal. However, there is a growing impression that the rally may be nearing temporary exhaustion, which could lead to a significant pullback.

Key Focus for the Upcoming Week

Investors will be closely watching the employment data, which has already hinted at labor market weakness. If new data further support this trend, it could heighten bearish sentiment.

Price action this week will likely provide important clues:

• Bullish Confirmation: If the breakout is followed by a swift continuation, this will confirm buyers’ conviction and overall market strength.

• Bearish Signals: Conversely, if the price pulls back below 600 or oscillates indecisively around this level, it may signal uncertainty among buyers, creating an opportunity for short sellers to capitalize.

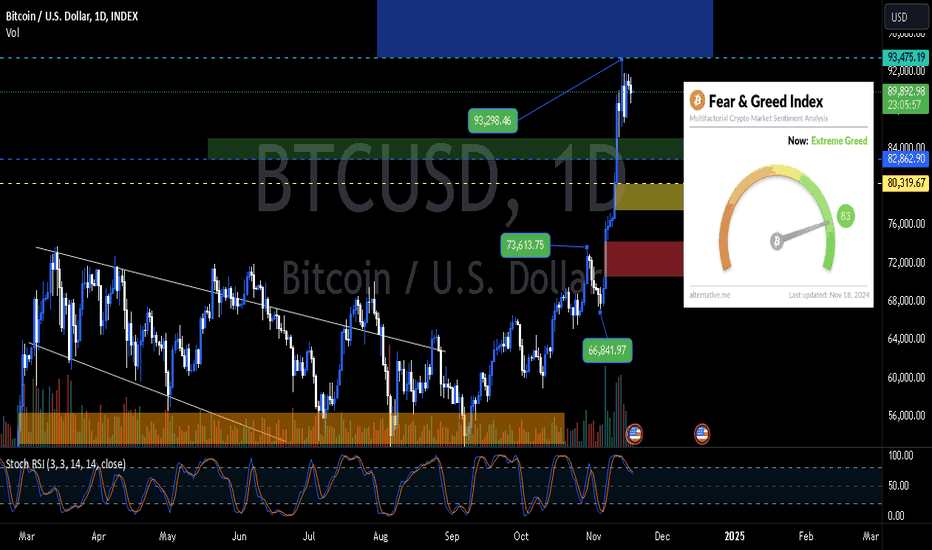

$BTC: $101K Pump Possible? Or Correction to $93K?Good morning, crypto bro's! 🌅

📊 Fear & Greed Index: 80 (Extreme Greed).

📈 Stoch RSI: Still oversold (25).

💡 Analysis:

Current Action: Bitcoin hasn't corrected to $93K yet.

Short-term Possibility: Small chance for an instant pump to $101K.

Larger Probability: Correction to $93K– GETTEX:92K remains the primary outlook.

📌 As always, stay safe, don’t let FOMO take over, and keep managing your risks.

I'm Akki, one chart at a time. Have a great day and stay SAFU!

