BTC & $DOGE - Asia started the week with a downmove for #BitcoinYo guys, welcome to the channel Hawkeye Charting.

Asia started this week with a follow through for a downmove and moves currently in the preparation for London.

Watch the video to understand, what I'm paying attention for.

Enjoy watching the video :)

No BS like bullflags. No Asking: when moon?

Always referring to the current state of psychology and what the market maker aims to do next.

Pointing out the major trend on Elliott Waves.

Peace

Disclaimer:

No financial advice!

All content is for information and entertainment purposes only and only reflects our personal opinions or market steps. Viewers are expressly requested to form their own opinion on the content and the statements as well as, if necessary, to seek professional advice.

Meanreversion

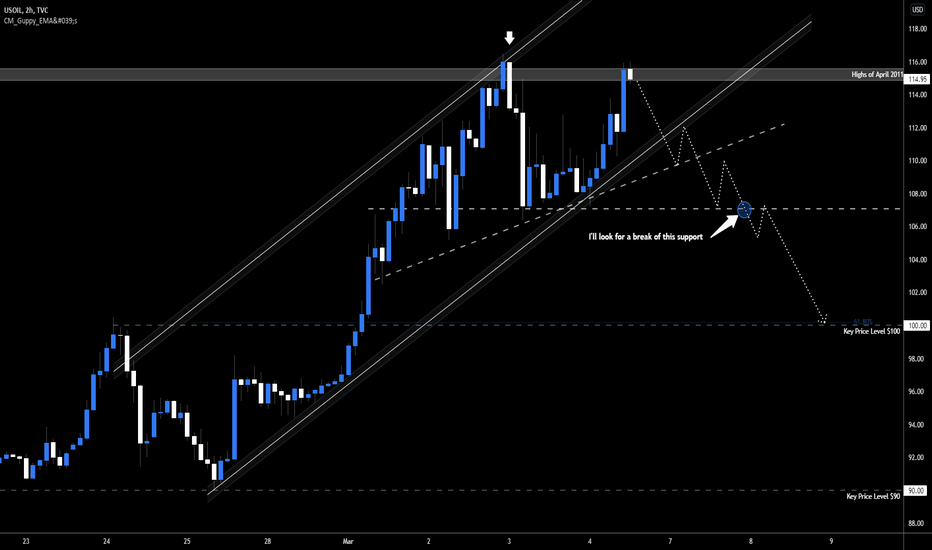

Oil at 2011 Highs - What to look forThis isn't strictly a technical analysis. I'd like to gage the market sentiment and geo political tensions before I commit to a trade. If I see price break support but I'm seeing bullish headlines, I won't take a oil short. I'm waiting for a bearish catalyst and a break of the support I pointed out.

Below are some bullish and bearish headlines I'll be looking out for.

Bearish Oil Headlines Examples:

Cease Fire in Ukraine

Russians Withdrawal

Iran Nuclear Deal reached

Refusal to sanction Russian Oil

More reserves released

Bullish Oil Headlines Examples:

Military action involving NATO countries

No fly zone implemented over Ukraine

More nuclear weapon rhetoric

Sanctions on Russian oil exports.

NATO countries supplying weapons/equipment to Ukraine.

