XAUMO XAUUSD (Gold Spot) ANALYSIS | AUG 01, 2025 | CAIRO TIME GMThis is a stealth bullish accumulation day. Market maker completed a fake drop and now prepping breakout. Play long bias from control zone with stop-hunt fade backup. Schabacker would call this a false breakdown spring + congestion base rally.

XAUUSD (Gold Spot) ANALYSIS | AUG 01, 2025 | CAIRO TIME GMT+3

🔍 Multi-Timeframe Technical Breakdown (Daily → 5m)

1️⃣ Price Action & Patterns

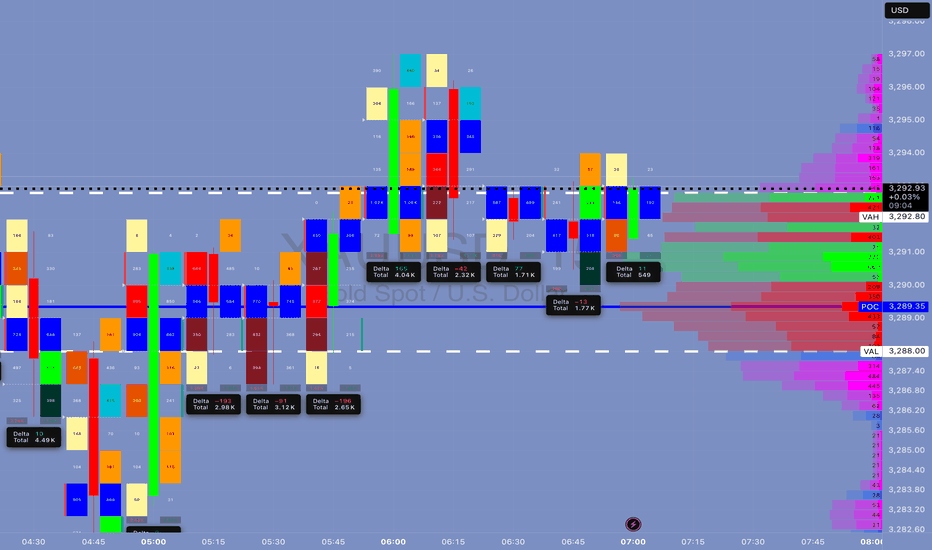

Daily: Bullish rejection tail forming (pin bar) off VAL (3,288). Strong buyer defense.

4H: Classic bullish engulfing off VAL support. High rejection wick to downside. Micro-structure shows market maker trap.

1H: V-shape recovery seen. Absorption bar confirmed via footprint delta spike.

15m: Buyers stepping in at POC (3,289.35), stealthy buying—confirmed by divergence between delta & price.

5m: Accumulation in box range between 3,289–3,292. High absorption on bid side, low offer lifting—sign of stealth long build.

2️⃣ Volume & Delta Footprint

POC Cluster across all TFs: 3,289.00–3,291.50 is the control zone.

Volume Node Rejection at 3,288 = confirmed buyer base.

Delta: Absorption → sellers hitting bids but no follow-through = market maker trap → bullish implication.

Volume Spike at 3,288 = fakeout move likely manipulated to hunt stops.

3️⃣ Support/Resistance

VAL: 3,288 🔥 Strong Demand Zone

POC: 3,289.35–3,291.75 🧠 Smart Money Zone

VAH: 3,292.80 🎯 Break above confirms momentum

Res. Extension: 3,296.20, 3,300

Fibonacci Confluence: 3,288 = 61.8% golden retracement from recent rally

5️⃣Volatility

Compression near VAH = Volatility Expansion imminent.

Expect Breakout in next 1–2 hours (likely post 09:00 Cairo Time – Kill Zone)

6️⃣ Market Maker Philosophy

Last 3 days show liquidity vacuum trap below 3,288.

MM has triggered stop hunts to shake weak longs.

Building long inventory stealthily under POC.

Expecting rally trap to suck in breakout buyers → then retrace → final breakout continuation.

🧨 JEWEL TRADE ENTRY (Highest Probability)

📈 Order: Buy Stop

🎯 Entry: 3,293.10

🛑 Stop Loss: 3,287.70

💰 Take Profit: 3,302.40

📊 Confidence: 87%

🧠 Justification: Breakout of VAH/Golden Zone + High Volume Node = Trend Shift Confirmed

This is for EDUCATIONAL PURPOSE ONLY, and not financial advise.

