Stop Chasing Results – Start Building a Winning ProcessIn trading, it’s easy to get caught up in goals like “I’m going to make X amount per month” or “I’m going to have X winning trades each week.”

The problem is that outcomes are something we have very little control over. When we fail to hit these targets, we risk overtrading, taking unnecessary risks, or abandoning our plan – which often leads to even worse results.

The truth is that uncertainty is a constant in trading. Even the most well-developed and “bulletproof” strategy will have losing periods.

Yet many traders interpret a winning trade as proof that the strategy works, and a losing trade as evidence that it’s flawed. This allows single outcomes to dictate confidence and decision-making, creating an emotional rollercoaster that makes us more impulsive and less disciplined.

Shifting the focus to the process means putting your energy into the things you can actually control:

✅ following your strategy

✅ sticking to your risk parameters

✅ completing your analysis before each trade

✅ reviewing how you executed – regardless of the result.

This shift helps maintain discipline during drawdowns, measure success by behavior rather than outcome, and develop the knowledge, skills, and mental tools needed for long-term success.

🎯A first step toward process focus is to set goals based on your actions, not on the market’s results. At the end of each trading day, ask yourself: ”Did I follow my process today?” If the answer is yes, that’s a win – even if the day’s P/L is negative.

🎯When a loss occurs, the next step is to analyze why it happened. Was it a natural result of market movement, or a deviation from your strategy? By consistently identifying these patterns, you build psychological tolerance for losses and learn to see them as a normal part of trading rather than as failures.

When you measure success by your process rather than by single outcomes, you reduce emotional highs and lows and create the conditions for stable performance over time.

💡Pro tip:

So next time you take a loss, pause before judging the result.

Ask yourself:

How well did I follow my process today?

Over the long run, your answer to that question will determine the kind of trader you become.

Happy compassionate trading! 💙

/ Tina the Tradingpsychologist

Mindsettips

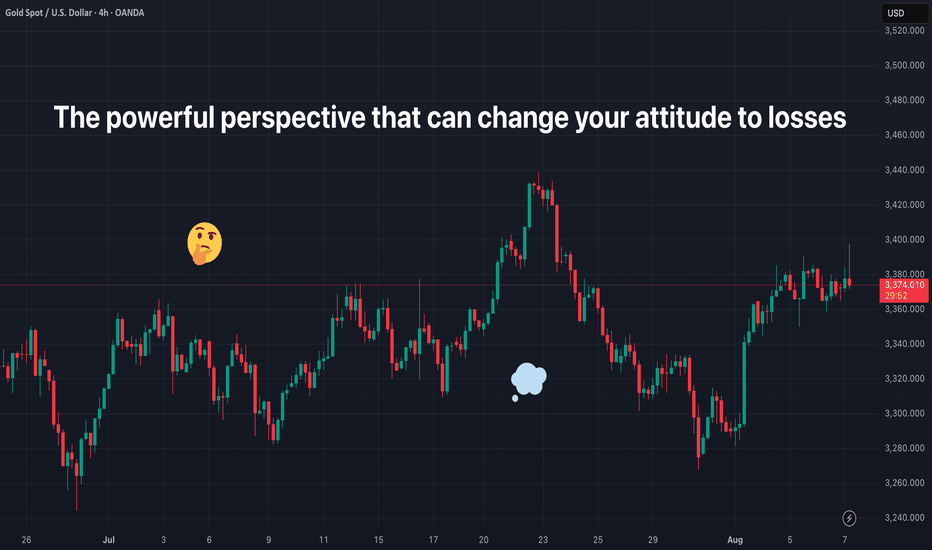

The powerful perspective that can change your attitude to losseWant to know a secret? You can actually change how you react to losing trades—just by thinking differently. Cool, huh?

🫣 Here’s a hard truth that every trader needs to accept: every trade is a potential loss.

Losses are an inevitable part of the game.

No matter how good your setup is, no matter how much you’ve prepared—there will always be trades that don’t work out.

Trading is already emotionally challenging as it is. But if you get stuck obsessing over one single trade, it becomes so much more emotionally exhausting. You start evaluate yourself after every outcome. And that’s not a sustainable way to trade.

Let’s be honest: the result of one trade doesn’t say much about your actual trading performance.

It’s only over time—after a series of trades—that you can honestly evaluate how you’re doing.

If we want to reduce some of the emotional storms that come with trading, we need a different strategy. A more compassionate one. One that gives us the space to breathe, recover and grow.

So how do we do that? By practicing a shift in perspective.

A shift that’s actually rooted in neuroscience. It’s about broadening your perspective.

👉 Broadening your perspective means reminding yourself:

"This is just one of many trades I’ll take in my trading journey."

That’s it. Simple. No complicated strategy. Just a small shift in thinking that helps you regulate your emotions.

