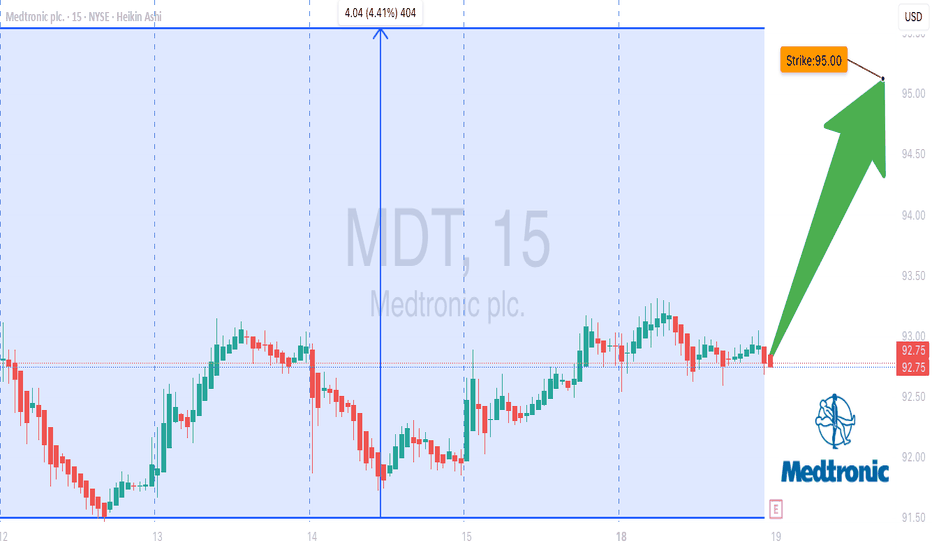

MDT Earnings Explosion – 95C Call for Big Gains!

# 💉 MDT Earnings Call Option – 95C Play (8/21 BMO)

📊 **Market Snapshot**

* Revenue Growth: +3.9% TTM

* Margins: Profit 13.9%, Operating 17.1%, Gross 65.4%

* Earnings Beat History: 100% past 8 quarters ✅

* Forward EPS: \$5.85 → ambitious 62% growth expectation

* Technical Support/Resistance: \$92 / \$96.25

* Options Flow: Balanced calls/puts, slight put skew

* IV Rank: 60% → moderate implied volatility

---

## 🎯 Trade Setup (Pre-Earnings)

* **Instrument**: MDT

* **Direction**: CALL (LONG)

* **Strike**: \$95

* **Expiry**: 2025-08-22

* **Entry Price**: \$1.62

* **Profit Target**: \$4.50 (\~200% potential)

* **Stop Loss**: \$0.81 (50% of premium)

* **Size**: 1 contract

* **Confidence**: 70%

* **Entry Timing**: Pre-earnings close

* **Earnings Date/Time**: 8/21 BMO

* **Expected Move**: \$4.90

---

## ⚡ Risk Management

* **Position Sizing**: Limit to 1–2% of portfolio

* **Exit Scenarios**:

* Profit Target → \$4.50

* Stop Loss → \$0.81

* Time Exit → Close within 2 hours post-earnings if neither triggered

* **Volatility Risk**: Moderate (watch IV crush)

---

# 🏥 MDT 95C Call – Earnings Surge Play 🐂

🎯 Entry: \$1.62 → Target: \$4.50

🛑 Stop: \$0.81

📅 Exp: 8/22 BMO

📈 Bias: Moderate Bullish (70%)

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "MDT",

"direction": "call",

"strike": 95.00,

"expiry": "2025-08-22",

"confidence": 70,

"profit_target": 4.50,

"stop_loss": 0.81,

"size": 1,

"entry_price": 1.62,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-21",

"earnings_time": "BMO",

"expected_move": 4.90,

"iv_rank": 0.60,

"signal_publish_time": "2025-08-18 14:10:12 UTC-04:00"