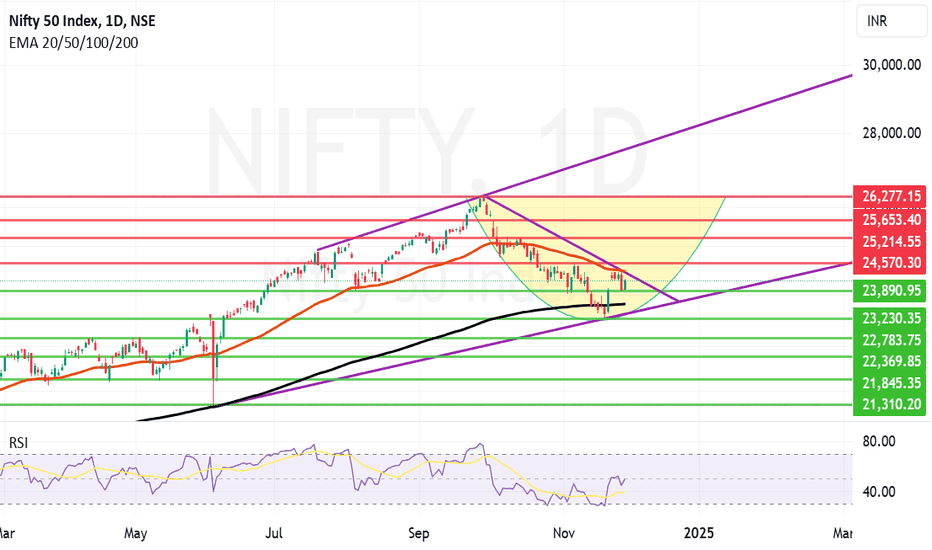

Long Term Nifty Outlook with Macro and Micro Economic commentaryNifty after making a new high is in volatile consolidation and correction mode. FIIs are selling big on every rally and DIIs and Retail are seeing this opportunity to consolidate their position in Indian market. Amidst all the volatility Nifty managed to close the month at 24131.

Every investor is seeking answer to one question which when will FII return to Indian market. There are too answers to this. Simple answer is they will return eventually sooner rather than later.

A more based answer is that when opportunity to earn more return elsewhere will diminish and there will be sort of global stability. Right now Ukraine and Russia conflict has opened another chapter of uncertainties. Stimulus package from China to stabilize its economy is also in an ongoing phase. Iran and Israel conflict is also contributed to environment of global uncertainties. On the other hand Maharashtra Election result has tried or is trying its best to comfort DII and retail investors.

Bond yield in US and surge in crypto post US election and China stimulus has provided a temporary oppenturnity for FIIs to make big money elsewhere. These are the Macro and Micro economic changes which led to FIIs searching better greener pastures elsewhere. Thus when the dust settles a bit and Indian companies again start giving attractive Q on Q results, FIIs will come back.

Results this quarter from India Inc in a traditionally weaker Quarter were a little below par. GDP growth was seen at 5.4% which is again slightly below par which can send Nifty into further consolidation mode. So there will be recovery from here but pointing out the timeline is a tough call even for seasoned economists.

Now coming to the Technical chart, Support and resistance levels. We can not say for sure if the bottom has already been made when earlier this month which was 23263 was the exact bottom or not but it will be an important level going below which we can see free fall in Nifty. So that will be a level to watch. On Daily candlestick chart there is currently a Cup shaped recovery in progress. There are clear trend lines suggesting that top of the channel is somewhere between 28K or 30K in the long run. Base support of the trend line includes 23263 hence that level is of prime importance. Mother line major resistance going forward will be 24367. Father Line major support will be at 23572.

Supports for Nifty remain at: 23890, 23263 to 23230 zone, 22783, 22369, 21845 and 21310.

Resistances for Nifty Remain at: Zone between 24367 to 24570, 25214, 25653 and 26277.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

$BTC Hit $98K! Will Corrections Pull it Back to $92K?Good morning, crypto bro's! 🌅

📊 Fear & Greed Index: 84 (Extreme Greed).

📈 Stoch RSI: Showing signs of exiting oversold.

💡 Analysis:

Current Status: FWB:98K has been reached.

Correction Outlook: Small probability for $93K– GETTEX:92K , with a larger chance for a deeper dip to $85K– GETTEX:82K if support breaks.

Upside Challenge: Breaching $100K seems tough without a significant correction first.

📌 Reminder: Stay sharp and manage risks well. Markets remain dynamic.

I'm Akki, as always, one chart at a time. Have a great day and stay SAFU!

GOLD 1HR CHART BACK TESTING OR..Backtesting in the gold market is a critical process that leverages historical price data to assess the viability and performance of trading strategies over a defined time period. By simulating trades and market conditions from the past, traders gain insights into how their strategies would have performed under varying market scenarios, including periods of volatility and stability. This detailed analysis helps identify strengths, weaknesses, and potential risks within a strategy, allowing for adjustments and refinements before applying it in live trading. In the context of the gold market, where price movements can be influenced by global economic factors, geopolitical tensions, and currency fluctuations, robust backtesting serves as an essential tool for developing informed and resilient trading approaches...

