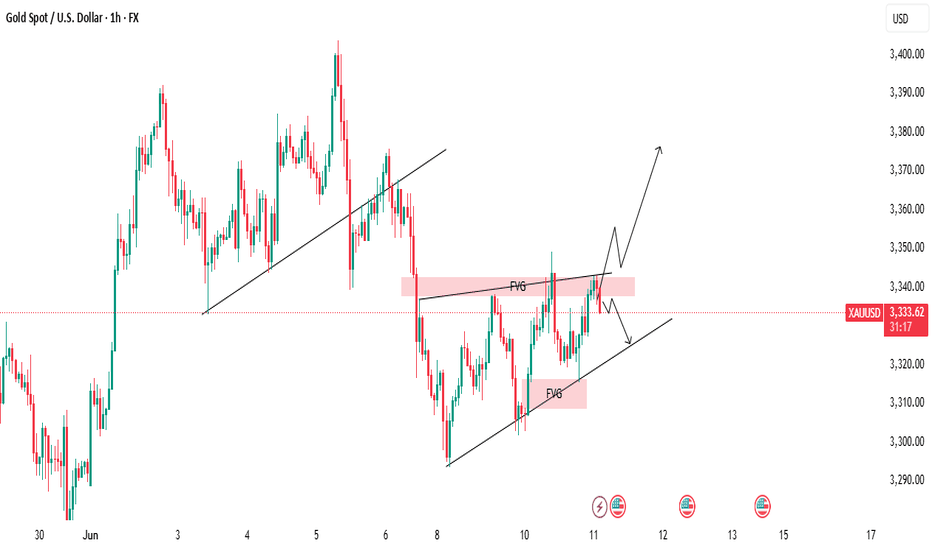

Gold - Powerful RunAfter its powerful run, gold has shown signs of fatigue, stalling near technical resistance between $3,330–$3,350 per ounce in late July. Analysts warn that while the bullish trend remains intact on a structural level, daily volatility is high and some profit-taking or consolidation could continue unless new destabilizing events emerge.

Will the Rally Continue?

The Bull Case

Structural Demand: Multiple sources, including J.P. Morgan and other major forecast groups, predict gold’s structural bull case remains strong with average prices of $3,220–$3,675 per ounce likely through the end of 2025, and even $4,000 possible by 2026.

Ongoing Uncertainty: Persistent geopolitical risks, trade disputes, and fiscal pressures are expected to maintain robust safe haven flows into gold.

Central Bank and Asian Demand: Sustained buying by central banks and consumers in Asia could provide a solid floor below current levels.

The Bear Case

Interest Rate Dynamics: If central banks, especially the US Federal Reserve, hold or increase interest rates, gold could lose momentum, higher rates increase the opportunity cost of holding non yielding bullion.

Diminishing New Risks: Unless fresh economic or geopolitical shocks appear, further upside may be capped in the near term. Several experts predict gold may consolidate or trade sideways pending new catalysts.

Speculator Flows: Rapid speculative bets could lead to sharp corrections, particularly on technical breakdowns after such a strong rally.

Conclusion

The gold rally of 2025 has been driven by an unusual mix of global volatility, central bank behavior, and shifting investor psychology. While prices could pause or pull back in the coming months, the fundamental supports structural demand, central bank buying, and persistent global risks, suggest that the broader gold bull cycle is not yet over, with $3,000+ likely forming the new base for gold as we look toward 2026.

*NOT INVESTMENT ADVICE*

#gold #safehaven #uncertainty #economy #finance #trading #indicator

Markets

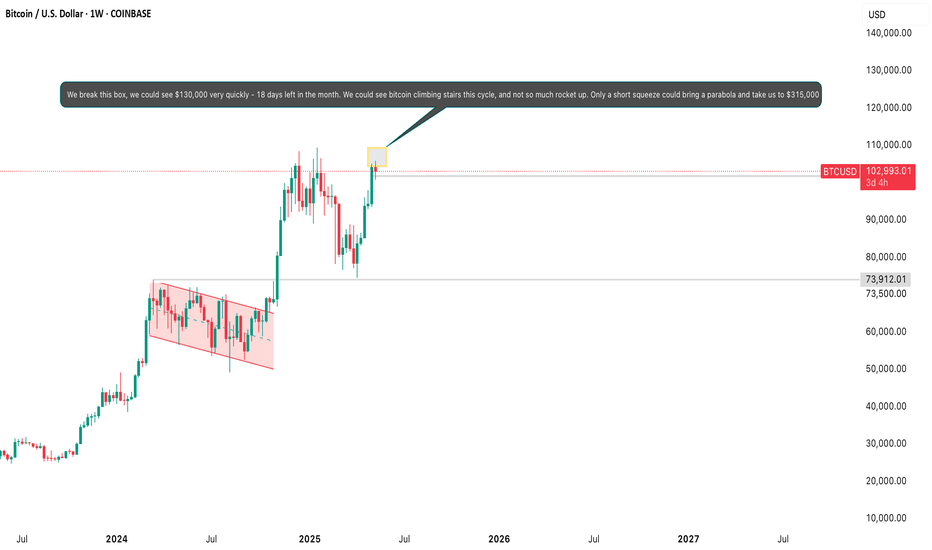

Bitcoin & Altcoins: Technical Analysis and Market OutlookBitcoin (BTC) Analysis

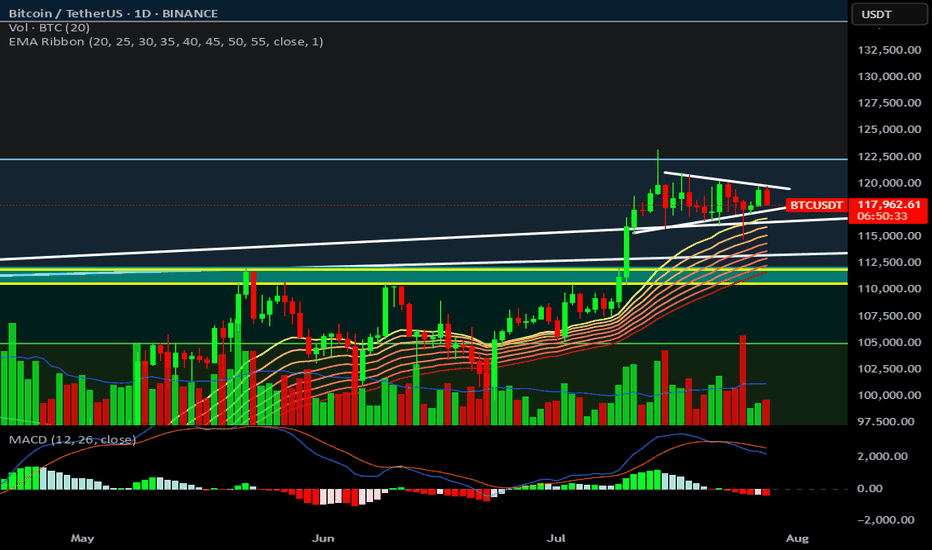

Bitcoin is currently forming a short-term bullish pennant within a larger long-term pattern, projecting a potential target around $135K.

Key Levels: BTC is consolidating between the lower zone at $117.3K and the upper zone at $119.7K.

Breakout Potential: A break above this pattern could propel BTC toward a new all-time high (ATH), surpassing the current ATH at $123K.

Macro Events This Week:

Wednesday: The Federal Reserve will announce its interest rate decision, with no changes expected.

