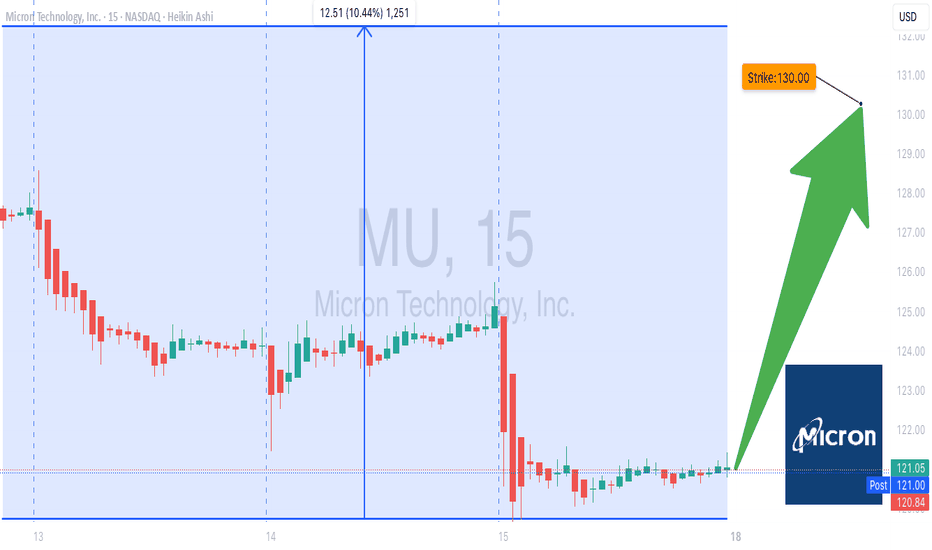

MU Momentum Play – $130 Calls in the Crosshairs!🚀 MU Swing Trade Setup – Riding the Momentum!**

**Moderate Bullish Bias | Aug 13, 2025**

**📊 Key Highlights:**

* **RSI:** Strong – Multi-timeframe momentum confirmed ✅

* **Volatility:** Low – Ideal for swing plays

* **Volume:** Weak ⚠️ (watch for fakeouts)

* **Options Flow:** Neutral – Institutions not leaning heavy yet

* **Resistance:** \$129.73 (52-week high)

---

**💡 Trade Plan:**

* **Type:** Aug 29 ’25 \$130 CALL

* **Entry:** \$2.45 (at open)

* **Stop Loss:** \$1.47 (-40%)

* **Target:** \$4.90 (+100%)

* **Confidence:** 72%

---

**⚠️ Risk Factors:**

* Weak volume could stall breakout

* Neutral options sentiment – big money still on the sidelines

* Pullback risk if price fails to hold above support

---

📆 **Signal Time:** 2025-08-13 12:28 EDT

💎 **Execution:** Buy calls at open, scale out at target

---

\#MU #SwingTrade #OptionsAlert #CallOptions #NASDAQ #BreakoutTrade #MomentumStocks #StockMarket

Microntechnologyoptions

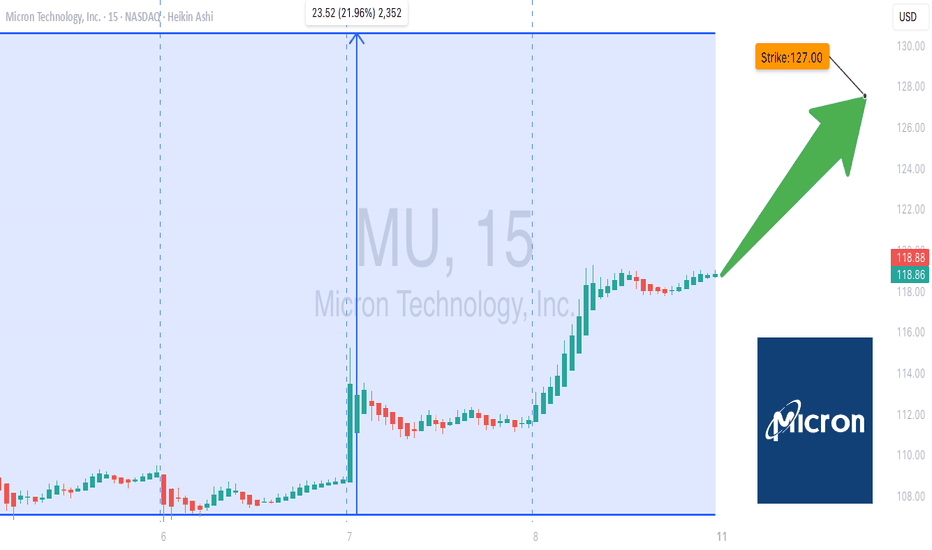

Micron Technology Bullish-But Is a Pullback the Real Money Make? 📈 MU Weekly Swing Setup (2025-08-10) 📈