$BTC Eyeing $98K Again? Oversold Signals Fading!Good morning, crypto bro's! 🌅

📊 Fear & Greed Index: 78 (Extreme Greed).

📉 Stoch RSI: Still oversold but showing signs of recovery.

💡 Analysis:

BTC price action remains consistent with yesterday’s outlook.

Short-term probability: Revisit FWB:98K –$99K.

Correction likelihood: May occur after BTC tests $98K.

📌 Reminder: Markets are dynamic. Stay sharp and avoid FOMO.

I'm Akki, as always, one chart at a time. Have a great day and stay SAFU!

BTC Oversold! $98K Revisit or Deeper Drop Incoming?Good morning, crypto bro's! 🌅

📊 Fear & Greed Index: 77 (Extreme Greed, dropping).

📉 Stoch RSI: Entered oversold territory.

💡 Analysis:

On H4 timeframe, BTC shows a strong probability of revisiting the FWB:98K –$99K range.

However, larger timeframes still suggest potential corrections toward the green zone at $85K–$82K.

📌 Stay cautious. The market remains greedy but oversold signals need confirmation.

I'm Akki, as always, one chart at a time. Have a great day and stay SAFU!

BTC Struggles to Break $100K? Watch These Zone!Good morning, crypto bro's! 🌅

📊 Fear & Greed Index: 79 (Extreme Greed, slight drop).

📉 Stoch RSI: Approaching oversold area.

💡 Analysis:

BTC peaked at FWB:98K yesterday before resuming its correction.

Breaking $100K seems challenging at the moment.

Major probability points to a correction towards the green zone at $85K– GETTEX:82K , as highlighted in previous updates.

📌 Market remains in a greed zone. Better to wait and see for now.

I'm Akki, as always, one chart at a time. Have a great day and stay SAFU!

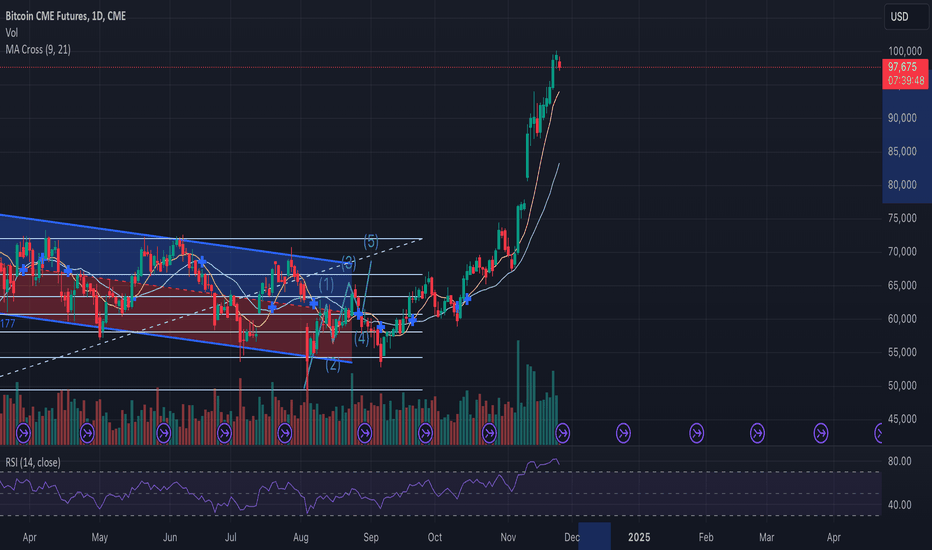

BTC Huge Gap!!! We going back to 75k?Hey guys!

