Is Fartcoin Meme Coin About to Crash Hard?In the ever-evolving world of crypto investment, memecoins continue to attract waves of speculative interest, even as their real-world use remains effectively nonexistent. One such meme coin token that’s recently caught the attention of traders and meme enthusiasts alike is Fartcoin—a cryptocurrency as ridiculous as its name implies. While Fartcoin may not be suitable for serious applications, it presents a fascinating case study in how to trade memecoins based purely on supply and demand imbalances.

The Origins of Fartcoin

Fartcoin emerged, predictably, as a joke. Like most memecoins, it was born not out of innovation but out of internet culture. Designed with no technical edge, no roadmap, and no ecosystem, its primary function is virality—riding the waves of social media hype and influencer shills. Fartcoin’s creators never intended it to disrupt finance or decentralize the web; they just wanted to make people laugh (and perhaps get rich in the process).

Yet, despite the lack of fundamentals, Fartcoin gained traction, thanks to Twitter and X memes, Reddit threads, and YouTube influencers who thrive on ironic tokens with humorous names. This is the bizarre paradox of memecoins and crypto investment: irrational exuberance often beats utility.

Why Fartcoin (Like All Memecoins) Can’t Be Used in Real Life

Let’s be clear—memecoins like Fartcoin offer no practical use. Unlike Bitcoin (store of value) or Ethereum (smart contract infrastructure), Fartcoin can’t pay for goods or services, nor does it solve any technological or economic problem. It exists solely for speculation.

Most real-world businesses won’t touch it. It lacks a stable price mechanism, a credible development team, and a long-term value proposition. In other words, Fartcoin is entirely unfit for real-life utility, making it a textbook example of a speculative asset detached from fundamentals.

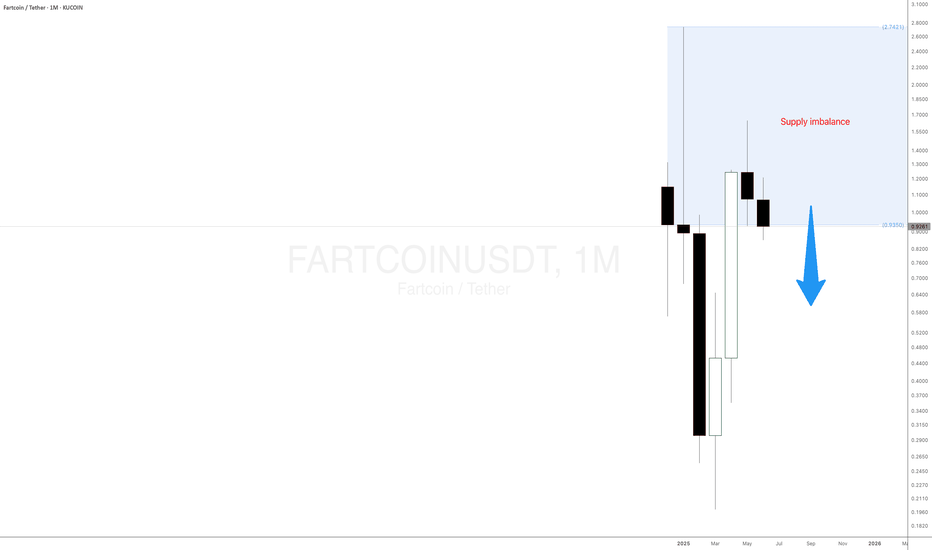

Technical Analysis: Supply Level Suggests a Dump Is Imminent

While Fartcoin may lack intrinsic value, it offers opportunities for active traders who understand market psychology and how to trade cryptos. Currently, the price action reveals a notable supply imbalance around the $0.8982 level—a monthly supply zone that has acted as a key area of institutional selling pressure.

This level is currently “in control,” meaning buyers have consistently failed to push through this resistance. Price is now hovering close to this supply level, suggesting a high probability of rejection. For traders familiar with trading memecoins, this presents a prime opportunity to take short positions using futures contracts available on select cryptocurrency exchanges, such as Kucoin, Binance, and ByBit.