Iran nuclear deal negotiations fall apart

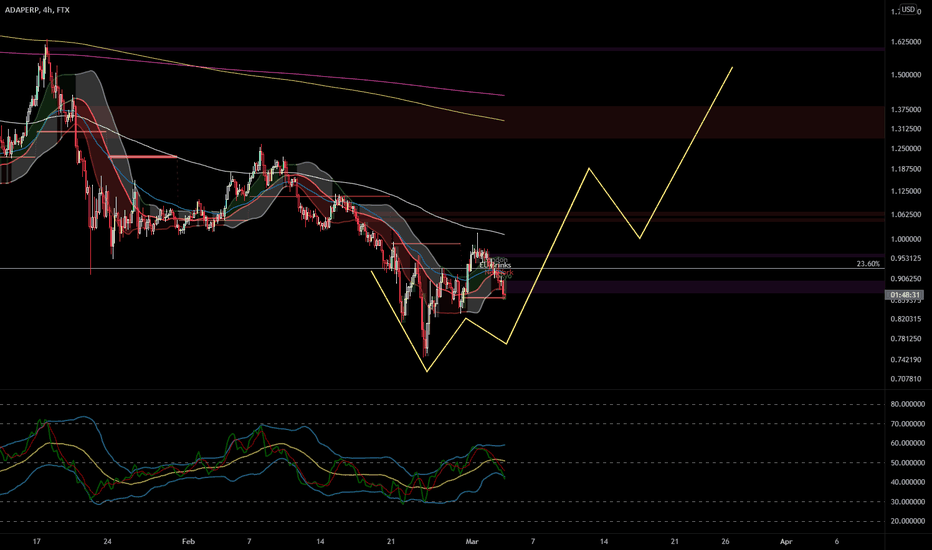

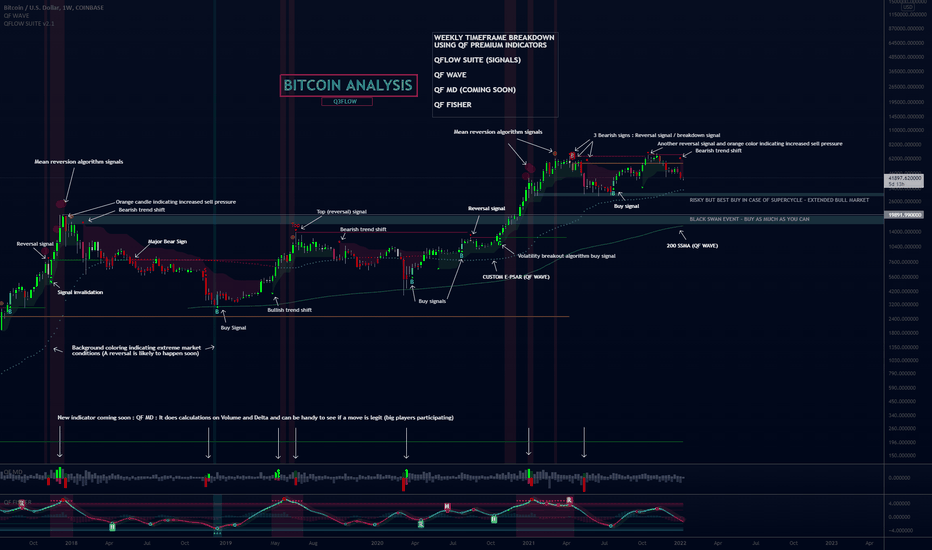

BTC - projection has worked, what NEXT? - Todays altcoin: ADAYo guys, welcome to the channel Hawkeye Charting.

Yesterdays plan has worked well and we understood the Market Makers intention.

But now we have to look again, where the liquidity is...

No BS like bullflags. No Asking: when moon?

Always referring to the current state of psychology and what the market maker aims to do next.

Pointing out the major trend on Elliott Waves .

Peace

Disclaimer:

No financial advice!

All content is for information and entertainment purposes only and only reflects our personal opinions or market steps. Viewers are expressly requested to form their own opinion on the content and the statements as well as, if necessary, to seek professional advice.

