Miners

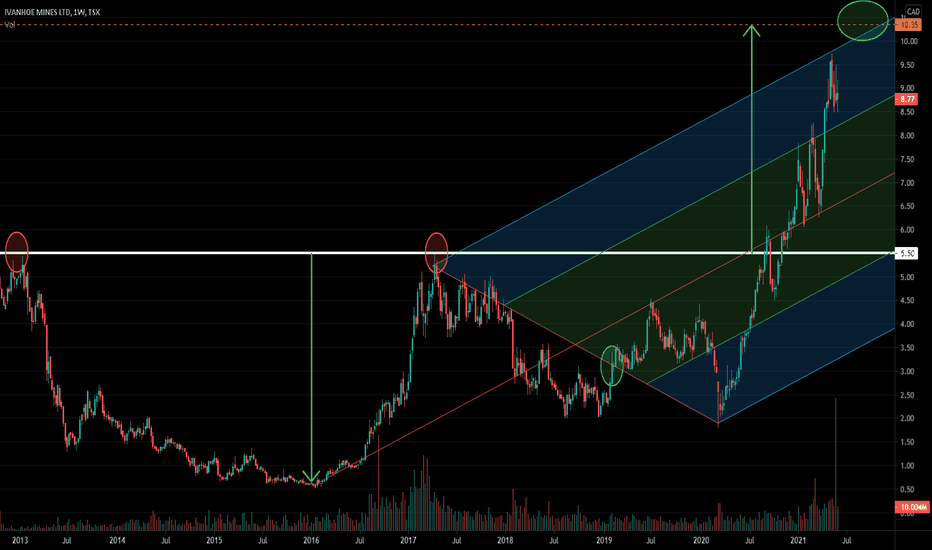

Ivanhoe Mines - Minimum Retracement Almost ReachedInternational mining consultant Wood Mackenzie has ranked the Kamoa-Kakula Copper Project as the world's fourth-largest copper discovery, with copper grades that are the highest by a wide margin of the world's top 10 copper deposits.

The company has 3 principal projects in Southern Africa: the development of new mines at the Kamoa-Kakula copper discoveries in the Democratic Republic of Congo (DRC) and the Platreef palladium-platinum-nickel-copper-rhodium-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the DRC.

Friedland is executive co-chairman. For more than 25 years, Friedland has been recognized by leaders of the international financial sector and mineral resource industries as an entrepreneurial explorer, technology innovator and company builder. He has successfully developed a portfolio of respected public and private companies whose initiatives have led to several of the world’s most significant mineral discoveries and mine developments, applications of disruptive technologies and contributions to significant economic growth in established and emerging markets in the Asia Pacific Region, Southern Africa and the Americas.

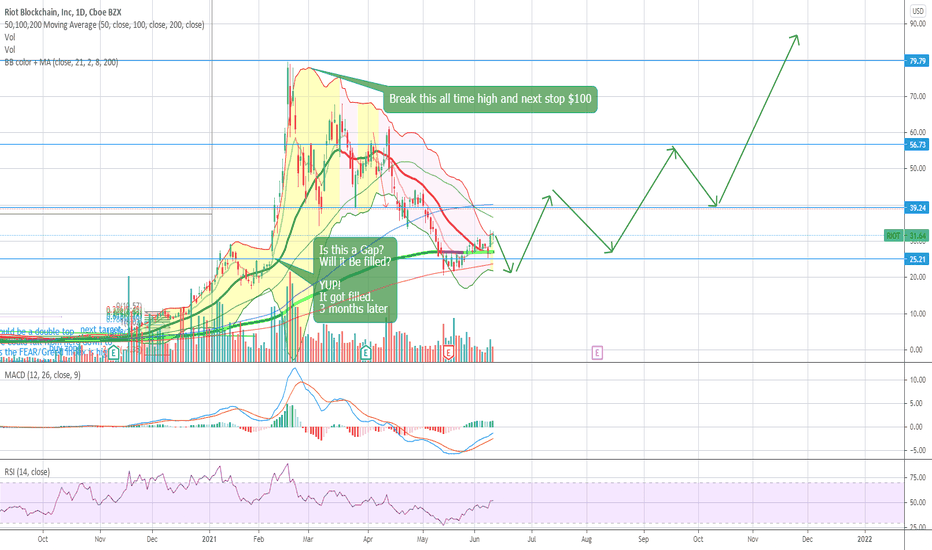

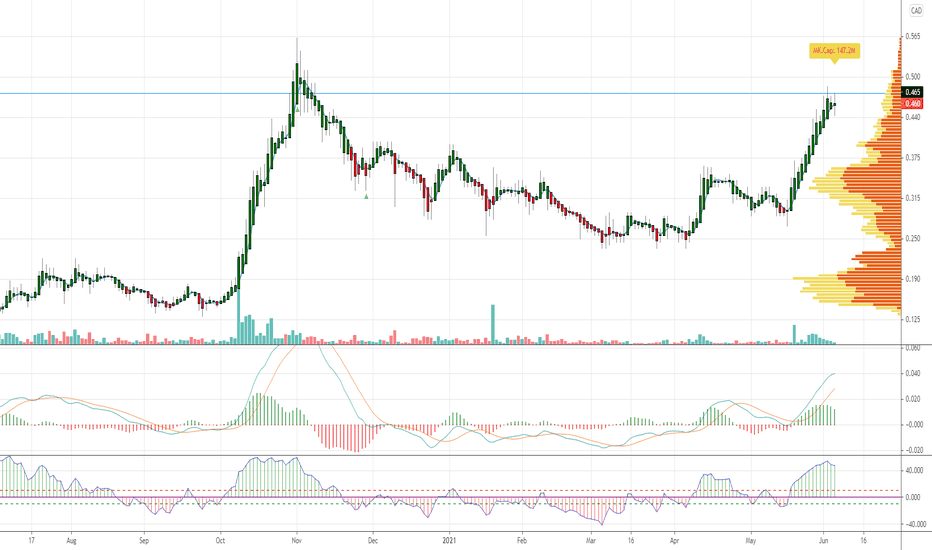

RIOT could roll up past All time High by End Of YearRIOT could roll up past All time High by End Of Year

Not Financial advice just a computer drawing - I should be painting right now.