Congrats all with BTC ATH and recent profits, I was not commenting the situation, because it was pretty clear, and we all know what was happening.

But also, as we know, even in the bull cycle have to be corrections and consolidations.

So here at the futures chart, we can see a huge gap around the healthy correction possible zone (max to 30%). Also, we have RSI oversold for sure and descending volumes.

Plus, in December there were no promises about decreasing US Interest rate, so possibly December can end up in this correction phase.

What's your thoughts about when and how much we could go? Let's chat in the comments =)

S&P 500 Weekly Recap: A Struggle to RecoverLast week’s market action reflected the ongoing struggle for recovery after the previous week’s sell-off. The market opened cautiously, with buyers stepping in to regain ground lost during the prior downturn. Despite early hesitation, bulls managed to push prices higher, eventually filling the gap created by the earlier sell-off. However, this recovery faced significant resistance from sellers, resulting in minimal upward progression in daily closes.

Strength in the recovery was primarily driven by Financials (XLF), which set a new all-time high. Other sectors, however, remained subdued, aligning with the broader market's hesitant tone. While this selectivity isn’t necessarily negative on its own, when combined with other signals, it may indicate growing risk aversion and a lack of conviction among market participants.

It is also worth zooming into the lower timeframes.

The 584 level provided key support but was retested multiple times during the week, which is not a good sign for buyers. Persistent tests of support typically indicate weakening demand, and bulls should be cautious of this development. Additionally, it was remarkable to observe how the rally went precisely to the Value Area Low ( 596 ) of the previous consolidation zone. Buyers should note that the market failed to push higher and close within the value area, signaling potential exhaustion of the current recovery attempt.

The immediate objective for the bulls is to push above 596 , reclaiming the previous value area, which would provide stronger validation for the recovery. On the other hand, bears will be focused on taking down the 584 level, where there is likely big liquidity pool.

Next week is rich in terms of key events.

The FOMC minutes are scheduled for release on Tuesday, preceded by significant economic data on Wednesday. These releases will be closely scrutinized as investors remain deeply concerned about the possibility of a recession. Any signals pointing toward a slowing economy could spark fear and trigger increased volatility.

While the long-term market trend remains intact, the warning signs outlined above suggest that investors should hold off on adding to their positions for the time being.

P.S. ES futures are currently rising in the pre-market session. If this momentum doesn't transform into a sell-off after the bell, it will certainly be a positive sign for the buyers.

