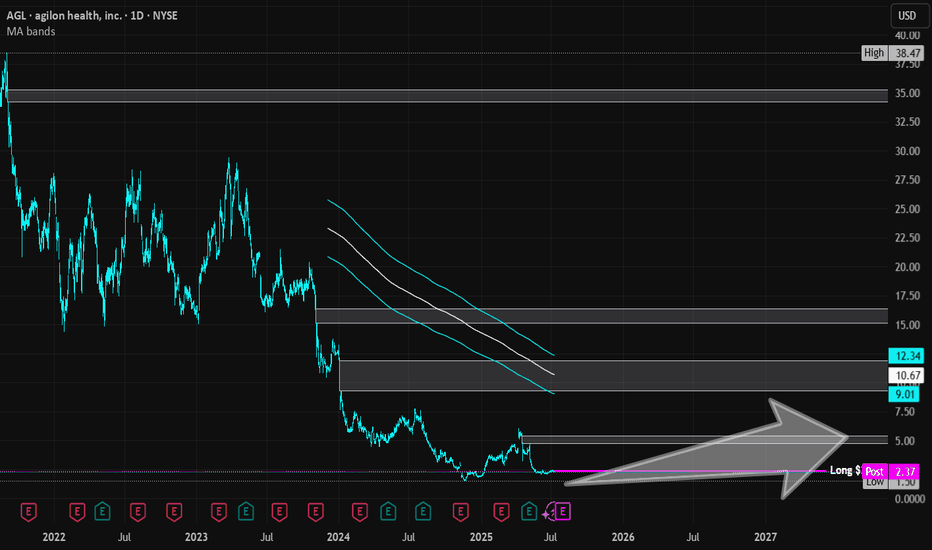

Agilon Health (Revised) | AGL | Long at $0.76This is a revised analysis of Agilon Health NYSE:AGL as seen here:

-------

Full disclosure: I am a holder of shares at $2.36, $0.76, and $0.79. Last entry planned near $0.50 if it reaches that level. Current cost average is near $1.11.

Let me be clear: This is a ***highly risky*** trade given the recent news regarding the CEO, securities fraud investigation, suspension of FY guidance. Do your own due diligence.

-------

The link above/previous writeup details some of the basic fundamentals of Agilon Health NYSE:AGL . As predicted, the price fell below $1 after the most recent earnings call. This was due to:

Revenue down 6% to $1.4B, Medicare Advantage membership at 498,000.

CEO Steve Sell resigning, Ron Williams appointed Executive Chairman.

2025 guidance suspended due to market challenges.

New securities fraud investigations.

I think the challenges NYSE:AGL is going through will extend through 2025 in into early 2026. If you look at the healthcare sector, it has taken a beating mostly due to Medicare and Medicaid cuts / rising healthcare costs. NYSE:AGL is not profitable and wasn't expected to become profitable until 2028 - but that may get revised....

However, the company focuses on senior patients, primarily through Medicare Advantage and ACO REACH programs, targeting value-based care for older adults across 31+ communities in 12 states. The need for services targeting the Baby Boom population is going to rapidly increase in the next few years. NYSE:AGL may become a leader in this area, but the company needs to regroup and focus on a model that returns money to investors - a dirty game. So, while the near-term is doom and gloom, the future could be very, very bright with NYSE:AGL if they are able to turn things around with this new leadership shakeup. Time will tell. It's a gamble. One I am, personally, willing to take.

Revised Targets into 2028:

$1.60 (+110.5%)

$3.00 (+294.7%)

Medicare

Agilon Health | AGL | Long at $2.36Reentering this trade (original: )

Agilon Health NYSE:AGL

Pros:

Revenue consistently grew from 2019 ($794 million) to 2024 ($6.06 billion). Expected to reach $9.16 billion by 2028.

Current debt-to-equity ratio 0.07 (very low)

Sufficient cash reserves to fund operations and strategic initiatives

Strong membership growth (659,000 in 2024, a 38% year-over-year increase)

Recent insider buying ($2 - $3) and awarding of options

Cons:

Rising medical costs - currently unprofitable and not forecast to become profitable over the next 3 years

Medicare Advantage Membership issues with the new political administration

No dividend

It's a gamble and I think it's a possibility this could drop near $1 in the near-term due to the Medicaid changes/fear... regardless, long-term, personal buy-zone at $2.36.