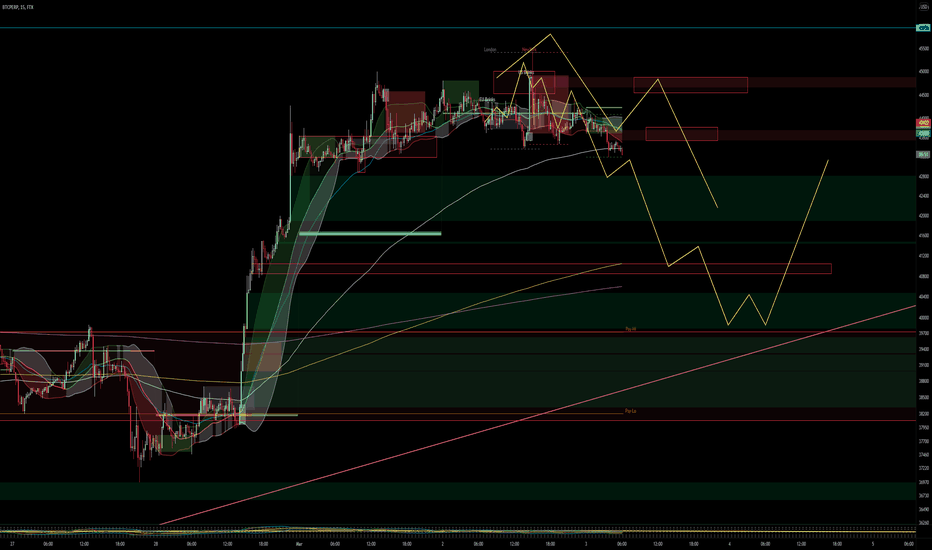

BTC - Mid Week Reversal incoming? Crypto world in moon feeling..Yo guys, welcome to the channel Hawkeye Charting.

No BS like bullflags. No Asking: when moon?

Always referring to the current state of psychology and what the market maker aims to do next.

Pointing out the major trend on Elliott Waves.

Peace

Disclaimer:

No financial advice!

All content is for information and entertainment purposes only and only reflects our personal opinions or market steps. Viewers are expressly requested to form their own opinion on the content and the statements as well as, if necessary, to seek professional advice.