If the story on these miners can turn to green energy and efficient tech the stock price will rise just on the speculation of a new good idea.

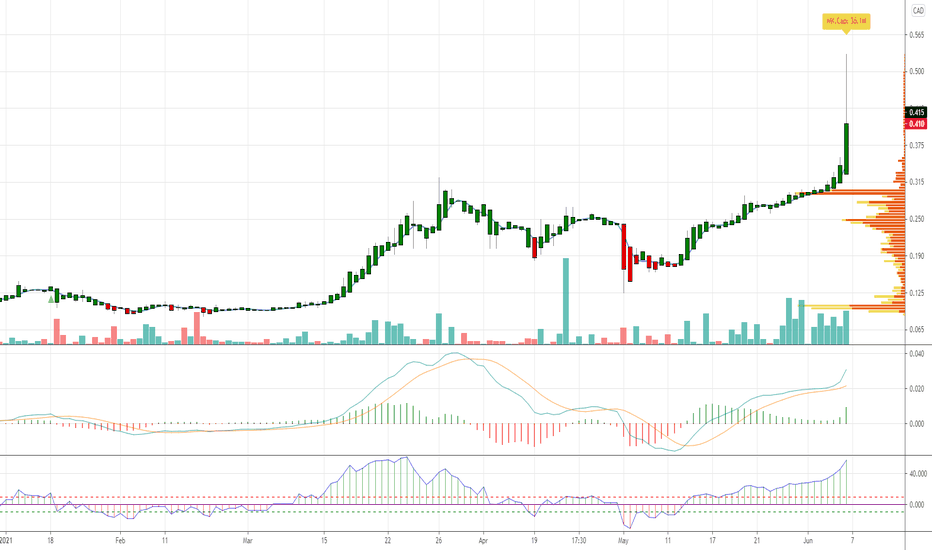

Asante Gold Corporation - 2021 - H4Asante Gold Corporation (CSE:ASE/ FRANKFURT:1A9/U.S.OTC:ASGOF)

About Asante Gold Corporation

Asante has announced plans to co-list its shares on the Ghana Stock Exchange, and is sourcing funding to develop its Kubi Gold Mine project to production. Asante is also exploring its’ Keyhole Project, Fahiakoba and Betenase concessions/options for new discoveries, all adjoining or along strike of major gold mines near the centre of Ghana’s Golden Triangle.

report that it has received notice from the Minerals Commission of Ghana that eight highly prospective concessions covering approximately 314 km2 have been recommended for transfer to Asante.

These licenses are comprised of the Diaso (104.1km2), Juabo (59.2 km2), Manhia (18.69km2), Dunkwa Gyimigya (32.72km2), Gyimigya (5.52km2), Agyaka Manso (40.0km2), Amuabaka (28.86km2) and Nkronua-Atifi (24.97km2) prospecting licenses (PL’s). All licenses are being acquired, on an as issued by the Minerals Commission basis, from Goknet Mining Company Limited (the “Vendor”) pursuant to the terms of agreement with Goknet dated December 28, 2016.

Maple Gold Mines - 2021 - Dailybout Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Quebec's prolific Abitibi Greenstone Gold Belt. The projects benefits from exceptional infrastructure access and boasts ~400 km2 of highly prospective ground including an established gold resource (RPA 2019) that holds significant expansion potential as well as the past-producing Telbel mine.

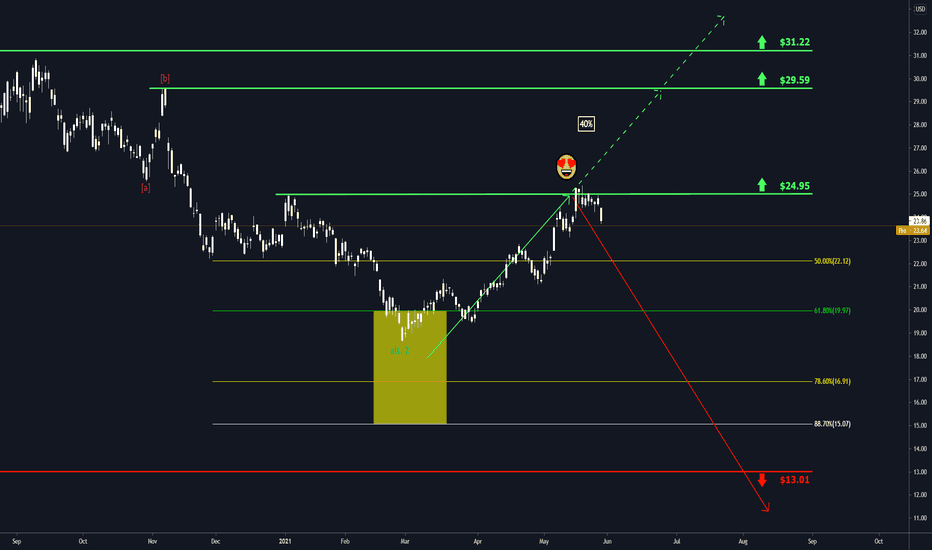

Barrick Gold: Bullseye? 😎😎😎With the current losses in the price for the Barrick Gold Corp. stock, we are perfectly on track to move all the way down under the support at $13.01. There, we will have amazing opportunities to re-enter the market on the long side. If there is no sustainable breakout above $24.95, our primary expectation will remain in place.

Happy weekend!