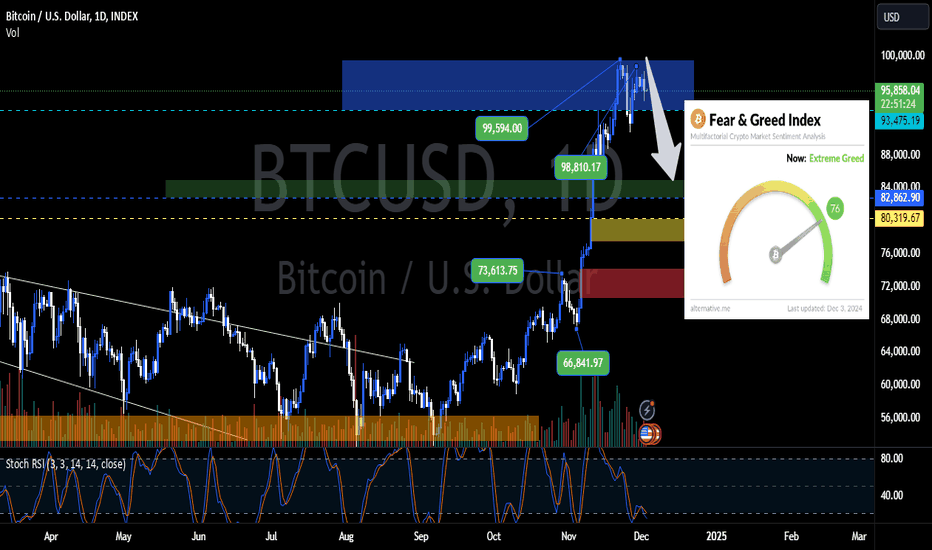

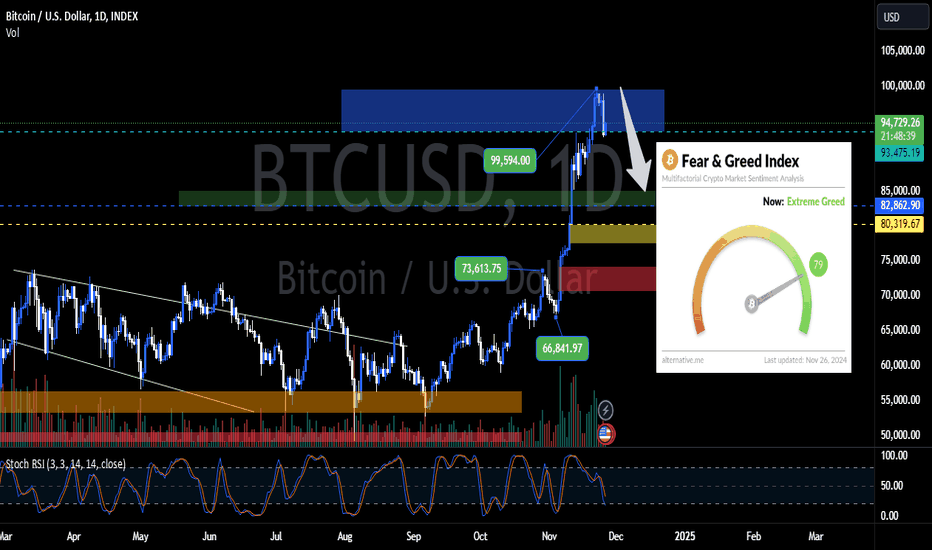

BTC Near $100K! Correction Ahead? Key Zones to Watch!Good morning, crypto bro's! 🌅

📊 Fear & Greed Index: 82 (Extreme Greed).

📉 Stoch RSI: Continuing downward toward oversold.

💡 Analysis:

BTC has corrected after its significant pump to $99,594.

H4 timeframe: BTC could revisit the $99K zone.

Daily & Weekly timeframes: High probability of a deeper correction to the green zone at $85K–$82K.

📌 Market remains in a greed zone, so it’s wise to adopt a wait-and-see approach.

I'm Akki, as always, one chart at a time. Have a great day and stay SAFU!

Nifty Short, Medium & Long Term : 25-Nov-24 to 29-Nov-24Nifty Short, Medium & Long Term : 25-Nov-24 to 29-Nov-24

Nifty closed at 23907 (two weeks before 24141) and touched high & low of 24233-23265

RSI ,Macd and stochastics levels are still down at the bottom.

Market bounced back from Trendline Support around 23250 and bounced back. But FII might continue to sell, hence please apply caution and let market move above the Ist & IInd short term target to buy in bulk. However, small SIP type buy in stocks/ MFs always better at this critica time.

FIIs was continuously selling in Indian market due to valuation issues of Indian Stocks, rather FIIs invested in Bitcoin which lead to Extraordinary increase in Bitcoin vallue and nearing 100,000 $ post US Election. Maharashtra election results gave confidence to current govt and will ease the pressure with current govt and can take free decisions in upcoming budget.

US indictment of Adani in bribe crime is a very bad issue and definitely it affects Adani Stocks and allied stocks. Example ITD Cementation is a great valued stock, but fell down drastically, as Adani was about to buy this company as per the news. Hence, avoid adani related stocks at present, as SEBI also might take action ( show cause notice/ Audit) on adani stocks.

Slowly started adding the stocks and Mutual Funds during this downfall, will continue to buy if there is further fall. Use the opportunity and grab the good value stocks.