Wednesday: ADP Employment Report, providing insights into potential future rate cuts.

Friday: Non-Farm Payrolls (NFP) data release, which could further influence market sentiment.

Ethereum (ETH) Breakout

Ethereum has decisively broken through its 4-year historical resistance around $3,725, closing the week above this level. This breakout signals a strong bullish outlook for ETH, with potential for further upside.

Altcoin Highlights

BNB: Has shattered its previous all-time highs, showcasing significant bullish momentum.

XRP: Reached approximately $3.64, reflecting strong gains and market interest.

Market Context

The crypto market is showing robust activity, with altcoins following Bitcoin and Ethereum's lead. Key macroeconomic events this week could introduce volatility, so traders should stay vigilant.

Disclaimer: This is not financial advice. Every trader is responsible for their own strategy and risk management.

Happy trading and good profits! 🚀

July 10th Market Outlook –Charted Waters & Uncertain Momentum🗓️📊 July 10th Market Outlook – Charted Waters & Uncertain Momentum 🌊⚠️

Today’s breakdown is a reality check for traders navigating a market full of setups but short on clarity. Resistance is stacking across the board, but that doesn’t mean we can’t break through — it just means we need to stay sharp and keep our charts close.

🔎 Highlights from the 19-minute video:

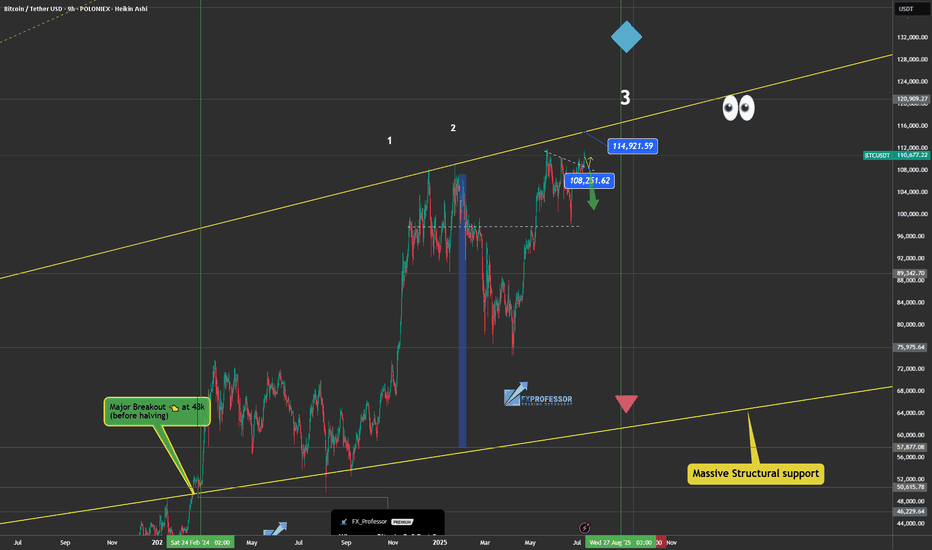

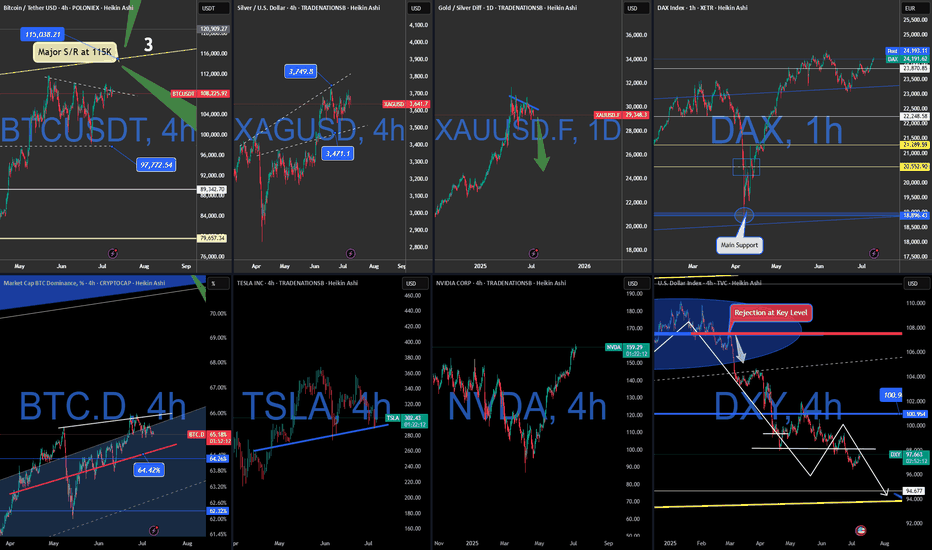

Bitcoin is approaching a third and crucial resistance test. A breakout could trigger ultra-FOMO, but failure here could send us lower.

Ethereum is in a pressure zone — the "Symplegades" setup from Greek mythology reflects today’s narrow trading path.

Bitcoin Dominance is clinging to support — if it breaks, altseason could be on. If it holds, alts may stay sidelined.

NASDAQ & Nvidia have delivered massive runs, but signs of exhaustion and reversal risk are showing.

Dollar Index (DXY) showing a Golden Cross, but unresolved rate expectations could catch markets off guard.

💬 I also speak candidly about market manipulation, being someone else’s exit liquidity, and why we might be heading toward a formative trap before any true breakout.

🎥 Watch the full video to catch all the details — from long-term setups to real-time chart reactions.

📌 Stay tuned for detailed updates today on Bitcoin, Ethereum, Bitcoin Dominance, NASDAQ and more.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Macro Moves & Market Reversals: BTC-Metals-Tech-Dollar & more! 🤖📊 Macro Moves & Market Reversals: Bitcoin, Metals, Tech, Dollar & DAX Breakdown 🔥💹

Hey beautiful people,

FXPROFESSOR here with a massive market update to kick off the week. This one’s for my serious traders—those of you ready to read the market like a pro 📚💡

We’re in a critical transition. The Trump–Powell standoff, rate cut games, tariff escalations, and a surprising shift in risk appetite across bonds, metals, and equities are reshaping the entire trading landscape.

Let’s get into the full breakdown 👇

🧠 MACRO FIRST – THE FUNDAMENTAL PULSE

🟢 Interest Rates:

The Fed is keeping rates steady at 4.25%–4.50%, citing strong jobs data. 147K jobs added, unemployment at 4.1%. The market wanted bad news for rate cuts... didn’t get it.

🗓 September remains the most likely cut, but the Fed isn’t rushing. Strong labor = slow policy change.

⚠️ Tariffs Heating Up:

Trump just slapped 25–40% tariffs on imports from Japan, Korea, and others – effective August 1.

➡️ If no political resolution by July 9, prepare for a volatility wave.

Tariffs = supply chain risks + cost-push inflation.

💣 Geopolitics:

Middle East tensions remain background noise, but no major disruptions for now. Still, oil remains sensitive.

📈 Risk Appetite (Bonds):

U.S. Treasuries still lagging, but junk bonds and quality credit (LQD) have pumped. That’s a big clue: risk appetite is returning, even without a Fed pivot.

📉 DOLLAR INDEX (DXY) – "THE YEAR OF THE NORMALIZED DOLLAR"

We’ve followed this dollar short all year.

🔻 From rejection at 100.965, DXY dropped straight into our long-term 94–95 target zone.

📌 Now what? This level is MAJOR. A bounce could trap dollar bears.