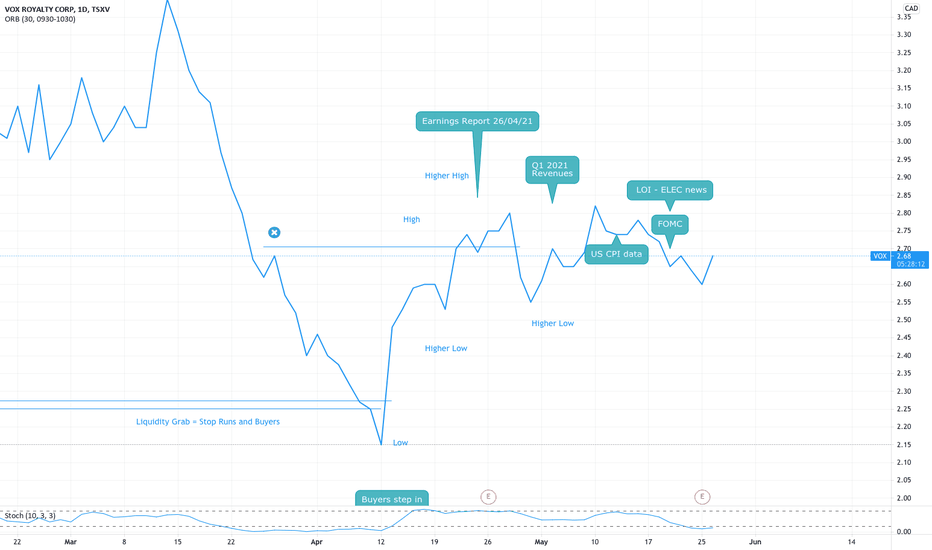

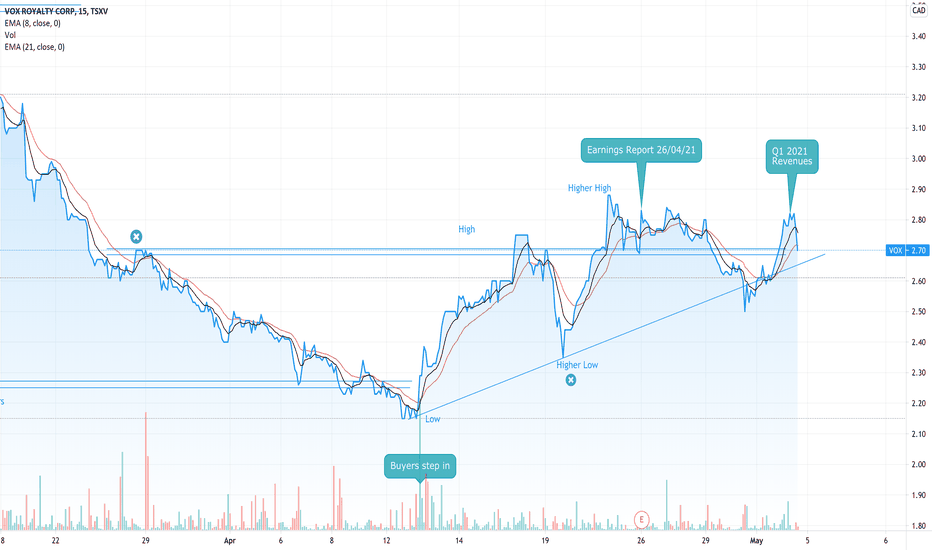

VOX HighlightsFirst Quarter 2021 Highlights

• Record revenue of $539,980 and gross profit of $479,271 reported for the quarter, with inaugural revenues received from

the Koolyanobbing royalty;

• Increased producing royalty asset count from one asset at May 2020 listing to four assets by Q1 2021 quarter-end;

• Strong balance sheet position at period end, including cash on hand of $10,723,135, working capital of $9,117,150 and

total assets of $29,024,889;

• Completed three portfolio transactions to acquire an additional ten royalties, reaching a total critical mass of 50 royalties

and streams;

• Completed an overnight marketed public offering for aggregate gross proceeds of C$16.85M;

• Subsequent to March 31, 2021:

- Announced a strategic partnership with Electric Royalties Limited (TSX-V: ELEC) and the potential

divestment of two non-core graphite royalties for C$2.9M; and

- The Company appointed PricewaterhouseCoopers LLP as their auditors effective April 30, 2021.

About the Koolyanobbing Royalty

The Koolyanobbing royalty is an uncapped royalty of 2% on the average/tonne Free on Board ("FOB") sales value of iron ore extracted from the Deception Deposit on mining lease M77/1258.

Prior to Vox acquiring the Koolyanobbing royalty from Vonex Limited ("Vonex") in 2020, a historical pre-payment of the royalty in the sum of A$3,000,000 was made by Cliffs Asia Pacific Iron Ore Pty Ltd to Vonex. As previously disclosed in Vox's filing statement dated May 12, 2020, no royalty cash flows are payable to Vox until this pre-payment amount has been exhausted. The outstanding balance as of December 31, 2020, was A$1,782,032.

Vox has entered into a binding agreement with Yilgarn Iron Pty Ltd pursuant to which Vox will extinguish the outstanding balance of the Koolyanobbing pre-payment through a cash payment of A$1,782,032 within five business days from the execution date of the agreement. Following payment of the settlement amount, effective January 1, 2021, Vox will earn royalty revenues from the Koolyanobbing royalty.

Royalty revenues associated with the Koolyanobbing (Deception Pit) royalty over the past two years and forecast for 2021 are as follows:

2019 = $724,198

2020 = $493,769

2021 Forecast = $600,000 – $800,000

The Deception Pit and the Altair Pit to the north are currently being mined at a rate of 1.1Mtpa – 1.3Mtpa. Historical royalty attributable annual production on the Vox royalty tenure (M77/1258, see Figure 2) has averaged 180,000t – 360,000t and Vox management expect this royalty attributable production rate to increase in coming years as mining transitions further north within M77/1258.

For more information on Koolyanobbing, please visit the Mineral Resources website at: www.mineralresources.com.au