Kindly read the Bitcoin Blog which i have written in Sep & Oct 24 with clear Indications to Buy with target of atleast 77000.

Caution was emphasized on Nifty for last 4 months as nifty PE ( Currently 22) was in high level with high valuation especially in Mid cap & Small Cap. PE touched 21.5 and bounced back.

Mutual Funds SIP shall be invested as the goal is for more than 5-10 years at this critical period , further market correction can happen upto nifty index to 22800 from current level, Individual value stock picking is a key at this critical time.

Fundamentally good stocks to be invested at these times. My Stock analysis of diwali recommendation from major financial agencies/ analyst and also some of the stock which is good as per my analysis will be provided upon request. DM : karthik_ss ( Twitter) . Individual need to analyse on their own. Further additional fundamental good value stocks ( which i analysed ) are added now after this downfall. Please note these are all not stock recommendation, rather an analysis. Individual Can analyse and add to your portfolio based on your risk profile.

Nifty 23907 Short term ( Short Term : Neutral)

Nifty short term resistance Market to firmly cross 24500, 24767(0.5 Fib resistance) and 25122 ( 0.618 Fib resistance) to move ahead to 26000.

Support at 23266 ( Last week Low), 23000 & 22800.

Medium Term next target is 25335( Shoulder Pattern), if move up decisively above next target 26268 ( all time high), 26968

Medium term Support 22248.

Long Term : Nifty have a target of 27740, 28000 & 28190 ( Fibonacci Resistance).

Support at 21240

BTC on the Verge of $100K! But Beware of Sudden Dumps! Good morning, crypto bro's! 🌞

📊 Fear & Greed Index: 94 (Extreme Greed).

📉 Stoch RSI: Bounced at 56.

💡 Analysis:

BTC successfully broke through the $95K resistance, boosting its potential to reach the coveted $100K mark soon. However, with the Fear & Greed Index in extreme greed, there's a heightened risk of a sudden dump.

⚠️ Stay cautious, avoid FOMO, and maintain strong risk management.

I'm Akki, as always, one chart at a time. Have a great day and stay SAFU!

BTC Faces Heavy Resistance in Blue Zone: Pump or Correction ?Good morning, crypto bro's! 🌅

📊 Fear & Greed Index: 82 (Extreme Greed).

📉 Stoch RSI: Heading toward the oversold zone.

💡 Analysis:

BTC's price action remains bullish, with the $95K target still on track. However, the current blue zone between $93K - $99K presents significant resistance and poses a high risk of correction.

🔑 Stay sharp, avoid FOMO, and prioritize risk management! 🛡️

I'm Akki, as always, one chart at a time. Have a fantastic day and stay SAFU!