🧭 No new short from me unless we re-tag 100+. The juice is squeezed.

Key takeaway:

The dollar already priced in rate cuts, and we didn’t even get them. That’s telling me the next macro move might not be so predictable.

💰 BITCOIN – STILL THE KING

📍 BTC at $115K resistance – a level I’ve charted for years, not weeks.

Three hits:

1️⃣ First rejection

2️⃣ Second rejection

3️⃣ And now... a decisive moment

🚨 Break 115K → BTC flies.

📉 Fail here → we could revisit $64K, yes, seriously. I’m ready for both outcomes.

This is not the time for hopium. It’s 50/50.

🪙 BTC DOMINANCE – THE ALTCOIN SWITCH

BTC.D is now above 65%. That means:

✔️ Capital flowing back into BTC

❌ Altcoins not ready yet

We don’t chase alts until BTC.D hits 71.3–72.9%. That’s the real “altseason trigger zone.”

🔒 I’m personally turned off from alts for now—too much noise, too many memes, not enough macro support.

🔩 PRECIOUS METALS – SHINING BRIGHT

💛 Gold (XAU/USD):

Reached near $3,500 highs

Now stalling

🛑 Taking profits here – caution warranted.

🤍 Silver (XAG/USD):

13-year high

Holding $36+ well

Potential breakout pending global inflation data

💿 Platinum (the sleeper):

+47% YTD

Beautiful long setup played out exactly as planned

Still bullish above $1,400 if supply squeeze continues

💡 ETFs in metals are seeing inflows – more institutions hedging as dollar weakens.

🚗🔌 TECH STOCKS – NVDA, TSLA & THE NASDAQ

📈 NVIDIA (NVDA)

Best trade of the year for me

Clean re-entry, now hitting ATH levels

AI demand + tight supply = rocket fuel

⚡ Tesla (TSLA)

Bounce off 4H trendline

Still lagging slightly – political tensions (Trump vs. Musk) not helping

But levels are working like a charm

📊 NASDAQ (QQQ)

Hit our “max pain” zone perfectly

Rebounded with textbook precision

Momentum intact – watching for new highs

🇩🇪 DAX INDEX – CHARTS DON’T LIE

All-time high. Boom. Called it weeks ago.

Despite:

No Russian energy

Industrial drag

ECB policy constraints

📌 But what worked?

➡️ Simple chart structure.

➡️ Market psychology.

➡️ Pure TA.

Now at resistance again. Watch carefully – support below is clearly defined.

🧾 FINAL THOUGHTS – THE PROFESSOR'S NOTES

🔹 The market’s narrative can change fast, especially with Trump in the mix. He’s Mr. Volatility.

🔹 Powell holds the real power – and right now, he’s not flinching.

🔹 Risk appetite is back – but not evenly. Bitcoin is leading, altcoins are lagging, metals are maturing.

🔹 If rate cuts materialize in September, expect massive rotation across all risk assets.

💭 Until then, I’m playing level-to-level. No FOMO. Just charts and logic. That’s how we survive, and thrive.

Let me know which chart you want next – and thank you for staying sharp 💪📚

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

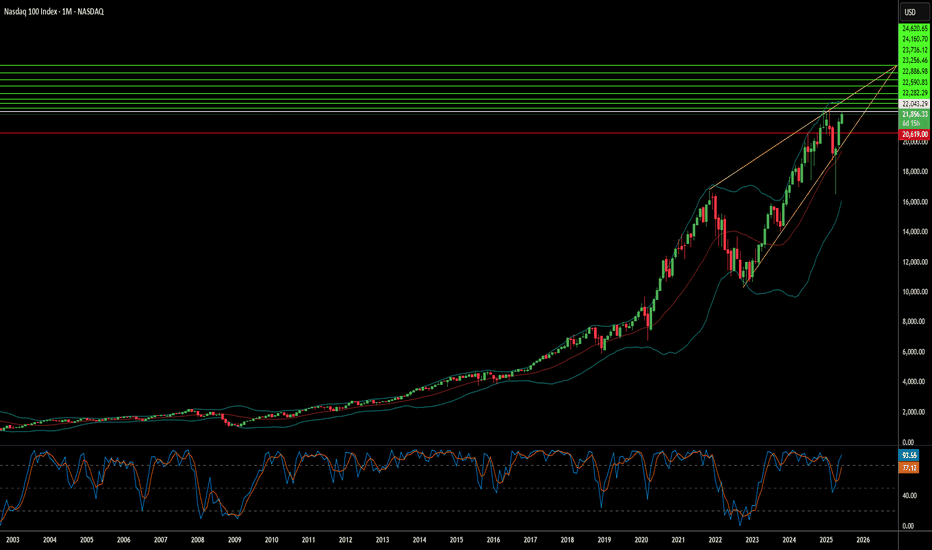

Can Geopolitics Power Tech's Ascent?The Nasdaq index recently experienced a significant surge, driven largely by an unexpected de-escalation of tensions between Israel and Iran. Following a weekend where U.S. forces reportedly attacked Iranian nuclear sites, investors braced for a volatile Monday. However, Iran's measured response - a missile strike on a U.S. base in Qatar, notably without casualties or significant damage - signaled a clear intent to avoid wider conflict. This pivotal moment culminated in President Trump's announcement of a "Complete and Total CEASEFIRE" on Truth Social, which immediately sent U.S. stock futures, including the Nasdaq, soaring. This rapid shift from geopolitical brinkmanship to a declared truce fundamentally altered risk perceptions, alleviating immediate concerns that had weighed on global markets.

This geopolitical calm proved particularly beneficial for the Nasdaq, an index heavily weighted towards technology and growth stocks. These companies, often characterized by global supply chains and reliance on stable international markets, thrive in environments of reduced uncertainty. Unlike sectors tied to commodity prices, tech firms derive their value from innovation, data, and software assets, which are less susceptible to direct geopolitical disruptions when tensions ease. The perceived de-escalation of conflict not only boosted investor confidence in these growth-oriented companies but also potentially reduced pressure on the Federal Reserve regarding future monetary policy, a factor that profoundly impacts the borrowing costs and valuations of high-growth technology firms.

Beyond the immediate geopolitical relief, other crucial factors are shaping the market's trajectory. Federal Reserve Chair Jerome Powell's upcoming testimony before the House Financial Services Committee, where he will discuss monetary policy, remains a key focus. Investors are closely scrutinizing his remarks for any indications regarding future interest rate adjustments, particularly given current expectations for potential rate cuts in 2025. Additionally, significant corporate earnings reports from major companies like Carnival Corporation (CCL), FedEx (FDX), and BlackBerry (BB) are due. These reports will offer vital insights into various sectors' health, providing a more granular understanding of consumer spending, global logistics, and software security, thereby influencing overall market sentiment and the Nasdaq's continued performance.