Whether you’ve just taken a loss or feel doubt creeping in before entering a trade—say it to yourself (out loud if you want!): “This is only one of many trades I will experience.”

And here comes the science part:

🧠 When you broaden your perspective like this, the brain responds. It decreases arousal in the amygdala—your brain’s “panic button.”

At the same time, it activates the prefrontal cortex—the part of your brain responsible for rational thinking, impulse control and analysis.

Put simply: you become more emotionally balanced—and more able to view the market objectively.

🤔 Why is that important?

Because when your amygdala calms down, the risk of emotionally driven mistakes decreases.

The fear becomes less intense.

And in trading terms: you’ll be better at cutting losers faster and holding on to winners longer.

🪄 Will this shift magically erase all tough emotions? No. The emotions will still be there—just not as loud.

And isn’t it more motivating to remind yourself that you are not defined by a single trade?

You’re defined by your overall journey. Your effort. Your long-term consistency.

💡Pro Tip:

Next time you feel hesitation—even with a solid setup, or after closing a losing trade

👉 Try this reminder:

“This is only one of many trades I will execute during my career.”

Let it soften the inner storm.

Happy, compassionate trading! 💙

/ Tina the Trading Psychologist

Serious psychological barriersSerious psychological barriers

1) Fear of missing out

The first thing you should define is your trading plan, trading method

You should remember the main factors of your setup formation (Time&Price). At what time this setup is formed, the presence of a sequence (context). If you do not know when your trading idea/setup can be formed, then most likely - you do not have a trading plan or a trading setup. Remember that trading is a game of probabilities, but trading is not a game.

Having a trading plan is the key, trading time, session, waiting for a possible setup to form, take notes based on what happens in each session, and in the future, some patterns can help you. Even if you miss some setup, you should not worry about it, since you know +- time when a new one will form

2) Fear of losing

You need to remember that there is not a single setup with 100% or even 70% accuracy of execution! In fact, there is no point in even such a setup or searching for it! The question is always only in your risk management! Fear of losing - arises from the lack of a plan.

3) Impatience

This occurs in young traders, even with a strategy, successful capital management. But, sometimes, we enter a position before we should. This requires a lot of attention, develop discipline, following the rules of your trading method. All this is due to the fact that you do not want to spend enough time on trading experience, since in most cases, when you achieve success or make a profitable decision, you will want to experience this rush of emotions as quickly as possible, so you can fix your profit ahead of time, or open a position before your setup is formed. Do not follow your emotional impulses, do not try to prove your case, just wait for the moment

4) Fear of not being a good enough trader

This is a side effect of being on social networks. Social networks are the problem of the 21st century! Everyone lives by the principle of Fake it till you make it. If you think you are not as fast a learner as the guy on Twitter, and even if he says that everything is fine - remember, in reality, it is not. Most people try to pretend and distinguish themselves as "the smartest in the room". Don't let this bore you too much or make you feel inferior

The most important thing is to study your statistics, your data over time, remember where you started and determine if you have achieved results since then.

5) Fear of losing streaks and drawdowns

This is directly related to money management. You do not have a process, a sequence of actions, when you have a losing streak or drawdown, you must understand how to reduce the risk, how to act in this situation. This is where your trading strategy will help you, where all the risk management is described. State everything about managing your deposit, when you stop trading, when you reduce risk or when you stop trading

6) Lack of discipline and rules

Listen to your inner voice that tells you: "Don't do this" but you continue anyway, you want to see what happens next. Do this outside the market, there must be clear discipline and rules that must be followed. Discipline is achieved by forcing yourself to follow a set of rules and these rules must be strict, short and detailed