**Bias:** ✅ **Moderate Bullish** — RSIs aligned across timeframes, options flow supports upside, but volume is light.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:MU

* **Type:** CALL (LONG)

* **Strike:** \$127.00

* **Entry:** \$0.71 (open)

* **Profit Target:** \$1.42 (+100%)

* **Stop Loss:** \$0.36 (-49%)

* **Expiry:** 2025-08-15

* **Size:** 1 contract

* **Confidence:** 75%

**📊 Key Notes**

* RSI strong on daily + weekly → momentum confirmed 📈

* Call/put ratio 1.27 → bullish options sentiment ✅

* Weekly performance +13.36% → trend intact 🔥

* Volume weak → watch for early stall ⚠️

* Low gamma risk into expiry → safer for quick swings 🛡️

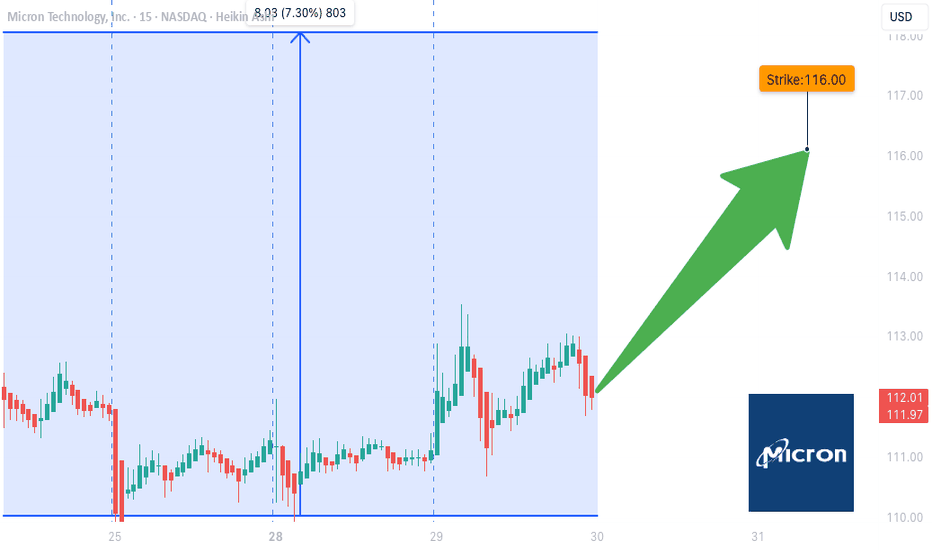

MU WEEKLY TRADE IDEA (2025-07-29)

### 🚀 MU WEEKLY TRADE IDEA (2025-07-29)

**Micron Technology (MU) – Bullish Call Play**

🔹 **Sentiment:** Moderate Bullish

🔹 **C/P Ratio:** 2.91 (Bullish Flow)

🔹 **RSI (Weekly):** 53.6 📈

🔹 **Volume:** Weak (⚠️ caution — low conviction)

---

### 🎯 Trade Setup

* **Strike:** \$116.00

* **Type:** CALL (LONG)

* **Expiry:** 2025-08-01

* **Entry:** \$0.62

* **Target:** \$0.89

* **Stop:** \$0.31

* **Risk:** 2–4% of account

* **Confidence:** 65% 🧠

* **Entry Timing:** Market Open

---

### 🤖 Multi-Model Consensus

5 AI Engines Agree:

✅ Buy \$114–\$116 Calls

🧠 Models: Grok, Gemini, Claude, Llama, DeepSeek

📉 Main Risk: Weak volume divergence despite strong options flow

---

### ⚠️ Key Notes

* 📊 Institutional call buying ✅

* ⚠️ Low volume = reduced confirmation

* 🎯 Play is short-dated — gamma spikes expected

* 💥 Manage exits actively near target zones

---

### 🧠 Quick Recap (for speed-readers)

**MU 116C ➜ \$0.62 → \$0.89**

💥 Weekly flow supports upside

⚠️ Volume = weak, but RSI rising

⏱️ Hold short-term with stops