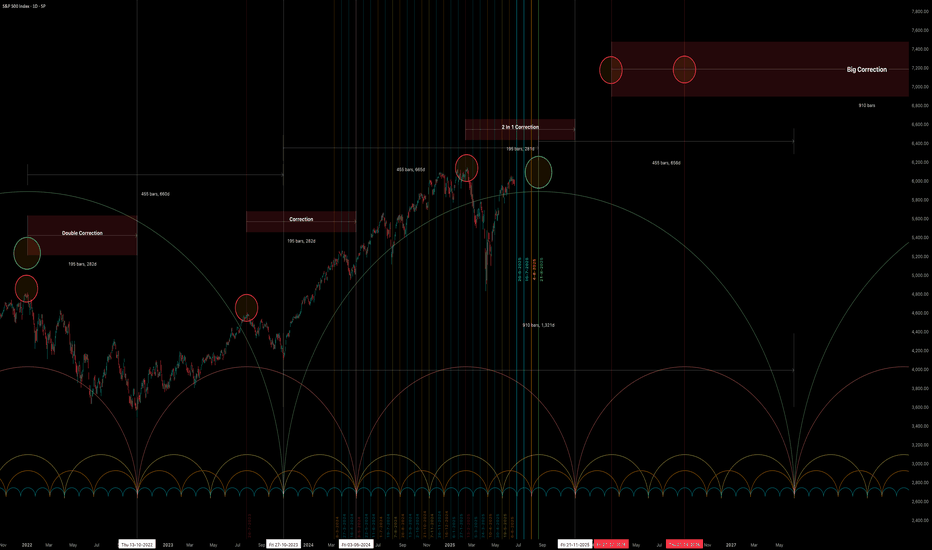

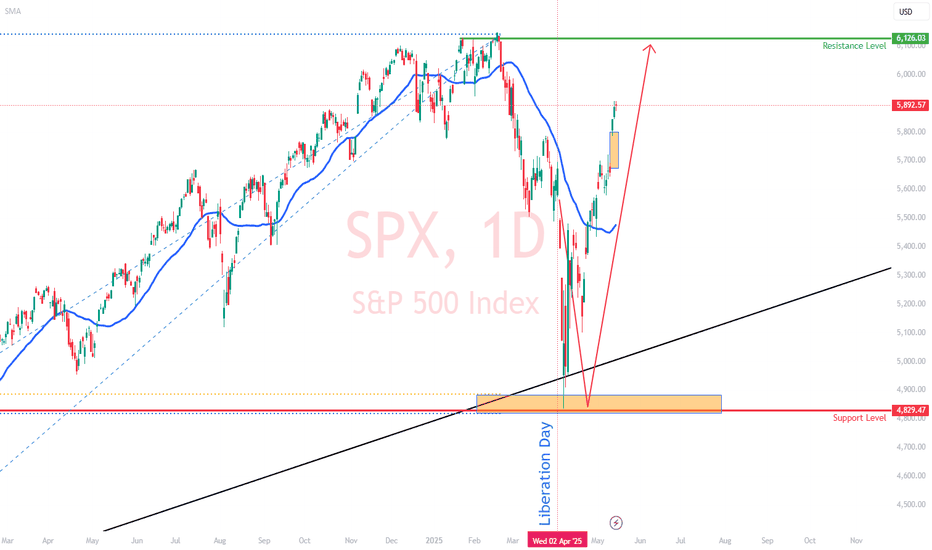

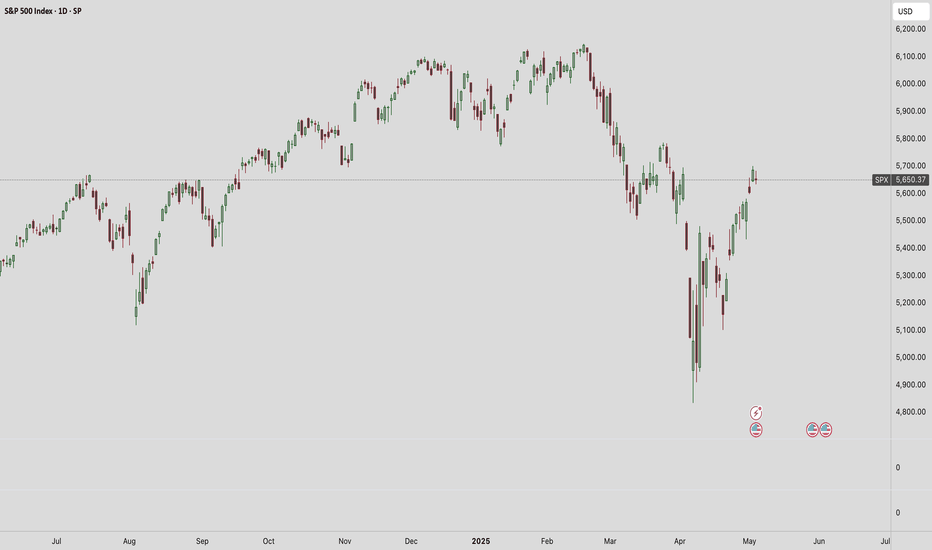

Big CorrectionThe S&P index.

The chart shows the potential end of the final rally from the 2009 low.

Currently, with this rally from the recent 4,800 low, we are still in a correction period that will end in late October (highs and lows are irrelevant), & We have a date coming up in August so let's see what happens there.

After this period, we will have a rally combined with uncertainty and unjustified speculative movements (bubble) that could take us to the final peak, which I expect in 2026.

This remains a possibility, but don't base your trades on it. However, caution is often good.

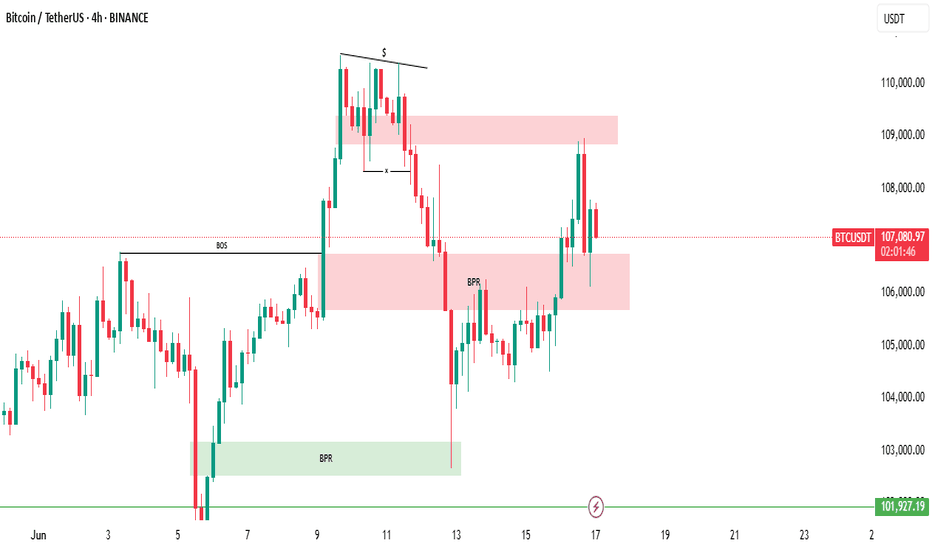

The market recently managed to close above the Breaker Block!Bitcoin Market Update (Extended & Insightful):

The current update for Bitcoin remains largely the same as the previous one. However, there have been some slight yet significant shifts in the market behavior.

The market recently managed to close above the Breaker Block (BPR), which initially seemed like a bullish signal. But as it approached the overhead supply zone, it faced strong rejection and started to decline again. This shows that sellers are still active at higher levels.

Right now, the market is treating the BPR as an inversion level, meaning it’s testing it as potential support. This level is crucial for determining Bitcoin's next move.

🔍 So, what’s the best approach now?

Patience is key at this point. The ideal strategy is to wait and watch. Let the market clearly break either the upper supply zone (which would confirm bullish momentum) or the lower BPR zone (indicating a bearish trend). Only then can we expect a strong directional move.