Memecoinstrading

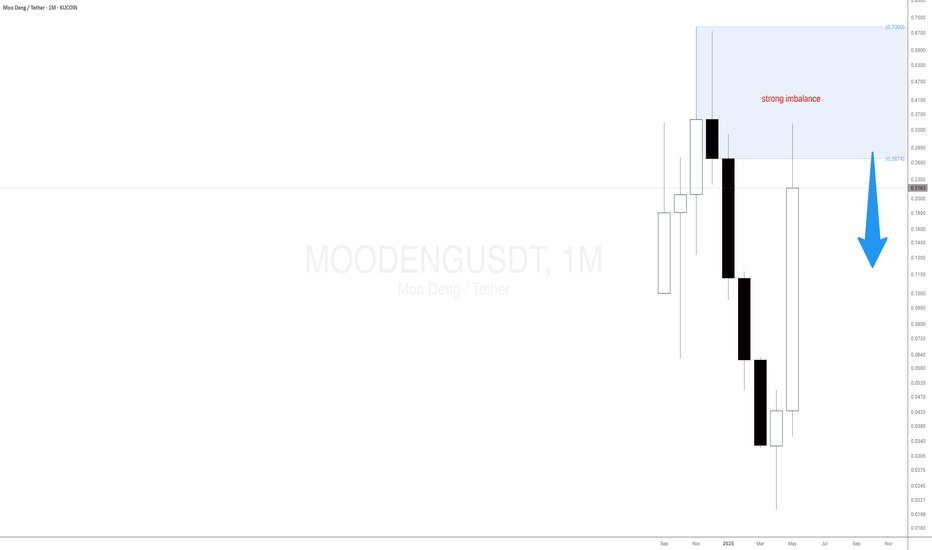

Beginners Guide To Winning Memecoin Trades! Moo DengMeme coins have taken the cryptocurrency world by storm, often starting as jokes but evolving into high-volatility assets that attract crypto traders seeking quick gains. From Dogecoin to Shiba Inu and now Moo Deng, these so-called useless meme coins can offer trading opportunities—if you know where to look.

In this updated crypto analysis, I will build on our previous analysis where I identified a strong monthly supply zone for Moo Deng meme coin at $0.26. If you're wondering how to trade meme coins like Moo Deng, even with little experience, this supply and demand analysis breaks it down using simple supply and demand concepts on larger timeframes.

The sell-off is trying to happen.

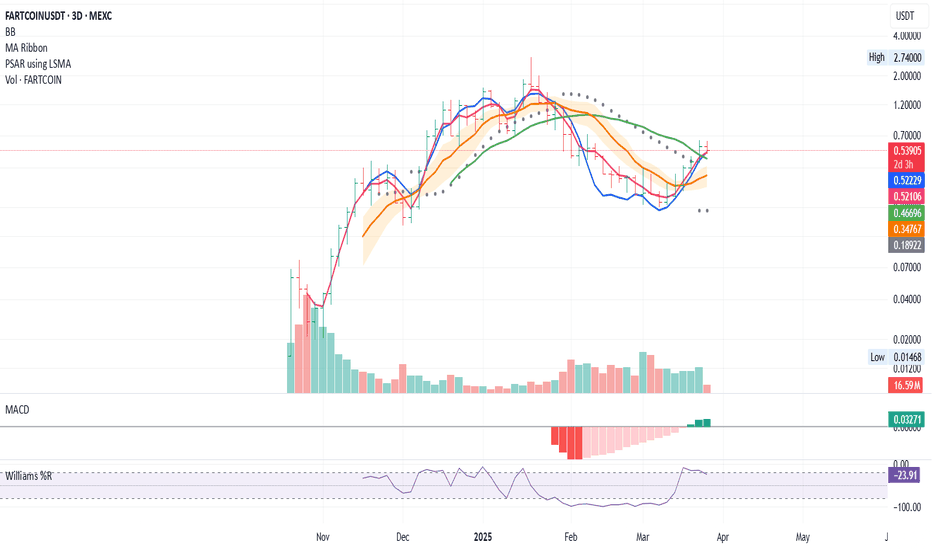

FARTCOIN Long Entry Signal for FARTCOIN / USDT 3Day Time FrameTicker: FARTCOINUSDT

Timeframe: 3D

Analysis:

MLR > SMA: The MLR (blue) is above the SMA (pink), signaling a bullish trend.

MLR > BB Center: MLR exceeds the Bollinger Bands Center Line (orange), showing strong bullish momentum.

PSAR: PSAR dots (black) are below the price, reinforcing the uptrend.

Price > SMA 21: Price is above the 21-period SMA (GREEN), indicating mid to long-term bullish strength for the 3Day time frame.

Trade Idea:

Entry: Consider a long position at this bar close.

Stop Loss: Place SL at the last PSAR level to limit downside risk.

Follow Me: Follow me for exit or profit-taking opportunities.

Outlook: All indicators align for a bullish move. Stay alert for reversal signals or trend shifts.

Risk Warning: Not financial advice, trade at your own risk