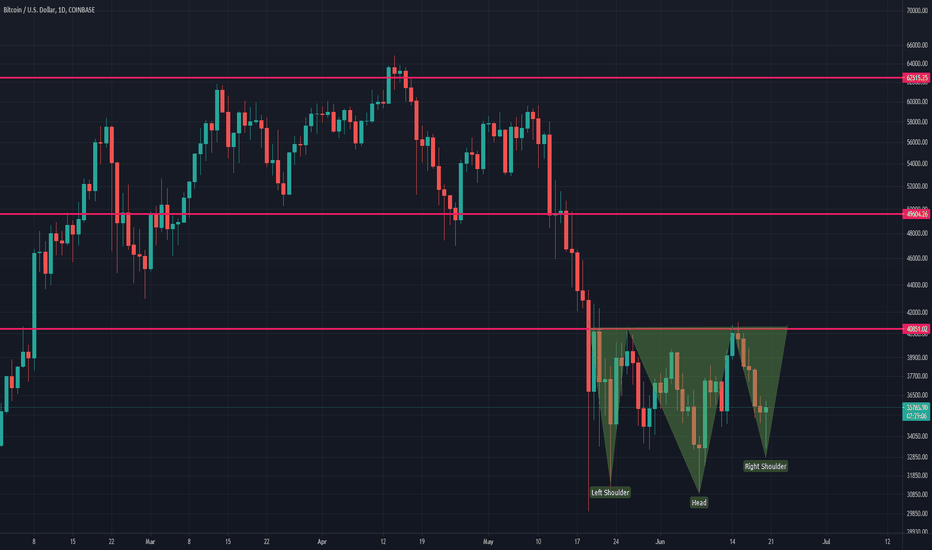

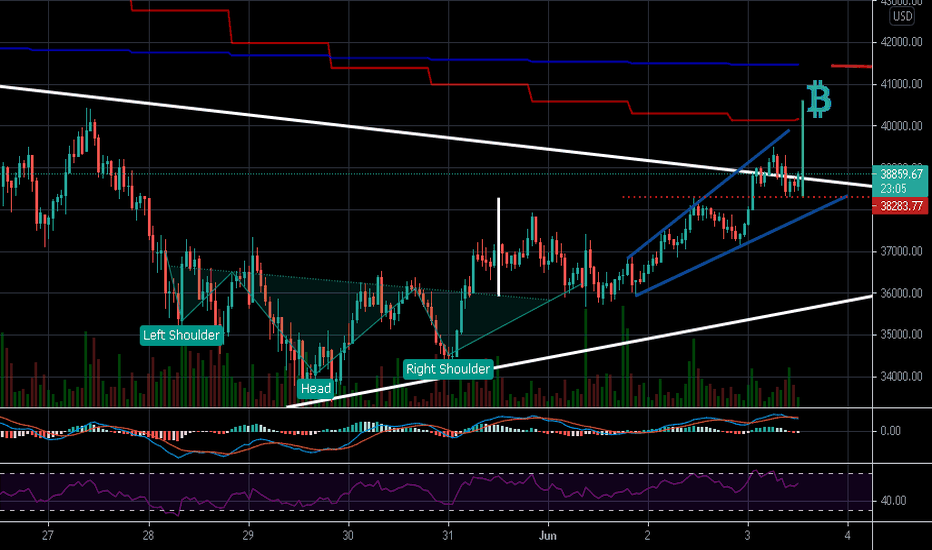

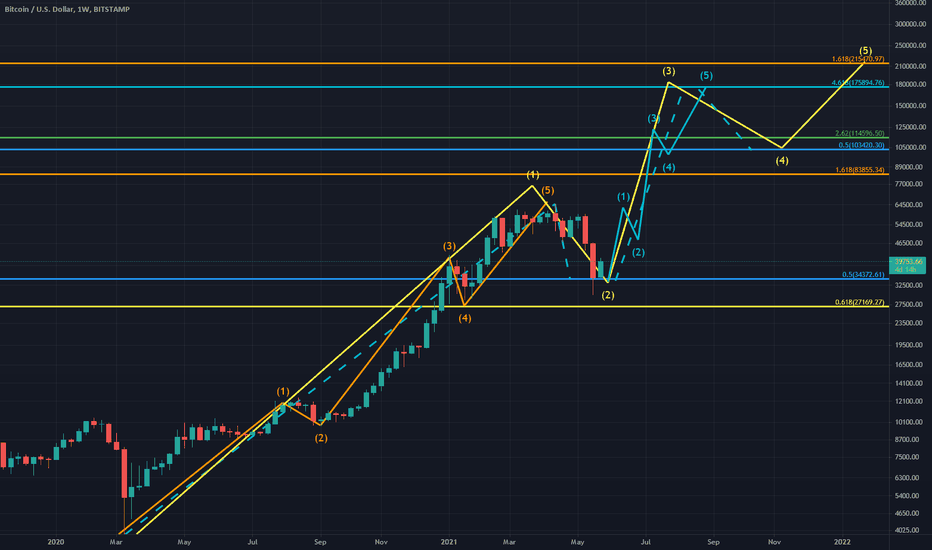

BTC- Fundamental, market cycle and capitulationThe great unwind... As Mark Cuban calls it. Such capitulations are, however, not uncommon throughout Bitcoin's history. Feb 2018, Nov 2018 and Mar 2020... To name a few. Of course, to newcomers, such volatility is difficult to stomach. At least, that was how I felt back in 2017.

The latest China FUD is simply three banking and payments associations in China reiterated on the central bank's 2017 ban on financial institutions and payment firms engaging in cryptocurrency transactions and these rules have been in place since 2017. China has been banning the retail trading and the operation of crypto exchange within China’s jurisdiction since 2017. I know this because I was at the front row seat and watched this event unfolded which also coincided with the deep correction of Ethereum from $400 to $140.

China’s latest crackdown on Bitcoin mining will be limited to operations that are not using hydroelectric power. If you think about it, it’s actually good for BTC’s reputation and the global environment in the long run as the world’s adoption of the decarbonation accelerates.

Elon musk’s bashing of BTC…. Hard to take him seriously when he doesn’t even know the high ownership concentration of DOGE and when he believes that he can magically 10x the block size of DOGE. Obviously, he hasn’t thought seriously about the scalability dilemma and the tradeoff between privacy & decentralization and transaction volume/speed/cost. He is right about the BTC’s environmental impact though and it is an important issue for Bitconers to address as the worldwide trend toward the greener environment marches on. I just wish that he didn’t flipflop on whether or not he would allow Tesla to accept BTC payment.

FOMOers, long-term holders/whales and miners determine crypto’s market cycle. Let’s examine them one by one.

Short-term holder's capitulation-

Panic selling is actually good as weak hands get shaken out and market cools off a bit.

Both aSOPR and STH-SOPR have dipped below 1.0 recently indicating the widespread and aggressive panic selling by new holders.

# of address with a non-zero balance has also decreased which is another sign of panic selling by FOMOers.

Bitcoin’s Net Transfer volume from/to Binance is another panic selling indicator as it went up when panic selling intensified.