}

``

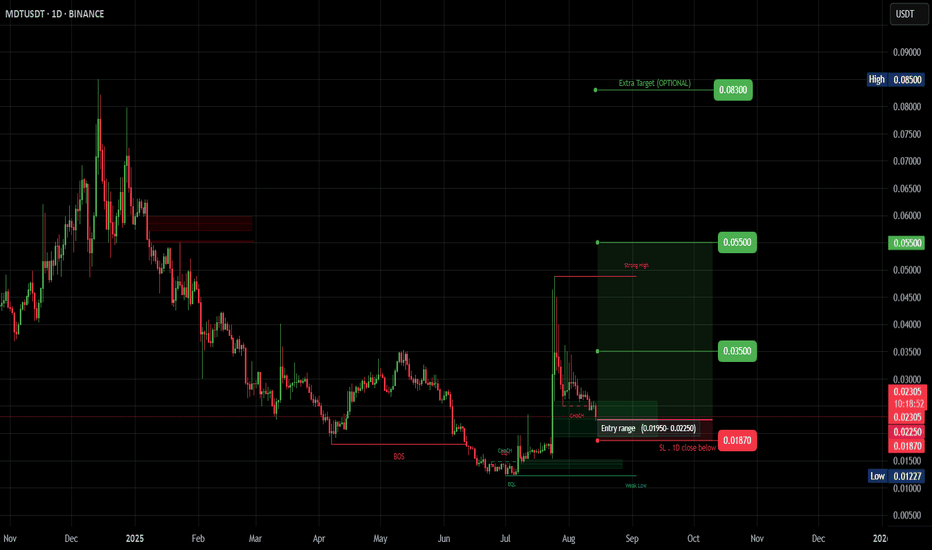

Mdtanalysis

MDT (SPOT)BINANCE:MDTUSDT

#MDT/ USDT

Entry range (0.01950- 0.02250)

SL 1D close below 0.01870

T1 0.03500

T2 0.05500

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

MDT (SPOT)BINANCE:MDTUSDT

#MDT/ USDT

Entry range (0.01350- 0.01480)

SL 4H close below 0.01251

T1 0.01900

T2 0.02200

T3 0.02438

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

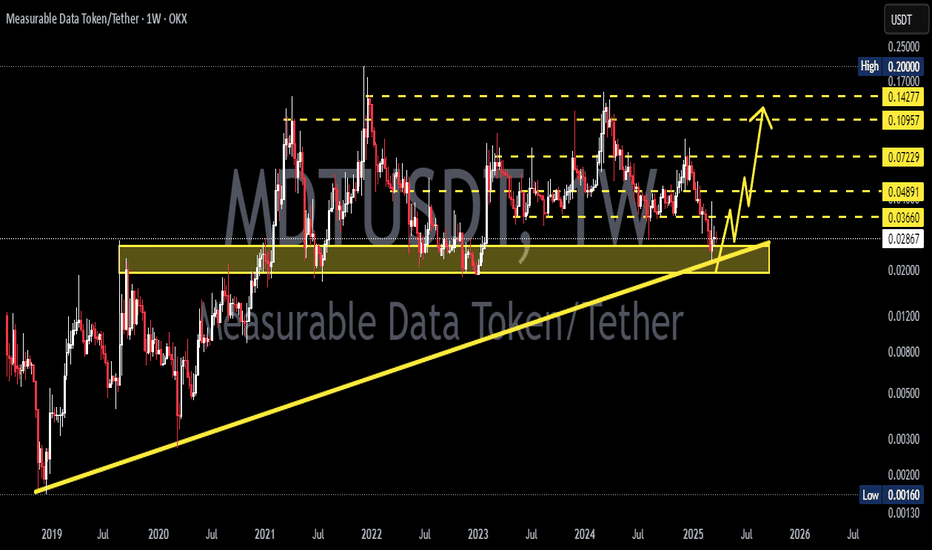

MDTUSDT 1WMDT ~ 1W Analysis

#MDT Trading is very high risk. Buy gradually from here with a short -term target of at least 20%+.