Until one of these key levels is decisively broken, Bitcoin is likely to continue consolidating within this range — moving sideways without a clear trend.

🧠 DYOR — Do Your Own Research!

Always analyze before making any trading decisions.

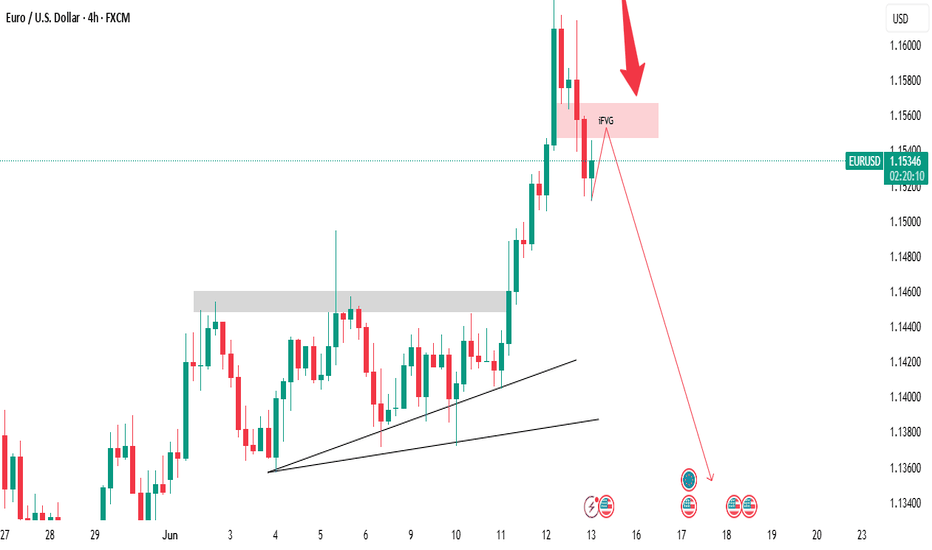

(iFVG) before continuing its fall.EUR/USD is now ready to move downward. The market has already cleared out all the liquidity above, which suggests that it's now in the mood to drop. Earlier, on the 4-hour timeframe, the market had formed a bullish Fair Value Gap (FVG), but that has now been broken to the downside.

Currently, there are chances that the market might touch the imbalance (iFVG) before continuing its fall. Keep an eye on that level and observe how the market reacts there. It could be an important zone.

Do Your Own Research (DYOR)! This is not financial advice.

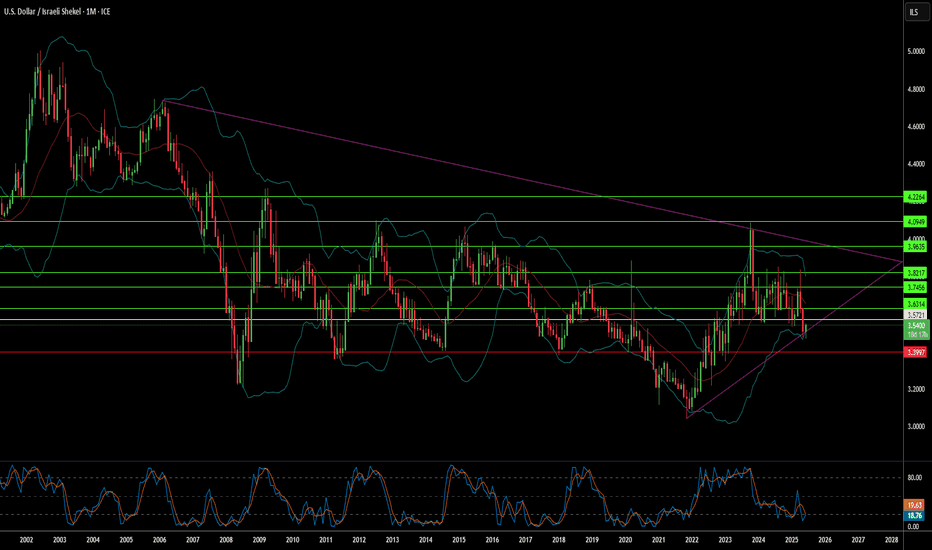

Uncertainty: The Dollar's Unexpected Ally?The recent strengthening of the US dollar (USD) against the Israeli shekel (ILS) serves as a potent illustration of the dollar's enduring role as a safe-haven currency amid heightened geopolitical uncertainty. This trend is particularly pronounced in the context of escalating tensions involving Iran, Israel, and the United States. Investors consistently gravitate towards the perceived stability of the dollar during periods of global unrest, leading to its appreciation against more volatile and susceptible currencies, such as the shekel.

A significant driver of this dollar demand stems from the precarious security landscape in the Middle East. Reports detailing Israel's potential operation into Iran, coupled with the United States' proactive measures like authorizing voluntary departures of military dependents and preparing for a partial evacuation of its Baghdad embassy, signal Washington's anticipation of potential Iranian retaliation. Assertive declarations from Iranian officials, explicitly threatening US military bases and claiming intelligence on Israeli nuclear facilities, further amplify regional risks, compelling investors to seek the dollar's perceived safety.

Compounding this geopolitical volatility is the stalled US-Iran nuclear diplomacy. Hurdles persist not only over core issues, such as uranium enrichment and sanctions relief, but also over the basic scheduling of talks, with both sides expressing diminishing confidence in a resolution. The recent International Atomic Energy Agency (IAEA) Board of Governors meeting, where the US and European allies introduced a non-compliance resolution against Iran, adds another layer of diplomatic tension, threatening increased sanctions or nuclear expansion and reinforcing the perception of a volatile environment that inherently strengthens the dollar.

These escalating tensions have tangible economic repercussions, further fueling investor flight to safety. The immediate aftermath has seen a significant increase in oil prices due to anticipated supply disruptions and a notable depreciation of the Iranian rial against the dollar. Warnings from maritime authorities regarding increased military activity in critical waterways also reflect broad market apprehension. During such periods of instability, capital naturally flows into assets perceived as low-risk, making the US dollar, backed by the world's largest economy and its status as a global reserve currency, the primary beneficiary. This flight-to-safety dynamic during major regional conflicts involving key global players consistently bolsters the dollar's value.

Current bullish movement there are still significant resistanceGold Market Update

In the short term, the gold market has entered an uptrend. This upward movement has been supported by a Market Structure Shift (MSS) followed by a Break of Structure (BOS), indicating a bullish momentum and a potential reversal or continuation of the trend to the upside.

However, despite the current bullish movement, there are still significant technical resistances that need to be considered before assuming a sustained rally. At the moment, gold is approaching a trendline resistance, which has historically acted as a barrier, limiting further upward price movement. In addition to this, there is also the presence of a bearish Fair Value Gap (FVG) in the same region, adding to the confluence of potential resistance zones.

If the price is able to break above both the trendline resistance and the bearish FVG, it would confirm the strength of the bullish trend, and we could expect the market to continue climbing higher, potentially testing even stronger resistance levels above.

On the other hand, if the market fails to break through this key resistance area and gets rejected, we may witness a retracement or a corrective move. In such a case, gold could decline back down toward the lower marked trendline, which would then act as the next significant support level.

In conclusion, the immediate price action around this resistance zone will be crucial in determining the next direction for gold. Traders and investors should watch closely for confirmation of either a breakout or a rejection before making any decisive moves.