Long-term holder is HODLing-

The ASOL, CDD and Dormancy metrics are all down indicating HODL sentiment among long-term holders.

# of Bitcoin supply held by Long Term Holders indicating that LTHs haven’t distributed their holdings to the lvl where the new accumulation phase typically begins.

Coinbase’s outflow continues to increase and its balance continue to decline which indicating institutional accumulation and demand and the increasing # of accumulation addresses also point to the same trend.

Total supply held by long-term holders has also slightly increased though this data by itself doesn’t tell us if LTH is accumulating at the bottom of the bullish retracement or the beginning of bearish cycle.

Miners' accumulation-

Last but not the least, miners’ behavior has great influence on the market sentiment. Both Bitcoin’s Miner Net Position Change and OTC Desks Balance indicate that miners are bullish and are accumulating BTC instead of distributing it.

Most other on-chain datas and technical indicators such as BTC NVT price, Bitcoin Difficulty Ribbon and Mayer multiple paint a bullish picture as well . However, one thing that concerns me is that Bitcoin Wallet Sizes: > 1,000 BTC seems to be declining a bit.

It’s possible that the price can continue to fall and bottom around 25k, but the likelihood of it happens will depend on if BTC can convincingly break above 38k and how long BTC stays below 40k. Whatever you do, base your judgement on the combination of different source and analysis rather than the biased intuition and simple trading patterns. Most importantly, play the long game. It's paramount that you can survive the bearish cycle, which will come eventually, and have enough capital set aside so you can buy at the bottom formation and enjoy the fruit of your labors when the market rises up again.

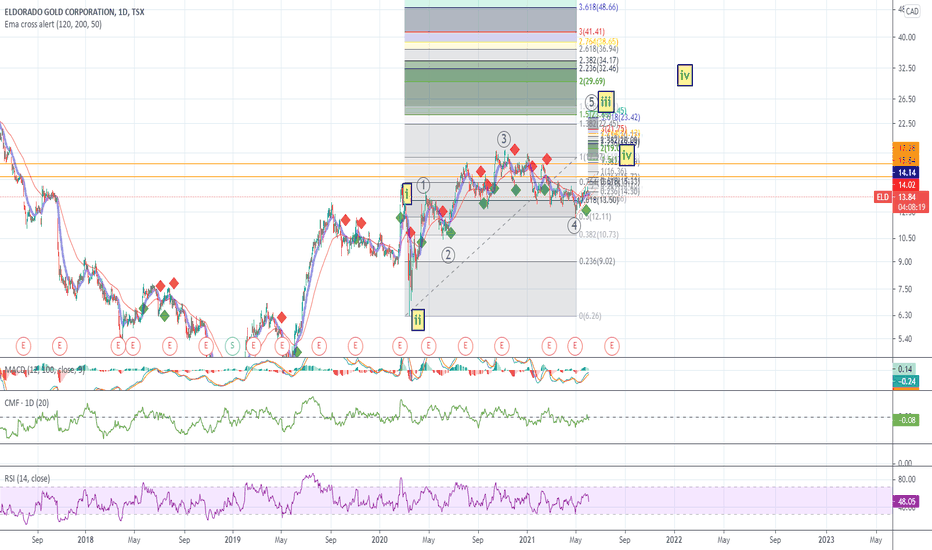

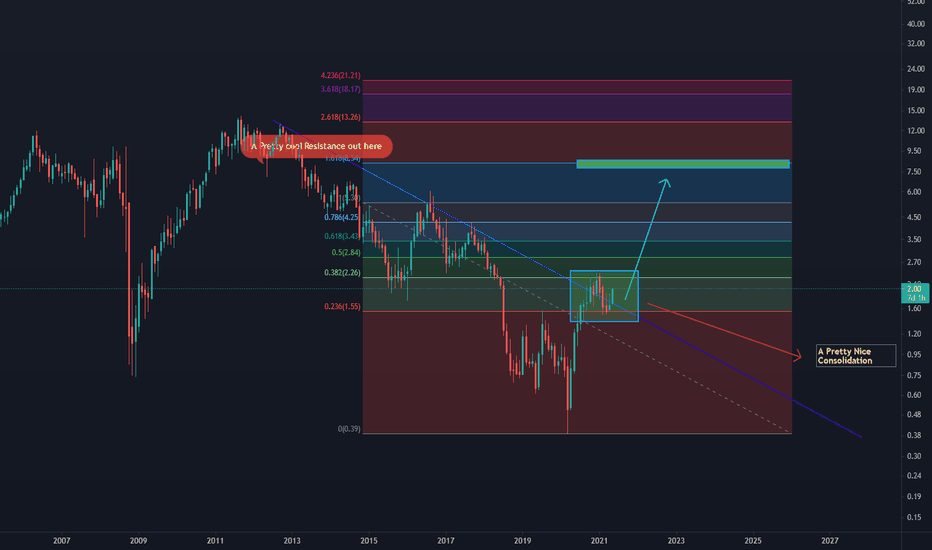

New Gold Inc /Gold Miners / Investment Idea

Fundamental side of The Idea :

Miners continue to outperform gold.

This ratio is now confirming a prior breakout with authority and making higher lows since March.

While all eyes remain on Gold and crypto , this industry is climbing a wall of worry.

About the company

New Gold's balance sheet is looking better thanks to a high gold price. However, all-in sustaining costs are very high and reached $1,550 per ounce in Q1'21, with an AISC of $1,586 per ounce for Rainy River. It is a red flashing signal.

The issue here is the lack of diversity. The company is running two so-so gold mines and doesn't have any leverage if something bad happens. So far, the gold momentum is helping but it wont for soo long.

The reasonable solution is to trade the stock and keep only a small long-term position , The company is clearly undervalued . let say untill The price Reach 7/9 $ range .

Do Not hesitate to Contact me .