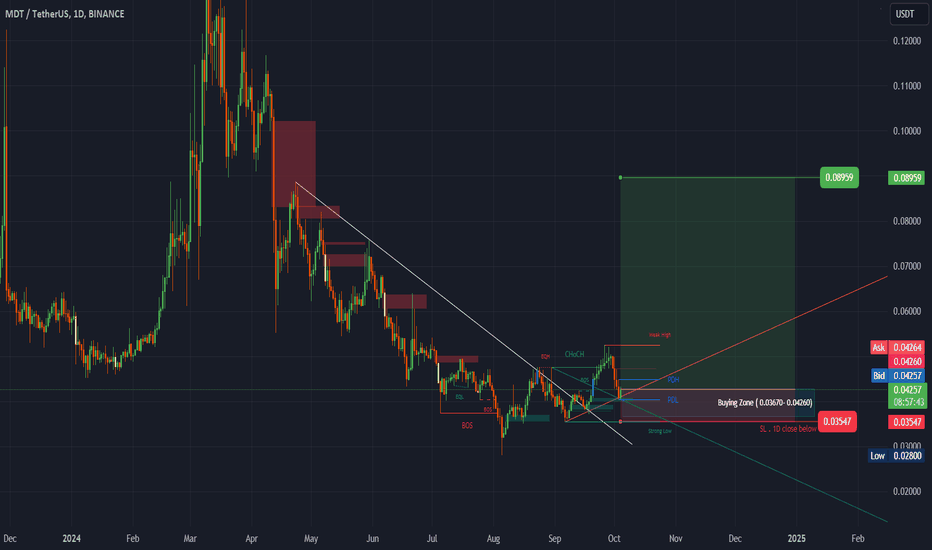

#MDT(SPOT) entry ( 0.03670- 0.04260) T.(0.08959) SL(0.03547)BINANCE:MDTUSDT

entry range ( 0.03670- 0.04260)

Target (0.08959)

SL .1D close below (0.03547)

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #CLV #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #MDT ****

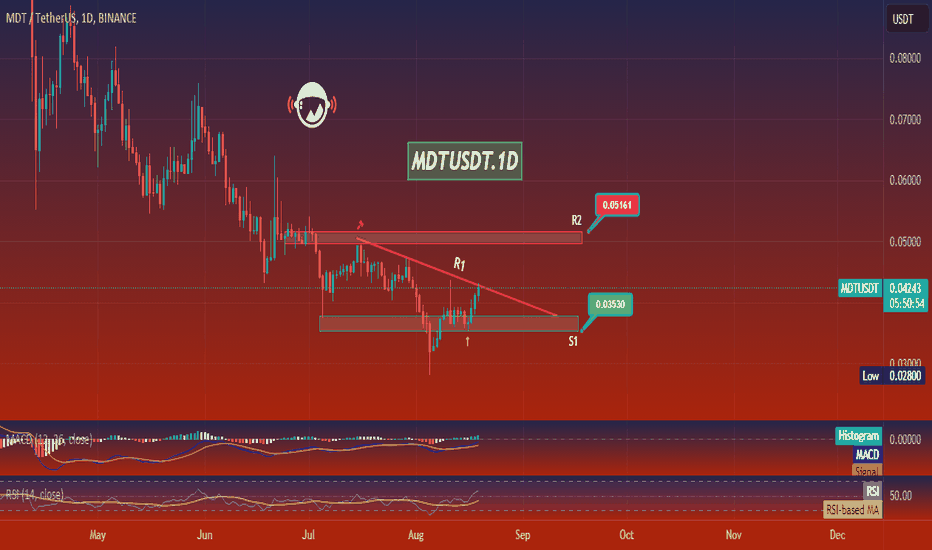

MDTUSDT.1DMDT/USDT Daily Analysis

As we examine the MDT/USDT daily chart, it is evident that the price is currently trading within a range-bound consolidation phase. The price has recently tested and respected the support level (S1) at $0.03530, which has acted as a strong demand zone, providing stability and preventing further declines.

