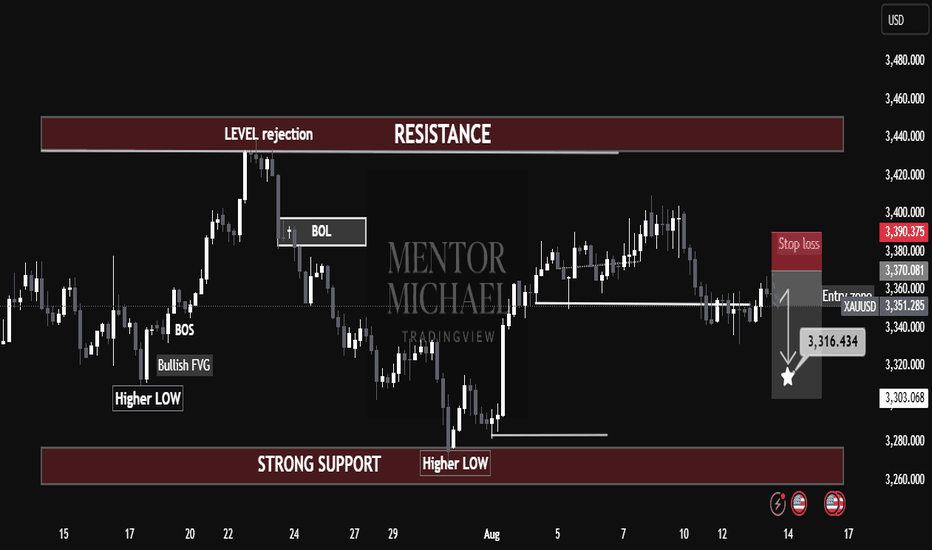

Gold Eyes Short-Term Pullback Before Key Support Test"Gold Eyes Short-Term Pullback Before Key Support Test 🏆📉"

Market Structure

The chart shows a clear range-bound price action between the strong support near 3,303 – 3,316 and the resistance zone around 3,420 – 3,440.

Multiple Higher Lows (HL) indicate that the market has been trying to build a bullish structure, but the recent level rejection from resistance suggests sellers are still defending that zone aggressively.

2. Key Zones

Resistance (3,420 – 3,440): Price tested this level and faced a sharp rejection, marking it as a strong supply zone.

Support (3,303 – 3,316): Historical buy reactions are seen here, making it a crucial demand zone.

Entry Zone: Around 3,351 – 3,360, which is being used for the current short setup.

3. Pattern & Price Action

BOS (Break of Structure) occurred earlier on the left side of the chart, breaking above previous highs and confirming bullish strength at that time.

BOL (Break of Low) later on indicates a shift in momentum, as price failed to maintain the bullish push and created a bearish swing.

The Bullish Fair Value Gap (FVG) earlier provided a springboard for upward movement, but recent momentum failed to sustain.

4. Current Trade Idea (Short Bias)

Entry: 3,351 – 3,360 (retracement to minor resistance after breakdown).

Stop Loss: Above 3,380, protecting against a false breakout.

Target: 3,316 (mid-term) with a possible extension to 3,303 if bearish pressure continues.

5. Sentiment & Risk Factors

Bears are currently favored due to the rejection from major resistance and the inability of bulls to reclaim 3,380+.

If the price reclaims and holds above 3,380, this short setup will be invalidated, and the market could retest 3,420 – 3,440.

📌 Summary:

XAUUSD is trading in a defined range, with the current structure leaning bearish after resistance rejection. A short position from the entry zone targets the strong support below, but traders should remain cautious as higher lows in the past indicate that bulls may still attempt to defend support aggressively.

Mentormichael

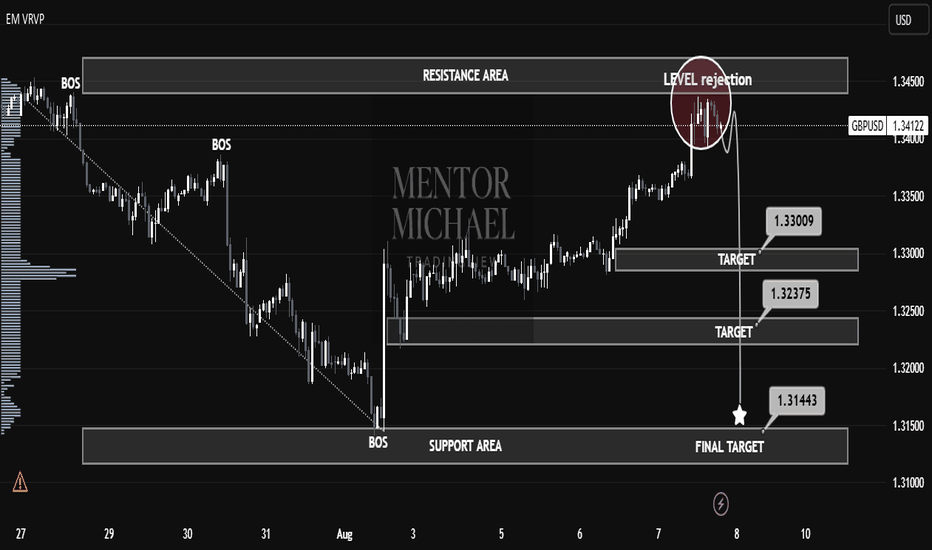

GBPUSD Technical Breakdown – High-Probability Rejection Play📉 GBPUSD Technical Breakdown – High-Probability Rejection Play

🔥 Clean Structure | Strong Confluences | Smart Money Insight

This GBPUSD setup is a textbook example of price action meeting institutional behavior.

🧠 Key Observations:

• Break of Structure (BOS) identified multiple times confirming clear trend shifts.

• Price tapped into a well-defined resistance zone and showed an aggressive rejection, validating seller presence.

• Liquidity grab from the highs led to an immediate drop, marking the start of bearish momentum.

🎯 Target Zones:

• First TP: 1.33009

• Second TP: 1.32375

• Final Target: 1.31443 (aligned with major support zone and BOS retest)

🛡 Why This Setup Matters:

• Strong rejection from premium zone

• BOS confirms direction

• Volume and structure align for high RR potential

• Clean imbalance fill expectations

✅ Plan:

Sell from rejection zone with SL above the wick high. Trail stops as price approaches each target.