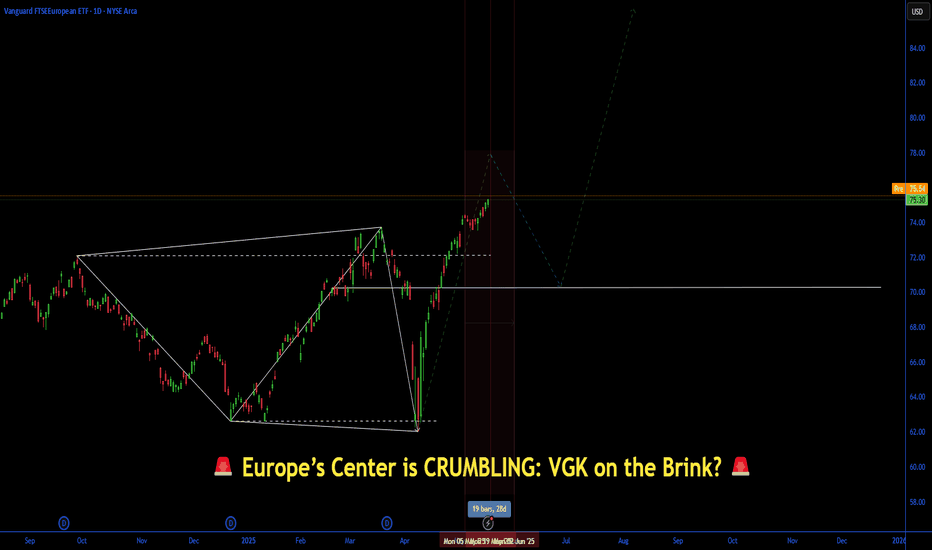

Europe’s Center is CRUMBLING: VGK on the Brink? 🚨 Europe’s Center is CRUMBLING: VGK on the Brink? 🚨

Europe’s elections just lit a FUSE! 💥 Poland (May 18), Portugal (May 18), and Romania (May 4 & 18) held off populists, but the center’s hanging by a thread—50% in Poland went right-wing, Portugal’s Chega is shaking things up.

Immigration and globalization fury could rattle EU trade & policy. 📉 VGK ($75.53) is inches from its yearly high ($75.56)—ready to crash or soar?

💡 Trade Idea: Plot VGK price action with election dates (May 4, May 18, June 1, 2025) to spot volatility breakouts. Watch for support near $70 or resistance at $76.

❓ Your Move? Will VGK tank or rally on Europe’s chaos? Drop your trade below! 👇

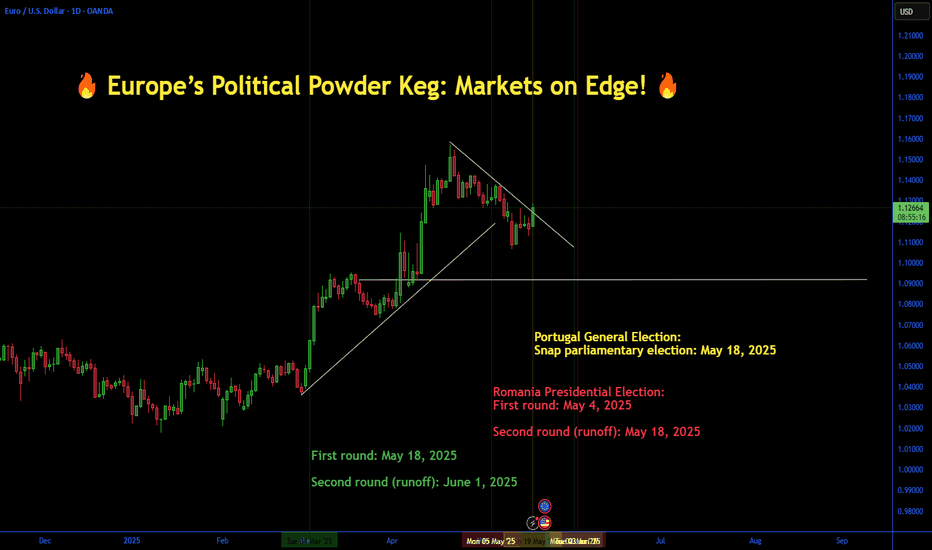

Europe’s Political Powder Keg: Markets on Edge!🔥 Europe’s Political Powder Keg: Markets on Edge! 🔥

Europe’s elections just dropped a BOMB! 💣 Poland (May 18), Portugal (May 18), and Romania (May 4 & 18) rejected far-right surges, but the center’s crumbling. 🇪🇺 Poland’s pro-EU Trzaskowski barely leads—June 1 runoff could flip it! Portugal’s Chega is shaking the old guard, and Romania’s Nicușor Dan rides an anti-corruption wave.

Why care? Political chaos = market volatility. 📉 EUR/USD is wobbling, DAX could tank, and defense stocks (🇺🇦 ties) are in play.

💡 Trade Idea: Overlay EUR/USD with election dates (May 4, May 18, June 1) to catch volatility spikes.

❓ What’s your move? Will Europe’s turmoil crash markets or spark a rally? Drop your take below! 👇

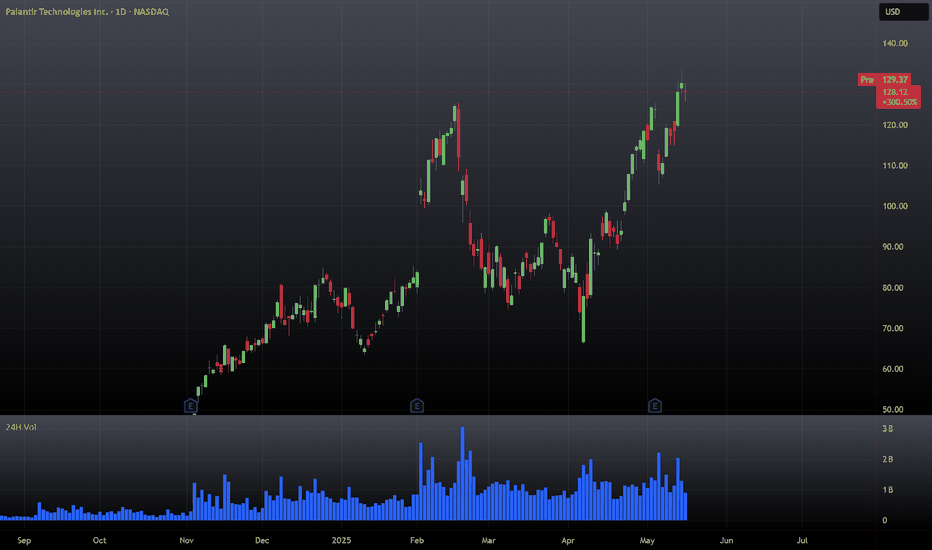

Why it's time to take a closer look at Palantir stockWell well well, a good mystery starts with a whisper. For Palantir, it began in 2003, in the shadows of war-torn Iraq and Afghanistan. U.S. forces were struggling. Data was scattered. Decisions were delayed. Then came a company that promised to stitch the chaos together - to map the battlefield, spot terrorists, and maybe, just maybe, save lives!

After two decades: Palantir is no longer just a software firm - it's a silent architect behind some of the West’s most mission-critical operations.

🕵️♂️ Mission?

Not just to build technology. Not just to analyze data. But to influence life-and-death decisions - "Our product is used on occasion to kill people," their leadership says without blinking.

💼 Game?

Winning Defense Department contracts - and commercial giants too.