Targets in 2027

$3.70 (+56.8%)

$5.25 (+122.5%)

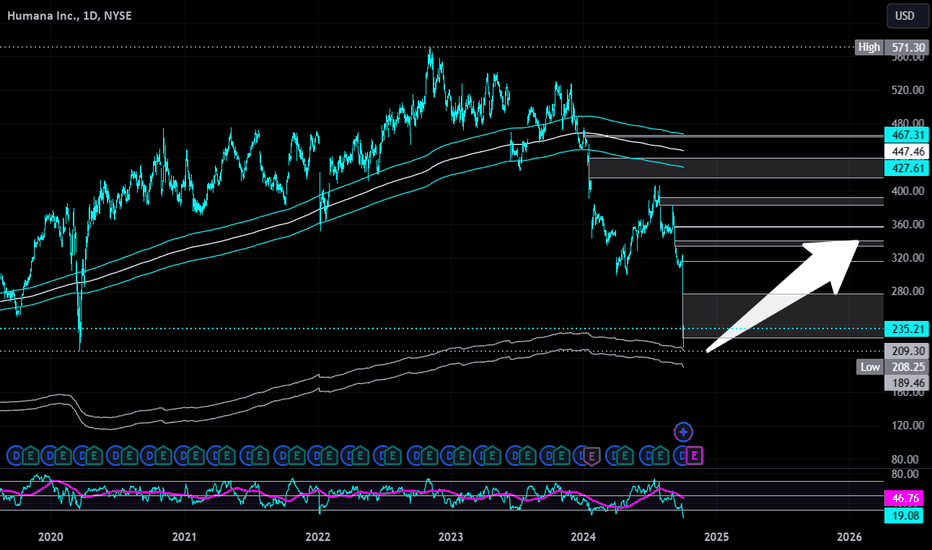

Humana | HUM | Long at $220.00Humana NYSE:HUM took a nosedive to "crash" levels (based on my selected simple moving averages (SMA)) this morning after a lower-performance rating for a widely used Medicare insurance plan is expected to hurt enrollments for 2025 (and will potentially hit the health insurer's revenue and bonus payments in 2026). However, I view this massive drop as an opportunity for an initial long entry for a great value stock. The company is strong, highly rated among patients, and solid fundamentals despite the anticipated earnings drop. From a technical analysis perspective, it touched my "crash" SMA, but may dip further after a dead cat bounce to the $190s in the coming days or weeks. But, predicting true bottom is a fool's game, so at $220.00, NYSE:HUM is in a personal buy zone for an initial long entry.

Target #1 = $250.00

Target #2 = $275.00

Target #3 = $314.00

Target #4 = $340.00

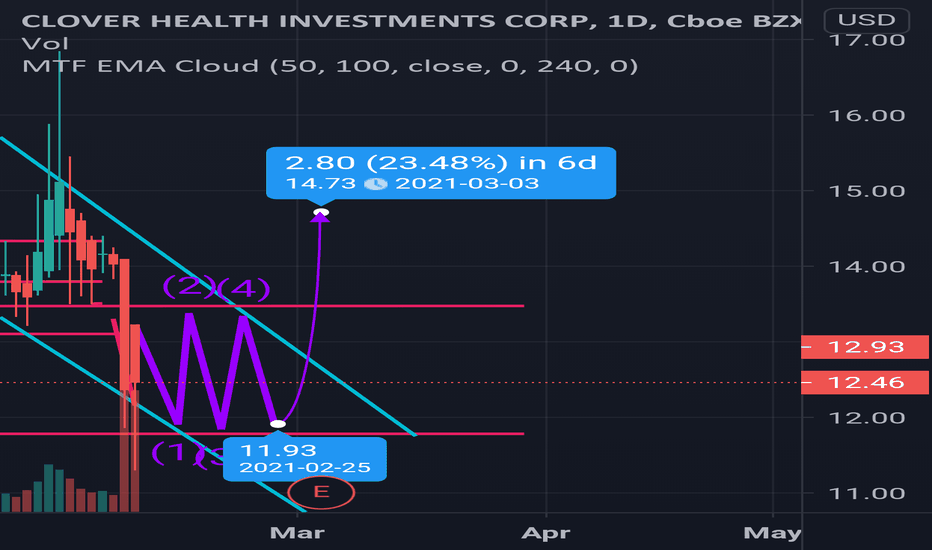

$CLOV Bearish Channels Breakout upward Incoming$CLOV was consolidating after a retracement down. After consolidation and approaching the edge of a wedge indicating a big movement. They were unexpectedly the target of a short sellers report which caused the movement to continue downward. With a well articulated rebuttal the doc was able to rally and bounce back up. We appear to be at the bottom of a bearish channel and will likely retrace back up in the near future a short squeeze caused by any positive catalyst will likely break the channel upward allowing us to retrace upward towards the $14 area. With February 19th options expiring I expect the retracement to happen soon after.