The resistance level (R1) at approximately $0.04310 has been a significant barrier for the bulls, as evidenced by multiple rejections in the past. This level is crucial for any bullish continuation. If the price manages to break above this resistance, the next target would be the secondary resistance (R2) around $0.05161.

The chart shows a potential bullish breakout, as the price is currently attempting to surpass the descending trendline that has been governing the downtrend since early May. A successful breakout above this trendline would likely confirm a reversal, leading to further upward momentum toward R2.

The MACD indicator, though currently showing a slight bullish crossover, remains relatively neutral, indicating a lack of strong momentum in either direction. However, the histogram's positive value suggests that buying pressure might be gradually increasing.

The RSI is currently at 43.15, indicating that the asset is neither overbought nor oversold, providing room for potential upside. The RSI's recent upward movement is a positive sign, hinting at a possible shift in market sentiment toward the bulls.

In conclusion, MDT/USDT is at a critical juncture. The price action suggests a potential bullish breakout, but confirmation is required with a sustained move above the R1 resistance level and the descending trendline. Should this occur, we could expect further gains toward the R2 resistance. However, failure to break above R1 could result in continued consolidation or a retest of the support at S1. Traders should remain cautious and look for strong confirmation before taking any positions.

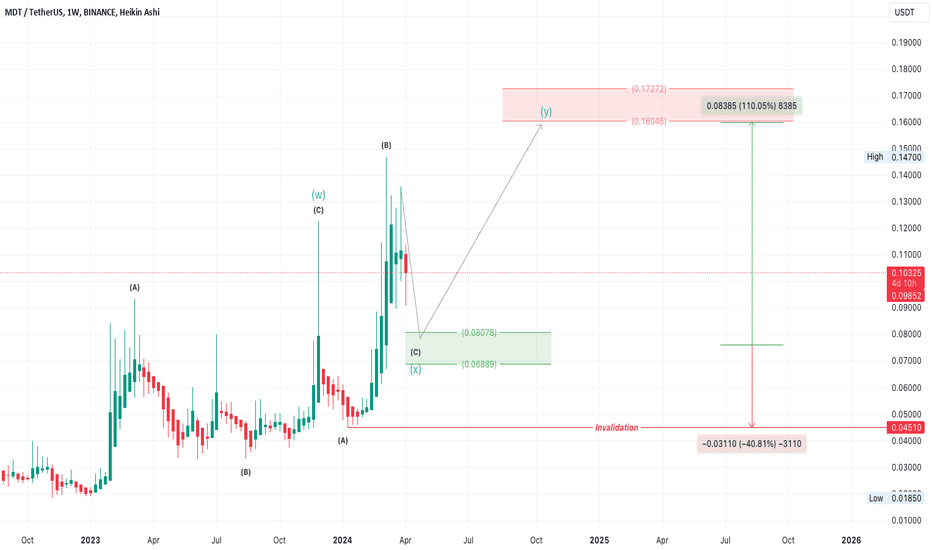

MDTUSDT long Spot TradeMDTUSDT Elliott Wave Technical Analysis

Mode: Corrective

Structure: Zizag

Position: Wave (c) of (x)

Direction: Wave (c) of (x) is still in play

Details: Wave (x) is still in play which I expected to be end around 0.080-0.068 forming a running flat, which will be my entry point.

Next Direction: Wave (y)

Targets: the area between 0.16-0.17 with 100-125% profit.

if it break the last high at 0.17888 then take a look on the Alt version bellow.

Wave Cancel invalid level: Daily closing below 0.045 with 40% loss, big loss so think a lot before you enter this trade.

ALT:

Disclaimer:

This analysis is intended for educational and informational purposes only and should not be construed as financial advice. Always conduct your own due diligence and consult with a professional financial advisor before making investment decisions.