They've hired former Pentagon insiders, like Gregory Barbaccia and Shyam Sankar, and even political power players like Machalagh Carr, formerly Chief of Staff to House Speaker Kevin McCarthy. Play chess, not checkers?

💉 During the COVID-19 pandemic, Palantir stepped into the public health arena, building the infrastructure to track outbreaks and distribute vaccines for the U.S. government. They weren’t just responding - they were organizing the response.

🧠 And now? AI is their battlefield.

In August 2024, they deepened ties with Microsoft, integrating Azure OpenAI with Palantir's AIP - but not just anywhere. In classified environments. The stakes? National security. The client? The U.S. government.

Magnificent Seven: Still Magnificent? Or Diverging for Good?The Nasdaq 100 has bounced, but under the surface, the “Magnificent Seven” are no longer marching in sync.

And this divergence matters, especially if you’re trading QQQ or using it as a momentum proxy.

⚔️ Leadership Rotation in Real Time

- Nvidia (NVDA): Still a beast. Making fresh highs, clear institutional momentum.

- Microsoft (MSFT): Quiet strength — not flashy, but technically clean.

- Meta, Amazon: Holding up, consolidating after major runs.

- Apple (AAPL) and Tesla (TSLA): Weak links. AAPL can't find a bid. TSLA is stuck below major resistance.

Trading QQQ directly?

Consider weighting your thesis by what’s working under the hood.

- QQQ reclaimed the 200-day MA with the May 12's gap echoing the broader S&P move.

- Look for a retest of the resistance and the previous high of 540

- Play breakouts with confirmation, or mean-reverting pullbacks.

🧠 Final Take

The Magnificent Seven are splitting into two camps: those still driving the rally, and those dragging it.

Tariffs Shocked the World, But Look What Happened NextTrump's “Liberation Day” reciprocal tariff announcement triggered a sharp selloff in the S&P 500 on the 2nd April. A classic policy shock! But the market has since clawed back every point.

So what now? Let’s break it down by strategy.

🔎 Long-Term Investors: Stay the Course

1) This recovery reinforces one truth: When you own quality businesses, Volatility ≠ Risk. Policy creates opportunity, not exit signals.

2) Stick with great companies, buy on fear, and ignore the noise. The next 10 years won’t be won by panic.

⚡ Momentum Traders: Technical Reversal Delivered

1) S&P 500 bounced above its 30-day MA. With the May 12th’s bullish gap (post temporary tariff pause) confirming the trend shift.

2) This was a textbook momentum setup. But if you didn’t plan for the whipsaw, you missed the edge.

📈 What This Means Now

Short-term volatility is likely to continue as tariffs, rates, and elections are all on the table.

Watch for pullbacks into structure and keep risk tight as news-driven moves will be fast and brutal.

Choose your timeframe. Respect the trend. Don’t confuse noise with signal.

The edge now isn’t in prediction — it’s in preparation.