Megabar

Schabacker's Gold Trap Inside the Trap: Schabacker Congestion, VWAP Warfare & The Silent Distribution on XAU/USD

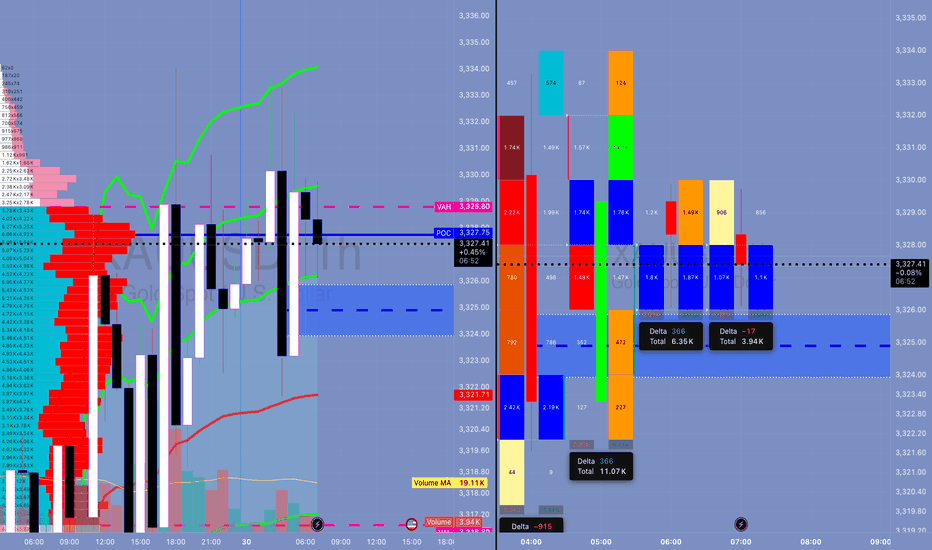

1. The Congestion Area – Schabacker Style

🔍 What We Saw:

Price action rotated in a tight range: 3,324.5 - 3,329.5.

This is not random. This is Schabacker’s classic Congestion Zone:

Duration: 12+ hours

Width: ~5 points

Volume: tapering near edges

Failed breakouts on both sides = classic neutral wedge compression.

🎯 Schabacker Teaching Applied:

"Congestion areas are places of rest and preparation — they are the breeding grounds of significant breakouts or breakdowns."

From his bible “Technical Analysis and Stock Market Profits”:

Congestion after a trend → likely a continuation (but confirm via breakout volume).

Multiple failed breakouts = deceptive strength/weakness → traps.

Range becomes psychological equilibrium → breakout from this zone is explosive.

📘 Lesson:

Watch for breakout confirmation only AFTER price escapes the congestion and retests the range (confirm with volume and delta). If volume weakens and price returns inside = fakeout, fade that sh*t.

🔥 How Schabacker Explains July 29 Price Action

"This was a classic congestion scenario with symmetrical compression, rejecting value high and value low over and over — a balanced market ripe for an imbalanced expansion."

Price coiled with lower highs + higher lows inside the value zone = triangle-like congestion.

Breakout attempts both sides failed = energy stored.

Delta flipped negative toward the close + volume dried = distribution inside the congestion.

✅ Congestion was not random chop. It was the Smart Money disguising their exit before slamming price.

⚔️ ENHANCED STRATEGIC OUTLOOK FOR TODAY (JULY 30, 2025)

🎯 Bias: Short bias unless proven wrong by breakout + acceptance above 3,329.50

Schabacker’s congestion broken to the downside = high probability short trigger.

First target = edge of congestion zone @ 3,316.80 (previous VAL).

Second target (extension) = swing low anchor near 3,310.

📘 Volatility Note:

After tight range like this (Schabacker Box), volatility expansion is imminent. Don’t get caught trading inside — trade the break and retest.

💣 HYPOTHETICAL TRADE PLAN: SCHABACKER STRATEGY IN PLAY

Order Type: 🔻 Sell Stop Below Congestion Break

Entry: 3,322.00

Stop Loss: 3,330.00 (above congestion top + failed breakout zone)

Take Profit 1: 3,316.80 (edge of range, VAL)

Take Profit 2: 3,310.00 (target from congestion width projection)

Confidence: 78%

🧠 Justification:

Factor Explanation

VWAP Flatlined = balanced market

FVRP Price camped near POC = equilibrium

Footprint Absorption at highs, silent selling = distribution confirmed

Delta Early buyer strength flipped = trap

Schabacker Congestion Classic box breakout setup = timing the expansion

🧠 EDUCATIONAL SUMMARY — WHAT YOU JUST LEARNED

✅ Schabacker’s Congestion Area Tactics

Congestion after a move Leads to continuation (trend resumes after pause)

Multiple failed breakouts Traps traders = setup for fakeout fade

Volume dries inside box = Explosive breakout likely

Use congestion width To project breakout targets

You don't fade chop — you exploit it after the breakout.

Don't waste your bullets inside the box. Wait for the beast to break loose — then you unload.