S.Sadki

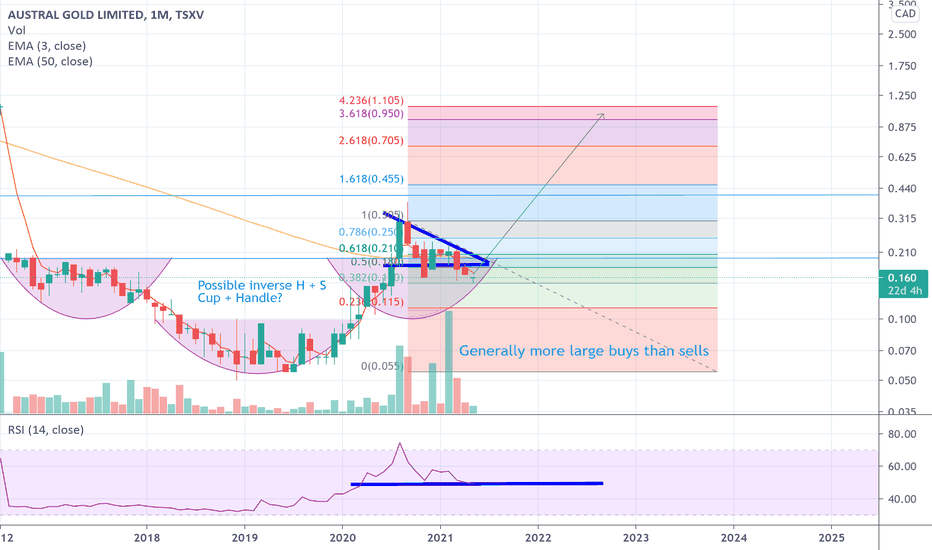

Gold Correction is Over. Re-pricing incomingThe gold market appears to have found its bottom and rallied back above 1800USD.

This correction is over IMO. The senior producers have sold off and the juniors are quiet again. Its time to add to positions or establish longs in advance of widespread commodity re-pricing to higher levels. Gold will not be left behind this time.

Austral gold is still hanging in there producing cash and the focus now should be on the exploration results which will be key in replenishing reserves. If austral gold can continue to mine 50k oz of gold and then grow their resources with the recent acquisitions this stock can be a multi-bagger.

The copper claims that austral has recently acquired are interesting and has a bit of a mini-barrick vibe.

GLTA.

Vox Royalty Announces Record Revenue in Q1 2021GEORGE TOWN, CAYMAN ISLANDS – May 4, 2021 – Vox Royalty Corp. (TSXV: VOX) (“Vox” or the “Company”) is

pleased to announce that the Company has realized record preliminary revenue of C$668,600 (US$540,000)

(1) for the three-month period ended March 31, 2021. All preliminary revenues were derived from royalties, not streams, as such, the cash operating

margin(1) was 100% for the quarter. During the quarter, the Company recognized inaugural royalty revenue from the Koolyanobbing

royalty, which is an uncapped 2% Free on Board sales value royalty from iron ore mined from the recently commissioned Altair

Pit and a portion of the Deception Pit.

Quarterly revenue benefitted from increased royalty-linked production by Mineral Resources Limited (ASX: MIN) and record iron

ore prices at Koolyanobbing, increased production by Karora Resources Inc. (TSX: KRR) from the Hidden Secret deposit at

Higginsville covered by the Dry Creek royalty and rebounding quarterly diamond prices associated with the Brauna royalty.

Kyle Floyd, Chief Executive Officer stated: “Record quarterly revenue for Q1 represents the start of Vox’s anticipated revenue

growth through 2023 as numerous royalty assets are expected to commence production. The Company’s preliminary quarterly

revenue is in line with previously announced 2021 full-year revenue guidance of C$1.7M to C$2.5M. Vox’s organic revenue growth

is a product of the Company’s stated strategy of acquiring high quality, attractively priced royalties many of which are near term

production opportunities. Vox held one producing royalty in May 2020 and anticipates finishing 2021 with seven producing assets

based on its current portfolio of 50 royalties.”

Vox is a growth precious metals royalty and streaming company with a portfolio of 50 royalties and streams spanning nine

jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused

transactional team and a global sourcing network which has allowed Vox to become the fastest growing company in the royalty

sector. Since the beginning of 2019, Vox has announced over 20 separate transactions to acquire over 45 royalties.