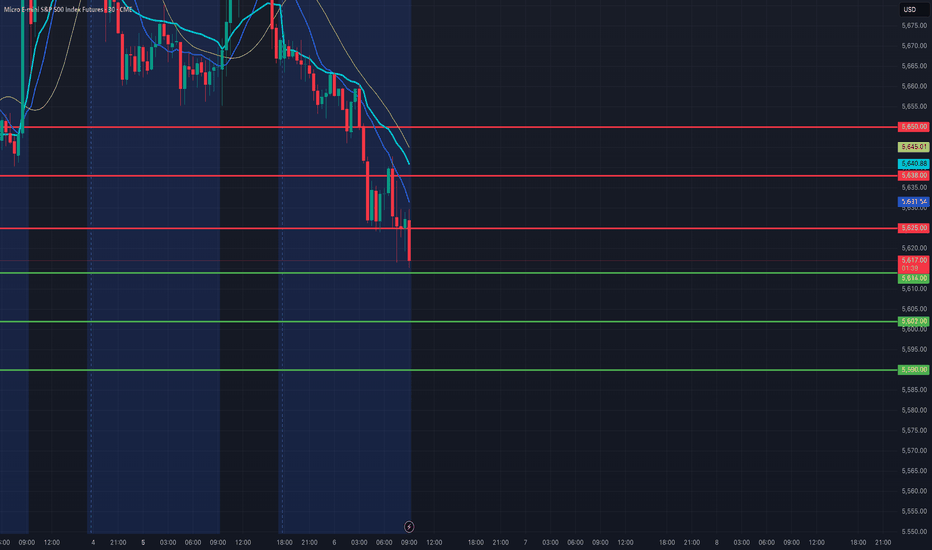

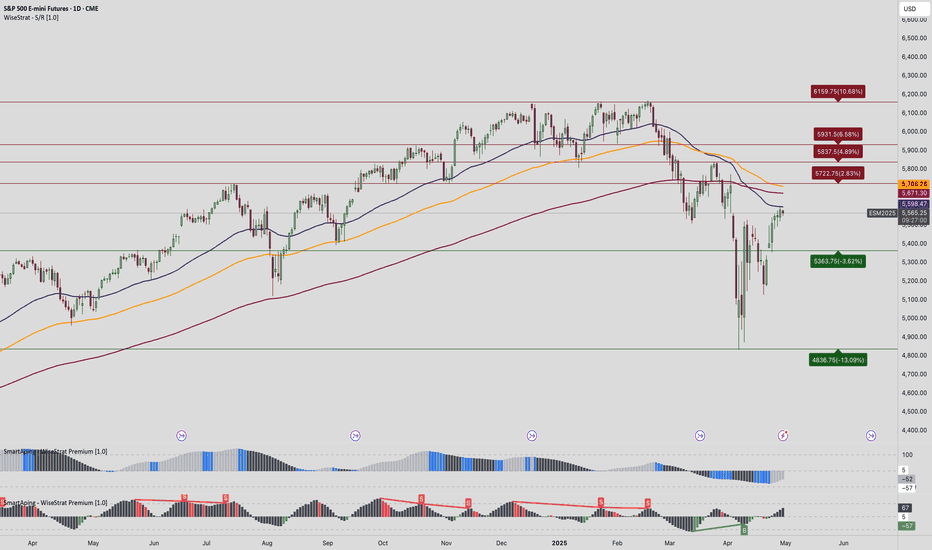

MES1!/ES1! Day Trade Plan for 05/06/2025MES1!/ES1! Day Trade Plan for 05/06/2025

📈 5625 5638 5650

📉 5614 5602 5590

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

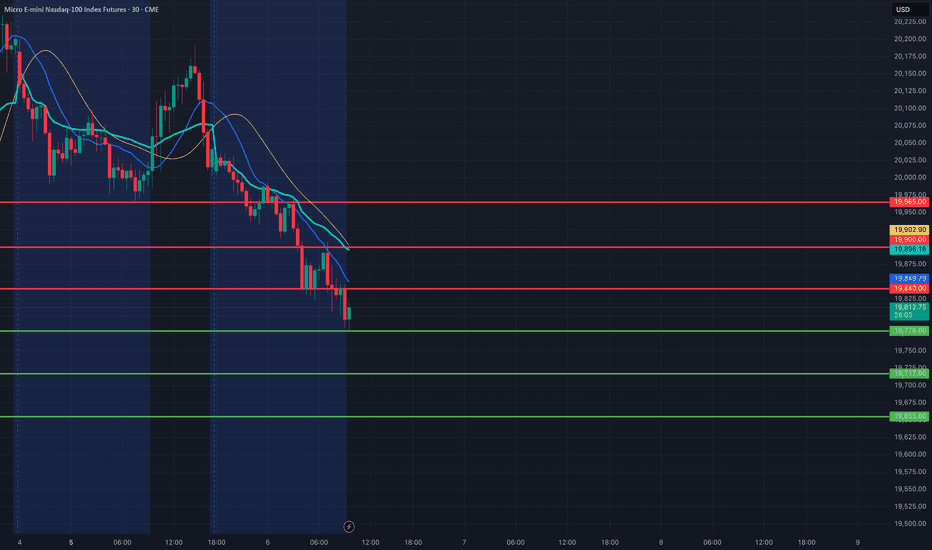

MNQ1!/NQ1! Day Trade Plan for 05/06/2025MNQ1!/NQ1! Day Trade Plan for 05/06/2025

📈 19840 19900 19965

📉 19779 19717 19655

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

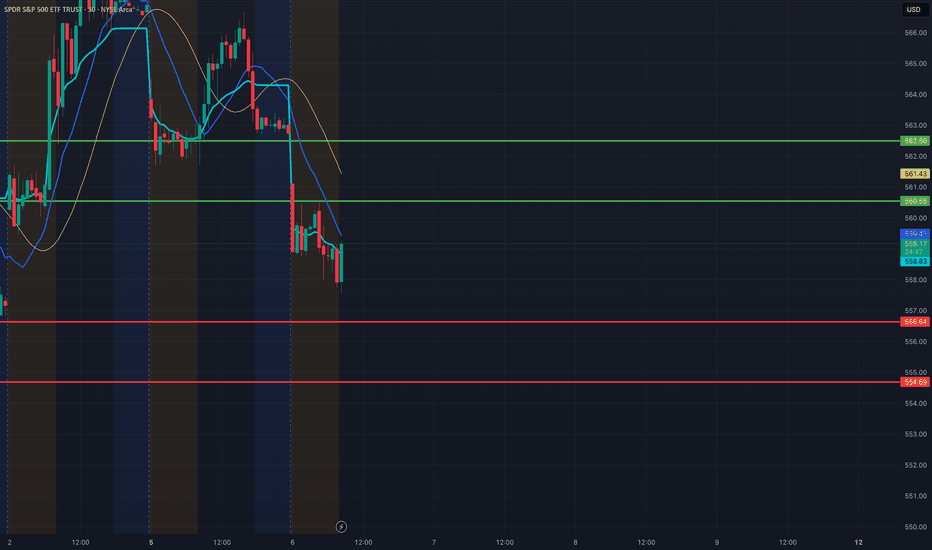

SPY Day Trade Plan for 05/06/2025SPY Day Trade Plan for 05/06/2025

📈 560.55 562.50

📉 556.64 554.69

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

May 6, 2025 - Markets Hold Their Breath Before Powell SpeaksHello everyone, it’s May 6, 2025 and markets are once again at the mercy of politics, Powell, and presidential mood swings.

After a 9-day rally, U.S. markets finally took a breather yesterday, with mild profit-taking ahead of the much-anticipated Federal Reserve decision. Investors are caught between two competing visions: Trump’s push for massive rate cuts, insisting inflation is a myth cooked up by bureaucrats, and Powell’s more sober stance acknowledging inflation isn’t dead, the economy is softening, and premature easing could trigger full-blown stagflation.

With Friday’s job report stronger than expected, Powell is expected to hold rates steady, staying cautious while tariffs and growth clouds loom. Markets are pricing in a July cut at best, but uncertainty lingers mostly around what Trump might tweet in reaction to Powell’s speech tomorrow night.

Meanwhile, despite the 90-day tariff moratorium, the trade war narrative hasn’t vanished. NYSE:F suspended its 2025 outlook, citing $1.5 billion in expected tariff costs and four major risks: disrupted supply chains, retaliatory measures, unclear tax policies, and emission rules. NASDAQ:MAT is also hedging its bets shifting production out of China and pausing forecasts, while begging for zero tariffs on toys “for the kids.” Their stocks dropped modestly after hours.

OANDA:XAUUSD surged again to $3,368, as fear and safe-haven demand ticked up. BLACKBULL:WTI rebounded to over $58 following an OPEC statement, helping airline stocks breathe a bit. BINANCE:BTCUSDT continued its meteoric rise, now sitting around $94,400.

On the macro front, inflation data like CPI and PPI are being shrugged off everyone’s waiting to see if Powell plays ball with Trump. There’s hope, too, that all this chaos is just Trump’s way of muscling the world into negotiation especially China and if a “deal” emerges, markets could rip higher. Until then, we’re stuck dancing between uncertainty and hope.

Asia opened strong this morning, led by China’s cautious optimism. Futures point slightly lower in the U.S., and volatility remains king. The Fed could flip the script tomorrow or keep us hanging. Stay buckled in.

Tariffs, and Tumult: Wall Street Waits on Super WednesdayHello everyone, it’s April 30, 2025. The TVC:DJI just closed its sixth consecutive green session, with markets clinging to hope as rumors swirl of a first tariff deal—possibly with India—though nothing is confirmed. That tiny breadcrumb of optimism was enough to boost sentiment late in yesterday’s session, even if volatility is dipping below 25% and investor enthusiasm seems to be fading in lockstep.

U.S. macro data continues to paint a picture of “not great, but not terrible.” Consumer confidence and job openings (JOLTS) came in below expectations but not disastrously so, prompting markets to collectively shrug and declare everything “less worse than feared.” It’s a strategy now: ignore bad data as long as it isn’t apocalyptic.

As earnings roll in, companies are split between those who pretend the tariff storm is “manageable” (hello, NASDAQ:COKE ) and those flying blind through economic fog ( NYSE:UPS , Snap, and Super Micro—who might be losing a major client named Nvidia). The overall takeaway? Visibility is garbage, and most companies are bracing rather than building.

All eyes are now on today’s so-called Super Wednesday, packed with economic data (U.S. GDP, PCE, ADP jobs, Chicago PMI) and mega-earnings from NASDAQ:MSFT and NASDAQ:META . But as usual, expectations may outpace reality. Markets often dream of clarity and wake up to more noise.

Meanwhile, China flashed its first big red light: a manufacturing PMI of 49, signaling contraction—the lowest in two years. No shock, considering their ongoing trade war with the U.S., which seems to be giving the global economy the flu.

On the political front, Trump celebrated his 100 days in office with a campaign-style detour to Detroit, throwing shade at Fed Chair Jerome Powell while declaring the economy in perfect health (despite the worst market performance since Nixon’s early days). He promised tax cuts, again, while doubling down on trade threats. Powell, of course, is just trying to survive the week.

Oil briefly dipped under $60 as markets considered the broader implications of economic warfare, gold sits at $3,311, and Bitcoin hovers around $95,000—looking resilient despite the madness.

As for corporate earnings, Starbucks missed on sales due to weak U.S. demand, Pfizer beat on EPS but saw revenue fall, and Visa continues to rake in profits as Americans keep spending like inflation isn’t real. Novartis crushed it but got no love from the market because apparently, +22% net income just isn’t sexy enough.

In short: chaos remains king. Markets seem oddly calm on the surface, but under the hood, it’s still all about tariffs, Trump tweets, and the fantasy that maybe—just maybe—some clarity will come today. Don’t hold your breath.

Enjoy the ride, and see you tomorrow for more market mayhem.