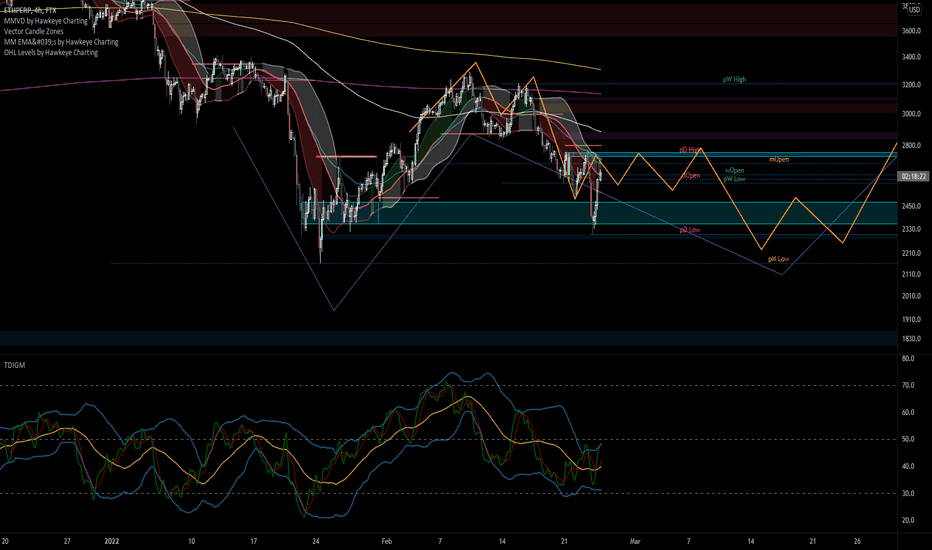

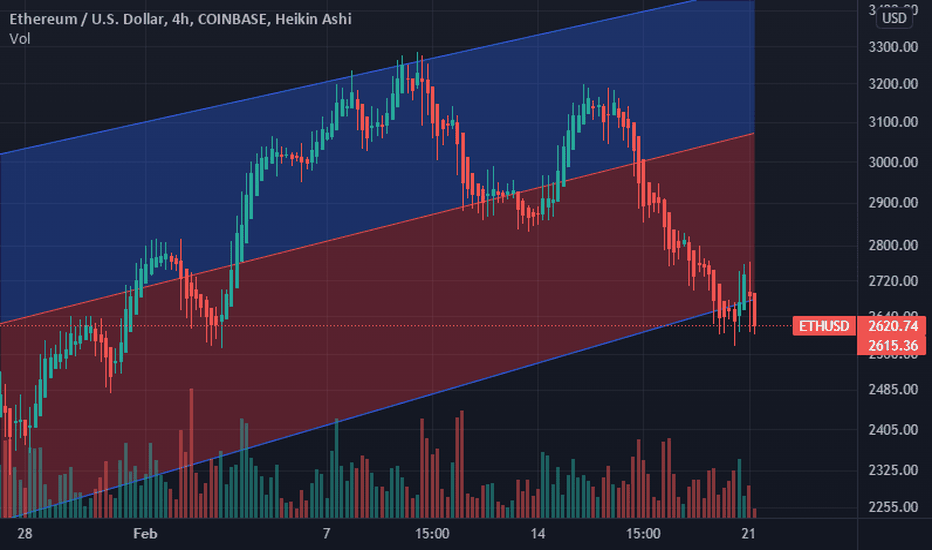

BTC - will there be the follow through? - Todays altcoin: ETHYo guys, welcome to the channel Hawkeye Charting.

Are we about to see the third hit to the high? Orderbook and TDI shows us some warning signals!

No BS like bullflags. No Asking: when moon?

Always referring to the current state of psychology and what the market maker aims to do next.

Pointing out the major trend on Elliott Waves .

Peace

Disclaimer:

No financial advice!

All content is for information and entertainment purposes only and only reflects our personal opinions or market steps. Viewers are expressly requested to form their own opinion on the content and the statements as well as, if necessary, to seek professional advice.