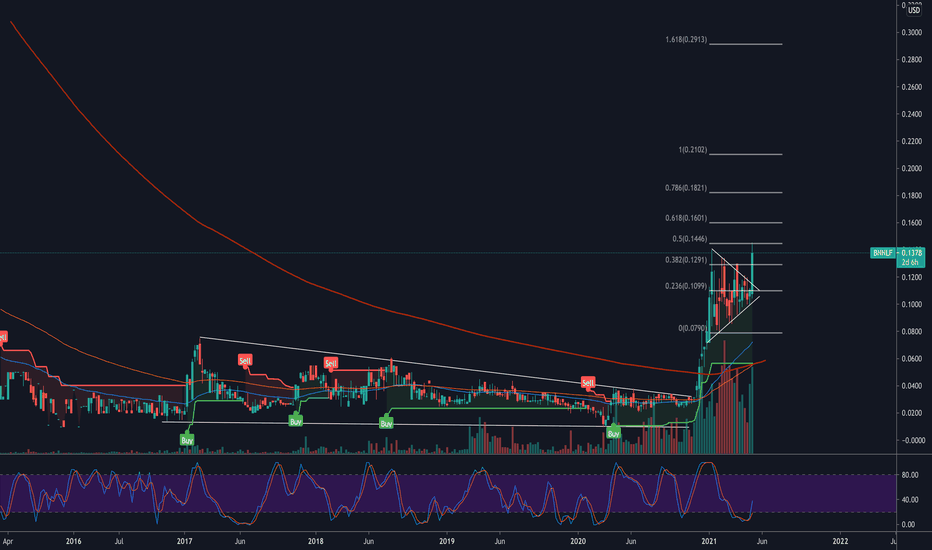

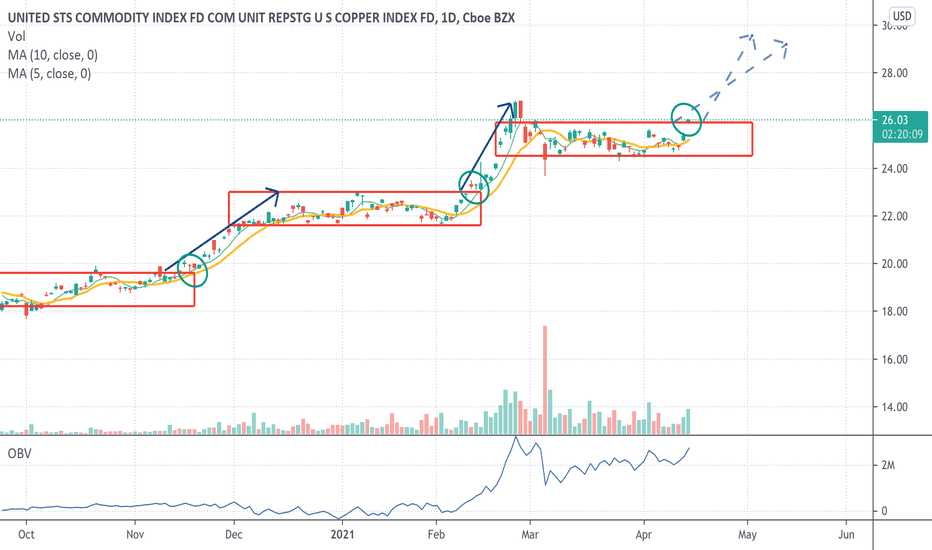

Copper breaking outTechnical Analysis

As you can see in the chart, every red square is showing a consolidation period, followed by a strong rally.

Today's action is showing strength as we are seeing a potential breakout, outside the 1-month consolidation period.

Trade setup

The light-blue arrows are potential measured moves. However, I would follow the 5sma or 10sma, as a stop-exit for 50% of your position.

Fundamental Analysis

There is some concern around inflation, all though the Fed maintains he believes it will be transitory.

Here is the way I follow inflation, which is a free chart by the Federal Reserve Economic Data :

fred.stlouisfed.org

Another way is with the TIP etf.

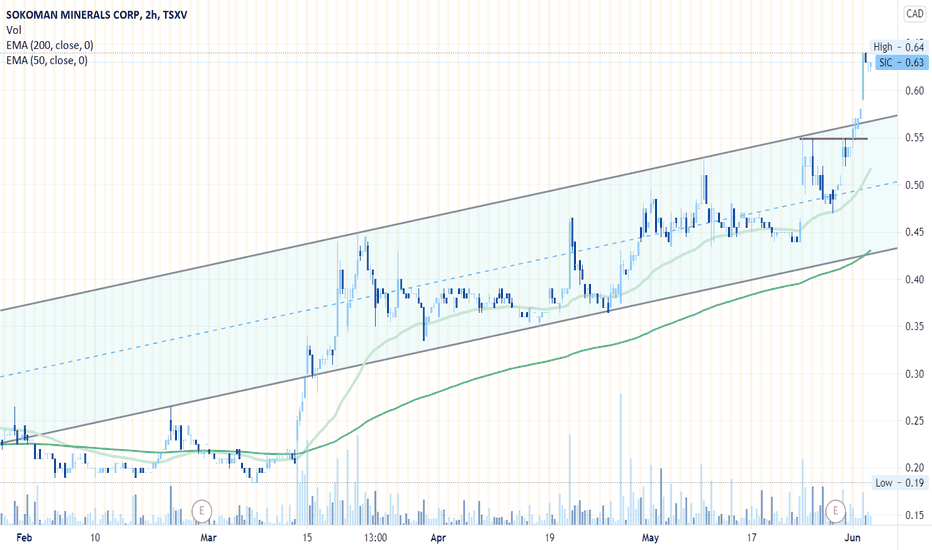

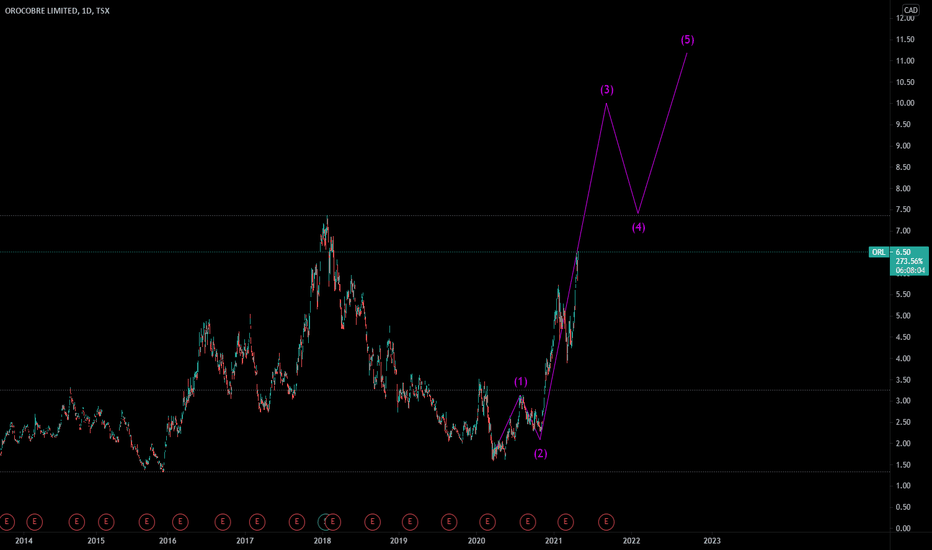

Metals - ORLEW Forecast for Orocobre Ltd:

- Orocobre Limited engages in the exploration, development, and production of lithium in Argentina. The company's flagship project is the Olaroz Lithium Facility located in the Jujuy province of northern Argentina. It also operates two open pit mines situated in Tincalayu and Sijes producing minerals, refined products, and boric acid. In addition, the company owns 100% Cauchari Lithium Project.

- Cup and Handle breakout.

- Orocobre is a leading producer and developer of lithium.

- We are bullish on commodities, especially metals.

- Lithium ion batteries are critical in the renewable energy industry.

- We are very excited about opportunities in the commodities sector, as we believe a macro turn is approaching in the nearest future.

- We are bullish on the clean energy and ESG sectors.

- Orocobre is due to complete a merger deal with Galaxy, creating the 5th largest global lithium chemicals company.

- We expect companies to accelerate the merging process, in the rush to become "too big to fail", as the macro turn approaches... only the biggest entities will be bailed out, or bailed in.

