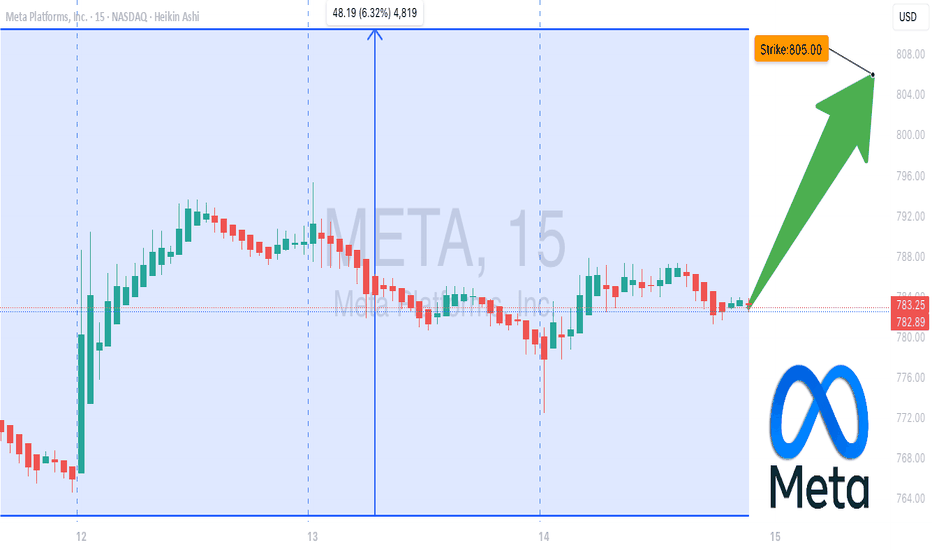

META Calls on Fire– Don’t Miss Out 🚀 META Bulls Eye \$805 – One-Day Call Sprint Before Expiry

**Sentiment:** 🟢 *Strong Bullish*

* **Daily RSI:** Rising 📈

* **Weekly RSI:** Rising 📈

* **C/P Ratio:** 1.82 → heavy call buying

* **Volume:** Weak (0.5× last week) → watch for hesitation

* **Gamma Risk:** HIGH — expiry in 1 day ⚡

---

### 📊 **Consensus Snapshot**

✅ All models agree: bullish momentum + strong options flow

⚠️ Weak volume + high gamma = manage risk tightly

---

### 🎯 **Trade Setup**

* **Type:** CALL (Single-Leg)

* **Strike:** \$805.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.57

* **Profit Target:** \$0.85 (+49%)

* **Stop Loss:** \$0.34 (–40%)

* **Confidence:** 75%

* **Entry Timing:** Market open

---

💬 *High-momentum, high-risk expiry play — eyes on the tape all day.*

📌 *Not financial advice. DYOR.*

---

**#META #OptionsTrading #GammaSqueeze #DayTrading #StocksToWatch #TradingSignals #OptionsFlow**

Metaoptions

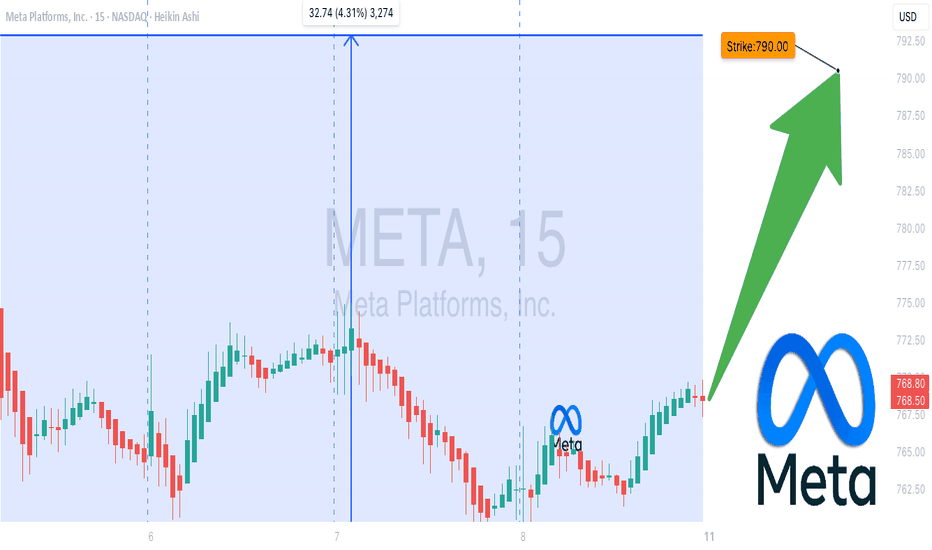

META Eyeing $800? Double-Up Play This Week! 📈 META Weekly Swing Setup (2025-08-10) 📈

**Bias:** ✅ **Moderate Bullish** — strong options flow + favorable volatility, but daily RSI and weak volume suggest caution.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:META

* **Type:** CALL (LONG)

* **Strike:** \$790.00

* **Entry:** \$3.30 (open)

* **Profit Target:** \$6.60 (+100%)

* **Stop Loss:** \$1.80 (-45%)

* **Expiry:** 2025-08-15

* **Size:** 2 contracts

* **Confidence:** 65%

**📊 Key Notes**

* Weekly RSI 70.7 rising → bullish trend intact 📈

* Call/put ratio 1.83 → strong institutional sentiment ✅

* VIX falling to 15.15 → low vol favors directional plays 🛡️

* Volume 0.5x previous week → lighter conviction ⚠️

* Resistance watch: \$784.75 🔍

**💡 Play Idea:**

Enter Monday open → target quick upside before Thursday → cut early if price stalls at resistance.