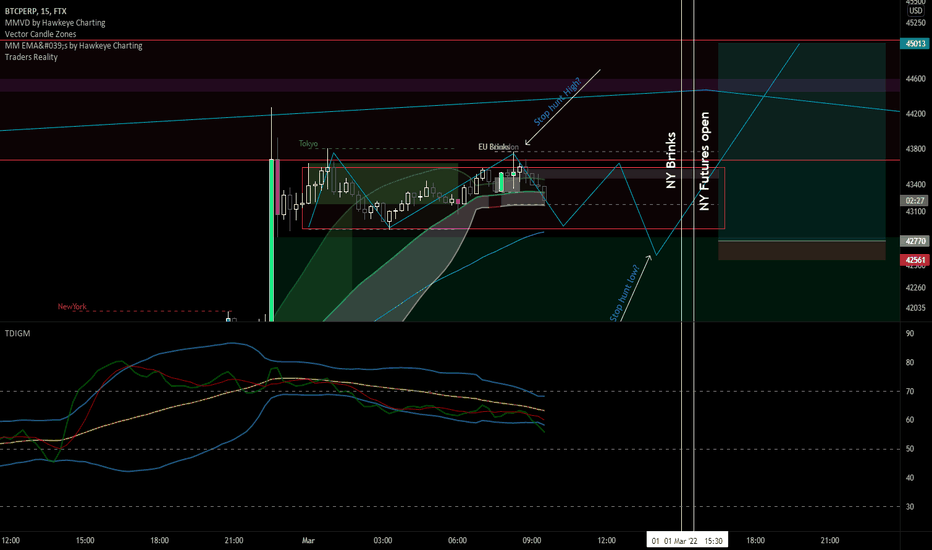

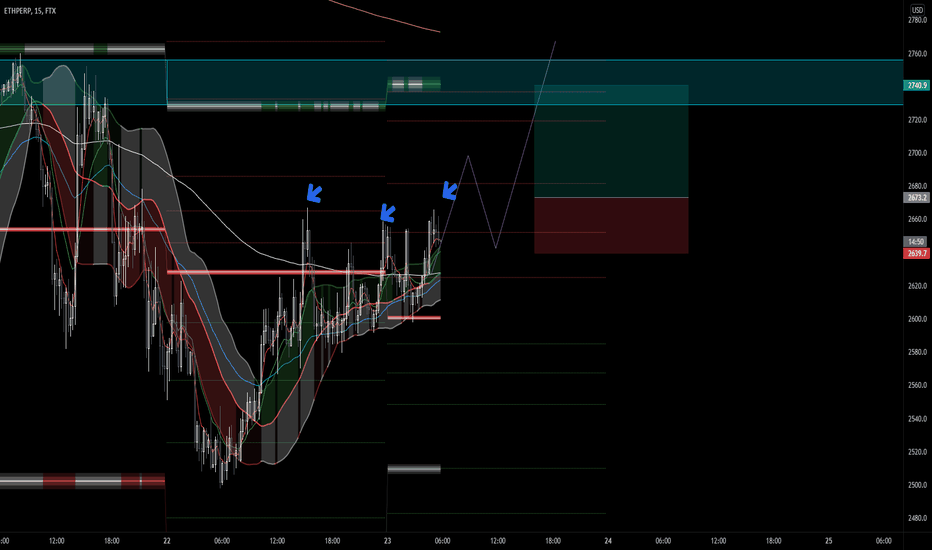

BTC Boring London Session - preparing the last hit to the high?Hey there guys,

there's a probability that we see some kind of accumulation for the last move to the upside.

I'm now waiting to see some kind of doji in the lower area of the marked box, favoured right before the NY Brinks or during the NY Brinks.

50 EMA is waiting in this area, could be the picture of mean reversion then....

Watch the linked video for detailed information on my thoughts.

Peace

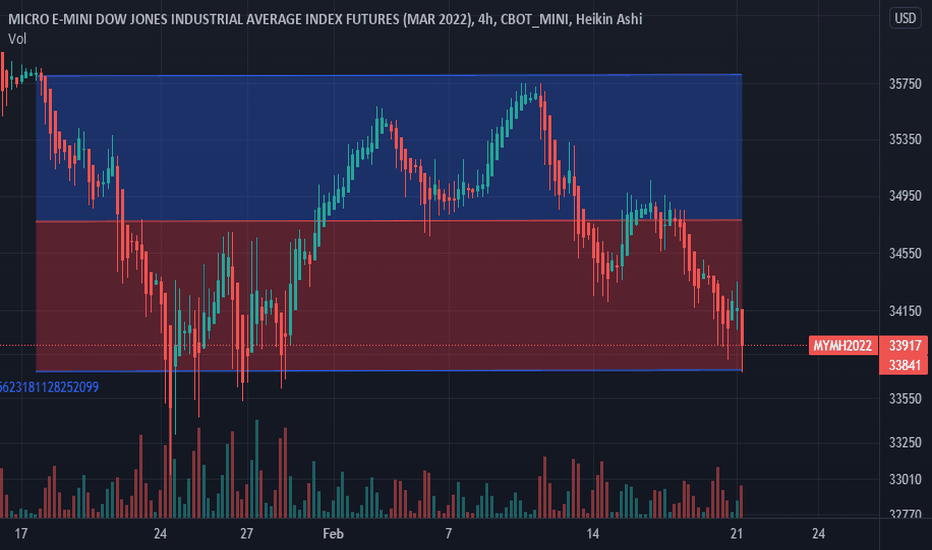

More adventures in elevated volatilityThe bottom of the current volatility futures trend channel is at about 26.20, a level that would have been considered alarmingly high a couple of months ago. If volatility reverses and starts coming back up from at or below that level on Monday or Tuesday, a long position in VIX futures would be a defensible speculation.