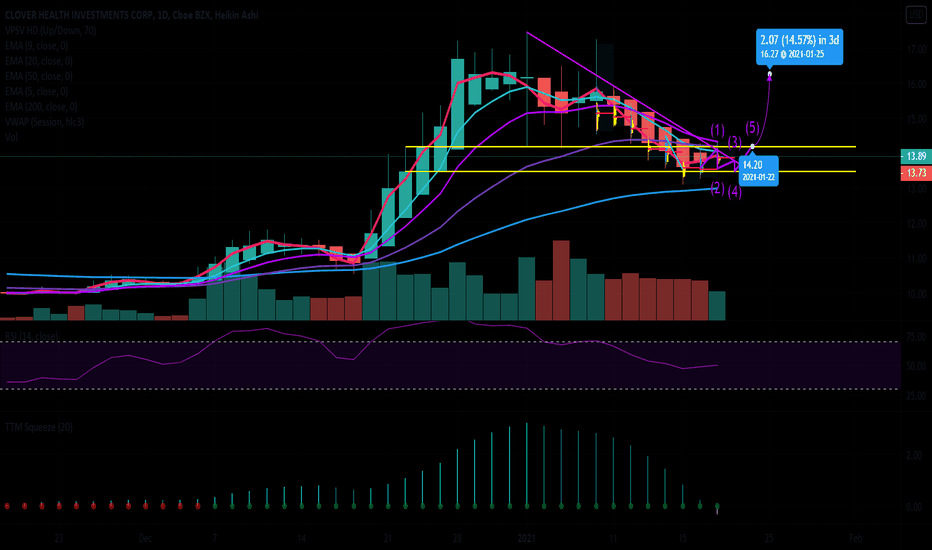

$CLOV Bullish Wedge, Incoming Break Upwards$CLOV revering and nearing end of bullish wedge pattern. We likely see a nice breakup going into next week. Additionally, the Medicare Advantage Leadership Innovations meeting will be held on January 27, 2021 where they stated they'd announce a previously unannounced partnership. Recently updated 2021 provider lists notes the addition of Costco $COST. So this could be potentially huge news incoming as well as a great catalyst to retrace and retest previous high's.

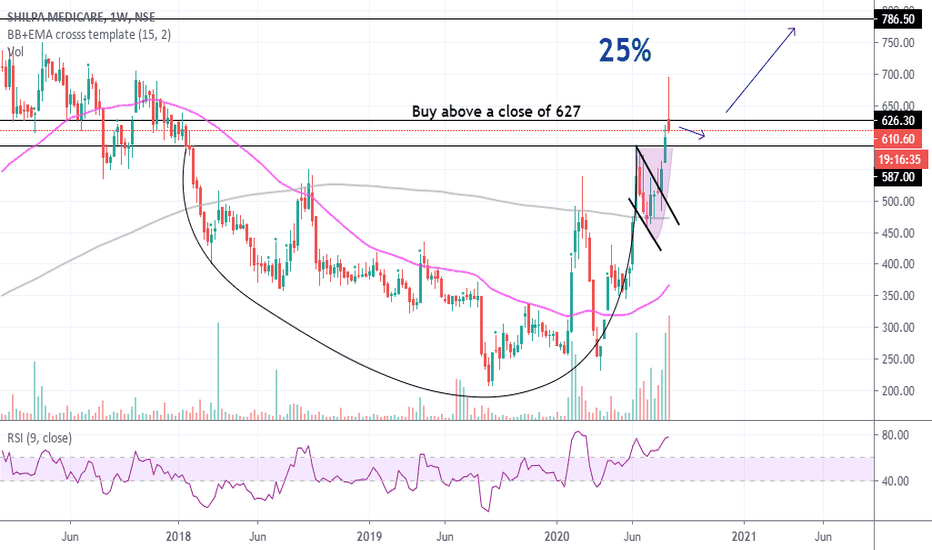

SHILPA MEDICARE - Pull back or breakoutToday's close suggests that there is more gravity towards a pull back.

After the "Cup and Handle" breakout wait for a pullback to end.

With patience 25% on the cards after it crosses 627 on closing basis.

*****

Help Me to Help Us.

I believe in keeping the chart simple with minimal drawings & easy to interpret.

So kindly express any disagreement & improvements so that we learn & earn together.

Please support the effort and appreciate it with a Like if you felt it deserves it and Following me would only add on to the confidence.