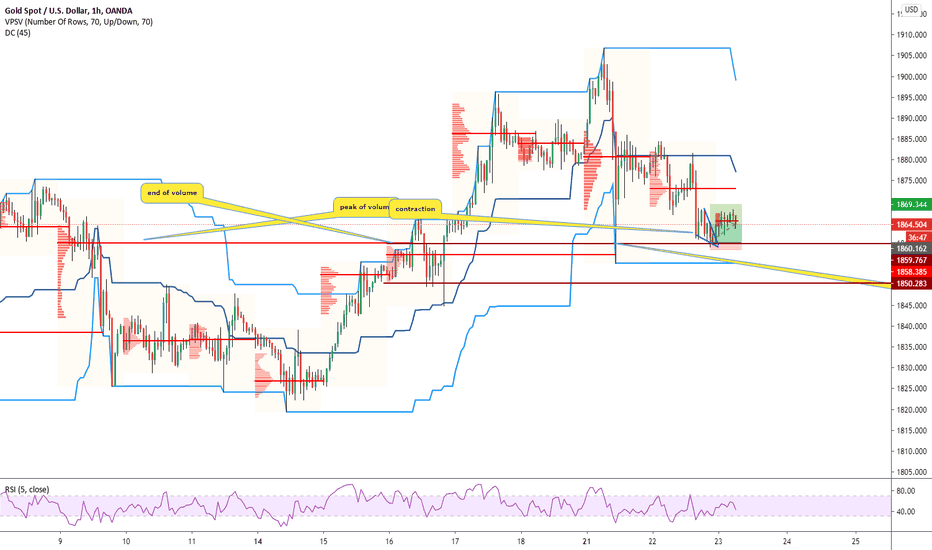

Higher Rewards For Less RiskI've changed my reward-to-risk ratio from 1:1 to 2:1.

You heard me right! They have changed.

I wasn't a stickler about my ratios, but I am now. I want to make more money and do less trading. How is this possible, you may be asking?

It's simple when you look into the details. So let's take a look at the losses first.

What do my losses look like?

Each time I lose a trade, I recently exited a previous winner or wasn't in a trade on that currency pair before I lost. Let me explain because these are two different things.

When I win a trade, I give back my profits on losing trades and may not enter the next trade due to my emotions being everywhere.

I noticed that I was stopped out, and the price flowed my way. But, honestly, I can do nothing to prevent this from happening.

You may say, "well, can't you change your stop loss?"

I could, but to what? I never know when I'll be stopped out or how big the wicks will be to get me out of the trade. This means every trade is unique, and I'm making a mistake if I don't follow my rules.

Being stopped out isn't the problem. Trading my system too much with almost the same reward to risk is the problem.

Question to myself, what if you could hold the trade longer(I'm a swing trader, so this fits) and increase your reward significantly, so you don't have to keep entering multiple trades unless the reward was worth it? So now, if I am stopped, my winning trades will make up for my losses and more.

What do my winning trades look like?

My winning trades look more significant than my losses. My focus is and will always be higher timeframes. I like to trade when markets are trending. So per the daily, weekly, or monthly timeframe, I'm trading if my currency pairs are trending.

My goal is to get the best entry that fits my rules and hold to my long-term targets, and any trade under a 2:1 reward-to-risk ratio will not be traded.

I'm also ok with not being triggered into trades set by my pending orders. I'm also ok with losing trades. That's part of the business.

In Summary

I seek to hold trades longer to receive bigger rewards and let the small losses be small. I've not changed my trading strategy. It works, and I am working on it. We go well together.

My belief is as long as the market is trending, I can hold my trade.

I pray this blessed you,

Shaquan

Remember, you don't trade the markets. You trade what you believe about the markets. "Van Tharp"

🧠 The Mind Of A Smart TraderTrading psychology is influenced by emotions like greed and fear, which can drive irrational behavior in markets. Greed causes excessive risk-taking and speculation, while fear causes traders to exit positions prematurely or avoid risk. Regret can also cause traders to violate discipline and make trades at peak prices, leading to losses. These emotions can be particularly prominent in bull or bear markets and can have a significant impact on market outcomes. Trading psychology is a crucial factor in determining success in trading securities. It includes aspects of an individual's character and behavior that affect their trading decisions. Discipline and risk-taking are critical components of trading psychology, as is the impact of emotions like fear, greed, hope, and regret. It can be as important as knowledge, experience, and skill in determining trading success.

🧠10 Trading mindset tips:

🔹 Stay informed: Stay updated with the latest market news, trends, and developments, as well as your preferred assets.

🔹 Create a trading plan: This should include a clear set of rules for entry, exit, and risk management. Stick to your plan.

🔹 Manage your emotions: Avoid making impulsive decisions, especially during volatile market conditions. Keep a clear head and stick to your plan.

🔹 Continuously educate yourself: Enhance your knowledge and skills by reading books, attending seminars, and practicing with demo accounts.

🔹 Diversify your portfolio: Spread your risk across different assets and markets to reduce your exposure to any one particular market.

🔹 Stay disciplined: Follow your plan and stick to your rules, even if your emotions are telling you otherwise.

🔹 Set realistic expectations: Be mindful of your limitations and don’t overreach. Accept small losses and focus on long-term success.

🔹 Stay focused: Avoid distractions and keep your mind on your trading activities.

🔹 Keep a trading journal: Record your trades, track your progress, and reflect on what you could have done differently.

🔹 Take breaks: Avoid overtrading, which can lead to burnout. Take time to recharge and come back fresh.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Cause & Effect in Day TradingCause and effect works in every aspect of our lives and if understood and used correctly can be of major help to the persons success, in live, trading and even love.

Seek more knowledge on cause and effect by yourself and that will be the first step you need to take to see it in action!

Good luck trading!

Checkout our signature!