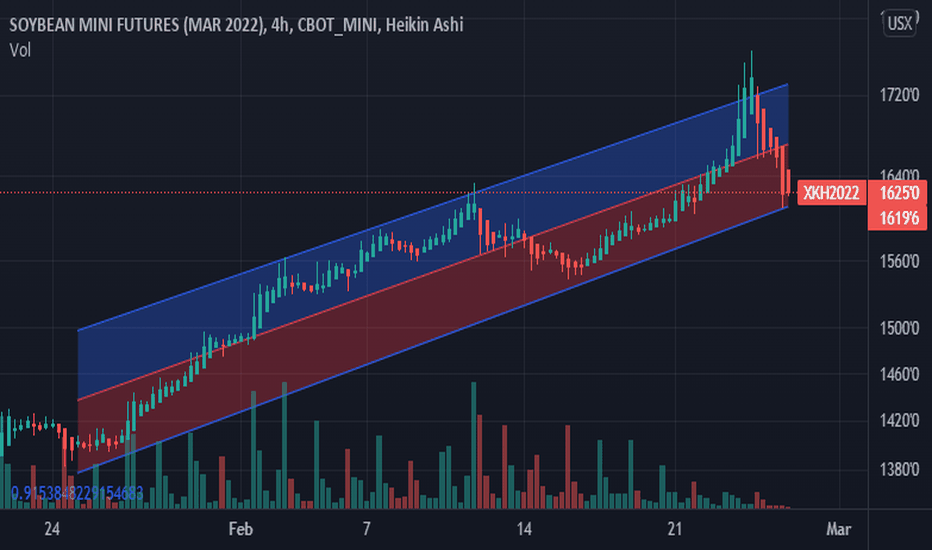

BTBD: Buy the bean dip?The world in general, and fertilizer prices in particular, are alleged to be going to Hell in a handcart. Infernal scenarios aside, a mean-reversion buy in soybeans off the bottom of the current trend channel could make sense. Beans have been a bit volatile lately, so watch this trade if you make it.

BTC Market Makers recovering prev down move - todays altcoin ETHYo guys, welcome to the channel Hawkeye Charting.

Yesterdays NY Session completely neutralized the the aggressive move to the downside af the asia session.

Will we see a recovery of the current zone 37.5 - 36k or will we see more preparations for another downmove?

No BS like bullflags. No Asking: when moon?

Always referring to the current state of psychology and what the market maker aims to do next.

Pointing out the major trend on Elliott Waves .

Peace

Disclaimer:

No financial advice!

All content is for information and entertainment purposes only and only reflects our personal opinions or market steps. Server members are expressly requested to form their own opinion on the content and the statements as well as, if necessary, to seek professional advice.

BTC Market Makers using ukraine news - todays altcoin: ADAYo guys, welcome to the channel Hawkeye Charting.

Yesterdays projection of working the 36-35k zone in BTC has been even surpassed and we're now waiting for some kind of reversal relating to the market maker method.

Is Price affected by the ukraine news or did the market makers simply use the news to hide their hand?

No BS like bullflags. No Asking: when moon?

Always referring to the current state of psychology and what the market maker aims to do next.

Pointing out the major trend on Elliott Waves .

Peace

Market Makers working the BTC 200EMA... Todays Altcoin: ETHYo guys, welcome to the channel Hawkeye Charting.

MM let us see their hands by working the 200EMA. Question is: Will we see a breakout and move towards the 800EMA first or will we directly go towards the currently interesting pool of liquidity at 36-35k?

Check out what I will pay attention to for today.

No BS like bullflags. No Asking: when moon?

Always referring to the current state of psychology and what the market maker aims to do next.

Pointing out the major trend on Elliott Waves.