GLHF,

DPT

Disclaimer:

We absolutely do not provide financial advice in any shape or form. We do not recommend investing based on our opinions and strongly cautions that securities trading and investment involves high risk and that you can lose a lot of money. Loss of principal is possible. We do not recommend risking money you cannot afford to lose. We do not guarantee future performance nor accuracy in historical analyses. We are not registered investment advisors. Our ideas, opinions and statements are not a substitute for professional investment advice. We provide ideas containing impersonal market observations and our opinions. Our speculations may be used in preparation to form your own ideas.

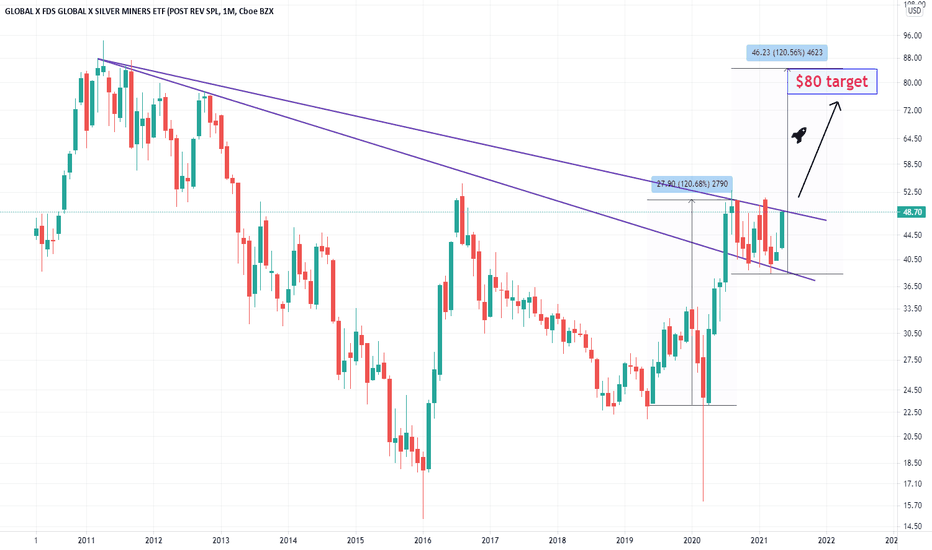

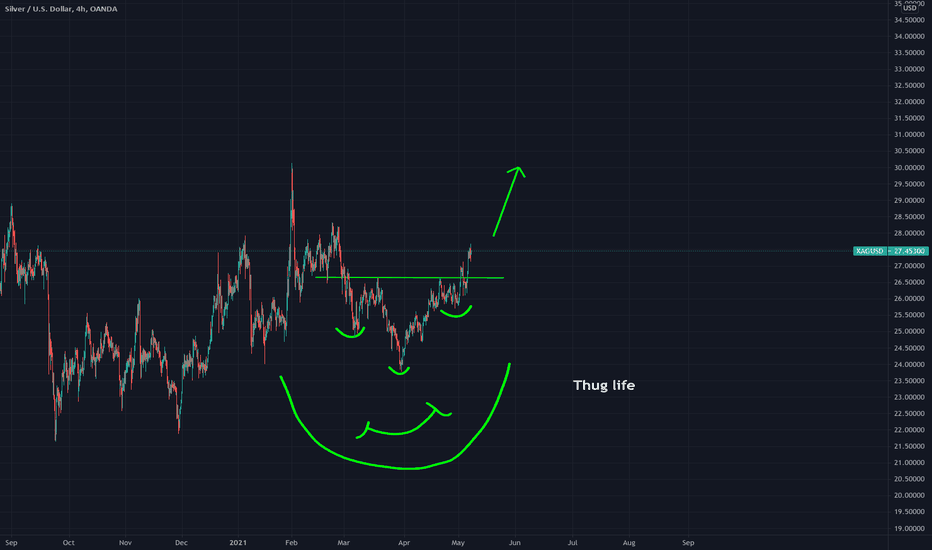

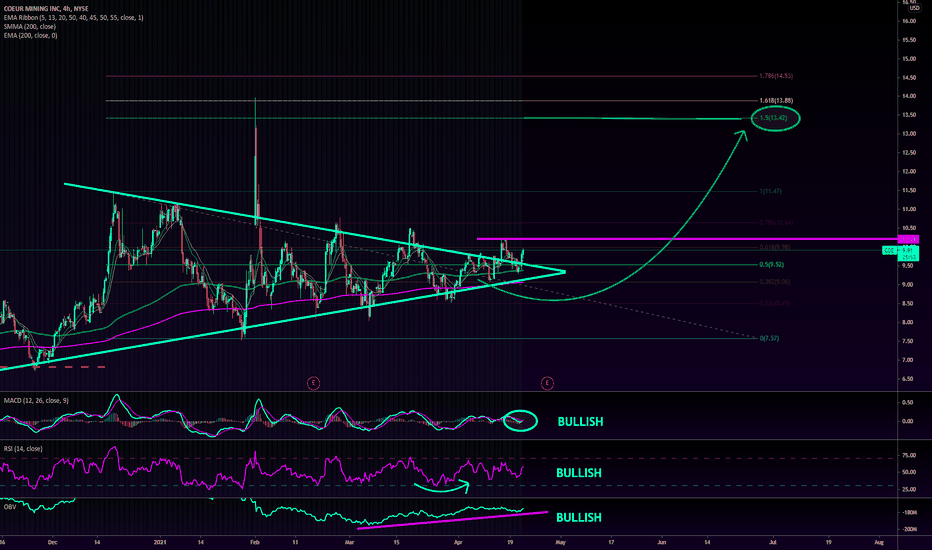

SILVER TECHNICAL SETUP - LONGWith substantial weakness in the dollar, precious metals and the USD currency index have a strong inverse correlation.

Silver has broken out from a bullish falling wedge pattern, which it has back tested and then broken out of the back test. We can also see bullish divergence for the MACd technical indicator on the 8H for Silver spot too.

The attached chart shows a bullish wedge patter having being broken out of, we will look for a close above the purple line to confirm a breakout and enter a long position.

Keep in mind the whipsaw effect we always see due to earnings, exercise caution.