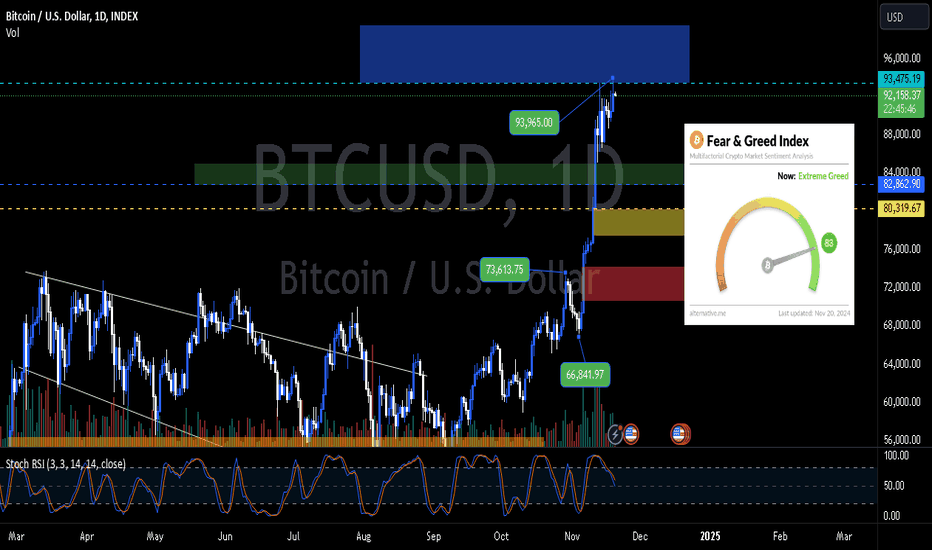

BTC Pumping to 95K? Or Correction to 90K?GM crypto bro's! 🌅 Fear & Greed Index stays in extreme greed at 83, while Stoch RSI trends down towards oversold territory. 🚦

📌 Current BTC top price: $93,965.

🔼 Potential pump: $95K range.

🔽 Possible correction: $90K-$89K.

Market remains greedy, so stay sharp, don’t FOMO, and always manage your risk! 🛡️

I'm Akki, closing with one chart at a time. Have a great day and stay SAFU!

S&P Weekly Recap: Rally Falters Amid Lack of ConvictionLast week’s market action delivered a reversal in sentiment, highlighting the fragility of the rally that had persisted since the so-called "Trump rally." The week began slowly, with the market testing buyers’ conviction to push prices higher. After confirming a lack of such conviction, sellers stepped in, driving prices sharply lower. As suggested in my previous recap, 585 (VAH) provided temporary support, and the week closed near this critical level.

Interestingly, most major sectors participated in the downward move, aligning with the broader market trend. However, XLF (Financials) stood out as the exception, managing to post gains despite the sell-off. This divergence suggests that there is still buying interest, with money continuing to flow selectively into the market.

The immediate objective for the bulls is to hold 585 and attempt to fill Friday’s gap. Failure to do so, with the price returning to the 568-585 range , would indicate that the rally is nearing exhaustion. While this would not immediately signal a transition into a bear market, it would mark a notable shift in sentiment. The 568 level remains critical for buyers; as long as it holds, the broader uptrend stays intact, and bulls maintain the upper hand. Meaning that I keep "bullish" outlook.

This week, the market’s attention will be on NVIDIA's earnings on Wednesday. While the previous report didn’t cause much volatility, traders will be closely watching for any surprises that could influence market momentum.

BTC Pump to 95K? Fear & Greed Index Still High! GM crypto bro's! 🌄 Fear & Greed Index stays in extreme greed at 83, and Stoch RSI begins exiting the overbought zone. 📊 BTC still hasn’t hit our correction target at FWB:83K - GETTEX:82K , but there’s a small chance we see a pump up to the $95K range. 🚀

As always, stay vigilant, avoid FOMO, and manage your risk properly. 🛡️ I'm Akki, signing off with one chart at a time. Have a great day and stay SAFU!

BTC Correction Incoming? Fear & Greed Index Drops to 80!GM crypto bro's! 🌅 Fear & Greed Index drops from 88 to 80 today, but we’re still deep in extreme greed zone! 😬 BTC finally showing signs of correction after a wild ride.

Current probability points towards a pullback to the FWB:83K - GETTEX:82K range. 🧐 Let’s see if this correction deepens or finds support here.

Stay sharp, avoid FOMO, and always manage your risk! I’m Akki, signing off with one chart at a time. Have a nice day & stay SAFU!

BTC Hits $93K! Is a Major Correction Next?GM crypto bro's! 🚀 BTC just hit a top at $93K! Fear & Greed Index is up again, reaching 88 — extreme greed mode is ON! Stoch RSI remains heavily overbought, making this bullish rally look ripe for a deeper correction. 📉

Personal outlook stays the same as yesterday; we’re seeing strong rejection around the 93K range. Expect potential corrections to revisit our yellow zone between 80K-77K. Keep your eyes on it! 👀

Stay sharp, avoid FOMO, and always manage your risk! I’m Akki, signing off with one chart at a time. Have a nice day & stay SAFU!