Peace

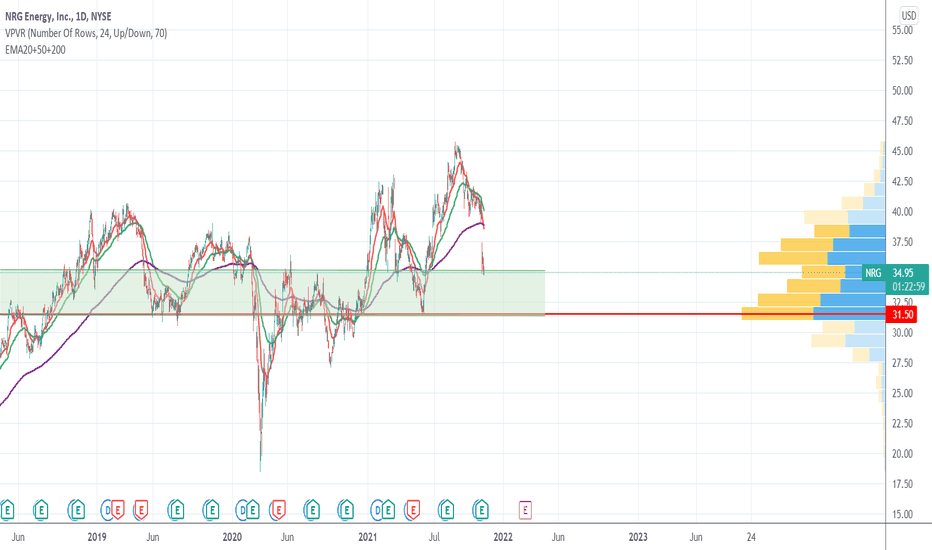

Power generators look poised for relief as O&G prices fallA Mean-Reversion Play

Power generators like NRG and PNW have been quite beaten down lately, mostly because of surging oil and natural gas prices as we head into winter. NRG is .8 standard deviations below its mean, with 82% upside to its median price multiple of the last 3 years. PNW is currently trading about 3 standard deviations below where it usually trades in relation to its 200-day EMA, with 29% upside to its median price multiple of the last 3 years. In my opinion, NRG has more attractive fundamentals, but PNW has the more attractive chart. PNW looks particularly ripe for mean reversion here.

Fundamentals

NRG trades at less than 4 price to free cash flow (P/FCF), which makes it a really good value here. It has a forward P/E below 5 and a forward P/S below .4. S&P Global gives its fundamentals an average score of 87/100, and it has an average analyst rating of 8.7/10. It has 28% upside to the average analyst price target. Of the stocks I follow, NRG's price ratios are in the 92nd percentile, and its price-growth ratios are in the 62nd percentile. So it's cheap on both an absolute basis and when you factor in its rate of growth.

PNW's fundamentals are less attractive. The company has been cash flow negative for a couple years. Its price-to-earnings ratio is just under 14, and its price-to-sales ratio is just under 1.9. Its dividend yield is higher, at 5.4% vs. NRG's 3.8%. But it needs to generate cash flow in order to sustain that dividend. PNW's ESG score is really high, at 2.75/3. It gets just a 35/100 fundamentals score from S&P Global and a 4.7 average analyst rating, however, and it has only 7% upside to the average analyst price target. Relative to the other stocks I follow, PNW is expensive, in the 26th percentile for price ratios and the 11th percentile for price growth ratios. So this is probably not a long-term hold for me.

Open Interest a Contrarian Indicator

Open interest from options traders on NRG is quite bullish, with put/call ratio at 0.6. Open interest on PNW is bearish, with a put/call ratio of 1.4. However, I've recently done some back-testing and discovered that open interest is actually a contrarian indicator in recent data. So the bearish open interest on PNW actually implies a better short-term return. The extremely negative z-score I mentioned in the first paragraph also tends to be correlated with high returns in my back-testing. So my algorithmic trading account has gone pretty heavy on PNW, whereas in my discretionary account I am overweight NRG.

The Catalyst

Power generators have recently gotten crushed due to rising natural gas and oil prices, not to mention uranium. Because power generators are so heavily regulated, it's really hard for them to pass rising fuel costs along to their customers.

However, natural gas prices are down sharply off their highs, and oil and uranium both pulled back a bit today:

If this continues, power generators may fly. NRG looks to be finding some support, and I particularly liked the price action in PNW today.

Both NRG and PNW are coming off better-than-expected earnings reports, but NRG's results excluded some large costs related to winter storm Uri, and PNW reported several very unfavorable decisions from Arizona regulators.

Part of the reason for NRG's outperformance is that it was well hedged against rising fuel costs. NRG announced that it will raise its dividend by 8% in the first quarter of 2022 and that it is paying down debt at a pretty impressive rate as it works toward an investment-grade credit rating. NRG paid down $255 million of senior notes through September 30, 2021 and plans to continue reducing its senior notes balance through 2023. This is just a really well-run company, IMO, which makes it a good long-term hold.

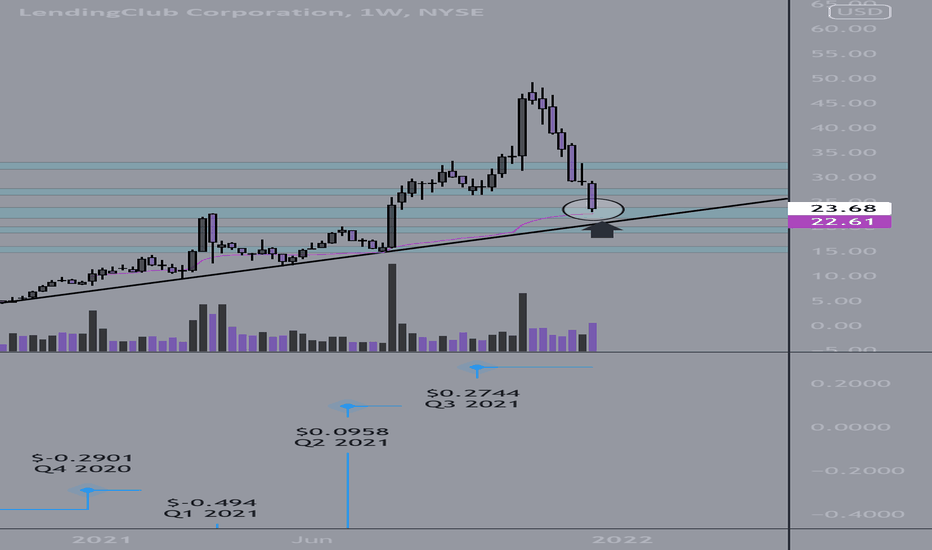

$LC mean reversion long idea, offers 100% upside. Strong growth.$LC mean reversion long after the stock has drifted significantly lower, company is under valued here and doing triple digit earnings. Expecting buyers to show up around this demand level and shorts to cover causing a nice snapback in price.

#GBPUSD long opportunityAs I said a few days ago there is a good potential for GBPUSD bullish move, and since then price has formed a falling wedge which eventually broken to the upside on Friday.

Because of the chart pattern bullish breakout, now we could look for buying opportunities, specially any pullbacks to our falling wedge.

Right now price is forming a bearish corrective move in 1H and 4H time frame. As a result I'm looking for lower time frame structure change to the upside and open a long position on this pair.

Keep in mind price can easily return to the wedge and manage to stay bearish for quite some time.

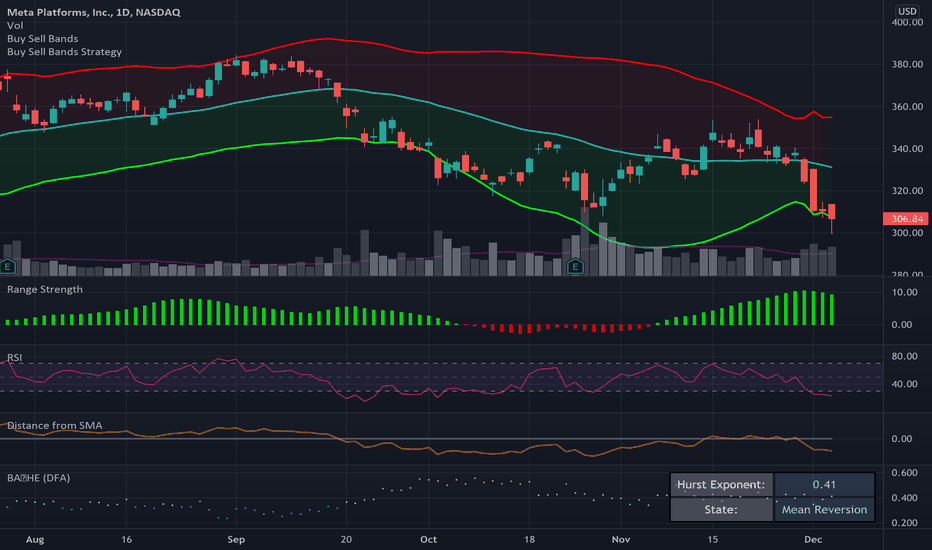

$FB Primed to BounceFacebook $FB is fundamentally and technically undervalued relative to the market $QQQ, with a forward p/e of 20 it's cheap for a big growing tech stock. Today's price action formed a bullish hammer candle pattern with the price under the lower Buy Sell Band making for a good long entry. Range Strength indicates the price is non-trending and we're 7.71% below the 50 day MA giving us a good risk/reward for a mean reversion trade.